Key Insights

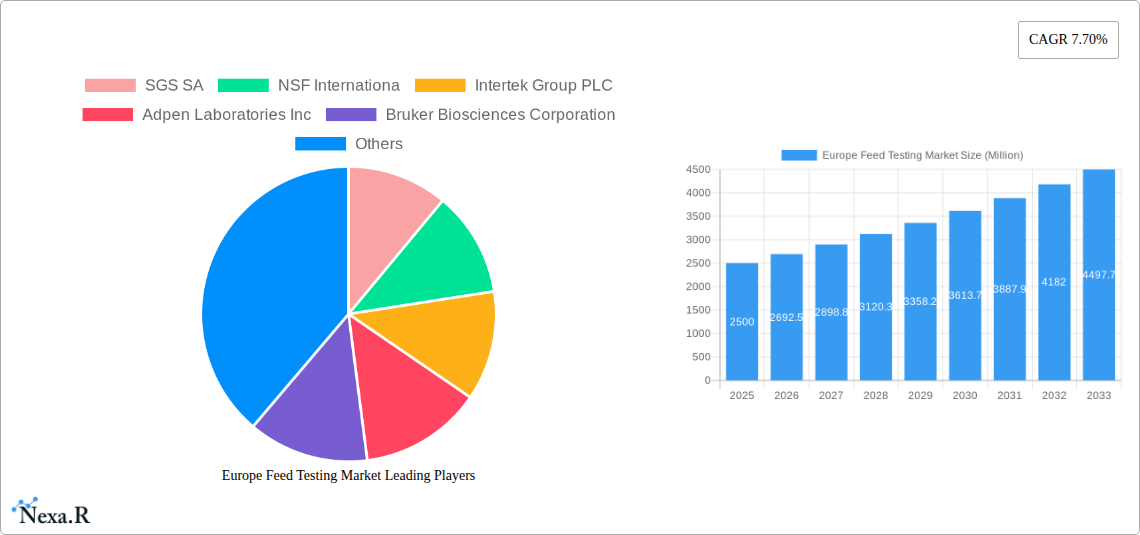

The Europe Feed Testing Market is poised for robust expansion, driven by an estimated market size of USD 2.5 billion in 2025 and a projected Compound Annual Growth Rate (CAGR) of 7.70% through 2033. This significant growth trajectory is underpinned by escalating concerns regarding animal health, food safety, and the increasing demand for high-quality animal feed across the continent. Stringent regulatory frameworks, such as those mandated by the European Union, are compelling feed producers to invest heavily in comprehensive testing to ensure compliance and safeguard animal welfare. Furthermore, a growing awareness among consumers about the traceability and safety of animal products is directly influencing the feed industry's commitment to rigorous quality control measures. The increasing prevalence of zoonotic diseases and the need to prevent their transmission through the food chain also act as critical catalysts for market expansion, emphasizing the indispensable role of advanced feed testing solutions.

Europe Feed Testing Market Market Size (In Billion)

Key trends shaping the Europe Feed Testing Market include the burgeoning adoption of advanced analytical technologies, such as mass spectrometry and DNA-based testing, to detect a wider array of contaminants and pathogens with greater accuracy and speed. The market is also witnessing a surge in demand for comprehensive testing services that cover the entire feed supply chain, from raw material sourcing to finished product analysis. Sustainability initiatives are further influencing the market, with a growing focus on testing for environmental contaminants and the development of sustainable feed ingredients. While the market presents substantial opportunities, potential restraints include the high cost of advanced testing equipment and specialized personnel, as well as variations in regulatory enforcement across different European nations. Nevertheless, the overarching commitment to animal and human health, coupled with evolving consumer expectations, ensures a positive outlook for the Europe Feed Testing Market.

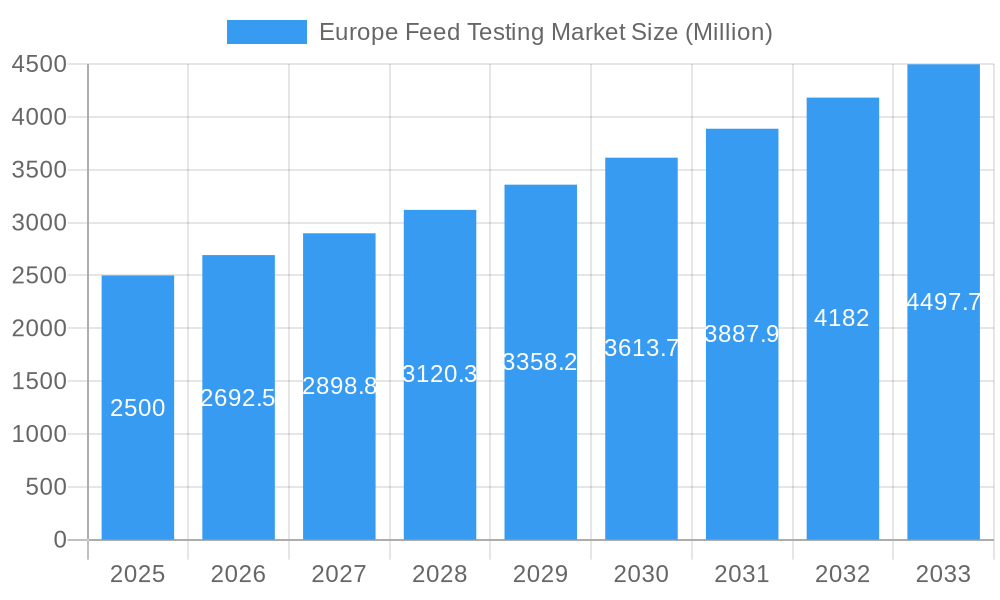

Europe Feed Testing Market Company Market Share

Europe Feed Testing Market: Comprehensive Analysis and Future Outlook (2019–2033)

This report provides an in-depth analysis of the Europe Feed Testing Market, covering key dynamics, growth trends, regional dominance, product landscape, drivers, barriers, opportunities, and strategic insights. The study encompasses the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033. All values are presented in million units.

Europe Feed Testing Market Market Dynamics & Structure

The Europe Feed Testing Market is characterized by a moderately concentrated landscape, with key players vying for market share through strategic acquisitions and technological advancements. Innovation in analytical techniques, such as advanced chromatography and mass spectrometry, is a significant driver, enabling more precise and comprehensive testing of feed composition, contaminants, and nutritional value. Stringent regulatory frameworks, including EU directives on animal feed safety and traceability, further propel market demand for accredited testing services. Competitive product substitutes, such as in-house testing by large feed manufacturers, exist but are often outweighed by the need for independent, certified laboratory validation. End-user demographics are diverse, encompassing feed manufacturers, livestock farmers, pet food producers, and government agencies, each with specific testing requirements. Mergers and acquisitions (M&A) are a notable trend, with larger entities acquiring smaller, specialized laboratories to expand their service offerings and geographical reach. For instance, the market has witnessed an average of 5-7 significant M&A deals annually over the past five years, with deal values ranging from €5 million to €50 million, reflecting consolidation efforts and expansion strategies. Barriers to innovation include the high cost of advanced analytical equipment and the lengthy validation processes for new testing methodologies.

Europe Feed Testing Market Growth Trends & Insights

The Europe Feed Testing Market is poised for robust growth, driven by an escalating emphasis on animal welfare, food safety, and the nutritional quality of animal feed. The market size, which stood at approximately €850 million in 2024, is projected to reach over €1,500 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period. Adoption rates for advanced testing methods, including those for detecting mycotoxins, heavy metals, and genetically modified organisms (GMOs), are on a steady rise, reflecting growing awareness and regulatory pressures. Technological disruptions, such as the integration of artificial intelligence (AI) in data analysis and the development of portable testing devices, are set to revolutionize the industry, offering faster and more efficient testing solutions. Consumer behavior shifts towards ethically sourced and sustainably produced animal products are indirectly influencing the demand for feed testing, as consumers increasingly link feed quality to the health and safety of the final animal products. Market penetration of comprehensive feed testing services has increased from approximately 55% in 2019 to an estimated 70% in 2025, indicating a growing reliance on professional testing services across the value chain. The increasing prevalence of zoonotic diseases and the need for rapid detection and prevention are also significant contributors to market expansion. Furthermore, the rising global population and the subsequent demand for animal protein are creating a sustained need for high-quality, safe animal feed, thereby boosting the feed testing market. The proactive stance of European regulatory bodies in enforcing strict feed quality standards plays a crucial role in driving the consistent demand for feed testing services.

Dominant Regions, Countries, or Segments in Europe Feed Testing Market

Production Analysis: The production of feed testing services is heavily concentrated in Western Europe, with Germany, France, and the United Kingdom leading the charge due to their advanced agricultural sectors, robust regulatory oversight, and significant presence of major feed manufacturers and testing laboratories. These countries collectively account for an estimated 55% of the total feed testing service production in Europe.

Consumption Analysis: Consumption of feed testing services is closely aligned with production, driven by the demand from livestock farming, poultry, aquaculture, and pet food industries. Germany and France are the largest consumers, driven by their extensive agricultural outputs and stringent quality control mandates for animal feed. The consumption in these two countries alone represents approximately 40% of the European market.

Import Market Analysis (Value & Volume): The import market for specialized feed testing equipment and reagents is significant, with European countries importing advanced analytical instruments and chemicals from North America and Asia. The value of imported feed testing-related products is estimated at €150 million in 2025, with a volume of approximately 10,000 units. Countries like the Netherlands and Belgium often act as key hubs for re-exportation.

Export Market Analysis (Value & Volume): Europe is a net exporter of feed testing services, particularly to Eastern European and Middle Eastern markets. The value of exported feed testing services is estimated at €200 million in 2025, with a significant volume attributed to specialized testing solutions and expertise. Germany and France are the primary exporters.

Price Trend Analysis: Price trends in the Europe Feed Testing Market are influenced by the cost of advanced instrumentation, skilled labor, and regulatory compliance. While routine testing prices remain competitive, specialized tests for emerging contaminants or novel ingredients command higher premiums. The average price for a comprehensive feed analysis package is around €250-€400, with specialized tests costing upwards of €800.

Industry Developments: Key industry developments driving dominance include the establishment of accredited laboratories, the adoption of advanced technologies like near-infrared spectroscopy (NIR) and DNA-based testing, and the strategic expansion of service portfolios by leading companies to cover a wider range of contaminants and nutritional parameters.

Europe Feed Testing Market Product Landscape

The product landscape in the Europe Feed Testing Market is characterized by a growing array of sophisticated analytical instruments, rapid test kits, and software solutions designed for accurate and efficient feed analysis. Innovations focus on enhancing sensitivity, reducing turnaround times, and expanding the scope of detectable analytes, including nutritional components, contaminants like mycotoxins and pesticides, pathogens, and allergens. Performance metrics are increasingly measured by detection limits, specificity, accuracy, and cost-effectiveness. Unique selling propositions often lie in the development of field-deployable testing devices for on-site analysis and the integration of AI-powered data interpretation to provide actionable insights for feed producers.

Key Drivers, Barriers & Challenges in Europe Feed Testing Market

Key Drivers:

- Stricter Food Safety Regulations: European Union regulations (e.g., Regulation (EC) No 183/2005) mandate rigorous feed safety testing, driving demand.

- Growing Demand for High-Quality Animal Protein: Increased consumption of meat, dairy, and eggs necessitates safe and nutritious feed.

- Consumer Awareness: Rising consumer concerns about animal welfare and the origin of food products influence feed quality demands.

- Technological Advancements: Development of advanced analytical techniques enhances accuracy and efficiency in testing.

- Preventing Zoonotic Diseases: Testing plays a crucial role in identifying and mitigating the risk of diseases transmissible from animals to humans.

Barriers & Challenges:

- High Cost of Advanced Equipment: The initial investment in sophisticated analytical instruments can be substantial.

- Skilled Labor Shortage: A lack of qualified technicians and scientists for operating advanced equipment poses a challenge.

- Regulatory Complexity: Navigating diverse and evolving regulations across different European countries can be burdensome.

- Price Sensitivity: Pressure from feed producers to keep testing costs low can impact profitability for testing laboratories.

- Supply Chain Disruptions: Geopolitical factors and logistical challenges can affect the availability of testing reagents and consumables. The impact of supply chain disruptions has led to an estimated 2-5% increase in operational costs for some laboratories.

Emerging Opportunities in Europe Feed Testing Market

Emerging opportunities in the Europe Feed Testing Market lie in the expanding demand for testing related to novel feed ingredients, such as insect-based proteins and alternative protein sources, driven by sustainability initiatives. The growth of precision livestock farming presents opportunities for real-time, on-farm feed monitoring solutions. Furthermore, there is a growing need for testing related to feed additives that enhance animal health and reduce antibiotic use. The development of digital platforms for sample tracking, results management, and data analytics offers significant potential for value-added services. The increasing focus on the environmental impact of animal agriculture also opens avenues for testing feed’s contribution to greenhouse gas emissions and nutrient runoff.

Growth Accelerators in the Europe Feed Testing Market Industry

Catalysts driving long-term growth in the Europe Feed Testing Market include continued investment in research and development by leading analytical instrument manufacturers and testing service providers. Strategic partnerships between technology companies, research institutions, and feed industry players are accelerating the adoption of innovative testing solutions. Market expansion strategies, including mergers and acquisitions to broaden service portfolios and geographical reach, will further fuel growth. The proactive stance of regulatory bodies in anticipating and addressing future food safety challenges, such as the emergence of new chemical contaminants or antimicrobial resistance, will also serve as a significant growth accelerator.

Key Players Shaping the Europe Feed Testing Market Market

- SGS SA

- NSF International

- Intertek Group PLC

- Adpen Laboratories Inc

- Bruker Biosciences Corporation

- Genetic ID NA Inc

- SYNLAB

- Eurofins Scientific

- Invisible Sentinel Inc

Notable Milestones in Europe Feed Testing Market Sector

- 2020/03: Eurofins Scientific acquires a significant stake in a specialized animal nutrition testing laboratory, expanding its service offerings in Europe.

- 2021/07: Intertek Group PLC launches a new suite of rapid testing solutions for mycotoxins in animal feed, enhancing on-site analysis capabilities.

- 2022/01: SGS SA introduces advanced DNA-based testing for feed authenticity and traceability, addressing concerns around fraudulent ingredients.

- 2023/05: NSF International expands its European laboratory network, focusing on enhancing testing capacity for pet food ingredients.

- 2024/02: Bruker Biosciences Corporation introduces a new high-resolution mass spectrometry system designed for the rapid identification of trace contaminants in animal feed.

In-Depth Europe Feed Testing Market Market Outlook

The Europe Feed Testing Market is expected to witness sustained growth in the coming years, propelled by an unwavering commitment to animal health and food safety. Key growth accelerators will include the ongoing evolution of analytical technologies, such as AI-driven data analytics and portable testing devices, which promise greater efficiency and accessibility. Strategic collaborations and market consolidations will further optimize service delivery and expand market reach. The market's future potential is intrinsically linked to its ability to adapt to evolving regulatory landscapes and emerging global health concerns, ensuring the continued integrity and safety of the animal feed supply chain across Europe.

Europe Feed Testing Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Feed Testing Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

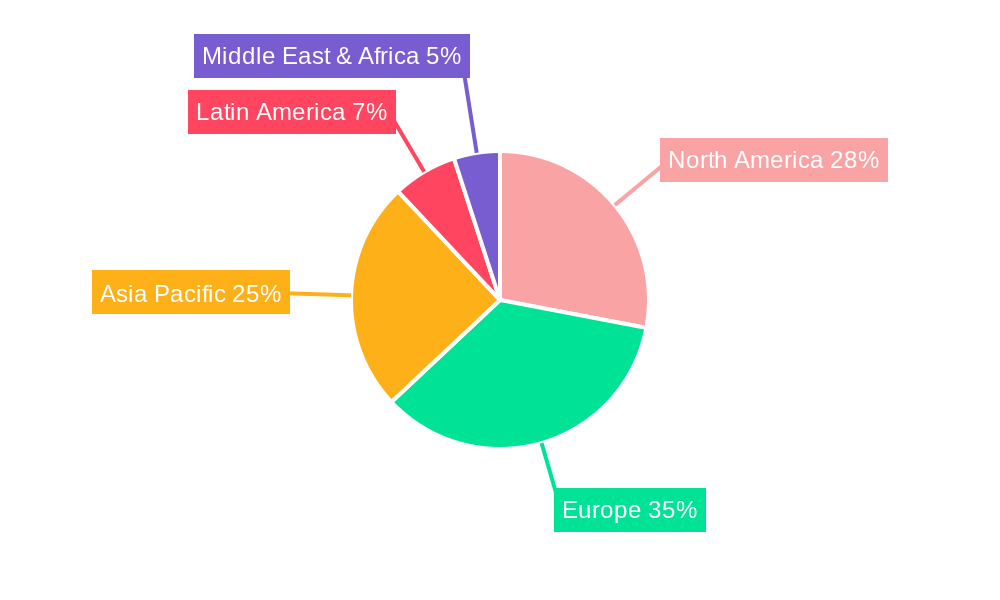

Europe Feed Testing Market Regional Market Share

Geographic Coverage of Europe Feed Testing Market

Europe Feed Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Decreasing Per Capita Arable Land; Increased Demand for Food

- 3.3. Market Restrains

- 3.3.1. High Initial Investments; Requirement of Precision Agriculture

- 3.4. Market Trends

- 3.4.1. Increased Awareness About Food Safety

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Feed Testing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SGS SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NSF Internationa

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Intertek Group PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Adpen Laboratories Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bruker Biosciences Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Genetic ID NA Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SYNLAB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Eurofins Scientific

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Invisible Sentinel Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 SGS SA

List of Figures

- Figure 1: Europe Feed Testing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Feed Testing Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Feed Testing Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Feed Testing Market Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 3: Europe Feed Testing Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 4: Europe Feed Testing Market Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 5: Europe Feed Testing Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: Europe Feed Testing Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: Europe Feed Testing Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: Europe Feed Testing Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: Europe Feed Testing Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: Europe Feed Testing Market Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: Europe Feed Testing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 12: Europe Feed Testing Market Volume Kiloton Forecast, by Region 2020 & 2033

- Table 13: Europe Feed Testing Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 14: Europe Feed Testing Market Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 15: Europe Feed Testing Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 16: Europe Feed Testing Market Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 17: Europe Feed Testing Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Europe Feed Testing Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Europe Feed Testing Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Europe Feed Testing Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: Europe Feed Testing Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: Europe Feed Testing Market Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: Europe Feed Testing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Europe Feed Testing Market Volume Kiloton Forecast, by Country 2020 & 2033

- Table 25: United Kingdom Europe Feed Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Europe Feed Testing Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 27: Germany Europe Feed Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany Europe Feed Testing Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 29: France Europe Feed Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: France Europe Feed Testing Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 31: Italy Europe Feed Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Italy Europe Feed Testing Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 33: Spain Europe Feed Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Spain Europe Feed Testing Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 35: Netherlands Europe Feed Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Netherlands Europe Feed Testing Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 37: Belgium Europe Feed Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Belgium Europe Feed Testing Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 39: Sweden Europe Feed Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Sweden Europe Feed Testing Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 41: Norway Europe Feed Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Norway Europe Feed Testing Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 43: Poland Europe Feed Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Poland Europe Feed Testing Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 45: Denmark Europe Feed Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Denmark Europe Feed Testing Market Volume (Kiloton) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Feed Testing Market?

The projected CAGR is approximately 7.70%.

2. Which companies are prominent players in the Europe Feed Testing Market?

Key companies in the market include SGS SA, NSF Internationa, Intertek Group PLC, Adpen Laboratories Inc, Bruker Biosciences Corporation, Genetic ID NA Inc, SYNLAB, Eurofins Scientific, Invisible Sentinel Inc.

3. What are the main segments of the Europe Feed Testing Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Decreasing Per Capita Arable Land; Increased Demand for Food.

6. What are the notable trends driving market growth?

Increased Awareness About Food Safety.

7. Are there any restraints impacting market growth?

High Initial Investments; Requirement of Precision Agriculture.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Feed Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Feed Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Feed Testing Market?

To stay informed about further developments, trends, and reports in the Europe Feed Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence