Key Insights

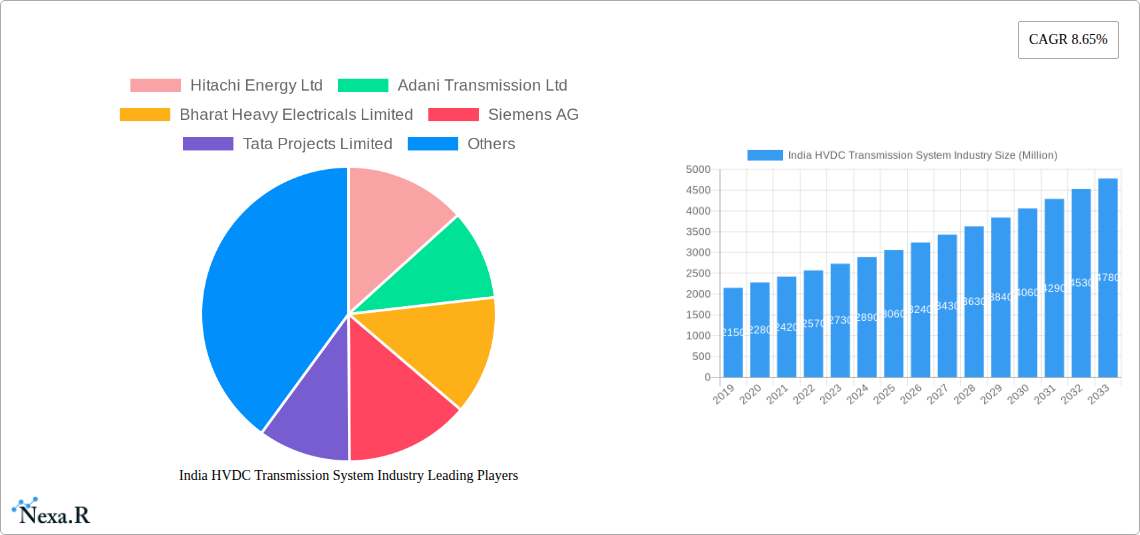

The Indian High Voltage Direct Current (HVDC) Transmission System market is poised for significant expansion, projected to reach a substantial value of $3.55 billion by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 8.65% anticipated through 2033. This robust growth is primarily fueled by the nation's escalating demand for electricity, driven by rapid industrialization, urbanization, and the increasing adoption of renewable energy sources. HVDC technology is crucial for efficiently transmitting large amounts of power over long distances with minimal losses, making it indispensable for integrating remote renewable energy farms and bolstering the national grid's stability. Key drivers include government initiatives focused on grid modernization, the expansion of inter-state and international power transmission networks, and the urgent need to address power deficits in various regions. The market is seeing substantial investments in both HVDC Overhead Transmission Systems and HVDC Underground & Submarine Transmission Systems, reflecting a diversified approach to power infrastructure development.

India HVDC Transmission System Industry Market Size (In Billion)

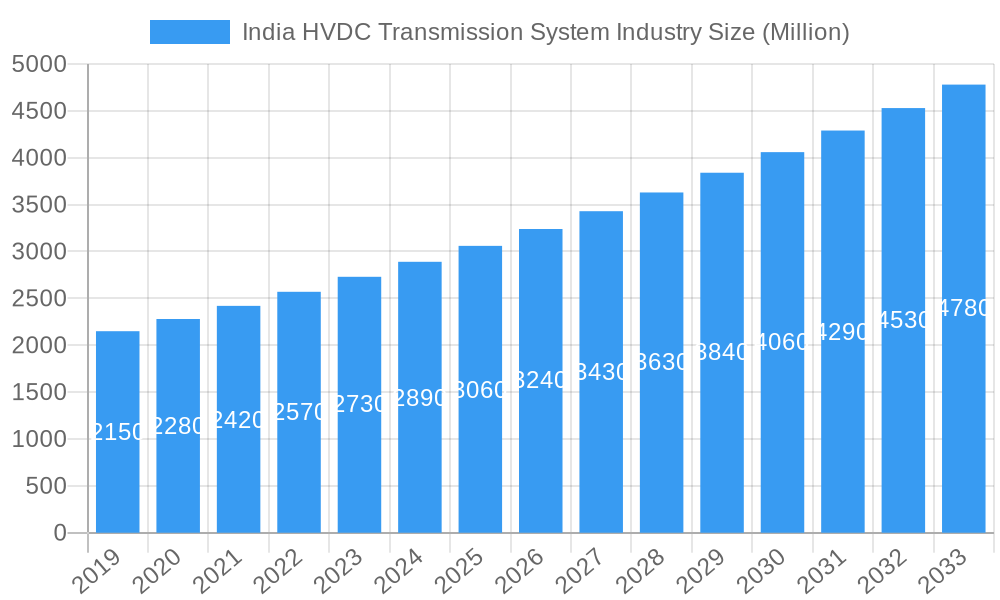

The market's trajectory is further shaped by emerging trends such as the rise of Voltage Source Converter (VSC) HVDC technology, which offers enhanced flexibility and control for grid stabilization and integration of distributed renewable energy. Advancements in converter stations and power electronics are also contributing to improved efficiency and reduced costs. However, certain restraints, including the high initial capital expenditure for HVDC projects and the need for specialized skilled labor, need to be strategically addressed. Despite these challenges, the strategic importance of HVDC for India's energy security and its ambition to achieve Net Zero emissions by 2070 will continue to propel market growth. Major players like Hitachi Energy Ltd, Siemens AG, and General Electric Company, alongside domestic giants such as Adani Transmission Ltd and Bharat Heavy Electricals Limited, are actively investing in R&D and project execution, underscoring the competitive landscape and the vast opportunities within the Indian HVDC transmission sector.

India HVDC Transmission System Industry Company Market Share

India HVDC Transmission System Industry: Market Dynamics, Growth Trends, and Future Outlook (2019–2033)

Unlock comprehensive insights into the burgeoning Indian High Voltage Direct Current (HVDC) Transmission System industry. This in-depth report provides a meticulous analysis of market dynamics, growth trajectories, key players, and emerging opportunities within this critical infrastructure sector. Covering the study period from 2019 to 2033, with a base year of 2025, this report is an essential resource for stakeholders seeking to understand and capitalize on the rapid evolution of India's power transmission landscape. We delve into both parent and child market segments, offering unparalleled clarity and predictive power.

India HVDC Transmission System Industry Market Dynamics & Structure

The Indian HVDC transmission system industry exhibits a moderately concentrated market structure, driven by the significant capital investments and specialized expertise required for project execution. Key market players are actively engaged in technological innovation, particularly in enhancing transmission capacity and efficiency. Regulatory frameworks, spearheaded by government initiatives like the National Smart Grid Mission, are crucial in shaping market access and project approvals. The competitive landscape is characterized by a mix of established global giants and strong domestic players, with limited direct substitutes for large-scale HVDC projects, although conventional AC transmission remains a backdrop. End-user demographics are primarily driven by utility companies, large industrial consumers, and renewable energy developers seeking to integrate remote power sources. Merger and acquisition trends are anticipated to increase as companies seek to consolidate capabilities and expand their market reach within India's rapidly developing power sector. Innovation barriers include the high cost of research and development and the need for specialized skilled labor.

- Market Concentration: Moderately concentrated with a few dominant players.

- Technological Innovation Drivers: Increased demand for efficient long-distance power transfer, integration of renewable energy, and grid modernization.

- Regulatory Frameworks: Government policies promoting grid stability, renewable energy adoption, and infrastructure development.

- Competitive Product Substitutes: Limited for large-scale projects, with conventional AC transmission being a primary alternative.

- End-User Demographics: State-owned utilities, private power producers, renewable energy integrators.

- M&A Trends: Expected to rise for market consolidation and capability enhancement.

India HVDC Transmission System Industry Growth Trends & Insights

The Indian HVDC transmission system industry is poised for remarkable growth, projected to witness a significant market size evolution driven by the nation's insatiable demand for electricity and ambitious renewable energy targets. Adoption rates for HVDC technology are rapidly increasing, as its inherent advantages in transmitting large blocks of power over long distances with lower losses become increasingly indispensable. Technological disruptions, such as advancements in Voltage Source Converter (VSC) technology and the development of more compact and efficient converter stations, are accelerating this adoption. Consumer behavior shifts, particularly from energy providers and grid operators, are prioritizing reliability, efficiency, and the seamless integration of diverse energy sources, all of which HVDC systems facilitate. The market penetration of HVDC solutions is expected to deepen as more large-scale power projects, including those connecting remote renewable energy hubs to consumption centers, are commissioned. The projected Compound Annual Growth Rate (CAGR) for the forecast period is approximately 8.5%, indicating a robust expansionary phase. The market is transitioning from a necessity for specific grid challenges to a preferred solution for overall grid enhancement and expansion, fueled by government initiatives and private sector investment. The increasing complexity of the Indian power grid, with its distributed generation and fluctuating demand, necessitates sophisticated transmission solutions, positioning HVDC at the forefront of future power infrastructure development. The report analyzes these trends through detailed market size forecasts, adoption rate projections, and the impact of emerging technologies on the overall market landscape, providing actionable insights for industry stakeholders.

Dominant Regions, Countries, or Segments in India HVDC Transmission System Industry

The HVDC Overhead Transmission System segment is currently the dominant force driving market growth within the Indian HVDC transmission industry. This dominance is attributed to several key factors, including its cost-effectiveness for transmitting substantial power over vast inter-state distances and its widespread application in connecting remote power generation sites, such as coal-fired power plants and upcoming renewable energy zones, to major load centers across India. The economic policies of the Indian government, which focus on strengthening the national grid and ensuring reliable power supply to all regions, heavily favor the deployment of overhead HVDC lines. Infrastructure development initiatives, such as the Green Energy Corridors and the expansion of the national power grid, are directly reliant on the capabilities offered by overhead HVDC transmission.

Furthermore, the Converter Stations segment, as a critical component of any HVDC system, also exhibits significant growth. The increasing number of HVDC projects necessitates a corresponding increase in the demand for sophisticated converter stations, equipped with advanced technologies like VSC. These stations are vital for converting AC power to DC for transmission and then back to AC at the receiving end. The ongoing technological advancements in converter technology, leading to smaller footprints, enhanced efficiency, and higher power handling capabilities, are further fueling the growth of this segment.

The Transmission Medium (Cables), particularly for HVDC Underground & Submarine Transmission System, represents a rapidly emerging and high-potential segment. While currently having a smaller market share compared to overhead lines, its growth is being propelled by specific urban and ecologically sensitive applications. The need to transmit power through densely populated urban areas where land acquisition for overhead lines is challenging, or to connect islands, is driving investments in underground and submarine HVDC cables. The successful implementation of projects like the Pugalur-Thrissur HVDC link, which included a significant portion of underground cables, demonstrates the growing viability and application of this segment. The Maharashtra Government's plan to invest in an underground HVDC line further underscores this trend.

- Dominant Segment: HVDC Overhead Transmission System, due to its cost-effectiveness for long-distance transmission and extensive use in connecting large power plants to load centers.

- Key Drivers for Overhead Transmission: Government infrastructure policies, need for grid expansion, integration of remote power sources.

- Significant Component Segment: Converter Stations, essential for all HVDC projects, with ongoing technological advancements driving demand.

- Emerging High-Potential Segment: HVDC Underground & Submarine Transmission System, driven by urban infrastructure needs and ecological considerations.

- Market Share Insights: While specific figures vary, overhead transmission commands the largest market share, followed by converter stations, with underground/submarine cables showing the fastest growth trajectory.

India HVDC Transmission System Industry Product Landscape

The product landscape within the Indian HVDC transmission system industry is characterized by a continuous drive towards higher voltage levels, increased power transfer capacity, and enhanced efficiency. Key product innovations revolve around the development of more robust and cost-effective converter technologies, particularly Voltage Source Converters (VSC), which offer greater flexibility and faster response times for grid control. Advanced insulation materials and cable designs are improving the reliability and longevity of both overhead lines and underground/submarine cables. Converter stations are evolving with modular designs for easier installation and maintenance, incorporating sophisticated control and protection systems. The performance metrics being pushed include reducing power losses during transmission to below 1%, increasing the energy throughput of existing corridors, and enabling faster grid integration of renewable energy sources. Unique selling propositions for manufacturers lie in their ability to offer end-to-end solutions, from converter technology to transmission infrastructure, coupled with robust project management and after-sales support. Technological advancements are focused on reducing the environmental footprint of HVDC systems and enhancing their resilience to external factors.

Key Drivers, Barriers & Challenges in India HVDC Transmission System Industry

The Indian HVDC transmission system industry is propelled by several key drivers. The escalating demand for electricity, fueled by economic growth and industrialization, necessitates robust and efficient transmission infrastructure. India's ambitious renewable energy targets, particularly for solar and wind power, require HVDC systems to transport electricity from remote generation sites to consumption hubs. Technological advancements in HVDC technology, leading to improved efficiency and reduced costs, are making it a more attractive option. Government initiatives promoting grid modernization and the development of a unified national grid are also significant catalysts.

However, the industry faces considerable barriers and challenges. The substantial capital investment required for HVDC projects is a major hurdle, requiring significant financial backing and long-term planning. Complex land acquisition processes and environmental clearances can lead to project delays. The availability of skilled manpower for the design, installation, and maintenance of HVDC systems is another constraint. Furthermore, supply chain disruptions and the reliance on imported components for certain specialized equipment can impact project timelines and costs. Intense competition among global and domestic players can also put pressure on profit margins, although the specialized nature of HVDC limits the number of direct competitors.

Emerging Opportunities in India HVDC Transmission System Industry

Emerging opportunities within the India HVDC transmission system industry are abundant, driven by the nation's rapid development and evolving energy landscape. The increasing integration of offshore wind farms presents a significant opportunity for submarine HVDC transmission systems. Furthermore, the development of smart grids and the need for enhanced grid stability and control are creating demand for advanced VSC-based HVDC solutions. Untapped markets in remote and underserved regions offer significant potential for expansion. The concept of HVDC rings and meshed grids for improved power flow and reliability is gaining traction, opening up new project avenues. Innovative applications, such as interconnecting different regional grids for better power sharing and the potential use of HVDC for offshore power transmission to support defense or industrial installations, are also emerging. Evolving consumer preferences towards cleaner energy are indirectly driving the demand for HVDC solutions capable of integrating large-scale renewable power.

Growth Accelerators in the India HVDC Transmission System Industry Industry

Several factors are acting as significant growth accelerators for the India HVDC transmission system industry. Technological breakthroughs, particularly in enhancing the power handling capacity of converter stations and developing more efficient transmission cables, are reducing project costs and improving performance. Strategic partnerships between domestic and international players are facilitating knowledge transfer and enhancing execution capabilities for complex projects. The Indian government's continued focus on infrastructure development, coupled with favorable policies for renewable energy adoption and grid modernization, provides a stable and supportive environment for growth. Market expansion strategies, including the development of smaller-scale HVDC solutions for specific regional needs and the focus on building indigenous manufacturing capabilities for critical components, are further accelerating the industry's upward trajectory. The successful implementation of pilot projects showcasing the benefits of HVDC technology is also building confidence and driving further investment.

Key Players Shaping the India HVDC Transmission System Industry Market

- Hitachi Energy Ltd

- Adani Transmission Ltd

- Bharat Heavy Electricals Limited

- Siemens AG

- Tata Projects Limited

- TAG Corporation

- General Electric Company

- Power Grid Corporation of India Limited

Notable Milestones in India HVDC Transmission System Industry Sector

- February 2021: Power Grid Corporation of India Limited (POWERGRID) inaugurated its 320 kV 2000 MW Pugalur (Tamil Nadu) - Thrissur (Kerala) HVDC project. This marked the first instance of Voltage Source Converter (VSC) technology being deployed in India for transmission. The project included 27 Km of underground cables out of its total 165 Km length, with an approximate overall project cost of INR 5070 crores.

- December 2020: The Maharashtra Government revised its plan to invest INR 8000 crore on an 80-kilometer (Km) underground High Voltage Direct Current (HVDC) line from Aarey to Kudus in Palghar district, highlighting the growing trend towards underground HVDC infrastructure in urbanized areas.

In-Depth India HVDC Transmission System Industry Market Outlook

The outlook for the India HVDC transmission system industry is exceptionally positive, characterized by sustained growth and expanding applications. The ongoing commitment to renewable energy targets and the continuous need for robust grid infrastructure will remain the primary growth accelerators. Future market potential is significant, driven by the planned expansion of the national grid, the integration of larger renewable energy parks, and the increasing demand for energy security and stability. Strategic opportunities lie in the development of advanced HVDC solutions for smart grids, the potential for inter-country grid interconnections, and the expansion of underground and submarine transmission networks in urban and coastal regions. Companies that focus on innovation, cost-efficiency, and localized manufacturing of critical components are well-positioned to capitalize on the immense opportunities presented by India's evolving power sector. The industry is transitioning towards more sophisticated, flexible, and integrated HVDC systems, promising a dynamic and growth-oriented future.

India HVDC Transmission System Industry Segmentation

-

1. Transmission Type

- 1.1. HVDC Overhead Transmission System

- 1.2. HVDC Underground & Submarine Transmission System

-

2. Component

- 2.1. Converter Stations

- 2.2. Transmission Medium (Cables)

India HVDC Transmission System Industry Segmentation By Geography

- 1. India

India HVDC Transmission System Industry Regional Market Share

Geographic Coverage of India HVDC Transmission System Industry

India HVDC Transmission System Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand For Power Quality In Industrial And Manufacturing Sectors4.; Increase In Smart Grid Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; High Costs Of Power Quality Equipment

- 3.4. Market Trends

- 3.4.1. HVDC Overhead Transmission Systems Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India HVDC Transmission System Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Transmission Type

- 5.1.1. HVDC Overhead Transmission System

- 5.1.2. HVDC Underground & Submarine Transmission System

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Converter Stations

- 5.2.2. Transmission Medium (Cables)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Transmission Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hitachi Energy Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Adani Transmission Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bharat Heavy Electricals Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Siemens AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tata Projects Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TAG Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 General Electric Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Power Grid Corporation of India Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Hitachi Energy Ltd

List of Figures

- Figure 1: India HVDC Transmission System Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India HVDC Transmission System Industry Share (%) by Company 2025

List of Tables

- Table 1: India HVDC Transmission System Industry Revenue Million Forecast, by Transmission Type 2020 & 2033

- Table 2: India HVDC Transmission System Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 3: India HVDC Transmission System Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India HVDC Transmission System Industry Revenue Million Forecast, by Transmission Type 2020 & 2033

- Table 5: India HVDC Transmission System Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 6: India HVDC Transmission System Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India HVDC Transmission System Industry?

The projected CAGR is approximately 8.65%.

2. Which companies are prominent players in the India HVDC Transmission System Industry?

Key companies in the market include Hitachi Energy Ltd, Adani Transmission Ltd, Bharat Heavy Electricals Limited, Siemens AG, Tata Projects Limited, TAG Corporation, General Electric Company, Power Grid Corporation of India Limited.

3. What are the main segments of the India HVDC Transmission System Industry?

The market segments include Transmission Type, Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.55 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand For Power Quality In Industrial And Manufacturing Sectors4.; Increase In Smart Grid Infrastructure.

6. What are the notable trends driving market growth?

HVDC Overhead Transmission Systems Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Costs Of Power Quality Equipment.

8. Can you provide examples of recent developments in the market?

In February 2021, Power Grid Corporation of India Limited (POWERGRID) inaugurated its 320 kV 2000 MW Pugalur (Tamil Nadu) - Thrissur (Kerala) HVDC project. The project was the first time a Voltage Source Converter (VSC) technology has been used introduced in the country for transmission. Out of the 165 kilometers (km) of the transmission, 27 Km were underground cables. The overall project cost was approximately INR 5070 crores.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India HVDC Transmission System Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India HVDC Transmission System Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India HVDC Transmission System Industry?

To stay informed about further developments, trends, and reports in the India HVDC Transmission System Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence