Key Insights

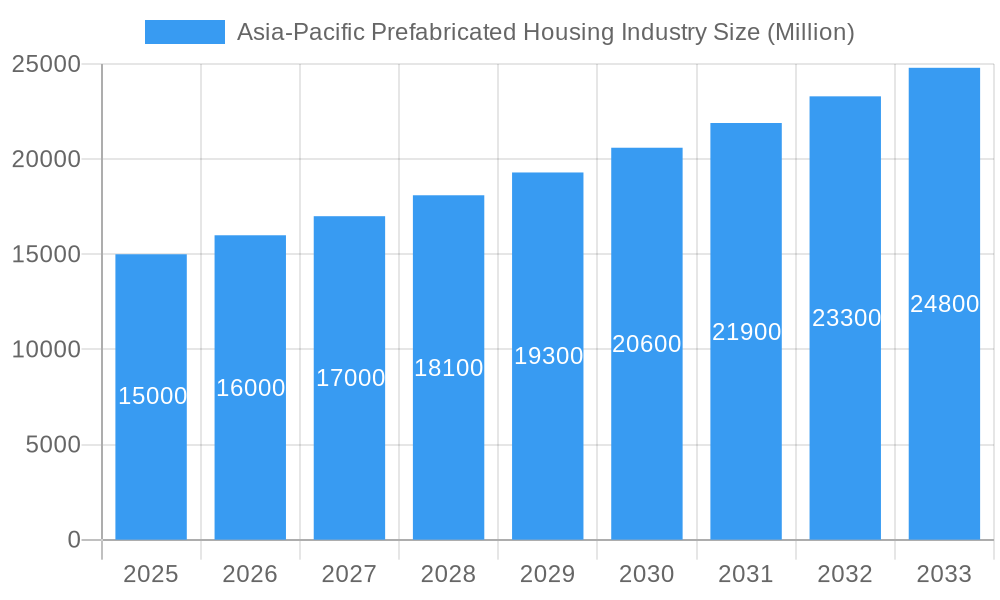

The Asia-Pacific prefabricated housing market is experiencing significant expansion, fueled by escalating urbanization, rising construction expenses, and a growing imperative for cost-effective and sustainable housing. The market, valued at $40.56 billion in the base year 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.32% from 2025 to 2033. Key growth catalysts include government incentives for eco-friendly construction, the demand for swift housing solutions in rapidly developing urban centers, and the inherent efficiency and cost advantages of prefabricated building techniques. Strong market activity is observed in China, Japan, and India, with other Asia-Pacific nations also contributing to overall growth. Market segmentation by type, including single-family and multi-family units, highlights varied demand patterns for prefabricated structures. Potential challenges such as navigating regulatory frameworks, developing skilled labor for prefabrication, and addressing public perceptions of quality and design will shape market evolution.

Asia-Pacific Prefabricated Housing Industry Market Size (In Billion)

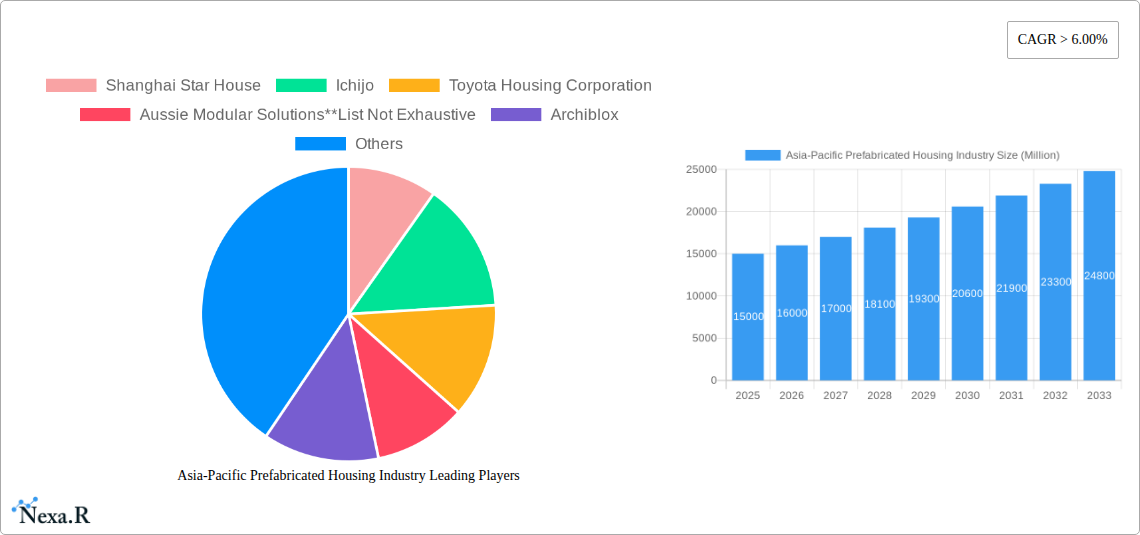

While specific market size figures for 2025 are extrapolated, the data points to substantial growth potential. Market expansion is significantly influenced by key industry leaders such as Shanghai Star House, Ichijo, Toyota Housing Corporation, and Sekisui House, who drive innovation and market share within their respective national markets. The consistent CAGR exceeding 6% signals a robust and sustained growth trajectory. Detailed regional analysis and economic considerations across Asia-Pacific nations are crucial for precise future market value and share predictions. Nevertheless, current trends indicate continued robust expansion for the prefabricated housing sector in the Asia-Pacific region.

Asia-Pacific Prefabricated Housing Industry Company Market Share

Asia-Pacific Prefabricated Housing Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific prefabricated housing industry, encompassing market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The report analyzes the market across key segments: single-family and multifamily housing, and by country (China, Japan, India, and the Rest of Asia-Pacific).

Asia-Pacific Prefabricated Housing Industry Market Dynamics & Structure

This section analyzes the market concentration, technological innovation, regulatory landscape, competitive dynamics, and end-user demographics within the Asia-Pacific prefabricated housing market. We examine mergers and acquisitions (M&A) activity and its impact on market consolidation.

- Market Concentration: The Asia-Pacific prefabricated housing market exhibits a moderately concentrated structure, with a few large players and numerous smaller, regional companies. The top five players hold approximately xx% of the market share in 2025.

- Technological Innovation: Technological advancements, such as modular construction techniques, 3D printing, and sustainable building materials, are key drivers of market growth. However, barriers to innovation include high initial investment costs and a lack of standardized building codes across the region.

- Regulatory Frameworks: Varying building codes and regulations across countries in the Asia-Pacific region create challenges for market standardization and expansion. Government initiatives promoting sustainable and affordable housing present significant opportunities.

- Competitive Product Substitutes: Traditional construction methods remain a significant competitor; however, the increasing demand for faster construction times and cost-effectiveness is driving the adoption of prefabricated housing.

- End-User Demographics: The growing urbanization and increasing demand for affordable housing in rapidly developing economies are driving market growth. Millennials and young professionals are key target demographics for prefabricated homes, seeking modern, sustainable, and customizable living spaces.

- M&A Trends: The number of M&A deals in the Asia-Pacific prefabricated housing sector has increased in recent years, primarily driven by consolidation and expansion strategies. Approximately xx M&A deals were recorded between 2019 and 2024.

Asia-Pacific Prefabricated Housing Industry Growth Trends & Insights

This section delves into the market size evolution, adoption rates, technological disruptions, and consumer behavior shifts influencing the growth of the Asia-Pacific prefabricated housing market. Analysis will include projections and CAGR calculations.

The Asia-Pacific prefabricated housing market is witnessing robust growth, driven by several factors including rapid urbanization, increasing demand for affordable housing, and the adoption of advanced construction technologies. The market size, which stood at xx million units in 2019, is projected to reach xx million units in 2025 and xx million units by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by the rising preference for sustainable and energy-efficient housing solutions, as well as government initiatives aimed at promoting affordable housing development. Consumer behavior is shifting towards a preference for customization and faster construction times, further propelling the demand for prefabricated homes. Technological disruptions, such as the increasing use of modular construction and 3D printing technologies, are streamlining the construction process and reducing overall costs, thereby bolstering market adoption.

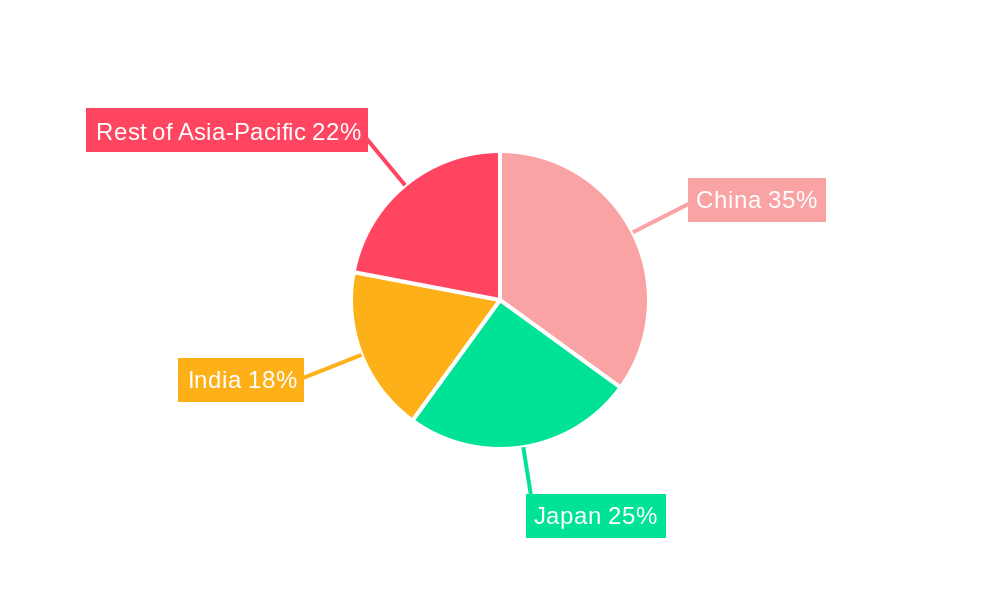

Dominant Regions, Countries, or Segments in Asia-Pacific Prefabricated Housing Industry

China, Japan, and India are the dominant markets for prefabricated housing in the Asia-Pacific region. However, growth is also expected in other countries like Vietnam and Indonesia.

- China: China’s massive urban population and government initiatives supporting affordable housing are key drivers of its market dominance.

- Japan: Japan’s aging population and the need for rapid reconstruction post-natural disasters contribute to significant demand for prefabricated housing. Technological advancement also makes it a prominent player.

- India: Rapid urbanization and infrastructure development in India are creating strong demand for cost-effective and quick construction solutions offered by prefabricated housing.

- Rest of Asia-Pacific: Growth in emerging economies like Vietnam and Indonesia is expected to contribute significantly to the overall growth of the Asia-Pacific region.

- Segment Dominance: The multifamily segment currently holds a larger market share than the single-family segment, driven by large-scale affordable housing projects across the region. However, the single-family segment is expected to experience significant growth in the forecast period, fueled by rising disposable incomes and changing consumer preferences.

Asia-Pacific Prefabricated Housing Industry Product Landscape

The Asia-Pacific prefabricated housing market offers a wide range of products, from basic modular units to sophisticated, high-tech homes. Innovations include improved insulation, energy-efficient designs, and smart home integration. Unique selling propositions include customization options, faster construction times, and cost savings compared to traditional construction. Technological advancements are primarily focused on streamlining the manufacturing process, enhancing material quality, and improving the overall aesthetics and functionality of prefabricated homes.

Key Drivers, Barriers & Challenges in Asia-Pacific Prefabricated Housing Industry

Key Drivers:

- Increasing urbanization and population growth.

- Rising demand for affordable and sustainable housing.

- Government initiatives and policies promoting prefabricated construction.

- Technological advancements leading to improved efficiency and cost reduction.

Key Challenges:

- Varying building codes and regulations across countries.

- High initial investment costs associated with prefabrication technologies.

- Potential supply chain disruptions impacting material availability and costs.

- Competition from traditional construction methods. This competition results in a xx% market share loss annually, impacting overall market growth projections.

Emerging Opportunities in Asia-Pacific Prefabricated Housing Industry

- Untapped markets in smaller cities and rural areas.

- Growing demand for eco-friendly and sustainable prefabricated housing.

- Increasing adoption of modular and 3D printing technologies.

- Rise in demand for customized and personalized prefabricated homes.

Growth Accelerators in the Asia-Pacific Prefabricated Housing Industry Industry

Technological breakthroughs in modular construction and sustainable building materials are major catalysts for long-term market growth. Strategic partnerships between prefabricated housing manufacturers and real estate developers are also driving market expansion. The focus on government initiatives for affordable housing and infrastructure development acts as a considerable growth accelerator.

Key Players Shaping the Asia-Pacific Prefabricated Housing Industry Market

- Shanghai Star House

- Ichijo

- Toyota Housing Corporation

- Aussie Modular Solutions

- Archiblox

- Anchor Homes

- Panasonic Homes

- Sekisui House

- Ausco Modular Construction

- Daiwa House Industry (List Not Exhaustive)

Notable Milestones in Asia-Pacific Prefabricated Housing Industry Sector

- Nov 2022: Singapore's Housing and Development Board (HDB) launched the Garden Waterfront I and II BTO project in Tengah, utilizing innovative "beamless" flat designs for approximately 2,000 units, demonstrating advancements in construction technology.

- Jan 2023: Apex Modular in Sri Lanka secured a contract to manufacture "coodo moon" housing units for LTG Lofts, signifying the growing adoption of prefabricated mobile homes in the Asian market.

In-Depth Asia-Pacific Prefabricated Housing Industry Market Outlook

The Asia-Pacific prefabricated housing market is poised for significant growth over the next decade. Continued technological advancements, supportive government policies, and the increasing demand for affordable and sustainable housing will fuel this expansion. Strategic partnerships and market expansion into untapped regions will further contribute to the market's potential. The focus on sustainable practices and technological innovation will drive product differentiation and market leadership, creating lucrative opportunities for both established players and new entrants.

Asia-Pacific Prefabricated Housing Industry Segmentation

-

1. Type

- 1.1. Single Family

- 1.2. Multifamily

Asia-Pacific Prefabricated Housing Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Prefabricated Housing Industry Regional Market Share

Geographic Coverage of Asia-Pacific Prefabricated Housing Industry

Asia-Pacific Prefabricated Housing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits

- 3.3. Market Restrains

- 3.3.1. High Initial Investments

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Housing Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Prefabricated Housing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single Family

- 5.1.2. Multifamily

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shanghai Star House

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ichijo

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Toyota Housing Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aussie Modular Solutions**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Archiblox

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Anchor Homes

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Panasonic Homes

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sekisui House

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ausco Modular Construction

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Daiwa House Industry

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Shanghai Star House

List of Figures

- Figure 1: Asia-Pacific Prefabricated Housing Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Prefabricated Housing Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Prefabricated Housing Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Prefabricated Housing Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Asia-Pacific Prefabricated Housing Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Asia-Pacific Prefabricated Housing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: China Asia-Pacific Prefabricated Housing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Japan Asia-Pacific Prefabricated Housing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: South Korea Asia-Pacific Prefabricated Housing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Asia-Pacific Prefabricated Housing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Australia Asia-Pacific Prefabricated Housing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: New Zealand Asia-Pacific Prefabricated Housing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Indonesia Asia-Pacific Prefabricated Housing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Malaysia Asia-Pacific Prefabricated Housing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Singapore Asia-Pacific Prefabricated Housing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Thailand Asia-Pacific Prefabricated Housing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Vietnam Asia-Pacific Prefabricated Housing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Philippines Asia-Pacific Prefabricated Housing Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Prefabricated Housing Industry?

The projected CAGR is approximately 7.32%.

2. Which companies are prominent players in the Asia-Pacific Prefabricated Housing Industry?

Key companies in the market include Shanghai Star House, Ichijo, Toyota Housing Corporation, Aussie Modular Solutions**List Not Exhaustive, Archiblox, Anchor Homes, Panasonic Homes, Sekisui House, Ausco Modular Construction, Daiwa House Industry.

3. What are the main segments of the Asia-Pacific Prefabricated Housing Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 40.56 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits.

6. What are the notable trends driving market growth?

Increasing Demand for Housing Driving the Market.

7. Are there any restraints impacting market growth?

High Initial Investments.

8. Can you provide examples of recent developments in the market?

Jan 2023: Apex Modular, a joint venture between JAT Property Group and Apex Asia Holdings in Sri Lanka, was recently appointed the Licensed Manufacturer for Estonian-based Mobile Module Supplier for LTG Lofts. Apex Modular was chosen as the most appropriately qualified and certified manufacturer for LTG's spectacular, retro-futuristic 'coodo moon' housing units for the Asian market, and it is expected to complete the first coodo Resort in Sri Lanka, which is set to open in Q2 2023. Coodo moon housing units are intended to become the most sought-after modern mobile home units, adaptable to a variety of regional climates and weather conditions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Prefabricated Housing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Prefabricated Housing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Prefabricated Housing Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Prefabricated Housing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence