Key Insights

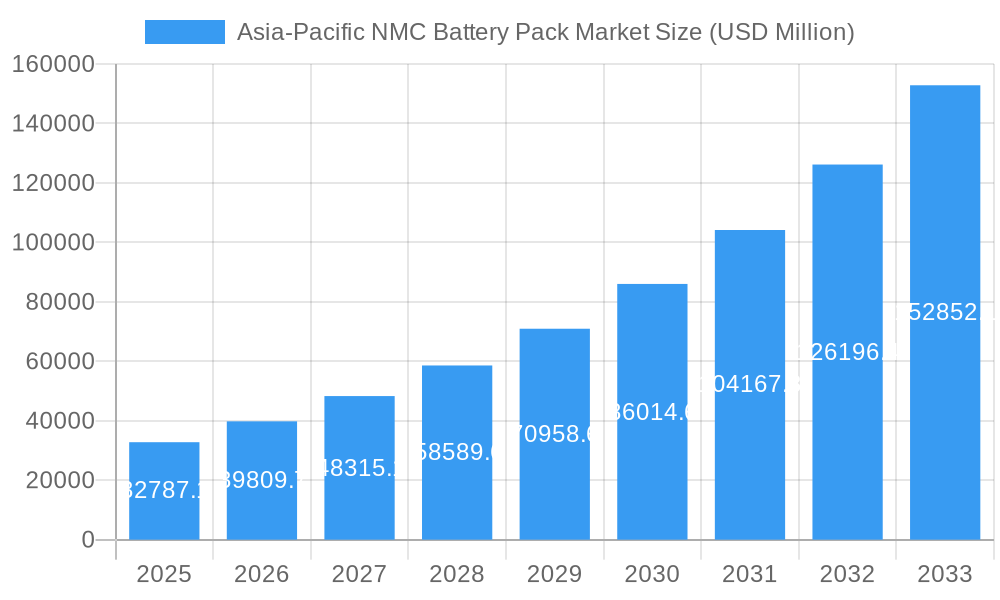

The Asia-Pacific NMC battery pack market is poised for remarkable expansion, projected to reach USD 32,787.1 million in 2025 and exhibit a robust Compound Annual Growth Rate (CAGR) of 21.2% through 2033. This significant growth is primarily fueled by the escalating demand for electric vehicles (EVs) across the region, driven by favorable government policies, increasing environmental consciousness, and a burgeoning middle class. The widespread adoption of Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs) is a dominant trend, necessitating a surge in high-capacity NMC battery packs. Key market segments include Passenger Cars and Buses, which are leading the charge in NMC battery integration. The technological evolution in battery form factors, such as pouch and prismatic cells, along with advancements in manufacturing methods like laser welding, are also contributing to improved performance and cost-effectiveness, further stimulating market growth.

Asia-Pacific NMC Battery Pack Market Market Size (In Billion)

Further propelling the Asia-Pacific NMC battery pack market are advancements in battery materials and components. The increasing focus on battery safety, energy density, and longevity is driving innovation in anode, cathode, electrolyte, and separator technologies. While cobalt remains a critical component, there is a growing trend towards reducing its reliance due to cost and ethical concerns, with an increased emphasis on nickel and manganese-based cathodes, alongside innovations in lithium and natural graphite utilization. Companies like CATL, BYD, and LG Energy Solution are at the forefront of this innovation, investing heavily in research and development to enhance battery performance and sustainability. The robust manufacturing capabilities and supportive industrial ecosystem in countries like China, South Korea, and Japan are also significant drivers, positioning Asia-Pacific as a global powerhouse in the NMC battery pack landscape.

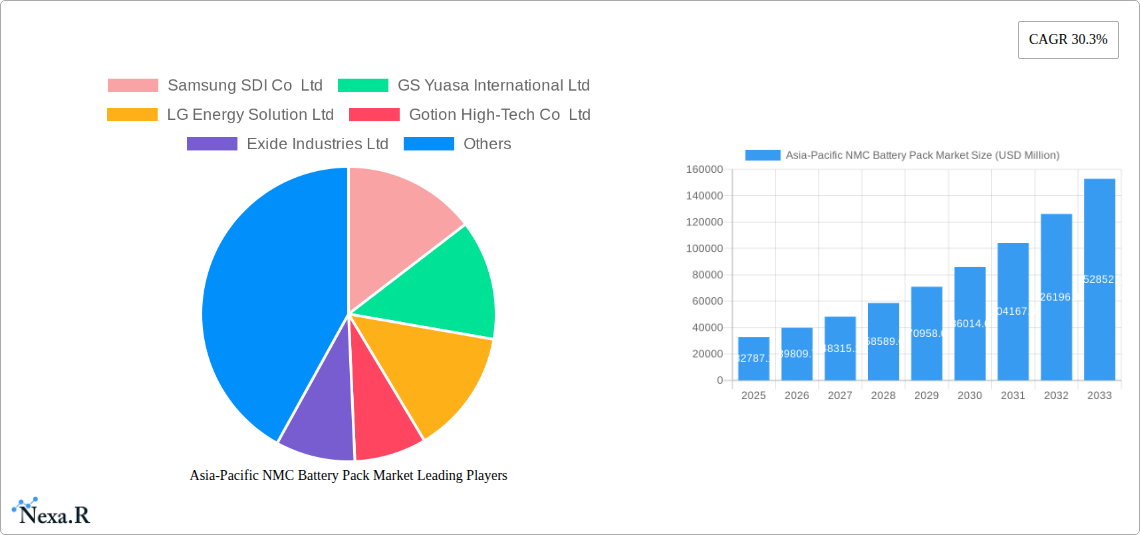

Asia-Pacific NMC Battery Pack Market Company Market Share

This in-depth report offers a detailed analysis of the Asia-Pacific Nickel Manganese Cobalt (NMC) battery pack market, providing critical insights into its dynamics, growth trends, competitive landscape, and future outlook. Covering the period from 2019 to 2033, with a base year of 2025, this study is an indispensable resource for stakeholders seeking to understand and capitalize on the rapidly evolving electric vehicle (EV) battery sector. We meticulously examine the parent market (Electric Vehicle Battery Packs) and child market (NMC Battery Packs) to deliver unparalleled clarity. All values are presented in millions of units.

Asia-Pacific NMC Battery Pack Market Market Dynamics & Structure

The Asia-Pacific NMC battery pack market exhibits a dynamic and evolving structure, influenced by a confluence of technological innovation, robust regulatory frameworks, and shifting end-user demographics. Market concentration remains significant, with a few dominant players holding substantial market share, yet the entry of new contenders and strategic alliances are gradually reshaping the competitive landscape. Technological innovation is primarily driven by the relentless pursuit of higher energy density, faster charging capabilities, and improved safety standards for NMC battery chemistries. Government policies, including subsidies for EV adoption, stricter emission norms, and investments in battery manufacturing infrastructure, play a pivotal role in shaping market trajectory. The competitive product landscape features ongoing advancements in battery materials, manufacturing processes, and thermal management systems. End-user demographics are characterized by a growing middle class with increasing disposable income, a heightened environmental consciousness, and a growing preference for technologically advanced mobility solutions. Merger and acquisition (M&A) trends are indicative of industry consolidation and strategic expansion, with companies seeking to secure supply chains, acquire advanced technologies, and broaden their market reach.

- Market Concentration: The market is characterized by a high degree of concentration, with key players like CATL, LG Energy Solution, and BYD dominating significant portions of the Asia-Pacific NMC battery pack supply.

- Technological Innovation Drivers: Key drivers include the demand for longer EV ranges, faster charging infrastructure, enhanced battery lifespan, and improved safety features.

- Regulatory Frameworks: Government mandates for EV adoption, emission standards (e.g., Euro 7 equivalent policies), and incentives for battery production and R&D are critical influencers.

- Competitive Product Substitutes: While NMC is dominant, advancements in LFP (Lithium Iron Phosphate) batteries for specific applications, solid-state battery research, and other advanced chemistries pose long-term competitive threats.

- End-User Demographics: Growing urban populations, increasing disposable incomes, and a rising awareness of environmental sustainability are driving demand for EVs and, consequently, NMC battery packs.

- M&A Trends: Strategic acquisitions and partnerships are aimed at securing critical raw materials (lithium, cobalt, nickel), expanding production capacity, and acquiring intellectual property in battery technology.

Asia-Pacific NMC Battery Pack Market Growth Trends & Insights

The Asia-Pacific NMC battery pack market is poised for substantial growth, driven by an insatiable demand for electric mobility solutions and supportive governmental policies across the region. The market size evolution is a testament to the accelerating adoption rates of electric vehicles, particularly passenger cars and buses, which are increasingly favored for their reduced environmental impact and lower running costs. Technological disruptions are a constant feature, with continuous improvements in battery chemistry, cell design, and manufacturing processes leading to higher energy densities, enhanced safety, and reduced production costs. Consumer behavior shifts are evident, with a growing segment of the population prioritizing sustainability and technological innovation when making vehicle purchase decisions. The market penetration of EVs is steadily increasing, spurred by wider model availability, expanding charging infrastructure, and attractive government incentives. The historical period (2019-2024) witnessed significant investments and early adoption, laying the groundwork for the robust growth projected in the forecast period (2025-2033). The base year 2025 serves as a crucial benchmark, reflecting the market's strong momentum and its transition into a phase of accelerated expansion. The estimated year 2025 further solidifies the market's growth trajectory. The CAGR for the forecast period is projected to be exceptionally high, reflecting the transformative impact of electrification on the automotive industry.

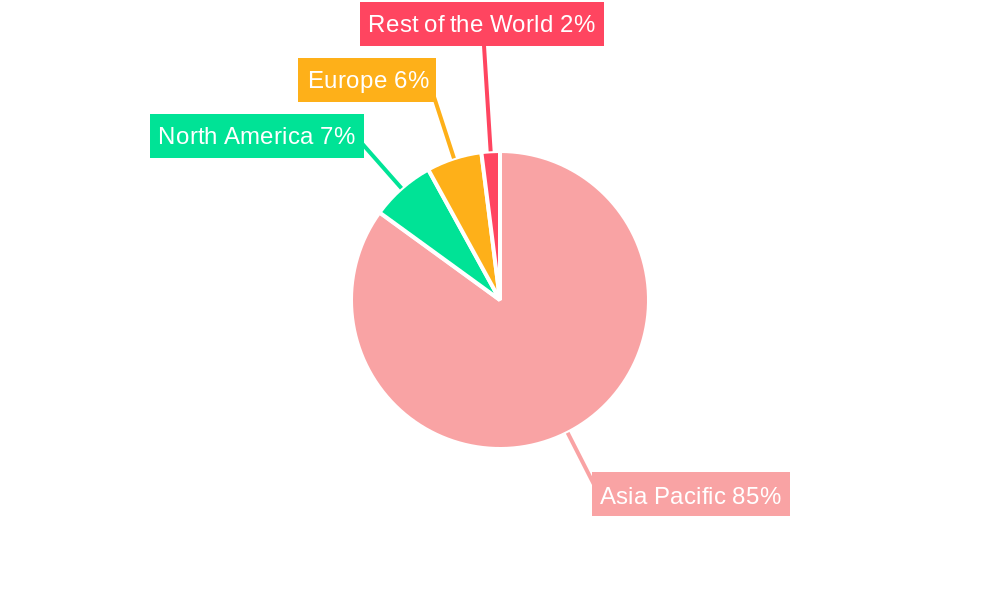

Dominant Regions, Countries, or Segments in Asia-Pacific NMC Battery Pack Market

The Asia-Pacific NMC battery pack market's dominance is a multifaceted phenomenon, with China unequivocally leading the charge due to its expansive automotive industry, proactive government policies, and a well-established battery manufacturing ecosystem. Within China, Passenger Cars represent the largest and fastest-growing segment by body type, propelled by strong consumer demand for electric sedans and SUVs. In terms of propulsion type, BEVs (Battery Electric Vehicles) are the primary drivers of NMC battery pack adoption, accounting for the vast majority of sales and projected growth. The 40 kWh to 80 kWh capacity segment is particularly dominant, catering to the needs of most mainstream passenger EVs offering competitive ranges. Prismatic battery cells are frequently favored for their space efficiency and thermal management capabilities in passenger car applications, though pouch cells also hold significant market share. The Laser welding method is gaining prominence due to its precision and efficiency in battery pack assembly. Looking at the component level, Cathode materials, particularly those rich in nickel and cobalt, are critical to the performance of NMC batteries, making Nickel and Cobalt key material types. The surge in demand for these batteries is further amplified by supportive economic policies in countries like South Korea and Japan, which are also key players in battery technology development and EV manufacturing. Infrastructure development, including widespread charging networks, plays a crucial role in facilitating EV adoption.

- Dominant Region: China, owing to its vast EV market and robust battery manufacturing capabilities.

- Dominant Country: China, with significant contributions from South Korea and Japan in terms of technological innovation and manufacturing.

- Dominant Body Type: Passenger Car, reflecting the primary application of NMC battery packs in personal mobility.

- Dominant Propulsion Type: BEV (Battery Electric Vehicle), as the global shift towards zero-emission vehicles intensifies.

- Dominant Capacity: 40 kWh to 80 kWh, aligning with the typical range requirements of modern electric passenger cars.

- Dominant Battery Form: Prismatic, offering advantages in terms of energy density and packaging efficiency for automotive applications.

- Dominant Method: Laser welding, enabling precise and efficient assembly of battery packs.

- Dominant Component: Cathode, as it dictates the electrochemical performance of NMC batteries.

- Dominant Material Type: Nickel, critical for achieving high energy density in NMC cathodes, alongside Cobalt and Manganese.

Asia-Pacific NMC Battery Pack Market Product Landscape

The Asia-Pacific NMC battery pack market is characterized by continuous product innovation focused on enhancing performance, safety, and cost-effectiveness. Manufacturers are actively developing battery packs with higher energy densities, enabling longer driving ranges for electric vehicles. Advancements in thermal management systems ensure optimal operating temperatures, crucial for battery longevity and safety. Innovations in cell chemistry, such as higher nickel content formulations (e.g., NMC 811, NMC 9.5.5), are gaining traction, offering improved energy density at potentially lower cobalt content. Applications extend across a wide spectrum of electric vehicles, from compact city cars to larger SUVs and commercial vehicles, with specialized battery pack designs tailored to each segment's power and energy requirements. Performance metrics such as cycle life, charge/discharge rates, and overall system efficiency are under constant refinement. Unique selling propositions for leading products often include proprietary cell chemistries, advanced battery management systems (BMS), and integrated cooling solutions that contribute to superior performance and reliability.

Key Drivers, Barriers & Challenges in Asia-Pacific NMC Battery Pack Market

Key Drivers: The Asia-Pacific NMC battery pack market is propelled by several significant drivers. The accelerating global shift towards decarbonization and stringent government regulations on tailpipe emissions are creating a robust demand for electric vehicles. Advancements in battery technology, leading to higher energy density and faster charging capabilities, are making EVs more practical and attractive to consumers. Government incentives, including purchase subsidies and tax credits for EVs and battery manufacturing, play a crucial role in driving adoption. The declining cost of battery production, driven by economies of scale and technological improvements, is making EVs increasingly competitive with internal combustion engine vehicles. Expanding charging infrastructure is further alleviating range anxiety, encouraging more consumers to switch to electric mobility.

Barriers & Challenges: Despite the strong growth potential, the market faces several challenges. The volatility in the prices of key raw materials like lithium, cobalt, and nickel can impact battery production costs and profitability. Supply chain disruptions, particularly for critical minerals, pose a significant risk to consistent production. The need for substantial investment in R&D for next-generation battery technologies, such as solid-state batteries, presents a continuous challenge. Ensuring the safety and reliability of battery packs, especially at higher energy densities, remains paramount and requires rigorous testing and certification processes. The development of a robust and widespread EV charging infrastructure across diverse geographies continues to be a hurdle in some parts of the region. Competition from alternative battery chemistries like LFP, which offer lower costs, also presents a challenge in certain market segments.

Emerging Opportunities in Asia-Pacific NMC Battery Pack Market

Emerging opportunities in the Asia-Pacific NMC battery pack market are abundant, driven by innovation and evolving consumer preferences. The growing demand for high-performance electric vehicles, including performance EVs and electric trucks, presents a significant opportunity for advanced NMC battery packs with higher energy densities and faster charging capabilities. The expansion of the electric two-wheeler and three-wheeler segment in many Asian countries offers a substantial market for cost-effective and efficient NMC battery solutions. Furthermore, the development of battery-swapping technologies for electric two-wheelers and commercial vehicles creates a new service-based opportunity for battery pack manufacturers. Increasing focus on battery recycling and second-life applications for EV batteries is opening up new revenue streams and addressing sustainability concerns. Untapped markets in Southeast Asia and other developing economies, with increasing urbanization and rising disposable incomes, represent significant growth potential as EV adoption accelerates.

Growth Accelerators in the Asia-Pacific NMC Battery Pack Market Industry

Several key factors are acting as significant growth accelerators for the Asia-Pacific NMC battery pack market. Technological breakthroughs in battery chemistry, such as solid-state electrolytes and advanced cathode materials, promise to further enhance energy density, safety, and charging speeds, making EVs even more appealing. Strategic partnerships between automotive manufacturers and battery producers are crucial for co-development and securing long-term supply agreements, accelerating the rollout of new EV models. Market expansion strategies, including the establishment of localized production facilities and R&D centers, are vital for serving regional demands effectively and reducing logistical costs. Government policies that promote local manufacturing and research into battery technologies are further stimulating growth. The increasing integration of battery technology into smart grids and renewable energy storage solutions also presents an ancillary growth avenue, diversifies revenue streams, and enhances the overall value proposition of battery manufacturers.

Key Players Shaping the Asia-Pacific NMC Battery Pack Market Market

- Samsung SDI Co Ltd

- GS Yuasa International Ltd

- LG Energy Solution Ltd

- Gotion High-Tech Co Ltd

- Exide Industries Ltd

- Contemporary Amperex Technology Co Ltd (CATL)

- Resonac Holdings Corporation

- Tesla Inc

- BYD Company Ltd

- SK Innovation Co Ltd

- Ningbo Tuopu Group Co Ltd

- Hebei Chinaust Automotive Plastics Co Ltd

- EVE Energy Co Ltd

- Panasonic Holdings Corporation

- SVOLT Energy Technology Co Ltd (SVOLT)

Notable Milestones in Asia-Pacific NMC Battery Pack Market Sector

- 2019: Increased investment in Gigafactories by major players to meet burgeoning EV demand.

- 2020: Significant advancements in NMC 811 chemistry leading to higher energy density.

- 2021: Surge in EV sales globally, driving unprecedented demand for NMC battery packs.

- 2022: Growing emphasis on ethical sourcing of raw materials and battery recycling initiatives.

- 2023: Emergence of new players and expansion of production capacities in Southeast Asia.

- 2024: Continued technological refinements focusing on faster charging and enhanced safety features.

In-Depth Asia-Pacific NMC Battery Pack Market Market Outlook

The Asia-Pacific NMC battery pack market is set for a sustained period of robust growth, fueled by a confluence of technological innovation, supportive government policies, and increasing consumer adoption of electric vehicles. Growth accelerators such as advancements in high-nickel cathode chemistries, the development of faster-charging technologies, and the expansion of Gigafactory capacities will continue to shape the market. Strategic partnerships between automotive OEMs and battery manufacturers will remain critical for ensuring a stable supply chain and driving product development. Furthermore, the growing trend towards electrification in commercial vehicles and the potential for battery-swapping solutions present new avenues for market expansion. The market's outlook is overwhelmingly positive, with continuous innovation promising to make NMC battery packs even more efficient, safer, and cost-effective, solidifying their position as a cornerstone of the global transition to sustainable mobility.

Asia-Pacific NMC Battery Pack Market Segmentation

-

1. Body Type

- 1.1. Bus

- 1.2. LCV

- 1.3. M&HDT

- 1.4. Passenger Car

-

2. Propulsion Type

- 2.1. BEV

- 2.2. PHEV

-

3. Capacity

- 3.1. 15 kWh to 40 kWh

- 3.2. 40 kWh to 80 kWh

- 3.3. Above 80 kWh

- 3.4. Less than 15 kWh

-

4. Battery Form

- 4.1. Cylindrical

- 4.2. Pouch

- 4.3. Prismatic

-

5. Method

- 5.1. Laser

- 5.2. Wire

-

6. Component

- 6.1. Anode

- 6.2. Cathode

- 6.3. Electrolyte

- 6.4. Separator

-

7. Material Type

- 7.1. Cobalt

- 7.2. Lithium

- 7.3. Manganese

- 7.4. Natural Graphite

- 7.5. Nickel

- 7.6. Other Materials

Asia-Pacific NMC Battery Pack Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific NMC Battery Pack Market Regional Market Share

Geographic Coverage of Asia-Pacific NMC Battery Pack Market

Asia-Pacific NMC Battery Pack Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rise of Trade Agreements Between Nations; Increasing Volume of International Trade

- 3.3. Market Restrains

- 3.3.1. Surge in Fuel Costs Affecting the Market

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific NMC Battery Pack Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 5.1.1. Bus

- 5.1.2. LCV

- 5.1.3. M&HDT

- 5.1.4. Passenger Car

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. BEV

- 5.2.2. PHEV

- 5.3. Market Analysis, Insights and Forecast - by Capacity

- 5.3.1. 15 kWh to 40 kWh

- 5.3.2. 40 kWh to 80 kWh

- 5.3.3. Above 80 kWh

- 5.3.4. Less than 15 kWh

- 5.4. Market Analysis, Insights and Forecast - by Battery Form

- 5.4.1. Cylindrical

- 5.4.2. Pouch

- 5.4.3. Prismatic

- 5.5. Market Analysis, Insights and Forecast - by Method

- 5.5.1. Laser

- 5.5.2. Wire

- 5.6. Market Analysis, Insights and Forecast - by Component

- 5.6.1. Anode

- 5.6.2. Cathode

- 5.6.3. Electrolyte

- 5.6.4. Separator

- 5.7. Market Analysis, Insights and Forecast - by Material Type

- 5.7.1. Cobalt

- 5.7.2. Lithium

- 5.7.3. Manganese

- 5.7.4. Natural Graphite

- 5.7.5. Nickel

- 5.7.6. Other Materials

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Samsung SDI Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GS Yuasa International Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 LG Energy Solution Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Gotion High-Tech Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Exide Industries Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Contemporary Amperex Technology Co Ltd (CATL)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Resonac Holdings Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tesla Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BYD Company Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SK Innovation Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Ningbo Tuopu Group Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Hebei Chinaust Automotive Plastics Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 EVE Energy Co Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Panasonic Holdings Corporation

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 SVOLT Energy Technology Co Ltd (SVOLT)

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Samsung SDI Co Ltd

List of Figures

- Figure 1: Asia-Pacific NMC Battery Pack Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific NMC Battery Pack Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific NMC Battery Pack Market Revenue undefined Forecast, by Body Type 2020 & 2033

- Table 2: Asia-Pacific NMC Battery Pack Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 3: Asia-Pacific NMC Battery Pack Market Revenue undefined Forecast, by Capacity 2020 & 2033

- Table 4: Asia-Pacific NMC Battery Pack Market Revenue undefined Forecast, by Battery Form 2020 & 2033

- Table 5: Asia-Pacific NMC Battery Pack Market Revenue undefined Forecast, by Method 2020 & 2033

- Table 6: Asia-Pacific NMC Battery Pack Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 7: Asia-Pacific NMC Battery Pack Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 8: Asia-Pacific NMC Battery Pack Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 9: Asia-Pacific NMC Battery Pack Market Revenue undefined Forecast, by Body Type 2020 & 2033

- Table 10: Asia-Pacific NMC Battery Pack Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 11: Asia-Pacific NMC Battery Pack Market Revenue undefined Forecast, by Capacity 2020 & 2033

- Table 12: Asia-Pacific NMC Battery Pack Market Revenue undefined Forecast, by Battery Form 2020 & 2033

- Table 13: Asia-Pacific NMC Battery Pack Market Revenue undefined Forecast, by Method 2020 & 2033

- Table 14: Asia-Pacific NMC Battery Pack Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 15: Asia-Pacific NMC Battery Pack Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 16: Asia-Pacific NMC Battery Pack Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: China Asia-Pacific NMC Battery Pack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Japan Asia-Pacific NMC Battery Pack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: South Korea Asia-Pacific NMC Battery Pack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: India Asia-Pacific NMC Battery Pack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Australia Asia-Pacific NMC Battery Pack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: New Zealand Asia-Pacific NMC Battery Pack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Indonesia Asia-Pacific NMC Battery Pack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Malaysia Asia-Pacific NMC Battery Pack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Singapore Asia-Pacific NMC Battery Pack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Thailand Asia-Pacific NMC Battery Pack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Vietnam Asia-Pacific NMC Battery Pack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Philippines Asia-Pacific NMC Battery Pack Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific NMC Battery Pack Market?

The projected CAGR is approximately 21.2%.

2. Which companies are prominent players in the Asia-Pacific NMC Battery Pack Market?

Key companies in the market include Samsung SDI Co Ltd, GS Yuasa International Ltd, LG Energy Solution Ltd, Gotion High-Tech Co Ltd, Exide Industries Ltd, Contemporary Amperex Technology Co Ltd (CATL), Resonac Holdings Corporation, Tesla Inc, BYD Company Ltd, SK Innovation Co Ltd, Ningbo Tuopu Group Co Ltd, Hebei Chinaust Automotive Plastics Co Ltd, EVE Energy Co Ltd, Panasonic Holdings Corporation, SVOLT Energy Technology Co Ltd (SVOLT).

3. What are the main segments of the Asia-Pacific NMC Battery Pack Market?

The market segments include Body Type, Propulsion Type, Capacity, Battery Form, Method, Component, Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

The Rise of Trade Agreements Between Nations; Increasing Volume of International Trade.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Surge in Fuel Costs Affecting the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific NMC Battery Pack Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific NMC Battery Pack Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific NMC Battery Pack Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific NMC Battery Pack Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence