Key Insights

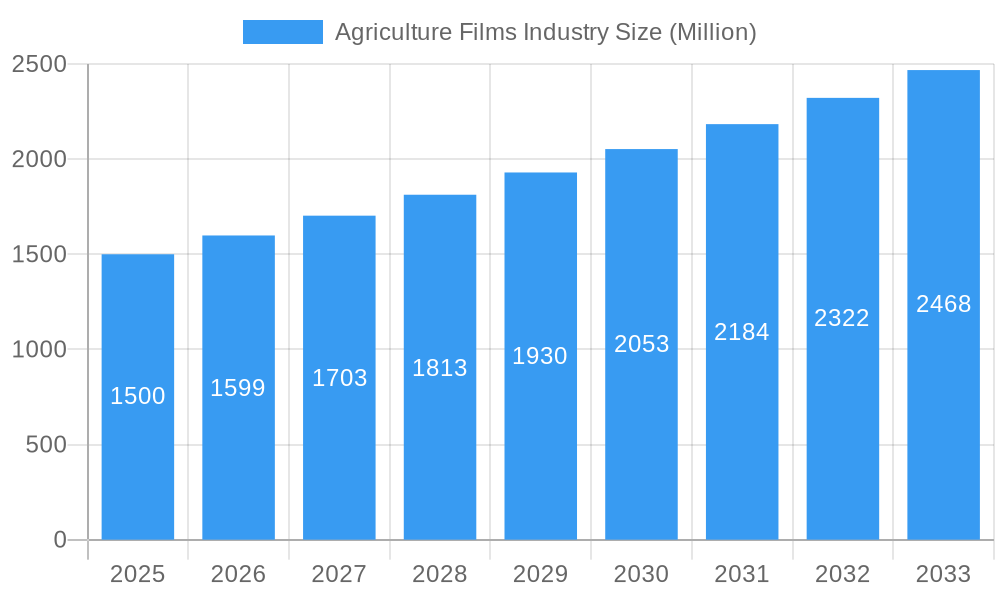

The global agriculture films market is forecast to reach $12.5 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 7.4% from 2025 to 2033. This growth is propelled by the escalating global demand for food production, driven by population expansion and the necessity for efficient farming methodologies. Agriculture films are instrumental in enhancing crop yields through mulching for moisture retention and weed suppression, and greenhouse cultivation for year-round production. Technological advancements, including the development of biodegradable and bio-based films, are also stimulating market expansion by addressing environmental concerns and plastic waste within the agricultural sector. Potential challenges include raw material price volatility and the emergence of alternative agricultural techniques. The market is segmented by film type (LDPE, LLDPE, HDPE, EVA/EBA, Reclaims, and Others) and application (Greenhouse, Silage, Mulching, and Others). The Asia-Pacific region is anticipated to lead market share due to its significant agricultural base and increasing adoption of modern farming practices.

Agriculture Films Industry Market Size (In Billion)

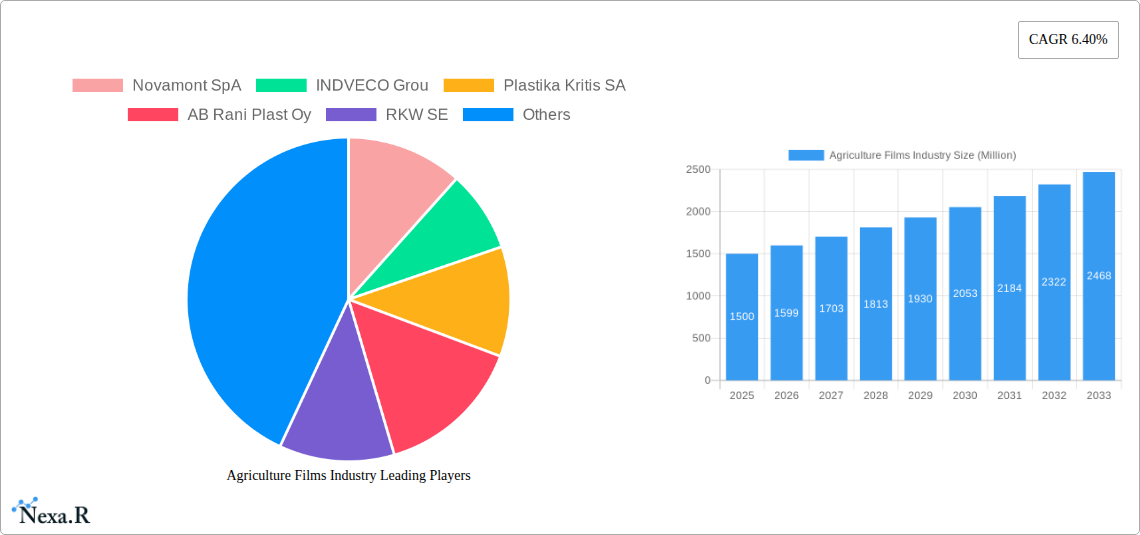

The competitive environment features a blend of multinational enterprises and regional suppliers. Prominent market participants include Novamont SpA, INDVECO Group, Plastika Kritis SA, AB Rani Plast Oy, RKW SE, ExxonMobil Chemical, Group Barbier, Berry Global Inc, Armando Alvarez Group, and BASF SE, all engaged in product innovation and market expansion. The development of specialized films with enhanced features, such as UV resistance and superior durability, will continue to drive market growth. Future expansion will be shaped by government initiatives supporting sustainable agriculture, advancements in film production technology, and shifts in global commodity prices, underscoring the ongoing need for efficient and sustainable solutions to boost agricultural output amidst a growing world population.

Agriculture Films Industry Company Market Share

Agriculture Films Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Agriculture Films industry, encompassing market dynamics, growth trends, regional landscapes, key players, and future outlooks. The study period covers 2019-2033, with a focus on 2025 as the base and estimated year. This report is crucial for industry professionals, investors, and strategists seeking to understand and capitalize on the opportunities within this dynamic sector. The report meticulously analyzes parent markets (plastics industry, agricultural inputs) and child markets (specific applications like greenhouse films, mulch films).

Agriculture Films Industry Market Dynamics & Structure

The global agriculture films market, valued at xx Million in 2024, is characterized by moderate concentration, with several multinational corporations and regional players competing. Technological innovation, driven by the need for sustainable and high-performance films, is a key dynamic. Stringent environmental regulations regarding plastic waste are shaping product development and influencing market trends. Biodegradable and compostable films are gaining traction, posing a competitive challenge to traditional petroleum-based films. Consumer preferences for sustainable agricultural practices further accelerate this shift.

- Market Concentration: Moderately concentrated, with top 10 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on biodegradable materials (PLA, PHA), enhanced UV resistance, improved water retention, and precision application techniques.

- Regulatory Framework: Increasingly stringent regulations on plastic waste management and promotion of sustainable materials are influencing market growth.

- Competitive Product Substitutes: Natural mulching materials (straw, wood chips) compete in niche segments; however, the efficiency and scalability of films maintain their dominance.

- End-User Demographics: Large-scale commercial farms dominate the demand, followed by smaller farms and horticultural businesses.

- M&A Trends: A moderate number of mergers and acquisitions occurred between 2019 and 2024, primarily focused on expanding product portfolios and geographical reach. Approximately xx M&A deals were recorded during this period.

Agriculture Films Industry Growth Trends & Insights

The agriculture films market experienced steady growth during 2019-2024, driven by rising agricultural production, increased adoption of advanced farming techniques, and a growing awareness of the benefits of film usage in optimizing crop yields and protecting against environmental stresses. The market is projected to witness a CAGR of xx% during the forecast period (2025-2033), reaching xx Million by 2033. This growth is attributed to technological advancements in film manufacturing, resulting in improved performance and cost-effectiveness. Shifting consumer preferences towards sustainable and eco-friendly agricultural practices are also fueling demand for biodegradable alternatives. Market penetration of biodegradable films is gradually increasing, projected to reach xx% by 2033.

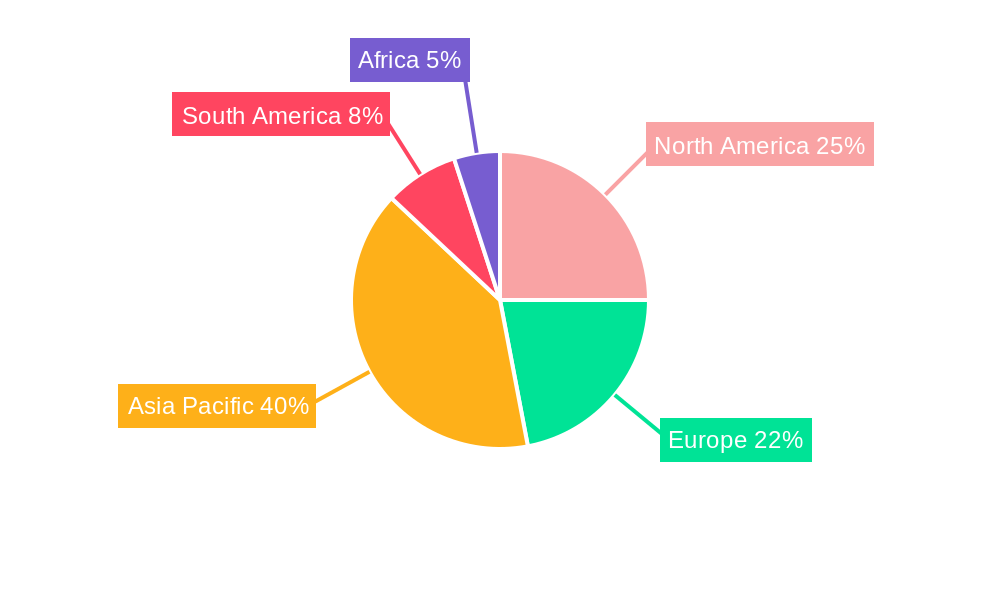

Dominant Regions, Countries, or Segments in Agriculture Films Industry

North America and Europe currently hold the largest market shares, driven by advanced agricultural practices and stringent environmental regulations that encourage the adoption of sustainable solutions. However, Asia-Pacific is anticipated to witness the fastest growth rate during the forecast period, driven by expanding agricultural lands, rising disposable incomes, and increasing government support for agricultural modernization.

Type: Low-Density Polyethylene (LDPE) currently dominates the market, followed by Linear Low-Density Polyethylene (LLDPE). However, the demand for biodegradable alternatives like Ethyl Vinyl Acetate (EVA)/Ethylene Butyl Acrylate (EBA) and Reclaims is growing rapidly.

Application: Mulching films represent the largest segment, driven by their effectiveness in weed control, moisture retention, and improved crop yields. Greenhouse films are also a significant segment, with continued growth projected as controlled-environment agriculture expands.

- Key Drivers (North America & Europe): High agricultural productivity, stringent environmental regulations, high adoption rates of advanced farming practices.

- Key Drivers (Asia-Pacific): Expanding agricultural land, rising disposable incomes, government support for agricultural modernization.

- Market Share: North America (xx%), Europe (xx%), Asia-Pacific (xx%), Rest of World (xx%). Growth potential is highest in Asia-Pacific.

Agriculture Films Industry Product Landscape

The agriculture film market offers a diverse range of products tailored to specific applications. Innovations focus on improving film strength, durability, UV resistance, and biodegradability. High-performance films with enhanced water retention and controlled release of fertilizers are gaining popularity. The unique selling proposition of many products lies in their ability to increase crop yields, reduce labor costs (e.g., weed control), and minimize environmental impact through biodegradability.

Key Drivers, Barriers & Challenges in Agriculture Films Industry

Key Drivers:

- Rising agricultural production and intensification.

- Increasing demand for high-quality crops.

- Growing awareness of environmental sustainability.

- Technological advancements in film manufacturing.

Challenges:

- Fluctuating raw material prices (particularly petroleum-based polymers).

- Concerns about plastic waste management.

- Competition from biodegradable alternatives with higher costs.

- Supply chain disruptions impacting availability and pricing. (estimated xx% impact on 2024 market growth)

Emerging Opportunities in Agriculture Films Industry

- Expansion into untapped markets, particularly in developing countries.

- Development of smart films with integrated sensors for precision agriculture.

- Increased focus on biodegradable and compostable films made from renewable resources.

- Growing demand for films tailored to specific crop types and growing conditions.

Growth Accelerators in the Agriculture Films Industry

The long-term growth of the agriculture films industry will be driven by technological advancements enabling the creation of more sustainable and efficient films. Strategic partnerships between film manufacturers and agricultural companies will accelerate market penetration and adoption. Expansion into new geographical markets, particularly in regions with growing agricultural sectors, will also fuel industry growth.

Key Players Shaping the Agriculture Films Industry Market

- Novamont SpA

- INDVECO Group

- Plastika Kritis SA

- AB Rani Plast Oy

- RKW SE

- ExxonMobil Chemical

- Group Barbier

- Berry Global Inc

- Armando Alvarez Group

- BASF SE

Notable Milestones in Agriculture Films Industry Sector

- January 2022: BASF increased production capacity for its biodegradable film product Ecovio.

- May 2021: Reyenvas (Armando Alvarez Group) introduced Reyfilm Bio BIO, a biodegradable mulching film.

- January 2021: AB Rani Plast unveiled Ecol, a sustainable film for agricultural use.

In-Depth Agriculture Films Industry Market Outlook

The agriculture films market is poised for significant growth, driven by the ongoing need for efficient and sustainable agricultural practices. The increasing adoption of precision farming and the growing demand for high-quality, safe food will continue to fuel demand. Companies that invest in research and development of innovative, sustainable film solutions will be well-positioned to capture significant market share in the coming years. Opportunities abound for strategic partnerships and market expansion into high-growth regions.

Agriculture Films Industry Segmentation

-

1. Type

- 1.1. Low-Density Polyethylene

- 1.2. Linear Low-Density Polyethylene

- 1.3. High-Density Polyethylene

- 1.4. Ethyl Vi

- 1.5. Reclaims

- 1.6. Other Ty

-

2. Application

- 2.1. Greenhouse

- 2.2. Silage

- 2.3. Mulching

-

3. Type

- 3.1. Low-Density Polyethylene

- 3.2. Linear Low-Density Polyethylene

- 3.3. High-Density Polyethylene

- 3.4. Ethyl Vi

- 3.5. Reclaims

- 3.6. Other Ty

-

4. Application

- 4.1. Greenhouse

- 4.2. Silage

- 4.3. Mulching

Agriculture Films Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North Amercia

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Australia

- 3.4. Japan

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Africa

- 5.1. South Africa

- 5.2. Egypt

- 5.3. Rest of Africa

Agriculture Films Industry Regional Market Share

Geographic Coverage of Agriculture Films Industry

Agriculture Films Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Shift Towards Protected Agriculture Drives the Demand for Agriculture Films

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Agriculture Films Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Low-Density Polyethylene

- 5.1.2. Linear Low-Density Polyethylene

- 5.1.3. High-Density Polyethylene

- 5.1.4. Ethyl Vi

- 5.1.5. Reclaims

- 5.1.6. Other Ty

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Greenhouse

- 5.2.2. Silage

- 5.2.3. Mulching

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Low-Density Polyethylene

- 5.3.2. Linear Low-Density Polyethylene

- 5.3.3. High-Density Polyethylene

- 5.3.4. Ethyl Vi

- 5.3.5. Reclaims

- 5.3.6. Other Ty

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Greenhouse

- 5.4.2. Silage

- 5.4.3. Mulching

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. South America

- 5.5.5. Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Agriculture Films Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Low-Density Polyethylene

- 6.1.2. Linear Low-Density Polyethylene

- 6.1.3. High-Density Polyethylene

- 6.1.4. Ethyl Vi

- 6.1.5. Reclaims

- 6.1.6. Other Ty

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Greenhouse

- 6.2.2. Silage

- 6.2.3. Mulching

- 6.3. Market Analysis, Insights and Forecast - by Type

- 6.3.1. Low-Density Polyethylene

- 6.3.2. Linear Low-Density Polyethylene

- 6.3.3. High-Density Polyethylene

- 6.3.4. Ethyl Vi

- 6.3.5. Reclaims

- 6.3.6. Other Ty

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Greenhouse

- 6.4.2. Silage

- 6.4.3. Mulching

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Agriculture Films Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Low-Density Polyethylene

- 7.1.2. Linear Low-Density Polyethylene

- 7.1.3. High-Density Polyethylene

- 7.1.4. Ethyl Vi

- 7.1.5. Reclaims

- 7.1.6. Other Ty

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Greenhouse

- 7.2.2. Silage

- 7.2.3. Mulching

- 7.3. Market Analysis, Insights and Forecast - by Type

- 7.3.1. Low-Density Polyethylene

- 7.3.2. Linear Low-Density Polyethylene

- 7.3.3. High-Density Polyethylene

- 7.3.4. Ethyl Vi

- 7.3.5. Reclaims

- 7.3.6. Other Ty

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Greenhouse

- 7.4.2. Silage

- 7.4.3. Mulching

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Agriculture Films Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Low-Density Polyethylene

- 8.1.2. Linear Low-Density Polyethylene

- 8.1.3. High-Density Polyethylene

- 8.1.4. Ethyl Vi

- 8.1.5. Reclaims

- 8.1.6. Other Ty

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Greenhouse

- 8.2.2. Silage

- 8.2.3. Mulching

- 8.3. Market Analysis, Insights and Forecast - by Type

- 8.3.1. Low-Density Polyethylene

- 8.3.2. Linear Low-Density Polyethylene

- 8.3.3. High-Density Polyethylene

- 8.3.4. Ethyl Vi

- 8.3.5. Reclaims

- 8.3.6. Other Ty

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Greenhouse

- 8.4.2. Silage

- 8.4.3. Mulching

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Agriculture Films Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Low-Density Polyethylene

- 9.1.2. Linear Low-Density Polyethylene

- 9.1.3. High-Density Polyethylene

- 9.1.4. Ethyl Vi

- 9.1.5. Reclaims

- 9.1.6. Other Ty

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Greenhouse

- 9.2.2. Silage

- 9.2.3. Mulching

- 9.3. Market Analysis, Insights and Forecast - by Type

- 9.3.1. Low-Density Polyethylene

- 9.3.2. Linear Low-Density Polyethylene

- 9.3.3. High-Density Polyethylene

- 9.3.4. Ethyl Vi

- 9.3.5. Reclaims

- 9.3.6. Other Ty

- 9.4. Market Analysis, Insights and Forecast - by Application

- 9.4.1. Greenhouse

- 9.4.2. Silage

- 9.4.3. Mulching

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Africa Agriculture Films Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Low-Density Polyethylene

- 10.1.2. Linear Low-Density Polyethylene

- 10.1.3. High-Density Polyethylene

- 10.1.4. Ethyl Vi

- 10.1.5. Reclaims

- 10.1.6. Other Ty

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Greenhouse

- 10.2.2. Silage

- 10.2.3. Mulching

- 10.3. Market Analysis, Insights and Forecast - by Type

- 10.3.1. Low-Density Polyethylene

- 10.3.2. Linear Low-Density Polyethylene

- 10.3.3. High-Density Polyethylene

- 10.3.4. Ethyl Vi

- 10.3.5. Reclaims

- 10.3.6. Other Ty

- 10.4. Market Analysis, Insights and Forecast - by Application

- 10.4.1. Greenhouse

- 10.4.2. Silage

- 10.4.3. Mulching

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Novamont SpA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 INDVECO Grou

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Plastika Kritis SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 AB Rani Plast Oy

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 RKW SE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ExxonMobil Chemical

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Group Barbier

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Berry Global Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Armando Alvarez Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BASF SE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Novamont SpA

List of Figures

- Figure 1: Global Agriculture Films Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Agriculture Films Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Agriculture Films Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Agriculture Films Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Agriculture Films Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Agriculture Films Industry Revenue (billion), by Type 2025 & 2033

- Figure 7: North America Agriculture Films Industry Revenue Share (%), by Type 2025 & 2033

- Figure 8: North America Agriculture Films Industry Revenue (billion), by Application 2025 & 2033

- Figure 9: North America Agriculture Films Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Agriculture Films Industry Revenue (billion), by Country 2025 & 2033

- Figure 11: North America Agriculture Films Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Agriculture Films Industry Revenue (billion), by Type 2025 & 2033

- Figure 13: Europe Agriculture Films Industry Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Agriculture Films Industry Revenue (billion), by Application 2025 & 2033

- Figure 15: Europe Agriculture Films Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Agriculture Films Industry Revenue (billion), by Type 2025 & 2033

- Figure 17: Europe Agriculture Films Industry Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Agriculture Films Industry Revenue (billion), by Application 2025 & 2033

- Figure 19: Europe Agriculture Films Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: Europe Agriculture Films Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Europe Agriculture Films Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Agriculture Films Industry Revenue (billion), by Type 2025 & 2033

- Figure 23: Asia Pacific Agriculture Films Industry Revenue Share (%), by Type 2025 & 2033

- Figure 24: Asia Pacific Agriculture Films Industry Revenue (billion), by Application 2025 & 2033

- Figure 25: Asia Pacific Agriculture Films Industry Revenue Share (%), by Application 2025 & 2033

- Figure 26: Asia Pacific Agriculture Films Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Asia Pacific Agriculture Films Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Agriculture Films Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: Asia Pacific Agriculture Films Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Pacific Agriculture Films Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Agriculture Films Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: South America Agriculture Films Industry Revenue (billion), by Type 2025 & 2033

- Figure 33: South America Agriculture Films Industry Revenue Share (%), by Type 2025 & 2033

- Figure 34: South America Agriculture Films Industry Revenue (billion), by Application 2025 & 2033

- Figure 35: South America Agriculture Films Industry Revenue Share (%), by Application 2025 & 2033

- Figure 36: South America Agriculture Films Industry Revenue (billion), by Type 2025 & 2033

- Figure 37: South America Agriculture Films Industry Revenue Share (%), by Type 2025 & 2033

- Figure 38: South America Agriculture Films Industry Revenue (billion), by Application 2025 & 2033

- Figure 39: South America Agriculture Films Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: South America Agriculture Films Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: South America Agriculture Films Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Africa Agriculture Films Industry Revenue (billion), by Type 2025 & 2033

- Figure 43: Africa Agriculture Films Industry Revenue Share (%), by Type 2025 & 2033

- Figure 44: Africa Agriculture Films Industry Revenue (billion), by Application 2025 & 2033

- Figure 45: Africa Agriculture Films Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: Africa Agriculture Films Industry Revenue (billion), by Type 2025 & 2033

- Figure 47: Africa Agriculture Films Industry Revenue Share (%), by Type 2025 & 2033

- Figure 48: Africa Agriculture Films Industry Revenue (billion), by Application 2025 & 2033

- Figure 49: Africa Agriculture Films Industry Revenue Share (%), by Application 2025 & 2033

- Figure 50: Africa Agriculture Films Industry Revenue (billion), by Country 2025 & 2033

- Figure 51: Africa Agriculture Films Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Agriculture Films Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Agriculture Films Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Agriculture Films Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Global Agriculture Films Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global Agriculture Films Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Agriculture Films Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 7: Global Agriculture Films Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global Agriculture Films Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 9: Global Agriculture Films Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global Agriculture Films Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States Agriculture Films Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada Agriculture Films Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico Agriculture Films Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Rest of North Amercia Agriculture Films Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Global Agriculture Films Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 16: Global Agriculture Films Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 17: Global Agriculture Films Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Global Agriculture Films Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Global Agriculture Films Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Germany Agriculture Films Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: United Kingdom Agriculture Films Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: France Agriculture Films Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Agriculture Films Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Italy Agriculture Films Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Russia Agriculture Films Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe Agriculture Films Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Global Agriculture Films Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 28: Global Agriculture Films Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 29: Global Agriculture Films Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 30: Global Agriculture Films Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 31: Global Agriculture Films Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: China Agriculture Films Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: India Agriculture Films Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Australia Agriculture Films Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Japan Agriculture Films Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Asia Pacific Agriculture Films Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Agriculture Films Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 38: Global Agriculture Films Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 39: Global Agriculture Films Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 40: Global Agriculture Films Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 41: Global Agriculture Films Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Brazil Agriculture Films Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: Argentina Agriculture Films Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Rest of South America Agriculture Films Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Global Agriculture Films Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 46: Global Agriculture Films Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 47: Global Agriculture Films Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 48: Global Agriculture Films Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 49: Global Agriculture Films Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 50: South Africa Agriculture Films Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Egypt Agriculture Films Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Africa Agriculture Films Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Agriculture Films Industry?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the Agriculture Films Industry?

Key companies in the market include Novamont SpA, INDVECO Grou, Plastika Kritis SA, AB Rani Plast Oy, RKW SE, ExxonMobil Chemical, Group Barbier, Berry Global Inc, Armando Alvarez Group, BASF SE.

3. What are the main segments of the Agriculture Films Industry?

The market segments include Type, Application, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Shift Towards Protected Agriculture Drives the Demand for Agriculture Films.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

January 2022: BASF increased the production capacity for its biodegradable film product Ecovio at its Ludwigshafen, Germany site.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Agriculture Films Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Agriculture Films Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Agriculture Films Industry?

To stay informed about further developments, trends, and reports in the Agriculture Films Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence