Key Insights

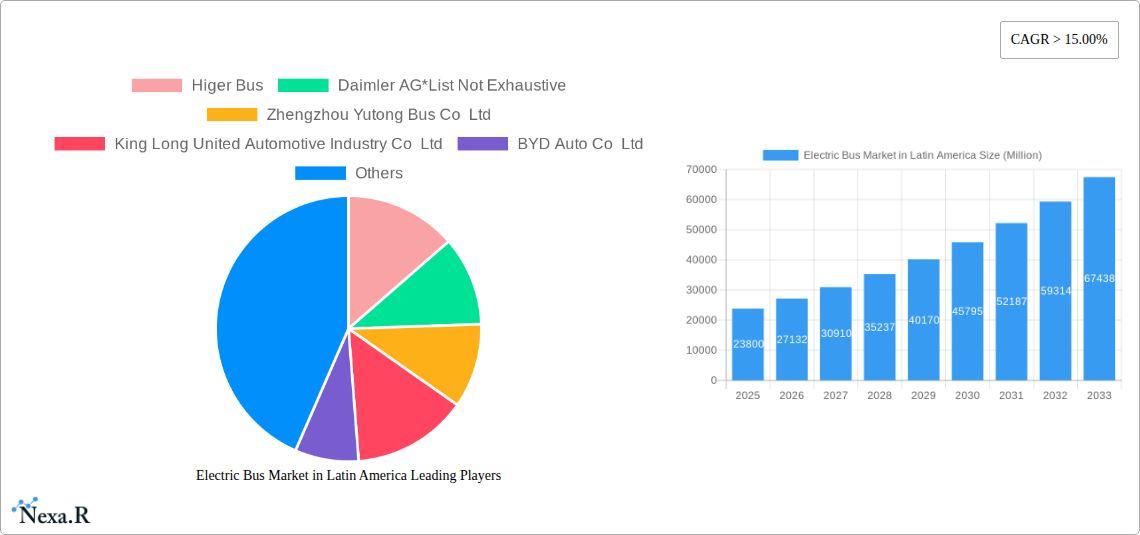

The Latin American electric bus market is poised for substantial expansion, driven by a burgeoning demand for sustainable public transportation solutions and supportive government initiatives. The market is estimated at USD 23.8 billion in 2025, with a projected Compound Annual Growth Rate (CAGR) of 14% through 2033. This robust growth trajectory is primarily fueled by increasing environmental consciousness, the urgent need to reduce urban air pollution, and the cost-effectiveness of electric vehicles in the long run, particularly in terms of lower operational and maintenance expenses compared to traditional internal combustion engine buses. Key segments like Battery Electric Buses are leading the charge, reflecting a strong preference for zero-emission technologies. Furthermore, the evolving consumer landscape, with government entities and fleet operators actively seeking to electrify their fleets, is a significant catalyst for market penetration across major economies.

Electric Bus Market in Latin America Market Size (In Billion)

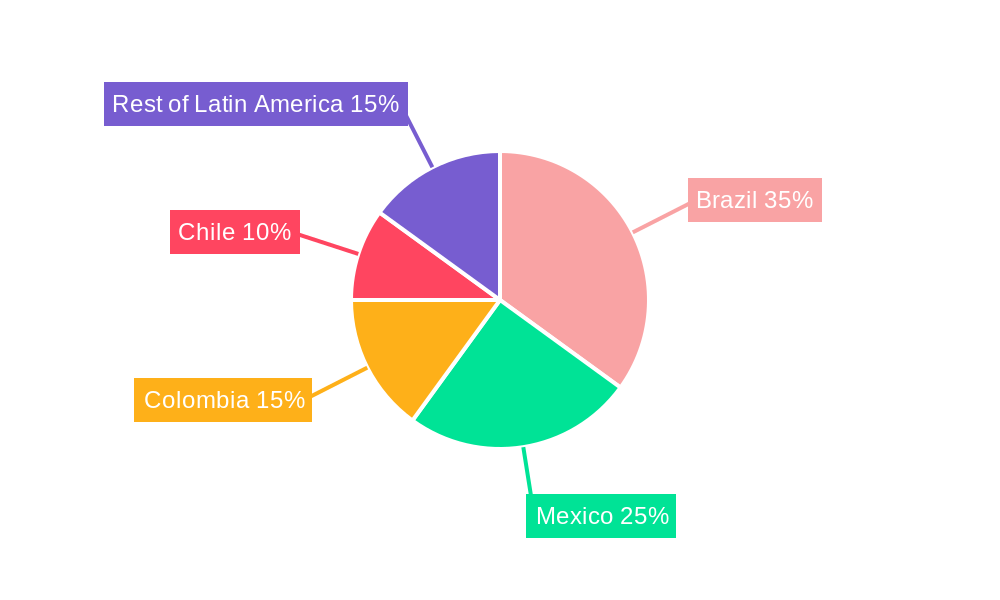

The expansion of the electric bus market in Latin America is further bolstered by evolving trends such as advancements in battery technology, leading to improved range and faster charging capabilities, and the development of dedicated charging infrastructure. Governments are playing a crucial role through incentives, subsidies, and the implementation of ambitious targets for public transport electrification. Geographically, Brazil, Mexico, and Colombia are emerging as key markets, with Chile also showing significant promise. Despite the optimistic outlook, certain restraints such as the initial high upfront cost of electric buses and the need for extensive charging infrastructure development in less developed areas could temper the pace of adoption. However, the overwhelming market drivers and the continuous innovation in the sector are expected to outweigh these challenges, paving the way for a transformative shift in Latin America's public transportation landscape.

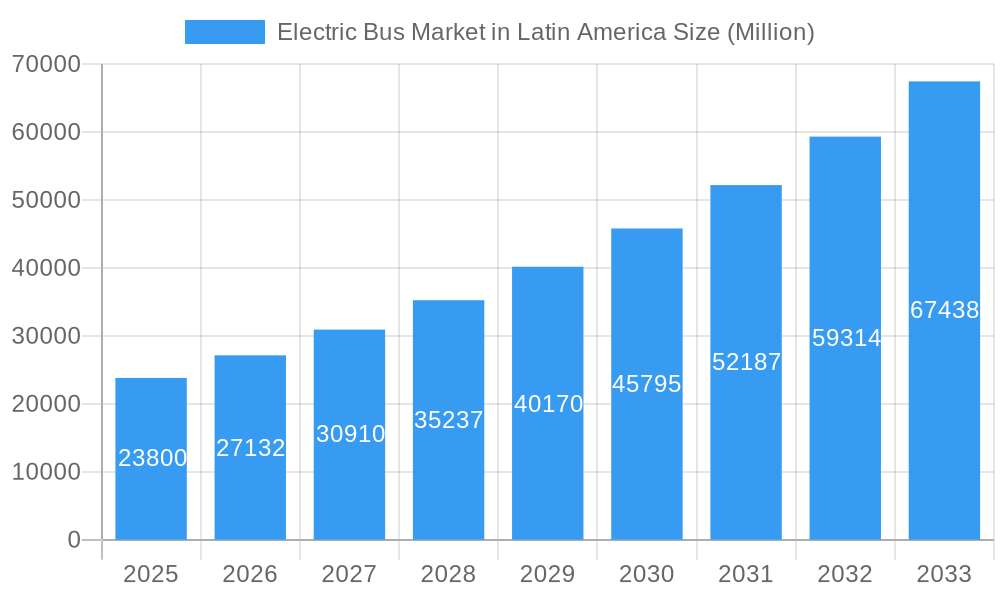

Electric Bus Market in Latin America Company Market Share

This comprehensive report delves into the burgeoning Electric Bus Market in Latin America, offering a detailed analysis of its dynamics, growth trajectory, and future potential. Spanning from 2019 to 2033, with a base year of 2025, the study examines key segments including Battery Electric and Plug-In Hybrid Electric buses, catering to Government and Fleet Operator consumer types across Brazil, Colombia, Mexico, Chile, and the Rest of Latin America. Discover pivotal industry developments and gain strategic insights into this transformative sector.

Electric Bus Market in Latin America Market Dynamics & Structure

The Latin American electric bus market is characterized by a dynamic interplay of evolving regulatory frameworks, significant technological innovation, and increasing environmental consciousness. Market concentration is gradually shifting as key global and regional players vie for dominance. Technological innovation is primarily driven by advancements in battery technology, charging infrastructure, and vehicle efficiency, addressing critical barriers such as range anxiety and initial cost. Regulatory frameworks are increasingly favoring zero-emission vehicles through incentives, subsidies, and stricter emission standards, particularly in urban centers aiming to combat air pollution. Competitive product substitutes, primarily traditional diesel buses, are facing mounting pressure from the superior operational costs and environmental benefits of electric alternatives. End-user demographics are dominated by government entities and public transportation fleet operators, who are instrumental in driving adoption through large-scale fleet procurements and pilot projects. Mergers and acquisitions (M&A) trends are expected to intensify as companies seek to expand their market reach, acquire critical technologies, and consolidate their positions. For instance, a notable M&A trend involves larger automotive manufacturers integrating electric vehicle capabilities into their existing bus portfolios.

- Market Share of Leading Battery Electric Bus Manufacturers: Expected to reach XX% by 2025.

- Volume of M&A Deals in the Latin American Electric Bus Sector: Anticipated to increase by XX% in the forecast period.

- Key Innovation Drivers: Enhanced battery energy density, reduced charging times, and integrated smart mobility solutions.

- Dominant Regulatory Influences: Emission reduction targets and subsidies for public transport electrification.

Electric Bus Market in Latin America Growth Trends & Insights

The Electric Bus Market in Latin America is poised for remarkable expansion, propelled by a confluence of economic, environmental, and technological factors. The market size evolution is projected to witness a substantial Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033, reaching an estimated value of $XX billion by the end of the forecast period. This robust growth trajectory is underpinned by an accelerating adoption rate of electric buses, driven by a growing awareness of their long-term operational cost savings and significant reduction in carbon emissions. Technological disruptions, such as advancements in battery manufacturing and the development of faster, more efficient charging solutions, are effectively mitigating previous concerns about infrastructure and range. Consumer behavior shifts are evident, with governments and fleet operators increasingly prioritizing sustainability and seeking to align their public transport fleets with global environmental goals. Market penetration is expected to surge, particularly in major urban agglomerations that are at the forefront of adopting cleaner transportation solutions. The initial investment barrier, while still a factor, is being steadily addressed through innovative financing models and government incentives. The growing demand for quieter, more comfortable, and emission-free public transportation is also influencing consumer preference and driving the transition away from legacy diesel fleets. Furthermore, the increasing availability of electric bus models tailored to the specific operational needs and climatic conditions of Latin America is fueling market acceptance and growth. The economic impetus for this transition is amplified by reduced fuel costs and lower maintenance expenses associated with electric powertrains, making them a financially attractive proposition for public transport authorities.

Dominant Regions, Countries, or Segments in Electric Bus Market in Latin America

Within the dynamic Latin American Electric Bus Market, Brazil stands out as the dominant country, consistently leading the charge in adoption and deployment. This regional supremacy is driven by a robust combination of economic policies, supportive regulatory frameworks, and a significant urban population necessitating large-scale public transportation solutions. The Battery Electric segment, within the Vehicle Type classification, is the primary driver of market growth, accounting for an estimated XX% market share in 2025. This dominance is attributed to its zero-emission capabilities and increasingly competitive total cost of ownership compared to plug-in hybrid electric variants. Government consumer types are the leading patrons, investing heavily in fleet electrification to meet national and international climate commitments and improve urban air quality.

Key drivers for Brazil's leadership include:

- Proactive Government Initiatives: Implementation of ambitious decarbonization targets for public transportation, coupled with substantial subsidies and tender processes for electric buses.

- Large Urban Centers: Cities like São Paulo and Rio de Janeiro present a significant demand for high-capacity, emission-free public transport.

- Growing Infrastructure Development: Investments in charging infrastructure and grid upgrades to support the increasing electric bus fleets.

- Technological Adoption: Early adoption and successful integration of advanced electric bus technologies from leading manufacturers.

Colombia and Mexico are emerging as significant secondary markets, with rapid growth fueled by similar policy drivers and a strong commitment to sustainable urban mobility. Chile also demonstrates considerable potential, with its focus on renewable energy integration aligning well with the electric bus transition. The Rest of Latin America, while currently less developed in terms of electric bus penetration, offers substantial untapped potential as awareness and investment grow. The Government consumer type's influence cannot be overstated; their procurement decisions set the pace for market expansion and encourage private sector investment. The growth potential within these leading segments remains exceptionally high, as they represent the vanguard of a continent-wide shift towards cleaner, more sustainable urban transportation.

Electric Bus Market in Latin America Product Landscape

The product landscape of the Latin American electric bus market is rapidly evolving, marked by continuous innovation in battery technology, powertrain efficiency, and smart vehicle features. Leading manufacturers are introducing electric buses with extended ranges, faster charging capabilities, and enhanced passenger comfort. Innovations include advanced thermal management systems for batteries, regenerative braking technologies to maximize energy recapture, and lightweight composite materials for improved efficiency. Unique selling propositions often revolve around lower operational costs, reduced emissions, and a quieter, smoother passenger experience. Technological advancements are focused on developing buses that can operate seamlessly within diverse urban environments, catering to varying route lengths and passenger loads.

Key Drivers, Barriers & Challenges in Electric Bus Market in Latin America

Key Drivers:

- Government Policies and Incentives: Subsidies, tax breaks, and preferential procurement policies are crucial for driving adoption.

- Environmental Concerns and Climate Goals: Increasing pressure to reduce urban air pollution and meet national decarbonization targets.

- Technological Advancements: Improvements in battery technology, charging infrastructure, and vehicle efficiency are making electric buses more viable.

- Total Cost of Ownership (TCO): Lower operational and maintenance costs compared to diesel buses offer long-term economic benefits.

Barriers & Challenges:

- High Initial Capital Cost: The upfront purchase price of electric buses remains a significant hurdle.

- Charging Infrastructure Development: The need for extensive and strategically located charging stations.

- Range Anxiety and Charging Time: Concerns about bus range and the time required for recharging.

- Grid Capacity and Stability: Ensuring sufficient power supply to support large-scale charging operations.

- Supply Chain Disruptions: Potential issues in the availability of batteries and other critical components.

- Skilled Workforce: The need for trained personnel for maintenance and repair of electric bus technology.

Emerging Opportunities in Electric Bus Market in Latin America

Emerging opportunities in the Latin American electric bus market lie in the expansion of charging-as-a-service models, the development of innovative battery-swapping solutions for rapid fleet turnaround, and the integration of electric buses with smart city initiatives. Untapped markets in smaller urban centers present significant growth potential as successful large-scale deployments demonstrate viability. Evolving consumer preferences for quieter and more environmentally friendly public transport further fuel demand. The development of localized manufacturing and assembly capabilities for electric buses and components also presents a promising avenue for economic growth and job creation within the region.

Growth Accelerators in the Electric Bus Market in Latin America Industry

The electric bus market in Latin America is being significantly accelerated by strategic partnerships between bus manufacturers and energy providers to develop integrated charging solutions, and by the ongoing refinement of battery technology that promises greater range and faster charging at reduced costs. Government commitments to ambitious fleet electrification targets, coupled with international funding and climate finance initiatives, are providing crucial financial impetus. Furthermore, pilot programs showcasing the economic and environmental benefits of electric buses are building confidence and paving the way for larger-scale deployments, acting as significant growth accelerators by de-risking investment for public and private entities.

Key Players Shaping the Electric Bus Market in Latin America Market

- Higer Bus

- Daimler AG

- Zhengzhou Yutong Bus Co Ltd

- King Long United Automotive Industry Co Ltd

- BYD Auto Co Ltd

- Advanced Power Vehicles

- Zhongtong Bus Holding Co Ltd

Notable Milestones in Electric Bus Market in Latin America Sector

- 2019: Launch of several pilot electric bus programs in major Brazilian cities, showcasing operational feasibility.

- 2020: Colombia announces ambitious targets for electrifying its bus fleets in major urban centers.

- 2021: BYD establishes a significant manufacturing presence in the region, boosting local production of electric buses.

- 2022: Mexico City accelerates its electric bus procurement plans, significantly expanding its zero-emission fleet.

- 2023: Chile receives international funding to support its national electric mobility strategy, including bus electrification.

- 2024: Advanced Power Vehicles secures a major contract for the supply of electric buses to a key Latin American city.

In-Depth Electric Bus Market in Latin America Market Outlook

The future outlook for the Electric Bus Market in Latin America is exceptionally promising, driven by sustained government commitment, continuous technological innovation, and a growing societal demand for sustainable urban mobility. The confluence of reduced operational costs, enhanced environmental performance, and an expanding charging infrastructure will continue to fuel market expansion. Strategic investments in battery manufacturing and local production capabilities are poised to further lower costs and increase accessibility. The market is expected to witness a significant shift towards fully electric fleets, with plug-in hybrids playing a transitional role. The increasing focus on smart city integration will unlock new opportunities for data-driven fleet management and optimized route planning, solidifying electric buses as a cornerstone of future urban transportation systems across the continent.

Electric Bus Market in Latin America Segmentation

-

1. Vehicle Type

- 1.1. Battery Electric

- 1.2. Plug-In Hybrid Electric

-

2. Consumer Type

- 2.1. Government

- 2.2. Fleet Operators

-

3. Geography

-

3.1. Latin America

- 3.1.1. Brazil

- 3.1.2. Columbia

- 3.1.3. Mexico

- 3.1.4. Chile

- 3.1.5. Rest of Latin America

-

3.1. Latin America

Electric Bus Market in Latin America Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Columbia

- 1.3. Mexico

- 1.4. Chile

- 1.5. Rest of Latin America

Electric Bus Market in Latin America Regional Market Share

Geographic Coverage of Electric Bus Market in Latin America

Electric Bus Market in Latin America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Increase in Automotive Sector

- 3.3. Market Restrains

- 3.3.1. Digitization of R&D Operations in Automotive Sector

- 3.4. Market Trends

- 3.4.1. New Contracts of E-Buses is Contributing the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Electric Bus Market in Latin America Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Battery Electric

- 5.1.2. Plug-In Hybrid Electric

- 5.2. Market Analysis, Insights and Forecast - by Consumer Type

- 5.2.1. Government

- 5.2.2. Fleet Operators

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Latin America

- 5.3.1.1. Brazil

- 5.3.1.2. Columbia

- 5.3.1.3. Mexico

- 5.3.1.4. Chile

- 5.3.1.5. Rest of Latin America

- 5.3.1. Latin America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Higer Bus

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Daimler AG*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Zhengzhou Yutong Bus Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 King Long United Automotive Industry Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BYD Auto Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Advanced Power Vehicles

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Zhongtong Bus Holding Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Higer Bus

List of Figures

- Figure 1: Electric Bus Market in Latin America Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Electric Bus Market in Latin America Share (%) by Company 2025

List of Tables

- Table 1: Electric Bus Market in Latin America Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 2: Electric Bus Market in Latin America Revenue undefined Forecast, by Consumer Type 2020 & 2033

- Table 3: Electric Bus Market in Latin America Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Electric Bus Market in Latin America Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Electric Bus Market in Latin America Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 6: Electric Bus Market in Latin America Revenue undefined Forecast, by Consumer Type 2020 & 2033

- Table 7: Electric Bus Market in Latin America Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Electric Bus Market in Latin America Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Brazil Electric Bus Market in Latin America Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Columbia Electric Bus Market in Latin America Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Electric Bus Market in Latin America Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Chile Electric Bus Market in Latin America Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Rest of Latin America Electric Bus Market in Latin America Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Bus Market in Latin America?

The projected CAGR is approximately 14%.

2. Which companies are prominent players in the Electric Bus Market in Latin America?

Key companies in the market include Higer Bus, Daimler AG*List Not Exhaustive, Zhengzhou Yutong Bus Co Ltd, King Long United Automotive Industry Co Ltd, BYD Auto Co Ltd, Advanced Power Vehicles, Zhongtong Bus Holding Co Ltd.

3. What are the main segments of the Electric Bus Market in Latin America?

The market segments include Vehicle Type, Consumer Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Exponential Increase in Automotive Sector.

6. What are the notable trends driving market growth?

New Contracts of E-Buses is Contributing the Market Growth.

7. Are there any restraints impacting market growth?

Digitization of R&D Operations in Automotive Sector.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electric Bus Market in Latin America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electric Bus Market in Latin America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electric Bus Market in Latin America?

To stay informed about further developments, trends, and reports in the Electric Bus Market in Latin America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence