Key Insights

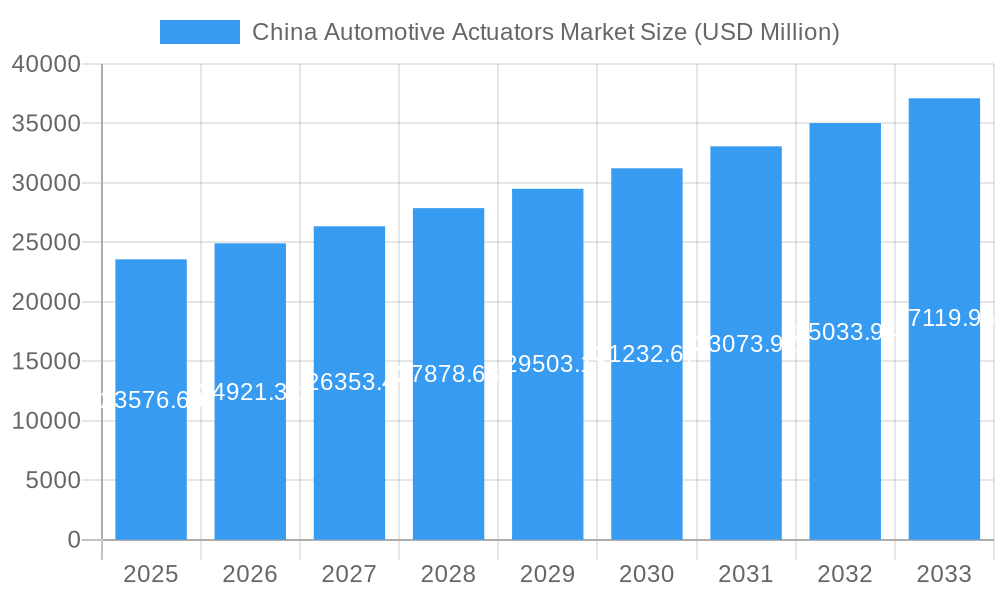

The China Automotive Actuators Market is poised for significant expansion, driven by the nation's robust automotive industry and increasing demand for advanced vehicle features. With a projected market size of USD 23,576.68 million in 2025, the sector is expected to witness a healthy Compound Annual Growth Rate (CAGR) of 5.6% during the forecast period of 2025-2033. This growth is primarily fueled by the escalating adoption of electric and hybrid vehicles, which inherently require a greater number of sophisticated actuators for functions like powertrain management, thermal control, and autonomous driving systems. Furthermore, government initiatives promoting vehicle safety and emission reduction are compelling automakers to integrate advanced actuator technologies, contributing to market momentum. The "drivers" influencing this market include the burgeoning demand for electric vehicle (EV) charging systems, the increasing complexity of modern automotive interiors and exteriors, and the relentless pursuit of enhanced fuel efficiency and performance in traditional internal combustion engine (ICE) vehicles.

China Automotive Actuators Market Market Size (In Billion)

The market landscape is characterized by a diverse range of actuator types, with electrical actuators leading the charge due to their precision, energy efficiency, and ease of integration into complex electronic architectures. Hydraulic and pneumatic actuators, while still relevant in specific heavy-duty applications and commercial vehicles, are gradually being supplemented by their electrical counterparts. Key application segments such as throttle actuators, seat adjustment actuators, and brake actuators are witnessing substantial demand, directly correlating with advancements in vehicle comfort, safety, and performance. The burgeoning passenger car segment, coupled with the evolving needs of commercial vehicles, presents a broad spectrum for actuator manufacturers. While the market is robust, potential "restrains" such as the high initial cost of advanced actuator technologies and the complexities associated with supply chain management in a rapidly evolving industry require strategic navigation by market participants. Nevertheless, the "trends" of miniaturization, increased intelligence, and integration of actuators with AI and IoT technologies are set to redefine the future of automotive actuation in China.

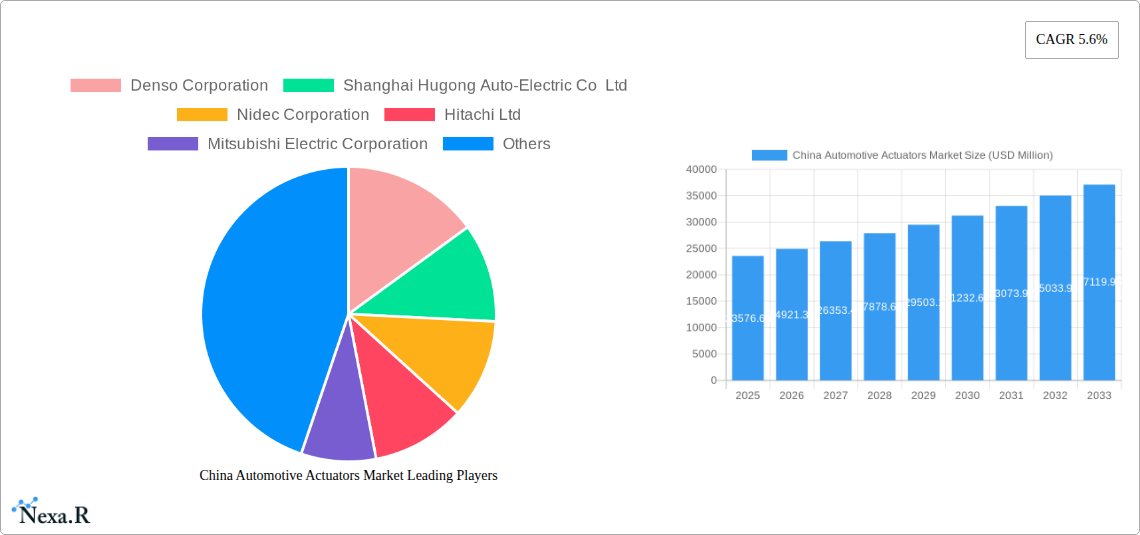

China Automotive Actuators Market Company Market Share

China Automotive Actuators Market Report: Comprehensive Analysis & Future Outlook (2019–2033)

This in-depth report provides a definitive analysis of the China Automotive Actuators Market, a critical component driving the advancement of modern vehicles. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this research offers unparalleled insights into market dynamics, growth trends, regional dominance, product innovation, and key players shaping the industry. Leveraging high-traffic keywords such as automotive actuators China, electric actuators market, brake actuators China, throttle actuators China, and automotive components market, this report is optimized for maximum search engine visibility and targets automotive OEMs, Tier 1 suppliers, component manufacturers, research institutions, and industry stakeholders. We present all values in million units to provide a clear and actionable quantitative understanding of the market.

China Automotive Actuators Market Market Dynamics & Structure

The China Automotive Actuators Market is characterized by a dynamic interplay of factors shaping its competitive landscape and future trajectory. Market concentration is moderate, with both established global players and emerging domestic manufacturers vying for market share. Technological innovation serves as a primary driver, fueled by the relentless pursuit of vehicle electrification, enhanced safety features, and improved fuel efficiency. Regulatory frameworks, particularly those promoting stricter emissions standards and safety mandates, are increasingly influencing product development and adoption rates. Competitive product substitutes exist, but the specialized nature of actuators often limits direct replacement without significant system redesign. End-user demographics are shifting, with a growing demand for advanced features and connected car technologies influencing actuator specifications. Mergers and acquisitions (M&A) trends are evident as companies seek to consolidate their market position, acquire new technologies, or expand their product portfolios.

- Market Concentration: A blend of global leaders and agile domestic suppliers.

- Technological Innovation Drivers: Electrification, ADAS (Advanced Driver-Assistance Systems), autonomous driving, and comfort features.

- Regulatory Frameworks: Emissions standards (e.g., China VI), safety regulations, and government incentives for NEVs (New Energy Vehicles).

- Competitive Product Substitutes: Limited direct substitutes; focus on performance and integration.

- End-User Demographics: Increasing demand for premium features, digital integration, and sustainable mobility solutions.

- M&A Trends: Strategic acquisitions to gain technology or market access.

China Automotive Actuators Market Growth Trends & Insights

The China Automotive Actuators Market is poised for significant expansion, driven by a confluence of evolving automotive technologies and shifting consumer preferences. The market size is projected to witness a robust Compound Annual Growth Rate (CAGR) over the forecast period (2025–2033), indicating sustained demand for various actuator types across diverse vehicle applications. Adoption rates for advanced actuators, particularly electric actuators, are escalating rapidly, propelled by the surging popularity of Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs). These vehicles rely heavily on sophisticated actuator systems for functions ranging from powertrain management to thermal regulation and battery management. Technological disruptions, such as advancements in miniaturization, power efficiency, and integrated sensor technologies, are further enhancing actuator performance and opening new application avenues. Consumer behavior shifts towards a greater emphasis on in-car comfort, personalized experiences, and enhanced safety are directly translating into increased demand for specialized actuators like seat adjustment actuators and sophisticated closure actuators. The growing penetration of intelligent vehicle systems and autonomous driving capabilities will necessitate even more precise and responsive actuation solutions. Furthermore, the expanding automotive manufacturing base in China, coupled with a strong domestic supply chain, provides a fertile ground for growth. The increasing complexity of vehicle architectures and the drive for feature differentiation among OEMs are also significant catalysts. As the automotive industry navigates its transformation towards a more sustainable and technologically advanced future, the China automotive components market, with actuators at its core, will experience sustained and dynamic growth. The increasing integration of actuators in vehicle control modules and their role in enabling advanced functionalities like regenerative braking further solidify their indispensable position.

Dominant Regions, Countries, or Segments in China Automotive Actuators Market

Within the expansive China Automotive Actuators Market, several key regions, segments, and vehicle types are demonstrating exceptional growth and market dominance. Electrical actuators are emerging as the leading actuator type, propelled by the accelerated adoption of EVs and HEVs. Their inherent efficiency, precise control capabilities, and compatibility with digital vehicle architectures make them indispensable for modern vehicle functions. Among application types, throttle actuators and brake actuators are experiencing substantial demand. Throttle actuators are crucial for optimizing engine performance and fuel efficiency in internal combustion engine vehicles, while their electronic counterparts are vital for precise acceleration control in EVs. The escalating focus on vehicle safety and the rapid development of Advanced Driver-Assistance Systems (ADAS) are driving the demand for sophisticated brake actuators, including electronic brake boosters and anti-lock braking system (ABS) actuators. The passenger car segment is the dominant vehicle type contributing to market growth, owing to China's vast consumer base and a burgeoning middle class with increasing purchasing power for personal mobility. The expanding urbanization and the growing demand for convenience are also boosting the uptake of seat adjustment actuators and closure actuators in passenger vehicles, enhancing occupant comfort and ease of use. Geographically, the eastern coastal regions of China, including the Yangtze River Delta and the Pearl River Delta, remain dominant due to their high concentration of automotive manufacturing facilities, established supply chains, and significant consumer markets. Government initiatives supporting the growth of the EV sector in these regions further amplify their leadership. The continuous technological advancements and the strategic presence of major automotive OEMs and Tier 1 suppliers in these areas create a self-reinforcing ecosystem for actuator market expansion. The increasing sophistication of vehicle electronics and the integration of smart features are further solidifying the dominance of electrical actuators and their application in passenger cars.

China Automotive Actuators Market Product Landscape

The China Automotive Actuators Market is witnessing a dynamic product landscape characterized by continuous innovation and technological advancements. Key product innovations revolve around enhancing actuator performance, efficiency, and integration capabilities. Manufacturers are focusing on developing smaller, lighter, and more energy-efficient electrical actuators for various applications, including electric power steering, electric throttle control, and electric braking systems. The increasing demand for enhanced driver comfort and convenience is driving the development of sophisticated seat adjustment actuators with memory functions and more precise positioning. In the realm of safety, advancements in brake actuators are leading to improved response times and greater controllability, crucial for ADAS and autonomous driving functionalities. Closure actuators are also evolving with the integration of smart features for hands-free operation and enhanced security. The trend towards electrification and digitalization is pushing the development of actuators with integrated sensors and advanced control algorithms, enabling seamless communication with other vehicle systems. These technological leaps offer unique selling propositions such as improved fuel economy, reduced emissions, enhanced vehicle dynamics, and a superior user experience, all contributing to the competitive edge in the automotive components market of China.

Key Drivers, Barriers & Challenges in China Automotive Actuators Market

The China Automotive Actuators Market is propelled by several key drivers, including the rapid growth of the New Energy Vehicle (NEV) sector, stringent government mandates for emissions reduction, and the increasing adoption of advanced driver-assistance systems (ADAS). The burgeoning Chinese automotive industry, coupled with rising consumer demand for sophisticated vehicle features and enhanced safety, also fuels market expansion. Technological advancements in electric and electronic actuators are creating new opportunities for improved vehicle performance and efficiency.

However, the market faces significant barriers and challenges. Supply chain disruptions, particularly those related to critical raw materials and semiconductor shortages, can impede production and increase costs. Intense competition among both domestic and international players can lead to price pressures and impact profit margins. Evolving regulatory landscapes, while often a driver, can also present challenges in terms of compliance costs and the need for continuous adaptation. High R&D investment required for developing next-generation actuators and the skilled labor shortage in specialized engineering fields also pose significant hurdles.

Emerging Opportunities in China Automotive Actuators Market

Emerging opportunities in the China Automotive Actuators Market are abundant, driven by the ongoing automotive revolution. The increasing sophistication of autonomous driving technology presents a significant avenue for advanced actuator systems, demanding unparalleled precision and reliability. The growing consumer preference for personalized in-cabin experiences opens doors for innovative seat adjustment actuators and advanced climate control actuators. Furthermore, the expansion of the connected car ecosystem necessitates actuators that can communicate seamlessly with other vehicle systems and external networks, enabling predictive maintenance and enhanced functionality. The continued growth of the NEV segment, coupled with government support for sustainable transportation, creates a sustained demand for lightweight, energy-efficient actuators. Untapped markets in commercial vehicle electrification and specialized industrial applications also offer considerable growth potential.

Growth Accelerators in the China Automotive Actuators Market Industry

Several catalysts are accelerating growth within the China Automotive Actuators Market. Technological breakthroughs in areas like advanced materials for lighter and more durable actuators, as well as sophisticated sensor integration for enhanced feedback control, are key growth accelerators. Strategic partnerships between actuator manufacturers, automotive OEMs, and technology providers are fostering innovation and streamlining product development cycles. The increasing focus on vehicle safety and the integration of ADAS are driving demand for highly reliable and responsive actuators, creating a sustained growth impetus. Market expansion strategies by domestic players, leveraging their understanding of local market needs and cost advantages, are also contributing significantly to the overall market growth. Furthermore, global supply chain diversification efforts are creating opportunities for Chinese manufacturers to increase their export capabilities.

Key Players Shaping the China Automotive Actuators Market Market

- Denso Corporation

- Shanghai Hugong Auto-Electric Co Ltd

- Nidec Corporation

- Hitachi Ltd

- Mitsubishi Electric Corporation

- Continental AG

- BorgWarner Inc

- Robert Bosch GmbH

- Hella KGaA Hueck & Co

- Ningbo Shuanglin Auto Parts Co Ltd

- Zhejiang Asia-Pacific Mechanical & Electronic Co Ltd

Notable Milestones in China Automotive Actuators Market Sector

- March 2023: Kongsberg Automotive SA secured a three-year contract with a major Chinese passenger car OEM for an electric rotary actuator (ARC) used in transmission drive mode changes (P, D, N, R), with an estimated lifetime revenue of USD 27.74 million.

- January 2022: BMW AG launched the BMW iX3 electric SUV in China, featuring brake actuators manufactured by Lucas Varity Langzhong Brake Co., Ltd. (LVLB).

- May 2021: ZF Friedrichshafen AG introduced its Brake Actuator Platform, highlighting significant safety and cost-efficiency benefits for OEMs.

In-Depth China Automotive Actuators Market Market Outlook

The future outlook for the China Automotive Actuators Market is exceptionally promising, driven by the transformative shifts within the global automotive industry. The accelerating electrification of vehicles, coupled with advancements in autonomous driving technologies, will continue to fuel demand for sophisticated and high-performance actuators. Strategic partnerships and collaborative innovation will play a crucial role in addressing the evolving needs of OEMs and developing integrated actuator solutions. The market's growth trajectory is further bolstered by government policies supporting green mobility and technological innovation. As China solidifies its position as a global automotive powerhouse, the automotive components market, particularly the segment for advanced actuators, is set for sustained expansion and will be a critical enabler of future mobility.

China Automotive Actuators Market Segmentation

-

1. Actuators Type

- 1.1. Electrical actuators

- 1.2. Hydraulic actuators

- 1.3. Pneumatic actuators

-

2. Application Type

- 2.1. Throttle Actuator

- 2.2. Seat Adjustment Actuator

- 2.3. Brake Actuator

- 2.4. Closure Actuator

- 2.5. Other Application Types

-

3. Vehicle Type

- 3.1. Passenger Car

- 3.2. Commercial Vehicles

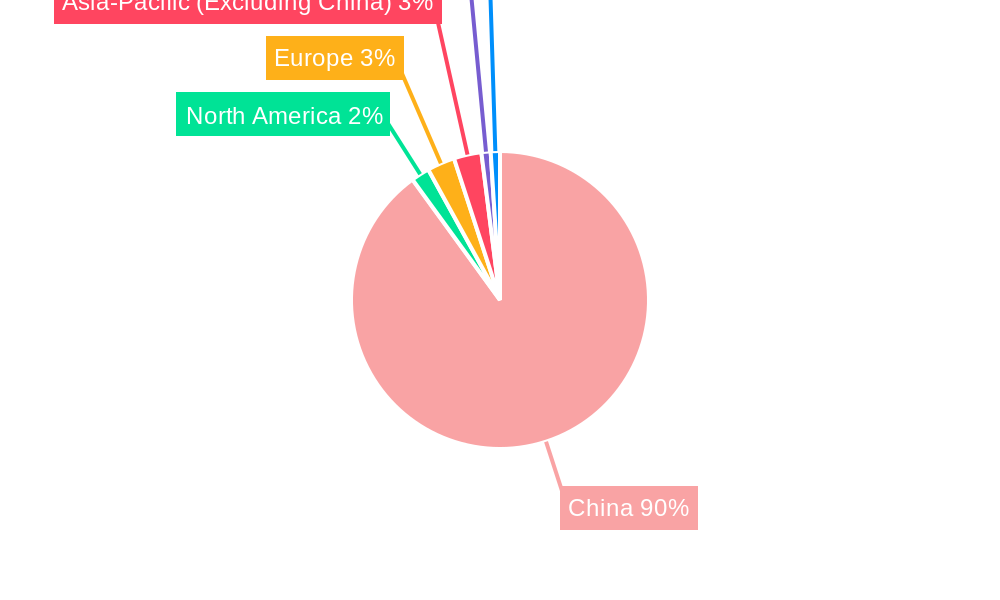

China Automotive Actuators Market Segmentation By Geography

- 1. China

China Automotive Actuators Market Regional Market Share

Geographic Coverage of China Automotive Actuators Market

China Automotive Actuators Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Sales of Electric Vehicles Aiding Market Growth

- 3.3. Market Restrains

- 3.3.1. High Cost of Installing Wireless Chargers

- 3.4. Market Trends

- 3.4.1. Electric Actuators is Driving the Growth of The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Automotive Actuators Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Actuators Type

- 5.1.1. Electrical actuators

- 5.1.2. Hydraulic actuators

- 5.1.3. Pneumatic actuators

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Throttle Actuator

- 5.2.2. Seat Adjustment Actuator

- 5.2.3. Brake Actuator

- 5.2.4. Closure Actuator

- 5.2.5. Other Application Types

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Car

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Actuators Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Denso Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shanghai Hugong Auto-Electric Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nidec Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hitachi Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mitsubishi Electric Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Continental AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BorgWarner Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Robert Bosch GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hella KGaA Hueck & Co

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ningbo Shuanglin Auto Parts Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Zhejiang Asia-Pacific Mechanical & Electronic Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Denso Corporation

List of Figures

- Figure 1: China Automotive Actuators Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: China Automotive Actuators Market Share (%) by Company 2025

List of Tables

- Table 1: China Automotive Actuators Market Revenue undefined Forecast, by Actuators Type 2020 & 2033

- Table 2: China Automotive Actuators Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 3: China Automotive Actuators Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 4: China Automotive Actuators Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: China Automotive Actuators Market Revenue undefined Forecast, by Actuators Type 2020 & 2033

- Table 6: China Automotive Actuators Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 7: China Automotive Actuators Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 8: China Automotive Actuators Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Automotive Actuators Market?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the China Automotive Actuators Market?

Key companies in the market include Denso Corporation, Shanghai Hugong Auto-Electric Co Ltd, Nidec Corporation, Hitachi Ltd, Mitsubishi Electric Corporation, Continental AG, BorgWarner Inc, Robert Bosch GmbH, Hella KGaA Hueck & Co, Ningbo Shuanglin Auto Parts Co Ltd, Zhejiang Asia-Pacific Mechanical & Electronic Co Ltd.

3. What are the main segments of the China Automotive Actuators Market?

The market segments include Actuators Type, Application Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Sales of Electric Vehicles Aiding Market Growth.

6. What are the notable trends driving market growth?

Electric Actuators is Driving the Growth of The Market.

7. Are there any restraints impacting market growth?

High Cost of Installing Wireless Chargers.

8. Can you provide examples of recent developments in the market?

March 2023: Kongsberg Automotive SA entered into a contract with one of China's largest original equipment manufacturers (OEMs) in the passenger cars segment. The contract involves the supply of an electric rotary actuator (ARC) used to change drive modes on the transmission, including park (P), drive (D), neutral (N), and reverse (R). The company announced that its driveline business unit successfully secured a new three-year contract for actuators, estimated to generate a lifetime revenue of USD 27.74 million.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Automotive Actuators Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Automotive Actuators Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Automotive Actuators Market?

To stay informed about further developments, trends, and reports in the China Automotive Actuators Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence