Key Insights

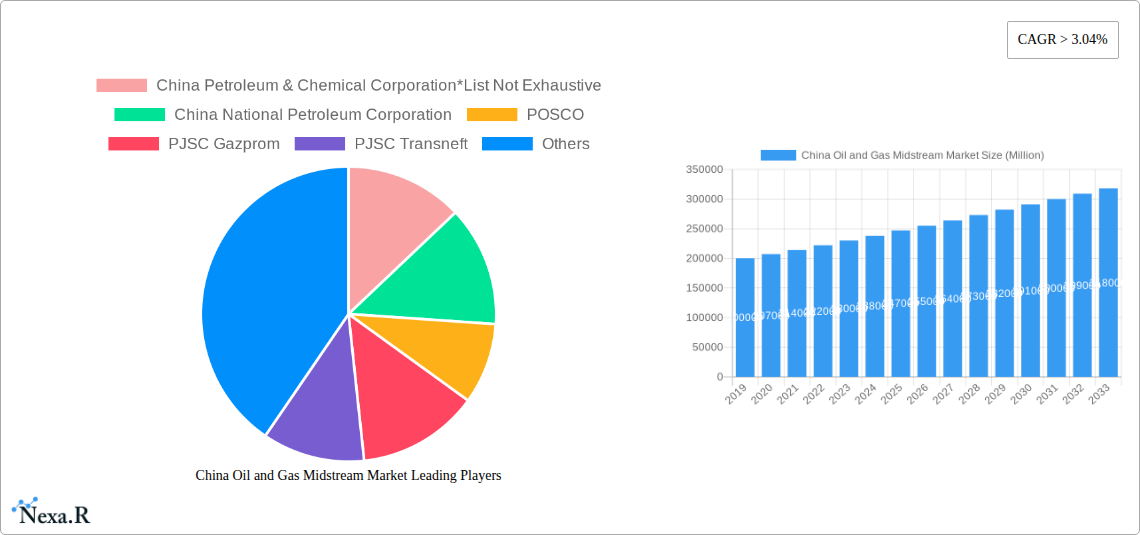

The China Oil and Gas Midstream Market is projected for substantial growth, estimated at 10.19 billion in the base year 2025. This expansion is driven by a Compound Annual Growth Rate (CAGR) of 12.42%, forecasting a market value to exceed 300 billion by 2033. Key growth catalysts include China's escalating energy demand, essential for its dynamic economy, and strategic imperatives to bolster energy security through diversified import channels and expanded domestic infrastructure. Significant investments are being channeled into upgrading and extending crude oil and natural gas pipeline networks, alongside developing Liquefied Natural Gas (LNG) terminals to accommodate rising LNG imports. The midstream sector's pivotal role in the safe and efficient transport of these resources is fundamental to China's economic progression.

China Oil and Gas Midstream Market Market Size (In Billion)

Several transformative trends are shaping the midstream sector. A pronounced shift towards cleaner energy is stimulating investment in natural gas infrastructure, positioning it as a critical transitional fuel. Advancements in pipeline integrity management, leak detection technologies, and automation are enhancing operational efficiency and safety standards. Furthermore, government initiatives aimed at establishing a more integrated and resilient national energy network are providing significant impetus for midstream development. However, the market faces certain constraints. Stringent environmental regulations, while promoting sustainability, can escalate compliance costs and introduce project delays. Geopolitical volatilities and fluctuating global commodity prices introduce market uncertainty, influencing investment decisions. The considerable capital expenditure required for large-scale infrastructure projects, coupled with the demand for specialized labor for operations and maintenance, present ongoing challenges for market participants.

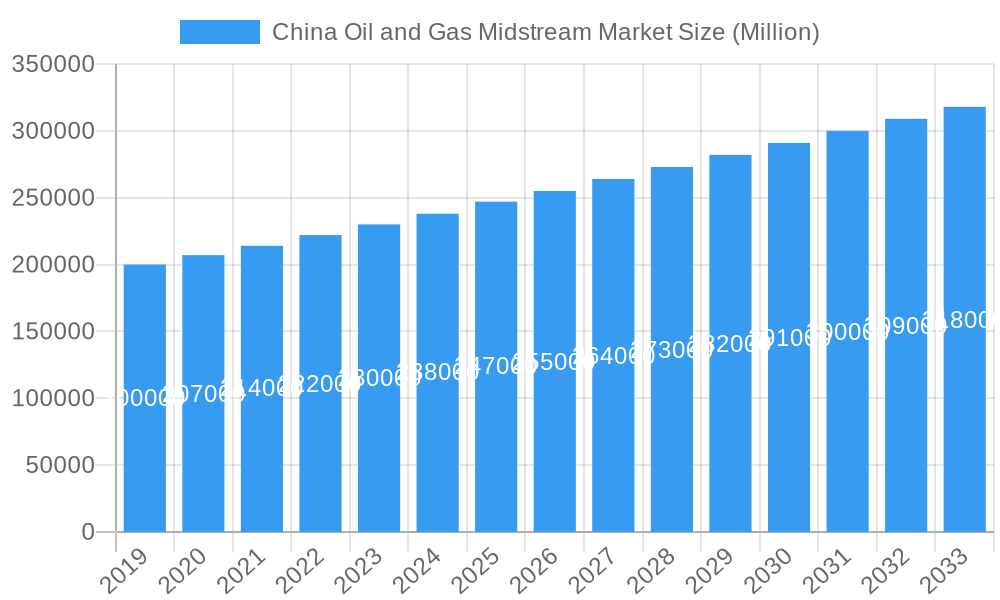

China Oil and Gas Midstream Market Company Market Share

This comprehensive report delivers a strategic outlook on the China Oil and Gas Midstream Market, offering critical insights into its market dynamics, growth trajectory, and future potential. The analysis, spanning from 2019 to 2033 with a base year of 2025, is invaluable for industry stakeholders seeking to navigate the evolving landscape of oil and gas transportation, storage, and LNG terminal operations in China. Market figures are presented in billions.

China Oil and Gas Midstream Market Market Dynamics & Structure

The China Oil and Gas Midstream Market is characterized by a moderately concentrated structure, with dominant state-owned enterprises like China National Petroleum Corporation (CNPC) and China Petroleum & Chemical Corporation (Sinopec) holding significant influence. However, the emergence of specialized entities such as PipeChina (China Oil & Gas Piping Network Corporation) is reshaping the competitive landscape by consolidating pipeline infrastructure. Technological innovation is a key driver, particularly in areas like pipeline integrity management, advanced leak detection systems, and the expansion of Liquefied Natural Gas (LNG) terminal capacity to meet growing energy demands and diversify supply sources. Regulatory frameworks, largely driven by national energy policies aimed at ensuring energy security and environmental sustainability, play a crucial role in market development. Competitive product substitutes are limited in the midstream sector, primarily revolving around the efficiency and capacity of existing infrastructure versus the development of new pipelines and terminals. End-user demographics are shifting towards a greater reliance on gas for power generation and industrial processes, influencing the demand for LNG import and storage solutions. Mergers and acquisitions (M&A) trends, while less frequent than in upstream or downstream sectors, are strategically focused on acquiring or consolidating key infrastructure assets and expanding operational reach. The market concentration is approximately 60% for the top three players, with M&A deal volumes in the historical period (2019-2024) estimated at over $5,000 Million. Innovation barriers include high capital expenditure for new infrastructure and stringent environmental approval processes.

China Oil and Gas Midstream Market Growth Trends & Insights

The China Oil and Gas Midstream Market is poised for significant expansion driven by robust economic growth, increasing domestic energy consumption, and government initiatives to enhance energy security and environmental performance. The market size evolution is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period (2025-2033). Adoption rates of advanced technologies in pipeline monitoring and LNG regasification are steadily increasing, contributing to operational efficiency and safety. Technological disruptions, such as the integration of digital twin technology for pipeline management and the development of smaller-scale, modular LNG facilities, are set to transform the market. Consumer behavior shifts, particularly the growing preference for cleaner energy sources like natural gas, are directly impacting the demand for midstream infrastructure. The market penetration of natural gas as a primary energy source is projected to reach over 35% by 2033, necessitating substantial investments in gas pipeline networks and LNG import terminals. The total market value in the base year (2025) is estimated at $55,000 Million, with a projected growth to over $95,000 Million by the end of the forecast period. This sustained growth is underpinned by China's strategic vision for a diversified and sustainable energy mix.

Dominant Regions, Countries, or Segments in China Oil and Gas Midstream Market

The Transportation segment, encompassing crude oil and natural gas pipelines, is the dominant force driving growth within the China Oil and Gas Midstream Market. This dominance is primarily attributed to the nation's vast geographical expanse and the continuous need to transport energy resources from production sites to consumption centers and import terminals. Key drivers for the transportation segment's supremacy include:

- Economic Policies: The Chinese government's consistent emphasis on energy self-sufficiency and the strategic development of energy corridors to connect resource-rich regions with major industrial hubs and coastal cities fuels immense investment in pipeline infrastructure. Policies promoting the use of natural gas as a cleaner alternative to coal further bolster demand for gas pipeline expansion.

- Infrastructure Development: China has undertaken ambitious infrastructure projects, including extensive national oil and gas pipeline networks, to ensure reliable energy supply across the country. The establishment of PipeChina itself signifies a strategic move to optimize and consolidate pipeline assets, enhancing efficiency and enabling larger-scale projects.

- Market Share and Growth Potential: The transportation segment currently accounts for over 65% of the total midstream market value. Its growth potential remains exceptionally high due to ongoing projects aimed at connecting remote gas fields, enhancing import capacities, and building intracity gas distribution networks. For instance, the projected expansion of the West-East Gas Pipeline network is a testament to this ongoing development.

- Technological Advancements: Innovations in pipeline construction, materials science, and leak detection technologies are making the transportation of hydrocarbons safer, more efficient, and environmentally sound, further encouraging investment. The ability to transport larger volumes at higher pressures also contributes to the segment's economic viability.

- End-User Demand: The burgeoning industrial sector, growing urbanization, and the increasing adoption of natural gas in vehicles and residential heating all contribute to a sustained and escalating demand for efficient and extensive pipeline transportation networks.

While LNG Terminals and Storage are critical components, their growth is intrinsically linked to the transportation networks that distribute the processed energy. LNG terminals serve as vital entry points for imported gas, which is then channeled through pipelines. Storage facilities, essential for managing supply-demand fluctuations, also rely on connectivity to transportation infrastructure. Therefore, the foundational role of transportation in the midstream value chain solidifies its position as the leading segment in the China Oil and Gas Midstream Market.

China Oil and Gas Midstream Market Product Landscape

The product landscape in the China Oil and Gas Midstream Market is defined by the critical infrastructure facilitating the movement and storage of hydrocarbons. This includes extensive pipeline networks for crude oil and natural gas, ranging from large-diameter trunk lines to smaller distribution lines. Innovations in pipeline materials, such as advanced composite pipes, are enhancing durability and reducing corrosion. LNG terminals, equipped with state-of-the-art regasification units and cryogenic storage tanks, are crucial for handling imported liquefied natural gas, with a focus on increasing receiving capacity and operational efficiency. Storage facilities, including underground gas storage caverns and aboveground tank farms, are vital for ensuring supply stability and peak demand management. Performance metrics are focused on flow rates, capacity utilization, energy efficiency in processing, and stringent safety standards, minimizing environmental impact.

Key Drivers, Barriers & Challenges in China Oil and Gas Midstream Market

Key Drivers: The China Oil and Gas Midstream Market is propelled by several key drivers. Firstly, China's insatiable demand for energy, driven by its robust industrial sector and growing population, necessitates efficient and expanded midstream infrastructure. Secondly, government initiatives prioritizing energy security and diversification, including a strong push towards natural gas, act as significant catalysts for investment in pipelines and LNG terminals. Thirdly, technological advancements in pipeline integrity and LNG handling are improving efficiency and safety, making new projects more viable. Finally, strategic investments in infrastructure development, particularly by state-owned enterprises, are expanding the network's reach and capacity.

Key Barriers & Challenges: Conversely, the market faces considerable barriers and challenges. The immense capital expenditure required for constructing large-scale pipelines and LNG terminals presents a significant financial hurdle. Stringent environmental regulations and lengthy approval processes can delay project timelines and increase costs. Geopolitical risks and the reliance on imported energy sources create supply chain vulnerabilities. Furthermore, land acquisition and rights-of-way issues in densely populated areas can complicate pipeline routing. Competition for resources and the need to balance traditional hydrocarbon infrastructure with the transition to renewable energy also pose ongoing challenges. The estimated impact of regulatory delays on project timelines can be up to 18 months, leading to cost overruns exceeding 10% of the total project value.

Emerging Opportunities in China Oil and Gas Midstream Market

Emerging opportunities in the China Oil and Gas Midstream Market are primarily centered around the expansion of natural gas infrastructure to meet the government's clean energy targets. This includes the development of more LNG import terminals and associated regasification facilities, particularly in coastal regions and to serve inland markets via pipeline. The increasing demand for underground gas storage to enhance energy security and manage seasonal demand fluctuations presents another significant opportunity. Furthermore, the integration of digitalization and advanced technologies such as AI-powered monitoring and predictive maintenance for pipelines offers avenues for operational optimization and cost reduction. There is also a growing opportunity in the repurposing of existing infrastructure for alternative energy carriers or in supporting the burgeoning hydrogen economy.

Growth Accelerators in the China Oil and Gas Midstream Market Industry

Several growth accelerators are poised to propel the China Oil and Gas Midstream Market forward. Technological breakthroughs in pipeline materials and construction techniques are enabling faster, more cost-effective, and environmentally friendly infrastructure development. Strategic partnerships between domestic and international energy companies are facilitating knowledge transfer and access to capital for large-scale projects. The Chinese government's continued commitment to energy transition and carbon neutrality goals provides a sustained policy tailwind, encouraging investment in natural gas infrastructure as a bridging fuel. Furthermore, market expansion strategies driven by integrated energy companies seeking to secure supply chains and optimize logistics will continue to fuel growth.

Key Players Shaping the China Oil and Gas Midstream Market Market

- China Petroleum & Chemical Corporation

- China National Petroleum Corporation

- POSCO

- PJSC Gazprom

- PJSC Transneft

- PipeChina (China Oil & Gas Piping Network Corporation)

- Sinotrans Limited

- Jiangsu Lianfa Chemical Fiber Co., Ltd.

- Shandong Dongming Petrochemical Group

- China National Chemical Corporation (ChemChina)

Notable Milestones in China Oil and Gas Midstream Market Sector

- November 2021: ExxonMobil announced the final investment decision (FID) to build a multi-billion dollar petrochemical complex in south China's Guangdong province. The Dayawan plant will produce performance polymers used in packaging, automotive, agricultural, and consumer products for hygiene and personal care.

- Ongoing: Continuous expansion of the West-East Gas Pipeline network, enhancing natural gas transmission from western production bases to eastern consumption centers.

- 2022-2023: Significant investments in upgrading and expanding LNG receiving terminals to accommodate increased imports.

- 2023: PipeChina continued its strategic consolidation of pipeline assets, aiming for enhanced operational efficiency and unified management.

- 2024: Exploration and development of new underground gas storage facilities to bolster national energy reserves.

In-Depth China Oil and Gas Midstream Market Market Outlook

The outlook for the China Oil and Gas Midstream Market remains exceptionally robust, fueled by sustained demand for energy and a strong policy impetus towards a cleaner energy mix. Growth accelerators such as technological innovation in pipeline engineering and digital management systems, coupled with strategic joint ventures, will further enhance operational efficiency and market reach. The ongoing expansion of natural gas infrastructure, including LNG terminals and extensive pipeline networks, is a primary focus, driven by China's commitment to reducing carbon emissions and ensuring energy security. Future market potential lies in the integration of smart technologies for real-time monitoring and predictive maintenance, optimizing asset utilization and minimizing environmental risks. Strategic opportunities will emerge from the development of more localized and modular energy infrastructure solutions and the potential role of midstream assets in the burgeoning hydrogen economy.

China Oil and Gas Midstream Market Segmentation

-

1. Type

- 1.1. Transportation

- 1.2. LNG Terminals

- 1.3. Storage

China Oil and Gas Midstream Market Segmentation By Geography

- 1. China

China Oil and Gas Midstream Market Regional Market Share

Geographic Coverage of China Oil and Gas Midstream Market

China Oil and Gas Midstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Electricity Demand4.; Rsing Investments in the Coal Industry

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Installation of Renewable Energy Sources

- 3.4. Market Trends

- 3.4.1. Transportation Sector to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Oil and Gas Midstream Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Transportation

- 5.1.2. LNG Terminals

- 5.1.3. Storage

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 China Petroleum & Chemical Corporation*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 China National Petroleum Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 POSCO

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PJSC Gazprom

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PJSC Transneft

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PipeChina (China Oil & Gas Piping Network Corporation)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sinotrans Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Jiangsu Lianfa Chemical Fiber Co. Ltd.

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shandong Dongming Petrochemical Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 China National Chemical Corporation (ChemChina)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 China Petroleum & Chemical Corporation*List Not Exhaustive

List of Figures

- Figure 1: China Oil and Gas Midstream Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Oil and Gas Midstream Market Share (%) by Company 2025

List of Tables

- Table 1: China Oil and Gas Midstream Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: China Oil and Gas Midstream Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: China Oil and Gas Midstream Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Oil and Gas Midstream Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 5: China Oil and Gas Midstream Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: China Oil and Gas Midstream Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 7: China Oil and Gas Midstream Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: China Oil and Gas Midstream Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Oil and Gas Midstream Market?

The projected CAGR is approximately 12.42%.

2. Which companies are prominent players in the China Oil and Gas Midstream Market?

Key companies in the market include China Petroleum & Chemical Corporation*List Not Exhaustive, China National Petroleum Corporation, POSCO, PJSC Gazprom, PJSC Transneft, PipeChina (China Oil & Gas Piping Network Corporation), Sinotrans Limited, Jiangsu Lianfa Chemical Fiber Co., Ltd., Shandong Dongming Petrochemical Group , China National Chemical Corporation (ChemChina).

3. What are the main segments of the China Oil and Gas Midstream Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.19 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Electricity Demand4.; Rsing Investments in the Coal Industry.

6. What are the notable trends driving market growth?

Transportation Sector to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Increasing Installation of Renewable Energy Sources.

8. Can you provide examples of recent developments in the market?

In November 2021, ExxonMobil announced the final investment decision (FID) to build a multi-billion dollar petrochemical complex in south China's Guangdong province. The Dayawan plant will produce performance polymers used in packaging, automotive, agricultural, and consumer products for hygiene and personal care.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Oil and Gas Midstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Oil and Gas Midstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Oil and Gas Midstream Market?

To stay informed about further developments, trends, and reports in the China Oil and Gas Midstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence