Key Insights

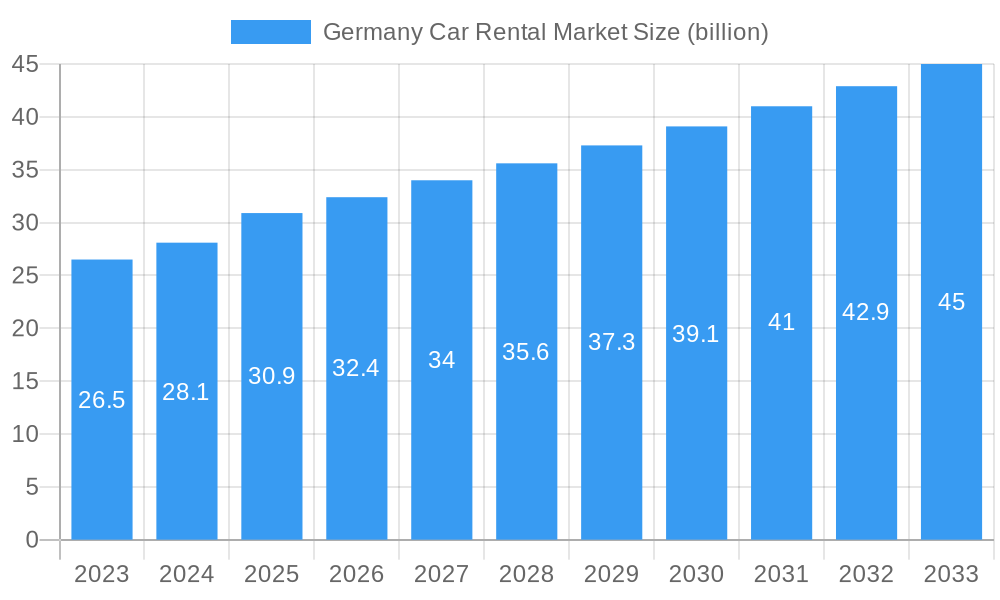

The German car rental market is poised for robust growth, projected to reach a substantial €30.9 billion by 2025. This expansion is driven by a healthy CAGR of 4.8% from 2025 to 2033, indicating sustained demand and increasing rental activities. The market's dynamism is fueled by several key drivers. The burgeoning tourism sector, both domestic and international, continues to be a significant contributor, with travelers increasingly opting for car rentals to explore Germany's diverse landscapes and cultural attractions. Furthermore, the growing business travel segment, encompassing corporate trips and project-based assignments, also propels demand for flexible and convenient transportation solutions. The convenience and cost-effectiveness offered by car rentals for both leisure and business purposes are central to this upward trajectory.

Germany Car Rental Market Market Size (In Million)

The rental landscape in Germany is evolving with shifting consumer preferences and technological advancements. The dominance of online booking platforms is a notable trend, offering greater transparency, competitive pricing, and ease of access for consumers. This digital shift is reshaping how car rental services are accessed and utilized. While short-term rentals remain a significant segment, the increasing prevalence of long-term rental solutions for individuals and businesses seeking flexibility over outright ownership is a growing trend. However, the market also faces certain restraints. Rising fuel costs and increasing environmental concerns could potentially temper growth, prompting a greater demand for electric and hybrid vehicle options. Regulatory changes and a highly competitive environment among established players like Europcar International, The Hertz Corporation, and Avis Budget Group Inc. also present ongoing challenges. Despite these factors, the German car rental market is expected to maintain a positive growth trajectory, driven by evolving travel patterns and economic recovery.

Germany Car Rental Market Company Market Share

Germany Car Rental Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the Germany car rental market, a dynamic and evolving sector driven by tourism, business travel, and evolving mobility preferences. Covering the historical period from 2019 to 2024 and extending to a detailed forecast up to 2033, this study offers unparalleled insights into market dynamics, growth trajectories, regional dominance, and the strategic landscapes of key players. We dissect parent and child market segments, delivering actionable intelligence for stakeholders seeking to capitalize on the burgeoning German car rental industry. The report is meticulously structured for maximum readability and SEO visibility, integrating high-traffic keywords such as car hire Germany, rental cars Germany, and vehicle rental Germany, to ensure industry professionals find the critical data they need. All values are presented in billions of units, with predictions where exact figures are unavailable.

Germany Car Rental Market Market Dynamics & Structure

The Germany car rental market exhibits a moderately concentrated structure, with a few major global players alongside a significant number of local and regional operators. Technological innovation, particularly in digitalization and fleet management, acts as a primary driver, enhancing customer experience and operational efficiency. Regulatory frameworks, such as those governing vehicle emissions and data privacy, also play a crucial role in shaping market strategies and investment decisions. Competitive product substitutes, including ride-sharing services and expanding public transportation networks, present ongoing challenges, requiring rental companies to continually innovate their service offerings. End-user demographics reveal a strong reliance on both leisure car rental Germany and business car rental Germany, with distinct needs and preferences. Mergers and acquisitions (M&A) trends are a significant feature, aimed at consolidating market share, expanding geographic reach, and acquiring technological capabilities. For instance, the acquisition of smaller, tech-focused rental startups by larger corporations is becoming increasingly common. The market is characterized by an evolving balance between established players and nimble disruptors, all vying for a share of the German mobility landscape.

- Market Concentration: Dominated by a blend of global giants and regional specialists.

- Technological Innovation: Focus on digital booking platforms, AI-powered customer service, and advanced fleet telematics.

- Regulatory Impact: Stringent environmental regulations and data protection laws influencing fleet composition and operational practices.

- Competitive Substitutes: Growing popularity of ride-sharing, carpooling, and integrated multimodal transport solutions.

- End-User Segments: Significant demand from both tourism car rental Germany and corporate travel sectors.

- M&A Activity: Strategic consolidation and acquisition of innovative technologies to gain competitive advantage.

Germany Car Rental Market Growth Trends & Insights

The Germany car rental market is poised for robust growth, projected to reach xx billion units by 2033. This expansion is fueled by a confluence of factors including recovering post-pandemic travel, a resurgence in business activity, and a growing preference for flexible mobility solutions. The adoption rate of online car rental Germany bookings continues to surge, with consumers increasingly valuing convenience and transparency. Technological disruptions are at the forefront, with advancements in electric vehicle (EV) integration, autonomous driving features (in development), and sophisticated mobile applications transforming the rental experience. Consumer behavior is shifting towards on-demand rentals and subscription-based models, moving away from traditional ownership.

The Germany car hire market experienced a significant rebound in the historical period (2019-2024) following the initial impact of the pandemic. The base year 2025 marks a pivotal point, with further acceleration anticipated. The forecast period 2025-2033 is expected to witness a Compound Annual Growth Rate (CAGR) of approximately xx%, driven by sustained economic recovery and innovative service delivery. The increasing integration of car rental services into broader mobility-as-a-service (MaaS) platforms is another key trend, offering users seamless access to various transportation options. Furthermore, a growing emphasis on sustainability is driving demand for eco-friendly vehicles, presenting a significant opportunity for rental companies to diversify their fleets and appeal to environmentally conscious travelers. The Germany car rental market size is thus expanding beyond traditional rental transactions to encompass a wider spectrum of mobility services.

Dominant Regions, Countries, or Segments in Germany Car Rental Market

Within the Germany car rental market, the Leisure/Tourism segment consistently emerges as the dominant force driving market growth. This is intrinsically linked to Germany's position as a premier travel destination, attracting millions of international and domestic tourists annually. The Application Type: Leisure/Tourism segment is characterized by a strong demand for short-term car rental Germany, particularly during peak holiday seasons. Key drivers for this dominance include Germany's extensive network of cultural attractions, scenic landscapes, and well-developed tourism infrastructure, which often necessitates independent transportation for optimal exploration.

The Booking Type: Online is increasingly prevalent, reflecting a global shift in consumer preference towards digital channels for convenience and price comparison. The ease of accessing Germany car rental deals online through various aggregators and direct booking platforms further solidifies this trend. However, offline booking still holds a significant share, especially for spontaneous travel or among demographics less inclined towards digital platforms.

In terms of Rental Length Type, Short-Term rentals (ranging from a few hours to a few weeks) overwhelmingly lead the market, catering to the immediate needs of tourists and short business trips. The accessibility of cheap car rental Germany for weekend getaways and shorter excursions fuels this segment's growth. While Long-Term car rental Germany is a smaller but growing segment, driven by extended business assignments, temporary relocation needs, and individuals opting out of vehicle ownership, it represents a significant area for future development. Economic policies promoting domestic tourism and infrastructure development, such as improvements to road networks and airport connectivity, indirectly bolster the dominance of the leisure and short-term rental segments. Market share within this segment is fiercely contested, with companies investing heavily in user-friendly online platforms and attractive promotional offers to capture the leisure traveler.

Germany Car Rental Market Product Landscape

The product landscape in the Germany car rental market is evolving rapidly, with a strong emphasis on fleet diversification and technological integration. Rental companies are increasingly offering a wider array of vehicles, including compact cars for urban exploration, SUVs for family trips, premium vehicles for business travelers, and a growing selection of electric vehicles (EVs) and hybrids to meet sustainability demands. Innovations in fleet management software allow for real-time tracking, dynamic pricing, and predictive maintenance, optimizing operational efficiency and customer service. Unique selling propositions are centered on seamless online booking, convenient pick-up and drop-off locations (including airport and city centers), flexible rental periods, and competitive pricing strategies. The performance metrics are gauged by fleet utilization rates, customer satisfaction scores, and the successful integration of new mobility solutions.

Key Drivers, Barriers & Challenges in Germany Car Rental Market

Key Drivers:

- Resurgent Tourism & Business Travel: Post-pandemic recovery in both leisure and corporate travel is a primary growth catalyst.

- Digitalization & Online Booking: Increasing consumer preference for convenient online platforms and mobile booking applications.

- Fleet Modernization & Electrification: Growing demand for EVs and eco-friendly vehicles, supported by government incentives and rising environmental awareness.

- Flexible Mobility Solutions: The shift towards car-sharing and subscription models catering to diverse user needs.

- Economic Stability: A strong German economy generally translates to higher disposable income and increased travel expenditure.

Barriers & Challenges:

- Intense Competition: High market saturation from global players and local operators leads to price pressures.

- Regulatory Hurdles: Stringent environmental regulations, evolving data protection laws (e.g., GDPR), and local traffic restrictions can impact operations and fleet choices.

- Infrastructure Limitations: Availability of EV charging stations, particularly in rural areas, can be a constraint for EV rentals.

- Supply Chain Disruptions: The global semiconductor shortage and other supply chain issues can affect new vehicle acquisition and fleet replenishment.

- Rising Operational Costs: Increasing fuel prices, insurance premiums, and maintenance expenses can squeeze profit margins.

- Perception of High Costs: Some consumers perceive car rental as expensive compared to alternative transportation, impacting market penetration.

Emerging Opportunities in Germany Car Rental Market

Emerging opportunities in the Germany car rental market lie in the burgeoning demand for sustainable mobility solutions. The increasing adoption of electric vehicles (EVs) and the expansion of charging infrastructure present a significant avenue for rental companies to differentiate themselves and attract environmentally conscious customers. The growth of niche rental segments, such as luxury car rentals, adventure vehicle rentals, and specialized commercial vehicle rentals, also offers untapped potential. Furthermore, the integration of car rental services into comprehensive Mobility-as-a-Service (MaaS) platforms represents a significant opportunity to reach a wider customer base and offer integrated travel solutions. The development of flexible subscription models and long-term rental packages catering to evolving work-from-home trends and the gig economy also holds considerable promise for future market expansion.

Growth Accelerators in the Germany Car Rental Market Industry

Several key catalysts are accelerating growth within the Germany car rental market industry. Technological breakthroughs, particularly in digital transformation, are paramount. This includes the widespread adoption of AI-powered chatbots for customer service, advanced telematics for efficient fleet management, and the development of seamless mobile applications for booking, unlocking, and returning vehicles. Strategic partnerships with airlines, hotels, and online travel agencies (OTAs) are crucial for expanding reach and offering bundled travel packages, thereby increasing customer acquisition. Market expansion strategies, such as introducing new rental locations in underserved areas or expanding service offerings to include electric scooters or bikes, also contribute significantly to growth. Furthermore, government initiatives promoting sustainable transportation and tourism infrastructure development provide a supportive ecosystem for industry expansion.

Key Players Shaping the Germany Car Rental Market Market

- Europcar International

- The Hertz Corporation

- Alamo (Enterprise Holdings Inc )

- Thrifty Car Rental Inc

- SIXT SE

- Buchbinder

- Avis Budget Group Inc

Notable Milestones in Germany Car Rental Market Sector

- 2020: Increased focus on enhanced cleaning protocols and contactless pick-up/drop-off services due to the global pandemic.

- 2021: Growing investment in electric vehicle fleets by major rental companies in response to environmental regulations and consumer demand.

- 2022: Significant recovery in rental volumes driven by the resurgence of international and domestic tourism.

- 2023: Expansion of digital booking platforms and mobile app functionalities, including in-app vehicle unlocking.

- 2024 (Early): Introduction of flexible subscription models and longer-term rental options to cater to changing work and lifestyle patterns.

In-Depth Germany Car Rental Market Market Outlook

The Germany car rental market outlook is exceptionally positive, characterized by sustained growth driven by evolving consumer preferences and technological advancements. The increasing integration of electric vehicles into rental fleets, supported by government policies and growing consumer environmental consciousness, will continue to be a major growth accelerator. Furthermore, the expanding reach of digital platforms and the development of sophisticated mobile applications will further enhance customer convenience and operational efficiency. The growing demand for flexible mobility solutions, including subscription services and on-demand rentals, presents a substantial opportunity for market players to innovate and capture new customer segments. Strategic partnerships and a focus on customer-centric services will be crucial for maintaining a competitive edge in this dynamic market. The future promises a more sustainable, digital, and personalized car rental experience in Germany.

Germany Car Rental Market Segmentation

-

1. Application Type

- 1.1. Leisure/Tourism

- 1.2. Business

-

2. Booking Type

- 2.1. Offline

- 2.2. Online

-

3. Rental Length Type

- 3.1. Short-Term

- 3.2. Long-Term

Germany Car Rental Market Segmentation By Geography

- 1. Germany

Germany Car Rental Market Regional Market Share

Geographic Coverage of Germany Car Rental Market

Germany Car Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for ADAS likely Drive the Market

- 3.3. Market Restrains

- 3.3.1. Lower efficiency in bad weather conditions

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Online Car Rental Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Car Rental Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Leisure/Tourism

- 5.1.2. Business

- 5.2. Market Analysis, Insights and Forecast - by Booking Type

- 5.2.1. Offline

- 5.2.2. Online

- 5.3. Market Analysis, Insights and Forecast - by Rental Length Type

- 5.3.1. Short-Term

- 5.3.2. Long-Term

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Europcar International

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Hertz Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Alamo (Enterprise Holdings Inc )

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Thrifty Car Rental Inc*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SIXT SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Buchbinder

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Avis Budget Group Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Europcar International

List of Figures

- Figure 1: Germany Car Rental Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Car Rental Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Car Rental Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 2: Germany Car Rental Market Revenue billion Forecast, by Booking Type 2020 & 2033

- Table 3: Germany Car Rental Market Revenue billion Forecast, by Rental Length Type 2020 & 2033

- Table 4: Germany Car Rental Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Germany Car Rental Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 6: Germany Car Rental Market Revenue billion Forecast, by Booking Type 2020 & 2033

- Table 7: Germany Car Rental Market Revenue billion Forecast, by Rental Length Type 2020 & 2033

- Table 8: Germany Car Rental Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Car Rental Market?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the Germany Car Rental Market?

Key companies in the market include Europcar International, The Hertz Corporation, Alamo (Enterprise Holdings Inc ), Thrifty Car Rental Inc*List Not Exhaustive, SIXT SE, Buchbinder, Avis Budget Group Inc.

3. What are the main segments of the Germany Car Rental Market?

The market segments include Application Type, Booking Type, Rental Length Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 30.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for ADAS likely Drive the Market.

6. What are the notable trends driving market growth?

Increasing Demand for Online Car Rental Services.

7. Are there any restraints impacting market growth?

Lower efficiency in bad weather conditions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Car Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Car Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Car Rental Market?

To stay informed about further developments, trends, and reports in the Germany Car Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence