Key Insights

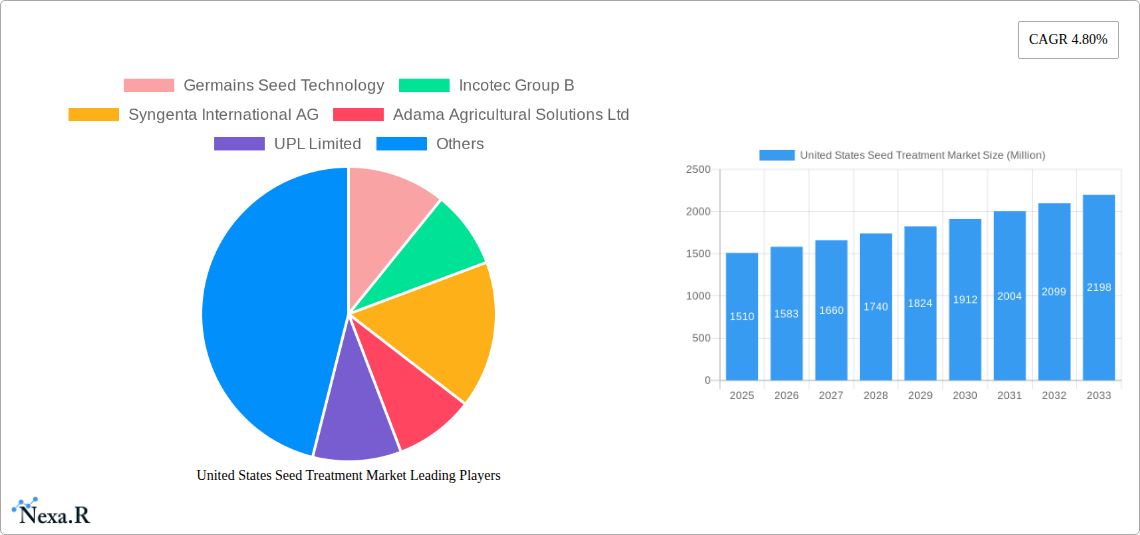

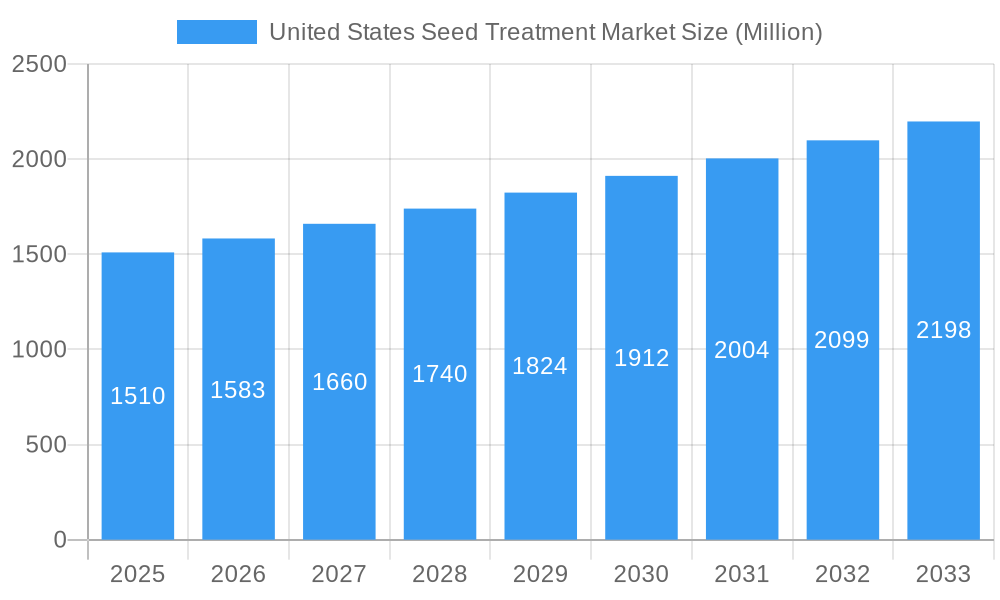

The United States seed treatment market is poised for robust expansion, projected to reach approximately USD 1.51 billion by 2025. Driven by a compound annual growth rate (CAGR) of 4.80%, the market is experiencing significant momentum as farmers increasingly recognize the value of seed treatments in enhancing crop yields, improving plant health, and reducing the need for broad-spectrum pesticide applications. Key drivers include the escalating demand for food production to meet a growing global population, coupled with advancements in seed technology that allow for more targeted and effective seed coatings. Furthermore, growing environmental concerns and a shift towards sustainable agricultural practices are propelling the adoption of seed treatments as a more eco-friendly alternative to traditional crop protection methods. The market is also benefiting from the development of sophisticated formulations that offer a broader spectrum of protection against a wider range of pests and diseases, thereby increasing farmer confidence and investment in these solutions.

United States Seed Treatment Market Market Size (In Billion)

The market's growth trajectory is further shaped by evolving agricultural trends, including precision agriculture and the increasing adoption of genetically modified seeds that often incorporate or are enhanced by seed treatment technologies. While the United States represents a significant market, the global demand for seed treatments continues to rise, influencing domestic market dynamics. Despite this positive outlook, certain restraints, such as the initial cost of advanced seed treatment technologies and fluctuating commodity prices, can pose challenges. However, ongoing research and development efforts focused on cost-effectiveness and the introduction of novel, multi-functional seed treatments are expected to mitigate these restraints. The market is characterized by intense competition among major agrochemical and seed technology companies, all vying to capture market share through innovation, strategic partnerships, and product differentiation, particularly in areas like biological seed treatments and advanced chemical formulations.

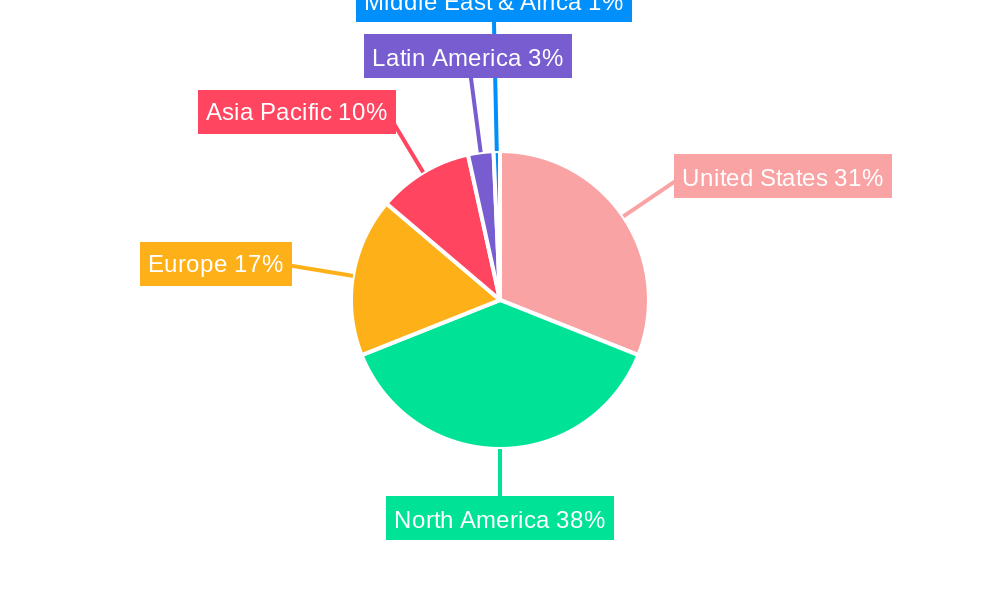

United States Seed Treatment Market Company Market Share

United States Seed Treatment Market: Comprehensive Market Analysis and Forecast (2019-2033)

This in-depth report provides a definitive analysis of the United States Seed Treatment Market, offering critical insights into its dynamics, growth trajectory, and future outlook. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025, this report leverages advanced analytics and proprietary XXX to deliver unparalleled market intelligence. We dissect the market into parent and child segments, providing a granular view of production, consumption, trade, pricing, and industry developments. This report is an essential resource for agribusiness stakeholders, investors, policymakers, and technology providers seeking to understand and capitalize on the evolving U.S. seed treatment landscape. All monetary values are presented in Million USD unless otherwise specified, and volume figures are in Million units.

United States Seed Treatment Market Market Dynamics & Structure

The United States Seed Treatment Market is characterized by a moderately concentrated structure, with a few key players dominating a significant portion of the market share. Technological innovation is a primary driver, propelled by the continuous development of novel chemical and biological seed coatings designed to enhance crop yield, protect against pests and diseases, and improve plant establishment. Regulatory frameworks, primarily governed by the Environmental Protection Agency (EPA) and state-level agricultural departments, play a crucial role in shaping market access and product approvals, balancing innovation with environmental safety and human health concerns. Competitive product substitutes, such as broad-spectrum pesticides and advanced breeding techniques, present a dynamic competitive landscape. End-user demographics are diverse, ranging from large-scale commercial farms to smaller, specialized agricultural operations, each with distinct needs and adoption rates for seed treatment technologies. Mergers and acquisitions (M&A) trends indicate a strategic consolidation within the industry, as companies seek to expand their product portfolios, gain market access, and achieve economies of scale. For instance, the period saw several strategic acquisitions aimed at integrating biological seed treatments with existing chemical offerings.

- Market Concentration: The market is dominated by multinational agrochemical corporations, though a growing number of specialized biological treatment providers are emerging.

- Technological Innovation Drivers: Focus on precision agriculture, integrated pest management (IPM) solutions, and the development of seed treatments with reduced environmental impact.

- Regulatory Frameworks: Strict adherence to EPA guidelines for product registration and efficacy claims.

- Competitive Product Substitutes: Traditional crop protection methods, genetically modified (GM) seeds with inherent resistance, and organic farming practices.

- End-User Demographics: Significant adoption by corn, soybean, and cotton farmers, with increasing interest in specialty crops.

- M&A Trends: Consolidation driven by the desire for diversified portfolios and enhanced R&D capabilities. For example, approximately 3-5 significant M&A deals were observed in the historical period, valued in the hundreds of millions of dollars.

United States Seed Treatment Market Growth Trends & Insights

The United States Seed Treatment Market has witnessed robust growth, driven by an increasing awareness of the benefits associated with enhanced crop protection and improved germination rates. The market size evolution indicates a steady upward trend, with adoption rates for advanced seed treatments consistently rising across key crop segments. Technological disruptions, including the advent of next-generation biologicals and advanced coating technologies, are fundamentally reshaping the landscape, offering more targeted and environmentally sustainable solutions. Consumer behavior shifts, influenced by growing demand for sustainable agriculture and reduced chemical residue in food products, are further propelling the adoption of seed treatments that minimize the need for post-emergence spraying. The market is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 6.8% from 2025 to 2033, reaching an estimated market size of $3,500 million by the forecast period's end. Market penetration is expanding beyond traditional row crops into high-value specialty crops, demonstrating a growing understanding of the economic advantages offered by seed treatments. The increasing integration of digital farming platforms also facilitates the data-driven application of seed treatments, optimizing their efficacy and ROI for farmers.

The U.S. seed treatment market's growth trajectory is intrinsically linked to the broader agricultural sector's performance and its adaptation to evolving environmental and economic pressures. The base year of 2025 marks a pivotal point, with established trends solidifying and new innovations poised to disrupt the status quo. The market's expansion is not merely about increased application volume but also about the sophistication of the treatments being deployed. For example, the development of seed treatments that not only protect against pathogens but also deliver essential micronutrients directly to the germinating seed is a significant technological leap. This enhances early-stage plant vigor, which is critical for establishing a resilient crop capable of withstanding environmental stresses.

The adoption rates are particularly high among large-scale agricultural enterprises that have the resources to invest in advanced seed technologies and the technical expertise to manage them effectively. However, there is a growing movement to make these technologies more accessible to smaller farms through tailored solutions and educational initiatives. The shift in consumer behavior is a powerful underlying force. With increasing public scrutiny on food safety and environmental sustainability, farmers are actively seeking methods that reduce their reliance on broad-spectrum chemical applications. Seed treatments, by their very nature, offer a more targeted and efficient approach to pest and disease management, often requiring significantly less active ingredient compared to conventional spraying. This aligns perfectly with the growing consumer demand for sustainably produced food.

Technological disruptions are a constant feature of this market. Beyond biologicals, advancements in nanotechnology for enhanced nutrient delivery and controlled-release of active ingredients are on the horizon. These innovations promise to further optimize seed performance and minimize environmental impact. The integration of artificial intelligence (AI) and machine learning (ML) in precision agriculture is also playing a role, enabling farmers to make more informed decisions about seed selection and treatment application based on soil conditions, weather patterns, and historical yield data. This data-driven approach maximizes the return on investment for seed treatments.

The forecast period (2025-2033) is expected to see continued acceleration in market growth, fueled by these interconnected factors. The increasing demand for higher yields to feed a growing global population, coupled with the imperative to practice more sustainable agriculture, creates a fertile ground for innovative seed treatment solutions. The market penetration is projected to reach approximately 75% of the total planted acreage by 2033, a significant increase from current levels. This expansion will be further supported by ongoing research and development efforts by key players, focusing on developing treatments for a wider array of crops and addressing emerging pest and disease challenges.

Dominant Regions, Countries, or Segments in United States Seed Treatment Market

Within the United States Seed Treatment Market, the Corn and Soybean Production Segment stands out as the dominant force, driving a substantial portion of the market's growth across all analyzed areas: Production Analysis, Consumption Analysis, Import Market Analysis, Export Market Analysis, and Price Trend Analysis. The Midwest region, often referred to as the "Corn Belt," is the epicenter of this dominance, leveraging its vast agricultural land and favorable climatic conditions.

- Production Analysis: The Midwest region, particularly states like Iowa, Illinois, and Indiana, leads in the production of seeds treated for corn and soybeans. This is directly linked to the high acreage dedicated to these crops, necessitating large-scale seed treatment operations. The availability of advanced manufacturing facilities and skilled labor further solidifies its position. The estimated production volume of treated seeds for these crops in the base year 2025 is projected to be around 550 million units.

- Consumption Analysis: Farmers in the Corn Belt are the primary consumers of seed treatments for corn and soybeans. They are early adopters of new technologies due to the economic incentives of maximizing yield and minimizing crop loss in these high-volume crops. The consumption volume in 2025 is estimated at 520 million units for these crops.

- Import Market Analysis (Value & Volume): While the U.S. has significant domestic production, imports of specialized seed treatment chemicals and formulations are crucial to support the vast demand. The import value for seed treatment inputs in 2025 is estimated at $850 million, with a volume of 150 million units. Key import origins include Europe and Asia, supplying active ingredients and advanced formulations.

- Export Market Analysis (Value & Volume): The United States is also a net exporter of treated seeds, particularly for corn and soybeans, to countries with expanding agricultural sectors. The export value of treated seeds in 2025 is estimated at $600 million, with a volume of 100 million units. This highlights the global competitiveness of U.S. seed technology.

- Price Trend Analysis: The price of treated seeds for corn and soybeans is influenced by the cost of raw materials, the complexity of the treatment applied, and market demand. Fluctuations in global commodity prices and currency exchange rates also play a role. In the base year 2025, the average price per unit of treated seed for these crops is estimated at $11.50.

Key Drivers of Dominance in Corn and Soybean Segments:

- Vast Acreage: The sheer scale of corn and soybean cultivation in the U.S. creates an enormous demand for seed treatments.

- Economic Significance: These crops are cornerstones of the U.S. agricultural economy, making investment in yield-enhancing technologies a priority for farmers.

- Technological Adoption: Farmers in these segments are generally more receptive to adopting new technologies that demonstrate a clear return on investment.

- Research and Development: Major agrochemical companies heavily invest in R&D focused on seed treatments for these crops, leading to a continuous stream of innovative products.

- Infrastructure and Supply Chain: Well-established logistics and supply chains ensure efficient distribution of treated seeds and associated products throughout these dominant regions.

United States Seed Treatment Market Product Landscape

The United States Seed Treatment Market product landscape is characterized by a dynamic range of innovative solutions designed to enhance seed viability, protect against biotic and abiotic stresses, and promote early-stage plant growth. These include advanced chemical fungicides, insecticides, and nematicides, as well as an expanding array of biological treatments such as beneficial microbes, biostimulants, and naturally derived compounds. Performance metrics focus on improved germination rates, enhanced seedling vigor, increased resistance to pests and diseases, and ultimately, higher crop yields with reduced environmental impact. Unique selling propositions often lie in the synergistic combinations of active ingredients, the precision delivery mechanisms of coating technologies, and the development of multi-functional treatments that address a spectrum of challenges with a single application. Technological advancements are increasingly emphasizing integrated solutions, combining chemical and biological components for broader efficacy and enhanced sustainability.

Key Drivers, Barriers & Challenges in United States Seed Treatment Market

Key Drivers:

- Increasing Demand for Food Security: The global need to enhance agricultural productivity to feed a growing population is a primary driver.

- Technological Advancements: Development of more effective, targeted, and environmentally friendly seed treatments.

- Focus on Sustainable Agriculture: Growing preference for solutions that reduce overall chemical usage and minimize environmental footprint.

- Economic Benefits for Farmers: Improved germination, seedling vigor, and yield protection lead to higher profitability.

- Regulatory Support for Integrated Pest Management (IPM): Seed treatments are a key component of IPM strategies.

Barriers & Challenges:

- High R&D Costs and Long Development Cycles: Bringing new seed treatment technologies to market is expensive and time-consuming.

- Stringent Regulatory Approvals: Navigating complex EPA and state-level regulations can be a significant hurdle.

- Pest and Disease Resistance Development: The emergence of resistant pest and pathogen populations requires continuous innovation.

- Supply Chain Disruptions: Global events can impact the availability and cost of raw materials and active ingredients.

- Farmer Education and Adoption: Convincing some farmers to adopt new technologies and overcome traditional practices can be challenging. Approximately 10-15% of potential market adoption is hindered by these educational gaps.

Emerging Opportunities in United States Seed Treatment Market

Emerging opportunities in the United States Seed Treatment Market lie in the expansion of biological seed treatments, which are gaining traction due to their sustainability credentials and potential to complement or replace chemical inputs. There is also a growing demand for seed treatments tailored to specialty crops and niche agricultural segments, offering higher-value solutions. Furthermore, the integration of digital agriculture platforms presents an opportunity for data-driven seed treatment recommendations and precision application, optimizing their effectiveness and farmer ROI. The development of seed treatments addressing abiotic stresses, such as drought and salinity, is another promising area, particularly in regions facing climate change impacts.

Growth Accelerators in the United States Seed Treatment Market Industry

Growth accelerators in the United States Seed Treatment Market industry are primarily driven by continuous technological breakthroughs in both chemical and biological formulations. Strategic partnerships between agrochemical giants, seed companies, and technology providers are crucial for developing integrated solutions and expanding market reach. Market expansion strategies, including the penetration into underserved agricultural regions and the development of cost-effective solutions for smallholder farmers, are also key accelerators. The increasing focus on precision agriculture and the development of smart seed coatings that deliver targeted nutrients and protectants at specific plant growth stages will further propel long-term growth.

Key Players Shaping the United States Seed Treatment Market Market

- Germains Seed Technology

- Incotec Group B

- Syngenta International AG

- Adama Agricultural Solutions Ltd

- UPL Limited

- Corteva Agriscience

- Bayer CropScience AG

- BASF SE

Notable Milestones in United States Seed Treatment Market Sector

- 2019: Launch of novel biological nematicide seed treatment by a leading player, enhancing plant root health.

- 2020: Significant M&A activity, with a major agrochemical company acquiring a specialized biological seed treatment firm to diversify its portfolio.

- 2021: Introduction of advanced seed coating technology for improved dust-off reduction and enhanced seed flowability.

- 2022: Development and limited release of seed treatments with enhanced drought tolerance capabilities in response to changing climate patterns.

- 2023: Increased investment in R&D for seed treatments that facilitate nutrient uptake, contributing to more sustainable farming practices.

- 2024: Emergence of more integrated seed treatment solutions combining multiple modes of action for broader pest and disease spectrum control.

In-Depth United States Seed Treatment Market Market Outlook

The United States Seed Treatment Market is poised for sustained growth, driven by escalating demand for efficient crop protection and yield enhancement. Future market potential is robust, fueled by ongoing advancements in biological and chemical seed treatment technologies. Strategic opportunities lie in expanding the application of these solutions across a wider range of crops, including high-value specialty crops, and in developing more sustainable and environmentally benign formulations. The integration of digital farming tools will further optimize the use and efficacy of seed treatments, presenting a lucrative avenue for innovation and market penetration. The market is expected to continue its upward trajectory, supported by a commitment to food security and sustainable agricultural practices.

United States Seed Treatment Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

United States Seed Treatment Market Segmentation By Geography

- 1. United States

United States Seed Treatment Market Regional Market Share

Geographic Coverage of United States Seed Treatment Market

United States Seed Treatment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Decreasing Per Capita Arable Land; Increased Demand for Food

- 3.3. Market Restrains

- 3.3.1. High Initial Investments; Requirement of Precision Agriculture

- 3.4. Market Trends

- 3.4.1. Increase in Cost of High-quality Seeds

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Seed Treatment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Germains Seed Technology

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Incotec Group B

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Syngenta International AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Adama Agricultural Solutions Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 UPL Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Corteva Agriscience

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bayer CropScience AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BASF SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Germains Seed Technology

List of Figures

- Figure 1: United States Seed Treatment Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Seed Treatment Market Share (%) by Company 2025

List of Tables

- Table 1: United States Seed Treatment Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: United States Seed Treatment Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: United States Seed Treatment Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: United States Seed Treatment Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: United States Seed Treatment Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: United States Seed Treatment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: United States Seed Treatment Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: United States Seed Treatment Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: United States Seed Treatment Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: United States Seed Treatment Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: United States Seed Treatment Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: United States Seed Treatment Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Seed Treatment Market?

The projected CAGR is approximately 4.80%.

2. Which companies are prominent players in the United States Seed Treatment Market?

Key companies in the market include Germains Seed Technology, Incotec Group B, Syngenta International AG, Adama Agricultural Solutions Ltd, UPL Limited, Corteva Agriscience, Bayer CropScience AG, BASF SE.

3. What are the main segments of the United States Seed Treatment Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Decreasing Per Capita Arable Land; Increased Demand for Food.

6. What are the notable trends driving market growth?

Increase in Cost of High-quality Seeds.

7. Are there any restraints impacting market growth?

High Initial Investments; Requirement of Precision Agriculture.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Seed Treatment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Seed Treatment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Seed Treatment Market?

To stay informed about further developments, trends, and reports in the United States Seed Treatment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence