Key Insights

The North America Satellite Manufacturing and Launch Systems Market is poised for significant expansion, driven by robust government investments and the escalating demand from the commercial sector. With an estimated market size exceeding $20 billion (derived from a CAGR of >3.00% and a historical growth trajectory), the market is projected to witness consistent growth throughout the forecast period. Key drivers fueling this expansion include the increasing adoption of satellite technology for national security initiatives, Earth observation, and the burgeoning demand for broadband internet services in remote areas. Technological advancements in miniaturization and cost-effective launch solutions are further democratizing access to space, attracting new players and fostering innovation. The military and government segments, in particular, are expected to remain dominant, with ongoing modernization programs and the development of advanced surveillance and communication satellites. Commercial applications, especially in telecommunications and remote sensing, are rapidly gaining traction, contributing substantially to market revenue.

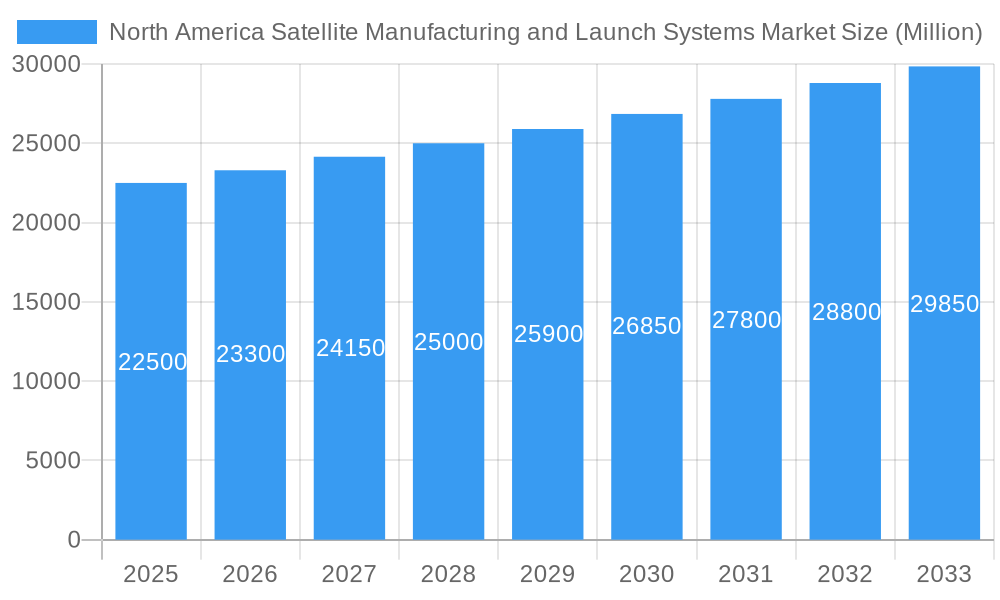

North America Satellite Manufacturing and Launch Systems Market Market Size (In Billion)

The competitive landscape in North America is characterized by the presence of established aerospace giants and agile new entrants, all vying for market share in this dynamic sector. Innovation in reusable launch vehicle technology and the development of small satellite constellations are transforming the market. However, the industry faces certain restraints, including stringent regulatory frameworks governing space activities and the high upfront capital expenditure required for manufacturing and launch infrastructure. Cybersecurity concerns for satellite systems and the growing challenge of space debris also present ongoing hurdles. Despite these challenges, the North America region, encompassing the United States, Canada, and Mexico, is anticipated to maintain its leading position due to substantial R&D investments, a skilled workforce, and a supportive governmental ecosystem that encourages private sector participation in space exploration and commercialization.

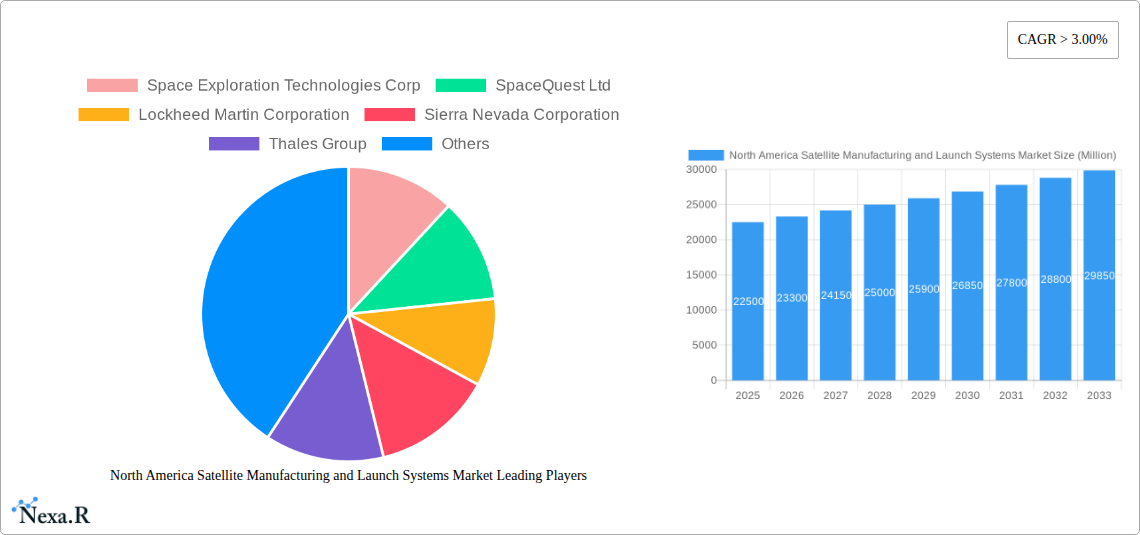

North America Satellite Manufacturing and Launch Systems Market Company Market Share

This comprehensive report delves into the dynamic North America Satellite Manufacturing and Launch Systems Market, providing an in-depth analysis of market size, growth trends, competitive landscape, and future outlook. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period from 2025 to 2033, this report offers actionable insights for stakeholders. The market is segmented by Product Type (Satellite, Launch Systems) and Application (Military and Government, Commercial). We meticulously analyze parent and child market segments to offer a holistic view.

North America Satellite Manufacturing and Launch Systems Market Market Dynamics & Structure

The North America Satellite Manufacturing and Launch Systems Market exhibits a moderate to high level of concentration, with a few key players dominating both satellite manufacturing and launch services. Technological innovation is the primary driver, fueled by advancements in miniaturization, propulsion systems, and reusable launch vehicles. Regulatory frameworks, particularly those from NASA, FAA, and national security agencies, play a crucial role in shaping market entry and operational standards. Competitive product substitutes are emerging in the form of high-altitude platforms and advanced drone technologies for certain niche applications, though they do not yet offer a comprehensive alternative to satellites. End-user demographics are shifting, with a growing demand from commercial entities in telecommunications, earth observation, and internet connectivity, complementing the established military and government sector. Mergers and acquisitions (M&A) are a significant trend, with major players consolidating to gain market share and technological capabilities. For instance, approximately 8-12 M&A deals are anticipated within the forecast period, with an average deal value of $500 million to $2 billion, reflecting the strategic importance of acquiring specialized expertise and infrastructure. Innovation barriers include high R&D costs, stringent safety regulations, and the long lead times associated with satellite development and launch campaigns.

- Market Concentration: Dominated by a few large corporations with specialized capabilities.

- Technological Innovation Drivers: Miniaturization, reusable launch technology, advanced sensor payloads, AI integration.

- Regulatory Frameworks: NASA, FAA, FCC, ITAR, export control regulations.

- Competitive Product Substitutes: High-altitude pseudo-satellites (HAPS), advanced UAVs for specific data acquisition.

- End-User Demographics: Growing commercial demand from internet providers, geospatial analytics firms, and content delivery networks.

- M&A Trends: Strategic acquisitions for technological integration and market expansion.

North America Satellite Manufacturing and Launch Systems Market Growth Trends & Insights

The North America Satellite Manufacturing and Launch Systems Market is poised for robust growth, driven by escalating demand for global connectivity, advanced defense capabilities, and comprehensive earth observation. The market size is projected to expand from approximately $50,000 million units in the historical period to an estimated $85,000 million units in 2025, with a projected Compound Annual Growth Rate (CAGR) of 7.5% during the forecast period of 2025–2033. Adoption rates for small satellites (smallsats) and constellations are rapidly increasing, enabling more frequent and cost-effective data acquisition and communication services. Technological disruptions, such as the development of electric propulsion systems, advanced optical and radar payloads, and the increasing adoption of AI for on-board processing, are revolutionizing satellite capabilities. Consumer behavior shifts, particularly in the commercial sector, are characterized by a preference for agile, on-demand data solutions and ubiquitous internet access, driving investment in constellations. For example, the commercial segment's market penetration is expected to grow from 40% to over 55% by 2033. The ongoing evolution of launch systems, including the commercialization of spaceflight and the development of super heavy-lift vehicles, is further reducing launch costs and increasing accessibility. This has led to a surge in satellite deployment and has opened new avenues for scientific research, resource management, and disaster monitoring. The increasing reliance on space-based assets for national security and critical infrastructure protection also underpins sustained government investment. The integration of satellite data with terrestrial networks and edge computing is another significant trend enhancing the value proposition of space-based services.

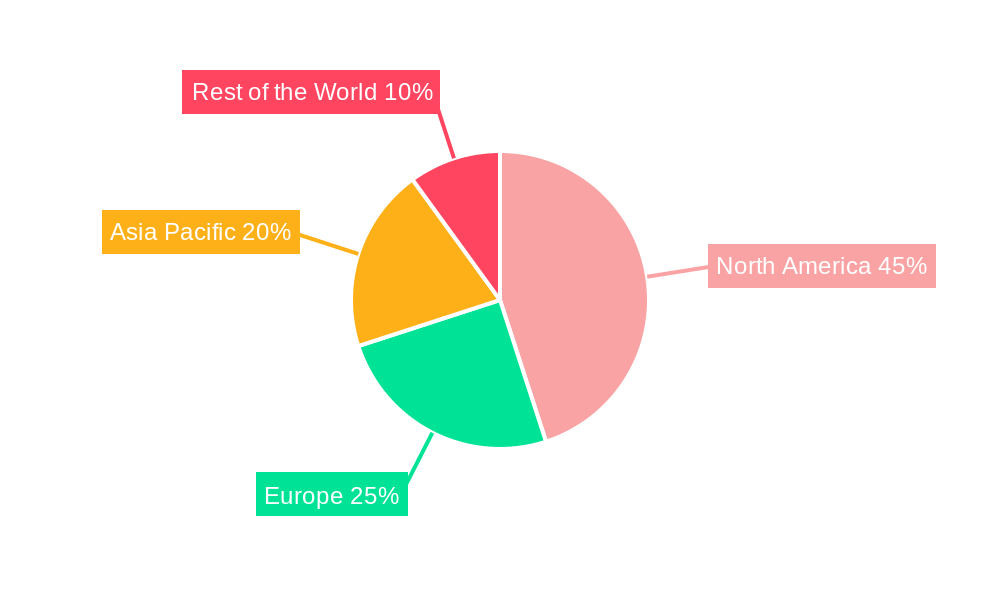

Dominant Regions, Countries, or Segments in North America Satellite Manufacturing and Launch Systems Market

The United States stands as the undisputed dominant region within the North America Satellite Manufacturing and Launch Systems Market, accounting for an estimated 80% of the total market share. This dominance is multifaceted, driven by a confluence of factors including unparalleled government investment in defense and civilian space programs, a thriving private sector innovation ecosystem, and world-leading research and development capabilities. Within the Product Type segmentation, both Satellites and Launch Systems are strong contributors, with the satellite segment holding a slightly larger share of approximately 55% of the total market value, driven by the continuous need for communication, navigation, and earth observation satellites. The Launch Systems segment, valued at approximately $30,000 million units in the base year 2025, is experiencing rapid growth due to the proliferation of small satellite launches and the demand for more flexible and frequent access to space.

In terms of Application, the Military and Government segment has historically been the largest, representing around 60% of the market share, driven by national security imperatives, intelligence gathering, and defense modernization efforts. However, the Commercial segment is exhibiting a higher growth trajectory, projected to grow at a CAGR of 9.2% during the forecast period, driven by the burgeoning demand for broadband internet services, advanced geospatial analytics, and global positioning systems.

Key drivers of dominance in the United States include:

- Robust Government Funding: Significant allocations from agencies like NASA, DoD, and NRO for research, development, and procurement.

- Private Sector Innovation: The presence of leading aerospace companies and a vibrant startup culture fosters continuous technological advancement and market competition.

- Advanced Infrastructure: Extensive launch facilities, manufacturing capabilities, and ground support networks.

- Skilled Workforce: A deep pool of engineers, scientists, and technicians specializing in aerospace and satellite technologies.

- Favorable Regulatory Environment: While stringent, regulatory frameworks are designed to encourage innovation and private sector participation.

The growth potential in the commercial segment is immense, fueled by constellations like SpaceX's Starlink and OneWeb, which are transforming global internet access and data services. The increasing demand for high-resolution earth observation data for applications such as precision agriculture, climate monitoring, and urban planning further bolsters the commercial sector. The interplay between government and commercial entities, often through public-private partnerships, further accelerates innovation and market expansion within the United States.

North America Satellite Manufacturing and Launch Systems Market Product Landscape

The product landscape in the North America Satellite Manufacturing and Launch Systems Market is characterized by rapid innovation and diversification. In the satellite segment, advancements are centered on miniaturization, enabling the deployment of constellations of small satellites (smallsats) and CubeSats, offering cost-effective solutions for communication, Earth observation, and scientific research. Key innovations include enhanced sensor technologies with higher resolution and spectral capabilities, advanced propulsion systems for station-keeping and orbit maneuvering, and more robust onboard processing for real-time data analysis. For launch systems, the focus is on reusability, with companies like SpaceX leading the charge in developing and deploying reusable rockets, significantly reducing launch costs. Furthermore, the development of dedicated small satellite launch vehicles, offering more flexibility and rapid deployment, is a prominent trend. The performance metrics of both satellites and launch systems are continuously improving, with satellites exhibiting longer operational lifespans and higher data throughput, while launch systems are achieving greater payload capacity and higher launch cadence.

Key Drivers, Barriers & Challenges in North America Satellite Manufacturing and Launch Systems Market

Key Drivers:

- Increasing Demand for Connectivity: The global need for ubiquitous internet access, particularly in remote and underserved areas, drives the development of satellite constellations.

- Government Investment in Defense and Security: National security requirements for surveillance, reconnaissance, and communication are a significant market driver.

- Advancements in Small Satellite Technology: Miniaturization and cost reduction in small satellites are enabling new applications and a wider user base.

- Technological Innovation in Launch Systems: Reusable rockets and the development of dedicated small satellite launch vehicles are making space more accessible.

- Growth of Earth Observation Data Applications: The increasing use of satellite imagery for climate monitoring, precision agriculture, and urban planning fuels demand.

Barriers & Challenges:

- High Development and Manufacturing Costs: The capital expenditure required for satellite development and launch remains substantial.

- Stringent Regulatory Hurdles: Navigating complex regulations from agencies like the FAA and FCC can lead to significant delays and costs.

- Supply Chain Vulnerabilities: Reliance on specialized components and manufacturing processes can create supply chain disruptions.

- Space Debris Mitigation: The growing concern over space debris necessitates the development of sustainable operational practices and end-of-life solutions, adding complexity and cost.

- Intense Competition: The market is highly competitive, requiring continuous innovation and cost optimization to maintain market share.

Emerging Opportunities in North America Satellite Manufacturing and Launch Systems Market

Emerging opportunities lie in the growing demand for edge computing in space, enabling real-time data processing onboard satellites to reduce latency and bandwidth requirements. The expansion of in-orbit servicing, assembly, and manufacturing (ISAM) presents a significant opportunity for extending satellite lifespans and enabling novel space-based manufacturing. The increasing interest in space-based solar power and lunar/Mars exploration also opens new frontiers for satellite and launch system development. Furthermore, the democratization of space data through more accessible platforms and analytics tools is creating a broader market for specialized satellite services.

Growth Accelerators in the North America Satellite Manufacturing and Launch Systems Market Industry

Long-term growth is being accelerated by advances in artificial intelligence and machine learning for satellite operations and data analysis, leading to more autonomous and efficient missions. Strategic partnerships between established aerospace companies and emerging technology startups are fostering rapid innovation and market entry. The development of next-generation propulsion systems, such as electric and solar electric propulsion, is enhancing satellite maneuverability and mission duration. Furthermore, the increasing global focus on climate change monitoring and disaster response is driving sustained government and commercial investment in Earth observation satellites. The successful demonstration and increasing deployment of reusable launch vehicle technology continue to be a major catalyst for market expansion by lowering launch costs.

Key Players Shaping the North America Satellite Manufacturing and Launch Systems Market Market

- Space Exploration Technologies Corp

- SpaceQuest Ltd

- Lockheed Martin Corporation

- Sierra Nevada Corporation

- Thales Group

- ArianeGroup

- Dynetics Inc

- Northrop Grumman Corporation

- The Boeing Company

Notable Milestones in North America Satellite Manufacturing and Launch Systems Market Sector

- 2019: SpaceX successfully conducted the first orbital launch of its Starship prototype, signaling a new era of heavy-lift capabilities.

- 2020: Northrop Grumman launched its Cygnus cargo spacecraft on a resupply mission to the International Space Station, demonstrating reliable launch capabilities.

- 2021: Lockheed Martin delivered its 100th AEHF satellite, highlighting its long-standing expertise in secure military communications.

- 2022: Sierra Nevada Corporation's Dream Chaser spaceplane completed its first captive carry flight test, moving closer to operational status for cargo resupply.

- 2023: The Boeing Company's Starliner capsule conducted a successful uncrewed test flight to the ISS, marking a significant step towards human spaceflight.

- 2024: Thales Group announced advancements in their satellite payload technology, focusing on enhanced sensor capabilities for Earth observation.

- 2024: SpaceQuest Ltd continued its focus on small satellite development, launching a new series of observational satellites for environmental monitoring.

- 2024: ArianeGroup showcased its advancements in reusable rocket engine technology, aiming to reduce launch costs.

- 2024: Dynetics Inc secured a significant contract for the development of next-generation defense satellite technology.

In-Depth North America Satellite Manufacturing and Launch Systems Market Market Outlook

The North America Satellite Manufacturing and Launch Systems Market is set for sustained and accelerated growth, driven by a powerful synergy of technological advancements and increasing global demand. The market's future is characterized by the proliferation of satellite constellations for global connectivity, sophisticated Earth observation for environmental and economic insights, and robust national security capabilities. Key growth accelerators include the continued innovation in AI for space operations, strategic public-private partnerships, and the relentless pursuit of lower launch costs through reusable technology. Emerging opportunities in in-orbit servicing and manufacturing, coupled with the expansion into new space frontiers, will further fuel market expansion. The strategic outlook points towards a future where space-based assets are increasingly integral to global infrastructure and daily life, presenting significant opportunities for innovation and investment.

North America Satellite Manufacturing and Launch Systems Market Segmentation

-

1. Product Type

- 1.1. Satellite

- 1.2. Launch Systems

-

2. Application

- 2.1. Military and Government

- 2.2. Commercial

North America Satellite Manufacturing and Launch Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Satellite Manufacturing and Launch Systems Market Regional Market Share

Geographic Coverage of North America Satellite Manufacturing and Launch Systems Market

North America Satellite Manufacturing and Launch Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. The Advent of Reusable Launch Vehicles Driving Down Satellite Launch Costs

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Satellite Manufacturing and Launch Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Satellite

- 5.1.2. Launch Systems

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Military and Government

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Space Exploration Technologies Corp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SpaceQuest Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lockheed Martin Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sierra Nevada Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Thales Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ArianeGroup

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dynetics Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Northrop Grumman Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 The Boeing Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Space Exploration Technologies Corp

List of Figures

- Figure 1: North America Satellite Manufacturing and Launch Systems Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Satellite Manufacturing and Launch Systems Market Share (%) by Company 2025

List of Tables

- Table 1: North America Satellite Manufacturing and Launch Systems Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: North America Satellite Manufacturing and Launch Systems Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: North America Satellite Manufacturing and Launch Systems Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: North America Satellite Manufacturing and Launch Systems Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: North America Satellite Manufacturing and Launch Systems Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: North America Satellite Manufacturing and Launch Systems Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States North America Satellite Manufacturing and Launch Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Satellite Manufacturing and Launch Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Satellite Manufacturing and Launch Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Satellite Manufacturing and Launch Systems Market?

The projected CAGR is approximately 14.4%.

2. Which companies are prominent players in the North America Satellite Manufacturing and Launch Systems Market?

Key companies in the market include Space Exploration Technologies Corp, SpaceQuest Ltd, Lockheed Martin Corporation, Sierra Nevada Corporation, Thales Group, ArianeGroup, Dynetics Inc, Northrop Grumman Corporation, The Boeing Company.

3. What are the main segments of the North America Satellite Manufacturing and Launch Systems Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

The Advent of Reusable Launch Vehicles Driving Down Satellite Launch Costs.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Satellite Manufacturing and Launch Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Satellite Manufacturing and Launch Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Satellite Manufacturing and Launch Systems Market?

To stay informed about further developments, trends, and reports in the North America Satellite Manufacturing and Launch Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence