Key Insights

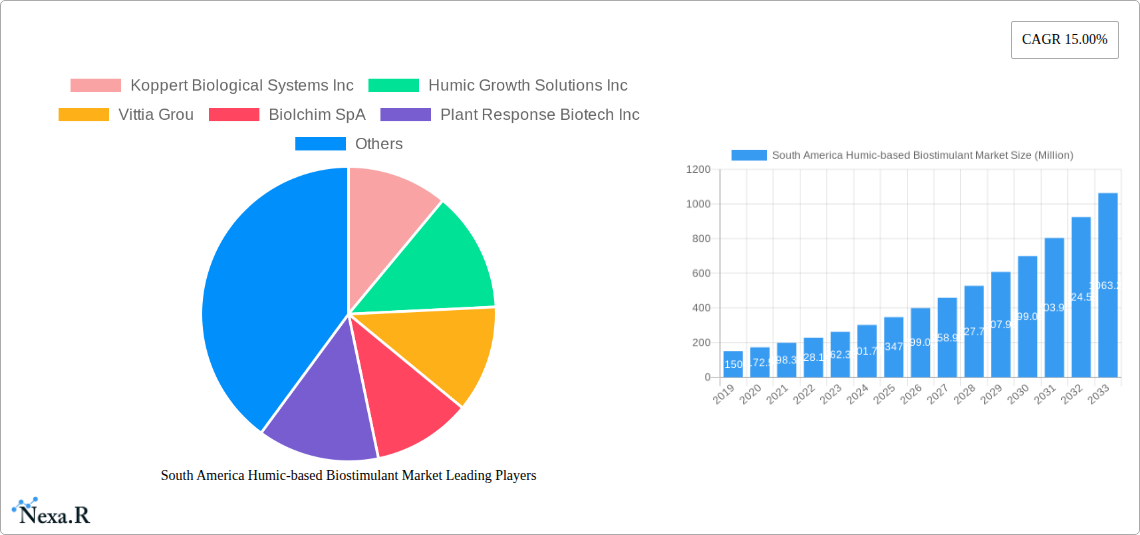

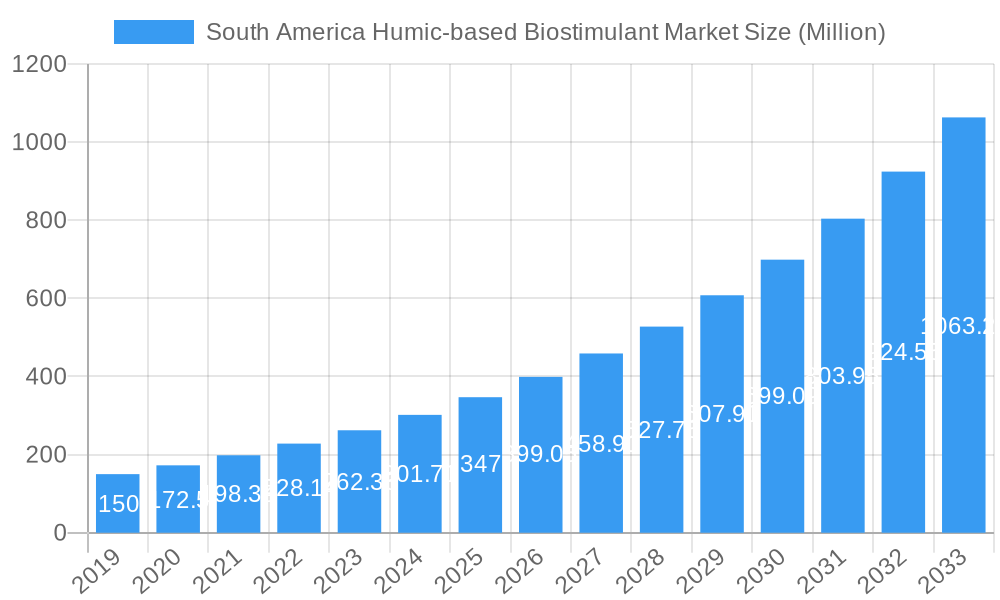

The South American humic-based biostimulant market is poised for exceptional growth, projected to reach an estimated USD 350 million by 2025 and expand at a robust Compound Annual Growth Rate (CAGR) of 15.00% through 2033. This surge is predominantly driven by increasing demand for sustainable agricultural practices, amplified by growing awareness of the environmental benefits of humic substances in enhancing crop yield and quality while reducing reliance on synthetic fertilizers. The region's significant agricultural output and its susceptibility to climate change impacts further bolster the adoption of these bio-based solutions, offering enhanced soil health and nutrient uptake efficiency. Key trends include the rise of organic farming, precision agriculture techniques, and an expanding product portfolio from leading companies like Koppert Biological Systems Inc. and Humic Growth Solutions Inc., who are investing in innovative formulations and expanding their market reach.

South America Humic-based Biostimulant Market Market Size (In Million)

Several factors contribute to the market's upward trajectory. The growing emphasis on food security and the need for increased agricultural productivity in South America, particularly in major economies like Brazil and Argentina, are significant catalysts. Furthermore, supportive government policies promoting sustainable agriculture and the integration of bio-stimulants into crop management programs are creating a favorable market environment. While the market demonstrates strong growth, potential restraints include the initial cost of certain advanced humic-based biostimulants and the need for greater farmer education on their optimal application and benefits. However, the long-term advantages of improved soil fertility, water retention, and reduced environmental impact are expected to outweigh these challenges, solidifying the market's strong growth forecast. The segmentation analysis highlights robust activity across production, consumption, and import/export dynamics, indicating a well-established and expanding value chain for humic-based biostimulants in South America.

South America Humic-based Biostimulant Market Company Market Share

This comprehensive report delves into the dynamic South America Humic-based Biostimulant Market, analyzing its trajectory from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033. We meticulously examine market dynamics, growth trends, regional dominance, product landscapes, key drivers, barriers, challenges, emerging opportunities, and growth accelerators, providing actionable insights for stakeholders. This report offers a deep dive into humic acid biostimulants, fulvic acid biostimulants, and leonardite biostimulants across South America, focusing on key markets like Brazil, Argentina, and Colombia. Our analysis encompasses production, consumption, imports, exports, and price trends, with all values presented in Millions of USD unless otherwise specified.

South America Humic-based Biostimulant Market Market Dynamics & Structure

The South America Humic-based Biostimulant Market is characterized by a moderate concentration of key players, with innovation in product formulation and application technology serving as primary drivers. Regulatory frameworks are evolving, with increasing emphasis on sustainable agricultural practices and organic certifications, influencing product development and market access. Competitive product substitutes, primarily synthetic fertilizers and other biostimulant types, pose a continuous challenge, necessitating a focus on superior efficacy and cost-effectiveness of humic-based solutions. End-user demographics are shifting towards a greater adoption of these bio-based inputs by large-scale agricultural enterprises seeking to enhance crop yield and quality while reducing environmental impact. Mergers and acquisitions (M&A) are a significant trend, as exemplified by The Mosaic Company's acquisition of Plant Response Biotech Inc. in February 2022, signaling consolidation and a drive for vertical integration.

- Market Concentration: Moderate, with a few dominant players and a growing number of regional and specialized providers.

- Technological Innovation Drivers: Enhanced extraction and purification methods for humic and fulvic acids, development of targeted delivery systems, and integration with digital farming solutions.

- Regulatory Frameworks: Growing support for sustainable agriculture and biostimulants, with some countries implementing specific guidelines and registration processes.

- Competitive Product Substitutes: Conventional fertilizers, other biostimulant categories (e.g., seaweed extracts, amino acids), and improved agricultural management practices.

- End-User Demographics: Increasingly sophisticated large-scale commercial farms, smallholder farmers seeking cost-effective solutions, and the organic farming sector.

- M&A Trends: Strategic acquisitions by larger chemical and fertilizer companies to expand their biostimulant portfolios and market reach.

South America Humic-based Biostimulant Market Growth Trends & Insights

The South America Humic-based Biostimulant Market is poised for substantial growth, driven by the imperative for enhanced agricultural productivity and sustainability across the region. A projected Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033 underscores this upward trajectory. The increasing adoption of humic-based biostimulants is directly linked to their proven ability to improve soil health, nutrient uptake efficiency, and plant stress tolerance, particularly in diverse South American agro-climatic conditions. This surge in adoption is fueled by a growing awareness among farmers regarding the long-term benefits of these organic inputs over conventional chemical fertilizers, which can degrade soil structure and contribute to environmental pollution. Technological disruptions, such as advancements in the formulation and application of humic and fulvic acids, are enhancing their efficacy and broadening their applicability across a wider range of crops, including soybeans, corn, fruits, and vegetables, which are staples of South American agriculture.

Consumer behavior shifts are also playing a pivotal role. With a growing global demand for sustainably produced food, South American producers are increasingly investing in inputs that align with these preferences. Humic-based biostimulants, derived from natural organic matter, perfectly fit this paradigm. Furthermore, the increasing frequency of extreme weather events due to climate change is pushing farmers to seek solutions that bolster crop resilience. Humic substances enhance root development and water retention in soils, making crops more tolerant to drought and other environmental stresses. The market penetration of humic-based biostimulants is expected to rise significantly as governments and agricultural institutions continue to promote their use through subsidies, educational programs, and research initiatives. The base year of 2025 marks a critical juncture, with an estimated market size of $450 Million, projected to expand to over $800 Million by 2033. This growth is further propelled by the development of novel product formulations, including liquid concentrates and granular forms, catering to diverse application methods and farm sizes. The transition from traditional farming practices towards more integrated and sustainable approaches is a fundamental driver, positioning humic-based biostimulants as a cornerstone of modern South American agriculture.

Dominant Regions, Countries, or Segments in South America Humic-based Biostimulant Market

Brazil stands out as the dominant force within the South America Humic-based Biostimulant Market, driven by its immense agricultural output and progressive adoption of advanced farming technologies. The country's vast arable land, coupled with a robust demand for enhancing yields in key export crops like soybeans, corn, and sugarcane, positions it as a prime market for humic-based biostimulants. The Production Analysis in Brazil is significant, with a growing number of domestic manufacturers leveraging abundant leonardite deposits and advanced extraction technologies. Consumption in Brazil is also the highest, reflecting its status as a leading agricultural producer and consumer of agrochemicals.

The Import Market Analysis for Brazil is substantial, showcasing a strong demand for specialized humic and fulvic acid formulations, particularly from international biostimulant specialists. While domestic production is strong, imports supplement the market with innovative products and technologies. Conversely, the Export Market Analysis for Brazil is also on an upward trend, with increasing volumes of humic-based biostimulants being shipped to neighboring South American countries and beyond, highlighting Brazil's growing influence in the global biostimulant landscape. The Price Trend Analysis in Brazil is influenced by raw material availability, production costs, and competitive dynamics, generally showing a stable to slightly increasing trend due to rising demand and product sophistication.

Argentina emerges as another crucial player, particularly in its Consumption Analysis, driven by its significant production of grains and beef. The country's focus on sustainable land management and soil fertility makes it a fertile ground for humic-based biostimulants. Colombian agriculture, with its diverse range of crops including coffee, flowers, and fruits, also contributes significantly to the Consumption Analysis, with a growing interest in biostimulants for improving crop quality and resilience. The increasing focus on organic and specialty crop production in countries like Chile and Peru further fuels the demand for humic-based biostimulants.

- Dominant Region: Brazil, due to its extensive agricultural sector and leadership in production and consumption.

- Key Drivers in Brazil:

- Vast agricultural land dedicated to major crops.

- Government support for sustainable agriculture initiatives.

- High adoption rates of advanced farming technologies.

- Abundant natural resources for humic substance extraction.

- Production Analysis: Brazil leads in domestic production of humic-based biostimulants, with a focus on utilizing leonardite. Other countries like Argentina are also increasing their production capabilities.

- Consumption Analysis: Brazil and Argentina represent the largest consumption markets. Colombia, Chile, and Peru show significant growth in consumption, driven by specialty and organic farming.

- Import Market Analysis (Value & Volume): Brazil is a major importer, seeking advanced formulations. Argentina also imports significant quantities to supplement domestic supply and access novel products.

- Export Market Analysis (Value & Volume): Brazil is a growing exporter, with increasing shipments to other South American nations.

- Price Trend Analysis: Generally stable to moderately increasing across the region, influenced by raw material costs, manufacturing expenses, and market demand.

South America Humic-based Biostimulant Market Product Landscape

The product landscape of the South America Humic-based Biostimulant Market is characterized by continuous innovation focused on enhancing the efficacy and application versatility of humic and fulvic acid-based products. Manufacturers are developing highly concentrated liquid formulations for easier mixing and spraying, as well as granular products for direct soil application, improving nutrient release and soil conditioning. Key innovations include products enriched with beneficial microorganisms, such as mycorrhizal fungi and plant growth-promoting rhizobacteria, creating synergistic effects for enhanced nutrient acquisition and plant health. Advanced extraction techniques are yielding purer forms of humic and fulvic acids, optimizing their bioavailability and impact on plant physiology.

- Product Innovations: Concentrated liquid formulations, granular products, microbially enhanced humic biostimulants, and biochar-humic acid blends.

- Applications: Soil conditioning, seed treatment, foliar sprays, fertigation, and enhancement of nutrient uptake for a wide array of crops.

- Performance Metrics: Increased root biomass, improved water and nutrient use efficiency, enhanced plant stress tolerance (drought, salinity), higher crop yields, and improved produce quality.

Key Drivers, Barriers & Challenges in South America Humic-based Biostimulant Market

Key Drivers: The South America Humic-based Biostimulant Market is propelled by a confluence of factors critical for modern agriculture. A primary driver is the increasing demand for sustainable agricultural practices and food production, driven by consumer preferences and regulatory pressures aimed at reducing the environmental impact of farming. The proven efficacy of humic-based biostimulants in improving soil health, enhancing nutrient use efficiency, and boosting crop yields makes them an attractive alternative to conventional synthetic fertilizers. Furthermore, growing awareness among farmers about the benefits of these organic inputs, coupled with government initiatives supporting sustainable agriculture, is accelerating market penetration. Climate change and its resultant effects, such as increased drought and soil degradation, are also driving the adoption of biostimulants that enhance plant resilience and soil water retention.

Barriers & Challenges: Despite the promising outlook, several barriers and challenges impede the full potential of the market. A significant challenge is the lack of standardized regulations and quality control across different South American countries, leading to inconsistencies in product quality and market access. Farmers' limited awareness and understanding of the specific benefits and optimal application of humic-based biostimulants, particularly in smaller-scale farming operations, can hinder adoption. The cost-effectiveness compared to conventional fertilizers, especially for certain crops and regions, can also be a deterrent. Supply chain disruptions, particularly in raw material sourcing and distribution logistics, can impact product availability and pricing. Moreover, the ongoing need for robust scientific research and field trials to conclusively demonstrate the ROI for various crops and soil types remains crucial to building farmer confidence and overcoming skepticism.

Emerging Opportunities in South America Humic-based Biostimulant Market

Emerging opportunities in the South America Humic-based Biostimulant Market lie in the untapped potential of niche crop segments and the expansion of integrated farming systems. The growing demand for organic and specialty produce, such as fruits, vegetables, and medicinal plants, presents a significant avenue for humic-based biostimulants that enhance quality and nutritional value. Furthermore, the development of customized biostimulant formulations tailored to specific soil types and crop requirements, integrating advanced analytical techniques, offers substantial growth potential. The increasing focus on regenerative agriculture practices and the circular economy model provides an opportunity for humic-based products derived from agricultural waste, fostering a more sustainable and resource-efficient farming approach across the region.

Growth Accelerators in the South America Humic-based Biostimulant Market Industry

Several catalysts are accelerating long-term growth in the South America Humic-based Biostimulant Market. Technological breakthroughs in the extraction and refinement of humic and fulvic acids are yielding more potent and bioavailable products, enhancing their perceived value and efficacy. Strategic partnerships between biostimulant manufacturers, agricultural input distributors, and research institutions are crucial for expanding market reach, providing technical support, and conducting localized field trials that validate product performance. Furthermore, market expansion strategies that focus on educating farmers, demonstrating tangible benefits through on-farm trials, and leveraging digital platforms for information dissemination are critical for driving adoption and fostering market growth.

Key Players Shaping the South America Humic-based Biostimulant Market Market

- Koppert Biological Systems Inc

- Humic Growth Solutions Inc

- Vittia Grou

- Biolchim SpA

- Plant Response Biotech Inc

- Sigma Agriscience LLC

- Haifa Group

- Trade Corporation International

- Atlántica Agrícola

- Valagro

Notable Milestones in South America Humic-based Biostimulant Market Sector

- February 2022: Plant Response was acquired by The Mosaic Company, a global fertilizer manufacturer. This acquisition strengthens the company's global presence and helps develop new products and solutions for the customers sustainably.

- September 2021: Tradecorp launched Biimore worldwide, a biostimulant obtained from a plant fermentation process. Biimore comprises a unique combination of primary and secondary compounds, L-α amino acids, vitamins, sugars, and traces of other natural compounds.

- January 2021: Atlántica Agrícola developed Micomix, a biostimulant composed primarily of mycorrhizal fungi, rhizobacteria, and chelated micronutrients. The presence and development of these microorganisms in the rhizosphere create a symbiotic relationship with the plant that favors the absorption of water and mineral nutrients and increases its tolerance to water and salt stress.

In-Depth South America Humic-based Biostimulant Market Market Outlook

The South America Humic-based Biostimulant Market is set for robust expansion, driven by the region's agricultural significance and the increasing global demand for sustainable food production. Future market potential is amplified by ongoing research and development leading to more sophisticated and targeted humic-based solutions. Strategic opportunities lie in capitalizing on the growing organic farming movement and the need for climate-resilient agriculture. Emphasis on farmer education, streamlined regulatory approvals, and the development of bio-fortified products will be crucial in unlocking the full economic and environmental benefits of these vital agricultural inputs.

South America Humic-based Biostimulant Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

South America Humic-based Biostimulant Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Humic-based Biostimulant Market Regional Market Share

Geographic Coverage of South America Humic-based Biostimulant Market

South America Humic-based Biostimulant Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs

- 3.3. Market Restrains

- 3.3.1. Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers

- 3.4. Market Trends

- 3.4.1. Row Crops is the largest Crop Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Humic-based Biostimulant Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Koppert Biological Systems Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Humic Growth Solutions Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Vittia Grou

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Biolchim SpA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Plant Response Biotech Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sigma Agriscience LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Haifa Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Trade Corporation International

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Atlántica Agrícola

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Valagro

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Koppert Biological Systems Inc

List of Figures

- Figure 1: South America Humic-based Biostimulant Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Humic-based Biostimulant Market Share (%) by Company 2025

List of Tables

- Table 1: South America Humic-based Biostimulant Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: South America Humic-based Biostimulant Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: South America Humic-based Biostimulant Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: South America Humic-based Biostimulant Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: South America Humic-based Biostimulant Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: South America Humic-based Biostimulant Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: South America Humic-based Biostimulant Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: South America Humic-based Biostimulant Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: South America Humic-based Biostimulant Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: South America Humic-based Biostimulant Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: South America Humic-based Biostimulant Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: South America Humic-based Biostimulant Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil South America Humic-based Biostimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina South America Humic-based Biostimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Chile South America Humic-based Biostimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Colombia South America Humic-based Biostimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Peru South America Humic-based Biostimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Venezuela South America Humic-based Biostimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Ecuador South America Humic-based Biostimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Bolivia South America Humic-based Biostimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Paraguay South America Humic-based Biostimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Uruguay South America Humic-based Biostimulant Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Humic-based Biostimulant Market?

The projected CAGR is approximately 15.00%.

2. Which companies are prominent players in the South America Humic-based Biostimulant Market?

Key companies in the market include Koppert Biological Systems Inc, Humic Growth Solutions Inc, Vittia Grou, Biolchim SpA, Plant Response Biotech Inc, Sigma Agriscience LLC, Haifa Group, Trade Corporation International, Atlántica Agrícola, Valagro.

3. What are the main segments of the South America Humic-based Biostimulant Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs.

6. What are the notable trends driving market growth?

Row Crops is the largest Crop Type.

7. Are there any restraints impacting market growth?

Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers.

8. Can you provide examples of recent developments in the market?

February 2022: Plant Response was acquired by The Mosaic Company, which is a global fertilizer manufacturer. This acquisition strengthens the company's global presence and helps develop new products and solutions for the customers sustainably.September 2021: Tradecorp launched Biimore worldwide, a biostimulant obtained from a plant fermentation process. Biimore comprises a unique combination of primary and secondary compounds, L-α amino acids, vitamins, sugars, and traces of other natural compounds.January 2021: Atlántica Agrícola developed Micomix, a biostimulant composed primarily of mycorrhizal fungi, rhizobacteria, and chelated micronutrients. The presence and development of these microorganisms in the rhizosphere create a symbiotic relationship with the plant that favors the absorption of water and mineral nutrients and increases its tolerance to water and salt stress.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Humic-based Biostimulant Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Humic-based Biostimulant Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Humic-based Biostimulant Market?

To stay informed about further developments, trends, and reports in the South America Humic-based Biostimulant Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence