Key Insights

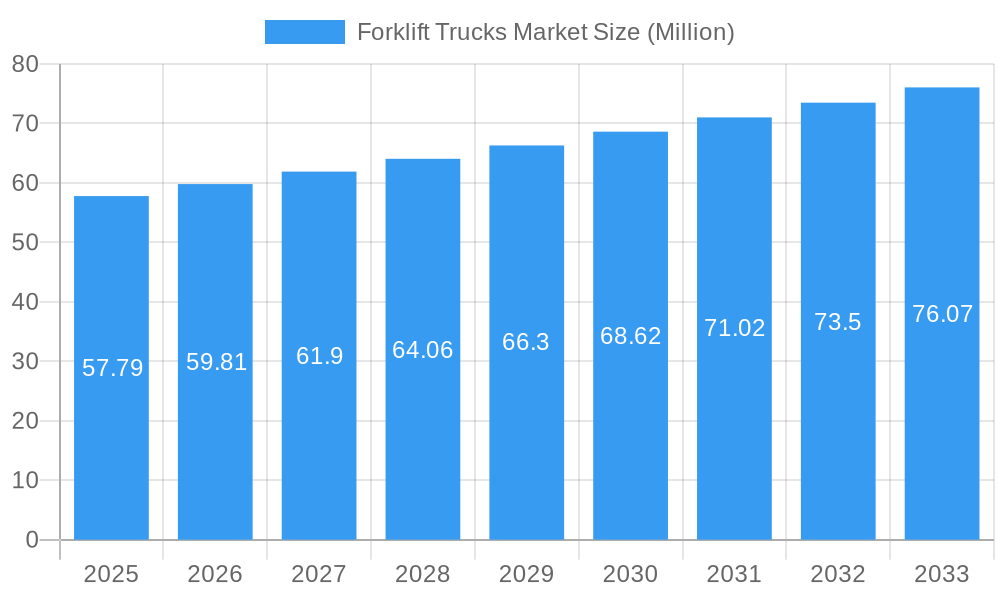

The global Forklift Trucks Market is poised for steady expansion, with a projected market size of USD 57.79 million in 2025. This growth is underpinned by a Compound Annual Growth Rate (CAGR) of 3.46%, indicating a robust and sustained upward trajectory over the forecast period of 2025-2033. This expansion is primarily driven by the escalating demand for efficient material handling solutions across key industries such as industrial, construction, and manufacturing. The increasing pace of industrialization and infrastructure development globally necessitates advanced logistics and warehousing capabilities, directly fueling the adoption of modern forklift trucks. Furthermore, the ongoing technological advancements, including the integration of electric powertrains and the development of autonomous and smart forklift solutions, are set to revolutionize the market by enhancing operational efficiency, safety, and sustainability. The shift towards electric forklifts, in particular, is gaining momentum due to increasing environmental regulations and a growing focus on reducing carbon footprints within supply chains.

Forklift Trucks Market Market Size (In Million)

Several critical trends are shaping the Forklift Trucks Market. The prominent shift towards electric forklifts is a significant driver, propelled by environmental consciousness and evolving government regulations. The increasing adoption of advanced technologies like IoT integration for fleet management, real-time data analytics, and semi-autonomous functionalities are enhancing operational efficiency and safety. Moreover, the growing e-commerce sector is creating a surge in demand for high-performance forklifts capable of handling increased volumes in warehouses and distribution centers. While the market demonstrates strong growth potential, certain restraints need to be addressed. High initial investment costs for advanced models and the need for specialized maintenance infrastructure can pose challenges, particularly for small and medium-sized enterprises. The availability of skilled labor for operating and maintaining sophisticated forklift systems also presents a hurdle. However, the overarching demand for enhanced productivity and automation in material handling operations is expected to outweigh these challenges, driving continued market penetration and innovation.

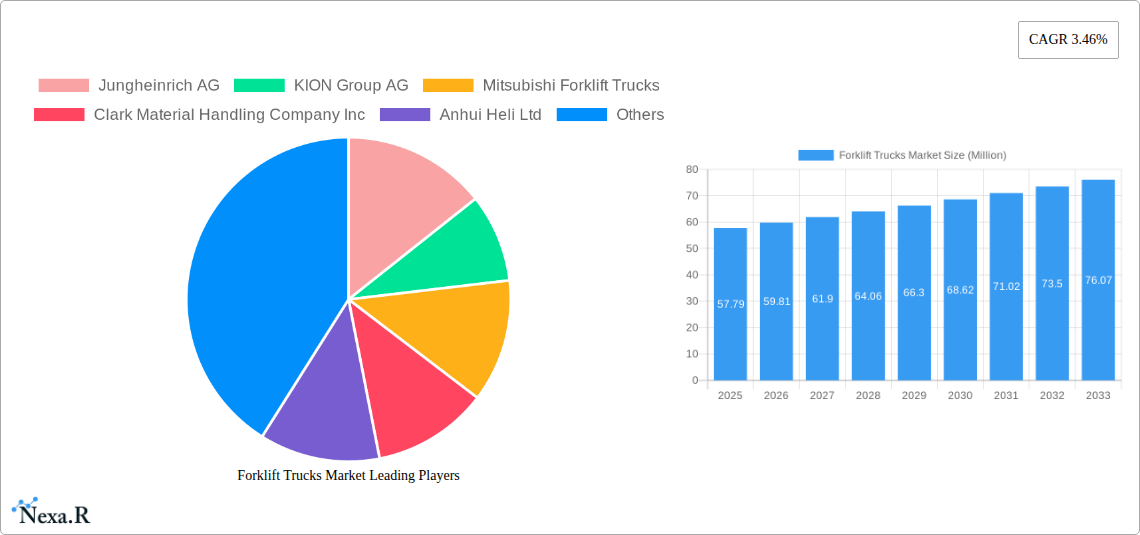

Forklift Trucks Market Company Market Share

Here is a compelling, SEO-optimized report description for the Forklift Trucks Market, designed for maximum search engine visibility and industry professional engagement.

Report Title: Forklift Trucks Market: Global Outlook, Growth Drivers, and Forecasts (2019–2033)

Report Description:

Dive deep into the global Forklift Trucks Market with this comprehensive industry analysis, forecasting robust growth from 2019 to 2033, with a detailed outlook for 2025. This report offers an in-depth examination of forklift truck sales, material handling equipment trends, and warehouse automation solutions, integrating high-traffic keywords to maximize search engine visibility. Explore parent and child market dynamics, including industrial forklift market growth and specialized warehouse forklift segments. Understand the critical shifts in electric forklift adoption, internal combustion engine forklifts, and advanced vehicle class innovations. Our analysis covers Industrial, Construction, and Manufacturing end-user verticals, providing actionable insights for manufacturers, distributors, and end-users alike. With a base year of 2025 and a forecast period extending to 2033, this report is an indispensable resource for strategic planning and investment decisions in the forklift market.

Forklift Trucks Market Market Dynamics & Structure

The Forklift Trucks Market exhibits a moderately concentrated structure, with leading players like KION Group AG, Jungheinrich AG, and Toyota Industries Corporation dominating global sales. Technological innovation is a primary driver, fueled by increasing demand for automation, electrification, and improved safety features. Regulatory frameworks, particularly concerning emissions and workplace safety, are increasingly influencing product development and market trends. Competitive product substitutes, such as automated guided vehicles (AGVs) and robotic solutions, are emerging, pushing traditional forklift manufacturers to innovate. End-user demographics are shifting towards more sophisticated material handling needs, driven by the growth of e-commerce and the need for optimized logistics. Mergers and acquisitions (M&A) are significant, with companies consolidating to expand their product portfolios, geographical reach, and technological capabilities. For instance, the historical period has seen several key acquisitions aimed at bolstering electric and autonomous offerings.

- Market Concentration: Dominated by a few key global players, with significant regional players contributing to market diversity.

- Technological Innovation Drivers: Automation, AI, IoT integration, battery technology advancements (e.g., Li-ION batteries), and alternative fuel solutions (e.g., hydrogen fuel cells).

- Regulatory Frameworks: Strict emissions standards (e.g., EPA in the US, Euro standards in Europe), safety regulations (e.g., OSHA), and evolving mandates for operator training and autonomous systems.

- Competitive Product Substitutes: AGVs, autonomous mobile robots (AMRs), and fixed automation systems are increasingly challenging traditional forklift dominance in specific applications.

- End-User Demographics: Growing demand from e-commerce fulfillment centers, manufacturing automation initiatives, and the construction sector's need for efficient lifting solutions.

- M&A Trends: Strategic acquisitions to gain access to new technologies, expand market share, and integrate supply chains. The historical period has witnessed several key deals aimed at strengthening electric and autonomous portfolios.

Forklift Trucks Market Growth Trends & Insights

The Forklift Trucks Market is poised for substantial growth, driven by a confluence of economic, technological, and operational factors. The overall market size has seen a consistent upward trajectory, propelled by increasing industrialization, global trade expansion, and the ever-growing demands of the logistics and e-commerce sectors. Adoption rates for electric forklifts are accelerating significantly, reflecting a global push towards sustainability, reduced operating costs, and quieter, emission-free operations in indoor environments like warehouses and manufacturing facilities. Technological disruptions, including the integration of AI, IoT, and advanced battery technologies like lithium-ion, are revolutionizing forklift capabilities, moving them beyond simple lifting devices to intelligent material handling solutions. Consumer behavior shifts are also paramount; businesses are increasingly prioritizing operational efficiency, safety, and predictive maintenance, leading to a greater demand for connected and autonomous forklift solutions. The forecast period is expected to witness a notable surge in the market penetration of advanced material handling equipment. For example, the trend towards electric counterbalance forklifts and specialized order picking forklifts demonstrates a clear adaptation to evolving warehousing needs. The increasing investment in warehouse automation globally is a primary accelerator, directly impacting the demand for sophisticated forklift trucks. Furthermore, government incentives and stricter environmental regulations are pushing industries to transition towards cleaner power sources, favoring electric and alternative fuel forklifts over traditional internal combustion engine models. The market is also witnessing a rise in the adoption of fleet management systems and telematics, enabling better utilization, reduced downtime, and enhanced safety through real-time data monitoring. These integrated solutions are becoming a standard expectation rather than a premium add-on. The expanding global manufacturing base, particularly in emerging economies, is also a significant contributor to sustained demand for material handling equipment. As supply chains become more complex and the need for agility increases, the role of efficient and versatile forklift trucks becomes even more critical. The development and integration of autonomous driving solutions within forklifts, as seen in recent industry developments, represent a paradigm shift, promising to reshape warehouse operations and improve worker safety by taking over repetitive or hazardous tasks. This evolution from basic machinery to intelligent automation is a key theme driving future market expansion.

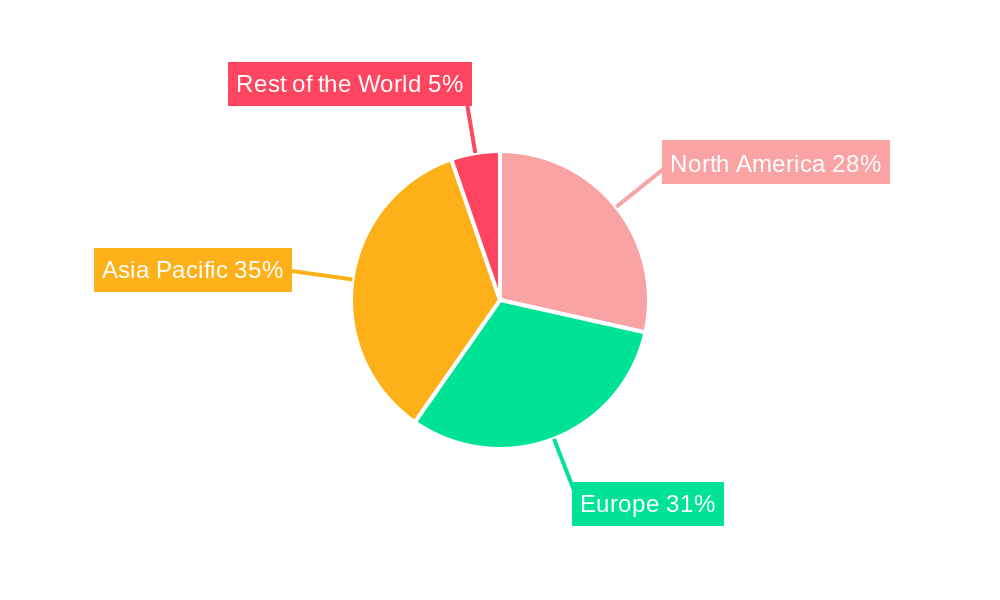

Dominant Regions, Countries, or Segments in Forklift Trucks Market

The Forklift Trucks Market is experiencing dynamic growth across various regions and segments, with specific areas and product categories leading the charge. North America and Europe currently hold significant market share, driven by established industrial bases, advanced logistics networks, and stringent regulations promoting sustainability and efficiency. Asia-Pacific, however, is emerging as the fastest-growing region, fueled by rapid industrialization, booming e-commerce, and increasing investments in manufacturing and infrastructure across countries like China, India, and Southeast Asian nations. Within the Power-train Type segment, Electric forklifts are increasingly dominating market growth, outpacing Internal Combustion Engine (ICE) models. This shift is primarily attributed to growing environmental consciousness, government incentives for green technologies, and the lower operating costs and reduced emissions associated with electric powertrains, especially in indoor warehouse and manufacturing environments. The Vehicle Class landscape sees Class III (Electric Motor Rider Trucks) and Class I (Electric Motor Sit-Down Counterbalance) forklifts showing robust demand, reflecting their widespread use in warehousing, retail, and general manufacturing. Class IV and Class V, which include cushion tire and pneumatic tire internal combustion engine forklifts, respectively, continue to be vital for outdoor and heavy-duty applications, particularly in construction and heavy manufacturing. The End-user Vertical analysis reveals that the Manufacturing sector is a major growth driver, encompassing automotive, electronics, and general manufacturing industries that rely heavily on efficient material handling. The Industrial sector, including logistics and distribution centers, is also a substantial contributor, directly benefiting from the surge in e-commerce. The Construction industry, while more reliant on rugged, ICE-powered forklifts, is also witnessing an increasing adoption of electric variants for specific tasks and indoor construction sites. Key drivers for dominance in these regions and segments include supportive government policies encouraging industrial growth and automation, significant investments in logistics and warehousing infrastructure, and a proactive approach to adopting advanced technologies. For example, the drive towards smart factories and Industry 4.0 initiatives in manufacturing hubs across Asia Pacific and North America is directly translating into higher demand for sophisticated and automated forklift solutions. Economic growth and increased disposable income also contribute to higher consumer spending, which in turn fuels demand for goods, necessitating robust supply chains and efficient material handling operations. The increasing focus on workplace safety regulations is also a significant factor, pushing for the adoption of safer and more ergonomic forklift designs, which are often integrated with advanced technology features.

Forklift Trucks Market Product Landscape

The Forklift Trucks Market product landscape is characterized by continuous innovation aimed at enhancing efficiency, safety, and sustainability. Recent developments include the introduction of advanced electric forklifts, such as Linde Series 1293 by KION North America, featuring Li-ION batteries for extended operational life and faster charging. Mitsubishi Logisnext Americas has unveiled the SCX N2 Series of Electric Stand-up Counterbalanced Lift Trucks, catering to specific warehousing needs. Furthermore, the integration of AI-powered autonomous driving solutions, as demonstrated by Cyngn Inc. in collaboration with BYD forklifts, is paving the way for intelligent, self-operating material handling. Toyota Australia has also showcased innovative fuel cell truck concepts, highlighting the growing interest in hydrogen technology as a sustainable power source. These advancements are pushing the performance metrics of forklifts, increasing lift capacities, improving maneuverability in confined spaces, and offering intuitive operator interfaces.

Key Drivers, Barriers & Challenges in Forklift Trucks Market

Key Drivers:

- E-commerce Growth: The exponential rise in online retail necessitates efficient warehouse operations and robust logistics, directly increasing forklift demand.

- Automation and Industry 4.0: The push for smart factories and automated operations drives the adoption of advanced and connected forklift technologies, including autonomous solutions.

- Electrification Trend: Growing environmental concerns and government regulations are accelerating the shift towards electric forklifts, reducing emissions and operating costs.

- Infrastructure Development: Investments in new warehouses, distribution centers, and manufacturing facilities globally create a consistent demand for material handling equipment.

- Technological Advancements: Innovations in battery technology, AI, IoT integration, and operator assistance systems enhance forklift capabilities and appeal.

Key Barriers & Challenges:

- Supply Chain Disruptions: Global supply chain issues, including shortages of key components like semiconductors and raw materials, can impact production and delivery timelines, leading to increased costs.

- High Initial Investment: The upfront cost of advanced electric or autonomous forklifts can be a barrier for smaller businesses, despite potential long-term savings.

- Infrastructure Requirements for Electric Forklifts: The need for adequate charging infrastructure and grid capacity can pose challenges for widespread adoption in certain locations.

- Skilled Labor Shortage: A lack of trained operators and maintenance technicians for advanced forklift technologies can hinder adoption and efficient utilization.

- Intense Competition: The market is highly competitive, with numerous global and regional players vying for market share, leading to price pressures.

- Regulatory Hurdles: Navigating varying international safety and emissions regulations can be complex and costly for manufacturers.

Emerging Opportunities in Forklift Trucks Market

Emerging opportunities in the Forklift Trucks Market lie in the burgeoning demand for autonomous forklifts and robotic material handling solutions. The increasing focus on warehouse automation within the e-commerce fulfillment sector presents a significant growth avenue. Furthermore, the development and widespread adoption of hydrogen fuel cell forklifts offer a promising sustainable alternative to battery-electric models, particularly for applications requiring longer runtimes and faster refueling. Untapped markets in developing economies, coupled with a growing awareness of the benefits of modern material handling equipment, also represent substantial potential. The evolution of forklift telematics and fleet management systems creates opportunities for value-added services and data-driven optimization solutions for end-users.

Growth Accelerators in the Forklift Trucks Market Industry

Several catalysts are accelerating long-term growth in the Forklift Trucks Market. Technological breakthroughs, particularly in battery technology for electric forklifts and the maturation of AI for autonomous operations, are key. Strategic partnerships between forklift manufacturers and technology providers are fostering innovation and faster market integration of advanced features. Market expansion strategies, including focusing on emerging economies and developing specialized equipment for niche applications like cold storage or outdoor construction, are driving diversified growth. The ongoing global push for increased productivity and efficiency across industries, coupled with stricter safety and environmental regulations, provides a sustained impetus for the adoption of modern, high-performance forklift trucks.

Key Players Shaping the Forklift Trucks Market Market

- Jungheinrich AG

- KION Group AG

- Mitsubishi Forklift Trucks

- Clark Material Handling Company Inc

- Anhui Heli Ltd

- Toyota Industries Corporation

- Hangcha Group Co

- Crown Equipment Corporation

- Caterpillar Inc

- Doosan Industrial Vehicles Co Ltd

- Komatsu Ltd

- Hyster-Yale Materials Handling Inc

Notable Milestones in Forklift Trucks Market Sector

- February 2024: KION North America introduced the Linde Series 1293, including electric counterbalance forklifts (E20BHP, E25BHP) with Linde Li-ION batteries, enhancing their North American product portfolio.

- September 2023: Mitsubishi Logisnext Americas launched the SCX N2 Series of Electric Stand-up Counterbalanced Lift Trucks, a state-of-the-art innovation for warehouse operations.

- June 2023: Cyngn Inc. made progress in adapting its DriveMod technology for autonomous forklifts through a paid contract with a building materials industry end-user, enabling AI-powered autonomous capabilities on an electric BYD forklift.

- April 2023: Toyota Australia showcased an innovative fuel cell truck concept, including a Toyota forklift, demonstrating potential applications for its hydrogen fuel cell technology.

In-Depth Forklift Trucks Market Market Outlook

The future outlook for the Forklift Trucks Market is exceptionally positive, driven by sustained demand for automation and electrification. Growth accelerators, including advancements in AI-powered autonomous systems and the increasing viability of hydrogen fuel cell technology, are set to redefine material handling. Strategic partnerships and focused market expansion into rapidly industrializing regions will further fuel this growth trajectory. The continuous drive for operational efficiency, coupled with evolving regulatory landscapes promoting sustainability, ensures a robust demand for innovative and eco-friendly forklift solutions. This dynamic evolution presents significant opportunities for stakeholders to capitalize on the transition towards smarter, safer, and more sustainable material handling.

Forklift Trucks Market Segmentation

-

1. Power-train Type

- 1.1. Internal Combustion Engine

- 1.2. Electric

-

2. Vehicle Class

- 2.1. Class I

- 2.2. Class II

- 2.3. Class III

- 2.4. Class IV

-

3. End-user Vertical

- 3.1. Industrial

- 3.2. Construction

- 3.3. Manufacturing

Forklift Trucks Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East

Forklift Trucks Market Regional Market Share

Geographic Coverage of Forklift Trucks Market

Forklift Trucks Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Sea Port Cargo Fueled By E-commerce Handling Boosting The Forklift Sales

- 3.3. Market Restrains

- 3.3.1. Cost and Price Sensitivity

- 3.4. Market Trends

- 3.4.1. Electric Forklifts Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Forklift Trucks Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Power-train Type

- 5.1.1. Internal Combustion Engine

- 5.1.2. Electric

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Class

- 5.2.1. Class I

- 5.2.2. Class II

- 5.2.3. Class III

- 5.2.4. Class IV

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Industrial

- 5.3.2. Construction

- 5.3.3. Manufacturing

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Power-train Type

- 6. North America Forklift Trucks Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Power-train Type

- 6.1.1. Internal Combustion Engine

- 6.1.2. Electric

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Class

- 6.2.1. Class I

- 6.2.2. Class II

- 6.2.3. Class III

- 6.2.4. Class IV

- 6.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.3.1. Industrial

- 6.3.2. Construction

- 6.3.3. Manufacturing

- 6.1. Market Analysis, Insights and Forecast - by Power-train Type

- 7. Europe Forklift Trucks Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Power-train Type

- 7.1.1. Internal Combustion Engine

- 7.1.2. Electric

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Class

- 7.2.1. Class I

- 7.2.2. Class II

- 7.2.3. Class III

- 7.2.4. Class IV

- 7.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.3.1. Industrial

- 7.3.2. Construction

- 7.3.3. Manufacturing

- 7.1. Market Analysis, Insights and Forecast - by Power-train Type

- 8. Asia Pacific Forklift Trucks Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Power-train Type

- 8.1.1. Internal Combustion Engine

- 8.1.2. Electric

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Class

- 8.2.1. Class I

- 8.2.2. Class II

- 8.2.3. Class III

- 8.2.4. Class IV

- 8.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.3.1. Industrial

- 8.3.2. Construction

- 8.3.3. Manufacturing

- 8.1. Market Analysis, Insights and Forecast - by Power-train Type

- 9. Rest of the World Forklift Trucks Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Power-train Type

- 9.1.1. Internal Combustion Engine

- 9.1.2. Electric

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Class

- 9.2.1. Class I

- 9.2.2. Class II

- 9.2.3. Class III

- 9.2.4. Class IV

- 9.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.3.1. Industrial

- 9.3.2. Construction

- 9.3.3. Manufacturing

- 9.1. Market Analysis, Insights and Forecast - by Power-train Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Jungheinrich AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 KION Group AG

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Mitsubishi Forklift Trucks

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Clark Material Handling Company Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Anhui Heli Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Toyota Industries Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Hangcha Group Co

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Crown Equipment Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Caterpillar Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Doosan Industrial Vehicles Co Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Komatsu Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Hyster-Yale Materials Handling Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Jungheinrich AG

List of Figures

- Figure 1: Global Forklift Trucks Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Forklift Trucks Market Revenue (Million), by Power-train Type 2025 & 2033

- Figure 3: North America Forklift Trucks Market Revenue Share (%), by Power-train Type 2025 & 2033

- Figure 4: North America Forklift Trucks Market Revenue (Million), by Vehicle Class 2025 & 2033

- Figure 5: North America Forklift Trucks Market Revenue Share (%), by Vehicle Class 2025 & 2033

- Figure 6: North America Forklift Trucks Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 7: North America Forklift Trucks Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 8: North America Forklift Trucks Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Forklift Trucks Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Forklift Trucks Market Revenue (Million), by Power-train Type 2025 & 2033

- Figure 11: Europe Forklift Trucks Market Revenue Share (%), by Power-train Type 2025 & 2033

- Figure 12: Europe Forklift Trucks Market Revenue (Million), by Vehicle Class 2025 & 2033

- Figure 13: Europe Forklift Trucks Market Revenue Share (%), by Vehicle Class 2025 & 2033

- Figure 14: Europe Forklift Trucks Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 15: Europe Forklift Trucks Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 16: Europe Forklift Trucks Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Forklift Trucks Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Forklift Trucks Market Revenue (Million), by Power-train Type 2025 & 2033

- Figure 19: Asia Pacific Forklift Trucks Market Revenue Share (%), by Power-train Type 2025 & 2033

- Figure 20: Asia Pacific Forklift Trucks Market Revenue (Million), by Vehicle Class 2025 & 2033

- Figure 21: Asia Pacific Forklift Trucks Market Revenue Share (%), by Vehicle Class 2025 & 2033

- Figure 22: Asia Pacific Forklift Trucks Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 23: Asia Pacific Forklift Trucks Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Asia Pacific Forklift Trucks Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Forklift Trucks Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Forklift Trucks Market Revenue (Million), by Power-train Type 2025 & 2033

- Figure 27: Rest of the World Forklift Trucks Market Revenue Share (%), by Power-train Type 2025 & 2033

- Figure 28: Rest of the World Forklift Trucks Market Revenue (Million), by Vehicle Class 2025 & 2033

- Figure 29: Rest of the World Forklift Trucks Market Revenue Share (%), by Vehicle Class 2025 & 2033

- Figure 30: Rest of the World Forklift Trucks Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 31: Rest of the World Forklift Trucks Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 32: Rest of the World Forklift Trucks Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Forklift Trucks Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Forklift Trucks Market Revenue Million Forecast, by Power-train Type 2020 & 2033

- Table 2: Global Forklift Trucks Market Revenue Million Forecast, by Vehicle Class 2020 & 2033

- Table 3: Global Forklift Trucks Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global Forklift Trucks Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Forklift Trucks Market Revenue Million Forecast, by Power-train Type 2020 & 2033

- Table 6: Global Forklift Trucks Market Revenue Million Forecast, by Vehicle Class 2020 & 2033

- Table 7: Global Forklift Trucks Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: Global Forklift Trucks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Forklift Trucks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Forklift Trucks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Forklift Trucks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Forklift Trucks Market Revenue Million Forecast, by Power-train Type 2020 & 2033

- Table 13: Global Forklift Trucks Market Revenue Million Forecast, by Vehicle Class 2020 & 2033

- Table 14: Global Forklift Trucks Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 15: Global Forklift Trucks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Forklift Trucks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Forklift Trucks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Forklift Trucks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Forklift Trucks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Forklift Trucks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Forklift Trucks Market Revenue Million Forecast, by Power-train Type 2020 & 2033

- Table 22: Global Forklift Trucks Market Revenue Million Forecast, by Vehicle Class 2020 & 2033

- Table 23: Global Forklift Trucks Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 24: Global Forklift Trucks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: China Forklift Trucks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Forklift Trucks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Forklift Trucks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Korea Forklift Trucks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Forklift Trucks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Forklift Trucks Market Revenue Million Forecast, by Power-train Type 2020 & 2033

- Table 31: Global Forklift Trucks Market Revenue Million Forecast, by Vehicle Class 2020 & 2033

- Table 32: Global Forklift Trucks Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 33: Global Forklift Trucks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: South America Forklift Trucks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Middle East Forklift Trucks Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Forklift Trucks Market?

The projected CAGR is approximately 3.46%.

2. Which companies are prominent players in the Forklift Trucks Market?

Key companies in the market include Jungheinrich AG, KION Group AG, Mitsubishi Forklift Trucks, Clark Material Handling Company Inc, Anhui Heli Ltd, Toyota Industries Corporation, Hangcha Group Co, Crown Equipment Corporation, Caterpillar Inc, Doosan Industrial Vehicles Co Ltd, Komatsu Ltd, Hyster-Yale Materials Handling Inc.

3. What are the main segments of the Forklift Trucks Market?

The market segments include Power-train Type, Vehicle Class, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 57.79 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Sea Port Cargo Fueled By E-commerce Handling Boosting The Forklift Sales.

6. What are the notable trends driving market growth?

Electric Forklifts Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Cost and Price Sensitivity.

8. Can you provide examples of recent developments in the market?

In February 2024, KION North America added another product to its existing portfolio of powered industrial forklifts. This time, the company added Linde Series 1293 to the North American market. The series includes models like E20BHP and E25BHP, which are electric counterbalance forklifts with a 4,000–5,000 lb capacity powered by Linde Li-ION batteries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Forklift Trucks Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Forklift Trucks Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Forklift Trucks Market?

To stay informed about further developments, trends, and reports in the Forklift Trucks Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence