Key Insights

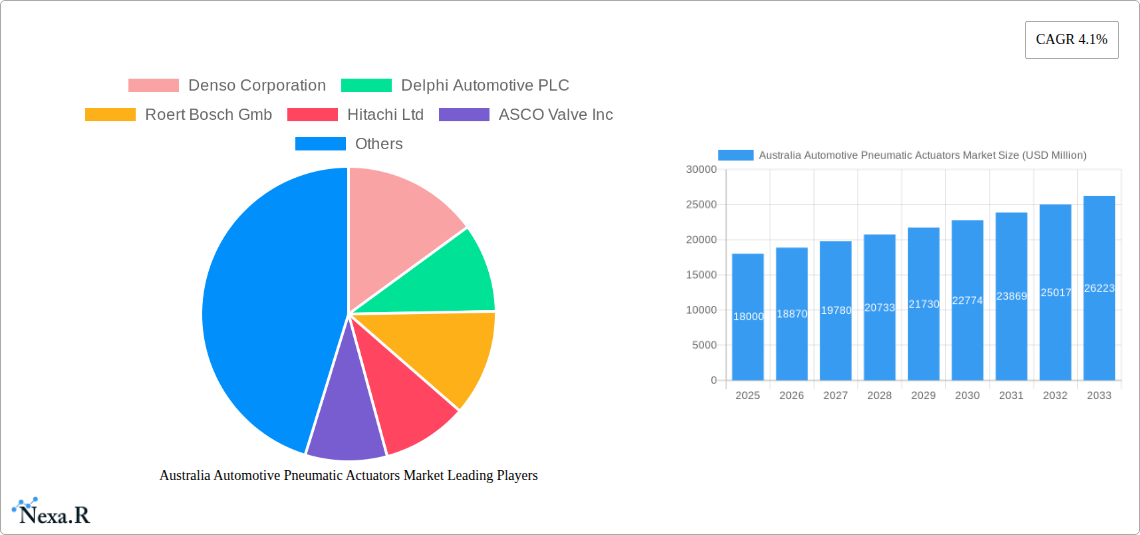

The Australian automotive pneumatic actuators market is poised for significant expansion, driven by the increasing adoption of advanced vehicle technologies and stringent emission regulations. With an estimated market size of $18 billion in 2025, the sector is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% through 2033. This growth is primarily fueled by the escalating demand for pneumatic actuators in critical automotive systems such as throttle control, fuel injection, and braking. As vehicles become more sophisticated, the need for precise and efficient actuation mechanisms becomes paramount, directly benefiting the pneumatic actuators segment. Furthermore, the ongoing push towards electrification, while seemingly counterintuitive, also presents opportunities, as pneumatic systems are often integrated into hybrid and even some electric vehicle architectures for auxiliary functions.

Australia Automotive Pneumatic Actuators Market Market Size (In Billion)

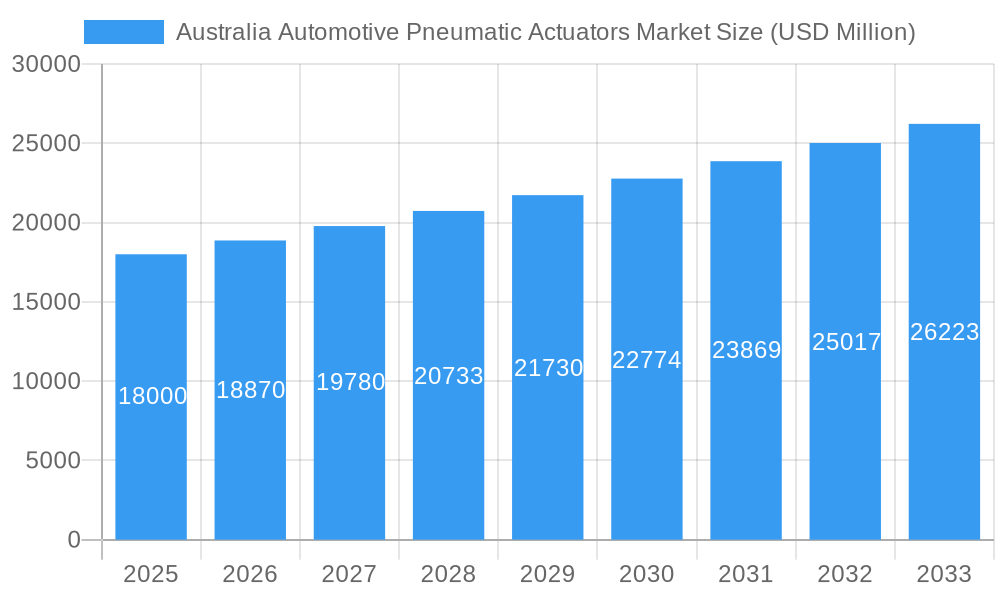

The market is characterized by strong competition among major global players like Denso Corporation, Robert Bosch GmbH, and Continental AG, who are investing in research and development to enhance actuator performance and integrate smart functionalities. Trends indicate a move towards more compact, lighter, and energy-efficient pneumatic actuators, alongside the integration of sensor technology for real-time monitoring and diagnostics. However, challenges such as the rising adoption of electro-mechanical actuators as alternatives in certain applications and the high initial investment costs for advanced pneumatic systems could potentially restrain rapid growth. Despite these headwinds, the inherent reliability and robust performance of pneumatic actuators in demanding automotive environments are expected to sustain their relevance and drive continued market expansion across passenger cars and commercial vehicles in Australia.

Australia Automotive Pneumatic Actuators Market Company Market Share

Here is a comprehensive, SEO-optimized report description for the Australia Automotive Pneumatic Actuators Market, designed for immediate use and maximum search engine visibility.

Report Title: Australia Automotive Pneumatic Actuators Market: Forecast to 2033 - Drivers, Opportunities, and Competitive Landscape

Report Description:

Dive deep into the burgeoning Australia automotive pneumatic actuators market with this indispensable industry report. Covering the period from 2019 to 2033, this analysis provides critical insights into market dynamics, growth trends, and the competitive landscape, focusing on pneumatic actuators for cars, vehicle pneumatic systems, and automotive air actuators. Explore the evolving adoption of throttle actuators, fuel injection actuators, and brake actuators in passenger cars and commercial vehicles. This report is essential for automotive manufacturers, component suppliers, technology developers, and investors seeking to capitalize on the expanding Australian automotive sector.

Key Findings:

Report Structure:

- Market Size: Estimated to reach USD XX billion in 2025, projecting a significant CAGR of XX% during the forecast period (2025-2033).

- Dominant Segments: Analysis of key growth drivers within throttle actuators and brake actuators for passenger cars.

- Key Players: In-depth profiles of industry leaders including Denso Corporation, Delphi Automotive PLC, Robert Bosch GmbH, Hitachi Ltd, ASCO Valve Inc, Continental AG, Sahrader Ducan Limited, Numatics Inc, CTS Corporation.

- Future Outlook: Strategic opportunities and growth accelerators shaping the future of the Australian automotive pneumatic actuators market.

Australia Automotive Pneumatic Actuators Market Market Dynamics & Structure

The Australia automotive pneumatic actuators market exhibits a moderate concentration, with leading players like Denso Corporation, Robert Bosch GmbH, and Continental AG holding significant shares. Technological innovation is primarily driven by the increasing demand for fuel efficiency, enhanced emission control, and improved vehicle safety features. Regulatory frameworks, particularly those related to emissions standards and vehicle safety, are indirectly influencing the adoption of advanced pneumatic actuator systems. Competitive product substitutes, such as electric actuators, present a growing challenge, necessitating continuous innovation in pneumatic technologies. End-user demographics are shifting towards a greater demand for reliable and cost-effective vehicle components. Mergers and acquisitions (M&A) activity is anticipated to increase as companies seek to consolidate their market position and expand their technological capabilities.

- Market Concentration: Moderate, with key global players dominating.

- Technological Innovation Drivers: Fuel efficiency, emission reduction, safety advancements.

- Regulatory Frameworks: Impact of emission standards and safety mandates.

- Competitive Substitutes: Growing competition from electric actuator technologies.

- End-User Demographics: Demand for performance, reliability, and cost-effectiveness.

- M&A Trends: Expected increase in consolidation for market access and technological synergy.

Australia Automotive Pneumatic Actuators Market Growth Trends & Insights

The Australia automotive pneumatic actuators market is on a robust growth trajectory, underpinned by increasing vehicle production and a gradual shift towards more sophisticated automotive systems. The market size is projected to expand significantly, driven by the integration of advanced pneumatic actuators in both new vehicle models and aftermarket applications. Adoption rates of these components are steadily rising, particularly in response to evolving vehicle performance expectations and stricter environmental regulations that necessitate precise control of engine and braking systems. Technological disruptions, such as the miniaturization of components and enhanced durability, are further stimulating market growth. Consumer behavior is also influencing trends, with a growing emphasis on vehicle reliability, performance, and safety, all of which are directly supported by efficient pneumatic actuation. The market is expected to witness a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033, with market penetration increasing as awareness and adoption of advanced automotive technologies become more widespread across the Australian automotive landscape. The transition towards cleaner energy sources is also indirectly influencing the demand for efficient engine management systems, where pneumatic actuators play a crucial role.

Dominant Regions, Countries, or Segments in Australia Automotive Pneumatic Actuators Market

Within the Australia automotive pneumatic actuators market, Passenger Cars consistently emerge as the dominant vehicle type driving demand. This dominance is fueled by several interconnected factors. Economically, the higher volume of passenger car sales compared to commercial vehicles directly translates into a larger addressable market for pneumatic actuators. Furthermore, increasing disposable incomes and a growing preference for technologically advanced and comfortable driving experiences in Australia encourage the adoption of features that rely on sophisticated actuator systems, such as advanced cruise control, electronic throttle control, and enhanced braking systems.

From an application perspective, Throttle Actuators are a significant growth segment, essential for modern internal combustion engines and increasingly for hybrid powertrains to optimize fuel delivery and performance. The continuous push for better fuel economy and lower emissions in passenger cars directly boosts the demand for precise throttle control, which pneumatic actuators facilitate. Brake Actuators also represent a substantial and growing segment, driven by the integration of anti-lock braking systems (ABS), electronic stability control (ESC), and other advanced driver-assistance systems (ADAS) that require rapid and precise actuation.

The leading geographical market within Australia is heavily influenced by major automotive manufacturing hubs and a high concentration of vehicle ownership. While specific regional data fluctuates, metropolitan areas and states with significant automotive assembly plants and a high density of vehicle registrations typically exhibit the strongest demand. The economic policies supporting local manufacturing and incentives for vehicle upgrades also play a pivotal role in segment dominance. The market share of Passenger Cars in the pneumatic actuator segment is estimated to be approximately XX% in 2025, with a projected growth potential of XX% by 2033. The Throttle Actuators segment is expected to capture around XX% of the market share in 2025, with a forecast CAGR of XX% during the study period.

- Dominant Vehicle Type: Passenger Cars.

- High sales volume and increasing demand for advanced features.

- Integration of sophisticated engine and braking systems.

- Dominant Application Type: Throttle Actuators and Brake Actuators.

- Essential for fuel efficiency and emissions control in throttle systems.

- Crucial for advanced safety features like ABS and ESC in brake systems.

- Geographical Influence: Major automotive hubs and areas with high vehicle ownership.

- Economic Factors: Supportive policies for manufacturing and vehicle upgrades.

Australia Automotive Pneumatic Actuators Market Product Landscape

The Australia automotive pneumatic actuators market is characterized by a range of innovative and high-performance products. Manufacturers are focusing on developing compact, lightweight, and highly durable pneumatic actuators that can withstand harsh automotive environments. Key product innovations include enhanced sealing technologies for improved reliability, faster response times for critical applications like braking and throttle control, and improved energy efficiency. Applications span across vital vehicle systems, from precise engine management in throttle actuators to robust actuation in brake actuators and efficient fuel delivery in fuel injection actuators. Performance metrics such as actuation speed, force output, precision, and lifespan are continuously being optimized. The unique selling propositions of leading products often revolve around their superior reliability, cost-effectiveness, and seamless integration with existing vehicle electronic control units (ECUs). Technological advancements are also geared towards developing actuators that are compatible with a wider range of vehicle architectures, including those incorporating hybrid and advanced combustion technologies.

Key Drivers, Barriers & Challenges in Australia Automotive Pneumatic Actuators Market

Key Drivers:

- Increasing Demand for Fuel Efficiency and Emission Control: Stringent environmental regulations globally and in Australia are pushing manufacturers to adopt technologies that optimize engine performance, directly boosting the need for precise pneumatic actuators.

- Advancements in Vehicle Safety Systems: The growing integration of ABS, ESC, and other ADAS necessitates faster and more reliable actuation, favoring pneumatic solutions for their responsiveness and robustness.

- Growth in Passenger Car Production and Sales: The sustained demand for passenger vehicles in Australia is a fundamental driver for the automotive components market.

- Cost-Effectiveness: Pneumatic actuators often offer a competitive advantage in terms of cost compared to some alternative actuation technologies for certain applications.

Key Barriers & Challenges:

- Competition from Electric Actuators: The ongoing development and adoption of electric actuators present a significant alternative, offering potentially higher precision and integration capabilities in some contexts.

- Supply Chain Volatility: Global supply chain disruptions can impact the availability and cost of raw materials and components required for pneumatic actuator manufacturing.

- Technological Obsolescence: The rapid pace of automotive technology development requires continuous investment in R&D to keep pneumatic solutions competitive.

- Complexity of Integration: Integrating pneumatic systems into increasingly complex vehicle electronic architectures can pose engineering challenges.

- Infrastructure Requirements: While less of a barrier for actuators themselves, the broader ecosystem for pneumatic systems, particularly in heavy-duty applications, may require specific maintenance infrastructure.

Emerging Opportunities in Australia Automotive Pneumatic Actuators Market

Emerging opportunities in the Australia automotive pneumatic actuators market lie in the development of next-generation actuators for hybrid and electric vehicle powertrains, where pneumatic systems can still play a role in auxiliary functions. The aftermarket segment also presents untapped potential, particularly for performance upgrades and retrofitting older vehicles with more efficient actuation systems. Furthermore, exploring applications beyond traditional engine and braking systems, such as in advanced suspension or active aerodynamics, could open new avenues for growth. The increasing focus on sustainability within the automotive industry also creates opportunities for developing pneumatic actuators made from recycled or more environmentally friendly materials.

Growth Accelerators in the Australia Automotive Pneumatic Actuators Market Industry

Several catalysts are accelerating the long-term growth of the Australia automotive pneumatic actuators market. Technological breakthroughs in materials science are leading to the development of lighter, stronger, and more durable actuators, enhancing their performance and lifespan. Strategic partnerships between pneumatic actuator manufacturers and automotive OEMs are crucial for co-developing customized solutions that meet specific vehicle platform requirements. Market expansion strategies, including the penetration into emerging vehicle segments and the development of specialized actuators for niche commercial vehicle applications, will also drive sustained growth. The increasing emphasis on autonomous driving technologies may also indirectly benefit pneumatic systems that require precise and rapid control of various vehicle functions.

Key Players Shaping the Australia Automotive Pneumatic Actuators Market Market

- Denso Corporation

- Delphi Automotive PLC

- Robert Bosch GmbH

- Hitachi Ltd

- ASCO Valve Inc

- Continental AG

- Sahrader Ducan Limited

- Numatics Inc

- CTS Corporation

Notable Milestones in Australia Automotive Pneumatic Actuators Market Sector

- 2019: Increased adoption of advanced throttle control systems in new passenger car models, boosting demand for pneumatic throttle actuators.

- 2020: Focus on enhanced emission control technologies leads to further development of precise pneumatic actuators for engine management.

- 2021: Growing emphasis on vehicle safety features like ABS and ESC drives innovation in pneumatic brake actuators.

- 2022: Supply chain challenges begin to impact component availability, prompting manufacturers to diversify sourcing.

- 2023: Innovations in miniaturization and efficiency of pneumatic actuators gain traction in the market.

- 2024: Initial exploration of pneumatic actuator applications in hybrid vehicle powertrains gains momentum.

In-Depth Australia Automotive Pneumatic Actuators Market Market Outlook

The future outlook for the Australia automotive pneumatic actuators market is characterized by continued innovation and strategic adaptation. Growth accelerators such as advancements in material science for lighter and more durable components, coupled with strategic partnerships between component suppliers and automotive manufacturers, will pave the way for sustained expansion. The market is poised to benefit from the ongoing integration of pneumatic systems into hybrid powertrains and the potential for new applications in areas like active aerodynamics. A proactive approach to addressing supply chain vulnerabilities and a commitment to research and development will be critical for stakeholders to capitalize on the evolving demands of the Australian automotive sector and maintain a competitive edge.

Australia Automotive Pneumatic Actuators Market Segmentation

-

1. Application Type

- 1.1. Throttle Actuators

- 1.2. Fuel Injection Actuators

- 1.3. Brake Actuators

- 1.4. Others

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicle

Australia Automotive Pneumatic Actuators Market Segmentation By Geography

- 1. Australia

Australia Automotive Pneumatic Actuators Market Regional Market Share

Geographic Coverage of Australia Automotive Pneumatic Actuators Market

Australia Automotive Pneumatic Actuators Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Luxury Vehicle Sale Across the Country

- 3.3. Market Restrains

- 3.3.1. High Costs Associated With the Component

- 3.4. Market Trends

- 3.4.1. Growing Demand for Throttle Actuators

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Automotive Pneumatic Actuators Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Throttle Actuators

- 5.1.2. Fuel Injection Actuators

- 5.1.3. Brake Actuators

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicle

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Denso Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Delphi Automotive PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Roert Bosch Gmb

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hitachi Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ASCO Valve Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Continental AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sahrader Ducan Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Numatics Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CTS Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Denso Corporation

List of Figures

- Figure 1: Australia Automotive Pneumatic Actuators Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Australia Automotive Pneumatic Actuators Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Automotive Pneumatic Actuators Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 2: Australia Automotive Pneumatic Actuators Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 3: Australia Automotive Pneumatic Actuators Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Australia Automotive Pneumatic Actuators Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 5: Australia Automotive Pneumatic Actuators Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 6: Australia Automotive Pneumatic Actuators Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Automotive Pneumatic Actuators Market?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the Australia Automotive Pneumatic Actuators Market?

Key companies in the market include Denso Corporation, Delphi Automotive PLC, Roert Bosch Gmb, Hitachi Ltd, ASCO Valve Inc, Continental AG, Sahrader Ducan Limited, Numatics Inc, CTS Corporation.

3. What are the main segments of the Australia Automotive Pneumatic Actuators Market?

The market segments include Application Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rise in Luxury Vehicle Sale Across the Country.

6. What are the notable trends driving market growth?

Growing Demand for Throttle Actuators.

7. Are there any restraints impacting market growth?

High Costs Associated With the Component.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Automotive Pneumatic Actuators Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Automotive Pneumatic Actuators Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Automotive Pneumatic Actuators Market?

To stay informed about further developments, trends, and reports in the Australia Automotive Pneumatic Actuators Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence