Key Insights

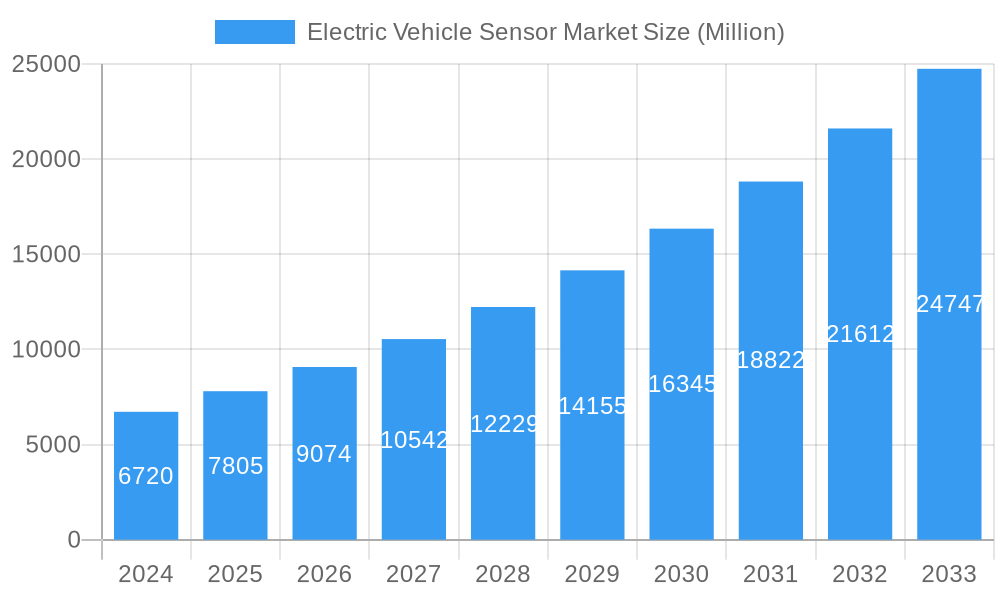

The Electric Vehicle (EV) sensor market is experiencing robust expansion, driven by the accelerating global transition towards sustainable mobility. With a market size of approximately USD 6.72 billion in 2024, the sector is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 16.2% during the forecast period of 2025-2033. This upward trajectory is fueled by escalating government regulations promoting EV adoption, declining battery costs, and increasing consumer awareness regarding environmental concerns. Key drivers include the fundamental need for sophisticated sensor technologies to manage the complex operational demands of EVs, such as battery management, powertrain control, and enhanced safety features. The burgeoning demand for advanced driver-assistance systems (ADAS) and autonomous driving capabilities within electric vehicles further propulates this growth, necessitating a greater array of high-precision sensors.

Electric Vehicle Sensor Market Market Size (In Billion)

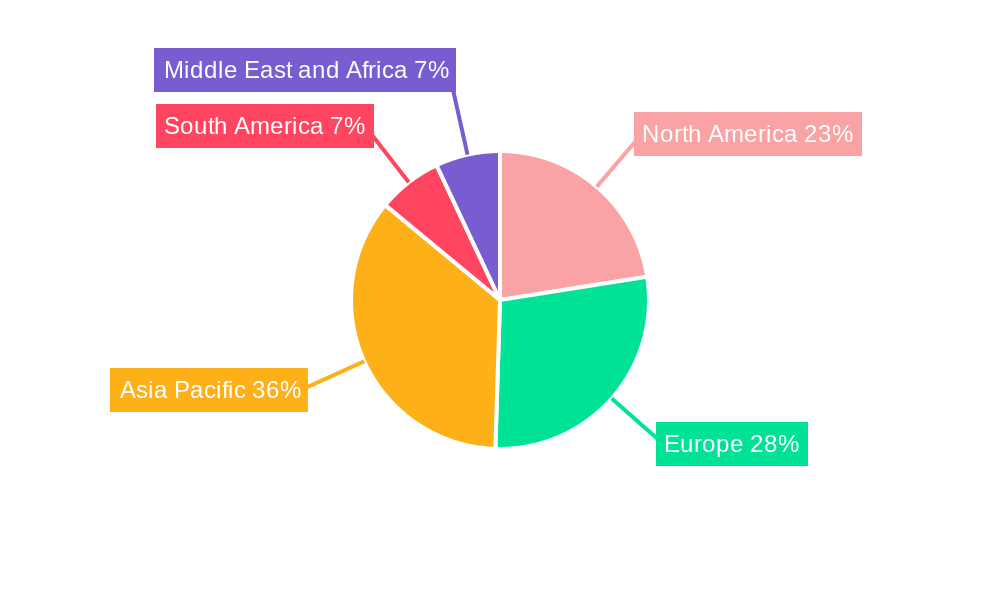

The market is segmented across various sensor types, including current, temperature, position, and pressure sensors, each playing a critical role in optimizing EV performance and efficiency. Passenger cars represent a dominant segment, but the commercial vehicle sector is rapidly catching up as electric trucks and buses become more prevalent. The propulsion type segment is characterized by strong growth in Battery Electric Vehicles (BEVs), followed by Plug-in Hybrid Electric Vehicles (PHEVs) and Fuel Cell Electric Vehicles (FCEVs). Geographically, the Asia Pacific region, led by China, is a significant market due to its manufacturing prowess and strong government support for EVs. North America and Europe also exhibit substantial growth, driven by ambitious electrification targets and supportive policies. Despite the promising outlook, challenges such as the high cost of advanced sensors and the need for standardization can pose restraints. However, ongoing innovation in sensor technology, miniaturization, and cost reduction is expected to mitigate these challenges, ensuring continued market expansion.

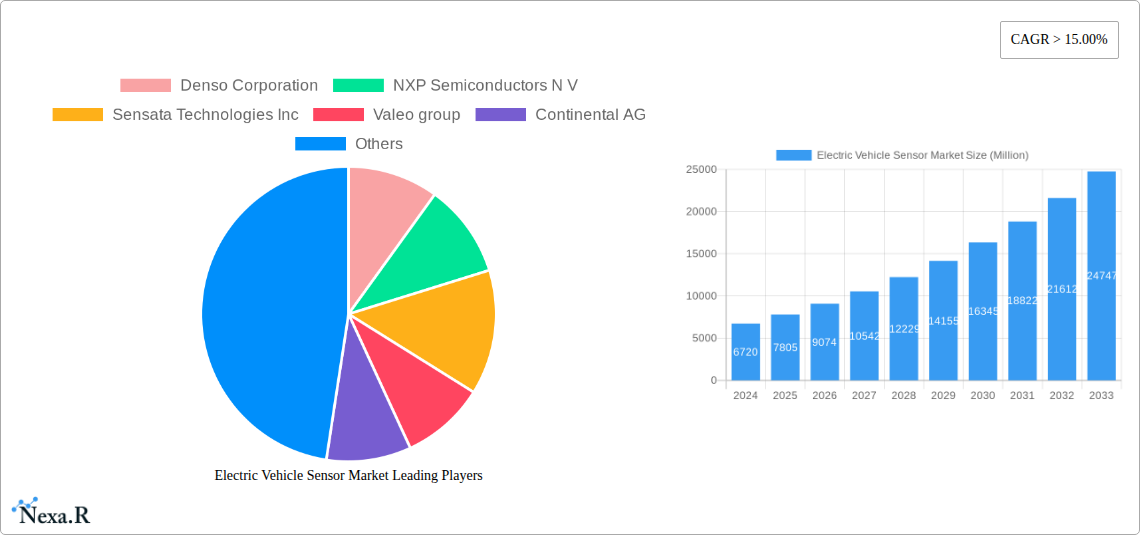

Electric Vehicle Sensor Market Company Market Share

This in-depth report provides a definitive analysis of the global Electric Vehicle (EV) Sensor Market, offering critical insights into its intricate dynamics, growth trajectories, and future potential. Covering the period from 2019 to 2033, with a base year of 2025, this research equips industry stakeholders with the data and strategic intelligence necessary to navigate this rapidly evolving landscape.

The EV Sensor Market is poised for substantial expansion, driven by the accelerating adoption of electric mobility worldwide. This report delves into the essential components that power the modern EV, from battery management to autonomous driving systems, providing a granular view of sensor types, including Current Sensors, Temperature Sensors, Position Sensors, Pressure Sensors, and Other Sensor Types. We also segment the market by Vehicle Type, encompassing Passenger Cars and Commercial Vehicles, and by Propulsion Type, including Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Fuel Cell Electric Vehicles (FCEVs).

The report offers a forward-looking perspective, forecasting the market's trajectory through 2033. It meticulously examines the parent market (e.g., the broader automotive sensor market) and the burgeoning child market (the specialized EV sensor segment), providing a holistic understanding of market interdependencies and growth drivers.

Electric Vehicle Sensor Market Market Dynamics & Structure

The Electric Vehicle Sensor Market exhibits a dynamic and increasingly consolidated structure, shaped by rapid technological advancements and a robust regulatory push towards electrification. Market concentration is influenced by the strategic investments and R&D prowess of key players like Denso Corporation, NXP Semiconductors N.V., Sensata Technologies Inc., Valeo Group, Continental AG, Amphenol Corporation, Renesas Electronics Corporation, Robert Bosch GmbH, and ZF Friedrichshafen AG. Technological innovation is a primary driver, with continuous efforts focused on miniaturization, enhanced accuracy, improved reliability, and reduced cost for sensors critical to EV performance and safety. Regulatory frameworks, including stringent emissions standards and safety mandates, are compelling automakers to integrate more sophisticated sensor suites, thereby fueling market demand. Competitive product substitutes, while present in more traditional automotive sectors, are largely being outpaced by the specialized and advanced sensor requirements of electric powertrains and advanced driver-assistance systems (ADAS). End-user demographics are shifting towards environmentally conscious consumers and fleet operators seeking operational efficiency and reduced running costs. Mergers and acquisitions (M&A) trends are notable as larger automotive suppliers seek to expand their EV sensor portfolios and secure market share. For instance, the past few years have seen a series of strategic partnerships and acquisitions aimed at bolstering capabilities in areas like battery management sensors and autonomous driving sensor technologies. Innovation barriers include the high cost of developing novel sensor technologies, the complexity of integration into vehicle platforms, and the need for extensive validation and testing to meet automotive-grade reliability standards.

Electric Vehicle Sensor Market Growth Trends & Insights

The Electric Vehicle Sensor Market is experiencing an unprecedented growth surge, projected to expand significantly over the forecast period. The market size evolution is directly correlated with the exponential rise in EV production volumes globally. As automakers commit to ambitious electrification targets, the demand for an array of sophisticated sensors – from those managing battery health to those enabling advanced driver-assistance systems – escalates. Adoption rates for EVs, and consequently for their integrated sensor technologies, are being accelerated by government incentives, declining battery costs, and a growing consumer awareness of environmental sustainability. Technological disruptions are at the forefront of this market's expansion. Innovations in sensor materials, signal processing, and data analytics are enabling more precise and reliable measurements, crucial for optimizing EV performance, safety, and driving range. For example, advancements in current sensors are crucial for efficient battery power management, while enhanced temperature sensors are vital for thermal runaway prevention. The shift towards autonomous and semi-autonomous driving capabilities in EVs further necessitates a proliferation of advanced sensing technologies, including lidar, radar, and sophisticated camera systems, many of which are becoming increasingly integrated with existing powertrain sensors. Consumer behavior shifts are playing a pivotal role, with a growing preference for vehicles offering enhanced safety features, superior performance, and a more connected driving experience, all of which are heavily reliant on advanced sensor integration. The market penetration of EVs is a key metric, and as it continues to climb, the demand for specialized EV sensors will mirror this ascent. The compound annual growth rate (CAGR) for the EV Sensor Market is robust, driven by these intertwined factors, indicating a sustained period of high growth and significant market opportunities.

Dominant Regions, Countries, or Segments in Electric Vehicle Sensor Market

The Electric Vehicle Sensor Market exhibits distinct patterns of dominance across various geographical regions, countries, and specific product segments, driven by a confluence of economic policies, infrastructure development, and consumer adoption trends. Globally, Asia Pacific stands out as a dominant region, with China leading the charge in both EV production and sensor market growth. This dominance is fueled by robust government subsidies for EV adoption, aggressive manufacturing targets, and a rapidly expanding domestic automotive industry investing heavily in electrification. The region's expansive manufacturing base for automotive components also provides a strong foundation for sensor production and innovation.

Within the Sensor Type segmentation, Current Sensors and Temperature Sensors are currently exhibiting significant growth and market share, directly attributable to their critical role in Battery Electric Vehicle (BEV) battery management systems. The precise monitoring of current flow and temperature is paramount for optimizing battery performance, ensuring longevity, and preventing thermal events. As battery technology advances and charging speeds increase, the demand for highly accurate and reliable current sensors and temperature sensors is expected to continue its upward trajectory. Position Sensors also play a crucial role in EV powertrain control and safety systems, contributing to market growth.

In terms of Vehicle Type, Passenger Cars currently represent the largest market segment. This is due to the widespread consumer appeal and increasing affordability of electric passenger vehicles. However, the Commercial Vehicle segment is poised for substantial growth as fleets transition to electric alternatives driven by lower operating costs and sustainability mandates.

Analyzing Propulsion Type, Battery Electric Vehicles (BEVs) unequivocally dominate the market. The sheer volume of BEV production and sales worldwide makes them the primary driver of demand for EV sensors. While Plug-in Hybrid Electric Vehicles (PHEVs) contribute to the market, their growth is relatively slower compared to pure electric counterparts. Fuel Cell Electric Vehicles (FCEVs), while holding future potential, currently represent a niche segment with a smaller market share.

Key drivers of dominance in the Asia Pacific region include:

- Government Policies: Aggressive targets for EV production and sales, coupled with consumer incentives.

- Infrastructure Development: Rapid expansion of charging infrastructure.

- Manufacturing Ecosystem: A well-established automotive supply chain that readily adapts to EV component production.

- Technological Advancement: Significant investment in R&D by local and international players.

The dominance of current sensors and temperature sensors is underpinned by:

- Battery Health Management: Essential for maximizing battery lifespan and performance.

- Safety Compliance: Critical for preventing overheating and ensuring safe operation.

- Range Optimization: Accurate sensor data contributes to efficient energy usage.

The leadership of Passenger Cars is driven by:

- Consumer Demand: Growing preference for eco-friendly and technologically advanced personal transport.

- Model Availability: A wider range of electric passenger car models across various price points.

Electric Vehicle Sensor Market Product Landscape

The product landscape of the Electric Vehicle Sensor Market is characterized by continuous innovation aimed at enhancing performance, reliability, and cost-effectiveness. Key advancements focus on miniaturized and integrated sensor solutions that reduce vehicle weight and complexity. For current sensors, higher precision in measuring instantaneous current flow is crucial for sophisticated battery management systems. Temperature sensors are evolving to offer faster response times and wider operating ranges for critical components like battery packs, electric motors, and power electronics. Position sensors are becoming more robust and accurate, supporting advanced functionalities in steering, braking, and powertrain control. The trend towards "sensor fusion" is prominent, where data from multiple sensor types is combined to provide a more comprehensive understanding of vehicle state and environment, enabling features like advanced ADAS and predictive diagnostics. Unique selling propositions often lie in the sensor's ability to operate reliably under extreme automotive conditions (temperature, vibration, electromagnetic interference) while meeting stringent automotive safety integrity levels (ASIL).

Key Drivers, Barriers & Challenges in Electric Vehicle Sensor Market

Key Drivers:

The Electric Vehicle Sensor Market is propelled by several potent drivers. Technologically, the increasing complexity of EV powertrains, including advanced battery management systems, electric motor control, and thermal management, necessitates a greater number of sophisticated sensors. Economically, the declining cost of EV components, coupled with rising fuel prices, makes EVs more attractive, driving demand. Policy-driven factors, such as government mandates for zero-emission vehicles and stringent safety regulations, further compel automakers to integrate advanced sensing technologies. For example, the EU's emission standards and the US's federal tax credits directly incentivize EV adoption and, by extension, EV sensor demand.

Barriers & Challenges:

Despite robust growth, the market faces significant challenges. Supply chain disruptions, particularly for rare earth materials and semiconductors, can lead to production delays and increased costs. Regulatory hurdles, such as evolving safety standards and homologation requirements for new sensor technologies, can slow down product development and market entry. Competitive pressures from established automotive suppliers and emerging tech companies intensify, demanding continuous innovation and cost optimization. The high cost of advanced sensors, especially for specialized applications like autonomous driving, remains a barrier to widespread adoption in lower-cost EV segments. Furthermore, the need for rigorous validation and testing to ensure automotive-grade reliability and longevity in harsh operating conditions adds to development timelines and expenses.

Emerging Opportunities in Electric Vehicle Sensor Market

Emerging opportunities within the Electric Vehicle Sensor Market are significant and multifaceted. The burgeoning field of vehicle-to-everything (V2X) communication presents a fertile ground for new sensor applications, enhancing road safety and traffic efficiency. As autonomous driving technology matures, the demand for highly advanced sensor suites, including next-generation lidar, radar, and ultra-reliable imaging sensors, will skyrocket. The development of innovative battery technologies, such as solid-state batteries, will require novel sensor solutions for monitoring their unique operating characteristics. Furthermore, the aftermarket and retrofitting segment for EVs, though nascent, offers potential for specialized sensor upgrades and diagnostics tools. Untapped markets in developing economies with growing EV adoption rates also represent a substantial opportunity for sensor manufacturers.

Growth Accelerators in the Electric Vehicle Sensor Market Industry

Several catalysts are accelerating the long-term growth of the Electric Vehicle Sensor Market. Technological breakthroughs in sensor materials science, such as the development of more sensitive and durable piezoelectric or magnetoresistive materials, will enable smaller, more efficient, and more cost-effective sensors. Strategic partnerships between sensor manufacturers, automakers, and technology providers are crucial for co-developing integrated solutions and accelerating time-to-market. Market expansion strategies, including entering new geographical markets with rising EV adoption and diversifying product portfolios to cater to emerging vehicle types like electric delivery vans and buses, will further fuel growth. The increasing focus on the circular economy and sustainable manufacturing practices within the automotive industry will also drive demand for sensors that facilitate improved diagnostics, predictive maintenance, and component lifespan optimization, contributing to a more sustainable EV ecosystem.

Key Players Shaping the Electric Vehicle Sensor Market Market

- Denso Corporation

- NXP Semiconductors N.V.

- Sensata Technologies Inc.

- Valeo group

- Continental AG

- Amphenol Corporation

- Renesas Electronics Corporation

- Robert Bosch GmbH

- ZF Friedrichshafen AG

Notable Milestones in Electric Vehicle Sensor Market Sector

- September 2022: Mutsuko Hatano and colleagues at the Tokyo Institute of Technology developed a new quantum sensor capable of measuring energy stored in EV batteries with significantly higher precision than existing devices, potentially boosting EV range and energy efficiency.

- March 2022: Nissan employed multiple sensors on dummy passengers to assess collision impacts for its upcoming Ariya electric crossover SUV, underscoring the critical role of sensors in vehicle safety testing and development.

In-Depth Electric Vehicle Sensor Market Market Outlook

The Electric Vehicle Sensor Market outlook is exceptionally positive, driven by sustained technological advancements and global decarbonization efforts. Future market potential is amplified by the increasing integration of intelligent sensing capabilities in EVs, paving the way for enhanced safety, improved performance, and unprecedented levels of connectivity. Strategic opportunities lie in leveraging advancements in artificial intelligence and machine learning for predictive sensor analytics, optimizing vehicle diagnostics and maintenance. The ongoing evolution of battery technology and charging infrastructure will continue to necessitate specialized sensor solutions, creating a sustained demand. Furthermore, the exploration of new applications, such as sensors for enhanced in-cabin air quality monitoring and advanced driver distraction detection, will open up new revenue streams. The global push towards electrification, coupled with stringent safety and environmental regulations, ensures a dynamic and growth-oriented future for the EV Sensor Market.

Electric Vehicle Sensor Market Segmentation

-

1. Sensor Type

- 1.1. Current Sensor

- 1.2. Temperature Sensor

- 1.3. Position Sensor

- 1.4. Pressure Sensor

- 1.5. Other Sensor Types

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicle

-

3. Propulsion Type

- 3.1. Battery Electric Vehicle

- 3.2. Plug-in Hybrid Electric Vehicle

- 3.3. Fuel Cell Electric Vehicle

Electric Vehicle Sensor Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

- 5.4. Rest Of Middle East and Africa

Electric Vehicle Sensor Market Regional Market Share

Geographic Coverage of Electric Vehicle Sensor Market

Electric Vehicle Sensor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of 2-wheelers across the Globe

- 3.3. Market Restrains

- 3.3.1. Rise in demand of Electric Vehicles

- 3.4. Market Trends

- 3.4.1. INCREASE IN PRODUCTION OF SEMI AUTONOMOUS PASSENGER VEHICLES FOSTER THE DEMAND OF ELECTRIC VEHICLE SENSOR MARKET

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electric Vehicle Sensor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sensor Type

- 5.1.1. Current Sensor

- 5.1.2. Temperature Sensor

- 5.1.3. Position Sensor

- 5.1.4. Pressure Sensor

- 5.1.5. Other Sensor Types

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicle

- 5.3. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.3.1. Battery Electric Vehicle

- 5.3.2. Plug-in Hybrid Electric Vehicle

- 5.3.3. Fuel Cell Electric Vehicle

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Sensor Type

- 6. North America Electric Vehicle Sensor Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sensor Type

- 6.1.1. Current Sensor

- 6.1.2. Temperature Sensor

- 6.1.3. Position Sensor

- 6.1.4. Pressure Sensor

- 6.1.5. Other Sensor Types

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicle

- 6.3. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.3.1. Battery Electric Vehicle

- 6.3.2. Plug-in Hybrid Electric Vehicle

- 6.3.3. Fuel Cell Electric Vehicle

- 6.1. Market Analysis, Insights and Forecast - by Sensor Type

- 7. Europe Electric Vehicle Sensor Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sensor Type

- 7.1.1. Current Sensor

- 7.1.2. Temperature Sensor

- 7.1.3. Position Sensor

- 7.1.4. Pressure Sensor

- 7.1.5. Other Sensor Types

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicle

- 7.3. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.3.1. Battery Electric Vehicle

- 7.3.2. Plug-in Hybrid Electric Vehicle

- 7.3.3. Fuel Cell Electric Vehicle

- 7.1. Market Analysis, Insights and Forecast - by Sensor Type

- 8. Asia Pacific Electric Vehicle Sensor Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sensor Type

- 8.1.1. Current Sensor

- 8.1.2. Temperature Sensor

- 8.1.3. Position Sensor

- 8.1.4. Pressure Sensor

- 8.1.5. Other Sensor Types

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicle

- 8.3. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.3.1. Battery Electric Vehicle

- 8.3.2. Plug-in Hybrid Electric Vehicle

- 8.3.3. Fuel Cell Electric Vehicle

- 8.1. Market Analysis, Insights and Forecast - by Sensor Type

- 9. South America Electric Vehicle Sensor Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sensor Type

- 9.1.1. Current Sensor

- 9.1.2. Temperature Sensor

- 9.1.3. Position Sensor

- 9.1.4. Pressure Sensor

- 9.1.5. Other Sensor Types

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Cars

- 9.2.2. Commercial Vehicle

- 9.3. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.3.1. Battery Electric Vehicle

- 9.3.2. Plug-in Hybrid Electric Vehicle

- 9.3.3. Fuel Cell Electric Vehicle

- 9.1. Market Analysis, Insights and Forecast - by Sensor Type

- 10. Middle East and Africa Electric Vehicle Sensor Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Sensor Type

- 10.1.1. Current Sensor

- 10.1.2. Temperature Sensor

- 10.1.3. Position Sensor

- 10.1.4. Pressure Sensor

- 10.1.5. Other Sensor Types

- 10.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.2.1. Passenger Cars

- 10.2.2. Commercial Vehicle

- 10.3. Market Analysis, Insights and Forecast - by Propulsion Type

- 10.3.1. Battery Electric Vehicle

- 10.3.2. Plug-in Hybrid Electric Vehicle

- 10.3.3. Fuel Cell Electric Vehicle

- 10.1. Market Analysis, Insights and Forecast - by Sensor Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Denso Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 NXP Semiconductors N V

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sensata Technologies Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Valeo group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Continental AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Amphenol Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Renesas Electronics Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Robert Bosch GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ZF Friedrichshafen AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Denso Corporation

List of Figures

- Figure 1: Global Electric Vehicle Sensor Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Electric Vehicle Sensor Market Revenue (undefined), by Sensor Type 2025 & 2033

- Figure 3: North America Electric Vehicle Sensor Market Revenue Share (%), by Sensor Type 2025 & 2033

- Figure 4: North America Electric Vehicle Sensor Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 5: North America Electric Vehicle Sensor Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America Electric Vehicle Sensor Market Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 7: North America Electric Vehicle Sensor Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 8: North America Electric Vehicle Sensor Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Electric Vehicle Sensor Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Electric Vehicle Sensor Market Revenue (undefined), by Sensor Type 2025 & 2033

- Figure 11: Europe Electric Vehicle Sensor Market Revenue Share (%), by Sensor Type 2025 & 2033

- Figure 12: Europe Electric Vehicle Sensor Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 13: Europe Electric Vehicle Sensor Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 14: Europe Electric Vehicle Sensor Market Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 15: Europe Electric Vehicle Sensor Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 16: Europe Electric Vehicle Sensor Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Electric Vehicle Sensor Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Electric Vehicle Sensor Market Revenue (undefined), by Sensor Type 2025 & 2033

- Figure 19: Asia Pacific Electric Vehicle Sensor Market Revenue Share (%), by Sensor Type 2025 & 2033

- Figure 20: Asia Pacific Electric Vehicle Sensor Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 21: Asia Pacific Electric Vehicle Sensor Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Asia Pacific Electric Vehicle Sensor Market Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 23: Asia Pacific Electric Vehicle Sensor Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 24: Asia Pacific Electric Vehicle Sensor Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Electric Vehicle Sensor Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Electric Vehicle Sensor Market Revenue (undefined), by Sensor Type 2025 & 2033

- Figure 27: South America Electric Vehicle Sensor Market Revenue Share (%), by Sensor Type 2025 & 2033

- Figure 28: South America Electric Vehicle Sensor Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 29: South America Electric Vehicle Sensor Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 30: South America Electric Vehicle Sensor Market Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 31: South America Electric Vehicle Sensor Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 32: South America Electric Vehicle Sensor Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: South America Electric Vehicle Sensor Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Electric Vehicle Sensor Market Revenue (undefined), by Sensor Type 2025 & 2033

- Figure 35: Middle East and Africa Electric Vehicle Sensor Market Revenue Share (%), by Sensor Type 2025 & 2033

- Figure 36: Middle East and Africa Electric Vehicle Sensor Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 37: Middle East and Africa Electric Vehicle Sensor Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 38: Middle East and Africa Electric Vehicle Sensor Market Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 39: Middle East and Africa Electric Vehicle Sensor Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 40: Middle East and Africa Electric Vehicle Sensor Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East and Africa Electric Vehicle Sensor Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electric Vehicle Sensor Market Revenue undefined Forecast, by Sensor Type 2020 & 2033

- Table 2: Global Electric Vehicle Sensor Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Electric Vehicle Sensor Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 4: Global Electric Vehicle Sensor Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Electric Vehicle Sensor Market Revenue undefined Forecast, by Sensor Type 2020 & 2033

- Table 6: Global Electric Vehicle Sensor Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 7: Global Electric Vehicle Sensor Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 8: Global Electric Vehicle Sensor Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Electric Vehicle Sensor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Electric Vehicle Sensor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Electric Vehicle Sensor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Electric Vehicle Sensor Market Revenue undefined Forecast, by Sensor Type 2020 & 2033

- Table 13: Global Electric Vehicle Sensor Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 14: Global Electric Vehicle Sensor Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 15: Global Electric Vehicle Sensor Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Germany Electric Vehicle Sensor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Electric Vehicle Sensor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: France Electric Vehicle Sensor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Italy Electric Vehicle Sensor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Spain Electric Vehicle Sensor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Electric Vehicle Sensor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Electric Vehicle Sensor Market Revenue undefined Forecast, by Sensor Type 2020 & 2033

- Table 23: Global Electric Vehicle Sensor Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 24: Global Electric Vehicle Sensor Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 25: Global Electric Vehicle Sensor Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: China Electric Vehicle Sensor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Japan Electric Vehicle Sensor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: India Electric Vehicle Sensor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: South Korea Electric Vehicle Sensor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Electric Vehicle Sensor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Global Electric Vehicle Sensor Market Revenue undefined Forecast, by Sensor Type 2020 & 2033

- Table 32: Global Electric Vehicle Sensor Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 33: Global Electric Vehicle Sensor Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 34: Global Electric Vehicle Sensor Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 35: Brazil Electric Vehicle Sensor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Argentina Electric Vehicle Sensor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of South America Electric Vehicle Sensor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Global Electric Vehicle Sensor Market Revenue undefined Forecast, by Sensor Type 2020 & 2033

- Table 39: Global Electric Vehicle Sensor Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 40: Global Electric Vehicle Sensor Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 41: Global Electric Vehicle Sensor Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 42: United Arab Emirates Electric Vehicle Sensor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: Saudi Arabia Electric Vehicle Sensor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: South Africa Electric Vehicle Sensor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Rest Of Middle East and Africa Electric Vehicle Sensor Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Vehicle Sensor Market?

The projected CAGR is approximately 16.2%.

2. Which companies are prominent players in the Electric Vehicle Sensor Market?

Key companies in the market include Denso Corporation, NXP Semiconductors N V, Sensata Technologies Inc, Valeo group, Continental AG, Amphenol Corporation, Renesas Electronics Corporation, Robert Bosch GmbH, ZF Friedrichshafen AG.

3. What are the main segments of the Electric Vehicle Sensor Market?

The market segments include Sensor Type, Vehicle Type, Propulsion Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of 2-wheelers across the Globe.

6. What are the notable trends driving market growth?

INCREASE IN PRODUCTION OF SEMI AUTONOMOUS PASSENGER VEHICLES FOSTER THE DEMAND OF ELECTRIC VEHICLE SENSOR MARKET.

7. Are there any restraints impacting market growth?

Rise in demand of Electric Vehicles.

8. Can you provide examples of recent developments in the market?

In September 2022, according to its creators, Mutsuko Hatano, at the Tokyo Institute of Technology and her colleagues in Japan, a new quantum sensor can measure the energy stored in electric vehicle batteries much more precisely than existing devices. The range and energy efficiency of electric vehicles could be significantly increased owing to their sensor, which uses nitrogen-vacancy (NV) centers in diamonds.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electric Vehicle Sensor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electric Vehicle Sensor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electric Vehicle Sensor Market?

To stay informed about further developments, trends, and reports in the Electric Vehicle Sensor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence