Key Insights

The global aviation industry is poised for significant expansion, projected to reach an estimated market size of approximately $2.5 trillion by 2025, with a steady Compound Annual Growth Rate (CAGR) of 4.0%. This growth is fueled by several key drivers, including the increasing demand for air travel driven by a rising global middle class, expanding e-commerce necessitating greater air cargo capacity, and advancements in aviation technology leading to more fuel-efficient and sustainable aircraft. The military aviation segment also contributes to this expansion through ongoing defense modernization programs and evolving geopolitical landscapes. Furthermore, emerging markets in Asia Pacific are expected to play a crucial role, with increased investments in infrastructure and a growing propensity for air travel among their burgeoning populations. The industry is also witnessing a strong trend towards the development and adoption of electric and hybrid-electric aircraft, driven by environmental concerns and regulatory pressures.

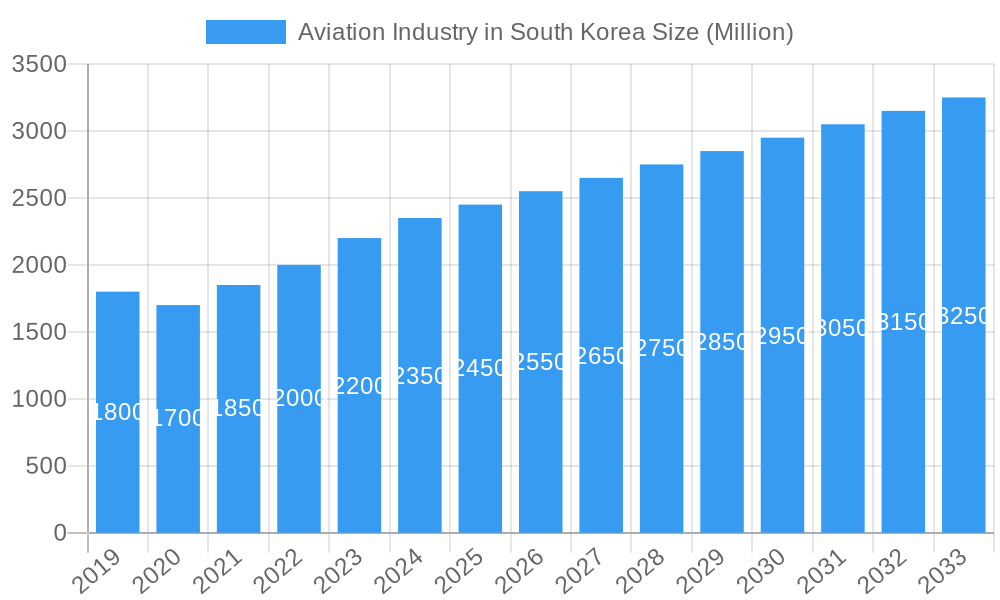

Aviation Industry in South Korea Market Size (In Billion)

However, the industry is not without its challenges. Significant restraints include the high cost of aircraft manufacturing and maintenance, stringent regulatory frameworks that can slow down innovation and market entry, and the inherent volatility of fuel prices, which directly impacts operational costs. Geopolitical instability and global economic downturns can also disrupt passenger and cargo demand. Despite these headwinds, the aviation sector's resilience and its vital role in global connectivity and trade suggest a robust future. Key players such as Boeing, Airbus, Lockheed Martin, and Dassault Aviation are at the forefront of innovation, focusing on sustainable solutions, advanced avionics, and enhanced passenger experience to capture market share and navigate the evolving industry landscape. The increasing demand for narrowbody and widebody commercial aircraft, alongside specialized military aircraft, will continue to shape the market's trajectory.

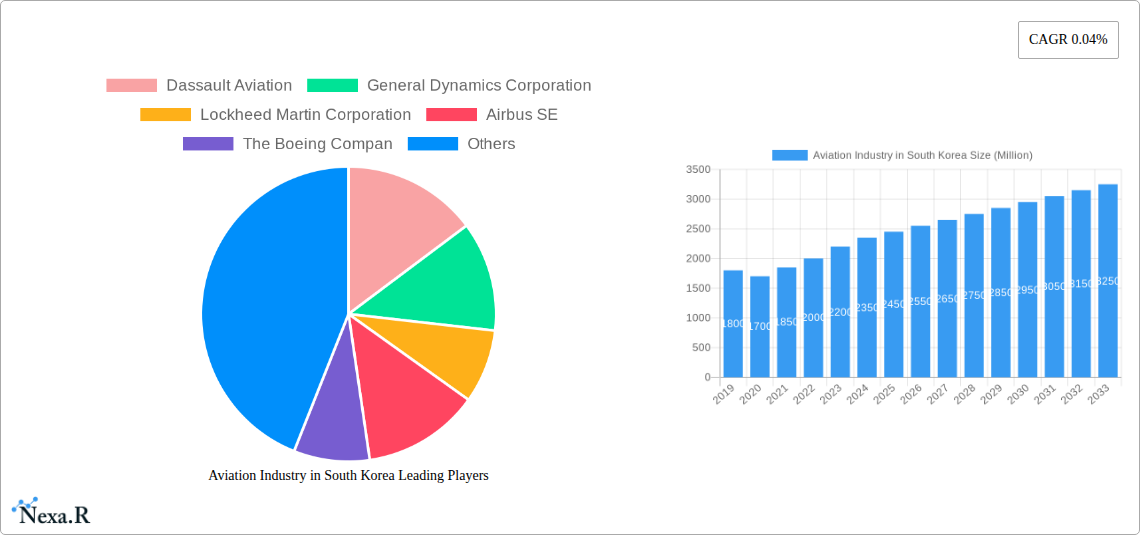

Aviation Industry in South Korea Company Market Share

Unlocking South Korea's Aviation Potential: A Comprehensive Market Analysis (2019-2033)

This in-depth report provides a strategic overview of the dynamic South Korean aviation industry, meticulously analyzing its market structure, growth trajectory, and future potential. Designed for industry professionals, investors, and policymakers, this report offers actionable insights into the parent and child markets, highlighting key drivers, emerging opportunities, and competitive landscapes. All values are presented in Million units for precise understanding.

Aviation Industry in South Korea Market Dynamics & Structure

The South Korean aviation market is characterized by a moderate to high level of concentration, with major players like The Boeing Company, Airbus SE, and Korea Aerospace Industries (KAI) holding significant shares, particularly in the commercial and military aviation segments. Technological innovation is a primary driver, fueled by substantial government investment in R&D and a strong focus on advanced manufacturing capabilities. Regulatory frameworks, while supportive of growth, also impose stringent safety and environmental standards, influencing market entry and operational costs. Competitive product substitutes are emerging in areas like drone technology for cargo and surveillance, posing a nascent challenge to traditional aviation models. End-user demographics are evolving, with increasing demand for premium air travel and specialized cargo services. Mergers and acquisitions (M&A) trends, though not as aggressive as in some global markets, are present, indicating consolidation opportunities and strategic partnerships aimed at enhancing market reach and technological prowess.

- Market Concentration: Dominated by a few key players, with increasing fragmentation in specialized segments.

- Technological Innovation: Driven by advanced aerospace R&D, smart manufacturing, and digitalization.

- Regulatory Framework: Robust safety and certification standards, with a focus on sustainability.

- Competitive Substitutes: Emerging presence of drone technology and advanced logistics solutions.

- End-User Demographics: Shifting preferences towards premium services and specialized cargo.

- M&A Trends: Strategic collaborations and acquisitions to expand capabilities and market share.

Aviation Industry in South Korea Growth Trends & Insights

The South Korean aviation industry is poised for substantial growth, propelled by a confluence of factors including a robust economy, increasing air traffic demand, and strategic government initiatives. The market size is projected to witness a healthy Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period of 2025–2033, expanding from an estimated XX Million units in 2025. This expansion is underpinned by increasing domestic and international travel, driven by a growing middle class and a vibrant tourism sector. Adoption rates for advanced aviation technologies, such as sustainable aviation fuels (SAFs) and next-generation aircraft, are expected to rise significantly as the industry prioritizes environmental responsibility. Technological disruptions, including the integration of AI in air traffic management and predictive maintenance, are set to enhance operational efficiency and safety. Consumer behavior shifts are evident, with a growing demand for personalized travel experiences, on-demand cargo solutions, and increased accessibility to business and general aviation services. The strategic importance of aviation for defense, logistics, and economic connectivity further solidifies its growth trajectory.

- Market Size Evolution: Projected to reach approximately XX Million units by 2033, with a CAGR of ~5.5% from 2025-2033.

- Adoption Rates: Increasing uptake of SAFs, advanced aircraft technologies, and digitalization solutions.

- Technological Disruptions: AI integration in air traffic control, predictive maintenance, and autonomous systems.

- Consumer Behavior Shifts: Growing demand for personalized travel, on-demand logistics, and accessible aviation services.

- Market Penetration: Deepening penetration of advanced solutions across commercial, general, and military aviation.

Dominant Regions, Countries, or Segments in Aviation Industry in South Korea

Within the multifaceted South Korean aviation landscape, Commercial Aviation stands out as the dominant segment, primarily driven by the robust performance of Passenger Aircraft. This sub-segment, further categorized by Narrowbody Aircraft and Widebody Aircraft, reflects the nation's strong demand for both domestic and international air travel. The South Korean Navy's recent acquisition of P-8A Poseidon aircraft from The Boeing Company in March 2020 highlights the significant role of Military Aviation, particularly Multi-Role Aircraft and Rotorcraft, in national security and defense strategies. General Aviation, while smaller in scale compared to commercial aviation, is witnessing steady growth, with a particular interest in Business Jets (Large Jet, Light Jet, Mid-Size Jet) catering to the needs of a burgeoning corporate sector.

Key drivers for Commercial Aviation's dominance include economic growth, an expanding middle class, and strategic government policies promoting air connectivity. The expansion of major international airports and the continuous modernization of fleets contribute to sustained demand for Passenger Aircraft. In Military Aviation, geopolitical considerations and the imperative to modernize defense capabilities are significant growth catalysts, fostering demand for advanced aircraft. The growth of General Aviation is supported by increasing disposable incomes and a desire for flexible and efficient travel solutions for businesses.

- Commercial Aviation (Passenger Aircraft):

- Narrowbody Aircraft: Dominant for domestic and short-to-medium haul international routes, driven by high passenger volume.

- Widebody Aircraft: Essential for long-haul international travel, catering to the growing demand for global connectivity.

- Military Aviation:

- Multi-Role Aircraft: Crucial for defense modernization, surveillance, and strategic deployments.

- Rotorcraft: Increasingly important for search and rescue, troop transport, and specialized military operations.

- General Aviation:

- Business Jets: Experiencing growth due to corporate travel needs and the demand for efficient business operations.

- Piston Fixed-Wing Aircraft: Serving niche markets and flight training sectors.

Aviation Industry in South Korea Product Landscape

The South Korean aviation industry is characterized by a forward-looking product landscape focused on enhancing performance, efficiency, and sustainability. Key innovations include advancements in aerodynamic design, lightweight composite materials, and fuel-efficient engine technologies. Companies are investing in the development of next-generation aircraft, including electric and hybrid-electric propulsion systems, to reduce environmental impact. The integration of smart cockpit technologies, advanced avionics, and data analytics platforms is enhancing pilot situational awareness and operational safety. Product applications span a wide spectrum, from ultra-long-range passenger aircraft and advanced cargo freighters to sophisticated military platforms and agile business jets. Performance metrics are consistently being pushed, with an emphasis on reduced fuel consumption, extended range, and improved passenger comfort.

Key Drivers, Barriers & Challenges in Aviation Industry in South Korea

Key Drivers:

- Economic Growth and Rising Disposable Incomes: Fueling demand for air travel and cargo services.

- Government Support and Investment: Strategic initiatives promoting aerospace R&D and infrastructure development.

- Technological Advancements: Adoption of cutting-edge technologies in aircraft design, manufacturing, and operations.

- Geopolitical Importance: Strong emphasis on military aviation for national security and defense capabilities.

- Expanding Global Connectivity: Increasing international trade and tourism driving demand for air transport.

Barriers & Challenges:

- High Capital Investment: Significant financial requirements for aircraft acquisition, manufacturing, and infrastructure.

- Stringent Regulatory Environment: Compliance with safety, environmental, and airworthiness standards.

- Skilled Workforce Shortages: Demand for highly trained engineers, technicians, and pilots.

- Global Supply Chain Volatility: Potential disruptions in the procurement of raw materials and components.

- Environmental Concerns and Sustainability Pressures: Need for significant investment in greener aviation solutions.

Emerging Opportunities in Aviation Industry in South Korea

Emerging opportunities in the South Korean aviation industry lie in the burgeoning drone delivery services for e-commerce and logistics, offering a more efficient and cost-effective alternative for last-mile delivery. The demand for advanced aerospace materials, driven by the push for lighter and more fuel-efficient aircraft, presents a significant avenue for innovation and manufacturing. Furthermore, the growing interest in urban air mobility (UAM) solutions, such as air taxis and personal eVTOL aircraft, signifies a future growth area for passenger transportation within metropolitan areas. The development of sustainable aviation fuels (SAFs) and related technologies is another critical emerging opportunity, aligning with global environmental goals and creating new market segments.

Growth Accelerators in the Aviation Industry in South Korea Industry

Long-term growth in the South Korean aviation industry will be significantly accelerated by breakthroughs in electric and hybrid-electric propulsion systems, promising a cleaner and quieter future for air travel. Strategic partnerships and collaborations between domestic and international aerospace companies will foster knowledge sharing, technology transfer, and market expansion. The continuous development of smart manufacturing techniques, including AI-driven automation and advanced robotics, will enhance production efficiency and cost-effectiveness. Furthermore, expansion strategies focusing on new international routes and cargo hubs will unlock new markets and cater to evolving global trade patterns, solidifying South Korea's position as a key aviation player.

Key Players Shaping the Aviation Industry in South Korea Market

- Dassault Aviation

- General Dynamics Corporation

- Lockheed Martin Corporation

- Airbus SE

- The Boeing Company

- Robinson Helicopter Company Inc

- Cirrus Design Corporation

- Korea Aerospace Industries

- Leonardo S p A

Notable Milestones in Aviation Industry in South Korea Sector

- July 2021: Establishment of the "Innovative Functional Materials for Aviation" collaborative research lab by Dassault Aviation, CNRS, University of Strasbourg, and University of Lorraine (MOLIERE) to develop novel anti-icing, electromagnetic, and acoustic materials for future aeroplanes.

- March 2020: Boeing received a USD 1.5 billion manufacturing agreement from the US Navy for 18 P-8A Poseidon aircraft, including six aircraft for the Republic of Korea Navy.

In-Depth Aviation Industry in South Korea Market Outlook

The future outlook for the South Korean aviation industry is exceptionally promising, driven by a strategic blend of technological innovation, robust demand, and supportive government policies. The sustained investment in research and development, particularly in sustainable aviation technologies and advanced manufacturing, will act as significant growth accelerators. Emerging opportunities in drone logistics and urban air mobility are poised to redefine air transportation paradigms. Strategic alliances and market expansion initiatives will further solidify South Korea's competitive edge. The industry's ability to navigate regulatory complexities and address workforce development will be crucial in capitalizing on its substantial future market potential and achieving sustainable, long-term growth.

Aviation Industry in South Korea Segmentation

-

1. Aircraft Type

-

1.1. Commercial Aviation

-

1.1.1. By Sub Aircraft Type

- 1.1.1.1. Freighter Aircraft

-

1.1.1.2. Passenger Aircraft

-

1.1.1.2.1. By Body Type

- 1.1.1.2.1.1. Narrowbody Aircraft

- 1.1.1.2.1.2. Widebody Aircraft

-

1.1.1.2.1. By Body Type

-

1.1.1. By Sub Aircraft Type

-

1.2. General Aviation

-

1.2.1. Business Jets

- 1.2.1.1. Large Jet

- 1.2.1.2. Light Jet

- 1.2.1.3. Mid-Size Jet

- 1.2.2. Piston Fixed-Wing Aircraft

- 1.2.3. Others

-

1.2.1. Business Jets

-

1.3. Military Aviation

- 1.3.1. Multi-Role Aircraft

- 1.3.2. Training Aircraft

- 1.3.3. Transport Aircraft

-

1.3.4. Rotorcraft

- 1.3.4.1. Multi-Mission Helicopter

- 1.3.4.2. Transport Helicopter

-

1.1. Commercial Aviation

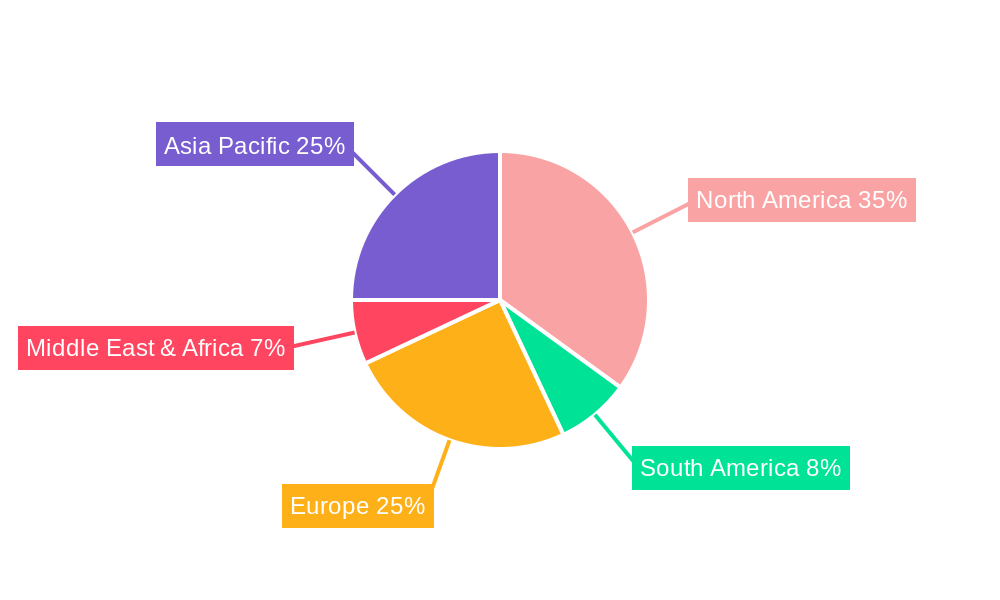

Aviation Industry in South Korea Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Aviation Industry in South Korea Regional Market Share

Geographic Coverage of Aviation Industry in South Korea

Aviation Industry in South Korea REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aviation Industry in South Korea Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.1.1. Commercial Aviation

- 5.1.1.1. By Sub Aircraft Type

- 5.1.1.1.1. Freighter Aircraft

- 5.1.1.1.2. Passenger Aircraft

- 5.1.1.1.2.1. By Body Type

- 5.1.1.1.2.1.1. Narrowbody Aircraft

- 5.1.1.1.2.1.2. Widebody Aircraft

- 5.1.1.1.2.1. By Body Type

- 5.1.1.1. By Sub Aircraft Type

- 5.1.2. General Aviation

- 5.1.2.1. Business Jets

- 5.1.2.1.1. Large Jet

- 5.1.2.1.2. Light Jet

- 5.1.2.1.3. Mid-Size Jet

- 5.1.2.2. Piston Fixed-Wing Aircraft

- 5.1.2.3. Others

- 5.1.2.1. Business Jets

- 5.1.3. Military Aviation

- 5.1.3.1. Multi-Role Aircraft

- 5.1.3.2. Training Aircraft

- 5.1.3.3. Transport Aircraft

- 5.1.3.4. Rotorcraft

- 5.1.3.4.1. Multi-Mission Helicopter

- 5.1.3.4.2. Transport Helicopter

- 5.1.1. Commercial Aviation

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6. North America Aviation Industry in South Korea Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6.1.1. Commercial Aviation

- 6.1.1.1. By Sub Aircraft Type

- 6.1.1.1.1. Freighter Aircraft

- 6.1.1.1.2. Passenger Aircraft

- 6.1.1.1.2.1. By Body Type

- 6.1.1.1.2.1.1. Narrowbody Aircraft

- 6.1.1.1.2.1.2. Widebody Aircraft

- 6.1.1.1.2.1. By Body Type

- 6.1.1.1. By Sub Aircraft Type

- 6.1.2. General Aviation

- 6.1.2.1. Business Jets

- 6.1.2.1.1. Large Jet

- 6.1.2.1.2. Light Jet

- 6.1.2.1.3. Mid-Size Jet

- 6.1.2.2. Piston Fixed-Wing Aircraft

- 6.1.2.3. Others

- 6.1.2.1. Business Jets

- 6.1.3. Military Aviation

- 6.1.3.1. Multi-Role Aircraft

- 6.1.3.2. Training Aircraft

- 6.1.3.3. Transport Aircraft

- 6.1.3.4. Rotorcraft

- 6.1.3.4.1. Multi-Mission Helicopter

- 6.1.3.4.2. Transport Helicopter

- 6.1.1. Commercial Aviation

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7. South America Aviation Industry in South Korea Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7.1.1. Commercial Aviation

- 7.1.1.1. By Sub Aircraft Type

- 7.1.1.1.1. Freighter Aircraft

- 7.1.1.1.2. Passenger Aircraft

- 7.1.1.1.2.1. By Body Type

- 7.1.1.1.2.1.1. Narrowbody Aircraft

- 7.1.1.1.2.1.2. Widebody Aircraft

- 7.1.1.1.2.1. By Body Type

- 7.1.1.1. By Sub Aircraft Type

- 7.1.2. General Aviation

- 7.1.2.1. Business Jets

- 7.1.2.1.1. Large Jet

- 7.1.2.1.2. Light Jet

- 7.1.2.1.3. Mid-Size Jet

- 7.1.2.2. Piston Fixed-Wing Aircraft

- 7.1.2.3. Others

- 7.1.2.1. Business Jets

- 7.1.3. Military Aviation

- 7.1.3.1. Multi-Role Aircraft

- 7.1.3.2. Training Aircraft

- 7.1.3.3. Transport Aircraft

- 7.1.3.4. Rotorcraft

- 7.1.3.4.1. Multi-Mission Helicopter

- 7.1.3.4.2. Transport Helicopter

- 7.1.1. Commercial Aviation

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8. Europe Aviation Industry in South Korea Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8.1.1. Commercial Aviation

- 8.1.1.1. By Sub Aircraft Type

- 8.1.1.1.1. Freighter Aircraft

- 8.1.1.1.2. Passenger Aircraft

- 8.1.1.1.2.1. By Body Type

- 8.1.1.1.2.1.1. Narrowbody Aircraft

- 8.1.1.1.2.1.2. Widebody Aircraft

- 8.1.1.1.2.1. By Body Type

- 8.1.1.1. By Sub Aircraft Type

- 8.1.2. General Aviation

- 8.1.2.1. Business Jets

- 8.1.2.1.1. Large Jet

- 8.1.2.1.2. Light Jet

- 8.1.2.1.3. Mid-Size Jet

- 8.1.2.2. Piston Fixed-Wing Aircraft

- 8.1.2.3. Others

- 8.1.2.1. Business Jets

- 8.1.3. Military Aviation

- 8.1.3.1. Multi-Role Aircraft

- 8.1.3.2. Training Aircraft

- 8.1.3.3. Transport Aircraft

- 8.1.3.4. Rotorcraft

- 8.1.3.4.1. Multi-Mission Helicopter

- 8.1.3.4.2. Transport Helicopter

- 8.1.1. Commercial Aviation

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9. Middle East & Africa Aviation Industry in South Korea Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9.1.1. Commercial Aviation

- 9.1.1.1. By Sub Aircraft Type

- 9.1.1.1.1. Freighter Aircraft

- 9.1.1.1.2. Passenger Aircraft

- 9.1.1.1.2.1. By Body Type

- 9.1.1.1.2.1.1. Narrowbody Aircraft

- 9.1.1.1.2.1.2. Widebody Aircraft

- 9.1.1.1.2.1. By Body Type

- 9.1.1.1. By Sub Aircraft Type

- 9.1.2. General Aviation

- 9.1.2.1. Business Jets

- 9.1.2.1.1. Large Jet

- 9.1.2.1.2. Light Jet

- 9.1.2.1.3. Mid-Size Jet

- 9.1.2.2. Piston Fixed-Wing Aircraft

- 9.1.2.3. Others

- 9.1.2.1. Business Jets

- 9.1.3. Military Aviation

- 9.1.3.1. Multi-Role Aircraft

- 9.1.3.2. Training Aircraft

- 9.1.3.3. Transport Aircraft

- 9.1.3.4. Rotorcraft

- 9.1.3.4.1. Multi-Mission Helicopter

- 9.1.3.4.2. Transport Helicopter

- 9.1.1. Commercial Aviation

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10. Asia Pacific Aviation Industry in South Korea Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10.1.1. Commercial Aviation

- 10.1.1.1. By Sub Aircraft Type

- 10.1.1.1.1. Freighter Aircraft

- 10.1.1.1.2. Passenger Aircraft

- 10.1.1.1.2.1. By Body Type

- 10.1.1.1.2.1.1. Narrowbody Aircraft

- 10.1.1.1.2.1.2. Widebody Aircraft

- 10.1.1.1.2.1. By Body Type

- 10.1.1.1. By Sub Aircraft Type

- 10.1.2. General Aviation

- 10.1.2.1. Business Jets

- 10.1.2.1.1. Large Jet

- 10.1.2.1.2. Light Jet

- 10.1.2.1.3. Mid-Size Jet

- 10.1.2.2. Piston Fixed-Wing Aircraft

- 10.1.2.3. Others

- 10.1.2.1. Business Jets

- 10.1.3. Military Aviation

- 10.1.3.1. Multi-Role Aircraft

- 10.1.3.2. Training Aircraft

- 10.1.3.3. Transport Aircraft

- 10.1.3.4. Rotorcraft

- 10.1.3.4.1. Multi-Mission Helicopter

- 10.1.3.4.2. Transport Helicopter

- 10.1.1. Commercial Aviation

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Dassault Aviation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 General Dynamics Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lockheed Martin Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Airbus SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Boeing Compan

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Robinson Helicopter Company Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cirrus Design Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Korea Aerospace Industries

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Leonardo S p A

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Dassault Aviation

List of Figures

- Figure 1: Global Aviation Industry in South Korea Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Aviation Industry in South Korea Revenue (undefined), by Aircraft Type 2025 & 2033

- Figure 3: North America Aviation Industry in South Korea Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 4: North America Aviation Industry in South Korea Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Aviation Industry in South Korea Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Aviation Industry in South Korea Revenue (undefined), by Aircraft Type 2025 & 2033

- Figure 7: South America Aviation Industry in South Korea Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 8: South America Aviation Industry in South Korea Revenue (undefined), by Country 2025 & 2033

- Figure 9: South America Aviation Industry in South Korea Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Aviation Industry in South Korea Revenue (undefined), by Aircraft Type 2025 & 2033

- Figure 11: Europe Aviation Industry in South Korea Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 12: Europe Aviation Industry in South Korea Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Aviation Industry in South Korea Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Aviation Industry in South Korea Revenue (undefined), by Aircraft Type 2025 & 2033

- Figure 15: Middle East & Africa Aviation Industry in South Korea Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 16: Middle East & Africa Aviation Industry in South Korea Revenue (undefined), by Country 2025 & 2033

- Figure 17: Middle East & Africa Aviation Industry in South Korea Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Aviation Industry in South Korea Revenue (undefined), by Aircraft Type 2025 & 2033

- Figure 19: Asia Pacific Aviation Industry in South Korea Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 20: Asia Pacific Aviation Industry in South Korea Revenue (undefined), by Country 2025 & 2033

- Figure 21: Asia Pacific Aviation Industry in South Korea Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aviation Industry in South Korea Revenue undefined Forecast, by Aircraft Type 2020 & 2033

- Table 2: Global Aviation Industry in South Korea Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Aviation Industry in South Korea Revenue undefined Forecast, by Aircraft Type 2020 & 2033

- Table 4: Global Aviation Industry in South Korea Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Mexico Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Global Aviation Industry in South Korea Revenue undefined Forecast, by Aircraft Type 2020 & 2033

- Table 9: Global Aviation Industry in South Korea Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Brazil Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Argentina Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Global Aviation Industry in South Korea Revenue undefined Forecast, by Aircraft Type 2020 & 2033

- Table 14: Global Aviation Industry in South Korea Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Germany Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: France Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Italy Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Spain Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Russia Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Benelux Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Nordics Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Global Aviation Industry in South Korea Revenue undefined Forecast, by Aircraft Type 2020 & 2033

- Table 25: Global Aviation Industry in South Korea Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Turkey Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Israel Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: GCC Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: North Africa Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Africa Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Aviation Industry in South Korea Revenue undefined Forecast, by Aircraft Type 2020 & 2033

- Table 33: Global Aviation Industry in South Korea Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: China Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: India Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Japan Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Korea Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Oceania Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aviation Industry in South Korea?

The projected CAGR is approximately 2.42%.

2. Which companies are prominent players in the Aviation Industry in South Korea?

Key companies in the market include Dassault Aviation, General Dynamics Corporation, Lockheed Martin Corporation, Airbus SE, The Boeing Compan, Robinson Helicopter Company Inc, Cirrus Design Corporation, Korea Aerospace Industries, Leonardo S p A.

3. What are the main segments of the Aviation Industry in South Korea?

The market segments include Aircraft Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2021: The collaborative research lab "Innovative Functional Materials for Aviation" was established by Dassualt Aviation, CNRS, University of Strasbourg, and University of Lorraine (MOLIERE). Its objective is to develop novel anti-icing, electromagnetic, and acoustic materials for future aeroplanes.March 2020: A USD 1.5 billion manufacturing agreement for 18 P-8A Poseidon aircraft was given to Boeing by the US Navy. The deal calls for four aircraft for the Royal New Zealand Air Force, six aircraft for the Republic of Korea Navy, and eight aircraft for the United States Navy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aviation Industry in South Korea," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aviation Industry in South Korea report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aviation Industry in South Korea?

To stay informed about further developments, trends, and reports in the Aviation Industry in South Korea, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence