Key Insights

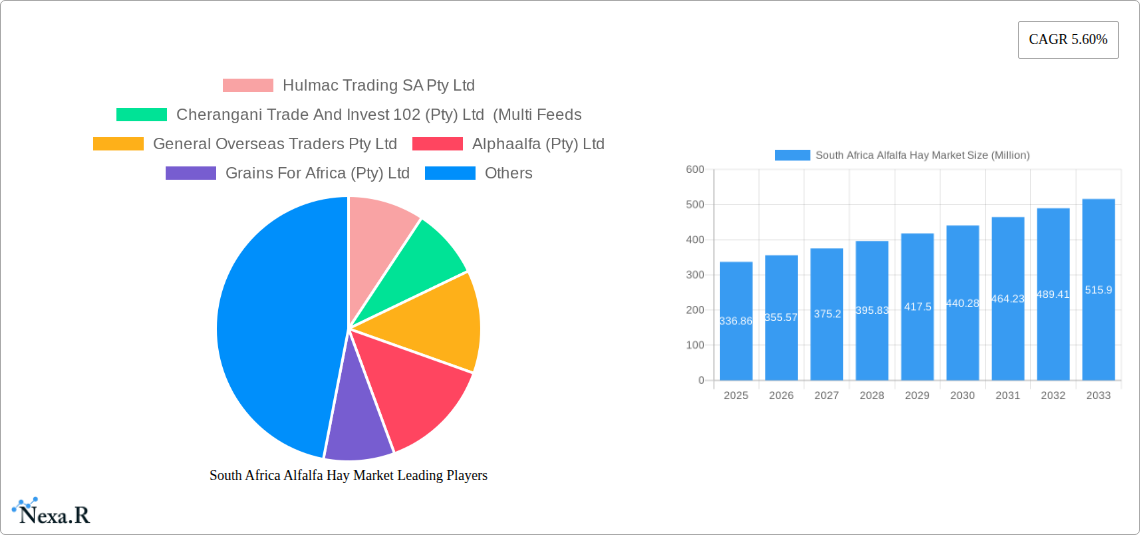

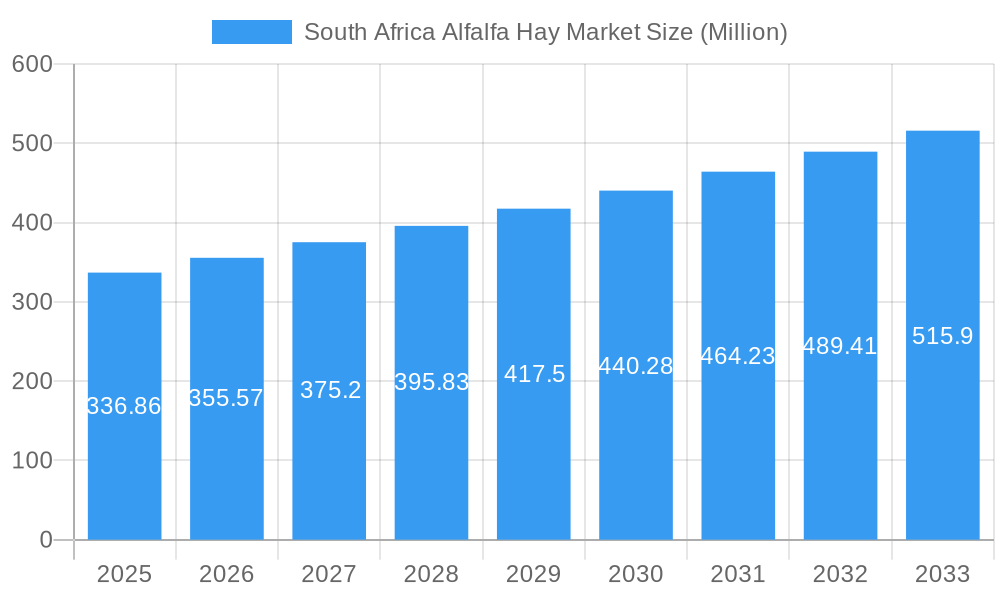

The South African Alfalfa Hay market is projected to reach a significant valuation of USD 336.86 million by 2025, demonstrating robust growth with a Compound Annual Growth Rate (CAGR) of 5.60% expected throughout the forecast period of 2025-2033. This upward trajectory is underpinned by several key drivers, including the increasing demand from the livestock sector, particularly for dairy and beef cattle, which rely on high-quality alfalfa hay for optimal nutrition and productivity. The growing awareness among farmers about the nutritional benefits of alfalfa, such as its high protein content and digestibility, further fuels its adoption. Moreover, advancements in agricultural technologies and improved cultivation practices are contributing to higher yields and better quality hay, thereby supporting market expansion. The market's dynamism is also influenced by evolving consumer preferences for ethically and sustainably produced animal products, which indirectly boosts the demand for premium animal feed.

South Africa Alfalfa Hay Market Market Size (In Million)

The market is characterized by a dynamic interplay of production, consumption, and international trade. South Africa's production capabilities, influenced by climatic conditions and agricultural policies, are a primary determinant of domestic supply. Consumption patterns are largely dictated by the size and health of the national livestock herd, along with the economic viability of different feed options for farmers. The import and export analyses reveal a globalized supply chain where South Africa participates, with both inbound and outbound trade contributing to market dynamics and price stability. While the market exhibits strong growth potential, certain restraints, such as the susceptibility of alfalfa cultivation to drought and water scarcity, and the fluctuating prices of alternative feed sources, can pose challenges. However, the consistent demand from a growing livestock population and the inherent nutritional superiority of alfalfa hay are expected to propel the market forward, creating sustained opportunities for key players like Hulmac Trading SA Pty Ltd, Cherangani Trade And Invest 102 (Pty) Ltd (Multi Feeds), and RCL Foods Consumer (Pty) Ltd (Epol Equine).

South Africa Alfalfa Hay Market Company Market Share

This in-depth report offers a definitive analysis of the South Africa Alfalfa Hay Market, providing critical insights for stakeholders navigating this dynamic sector. Covering the study period of 2019–2033, with a base year and estimated year of 2025, and a forecast period from 2025–2033, this report delves into historical trends, current dynamics, and future projections. It meticulously examines alfalfa production in South Africa, alfalfa consumption in South Africa, the South Africa alfalfa hay import market, the South Africa alfalfa hay export market, and alfalfa hay price trends in South Africa. Leveraging high-traffic keywords such as "South Africa alfalfa hay," "lucerne hay South Africa," "forage crops South Africa," "animal feed South Africa," and "agriculture South Africa," this report is optimized for maximum search engine visibility and designed to engage industry professionals, including farmers, feed manufacturers, traders, and investors. We present all quantitative values in Million units.

South Africa Alfalfa Hay Market Dynamics & Structure

The South Africa Alfalfa Hay Market is characterized by a moderate level of concentration, with a few key players dominating production and trade. Technological innovation is a significant driver, as alfalfa farmers in South Africa increasingly adopt advanced farming techniques and equipment to enhance yield and quality, thereby improving their competitiveness in both domestic and international markets. Regulatory frameworks, primarily concerning agricultural practices and trade, play a crucial role in shaping market accessibility and compliance. Competitive product substitutes, such as other types of fodder and grain-based feeds, exert pressure, necessitating a focus on the superior nutritional value of alfalfa. End-user demographics are diverse, ranging from commercial livestock operations to equestrian centers and smallholder farmers. Mergers and acquisitions (M&A) trends are observed as larger entities seek to consolidate market share and expand their supply chains.

- Market Concentration: Estimated to be moderate, with key players holding significant portions of production and export volumes.

- Technological Innovation Drivers: Mechanization, precision agriculture, and improved irrigation techniques are crucial for increasing alfalfa hay yield South Africa.

- Regulatory Frameworks: Government policies related to land use, water rights, and agricultural subsidies influence production costs and market access.

- Competitive Product Substitutes: Other forage crops like Rhodes grass and clover, alongside grain-based feeds, represent significant competitive pressures.

- End-User Demographics: Driven by dairy farming, beef cattle operations, sheep farming, and the equine industry in South Africa.

- M&A Trends: Consolidation opportunities exist for companies seeking vertical integration and expanded market reach.

South Africa Alfalfa Hay Market Growth Trends & Insights

The South Africa Alfalfa Hay Market is poised for robust growth, driven by an increasing demand for high-quality animal feed and the consistent expansion of the livestock sector. The market size evolution is a direct reflection of growing dairy and beef production, where alfalfa hay serves as a premium energy and protein source. Adoption rates of improved alfalfa varieties and advanced cultivation practices are on an upward trajectory, contributing to higher yields and better quality hay. Technological disruptions in farming, including automated harvesting and drying systems, are enhancing efficiency and reducing post-harvest losses. Consumer behavior shifts, particularly among large-scale livestock operators, are leaning towards nutritionally superior and consistent feed sources, making alfalfa a preferred choice. The market penetration of value-added alfalfa products, such as cubed or pelleted hay, is also expected to increase. Based on current trends, the South Africa Alfalfa Hay Market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 4.5% from 2025 to 2033.

Dominant Regions, Countries, or Segments in South Africa Alfalfa Hay Market

The South Africa Alfalfa Hay Market’s dominance is significantly influenced by its Production Analysis and Export Market Analysis. Regions with favorable climatic conditions, access to water resources, and well-developed agricultural infrastructure tend to lead in alfalfa production in South Africa. The Western Cape and the Free State provinces are particularly prominent due to their suitability for lucerne cultivation. In terms of the Import Market Analysis (Value & Volume), certain countries emerge as major buyers, primarily driven by their own livestock industry demands. Saudi Arabia, the United Arab Emirates, and Qatar represent substantial export destinations due to their large-scale livestock operations and import dependency for quality feed. Within the Consumption Analysis, the dairy and beef sectors are the largest consumers of alfalfa hay, demanding its high nutritional content for optimal animal health and productivity. The Price Trend Analysis is influenced by factors such as production volumes, global demand, and input costs, with premium grades often commanding higher prices.

- Production Analysis Drivers: Arable land availability, water resources (irrigation schemes), favorable climate, and government agricultural support. Key producing regions include the Western Cape and Free State.

- Consumption Analysis Drivers: Growth in the dairy industry, expansion of beef cattle feedlots, and the equine sector's demand for high-quality forage.

- Import Market Analysis Drivers: Demand from countries with limited domestic fodder production or specific nutritional requirements for their livestock. Saudi Arabia, UAE, and Qatar are key import markets.

- Export Market Analysis Drivers: South Africa's comparative advantage in producing high-quality alfalfa and the strong demand from Middle Eastern and neighboring African countries.

- Price Trend Analysis Drivers: Supply-demand dynamics, input costs (fertilizers, labor, energy), currency fluctuations, and global commodity prices.

South Africa Alfalfa Hay Market Product Landscape

The South Africa Alfalfa Hay Market product landscape is primarily focused on the production of high-quality, nutrient-dense alfalfa hay. Innovations are geared towards enhancing the nutritional profile, digestibility, and storability of the hay. This includes advancements in drying techniques to preserve carotene and other vital nutrients, and in packaging methods to maintain freshness and prevent spoilage. Applications extend beyond traditional animal feed, with research exploring its potential in specialized animal diets and even as a component in certain agricultural products. The unique selling proposition of premium South African alfalfa lies in its consistent quality, high protein content, and optimal fiber levels, making it ideal for dairy cows, high-performance horses, and other livestock requiring superior nutrition. Technological advancements are also optimizing harvesting methods to ensure minimal leaf loss, a critical factor in hay quality.

Key Drivers, Barriers & Challenges in South Africa Alfalfa Hay Market

Key Drivers:

- Growing Livestock Sector: The expanding dairy and beef industries in South Africa and key export markets are the primary demand drivers for alfalfa hay.

- High Nutritional Value: Alfalfa's superior protein, fiber, and vitamin content makes it an indispensable component of animal diets for optimal health and productivity.

- Technological Advancements in Farming: Adoption of modern irrigation, harvesting, and processing technologies enhances yield, quality, and efficiency, making production more profitable.

- Export Demand: Strong demand from countries in the Middle East and other regions with significant livestock populations provides substantial growth opportunities.

Barriers & Challenges:

- Water Scarcity: Alfalfa cultivation is water-intensive, making drought conditions and limited water availability a significant challenge, particularly in certain regions of South Africa.

- Input Costs: Fluctuations in the prices of fertilizers, fuel, and labor can impact production profitability and the competitiveness of South African alfalfa hay.

- Logistics and Transportation: The cost and efficiency of transporting hay from farms to ports and then to international destinations can affect export margins.

- Regulatory Hurdles: Navigating import regulations and phytosanitary requirements in destination countries can be complex and time-consuming.

- Pest and Disease Management: Effective control of pests and diseases is crucial to ensure crop yield and quality, requiring continuous investment in integrated pest management strategies.

Emerging Opportunities in South Africa Alfalfa Hay Market

Emerging opportunities in the South Africa Alfalfa Hay Market lie in expanding value-added products and exploring new export markets. The development of specialized alfalfa-based feeds for specific animal life stages or health conditions presents a lucrative avenue. Furthermore, opportunities exist in sustainable farming practices, such as organic alfalfa production, which could cater to niche markets demanding environmentally friendly feed options. Increased investment in research and development to enhance alfalfa varieties for drought resistance and improved nutritional profiles will also unlock new potential. Leveraging digital platforms for direct farmer-to-buyer connections can streamline the supply chain and reduce intermediaries. The growing demand for high-quality forage in other African nations beyond current export markets also presents untapped potential.

Growth Accelerators in the South Africa Alfalfa Hay Market Industry

Growth accelerators for the South Africa Alfalfa Hay Market are predominantly driven by strategic investments in agricultural technology and infrastructure. The ongoing adoption of precision farming techniques and advanced mechanization is significantly boosting production efficiency and the quality of hay, making it more competitive globally. Furthermore, the development of robust supply chain networks, including improved logistics and storage facilities, is crucial for reducing post-harvest losses and ensuring timely delivery to both domestic and international clients. Government initiatives that support agricultural exports through trade agreements and financial incentives can further propel market growth. The establishment of strong partnerships between farmers, processors, and international buyers fosters market stability and long-term demand.

Key Players Shaping the South Africa Alfalfa Hay Market Market

- Hulmac Trading SA Pty Ltd

- Cherangani Trade And Invest 102 (Pty) Ltd (Multi Feeds)

- General Overseas Traders Pty Ltd

- Alphaalfa (Pty) Ltd

- Grains For Africa (Pty) Ltd

- Agritrade Global(Pty) Ltd

- Al Dahra ACX Inc

- RCL Foods Consumer (Pty) Ltd (Epol Equine)

Notable Milestones in South Africa Alfalfa Hay Market Sector

- December 2022: Alfalfa farmers in South Africa adopted farming technology and equipment to produce high-quality alfalfa hay that fetches a good price in both the domestic and international markets.

- February 2022: According to National Lucerne Trust, Lucerne hay produced during 2020-21 was 416,862 metric tons, which increased compared to the previous year with 409,759 metric tons. South Africa exports alfalfa majorly to Saudi Arabia, United Arab Emirates, Qatar, Botswana, Namibia, Lesotho, and China.

In-Depth South Africa Alfalfa Hay Market Market Outlook

The South Africa Alfalfa Hay Market outlook is highly positive, driven by a confluence of factors including sustained demand from the livestock sector, ongoing technological advancements in agriculture, and expanding export opportunities. Growth accelerators such as improved irrigation techniques, a focus on drought-resistant alfalfa varieties, and enhanced post-harvest processing are set to fortify the market's competitive edge. Strategic investments in logistics and cold chain management will further optimize the supply chain, ensuring higher quality produce reaches its destination efficiently. The increasing recognition of alfalfa hay as a premium feed ingredient globally presents a significant opportunity for South African producers to further penetrate international markets and solidify their position as reliable suppliers of high-quality forage.

South Africa Alfalfa Hay Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

South Africa Alfalfa Hay Market Segmentation By Geography

- 1. South Africa

South Africa Alfalfa Hay Market Regional Market Share

Geographic Coverage of South Africa Alfalfa Hay Market

South Africa Alfalfa Hay Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. High Meat Consumption is Boosting Demand for Quality Hay

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Alfalfa Hay Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hulmac Trading SA Pty Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cherangani Trade And Invest 102 (Pty) Ltd (Multi Feeds

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 General Overseas Traders Pty Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Alphaalfa (Pty) Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Grains For Africa (Pty) Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Agritrade Global(Pty) Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Al Dahra ACX Inc Â

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 RCL Foods Consumer (Pty) Ltd (Epol Equine)*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Hulmac Trading SA Pty Ltd

List of Figures

- Figure 1: South Africa Alfalfa Hay Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Africa Alfalfa Hay Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa Alfalfa Hay Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: South Africa Alfalfa Hay Market Volume kilotons Forecast, by Production Analysis 2020 & 2033

- Table 3: South Africa Alfalfa Hay Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 4: South Africa Alfalfa Hay Market Volume kilotons Forecast, by Consumption Analysis 2020 & 2033

- Table 5: South Africa Alfalfa Hay Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: South Africa Alfalfa Hay Market Volume kilotons Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: South Africa Alfalfa Hay Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: South Africa Alfalfa Hay Market Volume kilotons Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: South Africa Alfalfa Hay Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: South Africa Alfalfa Hay Market Volume kilotons Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: South Africa Alfalfa Hay Market Revenue Million Forecast, by Region 2020 & 2033

- Table 12: South Africa Alfalfa Hay Market Volume kilotons Forecast, by Region 2020 & 2033

- Table 13: South Africa Alfalfa Hay Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 14: South Africa Alfalfa Hay Market Volume kilotons Forecast, by Production Analysis 2020 & 2033

- Table 15: South Africa Alfalfa Hay Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 16: South Africa Alfalfa Hay Market Volume kilotons Forecast, by Consumption Analysis 2020 & 2033

- Table 17: South Africa Alfalfa Hay Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: South Africa Alfalfa Hay Market Volume kilotons Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: South Africa Alfalfa Hay Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: South Africa Alfalfa Hay Market Volume kilotons Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: South Africa Alfalfa Hay Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: South Africa Alfalfa Hay Market Volume kilotons Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: South Africa Alfalfa Hay Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: South Africa Alfalfa Hay Market Volume kilotons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Alfalfa Hay Market?

The projected CAGR is approximately 5.60%.

2. Which companies are prominent players in the South Africa Alfalfa Hay Market?

Key companies in the market include Hulmac Trading SA Pty Ltd, Cherangani Trade And Invest 102 (Pty) Ltd (Multi Feeds, General Overseas Traders Pty Ltd, Alphaalfa (Pty) Ltd, Grains For Africa (Pty) Ltd, Agritrade Global(Pty) Ltd, Al Dahra ACX Inc Â, RCL Foods Consumer (Pty) Ltd (Epol Equine)*List Not Exhaustive.

3. What are the main segments of the South Africa Alfalfa Hay Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 336.86 Million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

High Meat Consumption is Boosting Demand for Quality Hay.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

December 2022: Alfalfa farmers in South Africa adopted farming technology and equipment to produce high-quality alfalfa hay that fetches a good price in both the domestic and international markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in kilotons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Alfalfa Hay Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Alfalfa Hay Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Alfalfa Hay Market?

To stay informed about further developments, trends, and reports in the South Africa Alfalfa Hay Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence