Key Insights

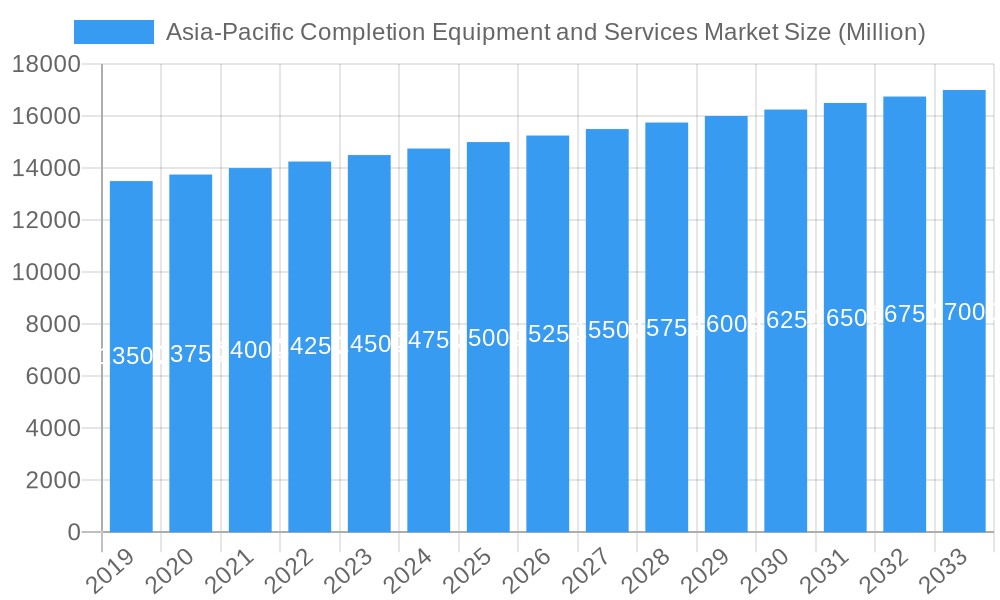

The Asia-Pacific Completion Equipment and Services Market is projected for substantial growth, with an estimated market size of $4.41 billion by 2024, expanding at a Compound Annual Growth Rate (CAGR) of 7.8% from 2024 to 2033. This expansion is driven by increasing regional energy demands, fueled by economic development and industrialization in major economies such as China, India, and Malaysia. The emphasis on optimizing oil and gas production and extending the operational life of existing wells further elevates demand for advanced completion equipment and specialized services. The market encompasses both onshore and offshore deployments, with offshore operations anticipated to grow significantly due to exploration in deeper reserves and complex geological structures. Key players are investing in innovative technologies to address the diverse challenges within the Asia-Pacific hydrocarbon basins.

Asia-Pacific Completion Equipment and Services Market Market Size (In Billion)

Market growth is further influenced by supportive government policies focused on energy security and substantial investments in upstream oil and gas exploration and production (E&P). Essential drivers include the adoption of enhanced oil recovery (EOR) techniques and sophisticated well completion technologies like intelligent completions and multistage fracturing for maximized resource extraction. Potential restraints include volatile crude oil prices, stringent environmental regulations, and the growing shift towards sustainable energy alternatives. Despite these factors, the inherent energy needs of developing Asia-Pacific nations, coupled with technological advancements from leading companies including Schlumberger Ltd, Baker Hughes Company, and China Oilfield Services Ltd, ensure a positive growth trajectory for the completion equipment and services sector. China and India are leading market demand, supported by significant contributions from Malaysia and Indonesia.

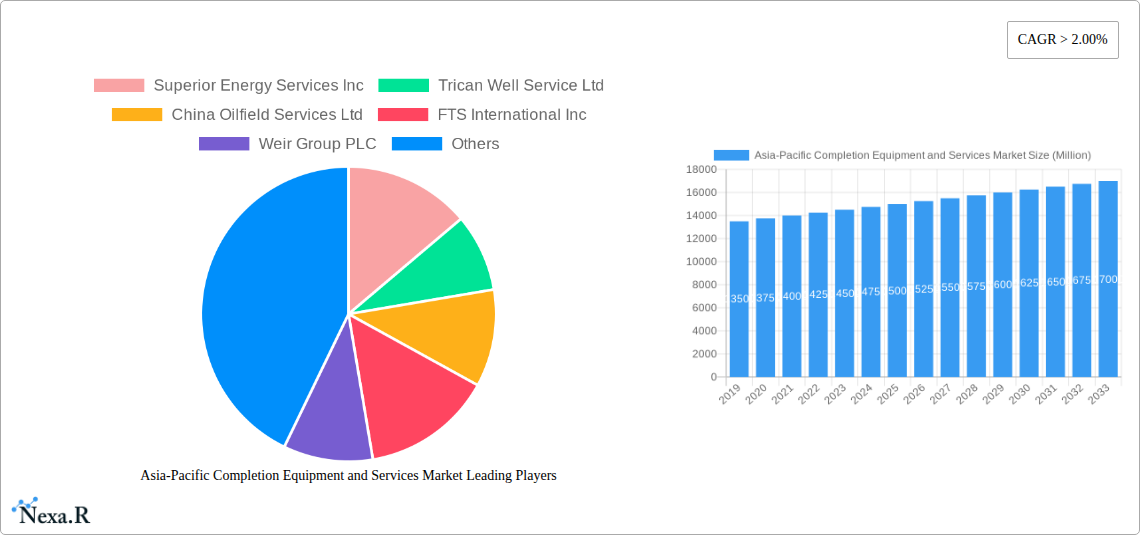

Asia-Pacific Completion Equipment and Services Market Company Market Share

This comprehensive report offers an in-depth analysis of the Asia-Pacific Completion Equipment and Services Market, forecasting its evolution from 2024 to 2033. Based on a 2024 base year, the study examines critical market dynamics, growth trends, regional leadership, product offerings, key drivers, challenges, emerging opportunities, and prominent players. This report is an essential resource for industry stakeholders seeking to understand the evolving landscape of oil and gas well completion in the Asia-Pacific region, a vital hub for energy production and exploration. All data is presented in billions for clear and actionable insights.

Asia-Pacific Completion Equipment and Services Market Market Dynamics & Structure

The Asia-Pacific completion equipment and services market exhibits a dynamic and evolving structure, characterized by a moderate level of market concentration. Key players like Schlumberger Ltd, Baker Hughes Company, and National-Oilwell Varco Inc. hold significant market shares, but the presence of regional specialists and emerging innovators contributes to a competitive landscape. Technological innovation is a primary driver, with continuous advancements in smart completions, intelligent intervention tools, and digital solutions aimed at enhancing well productivity, reducing operational costs, and improving safety. Regulatory frameworks, while generally supportive of energy exploration, can vary across countries, influencing investment and operational strategies. Competitive product substitutes are primarily driven by the ongoing pursuit of more efficient and cost-effective completion methods, including advancements in materials science and downhole tool technology. End-user demographics are shifting towards operators seeking integrated service solutions and tailored completion designs to optimize production from diverse reservoir conditions. Mergers and acquisitions (M&A) trends, though not pervasive, are strategic, often involving consolidation for market access or acquisition of specialized technologies. The market share for leading companies is estimated to be around xx% for the top 5 players combined, with M&A deal volumes averaging xx per year in the historical period. Innovation barriers include the high capital expenditure required for R&D and the cyclical nature of the oil and gas industry, which can impact investment appetite.

- Market Concentration: Moderate, with a blend of global giants and regional players.

- Technological Innovation: Driven by smart completions, digital solutions, and advanced downhole tools.

- Regulatory Frameworks: Varied across the region, impacting operational strategies.

- Competitive Substitutes: Focus on efficiency, cost-effectiveness, and performance optimization.

- End-User Demographics: Increasing demand for integrated services and customized solutions.

- M&A Trends: Strategic acquisitions for technology and market access.

- Innovation Barriers: High R&D costs and industry cyclicality.

Asia-Pacific Completion Equipment and Services Market Growth Trends & Insights

The Asia-Pacific completion equipment and services market is poised for robust growth, driven by escalating energy demand, ongoing exploration and production (E&P) activities, and a strategic focus on maximizing hydrocarbon recovery from existing and new fields. The market size is projected to expand significantly, moving from an estimated USD XXXX Million in the base year 2025 to an anticipated USD XXXX Million by 2033, reflecting a Compound Annual Growth Rate (CAGR) of approximately xx%. Adoption rates of advanced completion technologies, such as intelligent completion systems and multi-stage fracturing, are steadily increasing as operators prioritize efficiency and production optimization. Technological disruptions, including the integration of artificial intelligence (AI) and machine learning (ML) for real-time data analysis and predictive maintenance of downhole equipment, are transforming operational paradigms. Consumer behavior shifts are evident, with a growing preference for service providers offering end-to-end solutions, encompassing design, equipment supply, and specialized intervention services. The market penetration of sophisticated completion techniques is expected to rise as operators seek to unlock reserves in increasingly challenging geological formations, both onshore and offshore. Furthermore, the growing emphasis on enhanced oil recovery (EOR) techniques necessitates advanced completion solutions to maximize the efficiency of these processes. The historical period (2019-2024) saw a market size evolution from USD XXXX Million to USD XXXX Million, indicating steady progress prior to the projected acceleration.

- Market Size Evolution: Significant expansion projected from USD XXXX Million (2025) to USD XXXX Million (2033).

- CAGR: Estimated at xx% for the forecast period (2025-2033).

- Adoption Rates: Increasing for smart completions and multi-stage fracturing.

- Technological Disruptions: AI and ML integration for data analysis and predictive maintenance.

- Consumer Behavior: Preference for integrated, end-to-end service solutions.

- Market Penetration: Rising for advanced completion techniques in challenging reservoirs.

- EOR Focus: Driving demand for specialized completion equipment.

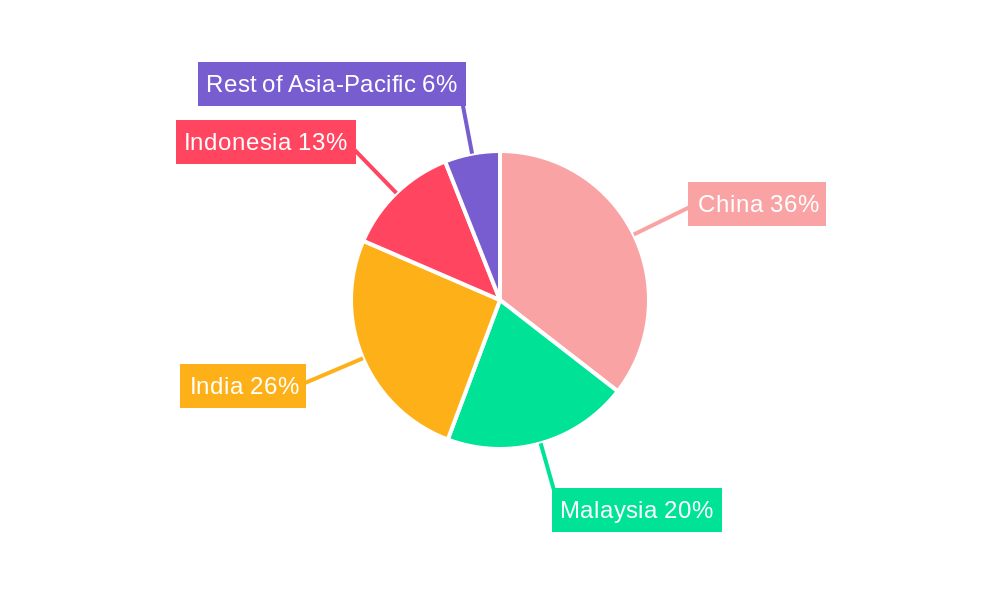

Dominant Regions, Countries, or Segments in Asia-Pacific Completion Equipment and Services Market

Within the Asia-Pacific completion equipment and services market, China emerges as a dominant region, driven by its vast energy reserves, substantial domestic demand, and aggressive investments in both onshore and offshore exploration and production. The country’s commitment to energy security fuels continuous development, necessitating advanced completion technologies and services. Its significant market share, estimated at xx% of the total Asia-Pacific market in 2025, is underpinned by a robust industrial base and a growing number of domestic oilfield service providers, alongside the presence of international giants.

- China's Dominance: Fueled by extensive E&P activities and energy security imperatives.

- Market Share: Estimated at xx% of the Asia-Pacific market in 2025.

- Key Drivers: Strong domestic demand, substantial reserves, and government support for energy independence.

- Infrastructure Development: Extensive investments in pipelines and processing facilities, requiring efficient well completions.

- Technological Adoption: Rapid uptake of advanced completion techniques to optimize production from complex formations.

- Regulatory Environment: Favorable policies promoting exploration and production activities.

- Growth Potential: Significant, with ongoing projects and new exploration frontiers.

Beyond China, Offshore deployments represent a key segment driving market growth across the Asia-Pacific. The region’s extensive coastlines and substantial offshore reserves, particularly in countries like Malaysia and Indonesia, necessitate specialized equipment and services for deepwater and complex subsea completions. The offshore segment is expected to contribute approximately xx% to the total market revenue in 2025.

- Offshore Segment Growth: Driven by exploration in deepwater and complex subsea environments.

- Key Regions: Malaysia and Indonesia are significant contributors to offshore completion activities.

- Technological Demand: High demand for subsea completion systems, risers, and production control equipment.

- Investment Trends: Sustained investment in offshore E&P projects.

- Challenges: Logistical complexities and stringent safety regulations in offshore operations.

India also presents a substantial growth opportunity, with government initiatives aimed at increasing domestic oil and gas production and a growing focus on unconventional resources, driving demand for specialized completion solutions. The "Rest of Asia-Pacific" segment, encompassing countries like Vietnam, Thailand, and Australia, collectively contributes significantly due to diverse E&P landscapes and evolving energy needs.

- India's Potential: Driven by energy security goals and unconventional resource development.

- Rest of Asia-Pacific Significance: Collective growth from diverse E&P environments.

Asia-Pacific Completion Equipment and Services Market Product Landscape

The product landscape in the Asia-Pacific completion equipment and services market is characterized by a focus on advanced, high-performance solutions designed to enhance well productivity and operational efficiency. Key product categories include completion strings, downhole tools (such as packers, safety valves, and intelligent control systems), sand screens, and artificial lift systems. Innovations are centered on materials science for enhanced durability in harsh environments, smart technologies for remote monitoring and control, and modular designs for ease of deployment and serviceability. Performance metrics are increasingly evaluated based on uptime, production optimization, and reduction in operational downtime. Unique selling propositions often lie in the integration of digital technologies for real-time data analysis and predictive maintenance, leading to reduced intervention costs and improved well integrity.

Key Drivers, Barriers & Challenges in Asia-Pacific Completion Equipment and Services Market

Key Drivers: The primary forces propelling the Asia-Pacific completion equipment and services market include the region's escalating energy demand, driving continued exploration and production activities. Government policies aimed at enhancing energy security and self-sufficiency are significant catalysts. Technological advancements in intelligent completions and enhanced oil recovery (EOR) techniques are critical drivers, enabling operators to maximize hydrocarbon extraction from existing and challenging reservoirs. Economic growth and increasing investments in the oil and gas sector across key Asia-Pacific nations further fuel market expansion.

- Escalating Energy Demand

- Government Energy Security Policies

- Technological Advancements (Intelligent Completions, EOR)

- Increased Oil & Gas Investments

Barriers & Challenges: Supply chain disruptions, exacerbated by geopolitical events and logistical complexities, pose significant challenges. Stringent environmental regulations and increasing scrutiny on carbon emissions can impact project timelines and operational costs. The high capital expenditure required for specialized completion equipment and services can be a barrier, particularly for smaller operators. Furthermore, a shortage of skilled labor in specialized areas of well completion and intervention presents a persistent challenge. Price volatility in crude oil can also influence investment decisions and, consequently, the demand for completion services.

- Supply Chain Disruptions

- Stringent Environmental Regulations

- High Capital Expenditure Requirements

- Shortage of Skilled Labor

- Crude Oil Price Volatility

Emerging Opportunities in Asia-Pacific Completion Equipment and Services Market

Emerging opportunities in the Asia-Pacific completion equipment and services market lie in the increasing focus on unconventional resources, such as shale gas and coal bed methane, which require specialized completion techniques. The development of marginal and mature fields presents a significant opportunity for enhanced oil recovery (EOR) services and intelligent intervention solutions. Furthermore, the growing adoption of digital technologies, including AI-powered analytics for well performance optimization and predictive maintenance, opens new avenues for service providers. The untapped potential in emerging economies within the Asia-Pacific region, with their growing energy needs, also presents a significant growth frontier for completion equipment and services.

Growth Accelerators in the Asia-Pacific Completion Equipment and Services Market Industry

Long-term growth in the Asia-Pacific completion equipment and services market is being accelerated by significant technological breakthroughs in downhole monitoring and control systems, enabling more efficient and precise well management. Strategic partnerships between global service providers and local operators are fostering market penetration and technology transfer. The ongoing expansion of offshore exploration and production activities in regions with substantial untapped reserves acts as a major growth accelerator. Furthermore, the increasing emphasis on sustainability and the development of lower-carbon energy solutions are driving innovation in completion technologies that minimize environmental impact.

Key Players Shaping the Asia-Pacific Completion Equipment and Services Market Market

- Superior Energy Services Inc

- Trican Well Service Ltd

- China Oilfield Services Ltd

- FTS International Inc

- Weir Group PLC

- Schlumberger Ltd

- Weatherford International PLC

- Baker Hughes Company

- National-Oilwell Varco Inc

- Schoeller-Bleckmann Oilfield Equipment AG

- Welltec AS

Notable Milestones in Asia-Pacific Completion Equipment and Services Market Sector

- August 2022: Shell Australia submitted an environment plan (EP) to the country's offshore authority for development drilling on the Crux natural gas field, seeking authorization for drilling and well completion activities. This signifies ongoing investment in offshore exploration and the associated demand for completion services.

- January 2022: OEG Offshore announced an exclusive distribution agreement with well-completion installation solutions provider Blue Manta International, expanding the reach of packaged completion equipment across Asia Pacific, indicating strategic channel development and market access initiatives.

In-Depth Asia-Pacific Completion Equipment and Services Market Market Outlook

The future of the Asia-Pacific completion equipment and services market is characterized by sustained growth, driven by the region's insatiable appetite for energy and its commitment to optimizing hydrocarbon production. Strategic opportunities lie in the burgeoning demand for intelligent completions and advanced EOR solutions that can unlock the full potential of complex reservoirs. The ongoing digital transformation of the oil and gas industry presents a pivotal growth accelerator, with AI and data analytics poised to revolutionize well performance management and operational efficiency. As energy portfolios evolve, innovative completion technologies that prioritize environmental sustainability and reduced operational footprints will gain increasing prominence, further shaping the market's trajectory.

Asia-Pacific Completion Equipment and Services Market Segmentation

-

1. Location of Deployment

- 1.1. Onshore

- 1.2. Offshore

-

2. Geography

- 2.1. China

- 2.2. Malaysia

- 2.3. India

- 2.4. Indonesia

- 2.5. Rest of Asia-Pacific

Asia-Pacific Completion Equipment and Services Market Segmentation By Geography

- 1. China

- 2. Malaysia

- 3. India

- 4. Indonesia

- 5. Rest of Asia Pacific

Asia-Pacific Completion Equipment and Services Market Regional Market Share

Geographic Coverage of Asia-Pacific Completion Equipment and Services Market

Asia-Pacific Completion Equipment and Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Global Inclination toward Renewable-based Power Generation4.; Increased Power Demand in Line with the Increasing Population

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Cost

- 3.4. Market Trends

- 3.4.1. Offshore Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Completion Equipment and Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. Malaysia

- 5.2.3. India

- 5.2.4. Indonesia

- 5.2.5. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. Malaysia

- 5.3.3. India

- 5.3.4. Indonesia

- 5.3.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. China Asia-Pacific Completion Equipment and Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.1.1. Onshore

- 6.1.2. Offshore

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. Malaysia

- 6.2.3. India

- 6.2.4. Indonesia

- 6.2.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7. Malaysia Asia-Pacific Completion Equipment and Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.1.1. Onshore

- 7.1.2. Offshore

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. Malaysia

- 7.2.3. India

- 7.2.4. Indonesia

- 7.2.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8. India Asia-Pacific Completion Equipment and Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.1.1. Onshore

- 8.1.2. Offshore

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. Malaysia

- 8.2.3. India

- 8.2.4. Indonesia

- 8.2.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9. Indonesia Asia-Pacific Completion Equipment and Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.1.1. Onshore

- 9.1.2. Offshore

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. Malaysia

- 9.2.3. India

- 9.2.4. Indonesia

- 9.2.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 10. Rest of Asia Pacific Asia-Pacific Completion Equipment and Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 10.1.1. Onshore

- 10.1.2. Offshore

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. Malaysia

- 10.2.3. India

- 10.2.4. Indonesia

- 10.2.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Superior Energy Services Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Trican Well Service Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 China Oilfield Services Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 FTS International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Weir Group PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Schlumberger Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Weatherford International PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Baker Hughes Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 National-Oilwell Varco Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Schoeller-Bleckmann Oilfield Equipment AG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Welltec AS

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Superior Energy Services Inc

List of Figures

- Figure 1: Asia-Pacific Completion Equipment and Services Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Completion Equipment and Services Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Completion Equipment and Services Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 2: Asia-Pacific Completion Equipment and Services Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: Asia-Pacific Completion Equipment and Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific Completion Equipment and Services Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 5: Asia-Pacific Completion Equipment and Services Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Completion Equipment and Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Asia-Pacific Completion Equipment and Services Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 8: Asia-Pacific Completion Equipment and Services Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: Asia-Pacific Completion Equipment and Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Asia-Pacific Completion Equipment and Services Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 11: Asia-Pacific Completion Equipment and Services Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Completion Equipment and Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Completion Equipment and Services Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 14: Asia-Pacific Completion Equipment and Services Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Completion Equipment and Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Completion Equipment and Services Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 17: Asia-Pacific Completion Equipment and Services Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Asia-Pacific Completion Equipment and Services Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Completion Equipment and Services Market?

The projected CAGR is approximately 7.8%.

2. Which companies are prominent players in the Asia-Pacific Completion Equipment and Services Market?

Key companies in the market include Superior Energy Services Inc, Trican Well Service Ltd, China Oilfield Services Ltd, FTS International Inc, Weir Group PLC, Schlumberger Ltd, Weatherford International PLC, Baker Hughes Company, National-Oilwell Varco Inc, Schoeller-Bleckmann Oilfield Equipment AG, Welltec AS.

3. What are the main segments of the Asia-Pacific Completion Equipment and Services Market?

The market segments include Location of Deployment, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.41 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Global Inclination toward Renewable-based Power Generation4.; Increased Power Demand in Line with the Increasing Population.

6. What are the notable trends driving market growth?

Offshore Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Initial Cost.

8. Can you provide examples of recent developments in the market?

In August 2022, Shell Australia, a subsidiary of the oil and gas giant Shell, submitted an environment plan (EP) to the country's offshore authority for development drilling on the Crux natural gas field off the coast of Western Australia. The company requested authorization for drilling and well completion activities in the Crux natural gas field by submitting paperwork.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Completion Equipment and Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Completion Equipment and Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Completion Equipment and Services Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Completion Equipment and Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence