Key Insights

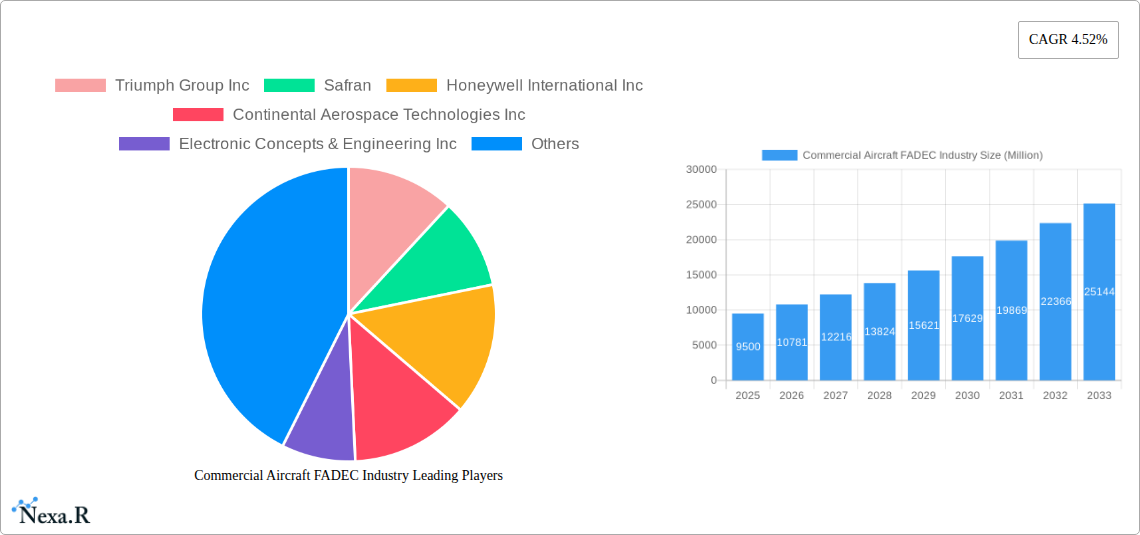

The global Commercial Aircraft FADEC (Full Authority Digital Engine Control) market is poised for substantial expansion, projected to reach USD 9.5 billion in 2025. This growth is fueled by a robust compound annual growth rate (CAGR) of 13.11%, indicating a dynamic and expanding sector within aviation. A primary driver for this surge is the increasing demand for fuel-efficient and technologically advanced aircraft. Modern FADEC systems are instrumental in optimizing engine performance, reducing fuel consumption, and minimizing emissions, aligning perfectly with the aviation industry's commitment to sustainability and operational cost reduction. Furthermore, the ongoing fleet modernization programs by major airlines worldwide, coupled with the introduction of new-generation aircraft featuring advanced engine technologies, are significantly boosting the adoption of sophisticated FADEC systems. The inherent benefits of FADEC, including enhanced engine reliability, reduced pilot workload, and improved safety through precise control and diagnostic capabilities, continue to solidify its importance.

Commercial Aircraft FADEC Industry Market Size (In Billion)

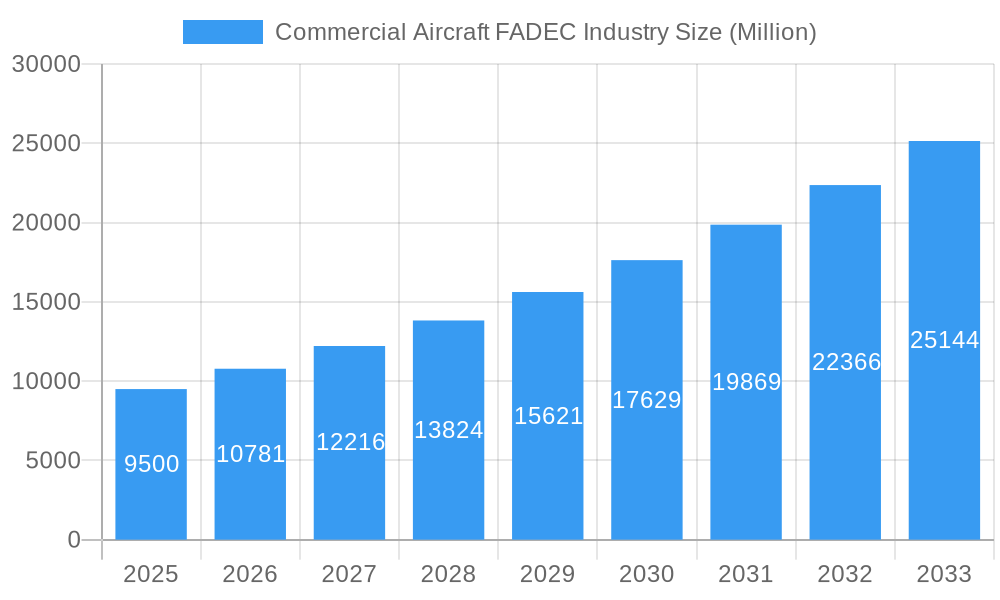

The market is segmented by engine type, with Turbofan engines representing the dominant segment due to their widespread application in large commercial airliners, followed by Turboprop engines, which are gaining traction in regional and cargo aircraft. Key players like Triumph Group Inc., Safran, and Honeywell International Inc. are at the forefront, investing heavily in research and development to innovate and cater to the evolving needs of aircraft manufacturers and operators. Despite the promising outlook, the market faces certain restraints, including the high initial cost of advanced FADEC systems and the stringent regulatory approval processes for new technologies. However, these challenges are being mitigated by strategic partnerships, technological advancements leading to cost efficiencies, and a growing emphasis on lifecycle support and aftermarket services. The Asia Pacific region is emerging as a significant growth hub, driven by rapid expansion in air travel and increasing investments in aviation infrastructure.

Commercial Aircraft FADEC Industry Company Market Share

Comprehensive Report: Commercial Aircraft FADEC Industry Market Analysis & Forecast (2019-2033)

This in-depth report delivers a definitive analysis of the global Commercial Aircraft Full Authority Digital Engine Control (FADEC) market, encompassing a critical examination of market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, opportunities, and a detailed outlook for the period of 2019–2033, with a base and estimated year of 2025. We provide actionable insights for stakeholders including manufacturers, airlines, component suppliers, and investors, leveraging high-traffic keywords and a structured, easy-to-digest format. This report is a standalone asset, requiring no further modification.

Commercial Aircraft FADEC Industry Market Dynamics & Structure

The Commercial Aircraft FADEC industry is characterized by a moderate market concentration, with a few key players dominating the supply chain for advanced engine control systems. Technological innovation is the primary driver, fueled by the relentless pursuit of enhanced fuel efficiency, reduced emissions, and improved engine performance. Regulatory frameworks, particularly those from the FAA and EASA, are stringent and continuously evolving, impacting design, certification, and maintenance protocols. Competitive product substitutes are limited due to the highly specialized nature of FADEC systems, but advancements in alternative control architectures and diagnostic tools present potential long-term competition. End-user demographics are predominantly commercial airlines and aircraft manufacturers, with an increasing emphasis on fleet modernization and sustainable aviation. Mergers and acquisitions (M&A) trends are observed as companies seek to consolidate expertise, expand product portfolios, and secure market share.

- Market Concentration: Dominated by a few leading aerospace manufacturers, with increasing opportunities for specialized component suppliers.

- Technological Innovation Drivers: Focus on advanced algorithms for optimized fuel burn, noise reduction, and predictive maintenance capabilities.

- Regulatory Frameworks: Strict adherence to aviation safety standards, emissions regulations, and cybersecurity protocols.

- Competitive Product Substitutes: Limited direct substitutes, but integration of AI and advanced sensor technology are indirect competitive forces.

- End-User Demographics: Commercial airlines, aircraft leasing companies, and original equipment manufacturers (OEMs).

- M&A Trends: Strategic acquisitions to gain access to intellectual property and expand product offerings in the advanced avionics sector.

Commercial Aircraft FADEC Industry Growth Trends & Insights

The global Commercial Aircraft FADEC market is poised for robust growth, driven by several interconnected factors. The market size is projected to expand significantly, with an estimated market value reaching $XX billion in 2025 and forecasted to grow at a Compound Annual Growth Rate (CAGR) of XX% through 2033. This expansion is underpinned by increasing air travel demand, necessitating the production of new commercial aircraft equipped with advanced FADEC systems. The adoption rate of FADEC technology is near-universal for new commercial aircraft due to its critical role in engine management, safety, and efficiency. Technological disruptions are constantly reshaping the landscape, with a significant push towards digitalization, increased sensor integration, and the incorporation of artificial intelligence (AI) for real-time performance optimization and predictive maintenance. Consumer behavior shifts, driven by airlines' focus on operational cost reduction and environmental sustainability, further propel the demand for FADEC systems that enable significant fuel savings and reduced emissions. The ongoing trend of fleet modernization, replacing older, less efficient aircraft with newer models featuring cutting-edge avionics, is a key catalyst. Furthermore, the increasing complexity of modern jet engines, especially in turbofan and turboprop segments, necessitates sophisticated digital control systems like FADEC for optimal operation and safety. The integration of advanced diagnostics and prognostics within FADEC systems allows airlines to move towards condition-based maintenance, significantly reducing downtime and operational expenses. The market penetration of advanced FADEC solutions is expected to deepen as manufacturers and airlines recognize the long-term return on investment and the critical role these systems play in achieving ambitious sustainability goals.

Dominant Regions, Countries, or Segments in Commercial Aircraft FADEC Industry

The Turbofan engine type segment is the primary driver of growth within the Commercial Aircraft FADEC industry, accounting for the lion's share of the market due to the overwhelming prevalence of turbofan-powered aircraft in commercial aviation. This segment's dominance stems from its application in narrow-body and wide-body aircraft, which constitute the vast majority of global commercial fleets. Key drivers for this segment's growth include the continuous introduction of new aircraft models featuring more fuel-efficient turbofan engines, such as the Airbus A320neo family and Boeing 737 MAX, both heavily reliant on advanced FADEC systems. Economic policies worldwide are increasingly favoring sustainable aviation, further pushing the development and adoption of advanced turbofan engines with enhanced FADEC capabilities for reduced emissions and noise pollution. Infrastructure development, including the expansion of airport capacity and air traffic control systems, indirectly supports the growth of air travel, thus boosting demand for new aircraft and their FADEC systems.

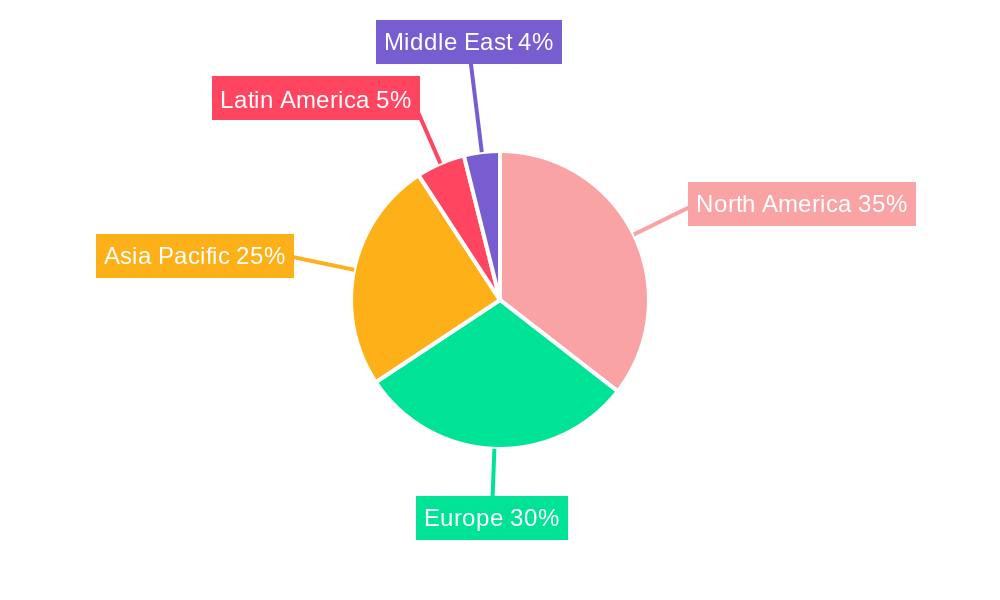

North America and Europe currently hold significant market share due to the presence of major aircraft manufacturers and a large existing commercial airline fleet. However, the Asia-Pacific region is emerging as a rapidly growing market, driven by increasing air travel demand and the expansion of domestic and international routes. This expansion is supported by favorable government initiatives promoting aviation and infrastructure investment. The market share for turbofan-powered aircraft FADEC systems is estimated at XX%, with a projected growth rate of XX% during the forecast period. The turboprop segment, while smaller, is also experiencing steady growth, particularly in regional aviation and specialized cargo operations, with its FADEC market share estimated at XX%. The demand for FADEC in turboprop engines is driven by their efficiency in shorter routes and smaller aircraft.

- Dominant Engine Type: Turbofan engines, powering the majority of commercial aircraft.

- Key Market Drivers (Turbofan):

- Introduction of new-generation fuel-efficient turbofan aircraft.

- Stringent emissions and noise reduction regulations.

- Growing global air passenger traffic.

- Fleet modernization initiatives by airlines.

- Regional Growth Dynamics:

- North America & Europe: Mature markets with high demand for upgrades and new aircraft.

- Asia-Pacific: Rapidly expanding market driven by increasing air travel and government support.

- Market Share (Turbofan): Estimated at XX% of the total FADEC market.

- Market Share (Turboprop): Estimated at XX% of the total FADEC market.

Commercial Aircraft FADEC Industry Product Landscape

The product landscape of the Commercial Aircraft FADEC industry is defined by continuous innovation focused on enhancing engine control precision, reliability, and integration capabilities. FADEC systems are integral to modern aircraft engines, managing critical functions such as fuel flow, ignition, variable stator vane positioning, and thrust reverser operation. Product advancements include the development of more powerful processing units, sophisticated sensor integration for real-time data acquisition, and enhanced software algorithms for optimized engine performance across a wider range of flight conditions. Applications span the entire commercial aircraft spectrum, from regional jets to wide-body airliners. Unique selling propositions of leading FADEC solutions lie in their adherence to stringent aerospace certification standards, superior fuel efficiency gains, reduced emissions profiles, and robust diagnostic and prognostic capabilities that enable predictive maintenance, thereby minimizing unscheduled downtime. Technological advancements are also focusing on improved cybersecurity features to protect critical engine control data from cyber threats.

Key Drivers, Barriers & Challenges in Commercial Aircraft FADEC Industry

The Commercial Aircraft FADEC industry is propelled by several key drivers. Technological advancements in digital control and sensor technology are paramount, enabling greater precision and efficiency. The increasing focus on environmental sustainability mandates the development of FADEC systems that optimize fuel burn and reduce emissions. The growth in global air travel directly translates to increased aircraft production and, consequently, higher demand for FADEC systems. Stringent aviation safety regulations also necessitate the adoption of advanced FADEC for enhanced reliability.

Conversely, the industry faces significant barriers and challenges. High research and development costs associated with sophisticated FADEC systems are a major hurdle. Lengthy and complex certification processes by aviation authorities add to development timelines and costs. Supply chain complexities, particularly for specialized electronic components, can lead to production delays and price volatility. Intense competition from established players and the threat of new market entrants with disruptive technologies present ongoing challenges. Geopolitical instability and economic downturns can impact airline profitability and fleet expansion plans, indirectly affecting FADEC demand. The ever-evolving regulatory landscape, while a driver for innovation, can also pose challenges in terms of continuous adaptation.

Emerging Opportunities in Commercial Aircraft FADEC Industry

Emerging opportunities in the Commercial Aircraft FADEC industry are concentrated in several key areas. The growing demand for sustainable aviation fuels (SAFs) presents an opportunity for FADEC systems to be further optimized for compatibility and performance with these alternative fuels, requiring new control logic and calibration. The increasing adoption of electric and hybrid-electric propulsion systems in next-generation aircraft opens up a new frontier for FADEC development, requiring entirely new control architectures. Furthermore, advancements in artificial intelligence and machine learning offer opportunities for highly sophisticated predictive maintenance algorithms embedded within FADEC systems, enabling airlines to anticipate and prevent component failures before they occur, significantly reducing operational costs and improving fleet availability. The expansion of air travel in emerging economies also presents untapped markets for FADEC solutions.

Growth Accelerators in the Commercial Aircraft FADEC Industry Industry

The long-term growth of the Commercial Aircraft FADEC industry is being significantly accelerated by several critical factors. Technological breakthroughs in areas such as advanced sensor technology, robust digital processing, and sophisticated control algorithms are continuously enhancing the capabilities and efficiency of FADEC systems. Strategic partnerships between FADEC manufacturers, engine OEMs, and aircraft constructors are crucial for co-developing integrated solutions that meet the evolving demands of the aerospace sector. The global push towards decarbonization and sustainable aviation is a powerful accelerator, driving the demand for FADEC systems that enable significant improvements in fuel efficiency and reduction in emissions. Market expansion strategies, particularly in the rapidly growing Asia-Pacific region, are also contributing to sustained growth. The continuous need for fleet modernization and replacement of aging aircraft with more fuel-efficient models equipped with advanced avionics, including FADEC, further solidifies this growth trajectory.

Key Players Shaping the Commercial Aircraft FADEC Industry Market

- Triumph Group Inc

- Safran

- Honeywell International Inc

- Continental Aerospace Technologies Inc

- Electronic Concepts & Engineering Inc

- BAE Systems plc

- Silver Atena GmbH

Notable Milestones in Commercial Aircraft FADEC Industry Sector

- 2019: Increased regulatory focus on stricter emissions standards leads to intensified research into more efficient FADEC algorithms.

- 2020: Major engine manufacturers announce ambitious targets for reducing carbon footprint, driving FADEC innovation for fuel optimization.

- 2021: Advancements in AI and machine learning begin to be integrated into FADEC development for predictive maintenance capabilities.

- 2022: Emergence of initial prototypes for FADEC systems designed for hybrid-electric aircraft propulsion.

- 2023: Growing emphasis on cybersecurity within FADEC systems due to increasing digital connectivity in aircraft.

- 2024: Further development and testing of FADEC systems for compatibility with sustainable aviation fuels (SAFs).

In-Depth Commercial Aircraft FADEC Industry Market Outlook

The future market outlook for the Commercial Aircraft FADEC industry is exceptionally promising, driven by a confluence of accelerating forces. The relentless pursuit of fuel efficiency and emissions reduction, spurred by environmental regulations and airline profitability concerns, will continue to fuel demand for advanced FADEC technologies. The ongoing transition towards sustainable aviation fuels and the nascent development of hybrid-electric propulsion systems represent significant long-term growth opportunities. Strategic collaborations between key industry players will be instrumental in de-risking new technology development and accelerating market penetration. As global air travel continues its recovery and expansion, particularly in emerging markets, the demand for new aircraft equipped with cutting-edge FADEC systems will remain robust, ensuring a dynamic and expanding market for years to come.

Commercial Aircraft FADEC Industry Segmentation

-

1. Engine Type

- 1.1. Turbofan

- 1.2. Turboprop

Commercial Aircraft FADEC Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Russia

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Australia

- 3.6. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

- 5. Middle East

-

6. United Arab Emirates

- 6.1. Saudi Arabia

- 6.2. Turkey

- 6.3. South Africa

- 6.4. Rest of Middle East

Commercial Aircraft FADEC Industry Regional Market Share

Geographic Coverage of Commercial Aircraft FADEC Industry

Commercial Aircraft FADEC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Turbofan Segment to Experience the Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Commercial Aircraft FADEC Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Engine Type

- 5.1.1. Turbofan

- 5.1.2. Turboprop

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East

- 5.2.6. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Engine Type

- 6. North America Commercial Aircraft FADEC Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Engine Type

- 6.1.1. Turbofan

- 6.1.2. Turboprop

- 6.1. Market Analysis, Insights and Forecast - by Engine Type

- 7. Europe Commercial Aircraft FADEC Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Engine Type

- 7.1.1. Turbofan

- 7.1.2. Turboprop

- 7.1. Market Analysis, Insights and Forecast - by Engine Type

- 8. Asia Pacific Commercial Aircraft FADEC Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Engine Type

- 8.1.1. Turbofan

- 8.1.2. Turboprop

- 8.1. Market Analysis, Insights and Forecast - by Engine Type

- 9. Latin America Commercial Aircraft FADEC Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Engine Type

- 9.1.1. Turbofan

- 9.1.2. Turboprop

- 9.1. Market Analysis, Insights and Forecast - by Engine Type

- 10. Middle East Commercial Aircraft FADEC Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Engine Type

- 10.1.1. Turbofan

- 10.1.2. Turboprop

- 10.1. Market Analysis, Insights and Forecast - by Engine Type

- 11. United Arab Emirates Commercial Aircraft FADEC Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Engine Type

- 11.1.1. Turbofan

- 11.1.2. Turboprop

- 11.1. Market Analysis, Insights and Forecast - by Engine Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Triumph Group Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Safran

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Honeywell International Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Continental Aerospace Technologies Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Electronic Concepts & Engineering Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 BAE Systems plc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Silver Atena GmbH

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.1 Triumph Group Inc

List of Figures

- Figure 1: Global Commercial Aircraft FADEC Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Commercial Aircraft FADEC Industry Revenue (undefined), by Engine Type 2025 & 2033

- Figure 3: North America Commercial Aircraft FADEC Industry Revenue Share (%), by Engine Type 2025 & 2033

- Figure 4: North America Commercial Aircraft FADEC Industry Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Commercial Aircraft FADEC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Commercial Aircraft FADEC Industry Revenue (undefined), by Engine Type 2025 & 2033

- Figure 7: Europe Commercial Aircraft FADEC Industry Revenue Share (%), by Engine Type 2025 & 2033

- Figure 8: Europe Commercial Aircraft FADEC Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe Commercial Aircraft FADEC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Commercial Aircraft FADEC Industry Revenue (undefined), by Engine Type 2025 & 2033

- Figure 11: Asia Pacific Commercial Aircraft FADEC Industry Revenue Share (%), by Engine Type 2025 & 2033

- Figure 12: Asia Pacific Commercial Aircraft FADEC Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific Commercial Aircraft FADEC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Commercial Aircraft FADEC Industry Revenue (undefined), by Engine Type 2025 & 2033

- Figure 15: Latin America Commercial Aircraft FADEC Industry Revenue Share (%), by Engine Type 2025 & 2033

- Figure 16: Latin America Commercial Aircraft FADEC Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Latin America Commercial Aircraft FADEC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East Commercial Aircraft FADEC Industry Revenue (undefined), by Engine Type 2025 & 2033

- Figure 19: Middle East Commercial Aircraft FADEC Industry Revenue Share (%), by Engine Type 2025 & 2033

- Figure 20: Middle East Commercial Aircraft FADEC Industry Revenue (undefined), by Country 2025 & 2033

- Figure 21: Middle East Commercial Aircraft FADEC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: United Arab Emirates Commercial Aircraft FADEC Industry Revenue (undefined), by Engine Type 2025 & 2033

- Figure 23: United Arab Emirates Commercial Aircraft FADEC Industry Revenue Share (%), by Engine Type 2025 & 2033

- Figure 24: United Arab Emirates Commercial Aircraft FADEC Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: United Arab Emirates Commercial Aircraft FADEC Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Commercial Aircraft FADEC Industry Revenue undefined Forecast, by Engine Type 2020 & 2033

- Table 2: Global Commercial Aircraft FADEC Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Commercial Aircraft FADEC Industry Revenue undefined Forecast, by Engine Type 2020 & 2033

- Table 4: Global Commercial Aircraft FADEC Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States Commercial Aircraft FADEC Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada Commercial Aircraft FADEC Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Global Commercial Aircraft FADEC Industry Revenue undefined Forecast, by Engine Type 2020 & 2033

- Table 8: Global Commercial Aircraft FADEC Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Commercial Aircraft FADEC Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Germany Commercial Aircraft FADEC Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: France Commercial Aircraft FADEC Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Italy Commercial Aircraft FADEC Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Russia Commercial Aircraft FADEC Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Rest of Europe Commercial Aircraft FADEC Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Global Commercial Aircraft FADEC Industry Revenue undefined Forecast, by Engine Type 2020 & 2033

- Table 16: Global Commercial Aircraft FADEC Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: China Commercial Aircraft FADEC Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: India Commercial Aircraft FADEC Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Japan Commercial Aircraft FADEC Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: South Korea Commercial Aircraft FADEC Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Australia Commercial Aircraft FADEC Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Commercial Aircraft FADEC Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Global Commercial Aircraft FADEC Industry Revenue undefined Forecast, by Engine Type 2020 & 2033

- Table 24: Global Commercial Aircraft FADEC Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Brazil Commercial Aircraft FADEC Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Mexico Commercial Aircraft FADEC Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Latin America Commercial Aircraft FADEC Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Commercial Aircraft FADEC Industry Revenue undefined Forecast, by Engine Type 2020 & 2033

- Table 29: Global Commercial Aircraft FADEC Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Global Commercial Aircraft FADEC Industry Revenue undefined Forecast, by Engine Type 2020 & 2033

- Table 31: Global Commercial Aircraft FADEC Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Saudi Arabia Commercial Aircraft FADEC Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Turkey Commercial Aircraft FADEC Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: South Africa Commercial Aircraft FADEC Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Rest of Middle East Commercial Aircraft FADEC Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Aircraft FADEC Industry?

The projected CAGR is approximately 9%.

2. Which companies are prominent players in the Commercial Aircraft FADEC Industry?

Key companies in the market include Triumph Group Inc, Safran, Honeywell International Inc, Continental Aerospace Technologies Inc, Electronic Concepts & Engineering Inc, BAE Systems plc, Silver Atena GmbH.

3. What are the main segments of the Commercial Aircraft FADEC Industry?

The market segments include Engine Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Turbofan Segment to Experience the Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Commercial Aircraft FADEC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Commercial Aircraft FADEC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Commercial Aircraft FADEC Industry?

To stay informed about further developments, trends, and reports in the Commercial Aircraft FADEC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence