Key Insights

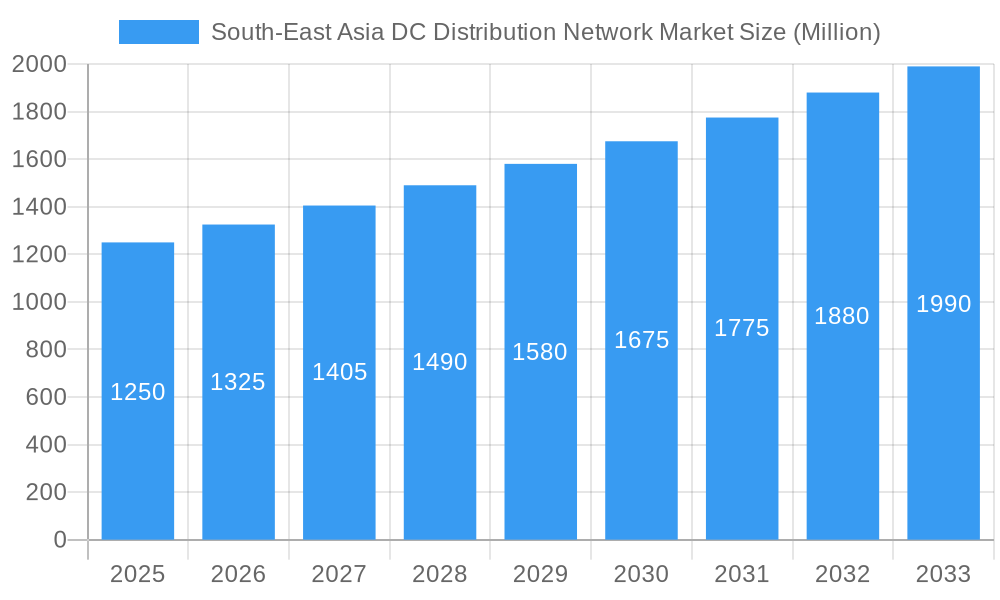

The South-East Asia DC Distribution Network Market is poised for significant expansion, projected to reach a substantial market size exceeding $1.2 billion by 2025 and sustain a robust Compound Annual Growth Rate (CAGR) of over 5.50% through 2033. This impressive growth is propelled by a confluence of powerful drivers, including the escalating demand for energy-efficient solutions across commercial buildings, the burgeoning infrastructure for remote cell towers supporting widespread mobile connectivity, and the critical need for reliable power in rapidly expanding data centers serving the region's digital transformation. Furthermore, the strategic imperative for robust power distribution in military applications and the accelerating adoption of electric vehicles (EVs), necessitating widespread fast-charging infrastructure, are also contributing factors to this dynamic market evolution. The increasing reliance on direct current (DC) distribution networks offers distinct advantages in terms of energy conversion efficiency and reduced power loss compared to traditional AC systems, making them an increasingly attractive proposition for a diverse range of end-users.

South-East Asia DC Distribution Network Market Market Size (In Billion)

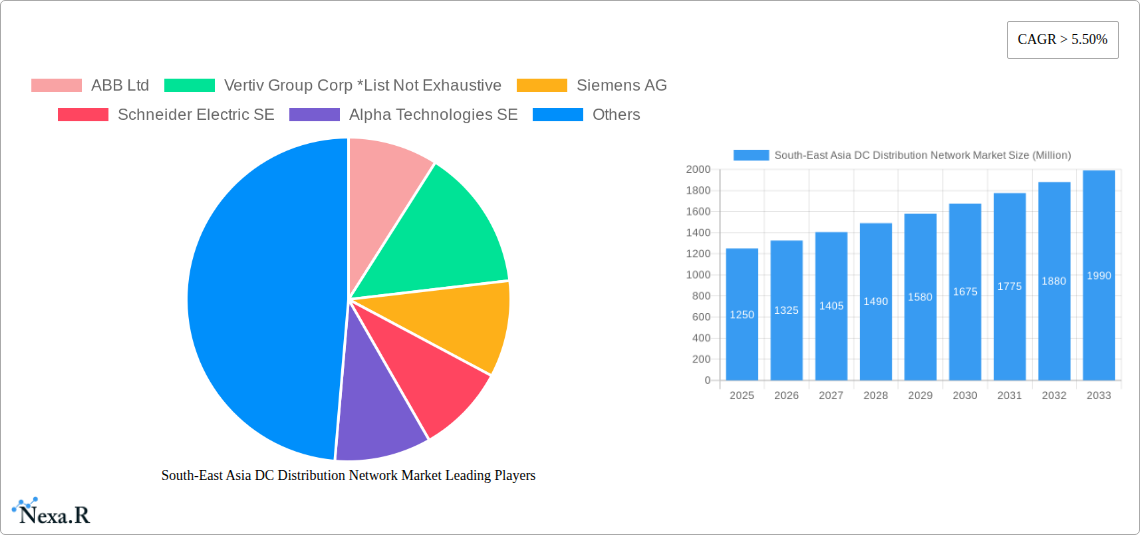

The market landscape is characterized by key trends such as the integration of smart grid technologies, the development of advanced power management solutions, and a growing focus on sustainability and renewable energy integration within DC distribution networks. Key players like ABB Ltd, Vertiv Group Corp, Siemens AG, Schneider Electric SE, and Eaton Corporation Plc are actively investing in research and development to offer innovative and tailored solutions to meet the unique demands of the South-East Asian region. While the market demonstrates strong growth potential, potential restraints include the initial capital investment associated with DC distribution network implementation, the need for skilled personnel for installation and maintenance, and evolving regulatory frameworks that may influence adoption rates. Nonetheless, the prevailing positive market dynamics and the strategic importance of reliable and efficient power distribution across key sectors in South-East Asia strongly indicate a promising trajectory for the DC Distribution Network Market.

South-East Asia DC Distribution Network Market Company Market Share

Here's a compelling, SEO-optimized report description for the South-East Asia DC Distribution Network Market, designed for maximum visibility and engagement:

South-East Asia DC Distribution Network Market: Growth, Trends, and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the South-East Asia DC Distribution Network Market, exploring its dynamics, growth trajectories, and competitive landscape from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this report provides actionable insights for industry stakeholders, including manufacturers, suppliers, investors, and policymakers. We delve into critical segments such as Commercial Buildings, Remote Cell Towers, Data Centers, Military Applications, and EV Fast Charging Stations across key geographies including Thailand, Malaysia, Indonesia, and the Rest of Southeast Asia. Discover the key players, technological innovations, and emerging opportunities that are shaping this rapidly evolving market.

South-East Asia DC Distribution Network Market Market Dynamics & Structure

The South-East Asia DC Distribution Network Market is characterized by a moderate level of market concentration, with a few leading players holding significant market share. Technological innovation is a primary driver, fueled by the increasing demand for efficient power distribution solutions in data centers, 5G infrastructure, and electric vehicle charging. Regulatory frameworks are evolving to support green energy initiatives and data localization policies, indirectly influencing the demand for robust DC distribution systems. Competitive product substitutes are emerging, primarily in the form of advanced AC-to-DC conversion technologies and distributed energy resource management systems.

- Market Concentration: Dominated by key global and regional players, but with increasing opportunities for specialized solution providers.

- Technological Innovation Drivers:

- Growth of hyperscale data centers and edge computing.

- Expansion of 5G networks requiring advanced power solutions.

- Rapid adoption of Electric Vehicles (EVs) and the need for high-power charging infrastructure.

- Government initiatives promoting digital transformation and sustainable energy.

- Regulatory Frameworks: Focus on energy efficiency standards, data privacy, and grid modernization.

- Competitive Product Substitutes: Smart grid technologies, advanced power converters, and microgrid solutions.

- End-User Demographics: Shifting towards greater reliance on digital infrastructure and electrification.

- M&A Trends: Increasing consolidation as larger companies acquire innovative startups to expand their product portfolios and market reach. Expected M&A deal volume for the forecast period is estimated at XX million units.

South-East Asia DC Distribution Network Market Growth Trends & Insights

The South-East Asia DC Distribution Network Market is poised for substantial growth, driven by an unprecedented surge in digital infrastructure development and the accelerating transition towards electrified transportation. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately XX% from 2025 to 2033, escalating from an estimated XX million units in the base year to XXX million units by the end of the forecast period. This impressive expansion is underpinned by several interconnected trends. The escalating demand for data storage and processing power, fueled by the proliferation of cloud computing, big data analytics, and the Internet of Things (IoT), is directly translating into a significant increase in the construction and expansion of data centers across the region. These facilities require highly efficient and reliable DC distribution networks to manage their complex power needs, minimizing energy loss and ensuring continuous operation.

Simultaneously, the rapid rollout of 5G networks across countries like Malaysia, Indonesia, and Thailand necessitates a robust and resilient power infrastructure for an increasing number of remote cell towers. These towers, often located in less accessible areas, demand localized and efficient DC power solutions to ensure uninterrupted connectivity. The burgeoning Electric Vehicle (EV) market is another pivotal growth catalyst. As governments implement policies to encourage EV adoption and invest in charging infrastructure, the demand for high-power DC fast charging stations is skyrocketing. These stations are critical components of the modern energy ecosystem, and their efficient operation hinges on sophisticated DC distribution networks.

Consumer behavior shifts are also playing a crucial role. A growing awareness of energy efficiency and sustainability is pushing end-users, from commercial enterprises to telecom operators, to opt for advanced DC distribution solutions that offer lower energy consumption and a reduced carbon footprint. Furthermore, the increasing adoption of smart building technologies and the growing trend towards automation in various industries are creating new avenues for DC distribution networks. This includes their integration into building management systems for more granular control and optimized energy usage. Technological disruptions, such as advancements in solid-state transformers and modular power distribution units, are further enhancing the performance, flexibility, and cost-effectiveness of DC distribution systems, making them increasingly attractive for a wider range of applications. The overall market penetration of DC distribution solutions is expected to rise significantly as these trends converge, creating a dynamic and highly promising market landscape.

Dominant Regions, Countries, or Segments in South-East Asia DC Distribution Network Market

The Data Centers segment is emerging as the undisputed dominant force within the South-East Asia DC Distribution Network Market. This ascendancy is propelled by a confluence of factors, including the region's status as a burgeoning digital hub, significant foreign direct investment in technology infrastructure, and the rapidly growing demand for cloud services, e-commerce, and digital entertainment. Countries like Indonesia, with its vast population and increasing digital adoption, and Malaysia, with its strategic location and pro-investment policies, are witnessing an exponential growth in data center construction and expansion.

- Dominant Segment: Data Centers

- Market Share: Estimated at XX% of the total market in 2025, projected to grow to XX% by 2033.

- Growth Potential: Driven by hyperscale cloud providers, colocation facilities, and enterprise data centers.

- Key Drivers:

- Digital Transformation: Accelerating adoption of cloud computing, AI, and IoT.

- E-commerce Growth: Surging online retail sales require robust data infrastructure.

- Edge Computing: Demand for localized processing power closer to end-users.

- Data Localization Policies: Government mandates to store data within national borders.

- Foreign Investment: Significant capital flowing into regional data center development.

Beyond data centers, the EV Fast Charging Stations segment is rapidly gaining traction and is expected to be a significant growth accelerator. The widespread adoption of electric vehicles across Southeast Asia, supported by government incentives and increasing consumer environmental awareness, is creating a robust demand for high-power DC charging infrastructure. Countries like Thailand and Indonesia are at the forefront of this transition, investing heavily in expanding their charging networks.

- Emerging Dominant Segment: EV Fast Charging Stations

- Market Share: Estimated at XX% in 2025, projected to reach XX% by 2033.

- Growth Potential: Fueled by government targets for EV adoption and charging infrastructure development.

- Key Drivers:

- Government Subsidies & Incentives: Policies encouraging EV purchases and charging station deployment.

- Decreasing Battery Costs: Making EVs more affordable and accessible.

- Environmental Concerns: Growing consumer preference for sustainable transportation.

- Technological Advancements: Faster charging speeds and improved battery technology.

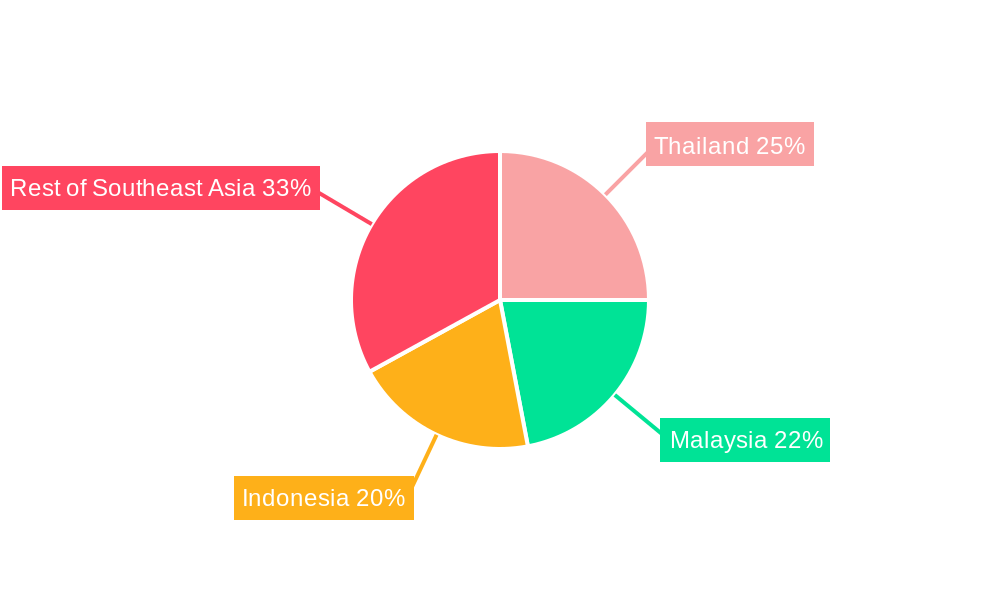

Geographically, Indonesia is anticipated to lead the market, owing to its massive population, expanding digital economy, and government initiatives to foster digital infrastructure development. Malaysia and Thailand are also critical growth engines, driven by strong government support for technology and a rapidly expanding digital ecosystem. The "Rest of Southeast Asia" category, encompassing countries like Vietnam, the Philippines, and Singapore, also presents substantial, albeit more fragmented, growth opportunities due to ongoing digitalization efforts and specific sector developments.

South-East Asia DC Distribution Network Market Product Landscape

The South-East Asia DC Distribution Network Market is witnessing a surge in innovative product offerings focused on enhanced efficiency, reliability, and scalability. Key innovations include advanced modular DC power distribution units (PDUs) that offer flexible configurations and ease of deployment for data centers and telecommunications infrastructure. High-efficiency DC-DC converters and rectifiers are also gaining prominence, minimizing energy losses during power conversion and contributing to lower operational costs. The market is also seeing a rise in smart DC distribution solutions equipped with advanced monitoring, control, and predictive maintenance capabilities, enabling real-time management and optimization of power flow. Furthermore, the development of compact and robust DC power solutions specifically tailored for edge computing deployments and EV fast charging stations is a notable trend, addressing the unique power requirements of these growing applications.

Key Drivers, Barriers & Challenges in South-East Asia DC Distribution Network Market

Key Drivers:

The South-East Asia DC Distribution Network Market is propelled by the relentless growth of digital infrastructure, including the massive expansion of data centers and the widespread deployment of 5G networks. The accelerating adoption of Electric Vehicles (EVs) and the subsequent demand for high-power DC charging stations represent a significant growth catalyst. Furthermore, supportive government policies promoting digitalization, renewable energy integration, and technological advancements are creating a favorable ecosystem for DC distribution networks.

Barriers & Challenges:

Despite robust growth, the market faces several challenges. High initial investment costs for advanced DC distribution systems can be a barrier for some smaller enterprises. The availability of skilled labor for installation and maintenance of sophisticated DC systems remains a concern in certain regions. Supply chain disruptions and fluctuations in raw material prices can impact production costs and delivery timelines. Regulatory fragmentation across different Southeast Asian countries can also pose challenges for market expansion. Furthermore, the ongoing development of highly efficient AC power solutions presents a competitive challenge, requiring continuous innovation in DC technology to maintain its edge.

Emerging Opportunities in South-East Asia DC Distribution Network Market

Emerging opportunities lie in the burgeoning demand for energy-efficient and resilient power solutions for edge data centers and distributed IT infrastructure. The rapid expansion of the Internet of Things (IoT) ecosystem across manufacturing, smart cities, and logistics sectors will necessitate localized DC power distribution for connected devices and sensors. The growing trend towards microgrids and off-grid power solutions in remote or underserved areas of Southeast Asia presents a significant untapped market for reliable DC distribution systems. Furthermore, the integration of DC distribution networks with renewable energy sources like solar and wind power offers substantial opportunities for sustainable energy solutions, catering to increasing environmental consciousness among businesses and consumers.

Growth Accelerators in the South-East Asia DC Distribution Network Market Industry

Several key catalysts are accelerating the growth of the South-East Asia DC Distribution Network Market. Technological breakthroughs in power electronics, leading to more efficient, compact, and cost-effective DC-DC converters and power distribution units, are a primary driver. Strategic partnerships and collaborations between technology providers, infrastructure developers, and energy companies are facilitating the deployment of integrated DC solutions. Market expansion strategies, including the development of localized manufacturing capabilities and customized product offerings for specific regional needs, are also playing a crucial role in driving adoption. The increasing awareness and adoption of Industry 4.0 principles, which rely heavily on robust digital infrastructure and automation, are further fueling the demand for advanced DC distribution networks.

Key Players Shaping the South-East Asia DC Distribution Network Market Market

- ABB Ltd

- Vertiv Group Corp

- Siemens AG

- Schneider Electric SE

- Alpha Technologies SE

- SGA SA

- EPE Malaysia

- Eaton Corporation Plc

Notable Milestones in South-East Asia DC Distribution Network Market Sector

- April 2022: The state-run telecom group, Viettel, announced plans to build a new data center in Ho Chi Minh, Vietnam. The company has earmarked an investment of around USD 261 million for the project. This significant investment underscores the growing demand for data center infrastructure in the region, a key driver for DC distribution networks.

In-Depth South-East Asia DC Distribution Network Market Market Outlook

The South-East Asia DC Distribution Network Market is set for sustained and robust growth, fueled by its pivotal role in enabling the region's digital transformation and electrification agenda. Key growth accelerators include ongoing investments in hyperscale and edge data centers, the aggressive expansion of 5G networks, and the accelerating adoption of electric vehicles, all of which demand advanced and efficient DC power solutions. Strategic partnerships, continuous technological innovation in power electronics, and supportive government policies aimed at fostering technological advancement and sustainable energy practices will further bolster market expansion. The increasing focus on energy efficiency and grid resilience, coupled with the growing demand for integrated smart energy management systems, presents a significant future market potential, positioning the DC distribution network sector as a critical enabler of Southeast Asia's economic and technological progress.

South-East Asia DC Distribution Network Market Segmentation

-

1. End User

- 1.1. Commercial Buildings

- 1.2. Remote Cell Towers

- 1.3. Data Centers

- 1.4. Military Applications

- 1.5. EV Fast Charging Stations

- 1.6. Other End Users

-

2. Geography

- 2.1. Thailand

- 2.2. Malaysia

- 2.3. Indonesia

- 2.4. Rest of Southeast Asia

South-East Asia DC Distribution Network Market Segmentation By Geography

- 1. Thailand

- 2. Malaysia

- 3. Indonesia

- 4. Rest of Southeast Asia

South-East Asia DC Distribution Network Market Regional Market Share

Geographic Coverage of South-East Asia DC Distribution Network Market

South-East Asia DC Distribution Network Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Several Government Plans for the Energy Transition in the Region

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Self-generated Renewable Power in the Residential and Commercial Sectors

- 3.4. Market Trends

- 3.4.1. Data Centers Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South-East Asia DC Distribution Network Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Commercial Buildings

- 5.1.2. Remote Cell Towers

- 5.1.3. Data Centers

- 5.1.4. Military Applications

- 5.1.5. EV Fast Charging Stations

- 5.1.6. Other End Users

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Thailand

- 5.2.2. Malaysia

- 5.2.3. Indonesia

- 5.2.4. Rest of Southeast Asia

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Thailand

- 5.3.2. Malaysia

- 5.3.3. Indonesia

- 5.3.4. Rest of Southeast Asia

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. Thailand South-East Asia DC Distribution Network Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Commercial Buildings

- 6.1.2. Remote Cell Towers

- 6.1.3. Data Centers

- 6.1.4. Military Applications

- 6.1.5. EV Fast Charging Stations

- 6.1.6. Other End Users

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Thailand

- 6.2.2. Malaysia

- 6.2.3. Indonesia

- 6.2.4. Rest of Southeast Asia

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Malaysia South-East Asia DC Distribution Network Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Commercial Buildings

- 7.1.2. Remote Cell Towers

- 7.1.3. Data Centers

- 7.1.4. Military Applications

- 7.1.5. EV Fast Charging Stations

- 7.1.6. Other End Users

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Thailand

- 7.2.2. Malaysia

- 7.2.3. Indonesia

- 7.2.4. Rest of Southeast Asia

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Indonesia South-East Asia DC Distribution Network Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Commercial Buildings

- 8.1.2. Remote Cell Towers

- 8.1.3. Data Centers

- 8.1.4. Military Applications

- 8.1.5. EV Fast Charging Stations

- 8.1.6. Other End Users

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Thailand

- 8.2.2. Malaysia

- 8.2.3. Indonesia

- 8.2.4. Rest of Southeast Asia

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. Rest of Southeast Asia South-East Asia DC Distribution Network Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Commercial Buildings

- 9.1.2. Remote Cell Towers

- 9.1.3. Data Centers

- 9.1.4. Military Applications

- 9.1.5. EV Fast Charging Stations

- 9.1.6. Other End Users

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Thailand

- 9.2.2. Malaysia

- 9.2.3. Indonesia

- 9.2.4. Rest of Southeast Asia

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ABB Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Vertiv Group Corp *List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Siemens AG

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Schneider Electric SE

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Alpha Technologies SE

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 SGA SA

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 EPE Malaysia

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Eaton Corporation Plc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 ABB Ltd

List of Figures

- Figure 1: South-East Asia DC Distribution Network Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South-East Asia DC Distribution Network Market Share (%) by Company 2025

List of Tables

- Table 1: South-East Asia DC Distribution Network Market Revenue Million Forecast, by End User 2020 & 2033

- Table 2: South-East Asia DC Distribution Network Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: South-East Asia DC Distribution Network Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: South-East Asia DC Distribution Network Market Revenue Million Forecast, by End User 2020 & 2033

- Table 5: South-East Asia DC Distribution Network Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: South-East Asia DC Distribution Network Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: South-East Asia DC Distribution Network Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: South-East Asia DC Distribution Network Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: South-East Asia DC Distribution Network Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: South-East Asia DC Distribution Network Market Revenue Million Forecast, by End User 2020 & 2033

- Table 11: South-East Asia DC Distribution Network Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: South-East Asia DC Distribution Network Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: South-East Asia DC Distribution Network Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: South-East Asia DC Distribution Network Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: South-East Asia DC Distribution Network Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South-East Asia DC Distribution Network Market?

The projected CAGR is approximately > 5.50%.

2. Which companies are prominent players in the South-East Asia DC Distribution Network Market?

Key companies in the market include ABB Ltd, Vertiv Group Corp *List Not Exhaustive, Siemens AG, Schneider Electric SE, Alpha Technologies SE, SGA SA, EPE Malaysia, Eaton Corporation Plc.

3. What are the main segments of the South-East Asia DC Distribution Network Market?

The market segments include End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Several Government Plans for the Energy Transition in the Region.

6. What are the notable trends driving market growth?

Data Centers Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Self-generated Renewable Power in the Residential and Commercial Sectors.

8. Can you provide examples of recent developments in the market?

April 2022: The state-run telecom group, Viettel, announced plans to build a new data center in Ho Chi Minh, Vietnam. The company has earmarked an investment of around USD 261 million for the project.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South-East Asia DC Distribution Network Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South-East Asia DC Distribution Network Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South-East Asia DC Distribution Network Market?

To stay informed about further developments, trends, and reports in the South-East Asia DC Distribution Network Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence