Key Insights

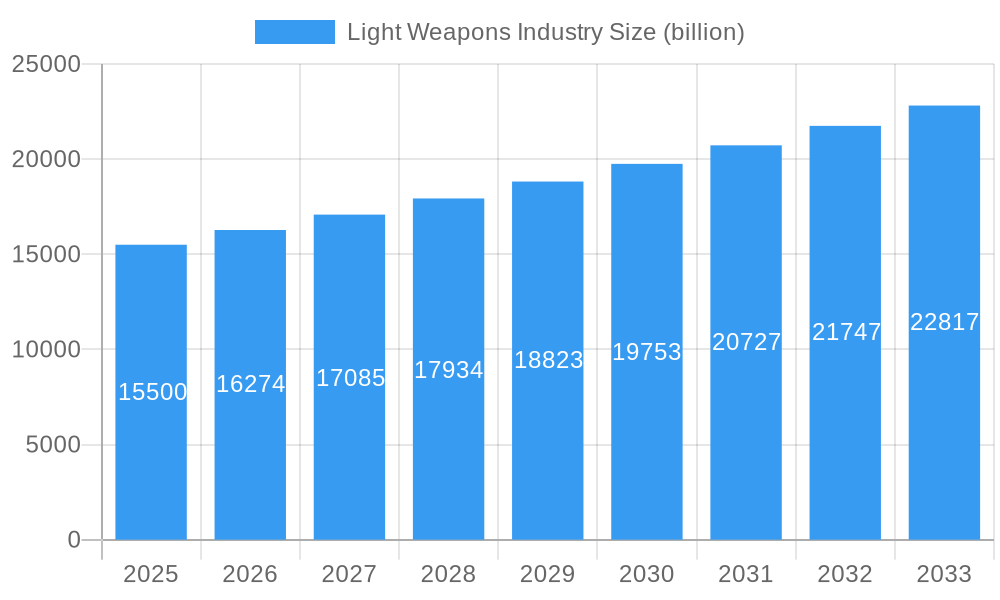

The global Light Weapons market is poised for robust expansion, projected to reach an estimated $15.5 billion in 2025. This growth is fueled by escalating geopolitical tensions, an increasing demand for advanced defense capabilities in emerging economies, and the continuous need for modernization of existing military arsenals. The market is characterized by a steady compound annual growth rate (CAGR) of 4.95%, indicating sustained momentum throughout the forecast period extending to 2033. Key growth drivers include the rising threat landscape, necessitating enhanced border security, counter-terrorism operations, and the deployment of sophisticated, yet portable, weaponry. Furthermore, advancements in technology, particularly in guided munitions and lightweight materials, are creating new market opportunities and driving product innovation. The increasing emphasis on precision strike capabilities and reduced collateral damage is also a significant factor contributing to market expansion, as nations invest in more effective and discriminate weapon systems.

Light Weapons Industry Market Size (In Billion)

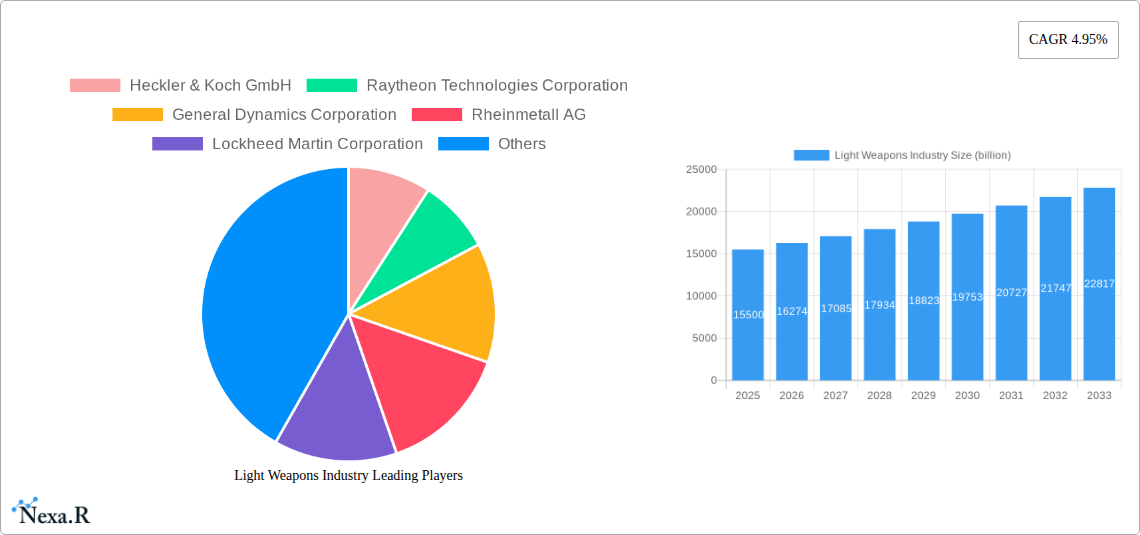

The light weapons market is segmented across a diverse range of product types, including Heavy Machine Guns (HMGs), Grenades and Grenade Launchers, Mortars, Man-portable Anti-tank Systems (MANPATS), and Man-portable Air Defense Systems (MANPADS). The technological landscape is equally varied, with significant advancements in both guided and unguided systems. Guided technologies such as laser, infrared, and satellite guidance, alongside semi-automatic command to line of sight (SACLOS) systems, are gaining prominence due to their enhanced accuracy and effectiveness. Conversely, unguided systems continue to hold relevance for their cost-effectiveness and widespread applicability in various combat scenarios. The competitive landscape is dominated by major global defense manufacturers, including Heckler & Koch GmbH, Raytheon Technologies Corporation, General Dynamics Corporation, and Lockheed Martin Corporation, among others, all actively engaged in research, development, and strategic partnerships to maintain their market positions. Regionally, North America and Europe represent significant markets, with Asia Pacific emerging as a key growth area due to increased defense spending by countries like China and India.

Light Weapons Industry Company Market Share

Unveiling the Global Light Weapons Market: A Comprehensive Forecast (2019-2033)

This in-depth report delivers a crucial analysis of the global light weapons industry, examining its current landscape, future trajectory, and the intricate dynamics shaping its evolution. Spanning from 2019 to 2033, with a base year of 2025, this study offers unparalleled insights into market size, growth drivers, segmentation, technological advancements, and key players. We dissect the parent market of defense systems and its child market of light weaponry, providing a holistic view for defense manufacturers, government procurement agencies, and strategic analysts. Leveraging high-traffic keywords such as "light weapons market," "man-portable anti-tank systems," "man-portable air defense systems," "guided missiles," "defense industry," and "military procurement," this report ensures maximum visibility and engagement within the defense sector.

Light Weapons Industry Market Dynamics & Structure

The global light weapons industry is characterized by a moderately concentrated market structure, with key players like Raytheon Technologies Corporation, Lockheed Martin Corporation, and BAE Systems PLC holding significant market shares. Technological innovation, particularly in guided munitions and advanced targeting systems, acts as a primary growth driver, pushing the demand for precision-strike capabilities. Stringent regulatory frameworks governing arms manufacturing, export, and import significantly influence market entry and product development. Competitive product substitutes, such as advanced drone technology and non-lethal weapon systems, present a growing challenge. End-user demographics are predominantly state-sponsored defense forces, with increasing demand from emerging economies seeking to modernize their infantry capabilities. Merger and acquisition (M&A) trends are driven by the need to consolidate capabilities, secure technological advantages, and expand geographical reach.

- Market Concentration: Dominated by a few large multinational defense contractors, but with a significant number of specialized manufacturers.

- Technological Innovation: Focus on miniaturization, enhanced lethality, improved guidance systems (Laser Guided, Infrared Guided, Satellite Guided, Semi-automatic Command to Line of Sight), and network-centric warfare integration.

- Regulatory Frameworks: Compliance with international arms treaties and national defense policies is paramount.

- Competitive Substitutes: Evolution of drone warfare and directed energy weapons posing potential long-term challenges.

- End-User Demographics: Primarily national militaries, with growing interest from paramilitary forces and law enforcement agencies.

- M&A Trends: Strategic acquisitions aimed at technology integration, market access, and cost optimization.

Light Weapons Industry Growth Trends & Insights

The global light weapons industry is projected to witness robust growth throughout the forecast period of 2025-2033, driven by escalating geopolitical tensions, modernization efforts by defense forces worldwide, and an increasing demand for man-portable defense solutions. The market size is expected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.2%, reaching an estimated xx billion units by 2033. Adoption rates for advanced guided light weapons, particularly Man-portable Anti-tank Systems (MANPATS) and Man-portable Air Defense Systems (MANPADS), are surging due to their cost-effectiveness and significant tactical advantages against modern armored threats and low-flying aircraft. Technological disruptions, such as the integration of artificial intelligence (AI) for enhanced targeting and improved battlefield awareness, are reshaping product development. Consumer behavior shifts within defense ministries are moving towards procuring systems that offer modularity, interoperability, and reduced logistical footprints. The increasing emphasis on asymmetrical warfare and counter-terrorism operations further fuels the demand for versatile and deployable light weapon systems.

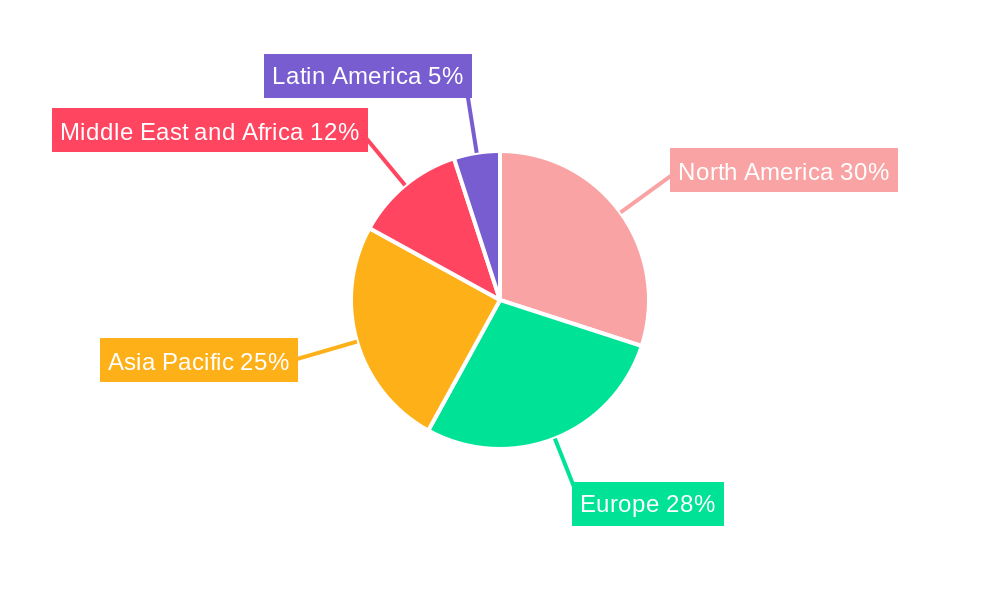

Dominant Regions, Countries, or Segments in Light Weapons Industry

The Man-portable Air Defense Systems (MANPADS) segment is a dominant force within the global light weapons industry, significantly influencing market growth from 2025 to 2033. This dominance is fueled by the persistent threat of low-altitude aerial attacks from conventional military aircraft, drones, and emerging unmanned aerial systems (UAS). Countries in North America and Europe are leading the charge in both procurement and technological development, driven by their extensive defense budgets and ongoing modernization programs. However, the Asia-Pacific region is emerging as a critical growth engine, with nations like India and China significantly increasing their investments in indigenous defense capabilities and advanced MANPADS technology.

- Dominant Segment: Man-portable Air Defense Systems (MANPADS)

- Key Drivers: Evolving aerial threats, counter-terrorism efforts, modernization of air defense capabilities, and the need for rapid deployment.

- Market Share: Estimated to hold xx% of the total light weapons market by 2033.

- Growth Potential: High, driven by continuous technological advancements and increasing regional security concerns.

- Dominant Region: North America

- Key Drivers: Advanced research and development, substantial defense spending, technological leadership (e.g., Raytheon Technologies Corporation's Stinger missile), and strong governmental support for defense innovation.

- Market Share: Holds a significant portion of the global market due to advanced procurement and manufacturing capabilities.

- Growth Potential: Stable and consistent, driven by ongoing modernization and strategic alliances.

- Emerging Growth Hub: Asia-Pacific

- Key Drivers: Rapidly expanding defense budgets, increasing regional security challenges, a focus on indigenous manufacturing, and the growing threat landscape.

- Market Share: Experiencing the highest growth rate, projected to capture a substantial market share by 2033.

- Growth Potential: Very high, fueled by geopolitical dynamics and government mandates for self-reliance in defense.

- Technological Dominance: Guided technologies, particularly Infrared Guided and Laser Guided systems, are critical for the effectiveness of MANPADS and MANPATS, driving innovation and market demand.

Light Weapons Industry Product Landscape

The light weapons industry is characterized by continuous product innovation, with a focus on enhanced lethality, accuracy, and user-friendliness. Applications range from infantry support and anti-armor operations to air defense against low-flying threats. Key product innovations include modular weapon systems allowing for various configurations, advanced targeting pods for improved situational awareness, and integrated fire control systems for guided munitions. Performance metrics are continuously improving, with advancements in range, penetration capabilities, and reduced collateral damage. The unique selling propositions revolve around reliability, portability, and cost-effectiveness in delivering decisive battlefield effects. Technological advancements are particularly evident in the integration of smart fuses, multi-target engagement capabilities, and man-portable guided missile systems that rival the effectiveness of larger platforms.

Key Drivers, Barriers & Challenges in Light Weapons Industry

Key Drivers:

- Geopolitical Instability: Rising global conflicts and regional tensions necessitate robust defense capabilities.

- Military Modernization Programs: Nations worldwide are investing heavily in upgrading their infantry and tactical weapon systems.

- Technological Advancements: Development of more precise, lighter, and multi-functional light weapons drives demand.

- Counter-Terrorism Operations: The need for effective portable weaponry in asymmetric warfare scenarios.

- Increasing Defense Budgets: Several key nations are allocating significant portions of their budgets to defense procurement.

Barriers & Challenges:

- Strict Export Controls and Regulations: International agreements and national policies can limit market access and sales.

- High Research and Development Costs: Developing advanced light weapons requires substantial investment.

- Ethical Concerns and Public Scrutiny: The use of lethal force and arms trade face ongoing ethical debates.

- Supply Chain Vulnerabilities: Reliance on global supply chains can be disrupted by political instability or logistical issues.

- Proliferation Risks: The unauthorized spread of light weapons poses significant security challenges.

- Emergence of Counter-Technologies: The development of countermeasures against light weapons, such as advanced armor or electronic warfare, can reduce their effectiveness.

Emerging Opportunities in Light Weapons Industry

Emerging opportunities in the light weapons industry lie in the development of next-generation guided munitions with enhanced artificial intelligence capabilities for autonomous target recognition and engagement. The burgeoning market for anti-drone weaponry presents a significant avenue for growth, requiring specialized man-portable systems. Furthermore, the increasing demand for less-lethal but highly effective incapacitation systems for law enforcement and special forces offers a niche but expanding market. The integration of advanced materials for lighter and more durable weapon systems, alongside user-friendly interfaces and augmented reality integration for training and target acquisition, represent further untapped potential. The growing emphasis on modularity and interoperability across different weapon platforms will also drive demand for adaptable light weapon solutions.

Growth Accelerators in the Light Weapons Industry Industry

Growth in the light weapons industry is being significantly accelerated by rapid technological breakthroughs, particularly in the field of precision-guided munitions and advanced sensor integration. The increasing adoption of guided technologies (Laser Guided, Infrared Guided, Satellite Guided, Semi-automatic Command to Line of Sight) is enhancing the effectiveness and desirability of light weapon systems. Strategic partnerships between defense contractors and technology firms are fostering innovation and creating synergistic development opportunities. Market expansion strategies, driven by the need to equip rapidly modernizing militaries in emerging economies, are also acting as major growth catalysts. Furthermore, government initiatives to promote indigenous defense manufacturing are spurring local innovation and creating new market avenues.

Key Players Shaping the Light Weapons Industry Market

- Heckler & Koch GmbH

- Raytheon Technologies Corporation

- General Dynamics Corporation

- Rheinmetall AG

- Lockheed Martin Corporation

- Rostec

- Israel Aerospace Industries Lt

- MBDA Inc

- Thales Group

- Denel SOC Ltd

- Rafael Advanced Defense Systems Ltd

- BAE Systems PLC

- FN Herstal SA

- Saab AB

Notable Milestones in Light Weapons Industry Sector

- February 2022: Indian Army signs a contract worth USD 413.50 million with Bharat Dynamics Limited (BDL) for the supply of Konkurs-M anti-tank guided missiles, bolstering anti-armor capabilities.

- January 2022: Finnish Defence Forces Logistics Command approves the procurement of new rifle systems from Sako, including the Sniper Rifle 23 and Designated Marksman Rifle 23, enhancing infantry precision.

- July 2021: US Department of Defense contracts Raytheon Technologies Corporation for USD 321 million for the supply of Stinger anti-aircraft guided missiles, reinforcing air defense capabilities.

- May 2021: Spanish Army awards a contract exceeding USD 25 million to Instalaza for the purchase of C90 shoulder-fired rocket-propelled grenade launchers, enhancing infantry anti-materiel and anti-personnel capabilities.

In-Depth Light Weapons Industry Market Outlook

The future outlook for the light weapons industry remains exceptionally strong, driven by persistent geopolitical uncertainties and an ongoing global imperative for enhanced national security. Growth accelerators, including the rapid integration of artificial intelligence into targeting systems and the development of highly effective counter-drone weaponry, are poised to redefine battlefield effectiveness. Strategic partnerships and increasing government investments in defense modernization will continue to fuel market expansion. The focus on modular, adaptable, and networked light weapon systems will further solidify their indispensable role in modern military operations, ensuring sustained demand and innovation throughout the forecast period and beyond.

Light Weapons Industry Segmentation

-

1. Type

- 1.1. Heavy Machine Guns (HMGs)

- 1.2. Grenades and Grenade Launchers

- 1.3. Mortars

- 1.4. Man-portable Anti-tank Systems (MANPATS)

- 1.5. Man-portable Air Defense Systems (MANPADS)

- 1.6. Other Types

-

2. Technology

-

2.1. Guided

- 2.1.1. Laser Guided

- 2.1.2. Infrared Guided

- 2.1.3. Satellite Guided

- 2.1.4. Semi-automatic Command to Line of Sight

- 2.2. Unguided

-

2.1. Guided

Light Weapons Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Israel

- 5.4. Rest of Middle East and Africa

Light Weapons Industry Regional Market Share

Geographic Coverage of Light Weapons Industry

Light Weapons Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Evolving Battlefield Engagement Scenarios Driving the Demand for New Generation Weapon Systems

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Light Weapons Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Heavy Machine Guns (HMGs)

- 5.1.2. Grenades and Grenade Launchers

- 5.1.3. Mortars

- 5.1.4. Man-portable Anti-tank Systems (MANPATS)

- 5.1.5. Man-portable Air Defense Systems (MANPADS)

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Guided

- 5.2.1.1. Laser Guided

- 5.2.1.2. Infrared Guided

- 5.2.1.3. Satellite Guided

- 5.2.1.4. Semi-automatic Command to Line of Sight

- 5.2.2. Unguided

- 5.2.1. Guided

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Light Weapons Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Heavy Machine Guns (HMGs)

- 6.1.2. Grenades and Grenade Launchers

- 6.1.3. Mortars

- 6.1.4. Man-portable Anti-tank Systems (MANPATS)

- 6.1.5. Man-portable Air Defense Systems (MANPADS)

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Guided

- 6.2.1.1. Laser Guided

- 6.2.1.2. Infrared Guided

- 6.2.1.3. Satellite Guided

- 6.2.1.4. Semi-automatic Command to Line of Sight

- 6.2.2. Unguided

- 6.2.1. Guided

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Light Weapons Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Heavy Machine Guns (HMGs)

- 7.1.2. Grenades and Grenade Launchers

- 7.1.3. Mortars

- 7.1.4. Man-portable Anti-tank Systems (MANPATS)

- 7.1.5. Man-portable Air Defense Systems (MANPADS)

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Guided

- 7.2.1.1. Laser Guided

- 7.2.1.2. Infrared Guided

- 7.2.1.3. Satellite Guided

- 7.2.1.4. Semi-automatic Command to Line of Sight

- 7.2.2. Unguided

- 7.2.1. Guided

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Light Weapons Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Heavy Machine Guns (HMGs)

- 8.1.2. Grenades and Grenade Launchers

- 8.1.3. Mortars

- 8.1.4. Man-portable Anti-tank Systems (MANPATS)

- 8.1.5. Man-portable Air Defense Systems (MANPADS)

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Guided

- 8.2.1.1. Laser Guided

- 8.2.1.2. Infrared Guided

- 8.2.1.3. Satellite Guided

- 8.2.1.4. Semi-automatic Command to Line of Sight

- 8.2.2. Unguided

- 8.2.1. Guided

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Light Weapons Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Heavy Machine Guns (HMGs)

- 9.1.2. Grenades and Grenade Launchers

- 9.1.3. Mortars

- 9.1.4. Man-portable Anti-tank Systems (MANPATS)

- 9.1.5. Man-portable Air Defense Systems (MANPADS)

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Guided

- 9.2.1.1. Laser Guided

- 9.2.1.2. Infrared Guided

- 9.2.1.3. Satellite Guided

- 9.2.1.4. Semi-automatic Command to Line of Sight

- 9.2.2. Unguided

- 9.2.1. Guided

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Light Weapons Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Heavy Machine Guns (HMGs)

- 10.1.2. Grenades and Grenade Launchers

- 10.1.3. Mortars

- 10.1.4. Man-portable Anti-tank Systems (MANPATS)

- 10.1.5. Man-portable Air Defense Systems (MANPADS)

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Guided

- 10.2.1.1. Laser Guided

- 10.2.1.2. Infrared Guided

- 10.2.1.3. Satellite Guided

- 10.2.1.4. Semi-automatic Command to Line of Sight

- 10.2.2. Unguided

- 10.2.1. Guided

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Heckler & Koch GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Raytheon Technologies Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 General Dynamics Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Rheinmetall AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lockheed Martin Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rostec

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Israel Aerospace Industries Lt

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 MBDA Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Thales Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Denel SOC Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Rafael Advanced Defense Systems Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 BAE Systems PLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 FN Herstal SA

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Saab AB

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Heckler & Koch GmbH

List of Figures

- Figure 1: Global Light Weapons Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Light Weapons Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Light Weapons Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Light Weapons Industry Revenue (billion), by Technology 2025 & 2033

- Figure 5: North America Light Weapons Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Light Weapons Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Light Weapons Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Light Weapons Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Light Weapons Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Light Weapons Industry Revenue (billion), by Technology 2025 & 2033

- Figure 11: Europe Light Weapons Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 12: Europe Light Weapons Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Light Weapons Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Light Weapons Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Light Weapons Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Light Weapons Industry Revenue (billion), by Technology 2025 & 2033

- Figure 17: Asia Pacific Light Weapons Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 18: Asia Pacific Light Weapons Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Light Weapons Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Light Weapons Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: Latin America Light Weapons Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Light Weapons Industry Revenue (billion), by Technology 2025 & 2033

- Figure 23: Latin America Light Weapons Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 24: Latin America Light Weapons Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Light Weapons Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Light Weapons Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Light Weapons Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Light Weapons Industry Revenue (billion), by Technology 2025 & 2033

- Figure 29: Middle East and Africa Light Weapons Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Middle East and Africa Light Weapons Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Light Weapons Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Light Weapons Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Light Weapons Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 3: Global Light Weapons Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Light Weapons Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Light Weapons Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 6: Global Light Weapons Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Light Weapons Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Light Weapons Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Light Weapons Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Global Light Weapons Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 11: Global Light Weapons Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Light Weapons Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: France Light Weapons Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Germany Light Weapons Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Russia Light Weapons Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Light Weapons Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Global Light Weapons Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Global Light Weapons Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 19: Global Light Weapons Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 20: China Light Weapons Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: India Light Weapons Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Japan Light Weapons Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: South Korea Light Weapons Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Light Weapons Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Global Light Weapons Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Global Light Weapons Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 27: Global Light Weapons Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Brazil Light Weapons Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of Latin America Light Weapons Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Global Light Weapons Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 31: Global Light Weapons Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 32: Global Light Weapons Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 33: Saudi Arabia Light Weapons Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: United Arab Emirates Light Weapons Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Israel Light Weapons Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East and Africa Light Weapons Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Light Weapons Industry?

The projected CAGR is approximately 4.95%.

2. Which companies are prominent players in the Light Weapons Industry?

Key companies in the market include Heckler & Koch GmbH, Raytheon Technologies Corporation, General Dynamics Corporation, Rheinmetall AG, Lockheed Martin Corporation, Rostec, Israel Aerospace Industries Lt, MBDA Inc, Thales Group, Denel SOC Ltd, Rafael Advanced Defense Systems Ltd, BAE Systems PLC, FN Herstal SA, Saab AB.

3. What are the main segments of the Light Weapons Industry?

The market segments include Type, Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.5 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Evolving Battlefield Engagement Scenarios Driving the Demand for New Generation Weapon Systems.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In February 2022, the Indian Army signed a contract worth INR 3,131.82 crore (USD 413.50 million) with Bharat Dynamics Limited (BDL) to manufacture and supply Konkurs-M anti-tank guided missiles to destroy armored vehicles equipped with explosive reactive armors. The contract is expected to run over a period of three years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Light Weapons Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Light Weapons Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Light Weapons Industry?

To stay informed about further developments, trends, and reports in the Light Weapons Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence