Key Insights

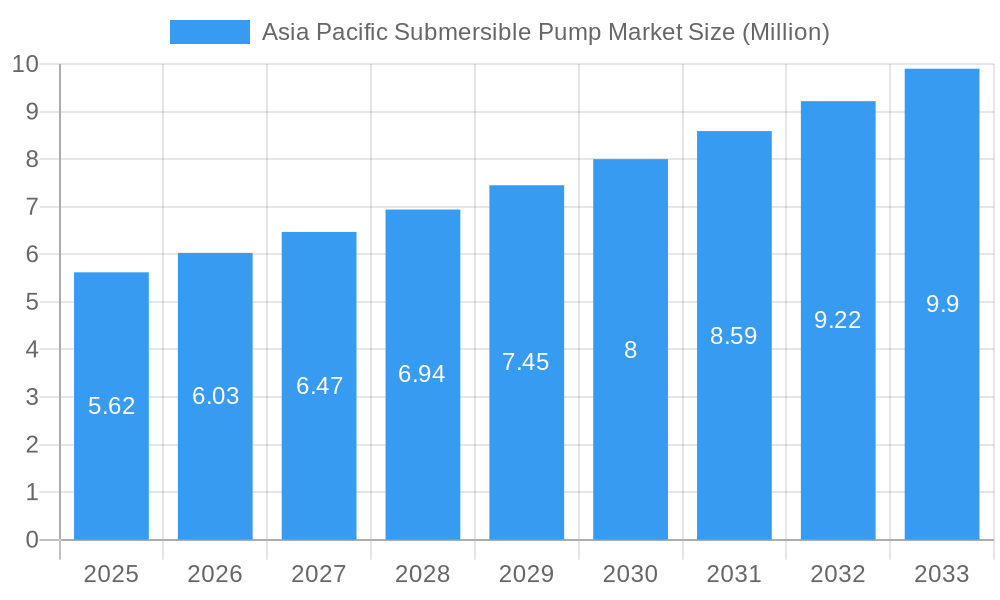

The Asia Pacific submersible pump market is poised for significant expansion, projected to reach $5.62 Million in value by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.20%. This impressive growth trajectory is underpinned by a confluence of strategic drivers, including the escalating demand for efficient water management solutions across rapidly urbanizing nations and the crucial role of submersible pumps in diverse industrial operations. The increasing investments in infrastructure development, particularly in water and wastewater treatment facilities, coupled with the burgeoning oil and gas exploration activities and the ongoing expansion within the mining and construction sectors, are collectively fueling market expansion. Furthermore, the adoption of advanced technologies, leading to more energy-efficient and durable submersible pump designs, is also a key contributor to this positive market outlook.

Asia Pacific Submersible Pump Market Market Size (In Million)

The market segmentation reveals distinct growth opportunities. Within types, Borewell Submersible Pumps are expected to dominate due to their widespread application in agricultural and domestic water supply, while Openwell Submersible Pumps will see steady demand for various industrial uses. Non-clog Submersible Pumps are gaining traction for wastewater management applications. Electric drive types are anticipated to lead the market, driven by their cost-effectiveness and environmental benefits, though Hydraulic and Truck drive types will cater to specific niche applications. Geographically, China and India are emerging as dominant markets, owing to their large populations, rapid industrialization, and substantial government initiatives focused on water infrastructure and resource management. The forecast period anticipates a sustained upward trend, with continuous innovation in pump technology and a persistent focus on sustainability and operational efficiency driving market dynamics.

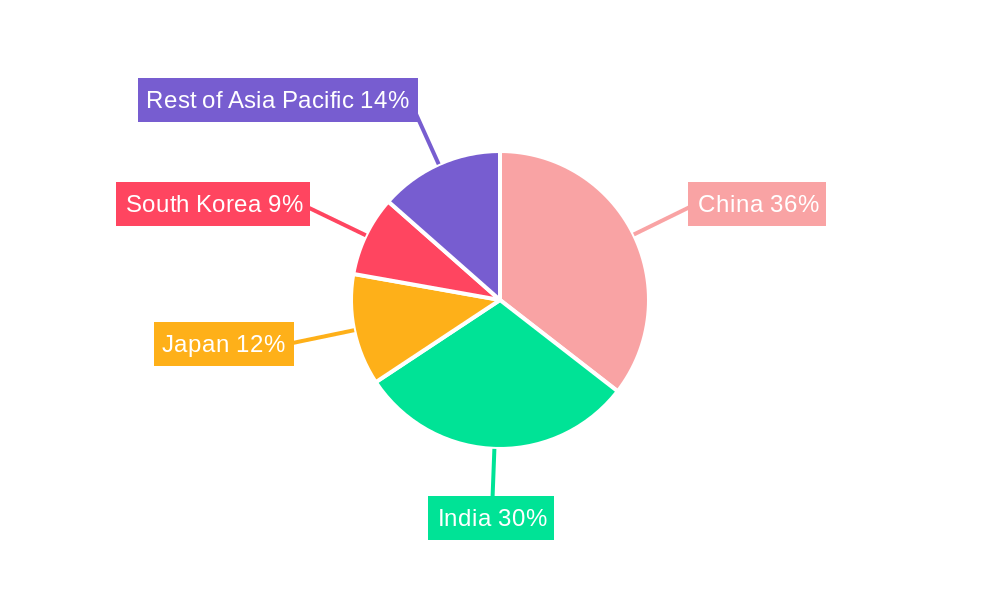

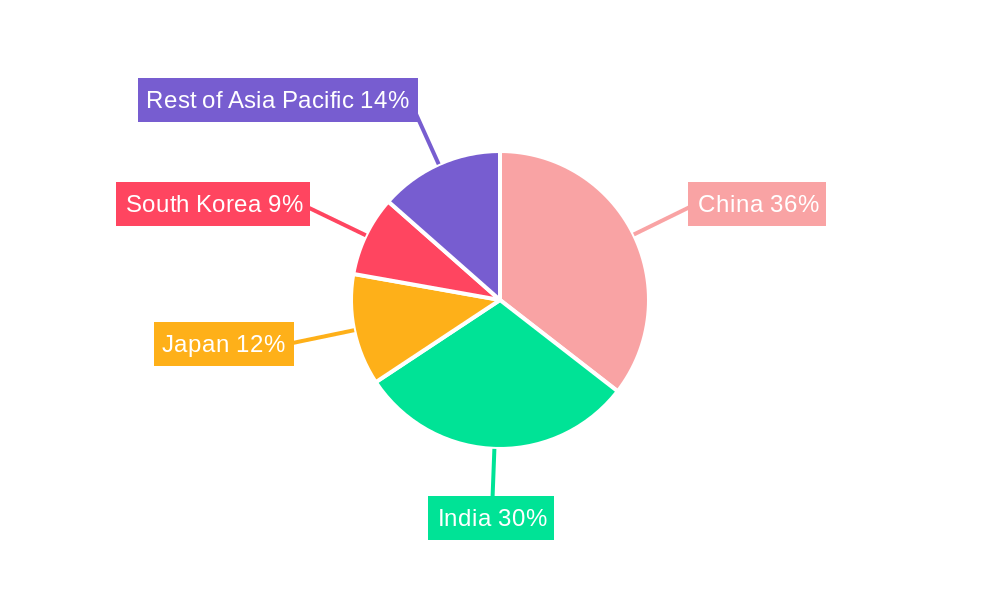

Asia Pacific Submersible Pump Market Company Market Share

Here's a comprehensive and SEO-optimized report description for the Asia Pacific Submersible Pump Market, incorporating all your specified requirements:

Asia Pacific Submersible Pump Market: A Deep Dive into Market Dynamics, Growth Trends, and Regional Dominance (2019-2033)

This in-depth report provides an exhaustive analysis of the Asia Pacific Submersible Pump Market, offering critical insights into market size, growth trajectories, and competitive landscapes. Covering a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the evolving dynamics of this crucial sector. We deliver detailed market segmentation by Type (Borewell Submersible Pump, Openwell Submersible Pump, Non-clog Submersible Pump), Drive Type (Truck, Electric, Hydraulic, Other Drive Types), Head (Below 50 m, Between 50 m to 100 m, Above 100 m), and End User (Water and Wastewater, Oil and Gas Industry, Mining and Construction Industry, Other End Users). The report also provides granular geographic analysis across China, India, Japan, South Korea, and the Rest of Asia-Pacific. Quantified data, including market share percentages and CAGR, are presented alongside qualitative analyses of market drivers, challenges, and emerging opportunities.

Asia Pacific Submersible Pump Market Regional Market Share

Asia Pacific Submersible Pump Market Market Dynamics & Structure

The Asia Pacific submersible pump market is characterized by a moderately fragmented structure, with a blend of global leaders and strong regional players contributing to market concentration. Technological innovation is a significant driver, fueled by advancements in energy efficiency, smart pump technologies, and materials science. Regulatory frameworks, particularly those promoting sustainable water management and energy conservation, are shaping product development and adoption rates. Competitive product substitutes, such as surface pumps and alternative water transfer solutions, exert pressure, necessitating continuous innovation and cost-effectiveness from submersible pump manufacturers. End-user demographics are increasingly diverse, with growing demand from agriculture, urban infrastructure development, and industrial applications. Mergers and acquisitions (M&A) trends are observed as companies seek to expand their market reach, acquire new technologies, and consolidate their positions. For instance, the growing emphasis on IoT-enabled pumps for remote monitoring and predictive maintenance represents a key innovation barrier for traditional manufacturers. Market share for key segments is influenced by these dynamics, with electric-driven pumps holding a substantial portion due to their widespread availability and cost-effectiveness.

- Market Concentration: Moderate, with key global players and robust regional manufacturers.

- Technological Innovation: Driven by energy efficiency, smart features, and durable materials.

- Regulatory Influence: Supportive policies for water conservation and renewable energy integration.

- Competitive Landscape: Intense competition from alternative pumping solutions.

- End-User Diversification: Expanding demand across agriculture, infrastructure, and industry.

- M&A Activity: Strategic acquisitions for market expansion and technological integration.

Asia Pacific Submersible Pump Market Growth Trends & Insights

The Asia Pacific submersible pump market is poised for robust growth, projected to expand significantly in terms of both volume and value. The market size evolution is intrinsically linked to increasing investments in water infrastructure, agricultural modernization, and industrial expansion across the region. Adoption rates for submersible pumps are escalating, particularly in developing economies where access to reliable water sources is paramount. Technological disruptions, such as the integration of variable frequency drives (VFDs) for enhanced energy efficiency and the development of smart pumps with IoT capabilities for remote monitoring and control, are reshaping consumer preferences. Consumer behavior shifts are evident, with a growing emphasis on durable, low-maintenance, and environmentally friendly pumping solutions. The agricultural sector, a cornerstone of many Asia Pacific economies, continues to be a major growth driver, with increasing demand for efficient irrigation systems. Similarly, rapid urbanization and the subsequent need for robust water and wastewater management systems are fueling market penetration. The mining and construction industries are also significant contributors, requiring high-capacity pumps for dewatering and fluid transfer. The overall market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period, driven by these multifaceted factors.

Dominant Regions, Countries, or Segments in Asia Pacific Submersible Pump Market

China and India stand out as the dominant regions within the Asia Pacific submersible pump market, driven by their immense populations, rapidly expanding industrial bases, and substantial investments in infrastructure development. In China, the sheer scale of urbanization and the government's focus on water resource management and agricultural modernization are primary growth enablers. The country's advanced manufacturing capabilities also contribute to a competitive domestic market. India, with its vast agricultural sector and ongoing rural electrification initiatives, presents a significant demand for borewell and openwell submersible pumps for irrigation. The "Make in India" initiative further fosters domestic production and innovation.

The Electric Drive Type segment holds a dominant position due to its widespread availability, cost-effectiveness, and versatility across various applications. Within end-users, the Water and Wastewater segment is a consistently large market, driven by the critical need for potable water supply and sewage management in both urban and rural areas. The Borewell Submersible Pump type is particularly dominant in regions like India, where groundwater extraction for agriculture is prevalent.

Key drivers for dominance in these regions include:

- Economic Policies: Government initiatives promoting infrastructure development, agricultural subsidies, and industrial growth.

- Infrastructure Development: Extensive investments in water supply networks, irrigation projects, and urban sanitation.

- Population Growth: Increasing demand for water in domestic, agricultural, and industrial sectors.

- Technological Adoption: Growing acceptance of energy-efficient and automated pumping solutions.

- Resource Availability: Significant groundwater reserves in certain regions fueling the demand for borewell pumps.

The market share for China and India in terms of units is estimated to be around 35% and 30% respectively, with the Rest of Asia-Pacific accounting for the remaining. The Water and Wastewater end-user segment is projected to hold over 40% of the market share.

Asia Pacific Submersible Pump Market Product Landscape

The Asia Pacific submersible pump market is characterized by a dynamic product landscape focused on enhanced efficiency, durability, and intelligent features. Manufacturers are increasingly offering advanced pump designs that minimize energy consumption and operational costs. Innovations include the development of pumps with higher head capacities for deeper wells and specialized non-clog designs for handling abrasive or debris-laden fluids. Product applications span critical sectors such as domestic water supply, large-scale irrigation systems, industrial fluid transfer, and wastewater management. The integration of smart technologies, enabling remote monitoring, diagnostics, and automated operation, is a key trend, enhancing user convenience and system reliability. Performance metrics such as flow rate, head, energy efficiency ratings, and material corrosion resistance are paramount selling propositions.

Key Drivers, Barriers & Challenges in Asia Pacific Submersible Pump Market

Key Drivers:

The Asia Pacific submersible pump market is propelled by several key drivers, including the escalating demand for water due to population growth and increased agricultural output, government initiatives promoting sustainable water management and smart agriculture, and the ongoing expansion of industrial and infrastructure projects across the region. Technological advancements, such as the development of energy-efficient motors and smart pump technologies, are also significantly boosting market growth. Furthermore, the increasing focus on renewable energy integration, particularly solar-powered submersible pumps, is opening new avenues for market expansion.

Barriers & Challenges:

Despite the positive growth trajectory, the market faces certain barriers and challenges. High initial investment costs for advanced submersible pumps can be a deterrent for some end-users, particularly small-scale farmers. Fluctuations in raw material prices, such as copper and steel, can impact manufacturing costs and profit margins. Intense competition among numerous players, leading to price pressures, is another significant challenge. Furthermore, inadequate maintenance infrastructure and a lack of skilled technicians in some developing regions can hinder the optimal performance and longevity of submersible pumps. Regulatory complexities and varying standards across different countries also pose challenges for market penetration.

Emerging Opportunities in Asia Pacific Submersible Pump Market

Emerging opportunities in the Asia Pacific submersible pump market lie in the increasing adoption of smart irrigation systems, driven by the need for precision agriculture and water conservation. The burgeoning renewable energy sector presents a substantial opportunity for solar-powered submersible pumps, particularly in off-grid rural areas. The growing demand for high-efficiency pumps in the burgeoning oil and gas sector for upstream and downstream operations, alongside the continuous need for reliable water and wastewater management solutions in rapidly urbanizing cities, also offers significant growth potential. Furthermore, the development of specialized submersible pumps for challenging industrial applications, such as chemical processing and mining, represents an untapped market segment.

Growth Accelerators in the Asia Pacific Submersible Pump Market Industry

The long-term growth of the Asia Pacific submersible pump market is being accelerated by significant technological breakthroughs, including the development of more energy-efficient motors, advanced control systems, and robust materials that enhance pump durability and performance. Strategic partnerships between manufacturers and technology providers are fostering innovation and the creation of integrated smart pumping solutions. Market expansion strategies, particularly in emerging economies with unmet water infrastructure needs, are crucial growth catalysts. The increasing government focus on water resource management, coupled with investments in smart cities and sustainable agriculture, are further accelerating the adoption of advanced submersible pump technologies.

Key Players Shaping the Asia Pacific Submersible Pump Market Market

- Falcon Pumps Pvt Ltd

- Flowserve Corporation

- Weir Group PLC

- Atlas Copco AB

- Baker Hughes Co

- Havells India Ltd

- Halliburton Co

- Crompton Greaves Consumer Electricals Limited

- Sulzer AG

- Schlumberger Limited

- Shimge Pump Industry Group Co Ltd

Notable Milestones in Asia Pacific Submersible Pump Market Sector

- September 2023: The Uttar Pradesh Government announced its goal to install more than 30,000 solar PV irrigation pumps under the PM KUSUM Yojana, allocating a budget of USD 52 million for FY 2023-24. This initiative aims to provide farmers in 75 districts with eco-friendly and sustainable energy solutions, overseeing installation through UPNEDA.

- February 2022: Shakti Pumps (India) Limited launched 4-inch Plug and Play Submersible Pumps, designed for higher efficiency, lower operational costs, and operation without a control box.

In-Depth Asia Pacific Submersible Pump Market Market Outlook

The future market outlook for the Asia Pacific submersible pump market is exceptionally promising, fueled by a confluence of accelerating factors. Continued urbanization, industrial growth, and the paramount need for efficient water management will drive sustained demand. The integration of Industry 4.0 technologies, leading to smarter, more connected, and predictive pumping systems, represents a significant future potential. Strategic collaborations and ongoing research and development will unlock new product segments and enhance existing offerings, catering to increasingly specialized requirements. Emerging economies are set to become key growth engines, offering substantial untapped market potential for innovative and cost-effective submersible pump solutions.

Asia Pacific Submersible Pump Market Segmentation

-

1. Type

- 1.1. Borewell Submersible Pump

- 1.2. Openwell Submersible Pump

- 1.3. Non-clog Submersible Pump

-

2. Drive Type

- 2.1. Truck

- 2.2. Electric

- 2.3. Hydraulic

- 2.4. Other Drive Types

-

3. Head

- 3.1. Below 50 m

- 3.2. Between 50 m to 100 m

- 3.3. Above 100 m

-

4. End User

- 4.1. Water and Wastewater

- 4.2. Oil and Gas Industry

- 4.3. Mining and Construction Industry

- 4.4. Other End Users

-

5. Geography

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. Rest of Asia-Pacific

Asia Pacific Submersible Pump Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asia Pacific Submersible Pump Market Regional Market Share

Geographic Coverage of Asia Pacific Submersible Pump Market

Asia Pacific Submersible Pump Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Presence of Strict Government Regulations to Control Air Pollution

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Oil and Gas Industry to Witness Significant Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Submersible Pump Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Borewell Submersible Pump

- 5.1.2. Openwell Submersible Pump

- 5.1.3. Non-clog Submersible Pump

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. Truck

- 5.2.2. Electric

- 5.2.3. Hydraulic

- 5.2.4. Other Drive Types

- 5.3. Market Analysis, Insights and Forecast - by Head

- 5.3.1. Below 50 m

- 5.3.2. Between 50 m to 100 m

- 5.3.3. Above 100 m

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Water and Wastewater

- 5.4.2. Oil and Gas Industry

- 5.4.3. Mining and Construction Industry

- 5.4.4. Other End Users

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. China

- 5.5.2. India

- 5.5.3. Japan

- 5.5.4. South Korea

- 5.5.5. Rest of Asia-Pacific

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. China

- 5.6.2. India

- 5.6.3. Japan

- 5.6.4. South Korea

- 5.6.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia Pacific Submersible Pump Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Borewell Submersible Pump

- 6.1.2. Openwell Submersible Pump

- 6.1.3. Non-clog Submersible Pump

- 6.2. Market Analysis, Insights and Forecast - by Drive Type

- 6.2.1. Truck

- 6.2.2. Electric

- 6.2.3. Hydraulic

- 6.2.4. Other Drive Types

- 6.3. Market Analysis, Insights and Forecast - by Head

- 6.3.1. Below 50 m

- 6.3.2. Between 50 m to 100 m

- 6.3.3. Above 100 m

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. Water and Wastewater

- 6.4.2. Oil and Gas Industry

- 6.4.3. Mining and Construction Industry

- 6.4.4. Other End Users

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. China

- 6.5.2. India

- 6.5.3. Japan

- 6.5.4. South Korea

- 6.5.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. India Asia Pacific Submersible Pump Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Borewell Submersible Pump

- 7.1.2. Openwell Submersible Pump

- 7.1.3. Non-clog Submersible Pump

- 7.2. Market Analysis, Insights and Forecast - by Drive Type

- 7.2.1. Truck

- 7.2.2. Electric

- 7.2.3. Hydraulic

- 7.2.4. Other Drive Types

- 7.3. Market Analysis, Insights and Forecast - by Head

- 7.3.1. Below 50 m

- 7.3.2. Between 50 m to 100 m

- 7.3.3. Above 100 m

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. Water and Wastewater

- 7.4.2. Oil and Gas Industry

- 7.4.3. Mining and Construction Industry

- 7.4.4. Other End Users

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. China

- 7.5.2. India

- 7.5.3. Japan

- 7.5.4. South Korea

- 7.5.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Asia Pacific Submersible Pump Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Borewell Submersible Pump

- 8.1.2. Openwell Submersible Pump

- 8.1.3. Non-clog Submersible Pump

- 8.2. Market Analysis, Insights and Forecast - by Drive Type

- 8.2.1. Truck

- 8.2.2. Electric

- 8.2.3. Hydraulic

- 8.2.4. Other Drive Types

- 8.3. Market Analysis, Insights and Forecast - by Head

- 8.3.1. Below 50 m

- 8.3.2. Between 50 m to 100 m

- 8.3.3. Above 100 m

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. Water and Wastewater

- 8.4.2. Oil and Gas Industry

- 8.4.3. Mining and Construction Industry

- 8.4.4. Other End Users

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. China

- 8.5.2. India

- 8.5.3. Japan

- 8.5.4. South Korea

- 8.5.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South Korea Asia Pacific Submersible Pump Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Borewell Submersible Pump

- 9.1.2. Openwell Submersible Pump

- 9.1.3. Non-clog Submersible Pump

- 9.2. Market Analysis, Insights and Forecast - by Drive Type

- 9.2.1. Truck

- 9.2.2. Electric

- 9.2.3. Hydraulic

- 9.2.4. Other Drive Types

- 9.3. Market Analysis, Insights and Forecast - by Head

- 9.3.1. Below 50 m

- 9.3.2. Between 50 m to 100 m

- 9.3.3. Above 100 m

- 9.4. Market Analysis, Insights and Forecast - by End User

- 9.4.1. Water and Wastewater

- 9.4.2. Oil and Gas Industry

- 9.4.3. Mining and Construction Industry

- 9.4.4. Other End Users

- 9.5. Market Analysis, Insights and Forecast - by Geography

- 9.5.1. China

- 9.5.2. India

- 9.5.3. Japan

- 9.5.4. South Korea

- 9.5.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Asia Pacific Asia Pacific Submersible Pump Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Borewell Submersible Pump

- 10.1.2. Openwell Submersible Pump

- 10.1.3. Non-clog Submersible Pump

- 10.2. Market Analysis, Insights and Forecast - by Drive Type

- 10.2.1. Truck

- 10.2.2. Electric

- 10.2.3. Hydraulic

- 10.2.4. Other Drive Types

- 10.3. Market Analysis, Insights and Forecast - by Head

- 10.3.1. Below 50 m

- 10.3.2. Between 50 m to 100 m

- 10.3.3. Above 100 m

- 10.4. Market Analysis, Insights and Forecast - by End User

- 10.4.1. Water and Wastewater

- 10.4.2. Oil and Gas Industry

- 10.4.3. Mining and Construction Industry

- 10.4.4. Other End Users

- 10.5. Market Analysis, Insights and Forecast - by Geography

- 10.5.1. China

- 10.5.2. India

- 10.5.3. Japan

- 10.5.4. South Korea

- 10.5.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Falcon Pumps Pvt Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Flowserve Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Weir Group PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Atlas Copco AB

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Baker Hughes Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Havells India Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Halliburton Co

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Crompton Greaves Consumer Electricals Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sulzer AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Schlumberger Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Shimge Pump Industry Group Co Ltd *List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Falcon Pumps Pvt Ltd

List of Figures

- Figure 1: Asia Pacific Submersible Pump Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Submersible Pump Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 4: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Drive Type 2020 & 2033

- Table 5: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Head 2020 & 2033

- Table 6: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Head 2020 & 2033

- Table 7: Asia Pacific Submersible Pump Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by End User 2020 & 2033

- Table 9: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 11: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Region 2020 & 2033

- Table 12: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 13: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 15: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 16: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Drive Type 2020 & 2033

- Table 17: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Head 2020 & 2033

- Table 18: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Head 2020 & 2033

- Table 19: Asia Pacific Submersible Pump Market Revenue Million Forecast, by End User 2020 & 2033

- Table 20: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by End User 2020 & 2033

- Table 21: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 23: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 27: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 28: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Drive Type 2020 & 2033

- Table 29: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Head 2020 & 2033

- Table 30: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Head 2020 & 2033

- Table 31: Asia Pacific Submersible Pump Market Revenue Million Forecast, by End User 2020 & 2033

- Table 32: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by End User 2020 & 2033

- Table 33: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 34: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 35: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 37: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 39: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 40: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Drive Type 2020 & 2033

- Table 41: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Head 2020 & 2033

- Table 42: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Head 2020 & 2033

- Table 43: Asia Pacific Submersible Pump Market Revenue Million Forecast, by End User 2020 & 2033

- Table 44: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by End User 2020 & 2033

- Table 45: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 46: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 47: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 49: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Type 2020 & 2033

- Table 50: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 51: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 52: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Drive Type 2020 & 2033

- Table 53: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Head 2020 & 2033

- Table 54: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Head 2020 & 2033

- Table 55: Asia Pacific Submersible Pump Market Revenue Million Forecast, by End User 2020 & 2033

- Table 56: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by End User 2020 & 2033

- Table 57: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 58: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 59: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 61: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Type 2020 & 2033

- Table 62: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 63: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 64: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Drive Type 2020 & 2033

- Table 65: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Head 2020 & 2033

- Table 66: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Head 2020 & 2033

- Table 67: Asia Pacific Submersible Pump Market Revenue Million Forecast, by End User 2020 & 2033

- Table 68: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by End User 2020 & 2033

- Table 69: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 70: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 71: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Country 2020 & 2033

- Table 72: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Submersible Pump Market?

The projected CAGR is approximately 7.20%.

2. Which companies are prominent players in the Asia Pacific Submersible Pump Market?

Key companies in the market include Falcon Pumps Pvt Ltd, Flowserve Corporation, Weir Group PLC, Atlas Copco AB, Baker Hughes Co, Havells India Ltd, Halliburton Co, Crompton Greaves Consumer Electricals Limited, Sulzer AG, Schlumberger Limited, Shimge Pump Industry Group Co Ltd *List Not Exhaustive.

3. What are the main segments of the Asia Pacific Submersible Pump Market?

The market segments include Type, Drive Type, Head, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.62 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Presence of Strict Government Regulations to Control Air Pollution.

6. What are the notable trends driving market growth?

Oil and Gas Industry to Witness Significant Demand.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Renewable Energy.

8. Can you provide examples of recent developments in the market?

September 2023, The Uttar Pradesh Government announced its goal to install more than 30,000 solar PV irrigation pumps under the PM KUSUM Yojana, allocating a budget of USD 52 million for FY 2023-24. The government officials stated the significant initiative aims to provide farmers in 75 districts of the state with eco-friendly and sustainable energy solutions. The implementation of this initiative falls under the purview of the Uttar Pradesh New and Renewable Energy Agency (UPNEDA), which will oversee the installation of clean energy-based irrigation systems through surface and submersible pump setups.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Submersible Pump Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Submersible Pump Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Submersible Pump Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Submersible Pump Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence