Key Insights

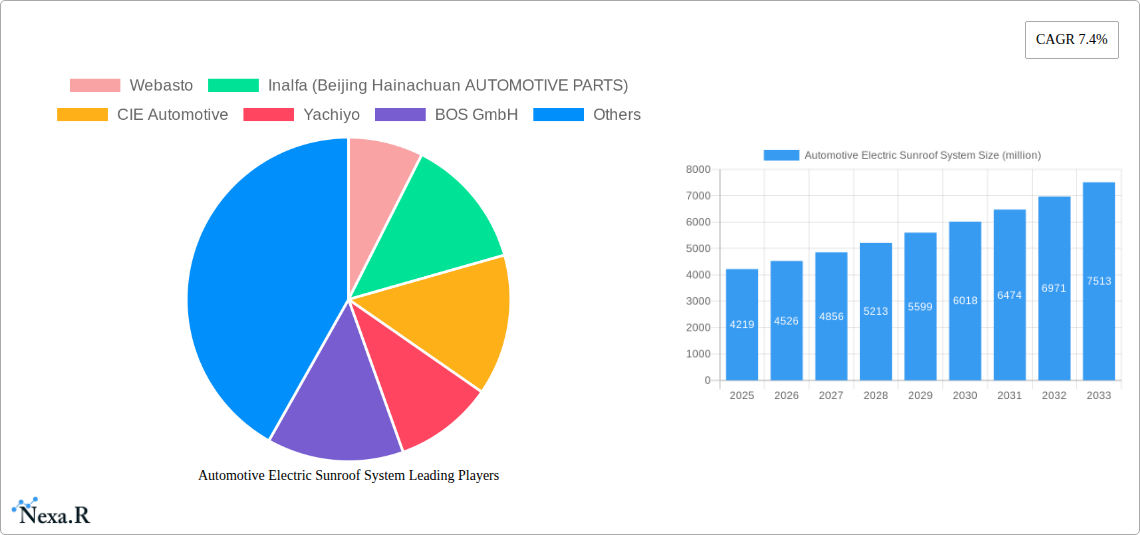

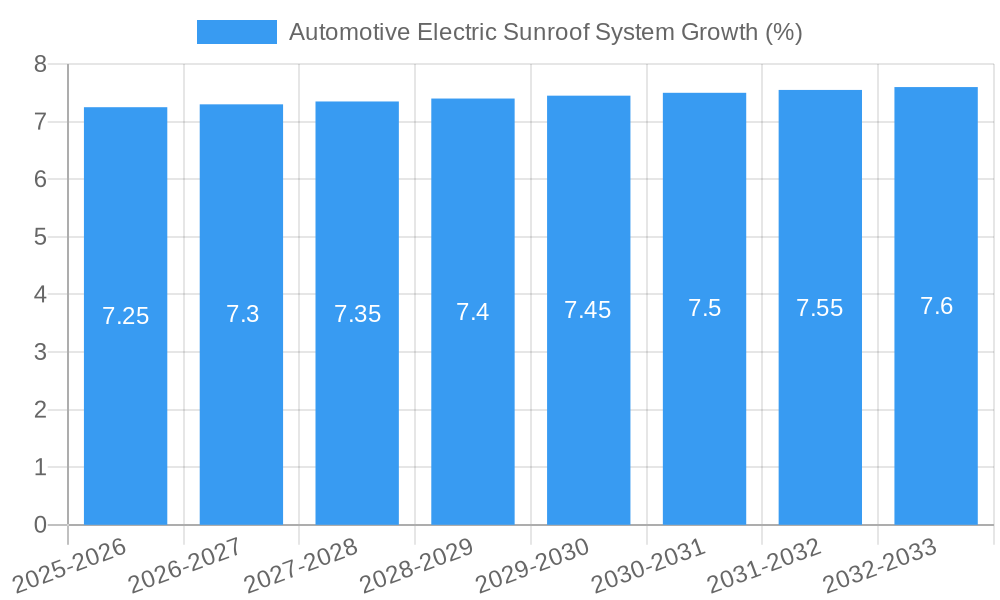

The global Automotive Electric Sunroof System market is poised for significant expansion, projected to reach an estimated market size of approximately USD 4,219 million. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 7.4% anticipated over the forecast period of 2025-2033. This upward trajectory is primarily driven by a confluence of factors, including the increasing consumer demand for enhanced vehicle aesthetics and premium features, particularly in the burgeoning SUV segment. The integration of electric sunroofs is no longer a luxury but a sought-after attribute that elevates the perceived value and comfort of vehicles. Furthermore, advancements in glass technology, such as integrated solar panels and improved noise insulation, are further stimulating market adoption. Automakers are increasingly standardizing these features in mid-range to high-end models, contributing to the overall market expansion.

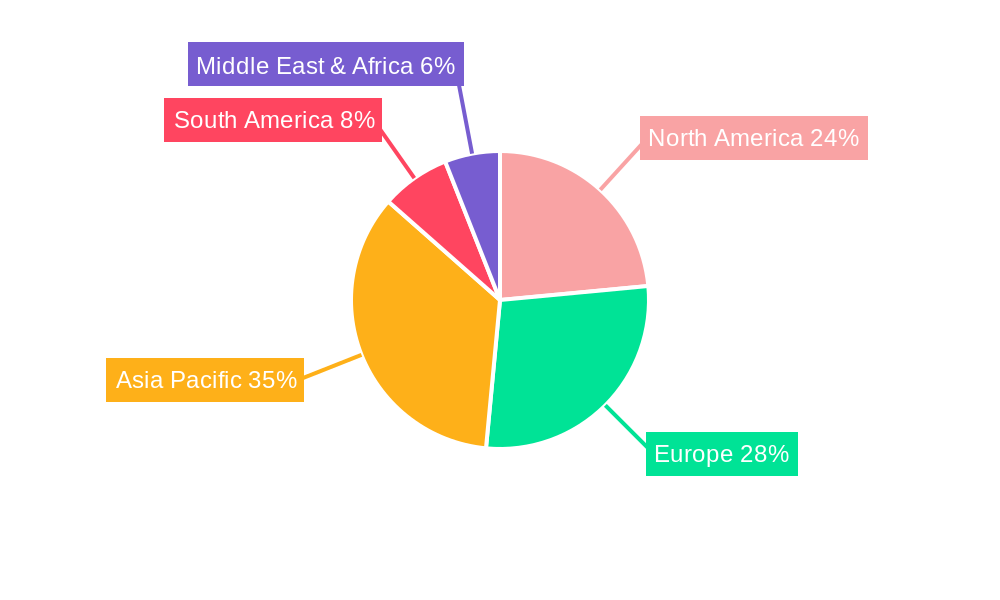

The market segmentation highlights a strong preference for Multi-Panel Sunroofs, reflecting a trend towards panoramic designs that offer a more open and airy cabin experience. While Sedan and SUV applications dominate the current landscape, the "Others" category, which might include electric vehicles with specialized sunroof requirements or advanced autonomous driving platforms, presents a nascent but promising growth avenue. Geographically, Asia Pacific, led by China and India, is expected to emerge as a dominant force due to its rapidly expanding automotive manufacturing base and a growing middle class with increasing disposable income. North America and Europe, established markets with a strong consumer appetite for premium automotive features, will continue to contribute significantly. Key players like Webasto, Inalfa, and CIE Automotive are at the forefront of innovation, driving the development of lighter, more efficient, and technologically advanced sunroof systems to meet evolving consumer expectations and stringent automotive regulations.

Automotive Electric Sunroof System Market: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report offers a panoramic view of the global Automotive Electric Sunroof System market, meticulously dissecting its current landscape and forecasting its trajectory through 2033. We delve into market dynamics, growth drivers, regional dominance, product innovations, competitive strategies, and emerging opportunities, providing actionable intelligence for industry stakeholders. The analysis encompasses historical data from 2019-2024, a detailed base year assessment of 2025, and a comprehensive forecast period from 2025-2033. This report is an essential resource for automotive OEMs, sunroof manufacturers, Tier-1 suppliers, technology providers, and investors seeking to navigate this dynamic and evolving market.

Automotive Electric Sunroof System Market Dynamics & Structure

The global Automotive Electric Sunroof System market is characterized by moderate to high concentration, with key players like Webasto and Inalfa (Beijing Hainachuan AUTOMOTIVE PARTS) holding significant market share. Technological innovation is a primary driver, fueled by advancements in materials science for lighter and more durable glass, as well as sophisticated control systems enhancing user experience and safety. Regulatory frameworks, particularly those related to vehicle safety and energy efficiency, subtly influence design and material choices. Competitive product substitutes include advanced panoramic roofs and conventional fixed roofs, though electric sunroofs offer a distinct premium feature. End-user demographics are increasingly shifting towards younger, affluent consumers who associate sunroofs with a premium and lifestyle-oriented automotive experience. Mergers and Acquisitions (M&A) trends are moderately active as larger players seek to consolidate their market position and expand their product portfolios, evidenced by a predicted xx M&A deal volume in the forecast period. Innovation barriers include the high cost of research and development for advanced features and the long certification cycles for automotive components.

- Market Concentration: Moderate to High, dominated by a few key global players.

- Technological Innovation Drivers: Lighter materials, advanced control systems, integration with ADAS.

- Regulatory Frameworks: Vehicle safety standards, noise reduction mandates, energy efficiency considerations.

- Competitive Product Substitutes: Panoramic roofs, fixed glass roofs, convertible vehicles.

- End-User Demographics: Growing demand from younger, affluent demographics valuing premium features.

- M&A Trends: Moderate activity, driven by consolidation and portfolio expansion efforts.

Automotive Electric Sunroof System Growth Trends & Insights

The global Automotive Electric Sunroof System market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.8% from 2025 to 2033, reaching an estimated market size of $28,500 million units by 2033. This upward trajectory is underpinned by a combination of increasing vehicle production volumes, a rising preference for premium automotive features, and the proliferation of SUVs and premium sedans, which often come equipped with or offer sunroofs as an option. The market penetration of electric sunroofs is steadily increasing, moving from approximately 25% of new vehicle production in 2025 to an estimated 35% by 2033. Technological disruptions, such as the integration of smart glass technology offering adjustable tinting and enhanced thermal insulation, are further enhancing the appeal of these systems. Consumer behavior shifts are evident, with a growing emphasis on enhancing the in-car experience, making vehicles feel more spacious, and connecting occupants with their surroundings. This demand is particularly pronounced in emerging economies as disposable incomes rise. The evolution of electric vehicle (EV) architectures also presents opportunities, as manufacturers seek to integrate sunroofs seamlessly into the vehicle's overall design and functionality, contributing to a more aesthetically pleasing and aerodynamic profile. The rising demand for customizable vehicle options and the perception of sunroofs as a key differentiator in the competitive automotive landscape are significant growth accelerators.

Dominant Regions, Countries, or Segments in Automotive Electric Sunroof System

The SUV application segment is emerging as the dominant force in the Automotive Electric Sunroof System market, projected to account for over 40% of the global market share by 2033. This dominance is driven by the unprecedented global surge in SUV sales, a trend fueled by evolving consumer preferences for versatility, perceived safety, and enhanced cargo space. The North America region, particularly the United States, continues to lead in SUV adoption, making it a prime market for electric sunroofs. Countries like China and Germany are also significant contributors, with a robust automotive manufacturing base and a growing demand for premium vehicle features.

- Application Dominance: SUVs are leading the charge due to their increasing popularity and premium feature offerings.

- Projected to hold over 40% of the market share by 2033.

- Fueled by consumer demand for versatility and perceived safety.

- Regional Leadership: North America and Europe are key markets, driven by high SUV penetration and consumer spending.

- The United States remains a critical market for sunroof adoption in SUVs.

- European markets show strong demand for premium features in both sedans and SUVs.

- Asia-Pacific, particularly China, is a rapidly growing market with increasing vehicle production and feature adoption.

- Segment Growth Potential: Multi-Panel Sunroofs are gaining traction, offering a more expansive and luxurious experience, particularly within the SUV segment.

- This type of sunroof is increasingly becoming a desirable option for higher trims and luxury vehicles.

- Technological advancements are making multi-panel systems more lightweight and efficient.

Automotive Electric Sunroof System Product Landscape

The Automotive Electric Sunroof System product landscape is marked by continuous innovation, focusing on enhancing user experience, safety, and vehicle aesthetics. Advancements include the development of intelligent anti-pinch mechanisms, integrated solar panels for auxiliary power, and smart glass technology capable of electrochromic dimming for glare reduction and improved thermal management. Lighter yet stronger composite materials are being utilized to reduce vehicle weight and improve fuel efficiency. Performance metrics such as opening speed, noise reduction levels, and sealing integrity are continually being refined to meet stringent OEM requirements. Unique selling propositions often revolve around seamless integration with vehicle interiors, advanced remote operation via smartphone apps, and customizable opening configurations.

Key Drivers, Barriers & Challenges in Automotive Electric Sunroof System

Key Drivers:

- Rising disposable incomes and demand for premium vehicle features: Consumers are increasingly willing to pay for enhanced comfort and aesthetics.

- Growth in SUV and premium sedan segments: These vehicle types are primary adopters of electric sunroofs.

- Technological advancements: Innovations in materials, smart glass, and control systems enhance functionality and appeal.

- OEM differentiation strategies: Sunroofs serve as a key differentiator in a competitive market.

Barriers & Challenges:

- Cost sensitivity in mass-market vehicles: The added cost of sunroofs can be a barrier in budget-conscious segments.

- Weight considerations for electric vehicles: Adding complexity and weight can impact EV range.

- Supply chain disruptions and raw material volatility: Global events can impact component availability and pricing.

- Stringent safety and durability regulations: Meeting evolving standards requires continuous investment in R&D.

- Competition from panoramic glass roofs: While not electric, they offer a similar sense of openness.

Emerging Opportunities in Automotive Electric Sunroof System

Emerging opportunities in the Automotive Electric Sunroof System market lie in the integration of advanced connectivity and smart features. The development of augmented reality overlays projected onto smart glass sunroofs presents a futuristic application. Furthermore, the increasing focus on lightweighting and sustainability is driving demand for innovative composite materials and energy-efficient drive systems for sunroof operation. Untapped markets in developing economies with a growing middle class represent significant growth potential, provided cost-effective solutions can be developed. The expansion of shared mobility services also opens avenues for durable and low-maintenance sunroof designs.

Growth Accelerators in the Automotive Electric Sunroof System Industry

Several catalysts are accelerating the growth of the Automotive Electric Sunroof System industry. Technological breakthroughs, such as self-healing glass coatings and integrated ambient lighting, are enhancing the perceived value of sunroofs. Strategic partnerships between sunroof manufacturers and automotive OEMs are crucial for co-development and tailored solutions, ensuring seamless integration into new vehicle platforms. Market expansion strategies focused on offering sunroofs as a standard feature in higher trim levels and as an attractive optional upgrade across a wider range of vehicle segments are also contributing significantly to market penetration.

Key Players Shaping the Automotive Electric Sunroof System Market

- Webasto

- Inalfa (Beijing Hainachuan AUTOMOTIVE PARTS)

- CIE Automotive

- Yachiyo

- BOS GmbH

- Aisin Seiki

- Motiontec

- Wanchao

- Jiangsu Tie MAO Glass

- Mobitech

- DeFuLai

- Segula Technologies

Notable Milestones in Automotive Electric Sunroof System Sector

- 2019: Increased adoption of panoramic sunroofs in mid-size SUVs.

- 2020: Introduction of advanced anti-pinch sensors with enhanced sensitivity.

- 2021: Development of lightweight composite materials for sunroof frames.

- 2022: Integration of smart glass technology with variable tinting capabilities.

- 2023: Growing demand for voice-controlled sunroof operations.

- 2024: Focus on aerodynamic design for improved EV efficiency.

- 2025 (Estimated): Significant market penetration of multi-panel sunroofs in premium EVs.

- 2028 (Projected): Wider adoption of solar-integrated sunroofs.

- 2030 (Projected): Integration with augmented reality features.

- 2033 (Projected): Standard offering in the majority of premium vehicle segments.

In-Depth Automotive Electric Sunroof System Market Outlook

The Automotive Electric Sunroof System market is poised for sustained and robust growth, driven by an amalgamation of evolving consumer preferences, technological advancements, and strategic industry initiatives. The increasing demand for enhanced vehicle interiors and premium features, coupled with the burgeoning popularity of SUVs and electric vehicles, creates a fertile ground for innovation and market expansion. As manufacturers continue to prioritize vehicle aesthetics, comfort, and functionality, electric sunroofs will solidify their position as a coveted component. The convergence of automotive technology with smart systems, such as integrated connectivity and advanced lighting, will further elevate the value proposition of these systems, paving the way for lucrative opportunities in the coming years.

Automotive Electric Sunroof System Segmentation

-

1. Application

- 1.1. Sedan

- 1.2. SUV

- 1.3. Others

-

2. Type

- 2.1. Multi-Panel Sunroof

- 2.2. Single Panel Sunroof

Automotive Electric Sunroof System Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Automotive Electric Sunroof System REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.4% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Electric Sunroof System Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Sedan

- 5.1.2. SUV

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Multi-Panel Sunroof

- 5.2.2. Single Panel Sunroof

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Automotive Electric Sunroof System Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Sedan

- 6.1.2. SUV

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Multi-Panel Sunroof

- 6.2.2. Single Panel Sunroof

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Automotive Electric Sunroof System Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Sedan

- 7.1.2. SUV

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Multi-Panel Sunroof

- 7.2.2. Single Panel Sunroof

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Automotive Electric Sunroof System Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Sedan

- 8.1.2. SUV

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Multi-Panel Sunroof

- 8.2.2. Single Panel Sunroof

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Automotive Electric Sunroof System Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Sedan

- 9.1.2. SUV

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Multi-Panel Sunroof

- 9.2.2. Single Panel Sunroof

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Automotive Electric Sunroof System Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Sedan

- 10.1.2. SUV

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Multi-Panel Sunroof

- 10.2.2. Single Panel Sunroof

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Webasto

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Inalfa (Beijing Hainachuan AUTOMOTIVE PARTS)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CIE Automotive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Yachiyo

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BOS GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Aisin Seiki

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Motiontec

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Wanchao

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Jiangsu Tie MAO Glass

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mobitech

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 DeFuLai

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Webasto

List of Figures

- Figure 1: Global Automotive Electric Sunroof System Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Automotive Electric Sunroof System Revenue (million), by Application 2024 & 2032

- Figure 3: North America Automotive Electric Sunroof System Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Automotive Electric Sunroof System Revenue (million), by Type 2024 & 2032

- Figure 5: North America Automotive Electric Sunroof System Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Automotive Electric Sunroof System Revenue (million), by Country 2024 & 2032

- Figure 7: North America Automotive Electric Sunroof System Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Automotive Electric Sunroof System Revenue (million), by Application 2024 & 2032

- Figure 9: South America Automotive Electric Sunroof System Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Automotive Electric Sunroof System Revenue (million), by Type 2024 & 2032

- Figure 11: South America Automotive Electric Sunroof System Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Automotive Electric Sunroof System Revenue (million), by Country 2024 & 2032

- Figure 13: South America Automotive Electric Sunroof System Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Automotive Electric Sunroof System Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Automotive Electric Sunroof System Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Automotive Electric Sunroof System Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Automotive Electric Sunroof System Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Automotive Electric Sunroof System Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Automotive Electric Sunroof System Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Automotive Electric Sunroof System Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Automotive Electric Sunroof System Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Automotive Electric Sunroof System Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Automotive Electric Sunroof System Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Automotive Electric Sunroof System Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Automotive Electric Sunroof System Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Automotive Electric Sunroof System Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Automotive Electric Sunroof System Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Automotive Electric Sunroof System Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Automotive Electric Sunroof System Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Automotive Electric Sunroof System Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Automotive Electric Sunroof System Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automotive Electric Sunroof System Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Automotive Electric Sunroof System Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Automotive Electric Sunroof System Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Automotive Electric Sunroof System Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Automotive Electric Sunroof System Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Automotive Electric Sunroof System Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Automotive Electric Sunroof System Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Automotive Electric Sunroof System Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Automotive Electric Sunroof System Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Automotive Electric Sunroof System Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Automotive Electric Sunroof System Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Automotive Electric Sunroof System Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Automotive Electric Sunroof System Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Automotive Electric Sunroof System Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Automotive Electric Sunroof System Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Automotive Electric Sunroof System Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Automotive Electric Sunroof System Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Automotive Electric Sunroof System Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Automotive Electric Sunroof System Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Automotive Electric Sunroof System Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Automotive Electric Sunroof System Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Automotive Electric Sunroof System Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Automotive Electric Sunroof System Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Automotive Electric Sunroof System Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Automotive Electric Sunroof System Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Automotive Electric Sunroof System Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Automotive Electric Sunroof System Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Automotive Electric Sunroof System Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Automotive Electric Sunroof System Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Automotive Electric Sunroof System Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Automotive Electric Sunroof System Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Automotive Electric Sunroof System Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Automotive Electric Sunroof System Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Automotive Electric Sunroof System Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Automotive Electric Sunroof System Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Automotive Electric Sunroof System Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Automotive Electric Sunroof System Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Automotive Electric Sunroof System Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Automotive Electric Sunroof System Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Automotive Electric Sunroof System Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Automotive Electric Sunroof System Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Automotive Electric Sunroof System Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Automotive Electric Sunroof System Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Automotive Electric Sunroof System Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Automotive Electric Sunroof System Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Automotive Electric Sunroof System Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Automotive Electric Sunroof System Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Electric Sunroof System?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the Automotive Electric Sunroof System?

Key companies in the market include Webasto, Inalfa (Beijing Hainachuan AUTOMOTIVE PARTS), CIE Automotive, Yachiyo, BOS GmbH, Aisin Seiki, Motiontec, Wanchao, Jiangsu Tie MAO Glass, Mobitech, DeFuLai.

3. What are the main segments of the Automotive Electric Sunroof System?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4219 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Electric Sunroof System," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Electric Sunroof System report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Electric Sunroof System?

To stay informed about further developments, trends, and reports in the Automotive Electric Sunroof System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence