Key Insights

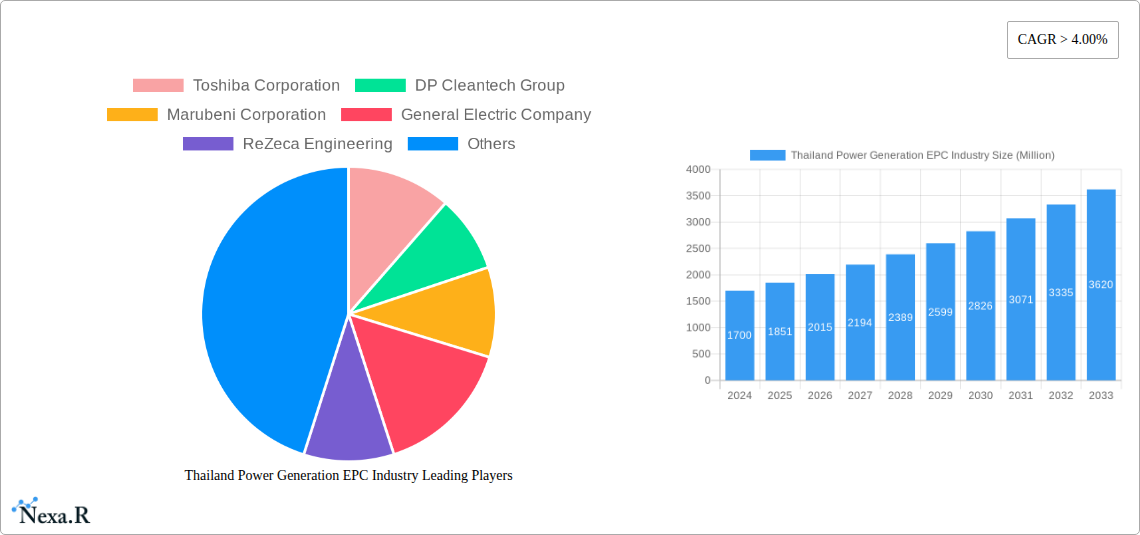

The Thailand Power Generation EPC Industry is poised for significant growth, driven by the nation's increasing energy demands and a strategic focus on modernizing its power infrastructure. With a current market size estimated at USD 1.7 billion in 2024, the industry is projected to expand at a robust Compound Annual Growth Rate (CAGR) of 9.1% through 2033. This expansion is fueled by critical drivers such as the ongoing need for new power plant constructions to meet rising electricity consumption from industrial, commercial, and residential sectors, as well as the imperative to upgrade existing, aging facilities for improved efficiency and environmental compliance. The Thai government's commitment to energy security and diversification, including investments in both conventional thermal power upgrades and a substantial push towards renewable energy sources, forms a strong foundation for this projected growth. Furthermore, the emphasis on adopting advanced technologies and smart grid solutions within power generation projects will also play a pivotal role in shaping the market landscape.

Thailand Power Generation EPC Industry Market Size (In Billion)

The industry's trajectory is characterized by a dynamic interplay of opportunities and challenges. While the expansion of renewable energy segments, including solar, wind, and potentially waste-to-energy, presents substantial opportunities for Engineering, Procurement, and Construction (EPC) companies, the evolving regulatory landscape and the need for skilled labor are key considerations. Trends indicate a growing preference for cleaner energy solutions, driving demand for EPC services in renewable energy projects and the retrofitting of existing plants for reduced emissions. Restraints, such as the high initial capital investment required for large-scale power projects and potential geopolitical uncertainties affecting supply chains, may pose challenges. However, the robust government support, coupled with the presence of established global and local players like Toshiba Corporation, General Electric Company, and Mitsubishi Heavy Industries Ltd, positions the Thailand Power Generation EPC Industry for sustained development and innovation.

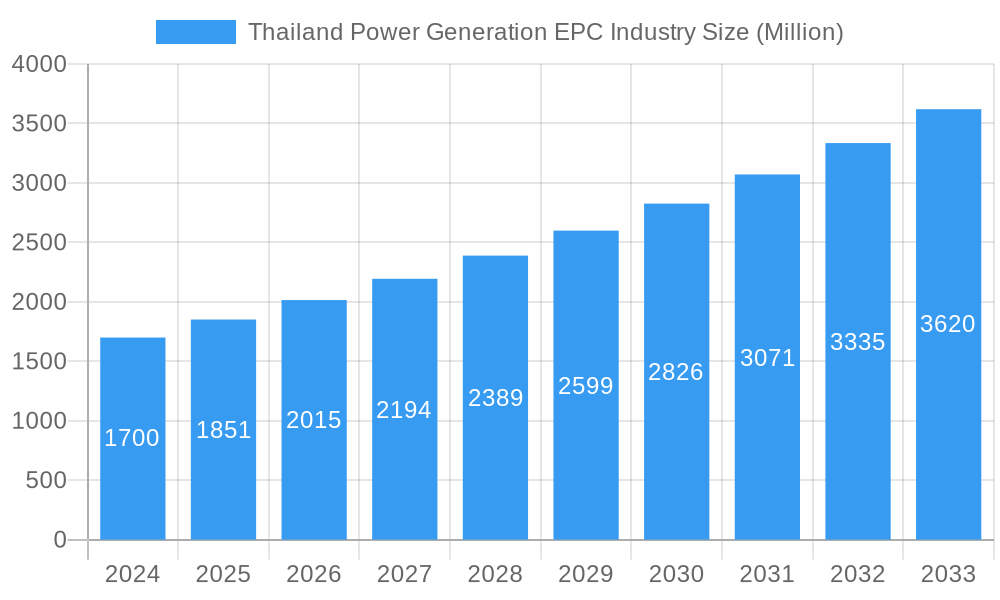

Thailand Power Generation EPC Industry Company Market Share

This comprehensive report provides an in-depth analysis of the Thailand Power Generation EPC (Engineering, Procurement, and Construction) industry, offering critical insights into market dynamics, growth trajectories, and key players. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is essential for industry stakeholders seeking to understand the evolving landscape of power project development in Thailand. The report leverages high-traffic keywords like "Thailand power generation," "EPC industry," "renewable energy Thailand," "thermal power projects," "energy infrastructure," and "Thailand energy market" to maximize search engine visibility and engagement. It examines both parent and child market segments, providing a holistic view of the sector. All monetary values are presented in billions of US dollars.

Thailand Power Generation EPC Industry Market Dynamics & Structure

The Thailand power generation EPC industry is characterized by a moderately concentrated market, with a few dominant players holding significant market share. Technological innovation is a key driver, particularly in the integration of renewable energy sources and the adoption of advanced, efficient conventional thermal power technologies. Regulatory frameworks, including government incentives for clean energy and stringent environmental standards, play a pivotal role in shaping project development and investment. Competitive product substitutes are emerging, primarily from advancements in energy storage solutions and decentralized power generation models. End-user demographics are shifting towards a greater demand for sustainable and reliable power. Mergers and acquisitions (M&A) trends are observed as companies seek to expand their capabilities, geographical reach, and technological portfolios. For instance, recent M&A activities in the broader APAC region suggest a consolidation trend aimed at achieving economies of scale and enhanced competitiveness.

- Market Concentration: The market is dominated by a mix of established international EPC firms and a growing number of local specialized contractors.

- Technological Innovation: Driven by a push for lower emissions and higher efficiency, innovations in gas turbine technology, renewable energy integration (solar, wind), and smart grid solutions are prominent.

- Regulatory Frameworks: Government policies promoting energy security, diversification of energy sources, and carbon emission reduction significantly influence project viability and EPC selection.

- Competitive Product Substitutes: Advancements in battery energy storage systems (BESS) and the increasing affordability of distributed solar PV are presenting alternatives to large-scale conventional power plants.

- End-User Demographics: Industrial sectors, commercial establishments, and a growing urban population are demanding consistent, high-quality power with a focus on sustainability.

- M&A Trends: Strategic alliances and acquisitions are likely to continue as firms aim to acquire new technologies, expand service offerings, and enter new market segments within Thailand and the surrounding region.

Thailand Power Generation EPC Industry Growth Trends & Insights

The Thailand power generation EPC industry is poised for robust growth, driven by the nation's expanding energy demands and its commitment to energy transition. The market size is projected to witness a significant upward trajectory, fueled by the continuous development of new power generation facilities across various segments. Adoption rates for renewable energy projects are accelerating, spurred by supportive government policies and declining technology costs. Technological disruptions, such as the integration of artificial intelligence (AI) in project management and the advancement of modular power plant construction, are transforming project execution efficiency. Consumer behavior shifts are also influencing the market, with a growing preference for cleaner energy sources and a demand for greater energy independence. The Compound Annual Growth Rate (CAGR) for the forecast period is estimated to be between 5.5% and 7.2%. Market penetration of utility-scale solar projects is expected to rise by approximately 15% by 2033. The increasing reliance on natural gas as a transitional fuel for thermal power plants will also sustain the demand for GTCC projects. Furthermore, the ongoing modernization of existing power infrastructure, coupled with the need to replace aging assets, will contribute to sustained market activity. The focus on energy efficiency and grid modernization will also drive investments in specialized EPC services, beyond just new plant construction. The government's long-term energy plans, emphasizing diversification and sustainability, will continue to be a critical factor in charting the growth path for the EPC sector. Investments in grid stability solutions to accommodate the increasing influx of intermittent renewable energy sources will also open new avenues for EPC providers.

Dominant Regions, Countries, or Segments in Thailand Power Generation EPC Industry

Within the Thailand power generation EPC industry, Conventional Thermal Power is currently the dominant segment, primarily driven by ongoing investments in natural gas-fired power plants. This dominance is further amplified by the country's strategic position in regional energy supply chains and its established infrastructure for natural gas procurement. The Renewables segment, while smaller in current market share for EPC contracts, exhibits the highest growth potential, propelled by Thailand's ambitious renewable energy targets and increasing investor confidence.

Conventional Thermal Power:

- Key Drivers:

- Energy Security: Reliance on stable, baseload power generation to meet industrial and residential demand.

- Natural Gas Availability: Favorable access to natural gas resources and infrastructure.

- Economic Development: Continued industrial growth necessitates substantial and reliable power supply.

- Technological Maturity: Proven efficiency and reliability of gas turbine combined cycle (GTCC) technology.

- Dominance Factors: Historically, conventional thermal power has been the backbone of Thailand's electricity generation, leading to established expertise and a robust supply chain for EPC services in this area. Current projects, such as the Hin Kong Power company Limited's 1.4GW natural gas-fired power plant, underscore its continued importance. The market share for conventional thermal power EPC contracts is estimated at approximately 65% in the current market landscape.

- Key Drivers:

Renewables:

- Key Drivers:

- Government Policies: Favorable feed-in tariffs (FiTs), tax incentives, and renewable portfolio standards.

- Environmental Concerns: Global and national commitment to reducing carbon emissions and combating climate change.

- Declining Technology Costs: Significant reductions in the cost of solar PV panels and wind turbines.

- International Commitments: Adherence to global climate agreements.

- Growth Potential: The renewable energy sector, particularly solar and, to a lesser extent, wind power, is experiencing rapid expansion. While currently representing a smaller portion of the EPC market, its growth trajectory is steep, projected to capture 25% of new EPC project value by 2033. Projects like the RATCH Cogeneration Expansion Project, incorporating gas engines alongside existing combined-cycle plants, signify a move towards hybrid solutions and increased efficiency, indirectly supporting the broader energy transition.

- Key Drivers:

Other Source Types: This segment encompasses emerging technologies like waste-to-energy, biomass, and potentially small modular reactors (SMRs) in the future. While these segments are currently niche, they represent significant future growth opportunities and contribute to market diversification, holding an estimated 10% of current EPC market value.

Thailand Power Generation EPC Industry Product Landscape

The product landscape within the Thailand power generation EPC industry is characterized by a dual focus on enhancing the efficiency and environmental performance of conventional power generation while aggressively integrating advanced renewable energy solutions. This includes the deployment of high-efficiency gas turbines, like those from Kawasaki Heavy Industries, for combined-cycle power plants, optimizing fuel consumption and reducing emissions. Simultaneously, EPC providers are increasingly offering comprehensive solutions for utility-scale solar farms, integrating advanced photovoltaic technologies and smart inverters. The application of sophisticated project management software and digital twin technologies is also becoming standard for optimizing construction and operational phases, ensuring timely and cost-effective project delivery. Performance metrics emphasize reliability, grid integration capabilities, and lifecycle cost reduction.

Key Drivers, Barriers & Challenges in Thailand Power Generation EPC Industry

Key Drivers:

- Growing Energy Demand: Thailand's expanding economy and population necessitate continuous investment in new power generation capacity.

- Government Support for Renewables: Ambitious targets and attractive incentives for clean energy projects are accelerating adoption.

- Technological Advancements: Innovations in efficiency, emissions reduction, and renewable energy integration are creating new project opportunities.

- Energy Security Concerns: Diversification of energy sources enhances national energy independence and resilience.

- Foreign Direct Investment: Attracting international expertise and capital for large-scale power projects.

Barriers & Challenges:

- Supply Chain Volatility: Global disruptions can impact the availability and cost of critical equipment and materials.

- Regulatory Hurdles and Permitting: Complex and time-consuming approval processes can delay project timelines.

- Skilled Workforce Shortage: A lack of specialized engineers and technicians can pose a constraint on project execution.

- Financing Accessibility: Securing substantial capital for large-scale, long-term projects can be challenging.

- Grid Integration of Renewables: Managing the intermittency of solar and wind power requires significant grid upgrades and sophisticated management systems.

- Competitive Pressures: Intense competition among EPC firms can lead to price wars and reduced profit margins.

Emerging Opportunities in Thailand Power Generation EPC Industry

Emerging opportunities in the Thailand power generation EPC industry lie in the growing demand for energy storage solutions to complement renewable energy integration, the development of waste-to-energy plants to address solid waste management challenges, and the expansion of distributed generation systems for industrial and commercial clients. Furthermore, the modernization and repowering of aging conventional power plants offer significant potential. The digitalization of power plant operations through IoT and AI-driven analytics presents opportunities for EPC firms to offer value-added services. The burgeoning electric vehicle (EV) market will also drive demand for charging infrastructure and the associated power generation upgrades.

Growth Accelerators in the Thailand Power Generation EPC Industry Industry

Growth in the Thailand Power Generation EPC Industry is being accelerated by significant investments in renewable energy infrastructure, particularly solar and wind power projects, driven by government targets and declining technology costs. Strategic partnerships between international EPC firms and local Thai companies are fostering knowledge transfer and enhancing execution capabilities. The ongoing shift towards cleaner energy sources, coupled with the need to replace aging conventional power plants, is creating a sustained pipeline of projects. Moreover, advancements in smart grid technologies and energy storage solutions are enabling higher penetration of intermittent renewables, further stimulating EPC activity.

Key Players Shaping the Thailand Power Generation EPC Industry Market

- Toshiba Corporation

- DP Cleantech Group

- Marubeni Corporation

- General Electric Company

- ReZeca Engineering

- Black and Veatch Corporation

- Mitsubishi Heavy Industries Ltd

- Grimm Power Public Company Limited

Notable Milestones in Thailand Power Generation EPC Industry Sector

- July 2021: Kawasaki Heavy Industries Ltd. receives an order for four Kawasaki Green Gas Engines from Singapore-based Jurong Engineering Ltd. (JEL) for the RATCH Cogeneration Expansion Project in Thailand, ordered via Kawasaki Gas Turbine Asia Sdn Bhd. This project adds a 30 MW class gas engine power plant to an existing 110 MW combined-cycle plant operated by RATCH Cogeneration Company Limited, under RATCH Group Public Company Limited.

- September 2020: Mitsubishi Power signs a contract to build a 1.4GW natural gas-fired power plant using gas-fired turbine combined cycle (GTCC) technology for Hin Kong Power Company Limited. This independent power producer project involves comprehensive EPC services and is planned in two phases, with commercial operations expected in March 2024 and January 2025.

In-Depth Thailand Power Generation EPC Industry Market Outlook

The Thailand power generation EPC industry is set for continued expansion, driven by a strong impetus towards energy diversification and sustainability. The outlook suggests a robust pipeline of projects focusing on both the continued development of efficient natural gas-fired power plants and a significant acceleration in renewable energy deployment. Growth accelerators include supportive government policies, technological advancements in clean energy solutions, and increasing foreign investment. Strategic opportunities lie in addressing the growing need for energy storage, expanding waste-to-energy initiatives, and modernizing existing power infrastructure. The industry is poised for dynamic evolution, with a clear trend towards cleaner, more efficient, and technologically advanced power generation solutions.

Thailand Power Generation EPC Industry Segmentation

- 1. Conventional Thermal Power

- 2. Renewables

- 3. Other Source Types

Thailand Power Generation EPC Industry Segmentation By Geography

- 1. Thailand

Thailand Power Generation EPC Industry Regional Market Share

Geographic Coverage of Thailand Power Generation EPC Industry

Thailand Power Generation EPC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Shift towards Renewable Energy4.; Less Electricity Generation Cost from Bioenergy

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Investments

- 3.4. Market Trends

- 3.4.1. Conventional Thermal Power Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Power Generation EPC Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Conventional Thermal Power

- 5.2. Market Analysis, Insights and Forecast - by Renewables

- 5.3. Market Analysis, Insights and Forecast - by Other Source Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Conventional Thermal Power

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Toshiba Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DP Cleantech Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Marubeni Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 General Electric Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ReZeca Engineering

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Black and Veatch Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mitsubishi Heavy Industries Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Grimm Power Public Company Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Toshiba Corporation

List of Figures

- Figure 1: Thailand Power Generation EPC Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Thailand Power Generation EPC Industry Share (%) by Company 2025

List of Tables

- Table 1: Thailand Power Generation EPC Industry Revenue undefined Forecast, by Conventional Thermal Power 2020 & 2033

- Table 2: Thailand Power Generation EPC Industry Revenue undefined Forecast, by Renewables 2020 & 2033

- Table 3: Thailand Power Generation EPC Industry Revenue undefined Forecast, by Other Source Types 2020 & 2033

- Table 4: Thailand Power Generation EPC Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Thailand Power Generation EPC Industry Revenue undefined Forecast, by Conventional Thermal Power 2020 & 2033

- Table 6: Thailand Power Generation EPC Industry Revenue undefined Forecast, by Renewables 2020 & 2033

- Table 7: Thailand Power Generation EPC Industry Revenue undefined Forecast, by Other Source Types 2020 & 2033

- Table 8: Thailand Power Generation EPC Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Power Generation EPC Industry?

The projected CAGR is approximately 9.1%.

2. Which companies are prominent players in the Thailand Power Generation EPC Industry?

Key companies in the market include Toshiba Corporation, DP Cleantech Group, Marubeni Corporation, General Electric Company, ReZeca Engineering, Black and Veatch Corporation, Mitsubishi Heavy Industries Ltd, Grimm Power Public Company Limited.

3. What are the main segments of the Thailand Power Generation EPC Industry?

The market segments include Conventional Thermal Power, Renewables, Other Source Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Shift towards Renewable Energy4.; Less Electricity Generation Cost from Bioenergy.

6. What are the notable trends driving market growth?

Conventional Thermal Power Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Investments.

8. Can you provide examples of recent developments in the market?

In July 2021, Kawasaki Heavy Industries Ltd announced that it received an order from Singapore-based Jurong Engineering Ltd. (JEL) for four Kawasaki Green Gas Engines to be used in the RATCH Cogeneration Expansion Project in Thailand. The order was placed through Kawasaki Gas Turbine Asia Sdn Bhd (KGA), which is based in Kuala Lumpur, Malaysia. In the RATCH Cogeneration Expansion Project, a 30 MW class gas engine power plant will be added to a 110 MW combined-cycle power plant operated by RATCH Cogeneration Company Limited, which operates under the parent company and major Thai power producer RATCH Group Public Company Limited.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Power Generation EPC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Power Generation EPC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Power Generation EPC Industry?

To stay informed about further developments, trends, and reports in the Thailand Power Generation EPC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence