Key Insights

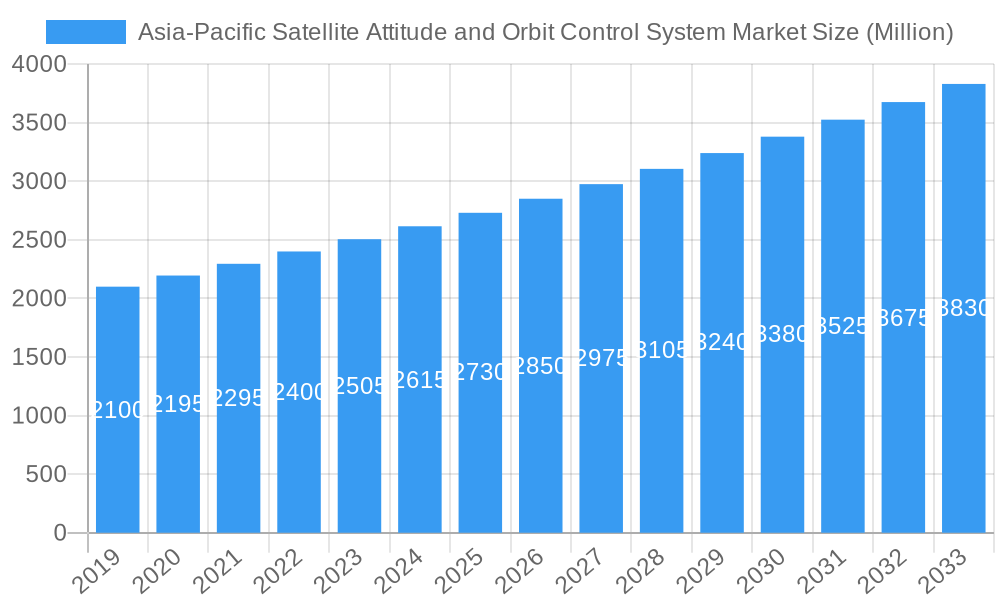

The Asia-Pacific Satellite Attitude and Orbit Control System (AOCS) Market is set for substantial expansion, driven by increasing demand for advanced satellite capabilities. With an estimated market size of 0.96 billion in the base year 2025, the market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.94% through 2033. This growth is fueled by the rising adoption of satellites for Earth Observation, telecommunications, space exploration, and commercial constellations. Innovations in AOCS component miniaturization, precision, and cost-effectiveness are key drivers.

Asia-Pacific Satellite Attitude and Orbit Control System Market Market Size (In Million)

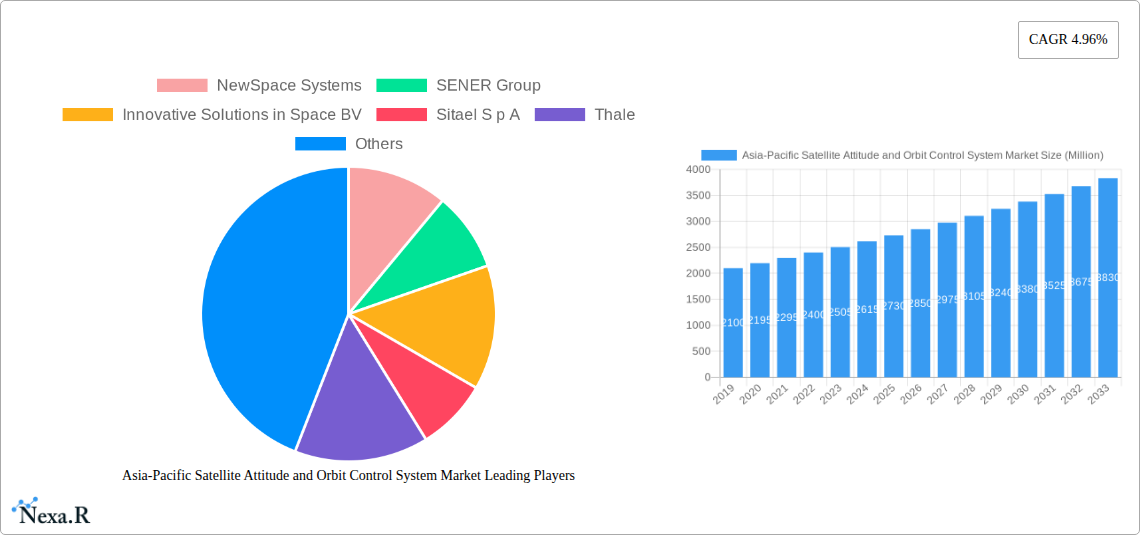

Key market players include Thales, SENER Group, NewSpace Systems, and AAC Clyde Space. Market segmentation highlights Communication and Earth Observation as leading applications. The 10-100kg and 100-500kg satellite mass segments, along with the Low Earth Orbit (LEO) class, are expected to see significant activity. Commercial and Military & Government sectors are primary end-users. The Asia-Pacific region, with strong government investment and a vibrant private space industry in countries like China, Japan, South Korea, and India, is a critical growth hub, positioning the AOCS market for sustained expansion.

Asia-Pacific Satellite Attitude and Orbit Control System Market Company Market Share

Asia-Pacific Satellite Attitude and Orbit Control System Market: Comprehensive Report 2019-2033

Unlock the future of space exploration and connectivity with our in-depth analysis of the Asia-Pacific Satellite Attitude and Orbit Control System (AOCS) Market. This report provides critical insights into market dynamics, growth trajectories, and competitive landscapes, empowering stakeholders to make informed strategic decisions. Covering the period from 2019 to 2033, with a base year of 2025, this research delves deep into the evolving AOCS sector, driven by advancements in satellite technology, burgeoning space programs, and increasing demand across various applications.

This report is a must-have for satellite manufacturers, AOCS component suppliers, space agencies, defense organizations, and investment firms seeking to understand the intricate workings and vast opportunities within the Asia-Pacific AOCS market.

Asia-Pacific Satellite Attitude and Orbit Control System Market Market Dynamics & Structure

The Asia-Pacific satellite attitude and orbit control system (AOCS) market is characterized by a dynamic interplay of technological innovation, evolving regulatory landscapes, and robust end-user demand. Market concentration is moderately fragmented, with established players and agile newcomers vying for market share. Technological innovation is a primary driver, fueled by the relentless pursuit of higher precision, miniaturization, and cost-effectiveness in AOCS components. Regulatory frameworks, while still developing in some regions, are increasingly supportive of space activities, encouraging private sector investment and fostering collaboration. Competitive product substitutes are limited, as AOCS are highly specialized systems, but advancements in software algorithms and sensor fusion are continuously enhancing performance. End-user demographics are shifting towards a larger commercial segment, driven by the proliferation of small satellites and constellations for Earth observation, communication, and IoT services. Mergers and acquisitions (M&A) trends are on the rise as companies seek to consolidate expertise, expand product portfolios, and gain a competitive edge.

- Market Concentration: Moderately fragmented, with a mix of large established aerospace companies and specialized AOCS providers.

- Technological Innovation Drivers: Miniaturization of components, enhanced sensor accuracy, advanced software algorithms, AI integration for autonomous control, and development of cost-effective solutions.

- Regulatory Frameworks: Increasing governmental support for space exploration, commercial satellite launches, and data utilization, with evolving policies on spectrum allocation and debris mitigation.

- Competitive Product Substitutes: Limited direct substitutes, but advancements in software and processing power offer potential for enhanced functionality within existing hardware.

- End-User Demographics: Growing demand from commercial entities for Earth Observation, communication constellations, and nascent space tourism initiatives, alongside continued government and military procurements.

- M&A Trends: Strategic acquisitions aimed at broadening AOCS capabilities, integrating sensor and actuator technologies, and expanding market reach across the Asia-Pacific region.

Asia-Pacific Satellite Attitude and Orbit Control System Market Growth Trends & Insights

The Asia-Pacific Satellite Attitude and Orbit Control System (AOCS) Market is experiencing a significant growth trajectory, propelled by a confluence of technological advancements, expanding space infrastructure, and a surge in satellite deployment across the region. The market size evolution is a testament to the increasing sophistication of space missions, with a projected Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2025 to 2033. This growth is underpinned by escalating adoption rates of AOCS in diverse satellite applications, ranging from high-resolution Earth observation for climate monitoring and resource management to the burgeoning demand for global broadband connectivity through large satellite constellations.

Technological disruptions are playing a pivotal role, with continuous innovations in sensor technology, reaction wheels, thrusters, and onboard processing units. The development of highly accurate and compact star trackers, inertial measurement units (IMUs), and magnetometers is enabling more precise attitude determination and control, crucial for mission success. Furthermore, the increasing integration of artificial intelligence (AI) and machine learning (ML) algorithms within AOCS is revolutionizing autonomous operations, fault detection, and real-time trajectory correction, thereby enhancing mission reliability and reducing operational costs.

Consumer behavior shifts, particularly within the commercial sector, are a key indicator of market expansion. The rise of NewSpace companies and the increasing affordability of satellite launches are democratizing space access, leading to a demand for standardized, cost-effective, and high-performance AOCS solutions for small satellite constellations. This shift also influences the demand for adaptable and scalable AOCS architectures that can support rapid deployment and evolving mission requirements. The robust growth in the navigation segment, driven by the need for enhanced precision positioning for autonomous vehicles and advanced mapping, further accentuates the upward trend. The space observation segment, fueled by scientific research and astronomical exploration, also contributes to the sustained demand for sophisticated AOCS.

The market penetration of advanced AOCS technologies is expected to deepen, as satellite manufacturers prioritize reliability, performance, and reduced operational overhead. The increasing complexity of missions, including deep space exploration and sophisticated orbital maneuvers, necessitates highly capable AOCS. The emphasis on miniaturization and power efficiency in AOCS components is also a significant trend, aligning with the miniaturization of satellites themselves. This holistic growth, driven by both technological prowess and evolving market demands, positions the Asia-Pacific AOCS market for sustained and robust expansion in the coming years, with an estimated market size of XXX Million USD by 2033.

Dominant Regions, Countries, or Segments in Asia-Pacific Satellite Attitude and Orbit Control System Market

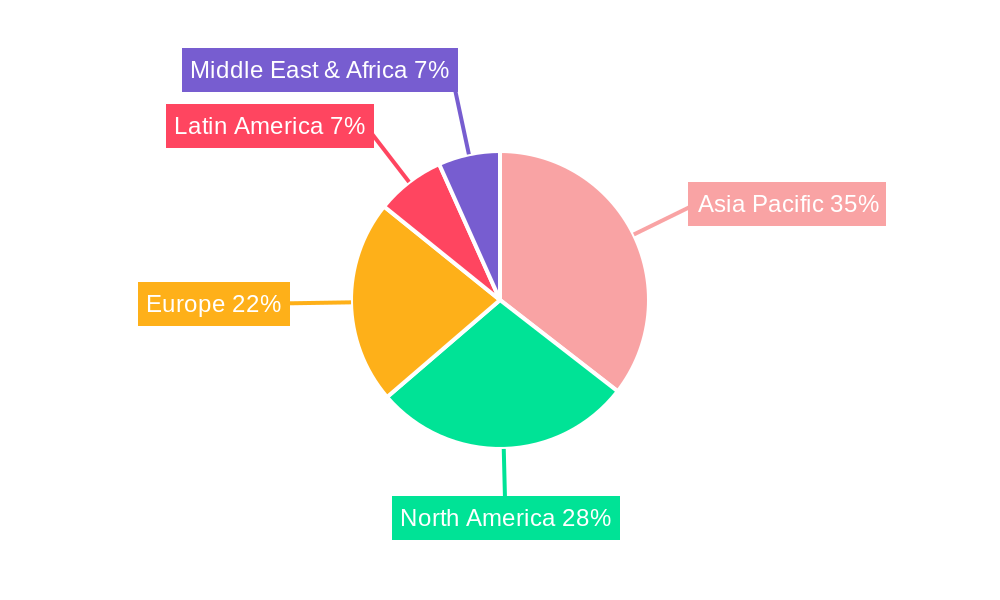

The Asia-Pacific Satellite Attitude and Orbit Control System (AOCS) Market is witnessing significant growth, with certain regions, countries, and segments emerging as dominant forces. China stands out as a leading country in the Asia-Pacific AOCS market. Its ambitious space program, characterized by extensive investments in satellite constellations for communication, Earth observation, and navigation (e.g., the BeiDou Navigation Satellite System), directly fuels the demand for advanced AOCS. Government-backed initiatives to establish a robust domestic space industry, coupled with a strong focus on indigenous technological development, position China at the forefront. The sheer volume of satellite launches planned and executed by China, including its own space station program, necessitates a continuous and substantial supply of sophisticated AOCS.

Within the Application segment, Communication is a dominant driver of market growth. The rapid expansion of satellite internet services, driven by both government initiatives and private ventures aiming to bridge the digital divide and provide global connectivity, requires a vast number of satellites equipped with reliable AOCS. This segment is characterized by the development and deployment of large LEO constellations, each demanding precise attitude control for optimal signal transmission and inter-satellite communication.

Regarding Satellite Mass, the 100-500kg and 500-1000kg categories are witnessing substantial traction. These mass classes are ideal for a wide range of missions, including advanced Earth observation satellites, commercial communication satellites, and scientific research platforms. They offer a balance between payload capacity and launch cost, making them attractive for both government and commercial entities. The increasing sophistication of sensors and payloads for these satellites directly translates into a demand for more advanced and precise AOCS.

In terms of Orbit Class, LEO (Low Earth Orbit) is experiencing the most rapid growth. The proliferation of LEO satellite constellations for Earth observation, communication, and remote sensing is a primary contributor to this dominance. LEO orbits offer advantages such as lower latency for communication and higher resolution for Earth observation, making them highly sought after. Consequently, the AOCS market must cater to the specific requirements of LEO satellites, including rapid maneuvering capabilities and precise station-keeping.

From an End User perspective, the Commercial segment is emerging as a significant growth accelerator. The influx of private companies investing in space-based services, such as imagery, connectivity, and data analytics, is creating substantial demand for AOCS. These commercial entities often focus on cost-effectiveness and rapid deployment, driving innovation in standardized and mass-produced AOCS solutions. However, the Military & Government segment remains a critical and substantial market, driven by national security interests, surveillance, reconnaissance, and strategic communication needs, often demanding highly robust and specialized AOCS.

Asia-Pacific Satellite Attitude and Orbit Control System Market Product Landscape

The Asia-Pacific Satellite Attitude and Orbit Control System (AOCS) product landscape is characterized by continuous innovation aimed at enhancing accuracy, reliability, miniaturization, and cost-effectiveness. Key product categories include star trackers, sun sensors, Earth sensors, magnetometers, inertial measurement units (IMUs), reaction wheels, magnetic torquers, and thrusters. Companies are focusing on developing highly integrated AOCS solutions, where multiple functionalities are combined into single units to reduce size, weight, and power (SWaP) requirements. Advanced algorithms and sophisticated sensor fusion techniques are integral to improving attitude determination and control precision. Innovations in materials science and manufacturing processes are also contributing to the development of more robust and space-hardened AOCS components.

Key Drivers, Barriers & Challenges in Asia-Pacific Satellite Attitude and Orbit Control System Market

Key Drivers:

- Growing demand for satellite-based services: Increased need for Earth observation, communication, navigation, and surveillance applications fuels AOCS procurement.

- Proliferation of LEO satellite constellations: The rise of commercial constellations for broadband internet and data services significantly boosts demand for AOCS for numerous small satellites.

- Advancements in satellite technology: Miniaturization and increased capabilities of satellites necessitate more sophisticated and efficient AOCS.

- Government investments in space programs: National space agencies and defense departments in Asia-Pacific countries are actively investing in satellite development and deployment.

- Technological innovation: Continuous improvements in sensor accuracy, control algorithms, and actuator performance drive the adoption of newer AOCS.

Barriers & Challenges:

- High development and production costs: The specialized nature of AOCS leads to significant research, development, and manufacturing expenses.

- Stringent reliability and performance requirements: AOCS failures can lead to mission loss, necessitating rigorous testing and qualification processes, which are time-consuming and costly.

- Complex supply chains and reliance on specialized components: Sourcing of critical AOCS components can be challenging due to limited suppliers and potential geopolitical disruptions.

- Regulatory hurdles and international standards: Navigating diverse national regulations and adhering to evolving international standards for space operations can pose challenges.

- Skilled workforce shortage: A scarcity of highly skilled engineers and technicians specialized in AOCS design, testing, and manufacturing.

Emerging Opportunities in Asia-Pacific Satellite Attitude and Orbit Control System Market

Emerging opportunities in the Asia-Pacific Satellite Attitude and Orbit Control System (AOCS) market lie in the growing demand for highly autonomous and intelligent AOCS for large satellite constellations, enabling reduced ground control intervention. The increasing focus on space debris mitigation and active debris removal missions presents an opportunity for specialized AOCS designed for precise orbital maneuvers and rendezvous capabilities. Furthermore, the development of AOCS for new space applications such as in-orbit servicing, assembly, and manufacturing (ISAM) will be a significant growth area. The expansion of regional space tourism and the growing interest in lunar and Martian exploration missions will also drive the need for advanced and reliable AOCS solutions.

Growth Accelerators in the Asia-Pacific Satellite Attitude and Orbit Control System Market Industry

Several catalysts are accelerating the growth of the Asia-Pacific Satellite Attitude and Orbit Control System (AOCS) industry. Technological breakthroughs in areas like miniaturized reaction wheels with higher momentum capacity, advanced digital star trackers with improved accuracy and wider field of view, and highly efficient micro-thruster systems are key growth accelerators. Strategic partnerships between satellite manufacturers, AOCS providers, and launch service providers are streamlining the development and deployment of satellite systems, thereby boosting AOCS demand. Market expansion strategies, including the establishment of local manufacturing and support facilities in key Asia-Pacific nations, are also critical in enhancing accessibility and responsiveness to regional market needs. The increasing adoption of AI and machine learning for predictive maintenance and autonomous operations within AOCS is further enhancing their value proposition.

Key Players Shaping the Asia-Pacific Satellite Attitude and Orbit Control System Market Market

- NewSpace Systems

- SENER Group

- Innovative Solutions in Space BV

- Sitael S p A

- Thales

- Jena-Optronik

- AAC Clyde Space

Notable Milestones in Asia-Pacific Satellite Attitude and Orbit Control System Market Sector

- February 2023: Jena-Optronik announced that it has been selected by satellite constellation manufacturer Airbus OneWeb Satellites to provide the ASTRO CL a Attitude and Orbit Control Systems (AOCS) sensor for the ARROW family of small satellites. This collaboration highlights the growing demand for advanced AOCS in LEO constellations.

- December 2022: ASTRO CL, the smallest member of Jena-Optronik's ASTRO star tracker family, has been chosen to support the new proliferated LEO satellite platform at Maxar. Each satellite will carry two ASTRO CL star trackers to enable its guidance, navigation and control. This signifies a trend towards miniaturization and high-performance sensors for LEO applications.

- November 2022: NASA's mission Artemis I was equipped with two star sensors by Jena-Optronik GmbH, which would ensure the precise alignment of the spaceship on its way to the Moon. This demonstrated the reliability and accuracy of Jena-Optronik's products for critical deep-space missions.

In-Depth Asia-Pacific Satellite Attitude and Orbit Control System Market Market Outlook

The future outlook for the Asia-Pacific Satellite Attitude and Orbit Control System (AOCS) market is exceptionally bright, driven by sustained investment in space technology and the escalating demand for satellite-enabled services. Growth accelerators such as advancements in AI-powered autonomous control systems, the development of radiation-hardened and SWaP-optimized AOCS for deep space missions, and the expansion of commercial space ventures will continue to shape market dynamics. Strategic opportunities abound in developing integrated AOCS solutions for mega-constellations, enhancing capabilities for lunar and Martian exploration, and supporting the burgeoning in-orbit servicing sector. The increasing emphasis on space sustainability will also drive innovation in AOCS for debris tracking and removal. The region's commitment to developing indigenous space capabilities ensures a robust and evolving market for advanced AOCS.

Asia-Pacific Satellite Attitude and Orbit Control System Market Segmentation

-

1. Application

- 1.1. Communication

- 1.2. Earth Observation

- 1.3. Navigation

- 1.4. Space Observation

- 1.5. Others

-

2. Satellite Mass

- 2.1. 10-100kg

- 2.2. 100-500kg

- 2.3. 500-1000kg

- 2.4. Below 10 Kg

- 2.5. above 1000kg

-

3. Orbit Class

- 3.1. GEO

- 3.2. LEO

- 3.3. MEO

-

4. End User

- 4.1. Commercial

- 4.2. Military & Government

- 4.3. Other

Asia-Pacific Satellite Attitude and Orbit Control System Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Satellite Attitude and Orbit Control System Market Regional Market Share

Geographic Coverage of Asia-Pacific Satellite Attitude and Orbit Control System Market

Asia-Pacific Satellite Attitude and Orbit Control System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Satellite Attitude and Orbit Control System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication

- 5.1.2. Earth Observation

- 5.1.3. Navigation

- 5.1.4. Space Observation

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 5.2.1. 10-100kg

- 5.2.2. 100-500kg

- 5.2.3. 500-1000kg

- 5.2.4. Below 10 Kg

- 5.2.5. above 1000kg

- 5.3. Market Analysis, Insights and Forecast - by Orbit Class

- 5.3.1. GEO

- 5.3.2. LEO

- 5.3.3. MEO

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Commercial

- 5.4.2. Military & Government

- 5.4.3. Other

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NewSpace Systems

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SENER Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Innovative Solutions in Space BV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sitael S p A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Thale

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jena-Optronik

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AAC Clyde Space

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 NewSpace Systems

List of Figures

- Figure 1: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Satellite Attitude and Orbit Control System Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 3: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 4: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by End User 2020 & 2033

- Table 5: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 8: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 9: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by End User 2020 & 2033

- Table 10: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: China Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Japan Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: South Korea Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: India Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Australia Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: New Zealand Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Indonesia Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Malaysia Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Singapore Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Thailand Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Vietnam Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Philippines Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Satellite Attitude and Orbit Control System Market?

The projected CAGR is approximately 10.94%.

2. Which companies are prominent players in the Asia-Pacific Satellite Attitude and Orbit Control System Market?

Key companies in the market include NewSpace Systems, SENER Group, Innovative Solutions in Space BV, Sitael S p A, Thale, Jena-Optronik, AAC Clyde Space.

3. What are the main segments of the Asia-Pacific Satellite Attitude and Orbit Control System Market?

The market segments include Application, Satellite Mass, Orbit Class, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.96 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Jena-Optronik announced that it has been selected by satellite constellation manufacturer Airbus OneWeb Satellites to provide the ASTRO CL a Attitude and Orbit Control Systems (AOCS) sensor for the ARROW family of small satellites.December 2022: ASTRO CL, the smallest member of Jena-Optronik's ASTRO star tracker family, has been chosen to support the new proliferated LEO satellite platform at Maxar. Each satellite will carry two ASTRO CL star trackers to enable its guidance, navigation and control.November 2022: NASA's mission Artemis I was equipped with two star sensors by Jena-Optronik GmbH, which would ensure the precise alignment of the spaceship on its way to the Moon.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Satellite Attitude and Orbit Control System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Satellite Attitude and Orbit Control System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Satellite Attitude and Orbit Control System Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Satellite Attitude and Orbit Control System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence