Key Insights

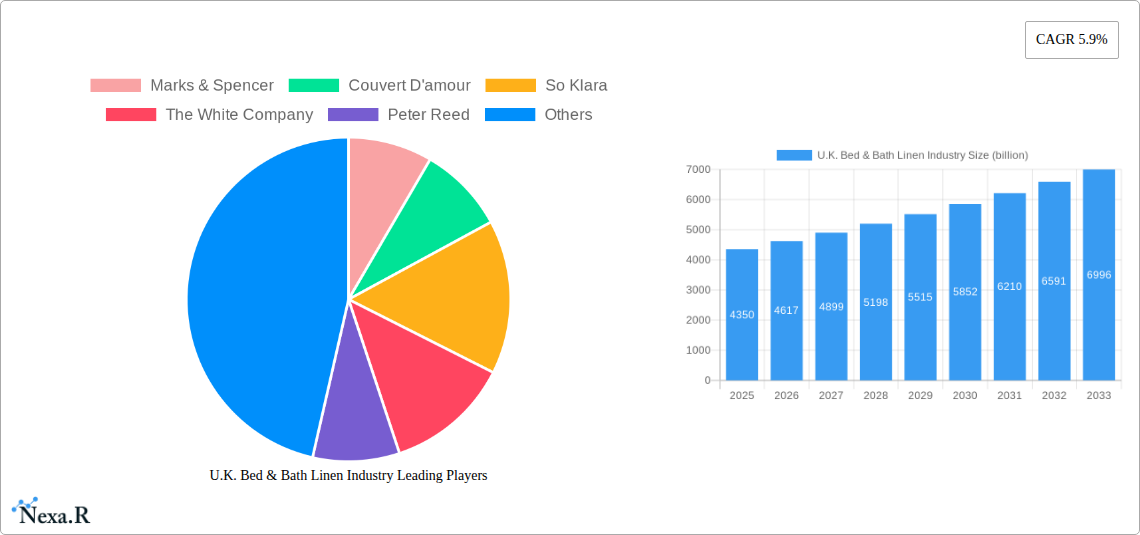

The U.K. Bed & Bath Linen Industry is poised for significant growth, with a projected market size of £4.35 billion in 2025. Driven by evolving consumer preferences for comfort, luxury, and sustainable materials, the market is expected to expand at a Compound Annual Growth Rate (CAGR) of 5.9% through 2033. This robust growth is fueled by increasing disposable incomes, a heightened focus on home décor and well-being, and a rising demand for premium and eco-friendly bedding and bath products. Retailers are responding to these trends by offering a wider array of innovative designs, high-quality fabrics, and personalized options. The market also benefits from a strong online retail presence, making these products more accessible to a broader consumer base.

U.K. Bed & Bath Linen Industry Market Size (In Billion)

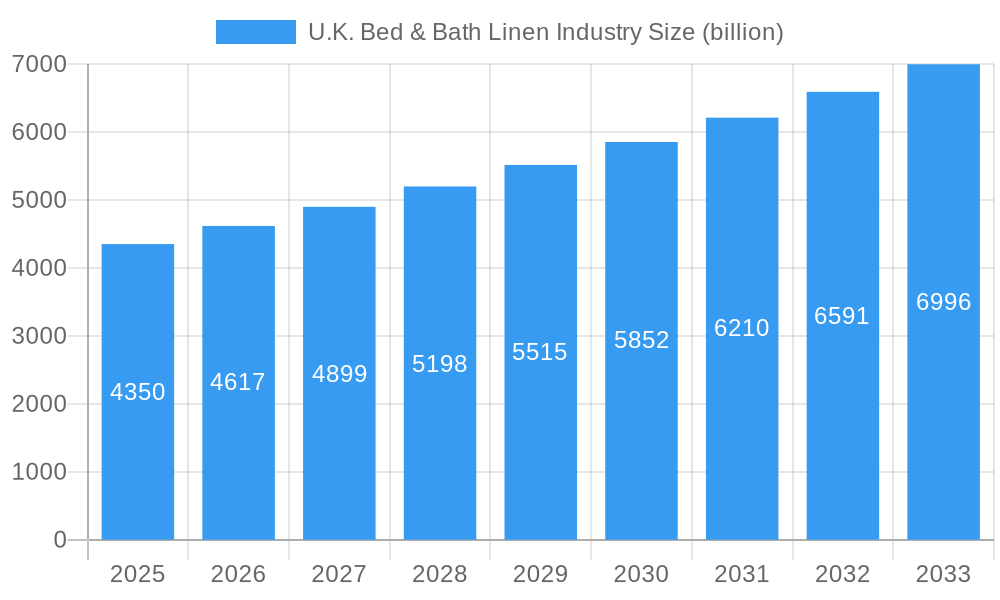

Several factors are shaping the trajectory of the U.K. Bed & Bath Linen Industry. While strong consumer spending on home goods and the persistent demand for quality linens act as key drivers, the market also faces certain restraints. Fluctuations in raw material prices, such as cotton, and potential supply chain disruptions can impact profitability. However, the increasing adoption of advanced manufacturing techniques and the growing emphasis on antimicrobial and hypoallergenic properties in textiles are emerging trends that are likely to foster further innovation and market expansion. The competitive landscape features established players like IKEA, Dunelm, and Marks & Spencer, alongside niche brands like The White Company and Couvert D'amour, all vying for market share by focusing on quality, design, and sustainability.

U.K. Bed & Bath Linen Industry Company Market Share

Here's your SEO-optimized report description for the U.K. Bed & Bath Linen Industry, designed for maximum visibility and engagement with industry professionals.

U.K. Bed & Bath Linen Industry: Market Analysis, Trends & Forecast 2019-2033

Gain unparalleled insights into the dynamic U.K. Bed & Bath Linen Industry. This comprehensive report dissects market size, growth trajectories, and strategic opportunities, offering an in-depth analysis of the bed linen market UK, bath linen market UK, and the broader home textile market UK. Covering the study period 2019–2033, with a base year and estimated year of 2025, this report is essential for manufacturers, retailers, distributors, and investors navigating the UK bedding industry and UK towels market. Explore critical segments including production analysis, consumption analysis, import market analysis (value & volume), export market analysis (value & volume), price trend analysis, and key industry developments. Discover the influence of luxury bed linen UK and the burgeoning sustainable bed linen UK trends, alongside insights into parent and child market interdependencies.

U.K. Bed & Bath Linen Industry Market Dynamics & Structure

The U.K. Bed & Bath Linen Industry is characterized by a moderately concentrated market, with a blend of established brands and emerging players vying for market share. Key companies like Dunelm, IKEA, and Marks & Spencer command significant presence, particularly within the mass-market segment. The luxury bed linen UK sector, however, sees strong competition from specialized brands such as The White Company and Victoria Linen. Technological innovation is largely driven by advancements in fabric technology, sustainable material development, and increasingly, e-commerce integration for direct-to-consumer sales. Regulatory frameworks primarily revolve around product safety standards, material sourcing transparency, and evolving environmental regulations impacting textile production and disposal.

- Market Concentration: Dominated by a few large retailers, but with strong niche players.

- Technological Innovation: Focus on fabric performance, eco-friendly materials, and supply chain efficiency.

- Regulatory Frameworks: Product safety, sustainability standards, and import/export regulations.

- Competitive Product Substitutes: Wide range of materials and price points, impacting consumer choice.

- End-User Demographics: Diverse, from budget-conscious consumers to high-net-worth individuals seeking premium quality.

- M&A Trends: Driven by consolidation, brand acquisition, and expansion into new market segments, with an estimated xx deal volumes in the historical period.

U.K. Bed & Bath Linen Industry Growth Trends & Insights

The U.K. Bed & Bath Linen Industry has demonstrated robust growth over the historical period (2019-2024), propelled by evolving consumer preferences for comfort, aesthetics, and sustainable living. The market size is projected to continue its upward trajectory through the forecast period (2025–2033), with an estimated CAGR of xx%. Adoption rates for premium and eco-friendly linens are increasing, reflecting a growing consumer consciousness towards health and environmental impact. Technological disruptions, including advanced material treatments for enhanced durability and hygiene, alongside the expansion of online retail channels, are reshaping the landscape. Consumer behavior shifts are evident in the increased demand for personalized bedding solutions, a greater emphasis on natural and organic materials like organic cotton bedding UK, and a willingness to invest in higher quality, longer-lasting products. This evolution in demand significantly influences the UK bedding market size and the UK towel market size. The influence of the parent market (overall home furnishings) on the child market (bed and bath linen) is significant, with trends in interior design and home décor directly impacting linen choices. For instance, a surge in home renovation projects often correlates with increased spending on premium bed and bath linens. Conversely, economic downturns in the parent market can lead to reduced discretionary spending on higher-ticket linen items. The report leverages extensive market data to project the market size of bed linen in the UK and the UK bath linen market value, providing a granular understanding of these interconnected segments.

Dominant Regions, Countries, or Segments in U.K. Bed & Bath Linen Industry

Within the U.K. Bed & Bath Linen Industry, Consumption Analysis emerges as the most dominant segment driving market growth. The U.K. domestic market, with its high disposable income and established consumer culture for home décor, represents a substantial consumption base. London and the South East of England are particularly strong regions, reflecting higher population density and a greater concentration of consumers with a propensity for premium and luxury bedding and bath textiles.

- Consumption Analysis Dominance: Driven by strong consumer demand, a culture of home comfort, and significant retail presence.

- Key Drivers for Consumption:

- Disposable Income: High levels of disposable income support spending on home goods.

- Home Renovation Trends: Increased investment in home improvement fuels demand for updated linens.

- E-commerce Penetration: Easy online access to a wide variety of products, including specialized items like Egyptian cotton sheets UK.

- Seasonal Demand: Peaks during holiday seasons and periods of home redecoration.

- Parent Market Influence: The overall U.K. home furnishings market significantly impacts bed and bath linen consumption, with trends in interior design directly translating into linen choices.

- Child Market Interdependence: The bed linen market UK and bath linen market UK are closely linked; consumers often purchase coordinating sets or consider their bath linens when selecting bedding, and vice versa. This creates a synergistic effect on overall U.K. home textile market growth.

- Economic Policies: Supportive economic policies, including low inflation and stable employment, bolster consumer confidence and spending on non-essential home goods.

- Growth Potential: Continued growth is expected due to ongoing urbanization and the enduring importance of home as a sanctuary, making the U.K. a prime market for bedding and bath linens.

U.K. Bed & Bath Linen Industry Product Landscape

The U.K. Bed & Bath Linen Industry is characterized by a diverse product landscape encompassing a wide array of materials, styles, and functionalities. Innovations focus on enhancing comfort, durability, and sustainability. Key product categories include bed sheets, duvet covers, pillowcases, quilts, blankets, towels (bath, hand, face), and bath mats. Performance metrics are increasingly scrutinized, with consumers seeking high thread counts, breathability, softness, and hypoallergenic properties for bed linens, and absorbency, quick-drying capabilities, and plushness for bath linens. Unique selling propositions often revolve around material origin (e.g., organic cotton bedding UK, Egyptian cotton sheets UK), intricate designs (e.g., bespoke prints by Mairi Helena), and ethical manufacturing processes. Technological advancements are evident in treated fabrics that offer antimicrobial properties or enhanced stain resistance.

Key Drivers, Barriers & Challenges in U.K. Bed & Bath Linen Industry

The U.K. Bed & Bath Linen Industry is propelled by several key drivers, including rising consumer spending on home comfort and aesthetics, a growing demand for sustainable and ethically sourced products, and the convenience offered by online retail channels. Technological advancements in textile manufacturing, such as improved dyeing techniques and the development of innovative, eco-friendly materials, also act as significant growth catalysts.

- Key Drivers:

- Increased focus on home comfort and interior design.

- Growing consumer preference for sustainable and organic materials.

- Expansion of e-commerce and direct-to-consumer sales models.

- Innovation in fabric technology for enhanced performance and durability.

Conversely, the industry faces significant barriers and challenges. Volatile raw material costs, particularly for cotton, can impact pricing and profitability. Intense competition from both domestic and international manufacturers, including low-cost alternatives, poses a constant threat. Supply chain disruptions, exacerbated by global events, can lead to stockouts and increased lead times. Furthermore, evolving consumer preferences and the need for continuous product innovation require substantial investment.

- Key Barriers & Challenges:

- Fluctuations in raw material prices (e.g., cotton, linen).

- Intense price competition and the presence of low-cost imports.

- Supply chain complexities and potential disruptions.

- The need for continuous innovation and adaptation to changing trends.

- Environmental regulations and increasing consumer demand for eco-friendly practices.

Emerging Opportunities in U.K. Bed & Bath Linen Industry

Emerging opportunities in the U.K. Bed & Bath Linen Industry lie in the expanding market for sustainable and ethically produced linens, tapping into the growing consumer consciousness. The demand for personalized and bespoke linen collections, catering to individual design preferences, presents a significant untapped market. Furthermore, the increasing popularity of smart home technologies could lead to innovative functional linens with integrated features.

- Sustainable & Ethical Products: Focus on organic, recycled, and Fair Trade certifications.

- Personalization & Bespoke Designs: Offering customization options for size, fabric, and prints.

- Functional Linens: Developing linens with enhanced properties like temperature regulation or easy-care finishes.

- Elderly & Niche Markets: Tailoring products for specific demographic needs.

Growth Accelerators in the U.K. Bed & Bath Linen Industry Industry

Several catalysts are set to accelerate long-term growth in the U.K. Bed & Bath Linen Industry. Strategic partnerships between manufacturers and retailers can streamline supply chains and enhance market reach. Technological breakthroughs in textile engineering, leading to more durable, comfortable, and sustainable fabrics, will be crucial. Market expansion through innovative product lines and effective branding strategies, particularly focusing on the wellness and eco-conscious consumer segments, will also be a key growth driver.

- Strategic Partnerships: Collaborations to optimize distribution and marketing efforts.

- Technological Advancements: Innovations in material science and textile production.

- Brand Storytelling: Emphasizing sustainability, quality, and provenance.

- Digital Transformation: Enhancing online presence and customer engagement.

Key Players Shaping the U.K. Bed & Bath Linen Industry Market

- Marks & Spencer

- Couvert D'amour

- So Klara

- The White Company

- Peter Reed

- Dunelm

- Primark

- IKEA

- Finest Linen Company

- John Lewis and Partners

- Victoria Linen

- Ralph Lauren Corporation

- Debenhams

- Coco and Wolf

- Emma Hardicker

- Mairi Helena

- NEXT

Notable Milestones in U.K. Bed & Bath Linen Industry Sector

- May 2023: Standard Fiber, a key supplier to home textile and hospitality markets, secured a licensing agreement with Highclere Castle, empowering them to develop and distribute a wide range of bed, bath, and pet products.

- April 2023: XPO logistics was awarded a multi-year contract for comprehensive end-to-end supply chain management for luxury bed and bath linen retailer Christy England across all channels in the UK and Ireland. This collaboration focused on designing a bespoke supply chain solution, integrating inbound logistics from various manufacturing sites and warehousing at XPO's facilities.

In-Depth U.K. Bed & Bath Linen Industry Market Outlook

The U.K. Bed & Bath Linen Industry is poised for sustained growth, fueled by a confluence of factors including evolving consumer lifestyles, a heightened emphasis on home comfort, and a growing demand for sustainable products. Strategic initiatives such as enhanced direct-to-consumer (DTC) channels, investment in eco-friendly manufacturing processes, and the development of innovative, high-performance textiles will act as primary growth accelerators. The market outlook suggests a significant opportunity for brands that can effectively communicate their commitment to quality, sustainability, and ethical sourcing, thereby building strong brand loyalty within the discerning U.K. consumer base. Exploring niche markets and personalized offerings will further solidify market position and capture incremental value.

U.K. Bed & Bath Linen Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

U.K. Bed & Bath Linen Industry Segmentation By Geography

- 1. U.K.

U.K. Bed & Bath Linen Industry Regional Market Share

Geographic Coverage of U.K. Bed & Bath Linen Industry

U.K. Bed & Bath Linen Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Hospitality Sector is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruptions are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Increasing Number of Hotel Constructions Growing the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. U.K. Bed & Bath Linen Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. U.K.

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Marks & Spencer

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Couvert D'amour

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 So Klara

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The White Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Peter Reed

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dunelm

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Primark

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 IKEA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Finest Linen Company**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 John Lewis and Partners

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Victoria Linen

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Ralph Lauren Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Debenhams

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Coco and Wolf

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Emma Hardicker

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Mairi Helena

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 NEXT

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Marks & Spencer

List of Figures

- Figure 1: U.K. Bed & Bath Linen Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: U.K. Bed & Bath Linen Industry Share (%) by Company 2025

List of Tables

- Table 1: U.K. Bed & Bath Linen Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: U.K. Bed & Bath Linen Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: U.K. Bed & Bath Linen Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: U.K. Bed & Bath Linen Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: U.K. Bed & Bath Linen Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: U.K. Bed & Bath Linen Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: U.K. Bed & Bath Linen Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: U.K. Bed & Bath Linen Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: U.K. Bed & Bath Linen Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: U.K. Bed & Bath Linen Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: U.K. Bed & Bath Linen Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: U.K. Bed & Bath Linen Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the U.K. Bed & Bath Linen Industry?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the U.K. Bed & Bath Linen Industry?

Key companies in the market include Marks & Spencer, Couvert D'amour, So Klara, The White Company, Peter Reed, Dunelm, Primark, IKEA, Finest Linen Company**List Not Exhaustive, John Lewis and Partners, Victoria Linen, Ralph Lauren Corporation, Debenhams, Coco and Wolf, Emma Hardicker, Mairi Helena, NEXT.

3. What are the main segments of the U.K. Bed & Bath Linen Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.35 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth in Hospitality Sector is Driving the Market.

6. What are the notable trends driving market growth?

Increasing Number of Hotel Constructions Growing the Market.

7. Are there any restraints impacting market growth?

Supply Chain Disruptions are Restraining the Market.

8. Can you provide examples of recent developments in the market?

May 2023: Standard Fiber, one of the suppliers to the home textile and hospitality markets, has established a licensing agreement with Highclere Castle, enabling the company the rights to develop and distribute a broad assortment of bed, bath, and pet products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "U.K. Bed & Bath Linen Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the U.K. Bed & Bath Linen Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the U.K. Bed & Bath Linen Industry?

To stay informed about further developments, trends, and reports in the U.K. Bed & Bath Linen Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence