Key Insights

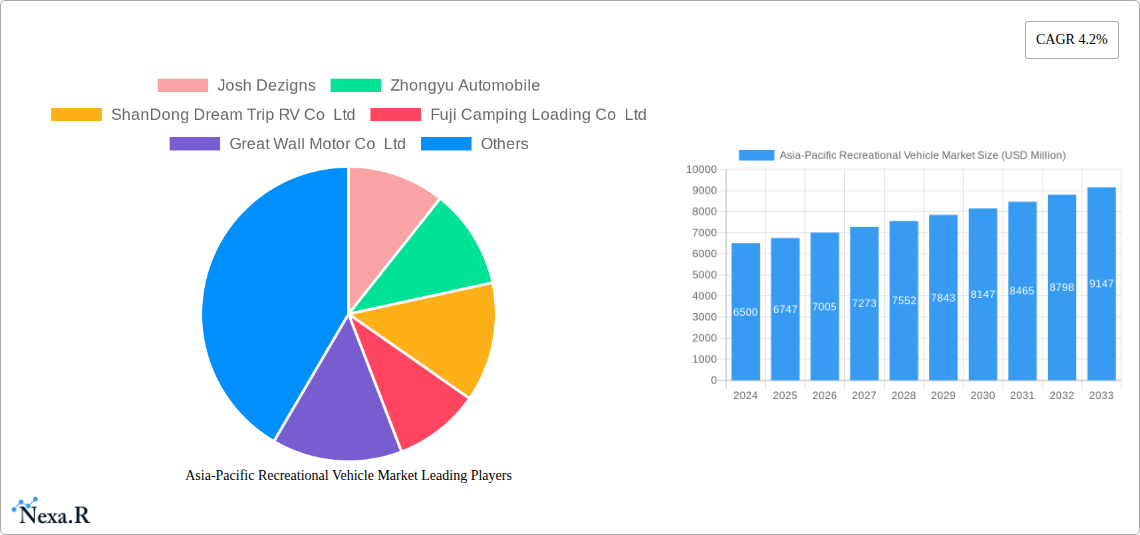

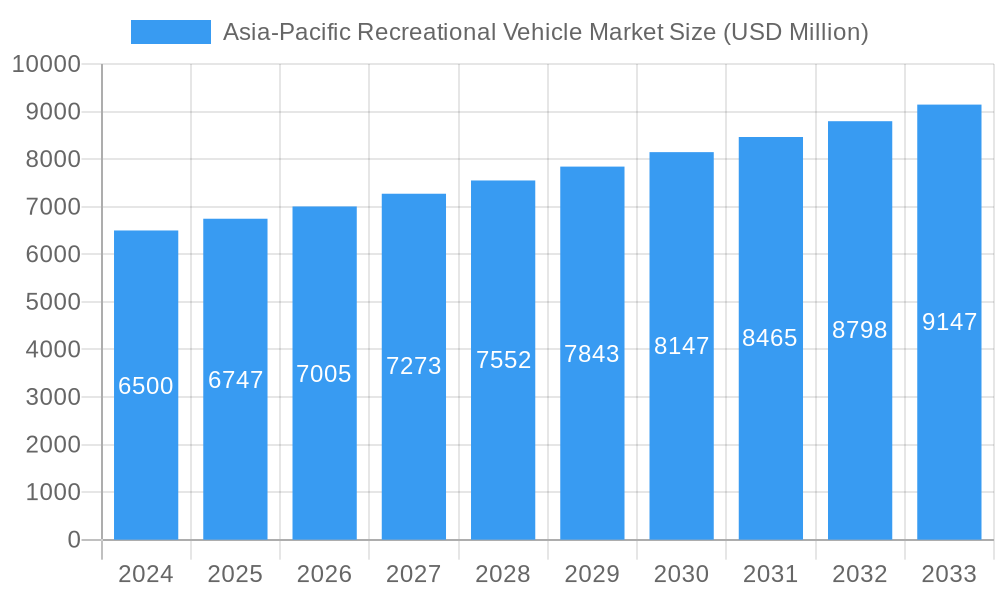

The Asia-Pacific Recreational Vehicle (RV) Market is poised for robust expansion, driven by a confluence of evolving consumer lifestyles, increasing disposable incomes, and a growing desire for nature-based and personalized travel experiences. With a market size of approximately USD 6.5 billion in 2024, the region is witnessing a steady upward trajectory. This growth is underpinned by a Compound Annual Growth Rate (CAGR) of 3.8%, projecting a sustained and healthy expansion throughout the forecast period of 2025-2033. Key drivers fueling this surge include the burgeoning middle class in countries like China and India, who are increasingly seeking leisure activities that offer both comfort and adventure. Furthermore, a growing appreciation for outdoor tourism and a shift away from traditional vacation models are encouraging greater adoption of RVs for domestic exploration. The segment of Towable RVs is expected to lead, owing to their affordability and versatility, while Motorhomes cater to the premium segment.

Asia-Pacific Recreational Vehicle Market Market Size (In Billion)

Several factors are contributing to the market's positive outlook. The rising prominence of 'glamping' and adventure tourism, coupled with government initiatives promoting tourism infrastructure, are creating a more conducive environment for RV ownership and rental services. Fleet owners, particularly in the tourism sector, are recognizing the potential for RVs to offer unique travel packages, thus contributing significantly to market demand. While the market enjoys strong tailwinds, potential restraints such as the initial cost of RVs and the availability of adequate parking and maintenance facilities in some developing economies need to be strategically addressed by industry players. However, with a strong presence of key companies and a diverse range of end-user segments including direct buyers and other niche users, the Asia-Pacific RV market is well-positioned for continued growth and innovation.

Asia-Pacific Recreational Vehicle Market Company Market Share

This in-depth report provides a definitive analysis of the Asia-Pacific Recreational Vehicle (RV) Market, exploring its dynamic growth, key segments, dominant regions, and future trajectory. Spanning from 2019 to 2033, with a base year of 2025, this research leverages comprehensive data to offer actionable insights for industry stakeholders. The report delves into both the parent Asia-Pacific Recreational Vehicle Market and its crucial child markets, providing a granular view of opportunities within Towable RVs and Motorhomes, and catering to Fleet Owners, Direct Buyers, and Other End Users.

Asia-Pacific Recreational Vehicle Market Market Dynamics & Structure

The Asia-Pacific Recreational Vehicle Market is characterized by a XX% market concentration, with leading players like Thor Industries Inc., Great Wall Motor Co., Ltd., and SAIC Motor vying for dominance. Technological innovation is a significant driver, with advancements in lightweight materials, smart RV features, and sustainable power solutions bolstering market appeal. Regulatory frameworks, while evolving, present a mixed landscape across the region, with some nations actively promoting RV tourism and others imposing restrictions. Competitive product substitutes, including vacation rentals and traditional hotels, pose a constant challenge, necessitating continuous product differentiation. End-user demographics are shifting, with a growing middle class and an increasing interest in outdoor leisure activities fueling demand. Mergers and acquisitions (M&A) are a notable trend, with XX M&A deals observed during the historical period (2019-2024), indicating industry consolidation and strategic expansion.

- Market Concentration: XX% dominated by top players.

- Technological Innovation Drivers: Lightweight materials, smart features, sustainable power.

- Regulatory Frameworks: Varied across nations, impacting market access and growth.

- Competitive Product Substitutes: Vacation rentals, hotels, impacting RV adoption.

- End-User Demographics: Growing middle class, increasing interest in outdoor leisure.

- M&A Trends: XX deals in historical period, indicating consolidation and expansion.

Asia-Pacific Recreational Vehicle Market Growth Trends & Insights

The Asia-Pacific Recreational Vehicle Market is poised for substantial growth, projected to expand from XX billion units in the base year 2025 to XX billion units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). The historical period (2019-2024) witnessed a steady increase in adoption rates, driven by a burgeoning middle class with increasing disposable incomes and a growing appetite for experiential travel. This shift in consumer behavior, influenced by social media trends and a desire for freedom and flexibility, is a key catalyst for market penetration. Technological disruptions, such as the integration of IoT devices for enhanced connectivity and convenience within RVs, are further enhancing their appeal. The market penetration currently stands at XX%, with significant room for expansion as awareness and infrastructure development progress. The demand for Towable RVs is expected to maintain a strong CAGR of XX%, while Motorhomes are projected to grow at XX%. Direct Buyers represent the largest end-user segment, accounting for XX% of the market in 2025, with Fleet Owners showing a promising CAGR of XX%.

Dominant Regions, Countries, or Segments in Asia-Pacific Recreational Vehicle Market

The Asia-Pacific Recreational Vehicle Market is experiencing robust growth, with Towable RVs emerging as the dominant segment, driven by their affordability and versatility. This segment is projected to capture XX% of the market share by 2033. The primary growth engine for RVs within the Asia-Pacific region is the East Asia sub-region, contributing XX% to the overall market in 2025. Key countries like China and Japan are at the forefront of this expansion. China's burgeoning middle class, coupled with government initiatives to promote domestic tourism and develop RV infrastructure, is a significant economic policy driver. Japan's established camping culture and increasing demand for weekend getaways further bolster the RV market.

- Dominant Segment: Towable RVs (projected XX% market share by 2033).

- Key Drivers: Affordability, versatility, ease of towing.

- Market Share (2025): XX%

- Dominant Region: East Asia (XX% market share in 2025).

- Key Countries: China, Japan.

- Dominance Factors in China:

- Growing disposable incomes and middle class.

- Government support for tourism and infrastructure development.

- Increasing consumer interest in outdoor leisure.

- Dominance Factors in Japan:

- Strong existing camping culture.

- Demand for weekend and short-term travel.

- Technological advancements in RV manufacturing.

- Dominant End-User Type: Direct Buyers (XX% market share in 2025).

- Growth Potential for Fleet Owners: XX% CAGR.

Asia-Pacific Recreational Vehicle Market Product Landscape

The Asia-Pacific Recreational Vehicle Market is witnessing a surge in product innovations aimed at enhancing user experience and functionality. Manufacturers are increasingly focusing on lightweight designs, fuel-efficient engines, and advanced safety features for both Towable RVs and Motorhomes. Smart technology integration, including voice-activated controls, remote monitoring systems, and enhanced connectivity, is a significant unique selling proposition. Applications range from family vacations and adventure travel to mobile workspaces and glamping experiences. Performance metrics are being optimized for durability, comfort, and off-grid living capabilities, meeting the diverse needs of Direct Buyers and emerging Fleet Owners.

Key Drivers, Barriers & Challenges in Asia-Pacific Recreational Vehicle Market

Key Drivers: The Asia-Pacific RV market is propelled by a growing middle class with increased disposable income, a rising trend in experiential and adventure tourism, and supportive government policies promoting domestic travel and infrastructure development. Technological advancements in RV manufacturing, offering enhanced comfort and convenience, also significantly drive adoption.

Barriers & Challenges: Significant challenges include the underdeveloped RV infrastructure (campsites, service centers) in many parts of the region, high initial purchase costs for consumers, and complex import/export regulations. Supply chain disruptions and the need for specialized maintenance expertise also present hurdles. XX% of potential buyers cite cost as a primary barrier.

Emerging Opportunities in Asia-Pacific Recreational Vehicle Market

Emerging opportunities lie in the development of eco-friendly and solar-powered RVs to cater to growing environmental consciousness. The untapped potential in Southeast Asian countries, with their diverse landscapes and burgeoning tourism sectors, presents a significant avenue for market expansion. Innovative business models, such as RV rental platforms and subscription services, are gaining traction, making RV ownership more accessible. Furthermore, the integration of advanced connectivity features and smart home technology within RVs is opening up new application possibilities for remote workers and digital nomads.

Growth Accelerators in the Asia-Pacific Recreational Vehicle Market Industry

Catalysts for long-term growth in the Asia-Pacific RV industry include strategic partnerships between RV manufacturers and tourism operators, fostering integrated travel experiences. Technological breakthroughs in battery storage and sustainable energy solutions will enhance the appeal of off-grid adventures. Government incentives, such as tax rebates for RV purchases and investment in public campgrounds, are crucial market expansion strategies. Furthermore, increasing media coverage and influencer marketing highlighting the benefits of RV travel will continue to drive consumer interest and adoption.

Key Players Shaping the Asia-Pacific Recreational Vehicle Market Market

- Josh Dezigns

- Zhongyu Automobile

- ShanDong Dream Trip RV Co Ltd

- Fuji Camping Loading Co Ltd

- Great Wall Motor Co Ltd

- Thor Industries Inc

- Henan Wuzhou Line Special Vehicle Co Ltd

- Ojes Automobile

- SAIC Motor

- Beijing North Rv Co Ltd

Notable Milestones in Asia-Pacific Recreational Vehicle Market Sector

- 2021 October: ShanDong Dream Trip RV Co Ltd launches a new line of lightweight, compact RVs designed for urban dwellers.

- 2022 March: Thor Industries Inc. expands its presence in the Asia-Pacific market through a strategic acquisition of a regional component supplier.

- 2022 August: Great Wall Motor Co Ltd unveils its first concept electric RV, signaling a commitment to sustainable mobility.

- 2023 January: China's Ministry of Culture and Tourism announces plans to invest heavily in RV-friendly campgrounds and infrastructure.

- 2023 May: Fuji Camping Loading Co Ltd introduces an innovative modular RV design, allowing for customizable interior layouts.

- 2024 February: SAIC Motor partners with a leading technology firm to integrate advanced AI-powered navigation and entertainment systems into its RV offerings.

In-Depth Asia-Pacific Recreational Vehicle Market Market Outlook

The future of the Asia-Pacific Recreational Vehicle Market is exceptionally promising, driven by a confluence of factors including sustained economic growth, evolving lifestyle preferences, and proactive government support. Key growth accelerators like technological innovation in sustainable energy and smart features, coupled with strategic market expansion initiatives and burgeoning tourism sectors in emerging economies, will solidify the region's position as a major player. The outlook points towards a significant increase in market penetration, with RVs becoming an increasingly popular choice for leisure and travel, presenting substantial opportunities for manufacturers, suppliers, and service providers.

Asia-Pacific Recreational Vehicle Market Segmentation

-

1. Type

- 1.1. Towable RVs

- 1.2. Motorhomes

-

2. End-user Type

- 2.1. Fleet Owners

- 2.2. Direct Buyers

- 2.3. Other End Users

Asia-Pacific Recreational Vehicle Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Recreational Vehicle Market Regional Market Share

Geographic Coverage of Asia-Pacific Recreational Vehicle Market

Asia-Pacific Recreational Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing EV Sales is Driving the Market Growth

- 3.3. Market Restrains

- 3.3.1. Lack of Proper Charging Infrastructure is a Chgallenge

- 3.4. Market Trends

- 3.4.1. RV Rental will hinder the growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Recreational Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Towable RVs

- 5.1.2. Motorhomes

- 5.2. Market Analysis, Insights and Forecast - by End-user Type

- 5.2.1. Fleet Owners

- 5.2.2. Direct Buyers

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Josh Dezigns

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Zhongyu Automobile

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ShanDong Dream Trip RV Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fuji Camping Loading Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Great Wall Motor Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Thor Industries Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Henan Wuzhou Line Special Vehicle Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ojes Automobile

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SAIC Motor

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Beijing North Rv Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Josh Dezigns

List of Figures

- Figure 1: Asia-Pacific Recreational Vehicle Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Recreational Vehicle Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Recreational Vehicle Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Recreational Vehicle Market Revenue undefined Forecast, by End-user Type 2020 & 2033

- Table 3: Asia-Pacific Recreational Vehicle Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific Recreational Vehicle Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Asia-Pacific Recreational Vehicle Market Revenue undefined Forecast, by End-user Type 2020 & 2033

- Table 6: Asia-Pacific Recreational Vehicle Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: China Asia-Pacific Recreational Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia-Pacific Recreational Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia-Pacific Recreational Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: India Asia-Pacific Recreational Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia-Pacific Recreational Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia-Pacific Recreational Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia-Pacific Recreational Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia-Pacific Recreational Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia-Pacific Recreational Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia-Pacific Recreational Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia-Pacific Recreational Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia-Pacific Recreational Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Recreational Vehicle Market?

The projected CAGR is approximately 3.8%.

2. Which companies are prominent players in the Asia-Pacific Recreational Vehicle Market?

Key companies in the market include Josh Dezigns, Zhongyu Automobile, ShanDong Dream Trip RV Co Ltd, Fuji Camping Loading Co Ltd, Great Wall Motor Co Ltd, Thor Industries Inc, Henan Wuzhou Line Special Vehicle Co Ltd, Ojes Automobile, SAIC Motor, Beijing North Rv Co Ltd.

3. What are the main segments of the Asia-Pacific Recreational Vehicle Market?

The market segments include Type, End-user Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing EV Sales is Driving the Market Growth.

6. What are the notable trends driving market growth?

RV Rental will hinder the growth of the Market.

7. Are there any restraints impacting market growth?

Lack of Proper Charging Infrastructure is a Chgallenge.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Recreational Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Recreational Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Recreational Vehicle Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Recreational Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence