Key Insights

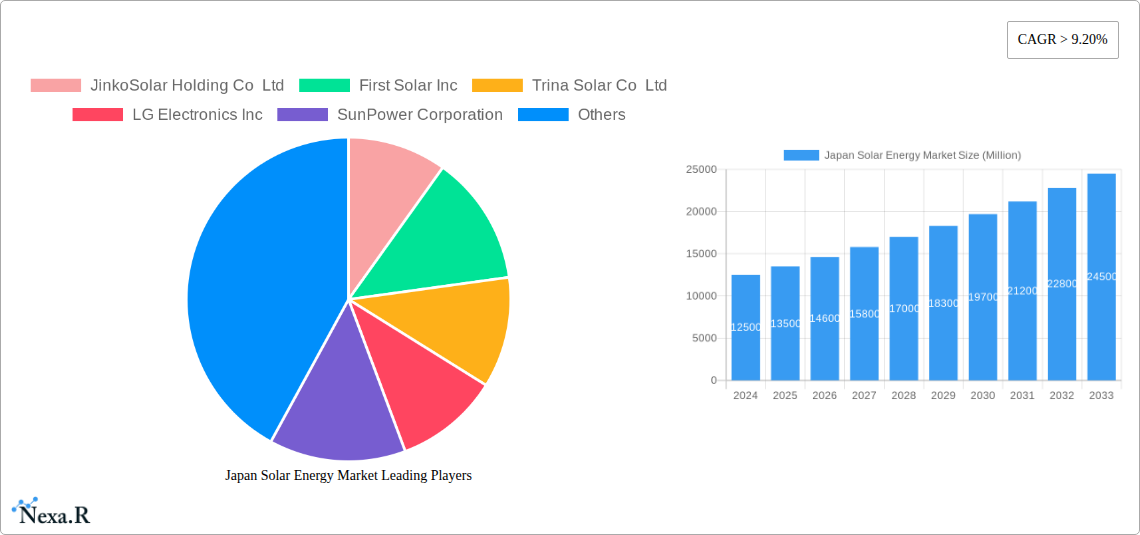

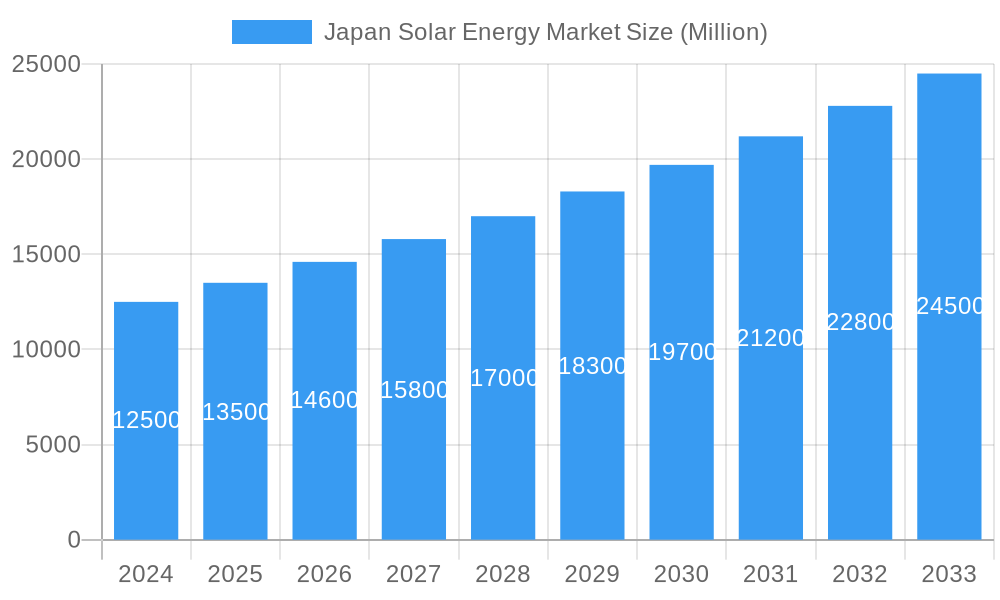

The Japan Solar Energy Market is experiencing robust growth, projected to reach an estimated $12.5 billion in 2024, fueled by a compound annual growth rate (CAGR) of 8.05%. This expansion is largely driven by government initiatives promoting renewable energy adoption, increasing energy independence concerns, and the declining costs of solar technology. The market is segmented across rooftop and ground-mounted deployments, catering to residential, commercial and industrial (C&I), and utility-scale applications. Rooftop installations are particularly dominant in Japan due to limited land availability, with both residential and C&I sectors actively investing in solar to reduce electricity bills and meet sustainability targets. The ongoing policy support, including feed-in tariffs (FIT) and net metering schemes, alongside growing environmental consciousness among consumers and businesses, are significant drivers accelerating this market trajectory.

Japan Solar Energy Market Market Size (In Billion)

Looking ahead, the market is poised for continued expansion, with utility-scale projects expected to play an increasingly important role as Japan aims to significantly increase its renewable energy portfolio. Technological advancements, such as improved panel efficiency and the integration of energy storage solutions, are further enhancing the attractiveness of solar power. However, challenges such as grid integration complexities, land acquisition for larger projects, and the need for consistent policy frameworks present potential restraints. Despite these hurdles, the strong governmental commitment to decarbonization and the inherent benefits of solar energy position Japan as a key market for future solar investments and innovation. Key players like JinkoSolar, First Solar, and Trina Solar are actively participating in this dynamic landscape, contributing to the market's overall growth and evolution.

Japan Solar Energy Market Company Market Share

Japan Solar Energy Market: Powering a Sustainable Future with Clean Energy Solutions

Unlock unparalleled insights into Japan's burgeoning solar energy sector with this comprehensive market report. Designed for industry professionals, investors, and policymakers, this analysis delivers a granular understanding of market dynamics, growth trajectories, and the innovative landscape shaping Japan's transition to renewable energy. We delve deep into the Japan solar energy market size, solar panel market Japan, photovoltaic (PV) market Japan, and the evolving renewable energy Japan ecosystem. Explore opportunities within the residential solar Japan, commercial solar Japan, and utility-scale solar Japan segments. This report meticulously details Japan solar energy market growth, driven by policy initiatives and technological advancements, and forecasts future trends through 2033.

Japan Solar Energy Market Market Dynamics & Structure

The Japan solar energy market is characterized by a moderately concentrated structure, with key players investing heavily in technological innovation and strategic acquisitions to maintain a competitive edge. Regulatory frameworks, including feed-in tariffs (FiTs) and tax incentives, continue to be pivotal in driving market expansion and ensuring a stable investment environment for solar PV development. The competitive landscape is shaped by the interplay of established domestic conglomerates and agile international players, all vying for market share.

- Market Concentration: Dominated by a few large-scale developers and manufacturers, with increasing participation from specialized project developers.

- Technological Innovation: Driven by advancements in PV cell efficiency, energy storage solutions, and smart grid integration, aiming to enhance reliability and cost-effectiveness.

- Regulatory Frameworks: Government policies supporting renewable energy adoption, such as net metering and carbon reduction targets, significantly influence market growth.

- Competitive Product Substitutes: While solar energy is gaining prominence, challenges from other renewable sources and traditional energy generation methods persist.

- End-User Demographics: A growing awareness of environmental issues and rising electricity costs are influencing both residential and commercial adoption rates.

- M&A Trends: Strategic mergers and acquisitions are evident as companies seek to consolidate market position, acquire new technologies, and expand their project portfolios. The Japan solar energy market share is continuously being reshaped by these activities.

Japan Solar Energy Market Growth Trends & Insights

The Japan solar energy market has experienced remarkable growth, propelled by a confluence of supportive government policies, increasing environmental consciousness, and significant technological advancements. The market size has expanded substantially, driven by a robust Japan solar energy market forecast, indicating sustained upward momentum. Adoption rates, particularly for rooftop and utility-scale deployments, have climbed steadily as the economic viability of solar power becomes increasingly apparent. Technological disruptions, such as the development of higher efficiency solar panels and advanced energy storage systems, are further accelerating this growth.

Consumer behavior has undergone a noticeable shift, with a greater preference for sustainable energy solutions among households and businesses alike. This shift is fueled by rising electricity prices from conventional sources and a growing desire to reduce carbon footprints. The penetration of solar energy across various applications, from residential installations to large-scale commercial and industrial projects, underscores its evolving role in Japan's energy mix. The Japan solar panel market is a testament to this, with continuous innovation in panel technology enhancing performance and reducing costs. Furthermore, the utility-scale solar Japan segment is witnessing significant investment, driven by the nation's commitment to large-scale renewable energy generation.

The market's trajectory is also influenced by evolving grid integration technologies and the development of smart grids, which enable more efficient management of intermittent solar power. As Japan continues its ambitious decarbonization goals, the solar energy sector is poised to play an even more critical role, contributing significantly to the nation's energy security and environmental sustainability objectives. This detailed analysis of Japan solar energy market trends provides a clear picture of its past evolution and future potential.

Dominant Regions, Countries, or Segments in Japan Solar Energy Market

The Japan solar energy market exhibits dominance across several key segments and geographical regions, driven by a combination of economic incentives, policy support, and geographical suitability. The Utility-scale solar deployment segment stands out as a major growth engine, attracting significant investment due to its capacity for large-scale power generation and contribution to national renewable energy targets. This segment's dominance is further bolstered by substantial government initiatives and the availability of suitable land for large solar farms, particularly in rural areas.

The Ground-mounted deployment method is intrinsically linked to the utility-scale segment, accounting for a significant portion of the installed solar capacity. These large solar farms, strategically located across the country, are instrumental in meeting Japan's energy demands with clean power. Key drivers for this segment's growth include streamlined permitting processes for utility-scale projects and attractive power purchase agreements (PPAs) that ensure revenue stability for investors.

Utility-scale Deployment: Continues to lead market growth due to its significant power generation capacity and contribution to national renewable energy goals.

- Economic Policies: Government support through large-scale project tenders and feed-in tariffs has fueled investment in utility-scale solar.

- Infrastructure: Development of dedicated solar farms on underutilized land and brownfield sites facilitates large-scale installations.

- Market Share: Holds the largest share of installed solar capacity, consistently expanding year-on-year.

- Growth Potential: Remains high due to Japan's ongoing commitment to increasing its renewable energy portfolio.

Ground-mounted Deployment: Facilitates the expansion of utility-scale solar, benefiting from suitable land availability and streamlined project development.

- Land Availability: Access to large tracts of land, especially in prefectures with lower population density, is a key enabler.

- Technological Advancements: Innovations in mounting structures and bifacial solar panels optimize land utilization and energy yield.

While utility-scale and ground-mounted deployments command significant attention, the Commercial and Industrial (C&I) application segment is also a critical growth driver. Businesses are increasingly adopting solar power to reduce operational costs, enhance their corporate social responsibility (CSR) profile, and achieve energy independence. The Rooftop deployment method is particularly prevalent in the C&I sector, leveraging existing building infrastructure to generate clean energy without requiring additional land. The residential solar segment, while smaller in terms of individual project scale, is crucial for widespread adoption and energy decentralization. Prefectures with strong economic activity and high energy consumption often lead in C&I solar adoption, while areas with favorable solar irradiance and government incentives see higher residential uptake.

Japan Solar Energy Market Product Landscape

The Japan solar energy market is characterized by a dynamic product landscape marked by continuous innovation and performance enhancements in photovoltaic (PV) technology. Manufacturers are intensely focused on increasing solar panel efficiency, with next-generation technologies like PERC, TOPCon, and heterojunction (HJT) cells gaining traction, offering higher energy yields per square meter. Bifacial solar panels, capable of capturing sunlight from both sides, are also becoming increasingly popular, especially for ground-mounted and commercial installations, optimizing energy generation in various conditions.

Beyond solar panels, advancements in energy storage solutions, including high-density lithium-ion batteries and emerging battery chemistries, are crucial for enhancing the reliability and grid integration of solar power. Inverters are also evolving, with smart inverters offering enhanced grid management capabilities, fault detection, and power optimizers. The integration of AI and IoT in solar monitoring and management systems is leading to more efficient operation, predictive maintenance, and optimized energy dispatch. These product innovations are critical in driving down the levelized cost of energy (LCOE) and making solar power more competitive across all deployment segments.

Key Drivers, Barriers & Challenges in Japan Solar Energy Market

The Japan solar energy market is propelled by several key drivers that are accelerating its growth and integration into the national energy framework. A primary catalyst is the robust government support through favorable policies such as feed-in tariffs (FiTs), tax incentives, and ambitious renewable energy targets aimed at decarbonization and energy security. Technological advancements in solar PV efficiency, coupled with declining manufacturing costs, have significantly improved the economic viability of solar power projects. Furthermore, growing corporate sustainability initiatives and increasing consumer awareness of climate change are fostering demand for clean energy solutions.

- Key Drivers:

- Supportive government policies and renewable energy targets.

- Technological advancements leading to increased efficiency and reduced costs.

- Growing corporate and consumer demand for sustainable energy.

- Energy security concerns driving diversification of energy sources.

Conversely, the market faces significant barriers and challenges that can impede its full potential. Land scarcity and high acquisition costs, particularly in densely populated urban areas, present a considerable hurdle for large-scale ground-mounted projects. Intermittency of solar power generation requires substantial investment in energy storage solutions and grid modernization to ensure grid stability and reliability. Regulatory complexities and lengthy permitting processes can also cause project delays. Moreover, competition from established energy sources and potential supply chain disruptions for critical components pose ongoing challenges.

- Barriers & Challenges:

- Land scarcity and high acquisition costs.

- Intermittency of solar power and need for energy storage.

- Grid integration challenges and infrastructure upgrades.

- Complex regulatory frameworks and permitting procedures.

- Supply chain vulnerabilities for raw materials and components.

- Competition from conventional energy sources.

Emerging Opportunities in Japan Solar Energy Market

Emerging opportunities in the Japan solar energy market are largely driven by innovations in energy storage and grid integration, alongside the untapped potential in distributed generation. The growing demand for reliable and resilient power supply is fueling the adoption of hybrid solar-plus-storage systems, particularly in commercial and industrial sectors seeking energy independence and backup power. Furthermore, the integration of solar energy with electric vehicles (EVs) and smart home technologies presents a significant growth avenue, enabling synergistic energy management and enhanced consumer value. The development of floating solar farms on reservoirs and inland water bodies also offers a novel approach to overcome land scarcity challenges.

- Hybrid Solar-Plus-Storage Systems: Increasing demand for grid resilience and energy independence.

- Solar-EV Integration: Synergistic energy management and charging solutions.

- Smart Home Energy Management: Enhanced efficiency and consumer control through integrated systems.

- Floating Solar Farms: Innovative solutions to address land constraints.

Growth Accelerators in the Japan Solar Energy Market Industry

Several key growth accelerators are poised to propel the Japan solar energy market forward in the coming years. Technological breakthroughs, particularly in the realm of high-efficiency solar cells and advanced battery technologies, are continuously driving down costs and improving performance, making solar power more competitive. Strategic partnerships and collaborations between solar developers, technology providers, and utilities are fostering innovation and enabling the development of larger, more complex projects. Market expansion strategies, including the exploration of offshore solar installations and the integration of solar energy with other renewable sources like wind power, will further diversify and strengthen the nation's renewable energy portfolio.

Key Players Shaping the Japan Solar Energy Market Market

- JinkoSolar Holding Co Ltd

- First Solar Inc

- Trina Solar Co Ltd

- LG Electronics Inc

- SunPower Corporation

- Mitsubishi Electric Corporation

- Canadian Solar Inc

- Sharp Corporation

- Toshiba Corp

- Hanwha Corporation

Notable Milestones in Japan Solar Energy Market Sector

- February 2022: US-based Enfinity Global acquired a USD 1 billion utility-scale solar photovoltaic (PV) power portfolio in Japan.

- February 2022: X-Elio closed a financing deal for its Sodegaura solar PV plant in Japan with Societe Generale and ING. The funding will be used for the construction, operation, and management of the 16MW Sodegaura solar PV plant in the Chiba prefecture of Japan in Tokyo Bay.

- February 2022: JERA and West Holdings Corporation (West HD) reached heads of agreement on a business alliance to develop solar power generation projects in Japan.

In-Depth Japan Solar Energy Market Market Outlook

The Japan solar energy market outlook is exceptionally promising, characterized by sustained growth driven by an unwavering commitment to clean energy and ambitious decarbonization targets. Growth accelerators such as continuous technological advancements in solar panel efficiency and energy storage solutions will further enhance the economic competitiveness of solar power. Strategic partnerships among key industry players will continue to unlock new project development opportunities and foster innovation. The market's future potential is immense, with significant scope for expansion in utility-scale projects, distributed generation, and the integration of solar energy with emerging technologies like hydrogen fuel cells and electric vehicles. These strategic opportunities position Japan at the forefront of global solar energy adoption, ensuring a cleaner and more sustainable energy future.

Japan Solar Energy Market Segmentation

-

1. Deployment

- 1.1. Rooftop

- 1.2. Ground-mounted

-

2. Application

- 2.1. Residential

- 2.2. Commercial and Industrial

- 2.3. Utility-scale

Japan Solar Energy Market Segmentation By Geography

- 1. Japan

Japan Solar Energy Market Regional Market Share

Geographic Coverage of Japan Solar Energy Market

Japan Solar Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Solar Energy Demand4.; Declining Cost of Solar PV Systems

- 3.3. Market Restrains

- 3.3.1. 4.; Strong Dependence on Prevailing Weather Condition

- 3.4. Market Trends

- 3.4.1. Ground-mounted to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Solar Energy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. Rooftop

- 5.1.2. Ground-mounted

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial and Industrial

- 5.2.3. Utility-scale

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 JinkoSolar Holding Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 First Solar Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Trina Solar Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LG Electronics Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SunPower Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mitsubishi Electric Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Canadian Solar Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sharp Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Toshiba Corp *List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hanwha Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 JinkoSolar Holding Co Ltd

List of Figures

- Figure 1: Japan Solar Energy Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Japan Solar Energy Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Solar Energy Market Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 2: Japan Solar Energy Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Japan Solar Energy Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Japan Solar Energy Market Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 5: Japan Solar Energy Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Japan Solar Energy Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Solar Energy Market?

The projected CAGR is approximately 7.6%.

2. Which companies are prominent players in the Japan Solar Energy Market?

Key companies in the market include JinkoSolar Holding Co Ltd, First Solar Inc, Trina Solar Co Ltd, LG Electronics Inc, SunPower Corporation, Mitsubishi Electric Corporation, Canadian Solar Inc, Sharp Corporation, Toshiba Corp *List Not Exhaustive, Hanwha Corporation.

3. What are the main segments of the Japan Solar Energy Market?

The market segments include Deployment, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Solar Energy Demand4.; Declining Cost of Solar PV Systems.

6. What are the notable trends driving market growth?

Ground-mounted to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Strong Dependence on Prevailing Weather Condition.

8. Can you provide examples of recent developments in the market?

In February 2022, US-based Enfinity Global acquired a USD 1 billion utility-scale solar photovoltaic (PV) power portfolio in Japan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Solar Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Solar Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Solar Energy Market?

To stay informed about further developments, trends, and reports in the Japan Solar Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence