Key Insights

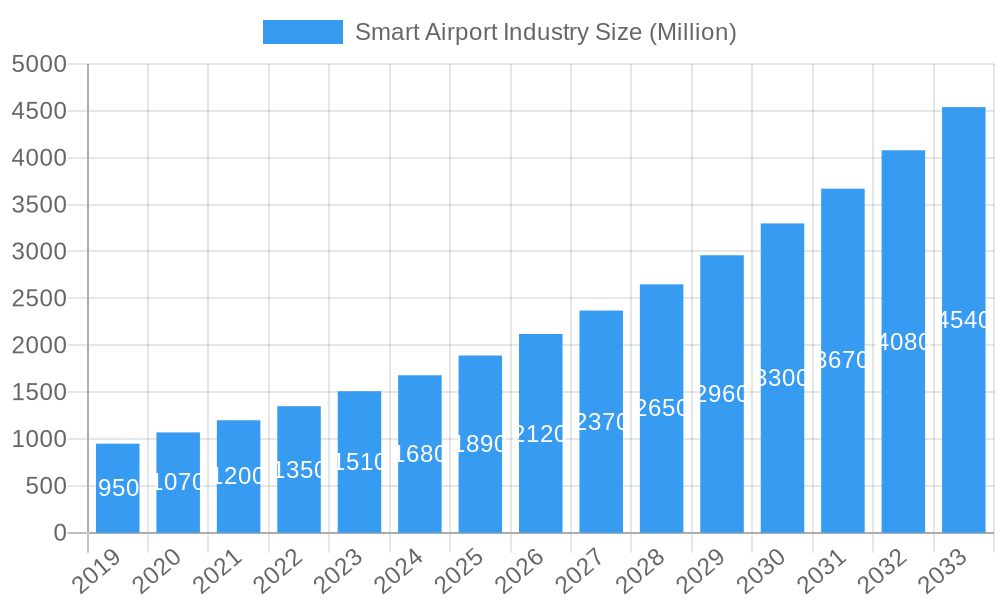

The global Smart Airport market is poised for significant expansion, projected to reach an estimated USD 1.89 Billion by 2025, driven by a robust CAGR of 13.63%. This impressive growth trajectory is fueled by the escalating demand for enhanced passenger experience, improved operational efficiency, and stringent security requirements within the aviation sector. Airports worldwide are increasingly investing in cutting-edge technologies such as AI-powered security systems, advanced communication networks, and integrated air and ground traffic control solutions to streamline operations from passenger check-in to baggage handling. The digital transformation of airport infrastructure is a paramount driver, with a strong emphasis on creating seamless, contactless, and personalized journeys for travelers. Furthermore, the burgeoning aviation industry, especially in emerging economies, necessitates modernized airport facilities that can handle increased air traffic and cargo volumes efficiently.

Smart Airport Industry Market Size (In Million)

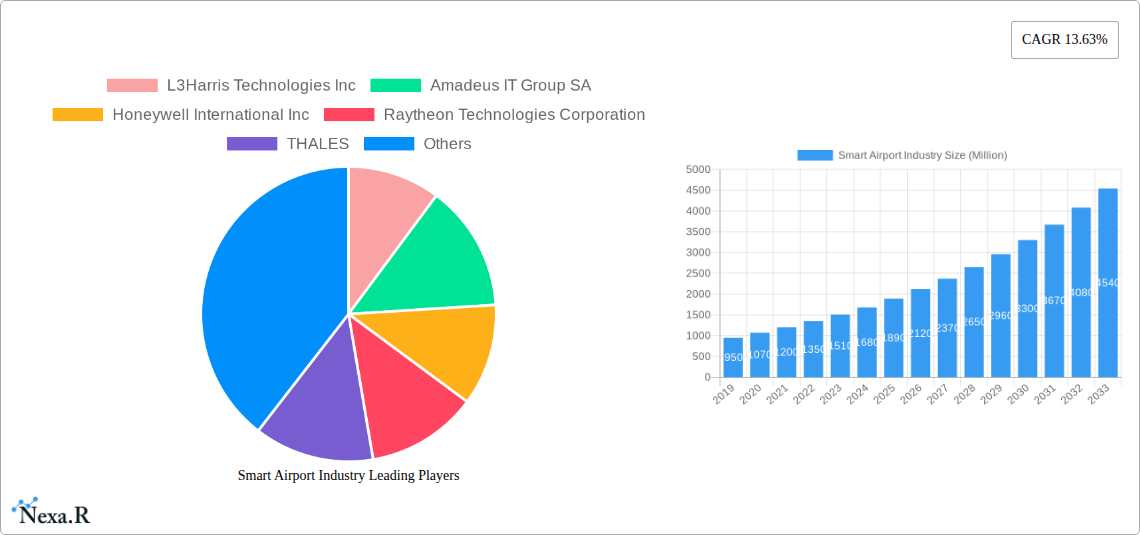

The market is segmented across various technology and operation types, highlighting the diverse applications of smart solutions. In terms of technology, Security Systems, Communication Systems, and Air and Ground Traffic Control are critical areas of investment, alongside Passenger, Cargo, and Baggage Ground Handling. Operationally, Landside, Airside, and Terminal Side developments are all benefiting from smart integration. Key players like L3Harris Technologies, Honeywell International, and Raytheon Technologies are at the forefront of innovation, offering comprehensive solutions that address the evolving needs of the aviation industry. The market's growth is further supported by global initiatives promoting digitalization and sustainability in aviation. While the market demonstrates strong upward momentum, potential challenges could arise from high implementation costs and the need for continuous technological upgrades to combat cyber threats.

Smart Airport Industry Company Market Share

Comprehensive Smart Airport Industry Market Report: Navigating the Future of Air Travel

This in-depth market report offers a detailed analysis of the global Smart Airport industry from 2019 to 2033, with a comprehensive outlook for the 2025-2033 forecast period. Covering a base year of 2025, the study delves into the evolving landscape of airport operations, driven by technological advancements, increasing passenger volumes, and the imperative for enhanced security and efficiency. We meticulously examine market dynamics, growth trends, regional dominance, product innovations, key drivers, challenges, emerging opportunities, and the pivotal players shaping this sector. This report is essential for industry professionals seeking to understand market segmentation, parent and child market influences, and strategic investment opportunities within the smart airport ecosystem.

Smart Airport Industry Market Dynamics & Structure

The smart airport industry is characterized by a dynamic interplay of technological innovation, stringent regulatory frameworks, and evolving passenger expectations. Market concentration is influenced by the presence of major technology providers and system integrators who are increasingly collaborating to offer comprehensive solutions. Technological innovation drivers include the demand for seamless passenger experiences, enhanced cybersecurity, and sustainable operational practices. Regulatory frameworks, particularly in aviation security and data privacy, play a crucial role in shaping technology adoption and deployment strategies. Competitive product substitutes are emerging from advancements in AI, IoT, and cloud computing, offering alternative pathways to achieve operational efficiency. End-user demographics are shifting towards a digitally savvy traveler who expects personalized services and minimal friction throughout their airport journey. Mergers and acquisition (M&A) trends indicate a consolidation of expertise, with larger entities acquiring smaller, specialized firms to broaden their service portfolios and market reach.

- Market Concentration: Moderate, with key players dominating specific technology verticals.

- Technological Innovation Drivers: AI-powered analytics for passenger flow optimization, advanced biometrics for secure and seamless boarding, IoT for real-time asset tracking, and sustainable energy solutions.

- Regulatory Frameworks: ICAO's Smart Facility initiatives, TSA's focus on advanced security screening, and GDPR's impact on passenger data management.

- Competitive Product Substitutes: Rise of cloud-based airport management software, drone-based infrastructure inspection, and advanced simulation tools for air traffic control training.

- End-User Demographics: Increasing demand for self-service options, personalized travel information, and efficient baggage handling from tech-savvy, global travelers.

- M&A Trends: Focus on acquiring companies with expertise in AI, cybersecurity, and passenger experience solutions. Deal volumes are projected to increase by 15% in the next three years.

Smart Airport Industry Growth Trends & Insights

The global smart airport market is poised for significant expansion, driven by a confluence of factors aimed at revolutionizing air travel. The market size is projected to grow from approximately $15,000 million in 2024 to over $35,000 million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately 10.5%. This growth is fueled by increasing investments in airport modernization and the adoption of advanced technologies that enhance operational efficiency, passenger convenience, and security. The adoption rates for technologies such as biometric identification, IoT-enabled baggage tracking, and AI-powered crowd management systems are accelerating as airports worldwide seek to optimize their infrastructure and service delivery. Technological disruptions, including the integration of 5G networks for enhanced connectivity and the proliferation of autonomous systems for ground handling, are further pushing the boundaries of smart airport capabilities.

Consumer behavior shifts are also playing a pivotal role. Passengers increasingly expect personalized experiences, faster processing times, and greater control over their travel journey, from booking to arrival. This demand is compelling airports to implement technologies that offer seamless check-in, intuitive navigation, and real-time travel updates. Furthermore, the global focus on sustainability is driving the adoption of smart energy management systems, waste reduction technologies, and eco-friendly transportation solutions within airport environments. The integration of these smart solutions not only improves the passenger experience but also contributes to significant cost savings and a reduced environmental footprint for airports. The projected market penetration of smart airport technologies is expected to reach over 70% by 2033, reflecting the widespread acceptance and integration of these innovations.

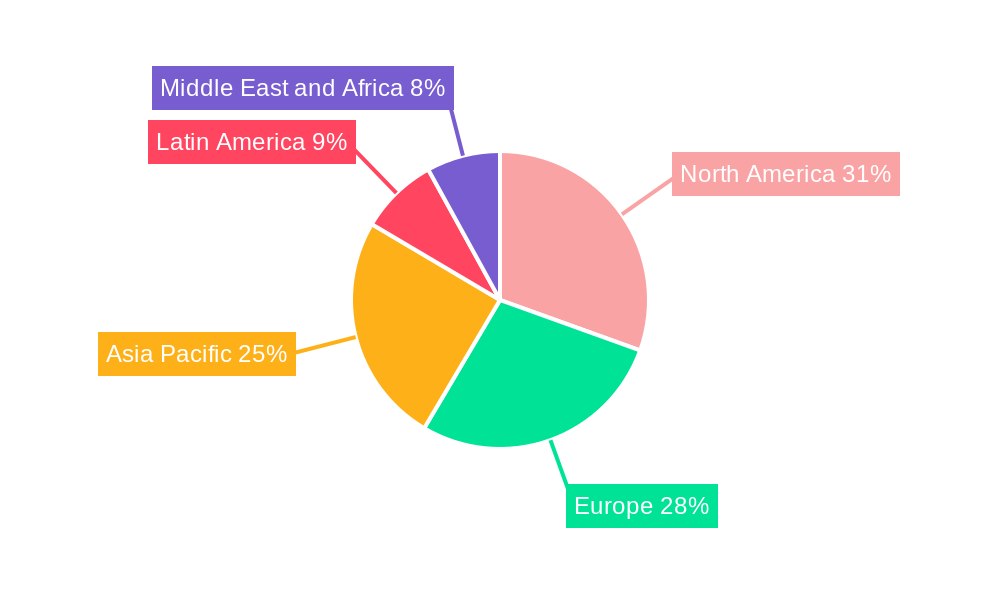

Dominant Regions, Countries, or Segments in Smart Airport Industry

The Technology: Security Systems segment is a dominant force driving growth within the global smart airport industry. This segment encompasses a wide array of critical technologies designed to ensure the safety and security of passengers, staff, and assets. The increasing threat landscape and the need for robust, multi-layered security solutions make this segment indispensable for modern airports. The implementation of advanced screening technologies, biometric identification systems, intelligent surveillance networks, and cybersecurity solutions are paramount for maintaining operational integrity and compliance with international aviation security regulations.

Key drivers for the dominance of security systems include:

- Heightened Global Security Concerns: Post-9/11 security mandates and evolving threats necessitate continuous upgrades and adoption of state-of-the-art security technologies.

- Passenger Safety as a Top Priority: Airports are prioritizing passenger well-being, leading to significant investments in systems that can detect threats quickly and effectively.

- Technological Advancements in Threat Detection: Innovations in AI, machine learning, and sensor technology are enabling more sophisticated and less intrusive security screening processes.

- Regulatory Compliance: International and national aviation authorities mandate stringent security protocols, pushing airports to invest in compliant technologies.

The market share for security systems within the smart airport ecosystem is estimated to be around 30% in 2025, with a projected growth rate exceeding 12% through 2033. The North America and Europe regions are leading in the adoption of these advanced security systems due to mature aviation infrastructure and stringent regulatory environments. However, the Asia Pacific region is rapidly emerging as a significant growth market, driven by the construction of new smart airports and the modernization of existing ones, particularly in countries like China and India. The growth potential within this segment is substantial, as airports continue to integrate more intelligent and proactive security measures.

Smart Airport Industry Product Landscape

The smart airport industry is witnessing an influx of innovative products designed to enhance every facet of airport operations. This includes advanced AI-powered passenger flow management systems that optimize queue times and improve navigation, next-generation biometric authentication solutions for seamless identity verification, and IoT-enabled baggage tracking systems providing real-time visibility from check-in to reclaim. Performance metrics are rapidly improving, with biometric solutions achieving over 99% accuracy rates and baggage tracking systems offering near-instantaneous location updates. Unique selling propositions lie in the integration of these disparate systems into a cohesive, intelligent network, creating a truly connected and responsive airport environment. Technological advancements are focused on predictive analytics for proactive issue resolution and enhanced cybersecurity to protect sensitive data.

Key Drivers, Barriers & Challenges in Smart Airport Industry

The smart airport industry is propelled by several key drivers, including the escalating demand for improved passenger experience, the necessity for enhanced operational efficiency, and the imperative to bolster aviation security. Technological advancements in AI, IoT, and biometrics are enabling innovative solutions that address these demands. Government initiatives and airport infrastructure development projects also play a significant role.

However, the industry faces considerable barriers and challenges. High initial investment costs for sophisticated technology deployments represent a major hurdle. Furthermore, complex regulatory landscapes and data privacy concerns can slow down adoption. Supply chain disruptions, particularly for specialized hardware and software components, can impact project timelines. Competitive pressures among technology providers and system integrators also influence market dynamics.

- Key Drivers:

- Improved Passenger Experience

- Enhanced Operational Efficiency

- Heightened Aviation Security Demands

- Technological Advancements (AI, IoT, Biometrics)

- Government Support & Infrastructure Development

- Barriers & Challenges:

- High Initial Investment Costs

- Complex Regulatory Frameworks & Data Privacy

- Integration Complexity of Diverse Systems

- Cybersecurity Threats

- Supply Chain Disruptions

- Skilled Workforce Shortages

Emerging Opportunities in Smart Airport Industry

Emerging opportunities in the smart airport industry are diverse and rapidly evolving. The expansion of facial recognition and biometric technologies beyond security checkpoints into retail and loyalty programs presents a significant avenue for personalized passenger engagement and revenue generation. The development of "airport-as-a-service" platforms, offering integrated digital solutions to smaller airports or those undergoing modernization, is another promising area. Furthermore, the growing emphasis on sustainability is creating demand for smart energy management systems, waste-to-energy solutions, and electric vehicle charging infrastructure within airport premises. The integration of drones for inspection and maintenance, as well as for cargo delivery, also represents an untapped potential.

Growth Accelerators in the Smart Airport Industry Industry

Several catalysts are accelerating long-term growth in the smart airport industry. Continuous technological breakthroughs, particularly in artificial intelligence, machine learning, and the Internet of Things (IoT), are enabling more sophisticated and integrated airport solutions. Strategic partnerships between technology providers, airlines, and airport authorities are fostering collaborative innovation and accelerating the deployment of new technologies. Market expansion strategies, including the development of scalable solutions for both large international hubs and smaller regional airports, are broadening the reach of smart airport technologies. The increasing adoption of cloud-based infrastructure is also lowering barriers to entry and enabling greater flexibility and cost-efficiency.

Key Players Shaping the Smart Airport Industry Market

- L3Harris Technologies Inc

- Amadeus IT Group SA

- Honeywell International Inc

- Raytheon Technologies Corporation

- THALES

- Sabre GLBL Inc

- IBM Corporation

- Cisco Systems Inc

- Siemens AG

- NATS Holdings Limited

- SITA

- T-Systems International GmbH

Notable Milestones in Smart Airport Industry Sector

- February 2023: Aviation Security Service (AvSec) of New Zealand awarded a contract to Smiths Detection for advanced checkpoint security technology at five major international airports. This highlights the ongoing focus on cutting-edge security solutions.

- June 2022: Fiumicino Airport, Italy, announced the development of a virtuous baggage handling system, including X-ray control for 100% of departing baggage. This underscores advancements in cargo and baggage ground handling efficiency and security.

- June 2022: SITA partnered with Alstef Group to launch Swift Drop, a self-bag drop solution. The early adoption by Mexico City's Felipe Ángeles International Airport with 20 units demonstrates the market's demand for faster passenger processing and reduced check-in times.

In-Depth Smart Airport Industry Market Outlook

The future of the smart airport industry is incredibly promising, driven by a strategic confluence of technological advancements and evolving operational demands. Growth accelerators like the pervasive integration of AI for predictive analytics, the expansion of IoT networks for real-time data flow, and the increasing adoption of cloud-native architectures are setting the stage for highly efficient, secure, and passenger-centric airports. Strategic opportunities lie in further developing integrated digital platforms that bridge the gap between various airport stakeholders, creating a seamless ecosystem. The increasing focus on sustainable aviation and smart city initiatives also presents a significant avenue for smart airport development, positioning them as vital hubs within broader urban and environmental strategies. The market potential for next-generation airport infrastructure is vast, promising a transformative era for air travel.

Smart Airport Industry Segmentation

-

1. Technology

- 1.1. Security Systems

- 1.2. Communication Systems

- 1.3. Air and Ground Traffic Control

- 1.4. Passenger, Cargo, and Baggage Ground Handling

-

2. Airport Operation

- 2.1. Landside

- 2.2. Airside

- 2.3. Terminal Side

Smart Airport Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Smart Airport Industry Regional Market Share

Geographic Coverage of Smart Airport Industry

Smart Airport Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1 The Passenger

- 3.4.2 Cargo & Baggage Ground Handling Segment to Dominate the Market During the Forecasted Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smart Airport Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Security Systems

- 5.1.2. Communication Systems

- 5.1.3. Air and Ground Traffic Control

- 5.1.4. Passenger, Cargo, and Baggage Ground Handling

- 5.2. Market Analysis, Insights and Forecast - by Airport Operation

- 5.2.1. Landside

- 5.2.2. Airside

- 5.2.3. Terminal Side

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Smart Airport Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Security Systems

- 6.1.2. Communication Systems

- 6.1.3. Air and Ground Traffic Control

- 6.1.4. Passenger, Cargo, and Baggage Ground Handling

- 6.2. Market Analysis, Insights and Forecast - by Airport Operation

- 6.2.1. Landside

- 6.2.2. Airside

- 6.2.3. Terminal Side

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Smart Airport Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Security Systems

- 7.1.2. Communication Systems

- 7.1.3. Air and Ground Traffic Control

- 7.1.4. Passenger, Cargo, and Baggage Ground Handling

- 7.2. Market Analysis, Insights and Forecast - by Airport Operation

- 7.2.1. Landside

- 7.2.2. Airside

- 7.2.3. Terminal Side

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Smart Airport Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Security Systems

- 8.1.2. Communication Systems

- 8.1.3. Air and Ground Traffic Control

- 8.1.4. Passenger, Cargo, and Baggage Ground Handling

- 8.2. Market Analysis, Insights and Forecast - by Airport Operation

- 8.2.1. Landside

- 8.2.2. Airside

- 8.2.3. Terminal Side

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Latin America Smart Airport Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Security Systems

- 9.1.2. Communication Systems

- 9.1.3. Air and Ground Traffic Control

- 9.1.4. Passenger, Cargo, and Baggage Ground Handling

- 9.2. Market Analysis, Insights and Forecast - by Airport Operation

- 9.2.1. Landside

- 9.2.2. Airside

- 9.2.3. Terminal Side

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Smart Airport Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Security Systems

- 10.1.2. Communication Systems

- 10.1.3. Air and Ground Traffic Control

- 10.1.4. Passenger, Cargo, and Baggage Ground Handling

- 10.2. Market Analysis, Insights and Forecast - by Airport Operation

- 10.2.1. Landside

- 10.2.2. Airside

- 10.2.3. Terminal Side

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 L3Harris Technologies Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Amadeus IT Group SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Honeywell International Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Raytheon Technologies Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 THALES

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sabre GLBL Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 IBM Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cisco Systems Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Siemens AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 NATS Holdings Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SITA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 T-Systems International GmbH

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 L3Harris Technologies Inc

List of Figures

- Figure 1: Global Smart Airport Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Smart Airport Industry Revenue (Million), by Technology 2025 & 2033

- Figure 3: North America Smart Airport Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Smart Airport Industry Revenue (Million), by Airport Operation 2025 & 2033

- Figure 5: North America Smart Airport Industry Revenue Share (%), by Airport Operation 2025 & 2033

- Figure 6: North America Smart Airport Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Smart Airport Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Smart Airport Industry Revenue (Million), by Technology 2025 & 2033

- Figure 9: Europe Smart Airport Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 10: Europe Smart Airport Industry Revenue (Million), by Airport Operation 2025 & 2033

- Figure 11: Europe Smart Airport Industry Revenue Share (%), by Airport Operation 2025 & 2033

- Figure 12: Europe Smart Airport Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Smart Airport Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Smart Airport Industry Revenue (Million), by Technology 2025 & 2033

- Figure 15: Asia Pacific Smart Airport Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Asia Pacific Smart Airport Industry Revenue (Million), by Airport Operation 2025 & 2033

- Figure 17: Asia Pacific Smart Airport Industry Revenue Share (%), by Airport Operation 2025 & 2033

- Figure 18: Asia Pacific Smart Airport Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Smart Airport Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Smart Airport Industry Revenue (Million), by Technology 2025 & 2033

- Figure 21: Latin America Smart Airport Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Latin America Smart Airport Industry Revenue (Million), by Airport Operation 2025 & 2033

- Figure 23: Latin America Smart Airport Industry Revenue Share (%), by Airport Operation 2025 & 2033

- Figure 24: Latin America Smart Airport Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Smart Airport Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Smart Airport Industry Revenue (Million), by Technology 2025 & 2033

- Figure 27: Middle East and Africa Smart Airport Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 28: Middle East and Africa Smart Airport Industry Revenue (Million), by Airport Operation 2025 & 2033

- Figure 29: Middle East and Africa Smart Airport Industry Revenue Share (%), by Airport Operation 2025 & 2033

- Figure 30: Middle East and Africa Smart Airport Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Smart Airport Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Smart Airport Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global Smart Airport Industry Revenue Million Forecast, by Airport Operation 2020 & 2033

- Table 3: Global Smart Airport Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Smart Airport Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 5: Global Smart Airport Industry Revenue Million Forecast, by Airport Operation 2020 & 2033

- Table 6: Global Smart Airport Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Smart Airport Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 10: Global Smart Airport Industry Revenue Million Forecast, by Airport Operation 2020 & 2033

- Table 11: Global Smart Airport Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Germany Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Italy Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Smart Airport Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 18: Global Smart Airport Industry Revenue Million Forecast, by Airport Operation 2020 & 2033

- Table 19: Global Smart Airport Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Smart Airport Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 26: Global Smart Airport Industry Revenue Million Forecast, by Airport Operation 2020 & 2033

- Table 27: Global Smart Airport Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Brazil Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Latin America Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Smart Airport Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 31: Global Smart Airport Industry Revenue Million Forecast, by Airport Operation 2020 & 2033

- Table 32: Global Smart Airport Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 33: Saudi Arabia Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: United Arab Emirates Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Middle East and Africa Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Airport Industry?

The projected CAGR is approximately 13.63%.

2. Which companies are prominent players in the Smart Airport Industry?

Key companies in the market include L3Harris Technologies Inc, Amadeus IT Group SA, Honeywell International Inc, Raytheon Technologies Corporation, THALES, Sabre GLBL Inc, IBM Corporation, Cisco Systems Inc, Siemens AG, NATS Holdings Limited, SITA, T-Systems International GmbH.

3. What are the main segments of the Smart Airport Industry?

The market segments include Technology, Airport Operation.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.89 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Passenger. Cargo & Baggage Ground Handling Segment to Dominate the Market During the Forecasted Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In February 2023, the Aviation Security Service (AvSec) of New Zealand awarded a contract to Smiths Detection, a leader in threat detection and security inspection technologies, to provide cutting-edge checkpoint security technology for its five main international airports: Auckland, Christchurch, Dunedin, Queenstown, and Wellington.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smart Airport Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smart Airport Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smart Airport Industry?

To stay informed about further developments, trends, and reports in the Smart Airport Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence