Key Insights

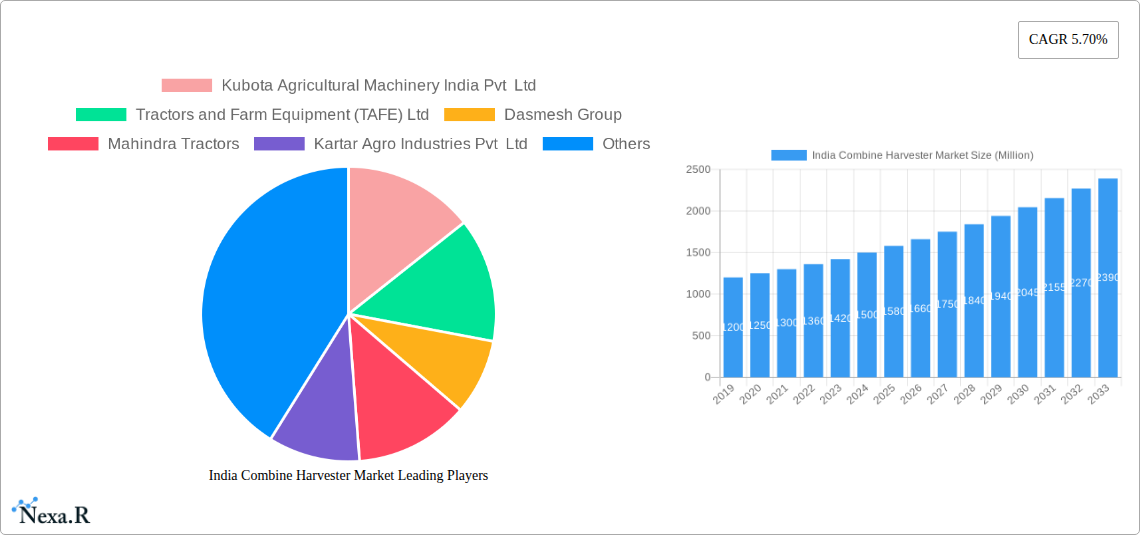

The Indian combine harvester market is projected to experience significant expansion, reaching an estimated market size of $275.4 million by 2025. This growth is driven by a compound annual growth rate (CAGR) of 5.7% through 2033. Key factors fueling this surge include the imperative for enhanced agricultural mechanization to bolster productivity and efficiency within India's vital agricultural sector. The government's strategic focus on modern farming techniques and farmer welfare initiatives, alongside increasing farmer awareness of advanced harvesting solutions, are pivotal drivers. Moreover, rising labor expenses and the critical need for timely harvesting to mitigate crop losses, particularly during peak seasons, are compelling farmers to adopt combine harvesters. Leading companies such as Mahindra Tractors, TAFE, John Deere India, and Sonalika Group are instrumental in shaping this market through continuous innovation and the introduction of diverse product lines catering to varied farm sizes and crop types. The market analysis encompasses production, consumption, import, export, and price trends, with a strong emphasis on India, highlighting robust domestic demand and manufacturing capabilities.

India Combine Harvester Market Market Size (In Million)

The Indian combine harvester market is marked by evolving trends designed to meet the varied requirements of its agricultural community. There is a clear trend towards adopting technologically advanced harvesters, featuring improved fuel efficiency, precision farming capabilities, and enhanced operator comfort. The growing availability of financing options and government subsidies is making this essential machinery more accessible to small and marginal farmers. However, challenges persist, including high initial investment costs, limited availability of skilled technicians for maintenance in remote areas, and the necessity for comprehensive training to operate complex machinery effectively. Despite these obstacles, the market's growth remains robust, propelled by the ongoing pursuit of improved agricultural output and the modernization of farming practices across India. The competitive arena comprises both established global manufacturers and prominent domestic players, fostering innovation and competitive pricing that ultimately benefits end-users.

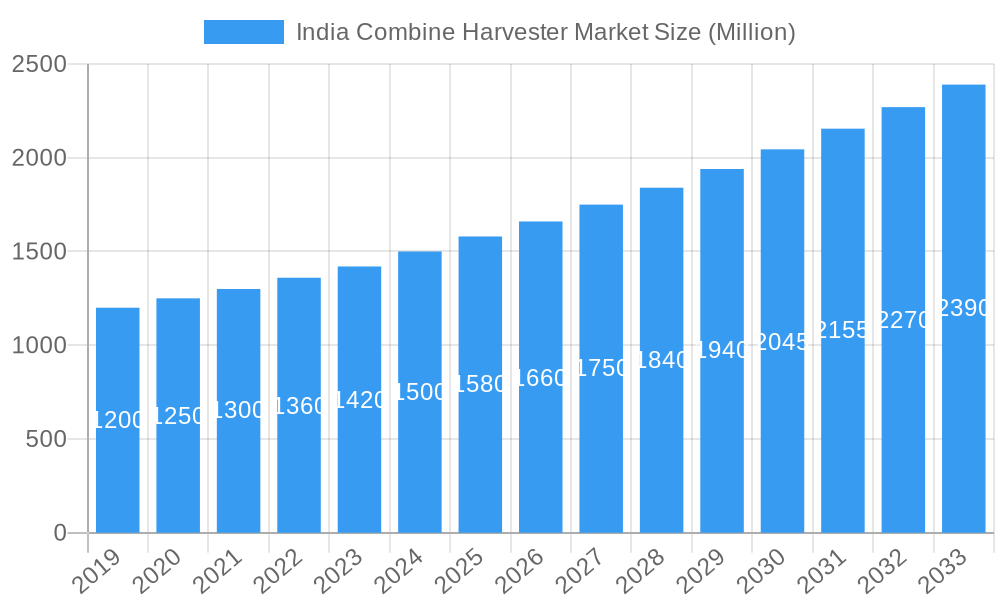

India Combine Harvester Market Company Market Share

India Combine Harvester Market: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report provides a granular analysis of the India Combine Harvester Market, forecasting its trajectory from 2025 to 2033, with a base year of 2025. Covering the historical period of 2019-2024, the study offers crucial insights into market dynamics, growth trends, regional dominance, product landscapes, and key players shaping this vital agricultural sector. Dive deep into parent market trends and child market segments to uncover hidden growth avenues and investment opportunities in the Indian agriculture machinery market, focusing on farm mechanization in India and harvesting solutions.

India Combine Harvester Market Market Dynamics & Structure

The India Combine Harvester Market is characterized by a moderate to high concentration, with key players like Kubota Agricultural Machinery India Pvt Ltd, TAFE Ltd, Mahindra Tractors, and John Deere India Pvt Ltd holding significant market shares. Technological innovation is a primary driver, with advancements in fuel efficiency, automation, and precision harvesting capabilities influencing product development. Regulatory frameworks, including government subsidies and farmer support schemes, play a crucial role in market penetration. Competitive product substitutes, primarily manual labor and older harvesting technologies, are gradually being phased out due to rising labor costs and the demand for increased efficiency. End-user demographics are shifting towards larger landholding farmers and agricultural cooperatives seeking to optimize their operations. Mergers and acquisitions (M&A) activity, though not overtly frequent, can significantly alter market concentration.

- Market Concentration: Dominated by a few major international and domestic players.

- Technological Innovation Drivers: Focus on improved fuel efficiency, AI-powered analytics, and modular designs.

- Regulatory Frameworks: Government initiatives promoting mechanization and subsidies for farm equipment.

- Competitive Product Substitutes: Manual harvesting, Reaper binders, and older combine models.

- End-User Demographics: Increasingly influenced by large-scale farming operations and contract farming.

- M&A Trends: Potential for consolidation driven by technological advancements and market expansion strategies.

India Combine Harvester Market Growth Trends & Insights

The India Combine Harvester Market is poised for significant expansion, driven by increasing agricultural productivity demands and government initiatives promoting farm mechanization in India. The market size has witnessed steady growth, fueled by the adoption of advanced harvesting technologies by farmers aiming to improve efficiency and reduce crop losses. The CAGR of the India Combine Harvester Market is projected to be robust, reflecting a growing penetration of modern machinery across various farming landscapes. Technological disruptions, such as the integration of GPS and IoT for precision agriculture, are reshaping the market. Consumer behavior is shifting towards seeking cost-effective, high-performance, and durable harvesting solutions that offer a better return on investment. The transition from traditional methods to mechanized harvesting is a key trend, accelerated by labor shortages and the desire for timely crop collection.

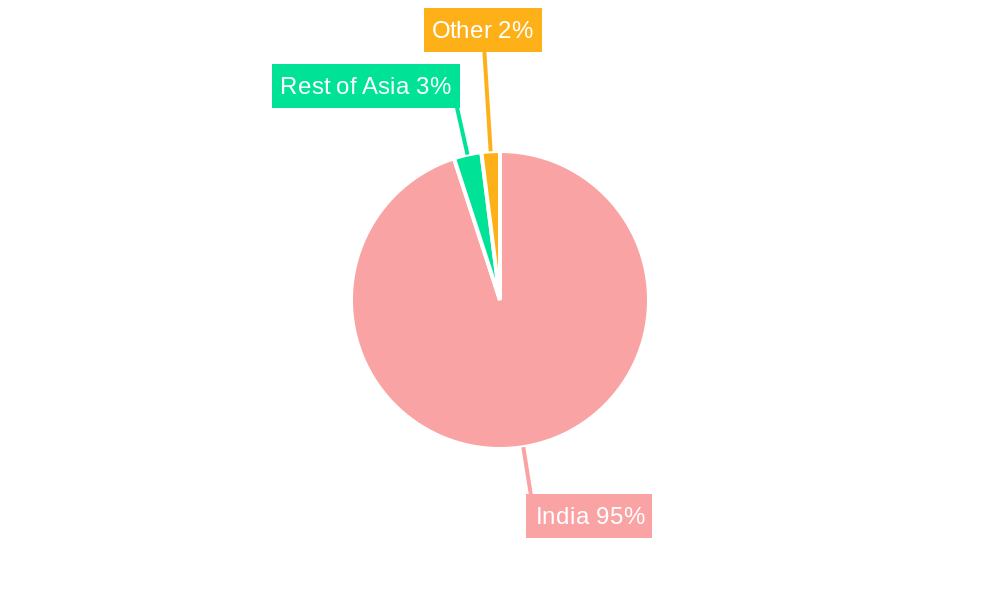

Dominant Regions, Countries, or Segments in India Combine Harvester Market

The Production Analysis of the India Combine Harvester Market is primarily concentrated in states with a strong agricultural base and manufacturing infrastructure. Punjab and Haryana emerge as dominant regions due to their extensive wheat and rice cultivation, necessitating large-scale harvesting equipment. Consumption Analysis further reinforces the dominance of these northern states, where the adoption of combine harvesters is highest to meet the demands of large landholdings and efficient crop cycles. The Import Market Analysis (Value & Volume) is influenced by the availability of advanced technologies and specific agricultural needs, with countries like Japan and European nations being key suppliers. Conversely, the Export Market Analysis (Value & Volume) is gradually gaining traction as Indian manufacturers enhance their capabilities and explore opportunities in neighboring countries and developing agricultural economies. The Price Trend Analysis is a critical factor influencing adoption rates, with fluctuating raw material costs and technological advancements impacting pricing strategies.

- Dominant Region (Production & Consumption): Northern states like Punjab and Haryana, driven by extensive cereal cultivation.

- Key Drivers of Dominance:

- Economic Policies: Government support for agriculture and mechanization.

- Infrastructure: Well-developed agricultural infrastructure and supply chains.

- Landholding Patterns: Presence of large and medium-sized farms.

- Crop Intensity: High cultivation of crops like wheat and rice.

- Import Market Influence: Driven by demand for specialized features and advanced technology.

- Export Market Potential: Growing as Indian manufacturers expand production capacity and quality.

- Price Trend Impact: Sensitivity to raw material costs, technological integration, and government subsidies.

India Combine Harvester Market Product Landscape

The product landscape of the India Combine Harvester Market is evolving with a strong emphasis on enhanced performance and operational efficiency. Manufacturers are continuously introducing innovative models equipped with features like adjustable cutting headers, optimized grain handling systems, and advanced cab ergonomics for operator comfort. Notable product advancements include the development of specialized harvesters for different crops, such as paddy, wheat, sugarcane, and maize, catering to the diverse agricultural needs of India. The integration of digital technologies, such as GPS tracking for route optimization and data logging for yield analysis, is becoming a standard offering in higher-end models. Performance metrics are constantly being improved, focusing on reduced fuel consumption, increased harvesting speed, and minimal grain loss, thereby maximizing farmer profitability.

Key Drivers, Barriers & Challenges in India Combine Harvester Market

Key Drivers:

- Government Initiatives: Subsidy schemes and policies promoting farm mechanization are significant growth drivers.

- Increasing Agricultural Output Demand: The need to meet the food requirements of a growing population.

- Labor Shortage & Rising Labor Costs: Mechanization offers a viable solution to these challenges.

- Technological Advancements: Introduction of fuel-efficient, high-performance, and smart combine harvesters.

- Favorable Crop Economics: Increased profitability for farmers adopting modern harvesting techniques.

Barriers & Challenges:

- High Initial Investment Cost: Combine harvesters represent a significant capital outlay for small and marginal farmers.

- Availability of Skilled Labor for Operation & Maintenance: A shortage of trained personnel can hinder adoption and efficient use.

- Fragmented Landholdings: The presence of small farms can make it difficult to justify the investment.

- Inadequate Infrastructure: Limited access to servicing centers and spare parts in remote agricultural regions.

- Financing Options: Lack of easily accessible and affordable financing for equipment purchase.

- Competition from Used Equipment Market: Availability of second-hand harvesters can impact the demand for new units.

Emerging Opportunities in India Combine Harvester Market

Emerging opportunities in the India Combine Harvester Market lie in the development of more affordable and versatile smaller-sized combine harvesters specifically designed for small and marginal landholdings. The integration of advanced sensor technology for real-time crop health monitoring and yield prediction presents a significant untapped market. Furthermore, the growing trend of contract farming and custom hiring centers creates a demand for efficient and reliable combine harvesters that can be leased out. The focus on sustainable agriculture and residue management is also opening avenues for harvesters equipped with features for efficient straw and chaff collection.

Growth Accelerators in the India Combine Harvester Market Industry

Growth accelerators in the India Combine Harvester Market industry are multifaceted, encompassing continuous technological innovation, strategic partnerships between manufacturers and financial institutions, and proactive government policies. The development of hybrid and electric combine harvesters, driven by environmental concerns and fuel cost volatility, will be a significant accelerator. Expansion into Tier 2 and Tier 3 cities, coupled with robust after-sales service networks, will enhance market penetration. Moreover, collaborations with agricultural universities and research institutes to promote best practices in mechanized harvesting will foster wider adoption and drive long-term sustainable growth.

Key Players Shaping the India Combine Harvester Market Market

- Kubota Agricultural Machinery India Pvt Ltd

- Tractors and Farm Equipment (TAFE) Ltd

- Dasmesh Group

- Mahindra Tractors

- Kartar Agro Industries Pvt Ltd

- CLAAS India

- Balkar Combines

- John Deere India Pvt Ltd

- PREET Group

- Sonalika Group

Notable Milestones in India Combine Harvester Market Sector

- August 2023: Mahindra & Mahindra Ltd (M&M Ltd) launched the Swaraj 8200 Wheel Harvester, enhancing harvesting acreage and grain quality.

- November 2022: Mahindra & Mahindra Farm Equipment Sector (FES) inaugurated its first dedicated farm machinery plant (non-tractor) in Pithampur, Madhya Pradesh, with an annual capacity of 1,200 combine harvesters.

- June 2022: The Andhra Pradesh government distributed combined harvesters as part of the YSR Yantra Seva Pathakam Scheme, boosting regional mechanization.

In-Depth India Combine Harvester Market Market Outlook

The India Combine Harvester Market exhibits a promising outlook, driven by relentless technological advancements and supportive government policies aimed at boosting agricultural productivity. Future market potential will be significantly shaped by the development of smart harvesting solutions, including AI-enabled harvesters that optimize operations based on real-time data. Strategic opportunities lie in expanding into underserved regions with tailored product offerings and strengthening the after-sales service network. Collaboration with agricultural cooperatives and custom hiring centers will be crucial for enhancing accessibility and affordability. The growing awareness among farmers regarding the economic and operational benefits of combine harvesters will continue to fuel market expansion, solidifying its role in modernizing Indian agriculture.

India Combine Harvester Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

India Combine Harvester Market Segmentation By Geography

- 1. India

India Combine Harvester Market Regional Market Share

Geographic Coverage of India Combine Harvester Market

India Combine Harvester Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Cost of Farm Labors; Increasing Consumption of Grain Crops

- 3.3. Market Restrains

- 3.3.1. High Cost of Combine Harvesters; Small and Fragmented Land Holdings

- 3.4. Market Trends

- 3.4.1. High Cost of Farm Labor

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Combine Harvester Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kubota Agricultural Machinery India Pvt Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tractors and Farm Equipment (TAFE) Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dasmesh Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mahindra Tractors

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kartar Agro Industries Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CLAAS India

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Balkar Combines

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 John Deere India Pvt Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PREET Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sonalika Group*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Kubota Agricultural Machinery India Pvt Ltd

List of Figures

- Figure 1: India Combine Harvester Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Combine Harvester Market Share (%) by Company 2025

List of Tables

- Table 1: India Combine Harvester Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: India Combine Harvester Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: India Combine Harvester Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: India Combine Harvester Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: India Combine Harvester Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: India Combine Harvester Market Revenue million Forecast, by Region 2020 & 2033

- Table 7: India Combine Harvester Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 8: India Combine Harvester Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: India Combine Harvester Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: India Combine Harvester Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: India Combine Harvester Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: India Combine Harvester Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Combine Harvester Market?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the India Combine Harvester Market?

Key companies in the market include Kubota Agricultural Machinery India Pvt Ltd, Tractors and Farm Equipment (TAFE) Ltd, Dasmesh Group, Mahindra Tractors, Kartar Agro Industries Pvt Ltd, CLAAS India, Balkar Combines, John Deere India Pvt Ltd, PREET Group, Sonalika Group*List Not Exhaustive.

3. What are the main segments of the India Combine Harvester Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 275.4 million as of 2022.

5. What are some drivers contributing to market growth?

High Cost of Farm Labors; Increasing Consumption of Grain Crops.

6. What are the notable trends driving market growth?

High Cost of Farm Labor.

7. Are there any restraints impacting market growth?

High Cost of Combine Harvesters; Small and Fragmented Land Holdings.

8. Can you provide examples of recent developments in the market?

August 2023: Mahindra & Mahindra Ltd (M&M Ltd) launched a new wheel harvester under the Swaraj brand in the domestic market. Swaraj 8200 Wheel Harvester provides maximum harvesting acreage in a year with best-in-class grain quality and maximum profit.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Combine Harvester Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Combine Harvester Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Combine Harvester Market?

To stay informed about further developments, trends, and reports in the India Combine Harvester Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence