Key Insights

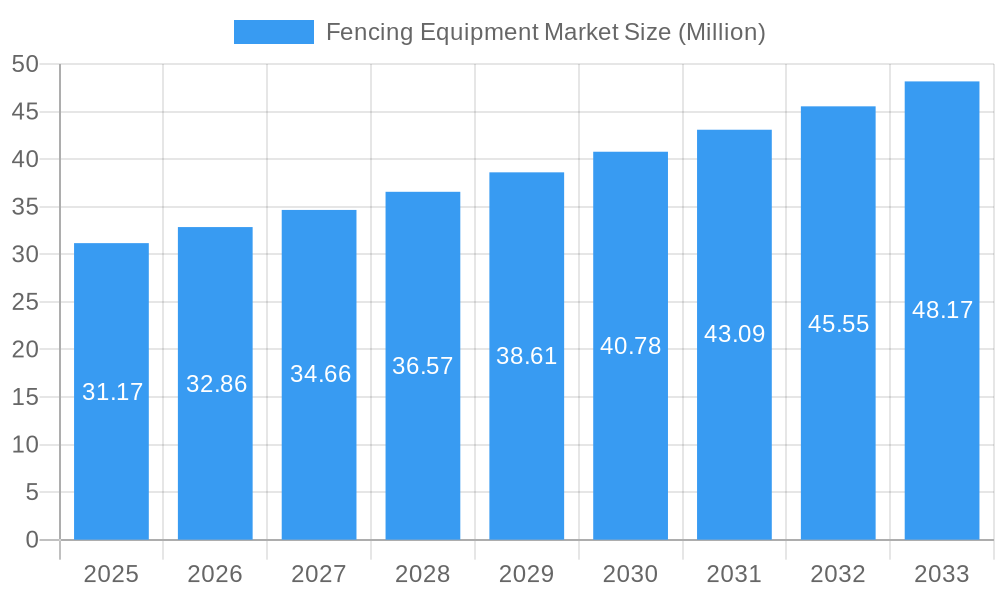

The global Fencing Equipment Market is poised for significant expansion, projected to reach a substantial USD 31.17 million in 2025. This growth trajectory is further underscored by an estimated Compound Annual Growth Rate (CAGR) of 5.43% throughout the forecast period of 2025-2033. This robust market expansion is primarily fueled by a confluence of escalating demand from the residential sector, driven by increasing homeownership and a focus on property enhancement, and the burgeoning agricultural industry's need for secure and durable fencing solutions for livestock and crop protection. Furthermore, the rising investments in infrastructure development, including the expansion of energy and power projects and the construction of new warehouses, are contributing significantly to this positive market outlook. The military and defense sector's ongoing requirements for perimeter security also play a crucial role in driving market demand for advanced fencing systems.

Fencing Equipment Market Market Size (In Million)

The Fencing Equipment Market is characterized by a dynamic landscape shaped by evolving trends and strategic company initiatives. Innovations in material science are leading to the development of more resilient, low-maintenance, and aesthetically pleasing fencing options, with a notable surge in the adoption of metal fencing for its durability and security. Conversely, while wood fencing maintains its appeal for residential aesthetics, its market share is seeing steady competition from more modern alternatives. Key market players such as Gregory Industries, BetaFence, Bekaert, and Ameristar Perimeter Security are actively engaged in research and development, focusing on smart fencing technologies and sustainable manufacturing practices to gain a competitive edge. However, the market faces certain restraints, including the fluctuating raw material prices, particularly for metals like steel and aluminum, which can impact production costs and ultimately pricing strategies. Stringent environmental regulations concerning the sourcing and disposal of fencing materials also present a challenge, necessitating a greater emphasis on eco-friendly solutions and responsible manufacturing.

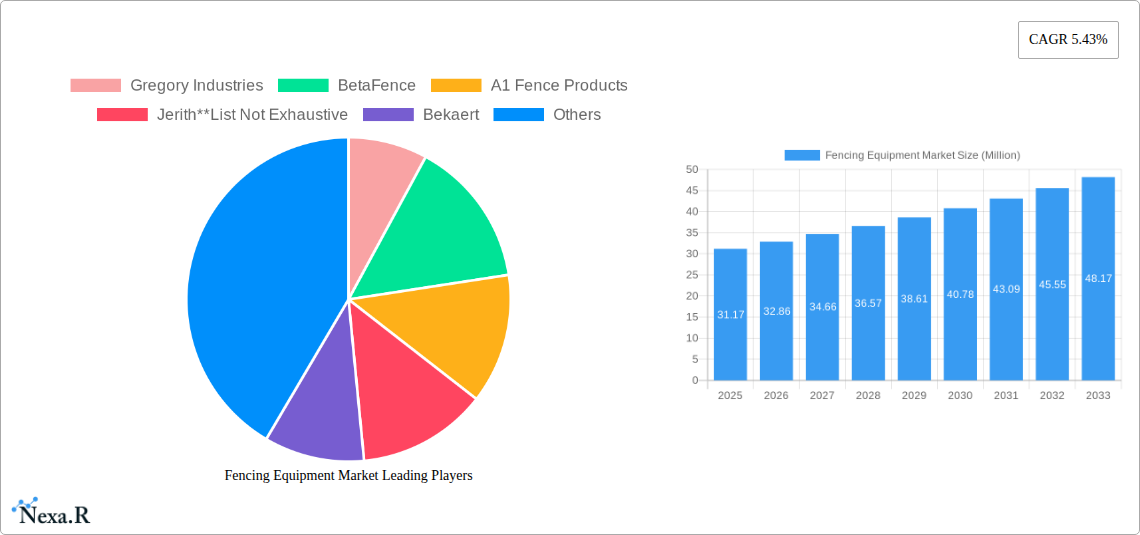

Fencing Equipment Market Company Market Share

This in-depth Fencing Equipment Market report provides a comprehensive analysis of the global fencing solutions landscape, from residential security to industrial containment. Covering the period from 2019 to 2033, with a base year of 2025 and a detailed forecast from 2025 to 2033, this research delves into market dynamics, growth trends, regional dominance, product innovations, key drivers, emerging opportunities, and the competitive strategies of leading players. We meticulously analyze parent and child market segments, offering unparalleled insights for industry professionals, investors, and stakeholders seeking to capitalize on the evolving demand for robust and reliable fencing solutions. All quantitative data is presented in Million units for clarity and actionable intelligence.

Fencing Equipment Market Market Dynamics & Structure

The global fencing equipment market is characterized by a moderate level of concentration, with a blend of established global manufacturers and regional specialists vying for market share. Technological innovation remains a significant driver, fueled by advancements in materials science, smart fencing technologies integrating security sensors, and sustainable fencing solutions. Regulatory frameworks, particularly concerning border security, property demarcation, and safety standards in industrial sectors, significantly influence market demand and product development. Competitive product substitutes, ranging from advanced electronic security systems to natural landscaping barriers, present a dynamic competitive landscape. End-user demographics are diverse, with residential demand driven by security and aesthetics, while agricultural and industrial sectors prioritize durability, containment, and protection. Mergers and acquisitions (M&A) trends indicate a consolidation phase, with private equity firms actively investing in market leaders to expand their product portfolios and geographical reach. For instance, Crossplane Capital's investment in Viking Fence and TriWest Capital Partners' acquisition of Phoenix Fence Corp. highlight this trend, aiming to enhance service offerings and market penetration. The market share of top players, though not exhaustive, is influenced by their ability to adapt to these evolving industry needs.

- Market Concentration: Moderate, with key players holding significant but not dominant market shares.

- Technological Innovation: Driven by smart fencing, advanced materials, and sustainability initiatives.

- Regulatory Influence: Crucial for government, military, and industrial fencing applications.

- Competitive Substitutes: Electronic surveillance, natural barriers, and other security measures.

- End-User Diversification: Residential, agricultural, industrial, and governmental needs shaping product development.

- M&A Activity: Increasing consolidation and strategic partnerships to gain market advantage.

- Parent Market Value (2025): XXX Million units

- Child Market - Wood Fencing Value (2025): XXX Million units

- Child Market - Metal Fencing Value (2025): XXX Million units

Fencing Equipment Market Growth Trends & Insights

The Fencing Equipment Market is poised for significant expansion, driven by a confluence of economic, social, and technological factors. The estimated market size in 2025 is projected to reach XXX Million units, with a robust Compound Annual Growth Rate (CAGR) anticipated over the forecast period (2025-2033). This growth trajectory is underpinned by increasing urbanization, a heightened awareness of security concerns across all end-user segments, and a continuous demand for durable and low-maintenance fencing solutions. Adoption rates for advanced fencing technologies, such as automated gates and integrated surveillance systems, are on the rise, particularly in commercial and government applications. Technological disruptions are also playing a crucial role; for example, the development of more resilient and eco-friendly materials is broadening the appeal of certain fencing types. Consumer behavior shifts are evident, with a growing preference for aesthetically pleasing yet highly functional fencing in residential markets, and a demand for customized security solutions in industrial and military sectors. The market penetration of specialized fencing, such as high-security barriers for critical infrastructure and agricultural fencing for livestock management and crop protection, is expected to accelerate. The historical period (2019-2024) showcased a steady increase in demand, laying a strong foundation for future growth. The integration of smart technologies into fencing systems, offering remote monitoring and control capabilities, is a key trend that will continue to shape market evolution and drive higher adoption rates. Furthermore, government initiatives promoting infrastructure development and border security are substantial growth accelerators for the fencing equipment market.

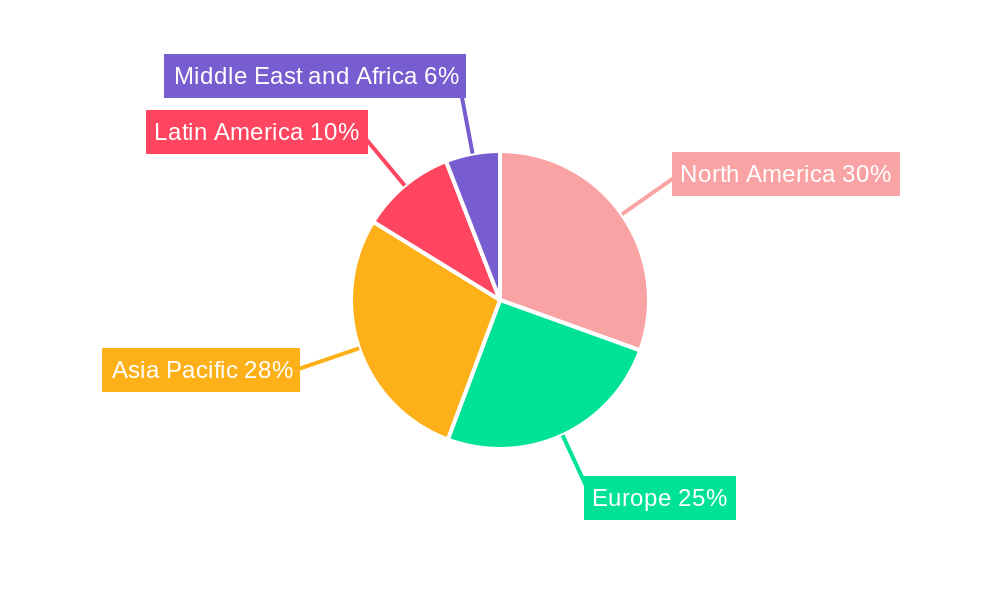

Dominant Regions, Countries, or Segments in Fencing Equipment Market

The Fencing Equipment Market is experiencing robust growth across multiple regions and segments, with certain areas and applications demonstrating exceptional dominance. Currently, North America stands out as a leading region, driven by strong demand from the Residential and Government end-user segments. Factors such as high disposable incomes, a mature construction industry, and significant investments in infrastructure and border security contribute to this dominance. Within the United States, states with extensive suburban development and a high prevalence of single-family homes are major consumers of residential fencing, encompassing both Wood Fencing and Metal Fencing types. The agricultural sector in the US also presents a substantial market for robust fencing solutions, crucial for livestock containment and crop protection.

- Dominant Region: North America, projecting a market share of XX% in 2025.

- Key Drivers: Strong economic conditions, high security consciousness, significant infrastructure projects, and a well-established construction sector.

- Growth Potential: Continued expansion due to ongoing residential development and government security investments.

- Dominant End User Segment: Residential, expected to account for XX% of the market in 2025.

- Analysis: Fueled by homeowners' desire for privacy, security, and enhanced property aesthetics.

- Sub-segments: Vinyl, wood, and aluminum fencing are popular choices.

- Dominant Type Segment: Metal Fencing, including aluminum, steel, and wrought iron, projected to hold XX% market share in 2025.

- Analysis: Valued for its durability, longevity, and security features, making it suitable for a wide range of applications from residential to industrial.

- Growth Potential: Increasing demand for high-security metal fencing in government and military sectors.

- Emerging Dominance in Agricultural Sector: The Agricultural end-user segment is experiencing accelerated growth globally, driven by the need for efficient land management, livestock containment, and protection against wildlife. Countries with large agricultural economies are key markets.

- Government and Military & Defense: These sectors represent critical growth areas, particularly for high-security and specialized fencing solutions. Increased global security concerns and border reinforcement efforts are significant contributors.

Fencing Equipment Market Product Landscape

The fencing equipment market is witnessing a surge in product innovations designed to enhance durability, security, and user convenience. Advanced materials such as high-strength steel alloys, corrosion-resistant aluminum, and eco-friendly composite lumber are gaining traction, offering extended lifespans and reduced maintenance. Smart fencing technologies are emerging, integrating sensors for intrusion detection, automated gate openers, and remote monitoring capabilities via mobile applications. For the Residential sector, aesthetic appeal is paramount, with manufacturers offering a wide array of styles, colors, and finishes for both Wood Fencing and Metal Fencing options. In industrial and security-focused applications, reinforced steel, barbed wire, and anti-climb designs are paramount for ensuring perimeter integrity. The performance metrics that differentiate products include tensile strength, resistance to environmental degradation, ease of installation, and overall cost-effectiveness throughout the product lifecycle.

Key Drivers, Barriers & Challenges in Fencing Equipment Market

Key Drivers:

- Rising Security Concerns: Increased demand for perimeter security in residential, commercial, and governmental sectors.

- Infrastructure Development: Government investments in border security, public facilities, and critical infrastructure projects.

- Agricultural Needs: Growing demand for effective fencing for livestock management, crop protection, and land demarcation.

- Technological Advancements: Innovations in materials science and smart fencing technology enhance product performance and functionality.

- Urbanization and Population Growth: Expanding residential areas necessitate increased fencing solutions.

Barriers & Challenges:

- Supply Chain Volatility: Fluctuations in raw material prices (e.g., steel, wood) and global shipping disruptions can impact costs and availability.

- High Initial Investment: Certain advanced fencing systems can have a significant upfront cost, posing a barrier for some consumers.

- Competition from Substitutes: Electronic security systems and natural landscaping can sometimes serve as alternatives to traditional fencing.

- Regulatory Hurdles: Stringent building codes and environmental regulations can influence product design and installation processes.

- Skilled Labor Shortage: Availability of qualified installers can be a limiting factor in some regions.

Emerging Opportunities in Fencing Equipment Market

The Fencing Equipment Market is ripe with emerging opportunities, particularly in the realm of smart and sustainable solutions. The growing demand for integrated security systems presents a significant avenue, with opportunities for manufacturers to develop and deploy fencing equipped with advanced sensors, AI-powered intrusion detection, and seamless integration with existing security networks. The focus on sustainability is also creating a market for eco-friendly fencing materials, such as recycled plastics and sustainably sourced wood, appealing to environmentally conscious consumers and businesses. Furthermore, the expansion of renewable energy infrastructure, including solar farms and wind energy projects, necessitates specialized fencing for site security, presenting a growing niche. The development of customized and modular fencing systems that can be easily adapted to diverse terrains and specific application needs also holds considerable promise.

Growth Accelerators in the Fencing Equipment Market Industry

Several key catalysts are accelerating long-term growth in the Fencing Equipment Market. Technological breakthroughs in material science, leading to stronger, lighter, and more weather-resistant fencing options, are continuously expanding product capabilities and market appeal. Strategic partnerships between fencing manufacturers and smart home technology providers are creating integrated security ecosystems, driving demand for advanced fencing solutions. Furthermore, market expansion strategies focusing on emerging economies, where infrastructure development and security consciousness are rapidly increasing, represent significant growth avenues. Government initiatives aimed at enhancing national security and upgrading critical infrastructure will continue to fuel demand for high-security fencing. The increasing adoption of do-it-yourself (DIY) trends in home improvement also presents an opportunity for manufacturers to develop user-friendly and easily installable fencing products.

Key Players Shaping the Fencing Equipment Market Market

- Gregory Industries

- BetaFence

- A1 Fence Products

- Jerith

- Bekaert

- Ameristar Perimeter Security

- PLY Gem

- Long Fence

- Specrail

- CertainTeed

Notable Milestones in Fencing Equipment Market Sector

- February 2023: Crossplane Capital ("Crossplane"), a Dallas-based private equity firm, declared that it joined forces with Sal Chavarria and the company's management to purchase a controlling stake in Viking Fence, a top provider of fence rentals, sanitation rentals, fence installations, and additional building products and services to commercial and residential markets all over Texas. This acquisition signifies a move towards consolidation and expansion within the service-oriented fencing sector.

- February 2023: A well-known, market-leading provider of fences and related goods and services, Phoenix Fence Corp., announced that TriWest Capital Partners had acquired a controlling interest in the company. The company will continue to be managed by the current management group at Phoenix Fence. The USD 175 million Growth Fund's sixth platform investment by TriWest is Phoenix Fence (2021 vintage). This strategic investment highlights investor confidence and the pursuit of growth opportunities by established market players.

In-Depth Fencing Equipment Market Market Outlook

The Fencing Equipment Market is set for a sustained period of robust growth, fueled by an increasing global emphasis on security, infrastructure development, and technological innovation. Future market potential lies in the continued integration of smart technologies, offering enhanced control and monitoring capabilities for a wide range of applications. The development of sustainable and eco-friendly fencing materials will also be a key differentiator, aligning with growing environmental consciousness. Strategic opportunities exist in catering to the evolving needs of the agricultural and renewable energy sectors, which require specialized and durable fencing solutions. The consolidation trend through M&A is expected to continue, leading to more integrated offerings and potentially greater market efficiencies. The overall outlook suggests a dynamic market with ample scope for both established players and innovative newcomers to thrive, driven by a diverse and evolving demand landscape.

Fencing Equipment Market Segmentation

-

1. Type

- 1.1. Wood Fencing

- 1.2. Metal Fencing

- 1.3. Other Types

-

2. End User

- 2.1. Residential

- 2.2. Agricultural

- 2.3. Military and Defense

- 2.4. Government

- 2.5. Petroleum and Chemicals

- 2.6. Mining

- 2.7. Energy and Power

- 2.8. Warehouse

- 2.9. Other End Users

Fencing Equipment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Latin America

- 2.1. Brazil

- 2.2. Colombia

- 2.3. Argentina

- 2.4. Rest of Latin America

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Russia

- 3.5. Rest of Europe

-

4. Asia Pacific

- 4.1. China

- 4.2. Japan

- 4.3. India

- 4.4. South Korea

- 4.5. Rest of Asia Pacific

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. Egypt

- 5.3. South Africa

- 5.4. United Arab Emirates

- 5.5. Rest of Middle East and Africa

Fencing Equipment Market Regional Market Share

Geographic Coverage of Fencing Equipment Market

Fencing Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Government Investments in Infrastructure Projects

- 3.2.2 Such as Highways

- 3.2.3 Airports

- 3.2.4 and Railways

- 3.2.5 Often Require Fencing for Safety and Security; Advancements in Fencing Technologies

- 3.2.6 Such as Smart Fencing Systems With Integrated Surveillance and Alarm Systems

- 3.2.7 are Attracting Customers Looking for Enhanced Security Solutions

- 3.3. Market Restrains

- 3.3.1. Soaring Prices of Raw Material; Increasing Competition from Low-cost Products

- 3.4. Market Trends

- 3.4.1. The Fencing Market in North America is Witnessing the Highest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fencing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wood Fencing

- 5.1.2. Metal Fencing

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Agricultural

- 5.2.3. Military and Defense

- 5.2.4. Government

- 5.2.5. Petroleum and Chemicals

- 5.2.6. Mining

- 5.2.7. Energy and Power

- 5.2.8. Warehouse

- 5.2.9. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Latin America

- 5.3.3. Europe

- 5.3.4. Asia Pacific

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Fencing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Wood Fencing

- 6.1.2. Metal Fencing

- 6.1.3. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Agricultural

- 6.2.3. Military and Defense

- 6.2.4. Government

- 6.2.5. Petroleum and Chemicals

- 6.2.6. Mining

- 6.2.7. Energy and Power

- 6.2.8. Warehouse

- 6.2.9. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Latin America Fencing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Wood Fencing

- 7.1.2. Metal Fencing

- 7.1.3. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Agricultural

- 7.2.3. Military and Defense

- 7.2.4. Government

- 7.2.5. Petroleum and Chemicals

- 7.2.6. Mining

- 7.2.7. Energy and Power

- 7.2.8. Warehouse

- 7.2.9. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Fencing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Wood Fencing

- 8.1.2. Metal Fencing

- 8.1.3. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Agricultural

- 8.2.3. Military and Defense

- 8.2.4. Government

- 8.2.5. Petroleum and Chemicals

- 8.2.6. Mining

- 8.2.7. Energy and Power

- 8.2.8. Warehouse

- 8.2.9. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Asia Pacific Fencing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Wood Fencing

- 9.1.2. Metal Fencing

- 9.1.3. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Residential

- 9.2.2. Agricultural

- 9.2.3. Military and Defense

- 9.2.4. Government

- 9.2.5. Petroleum and Chemicals

- 9.2.6. Mining

- 9.2.7. Energy and Power

- 9.2.8. Warehouse

- 9.2.9. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Fencing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Wood Fencing

- 10.1.2. Metal Fencing

- 10.1.3. Other Types

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Residential

- 10.2.2. Agricultural

- 10.2.3. Military and Defense

- 10.2.4. Government

- 10.2.5. Petroleum and Chemicals

- 10.2.6. Mining

- 10.2.7. Energy and Power

- 10.2.8. Warehouse

- 10.2.9. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Gregory Industries

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BetaFence

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 A1 Fence Products

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Jerith**List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bekaert

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ameristar Perimeter Security

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 PLY Gem

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Long Fence

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Specrail

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CertainTeed

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Gregory Industries

List of Figures

- Figure 1: Global Fencing Equipment Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Fencing Equipment Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Fencing Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Fencing Equipment Market Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Fencing Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Fencing Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Fencing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Latin America Fencing Equipment Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Latin America Fencing Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Latin America Fencing Equipment Market Revenue (Million), by End User 2025 & 2033

- Figure 11: Latin America Fencing Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Latin America Fencing Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Latin America Fencing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Fencing Equipment Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Fencing Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Fencing Equipment Market Revenue (Million), by End User 2025 & 2033

- Figure 17: Europe Fencing Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Europe Fencing Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Fencing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Asia Pacific Fencing Equipment Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Asia Pacific Fencing Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Pacific Fencing Equipment Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Asia Pacific Fencing Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Fencing Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Fencing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Fencing Equipment Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Fencing Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Fencing Equipment Market Revenue (Million), by End User 2025 & 2033

- Figure 29: Middle East and Africa Fencing Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Middle East and Africa Fencing Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Fencing Equipment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fencing Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Fencing Equipment Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Fencing Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Fencing Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Fencing Equipment Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Fencing Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Fencing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Fencing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Fencing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Fencing Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Fencing Equipment Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Fencing Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Fencing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Colombia Fencing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Argentina Fencing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Latin America Fencing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Fencing Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Fencing Equipment Market Revenue Million Forecast, by End User 2020 & 2033

- Table 19: Global Fencing Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Germany Fencing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: United Kingdom Fencing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: France Fencing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Russia Fencing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Europe Fencing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Fencing Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Fencing Equipment Market Revenue Million Forecast, by End User 2020 & 2033

- Table 27: Global Fencing Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: China Fencing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Japan Fencing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: India Fencing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: South Korea Fencing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Fencing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Fencing Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 34: Global Fencing Equipment Market Revenue Million Forecast, by End User 2020 & 2033

- Table 35: Global Fencing Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Saudi Arabia Fencing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Egypt Fencing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: South Africa Fencing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: United Arab Emirates Fencing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Fencing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fencing Equipment Market?

The projected CAGR is approximately 5.43%.

2. Which companies are prominent players in the Fencing Equipment Market?

Key companies in the market include Gregory Industries, BetaFence, A1 Fence Products, Jerith**List Not Exhaustive, Bekaert, Ameristar Perimeter Security, PLY Gem, Long Fence, Specrail, CertainTeed.

3. What are the main segments of the Fencing Equipment Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 31.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Investments in Infrastructure Projects. Such as Highways. Airports. and Railways. Often Require Fencing for Safety and Security; Advancements in Fencing Technologies. Such as Smart Fencing Systems With Integrated Surveillance and Alarm Systems. are Attracting Customers Looking for Enhanced Security Solutions.

6. What are the notable trends driving market growth?

The Fencing Market in North America is Witnessing the Highest Growth Rate.

7. Are there any restraints impacting market growth?

Soaring Prices of Raw Material; Increasing Competition from Low-cost Products.

8. Can you provide examples of recent developments in the market?

February 2023: Crossplane Capital ("Crossplane"), a Dallas-based private equity firm, declared that it joined forces with Sal Chavarria and the company's management to purchase a controlling stake in Viking Fence, a top provider of fence rentals, sanitation rentals, fence installations, and additional building products and services to commercial and residential markets all over Texas.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fencing Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fencing Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fencing Equipment Market?

To stay informed about further developments, trends, and reports in the Fencing Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence