Key Insights

The Middle East renewable energy market is projected to experience substantial growth, reaching a market size of 52.91 billion by 2025, with a projected CAGR of 14.4%. This expansion is fueled by aggressive national diversification strategies away from fossil fuels, significant government investment in sustainable infrastructure, and a growing commitment to addressing climate change. The rising demand for clean energy is evident in the increasing adoption of solar and wind power, which are becoming increasingly cost-competitive with conventional energy sources. Governments across the region are actively implementing supportive policies, offering incentives, and simplifying regulatory frameworks to attract investment in renewable energy projects, fostering the development of large-scale solar farms, offshore wind projects, and innovative energy storage solutions. The market is witnessing a strong trend towards utility-scale projects, complemented by growing interest in distributed renewable energy generation, particularly within the commercial and industrial sectors.

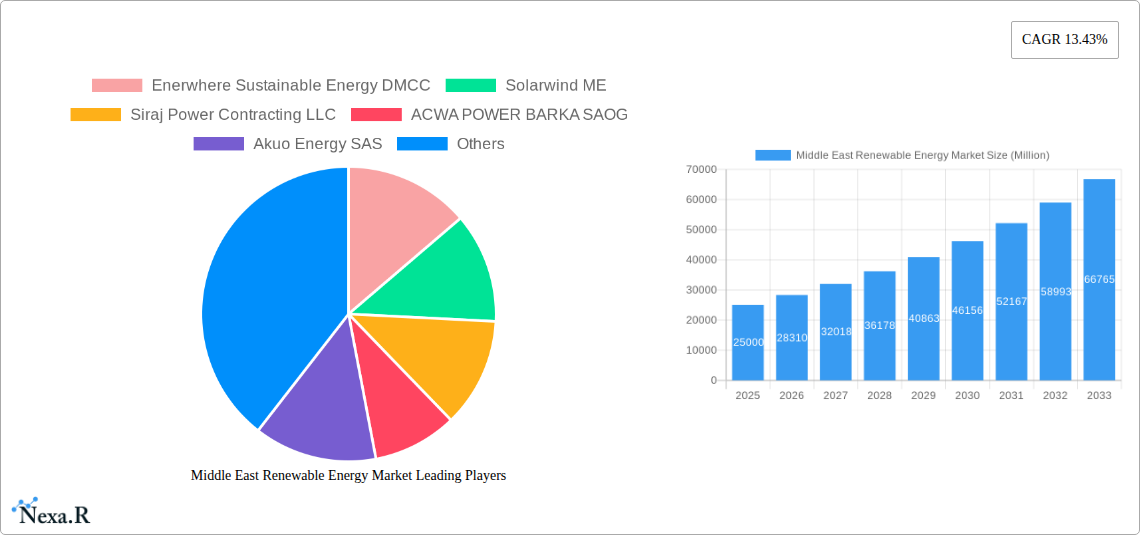

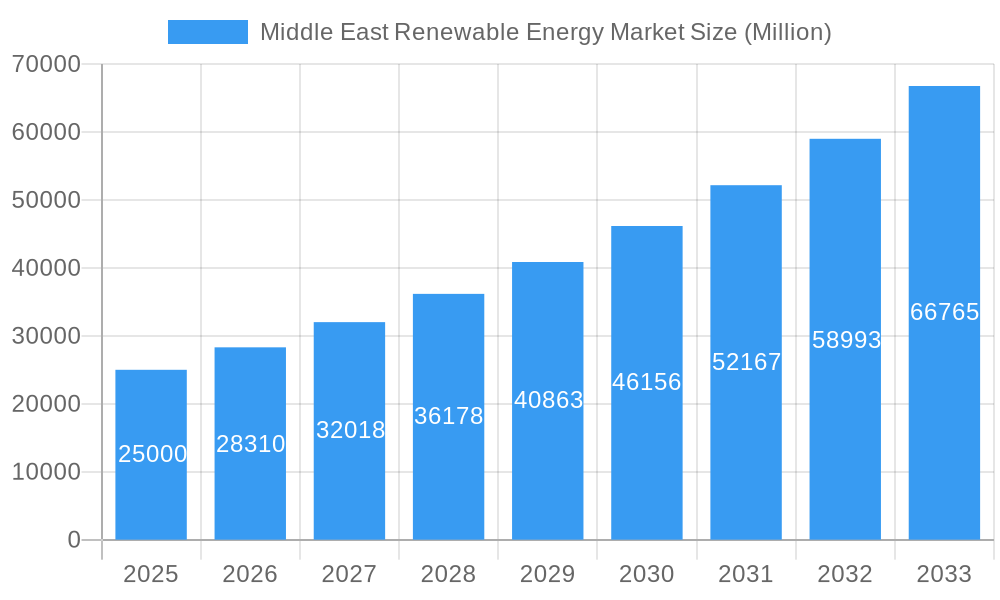

Middle East Renewable Energy Market Market Size (In Billion)

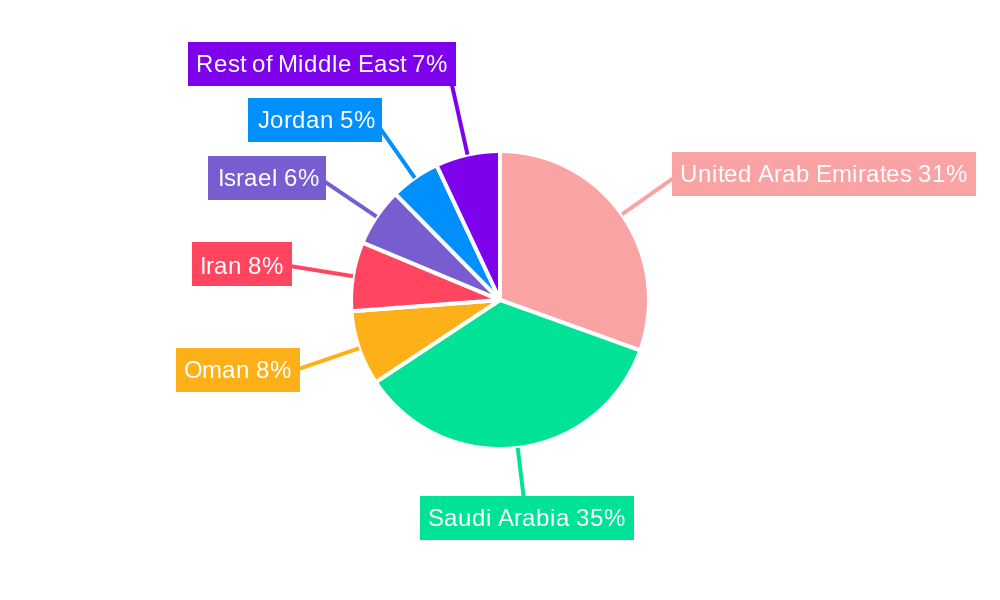

Key market dynamics include the integration of smart grid technologies for enhanced grid stability and efficiency, the exploration of green hydrogen as a future energy carrier, and advancements in energy storage systems to mitigate the intermittency of renewable sources. Potential challenges include high upfront capital investment, the requirement for skilled labor, and the possibility of intermittent policy changes. Nevertheless, the region's commitment to sustainability and energy security positions it as a key area for renewable energy innovation and deployment. Leading nations such as the United Arab Emirates and Saudi Arabia are spearheading this transformation with extensive project pipelines, setting a regional benchmark. The competitive landscape comprises established energy leaders and emerging players, all seeking to leverage the opportunities within this dynamic market.

Middle East Renewable Energy Market Company Market Share

Middle East Renewable Energy Market: Comprehensive Analysis and Forecast (2019–2033)

Unlock the immense potential of the Middle East renewable energy sector with this in-depth report. Covering the period from 2019 to 2033, with a base year of 2025, this analysis delves into critical market dynamics, growth trends, regional dominance, product landscapes, and key players shaping the future of sustainable energy in the region. Gain actionable insights into market size evolution, adoption rates, technological advancements, and emerging opportunities, essential for strategic decision-making in solar power, wind energy, and other renewable segments. This report provides a granular view of the market, segmented by Type (Hydro, Solar, Wind, Other Types) and Geography (United Arab Emirates (UAE), Saudi Arabia, Oman, Iran, Israel, Jordan, Rest of Middle East), offering a complete picture for investors, policymakers, and industry professionals.

Middle East Renewable Energy Market Market Dynamics & Structure

The Middle East renewable energy market is characterized by a growing concentration of large-scale projects, driven by ambitious national energy diversification strategies and a strong push for decarbonization. Technological innovation is a primary driver, with significant advancements in solar photovoltaic (PV) efficiency and concentrated solar power (CSP) technologies, alongside increasing interest in wind energy solutions. Robust regulatory frameworks, including supportive feed-in tariffs and renewable energy targets, are instrumental in fostering market growth. While direct competitive product substitutes are limited in the core renewable energy generation, efficiency improvements in traditional energy sources and evolving energy storage solutions present indirect competitive pressures. End-user demographics are shifting, with governments, utilities, and increasingly, large industrial consumers, actively seeking to integrate renewable energy into their portfolios. Mergers and acquisitions (M&A) are a significant trend, consolidating market players and facilitating the scaling of projects. For instance, in 2023, there were an estimated xx M&A deals, with a combined value of xx million units, indicative of a maturing and consolidating market.

- Market Concentration: Dominated by utility-scale projects with a few key developers holding significant market share.

- Technological Innovation Drivers: Focus on cost reduction, efficiency gains in solar PV and CSP, and advancements in energy storage.

- Regulatory Frameworks: Government-led initiatives, national renewable energy targets, and supportive policies are crucial.

- Competitive Product Substitutes: Advancements in energy efficiency technologies and grid modernization.

- End-User Demographics: Government mandates, utility-led procurement, and growing corporate demand for clean energy.

- M&A Trends: Increasing consolidation among developers and manufacturers to achieve economies of scale and market access.

Middle East Renewable Energy Market Growth Trends & Insights

The Middle East renewable energy market is experiencing a period of unprecedented growth, projected to expand significantly in the coming years. This expansion is fueled by a substantial increase in installed capacity, driven by a combination of declining technology costs and strong governmental commitments to diversify away from fossil fuels. The market size is anticipated to grow from xx million units in 2019 to an estimated xx million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period (2025-2033). Adoption rates for solar energy, particularly utility-scale PV projects, have surged, becoming the dominant renewable technology across the region. Technological disruptions, such as the integration of AI for grid management and the development of more efficient solar panels, are further accelerating this adoption. Consumer behavior is evolving, with a growing awareness of climate change and a demand for cleaner energy options from both residential and commercial sectors, although this is still nascent compared to developed markets. The market penetration of renewable energy is projected to reach xx% by 2033, a significant increase from xx% in 2019.

Dominant Regions, Countries, or Segments in Middle East Renewable Energy Market

The United Arab Emirates (UAE) stands out as the dominant region and country driving the Middle East renewable energy market. This leadership is underpinned by a clear vision for a sustainable future, exemplified by ambitious targets for clean energy integration and substantial investments in cutting-edge renewable energy projects. The UAE's strategic geographical location, abundant solar resources, and supportive investment climate make it an attractive hub for renewable energy development. The Solar segment, within the renewable energy market, is overwhelmingly the primary driver of growth, accounting for an estimated xx% of the total installed capacity by 2025. This dominance is a direct consequence of the region's high solar irradiation levels and the significant technological advancements and cost reductions in solar PV and CSP technologies.

Key drivers for the UAE's dominance and the growth of solar energy include:

- Economic Policies and Diversification: Strong government policies aimed at diversifying the economy away from oil and gas, with renewable energy a cornerstone of this strategy. The UAE aims to generate 50% of its energy from clean sources by 2050.

- Infrastructure Development: Massive investments in grid modernization and infrastructure to support the integration of large-scale renewable energy projects. The development of dedicated solar parks has been crucial.

- Technological Adoption: Early and widespread adoption of advanced solar technologies, including bifacial panels and high-efficiency inverters.

- International Collaboration and Investment: Attracting significant foreign direct investment and forging partnerships with global renewable energy leaders.

- Supportive Regulatory Frameworks: Clear regulations, competitive tendering processes, and long-term power purchase agreements (PPAs) that de-risk investments.

- Market Share Growth: The solar segment's market share is projected to reach xx% of the total Middle East renewable energy market by 2033, with the UAE contributing a substantial portion of this.

Middle East Renewable Energy Market Product Landscape

The product landscape within the Middle East renewable energy market is rapidly evolving, with a focus on enhancing efficiency, reducing costs, and improving reliability. Solar PV modules are seeing continuous innovation, with advancements in materials and manufacturing processes leading to higher energy conversion rates and increased durability in harsh desert conditions. Concentrated Solar Power (CSP) technologies are also being refined, with molten salt storage solutions offering enhanced dispatchability and grid integration capabilities. Wind turbine technology is being adapted for the region's specific wind profiles, with some emerging developments in smaller, distributed wind solutions. The integration of advanced inverters and smart grid technologies is becoming standard, enabling better monitoring, control, and optimization of renewable energy generation.

Key Drivers, Barriers & Challenges in Middle East Renewable Energy Market

Key Drivers:

- Government Mandates and Targets: Ambitious national renewable energy goals set by various Middle Eastern countries.

- Declining Technology Costs: Significant reductions in the cost of solar PV and wind power technologies.

- Energy Diversification Strategies: National initiatives to reduce reliance on fossil fuels and enhance energy security.

- Environmental Concerns and Climate Change Commitments: Growing awareness and commitment to reducing carbon emissions.

- Foreign Direct Investment: Significant influx of capital from international investors attracted by the region's potential.

Barriers & Challenges:

- Intermittency of Renewable Sources: The inherent variability of solar and wind power requires robust grid integration and energy storage solutions.

- Grid Infrastructure Limitations: Existing grid infrastructure may require upgrades to handle the integration of large-scale renewable energy projects, with an estimated investment of xx million units needed for grid modernization by 2030.

- Water Scarcity for CSP Cooling: CSP technologies requiring water for cooling can be a challenge in arid regions, driving innovation in dry-cooling technologies.

- Supply Chain and Logistics: Ensuring efficient and cost-effective supply chains for components and equipment in a vast and sometimes remote region.

- Skilled Workforce Development: A need for trained personnel for installation, operation, and maintenance of renewable energy systems.

- Regulatory and Permitting Complexities: Navigating diverse regulatory landscapes and lengthy permitting processes can delay project implementation.

Emerging Opportunities in Middle East Renewable Energy Market

Emerging opportunities in the Middle East renewable energy market lie in the increasing demand for energy storage solutions to complement intermittent renewable sources, with the market for battery storage projected to reach xx million units by 2030. The development of green hydrogen production, leveraging the region's abundant solar and wind resources, presents a significant future growth avenue. Furthermore, distributed renewable energy systems and smart grid technologies offer opportunities for enhanced energy efficiency and resilience. The "Rest of Middle East" category, encompassing countries with developing renewable energy programs, represents untapped potential for investors and technology providers. Innovative applications such as solar-powered desalination plants and Agri-PV (agriculture integrated with PV) are also gaining traction.

Growth Accelerators in the Middle East Renewable Energy Market Industry

Several catalysts are accelerating the growth of the Middle East renewable energy market. Technological breakthroughs in solar panel efficiency, such as perovskite solar cells, and the advancement of long-duration energy storage technologies are crucial. Strategic partnerships between international renewable energy developers and local entities are fostering knowledge transfer and project execution. Government-led initiatives to streamline permitting processes and offer attractive incentives are vital market expansion strategies. The growing interest in corporate power purchase agreements (PPAs) from large industrial consumers seeking to meet their sustainability goals is a significant accelerator.

Key Players Shaping the Middle East Renewable Energy Market Market

- Enerwhere Sustainable Energy DMCC

- Solarwind ME

- Siraj Power Contracting LLC

- ACWA POWER BARKA SAOG

- Akuo Energy SAS

- Canadian Solar Inc

- EDF Renewables

- Yellow Door Energy Limited

- Masdar (Abu Dhabi Future Energy Co)

- MASE

Notable Milestones in Middle East Renewable Energy Market Sector

- July 2022: The fourth phase of Mohammed bin Rashid Solar Park was announced to be implemented by Noor Energy 1 PSC, which contains 0.7 GW CSP and 0.25 GW PV, including Parabolic Trough CSP plants of 0.6 GW (0.2 GW for each unit) & Molten Salt Tower CSP Plant of 0.1 GW. This project is expected to drive the cleanliness of Dubai to extend the clean energy share to 25% by 2030.

- February 2022: Energy China Hunal Thermal Power & China Machinery Engineering Corporation formally signed a subcontract for the Al Dhafra PV2 Solar Power Plant Project in UAE with an installed capacity of 2.1 GW. The project is expected to lower carbon emissions by more than 2.4 million metric tons per year in Abu Dhabi.

In-Depth Middle East Renewable Energy Market Market Outlook

The future outlook for the Middle East renewable energy market is exceptionally promising, fueled by sustained government commitment, rapid technological advancements, and increasing global pressure for decarbonization. Growth accelerators such as the escalating adoption of smart grid technologies, significant investments in green hydrogen infrastructure valued at over xx million units, and the expansion of utility-scale solar and wind projects will continue to propel the market forward. Strategic opportunities lie in further developing energy storage capacity, fostering regional cooperation for cross-border energy trade, and nurturing local manufacturing capabilities for renewable energy components. The market is poised for robust expansion, offering significant returns for stakeholders invested in the region's sustainable energy transition.

Middle East Renewable Energy Market Segmentation

-

1. Type

- 1.1. Hydro

- 1.2. Solar

- 1.3. Wind

- 1.4. Other Types

-

2. Geography

- 2.1. United Arab Emirates (UAE)

- 2.2. Saudi Arabia

- 2.3. Oman

- 2.4. Iran

- 2.5. Israel

- 2.6. Jordan

- 2.7. Rest of Middle East

Middle East Renewable Energy Market Segmentation By Geography

- 1. United Arab Emirates

- 2. Saudi Arabia

- 3. Oman

- 4. Iran

- 5. Israel

- 6. Jordan

- 7. Rest of Middle East

Middle East Renewable Energy Market Regional Market Share

Geographic Coverage of Middle East Renewable Energy Market

Middle East Renewable Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Costs and Increasing Efficiencies of Solar PV Panels 4.; Supportive Government Policies Towards Solar

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Alternative Clean Energy Sources and Increasing Natural Gas Consumption

- 3.4. Market Trends

- 3.4.1. Solar Energy Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Renewable Energy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hydro

- 5.1.2. Solar

- 5.1.3. Wind

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United Arab Emirates (UAE)

- 5.2.2. Saudi Arabia

- 5.2.3. Oman

- 5.2.4. Iran

- 5.2.5. Israel

- 5.2.6. Jordan

- 5.2.7. Rest of Middle East

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Arab Emirates

- 5.3.2. Saudi Arabia

- 5.3.3. Oman

- 5.3.4. Iran

- 5.3.5. Israel

- 5.3.6. Jordan

- 5.3.7. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United Arab Emirates Middle East Renewable Energy Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hydro

- 6.1.2. Solar

- 6.1.3. Wind

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United Arab Emirates (UAE)

- 6.2.2. Saudi Arabia

- 6.2.3. Oman

- 6.2.4. Iran

- 6.2.5. Israel

- 6.2.6. Jordan

- 6.2.7. Rest of Middle East

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Saudi Arabia Middle East Renewable Energy Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hydro

- 7.1.2. Solar

- 7.1.3. Wind

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United Arab Emirates (UAE)

- 7.2.2. Saudi Arabia

- 7.2.3. Oman

- 7.2.4. Iran

- 7.2.5. Israel

- 7.2.6. Jordan

- 7.2.7. Rest of Middle East

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Oman Middle East Renewable Energy Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hydro

- 8.1.2. Solar

- 8.1.3. Wind

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United Arab Emirates (UAE)

- 8.2.2. Saudi Arabia

- 8.2.3. Oman

- 8.2.4. Iran

- 8.2.5. Israel

- 8.2.6. Jordan

- 8.2.7. Rest of Middle East

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Iran Middle East Renewable Energy Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hydro

- 9.1.2. Solar

- 9.1.3. Wind

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. United Arab Emirates (UAE)

- 9.2.2. Saudi Arabia

- 9.2.3. Oman

- 9.2.4. Iran

- 9.2.5. Israel

- 9.2.6. Jordan

- 9.2.7. Rest of Middle East

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Israel Middle East Renewable Energy Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Hydro

- 10.1.2. Solar

- 10.1.3. Wind

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. United Arab Emirates (UAE)

- 10.2.2. Saudi Arabia

- 10.2.3. Oman

- 10.2.4. Iran

- 10.2.5. Israel

- 10.2.6. Jordan

- 10.2.7. Rest of Middle East

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Jordan Middle East Renewable Energy Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Hydro

- 11.1.2. Solar

- 11.1.3. Wind

- 11.1.4. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. United Arab Emirates (UAE)

- 11.2.2. Saudi Arabia

- 11.2.3. Oman

- 11.2.4. Iran

- 11.2.5. Israel

- 11.2.6. Jordan

- 11.2.7. Rest of Middle East

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Middle East Middle East Renewable Energy Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Hydro

- 12.1.2. Solar

- 12.1.3. Wind

- 12.1.4. Other Types

- 12.2. Market Analysis, Insights and Forecast - by Geography

- 12.2.1. United Arab Emirates (UAE)

- 12.2.2. Saudi Arabia

- 12.2.3. Oman

- 12.2.4. Iran

- 12.2.5. Israel

- 12.2.6. Jordan

- 12.2.7. Rest of Middle East

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Enerwhere Sustainable Energy DMCC

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Solarwind ME

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Siraj Power Contracting LLC

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 ACWA POWER BARKA SAOG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Akuo Energy SAS

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Canadian Solar Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 EDF Renewables

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Yellow Door Energy Limited

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Masdar (Abu Dhabi Future Energy Co )

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 MASE

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Enerwhere Sustainable Energy DMCC

List of Figures

- Figure 1: Middle East Renewable Energy Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East Renewable Energy Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Renewable Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 3: Middle East Renewable Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 5: Middle East Renewable Energy Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 7: Middle East Renewable Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 9: Middle East Renewable Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 11: Middle East Renewable Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 13: Middle East Renewable Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 15: Middle East Renewable Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 17: Middle East Renewable Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 19: Middle East Renewable Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 21: Middle East Renewable Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 23: Middle East Renewable Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 25: Middle East Renewable Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 27: Middle East Renewable Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 29: Middle East Renewable Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 31: Middle East Renewable Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 32: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 33: Middle East Renewable Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 34: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 35: Middle East Renewable Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 37: Middle East Renewable Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 38: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 39: Middle East Renewable Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 40: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 41: Middle East Renewable Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 43: Middle East Renewable Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 44: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 45: Middle East Renewable Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 46: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 47: Middle East Renewable Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Renewable Energy Market?

The projected CAGR is approximately 14.4%.

2. Which companies are prominent players in the Middle East Renewable Energy Market?

Key companies in the market include Enerwhere Sustainable Energy DMCC, Solarwind ME, Siraj Power Contracting LLC, ACWA POWER BARKA SAOG, Akuo Energy SAS, Canadian Solar Inc, EDF Renewables, Yellow Door Energy Limited, Masdar (Abu Dhabi Future Energy Co ), MASE.

3. What are the main segments of the Middle East Renewable Energy Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 52.91 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Costs and Increasing Efficiencies of Solar PV Panels 4.; Supportive Government Policies Towards Solar.

6. What are the notable trends driving market growth?

Solar Energy Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Alternative Clean Energy Sources and Increasing Natural Gas Consumption.

8. Can you provide examples of recent developments in the market?

July 2022: The fourth phase of Mohammed bin Rashid Solar Park was announced to be implemented by Noor Energy 1 PSC, which contains 0.7 GW CSP and 0.25 GW PV, including Parabolic Trough CSP plants of 0.6 GW ( 0.2 GW for each unit) & Molten Salt Tower CSP Plant of 0.1 GW. This project is expected to drive the cleanliness of Dubai to extend the clean energy share to 25% by 2030.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Renewable Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Renewable Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Renewable Energy Market?

To stay informed about further developments, trends, and reports in the Middle East Renewable Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence