Key Insights

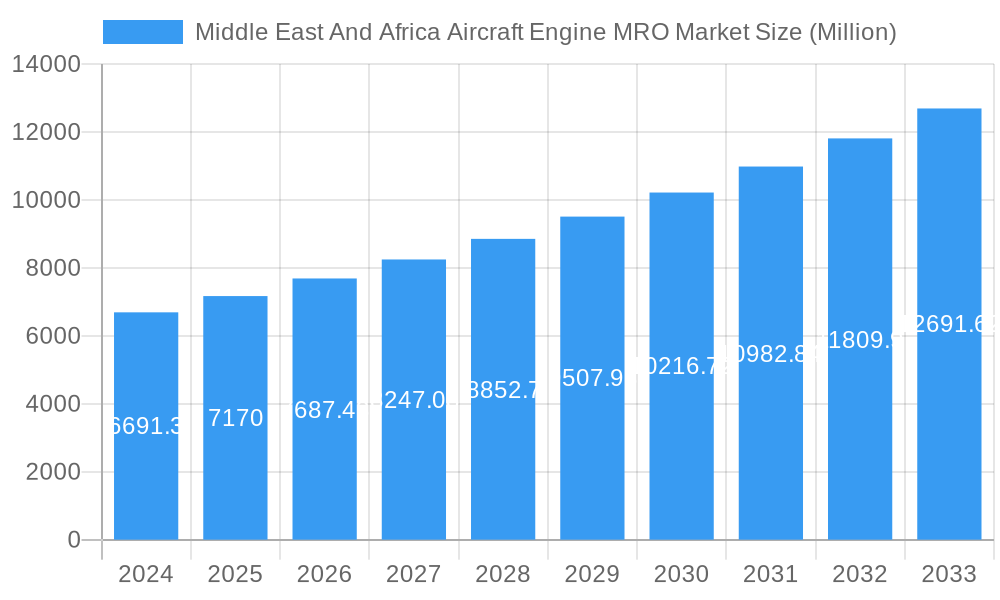

The Middle East and Africa Aircraft Engine Maintenance, Repair, and Overhaul (MRO) market is poised for substantial growth, projected to reach USD 7.17 billion by 2025, expanding at a robust Compound Annual Growth Rate (CAGR) of 6.96% through 2033. This expansion is fueled by a confluence of factors, including the burgeoning aviation sector across both regions, an increasing fleet size, and a growing demand for advanced MRO services to ensure operational efficiency and safety. The Middle East, in particular, is a significant contributor to this market, driven by its status as a global aviation hub and the presence of major airlines investing heavily in fleet modernization and maintenance capabilities. Furthermore, the rising disposable incomes and growing tourism in African nations are indirectly bolstering the demand for air travel, subsequently driving MRO activities. The strategic geographical location of the Middle East, facilitating transcontinental air travel, also plays a crucial role in sustaining high MRO volumes.

Middle East And Africa Aircraft Engine MRO Market Market Size (In Billion)

The market's dynamics are further shaped by an increasing focus on extending engine life, optimizing fuel efficiency, and adhering to stringent regulatory standards, all of which necessitate comprehensive MRO solutions. Key market drivers include the retirement of older aircraft and the acquisition of newer, more technologically advanced fleets that require specialized MRO expertise. Trends such as the adoption of predictive maintenance technologies, the rise of independent MRO providers, and strategic collaborations between airlines and MRO organizations are expected to shape the competitive landscape. Despite the positive outlook, certain restraints, such as the high cost of specialized MRO equipment and the scarcity of skilled technicians, may pose challenges. However, the strong underlying demand and continuous innovation in MRO techniques are anticipated to outweigh these limitations, ensuring a dynamic and evolving market.

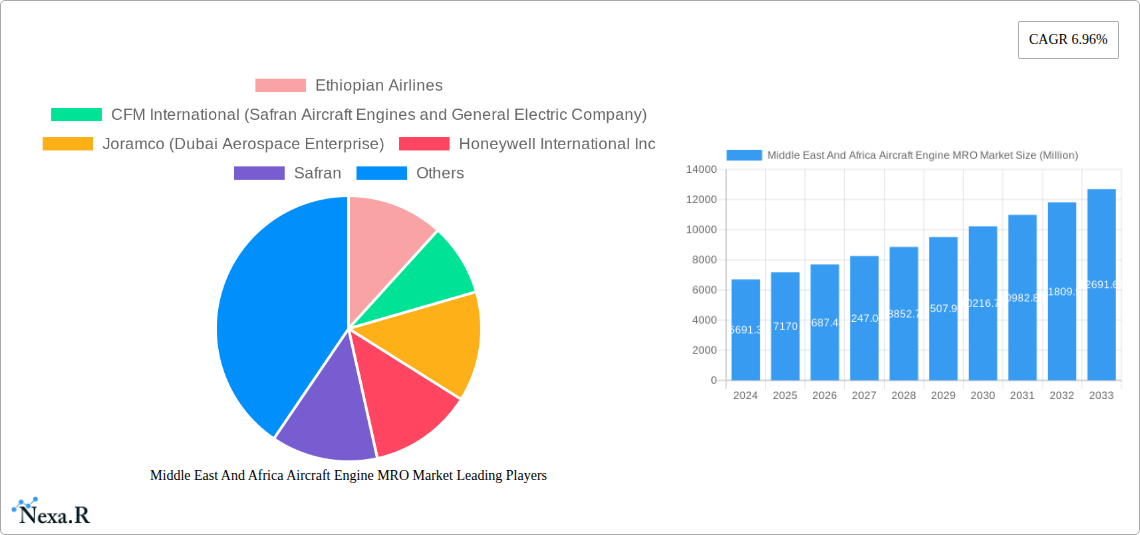

Middle East And Africa Aircraft Engine MRO Market Company Market Share

This in-depth report provides an exhaustive analysis of the Middle East and Africa Aircraft Engine MRO (Maintenance, Repair, and Overhaul) Market, offering critical insights for stakeholders navigating this dynamic sector. The study encompasses a detailed examination of market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, opportunities, growth accelerators, and the strategic positioning of major players. With a focus on both parent and child markets, this report is optimized for high search engine visibility using relevant, high-traffic keywords.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

Middle East And Africa Aircraft Engine MRO Market Market Dynamics & Structure

The Middle East and Africa aircraft engine MRO market is characterized by a moderate to high concentration, with a few key players holding significant market share. Technological innovation is primarily driven by the demand for increased fuel efficiency, reduced emissions, and enhanced engine performance, spurred by advancements in materials science, digital diagnostics, and predictive maintenance technologies. Regulatory frameworks, including stringent aviation safety standards set by bodies like the GCC's General Civil Aviation Authority (GCAA) and the African Civil Aviation Commission (AFCAC), significantly influence MRO practices and investments. Competitive product substitutes are limited within the engine MRO space, as specialized skills and original equipment manufacturer (OEM) approvals are crucial. End-user demographics are dominated by commercial airlines, followed by cargo operators, business aviation, and military entities. Mergers and acquisitions (M&A) trends are evident, with larger MRO providers acquiring smaller entities to expand service offerings and geographic reach. For instance, a significant volume of M&A deals in the region indicates a consolidation strategy aimed at achieving economies of scale. Barriers to innovation include the high cost of specialized equipment, the need for extensive technician training, and the lengthy certification processes required for new MRO techniques.

- Market Concentration: Dominated by a few key global and regional MRO providers, with an estimated market share concentration of 60-70% by top 5 players.

- Technological Innovation Drivers: Focus on advanced diagnostics, predictive maintenance, and sustainable engine technologies.

- Regulatory Frameworks: Stringent safety and environmental regulations are critical compliance factors.

- End-User Demographics: Commercial airlines represent the largest segment, followed by cargo and military operations.

- M&A Trends: Increasing consolidation to gain market share and expand service portfolios.

- Innovation Barriers: High capital investment for advanced equipment and skilled workforce development.

Middle East And Africa Aircraft Engine MRO Market Growth Trends & Insights

The Middle East and Africa aircraft engine MRO market is poised for robust growth, driven by an expanding fleet size and increasing air traffic in both regions. The market size is projected to witness a significant evolution, with an estimated compound annual growth rate (CAGR) of approximately 6.5% during the forecast period. Adoption rates for advanced MRO solutions, such as digital twin technology and AI-powered predictive maintenance, are steadily increasing as operators seek to optimize engine performance, reduce downtime, and manage operational costs more effectively. Technological disruptions are emerging with the integration of IoT sensors for real-time engine monitoring and the development of modular engine designs that facilitate quicker repairs and overhauls. Consumer behavior shifts are evident, with airlines prioritizing long-term maintenance contracts and strategic partnerships with MRO providers to ensure fleet reliability and cost predictability. The growing emphasis on sustainability is also influencing MRO practices, with a focus on extending engine life and reducing the environmental impact of maintenance activities. Market penetration of specialized MRO services is expected to deepen as regional hubs continue to invest in world-class aviation infrastructure. The increasing demand for engine upgrades and retrofits to meet newer environmental standards also contributes to the market’s upward trajectory.

- Market Size Evolution: Significant expansion anticipated, driven by fleet growth and air traffic recovery.

- Adoption Rates: Increasing uptake of digital MRO solutions and predictive maintenance technologies.

- Technological Disruptions: Integration of IoT, AI, and advanced diagnostics reshaping MRO services.

- Consumer Behavior Shifts: Airlines prioritizing long-term partnerships for cost optimization and reliability.

- Market Penetration: Deepening of specialized MRO service penetration across the region.

- CAGR: Estimated at 6.5% during the forecast period.

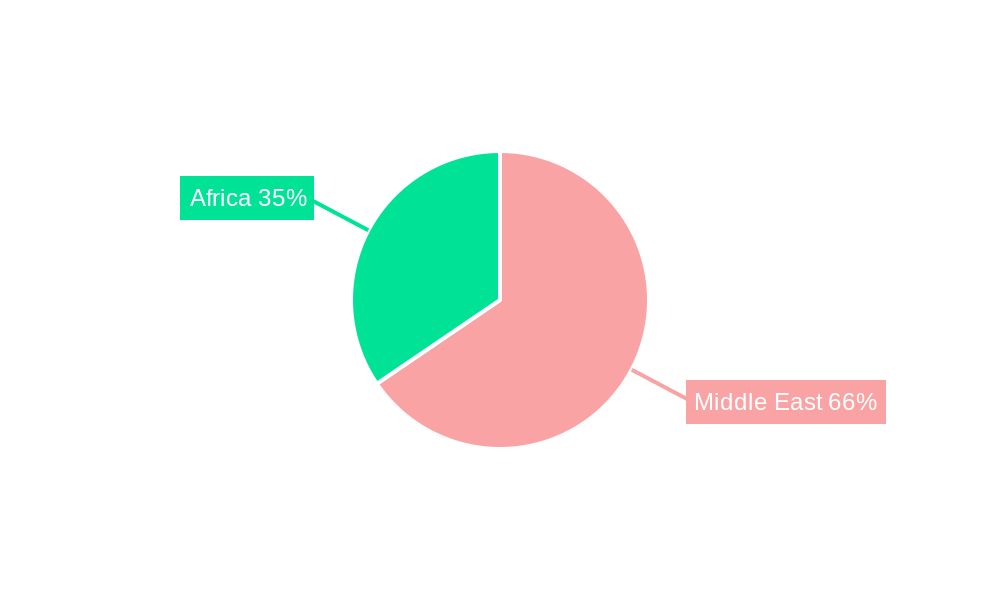

Dominant Regions, Countries, or Segments in Middle East And Africa Aircraft Engine MRO Market

The Middle East region, specifically countries like the UAE and Saudi Arabia, currently dominates the Middle East and Africa Aircraft Engine MRO Market in terms of value and volume for Production Analysis, Consumption Analysis, and Import Market Analysis. This dominance is attributed to the presence of major international airlines with extensive fleet operations, significant investments in state-of-the-art aviation infrastructure, and the establishment of world-class MRO facilities. For instance, the UAE, with hubs like Dubai International Airport, serves as a critical transit point and has fostered a thriving aviation ecosystem that necessitates robust engine MRO capabilities. Saudi Arabia's Vision 2030 initiatives also include substantial investments in the aviation sector, further bolstering MRO demand.

In Export Market Analysis, while the Middle East leads, certain African nations are showing promising growth, particularly those with developing aviation sectors and strategic geographic locations. Countries like South Africa and Ethiopia are emerging as key players in specialized MRO services for specific engine types. The Price Trend Analysis is influenced by a combination of global OEM pricing, regional labor costs, and the competitive landscape, with the Middle East generally exhibiting higher price points due to the advanced nature of its services and infrastructure.

Key drivers for this regional dominance include:

- Economic Policies: Favorable government policies promoting aviation growth and foreign investment.

- Infrastructure Development: Significant investments in airports, MRO facilities, and aerospace hubs.

- Airline Fleet Size & Growth: Presence of large and expanding airline fleets requiring extensive MRO support.

- Technological Adoption: Early and widespread adoption of advanced MRO technologies.

- Strategic Location: The Middle East's position as a global aviation crossroads.

The Consumption Analysis is predominantly driven by the commercial aviation sector, which constitutes over 75% of the market demand. Military MRO services represent a significant secondary segment, particularly in countries with substantial defense spending. The growth potential for African nations lies in developing indigenous MRO capabilities, attracting foreign investment, and catering to the rapidly growing domestic aviation markets within the continent.

Middle East And Africa Aircraft Engine MRO Market Product Landscape

The product landscape within the Middle East and Africa Aircraft Engine MRO market is defined by a comprehensive range of services focused on maintaining, repairing, and overhauling various aircraft engine models. This includes line maintenance, heavy maintenance (including engine strip and build), component repair, and specialized services such as NDT (Non-Destructive Testing) and engine testing. Innovations are centered around optimizing engine efficiency, extending component life, and reducing turnaround times for repairs. Unique selling propositions for MRO providers often revolve around their OEM certifications, technical expertise, advanced diagnostic capabilities, and strategically located facilities. The technological advancements in this sector are crucial for ensuring the safety, reliability, and economic viability of aircraft operations across the region.

Key Drivers, Barriers & Challenges in Middle East And Africa Aircraft Engine MRO Market

Key Drivers:

- Growing Air Passenger Traffic: The post-pandemic rebound and sustained growth in air travel directly fuel demand for aircraft engine MRO services.

- Fleet Expansion: Airlines in the Middle East and Africa are continuously expanding their fleets, necessitating increased MRO support.

- Aging Aircraft Fleets: As aircraft age, they require more frequent and comprehensive maintenance, including major engine overhauls.

- Technological Advancements: Adoption of digital MRO solutions, predictive maintenance, and advanced diagnostics improve efficiency and reduce costs.

- Government Support and Investment: Favorable policies and investments in aviation infrastructure by regional governments.

Barriers & Challenges:

- Skilled Workforce Shortage: A significant challenge is the availability of highly skilled and certified MRO technicians and engineers.

- High Capital Investment: Setting up and maintaining advanced MRO facilities requires substantial capital expenditure.

- Regulatory Compliance: Navigating complex and evolving international and regional aviation regulations can be challenging.

- Supply Chain Disruptions: Global supply chain issues can impact the availability of spare parts and specialized components.

- Competition from Global Players: Intense competition from established global MRO providers can pressure local players.

- Economic Volatility: Fluctuations in oil prices and global economic downturns can impact airline profitability and MRO spending.

Emerging Opportunities in Middle East And Africa Aircraft Engine MRO Market

Emerging opportunities in the Middle East and Africa aircraft engine MRO market lie in the increasing demand for sustainable MRO solutions, including eco-friendly repair processes and the refurbishment of older engine components to extend their service life. The growth of low-cost carriers (LCCs) and regional airlines across Africa presents a significant untapped market for tailored MRO services. Furthermore, the development of specialized MRO capabilities for newer generation engines, such as advanced turboprops and regional jets, offers a niche for service providers. The "smart MRO" concept, integrating AI, IoT, and big data analytics for predictive maintenance and optimized workshop operations, is a rapidly evolving area with substantial growth potential.

Growth Accelerators in the Middle East And Africa Aircraft Engine MRO Market Industry

Several catalysts are accelerating the growth of the Middle East and Africa aircraft engine MRO industry. The ongoing digital transformation is a major accelerator, with investments in AI, machine learning, and data analytics for predictive maintenance and operational efficiency. Strategic partnerships between OEMs, airlines, and MRO providers are fostering innovation and service expansion. For instance, long-term power-by-the-hour contracts are becoming increasingly prevalent, creating a stable revenue stream for MRO providers and predictable costs for airlines. Market expansion strategies, including the establishment of new MRO facilities and the acquisition of smaller players to broaden service portfolios, are also driving growth. Furthermore, the growing emphasis on localized MRO capabilities within Africa, supported by government initiatives, is creating new avenues for growth and skill development.

Key Players Shaping the Middle East And Africa Aircraft Engine MRO Market Market

- Ethiopian Airlines

- CFM International (Safran Aircraft Engines and General Electric Company)

- Joramco (Dubai Aerospace Enterprise)

- Honeywell International Inc

- Safran

- Lockheed Martin Corporation

- Pratt & Whitney (RTX Corporation)

- EGYPTAIR MAINTENANCE & ENGINEERING (EGYPTAIR Group)

- Sanad (Mubadala Investment Company)

- 6 2 Other Players

- Lufthansa Technik AG (Lufthansa Group)

- Rolls-Royce plc

- Emirates Engineering (Emirates Group)

- Turbine Engine Maintenance Repair and Overhaul (Pty) Ltd

- AMMROC (Edge)

- General Electric Company

- STS Aviation Group

- Saudia Aerospace Engineering Industries

Notable Milestones in Middle East And Africa Aircraft Engine MRO Market Sector

- 2023: Sanad (Mubadala Investment Company) announces expansion of its engine MRO capabilities to support new engine types.

- 2022: Emirates Engineering undertakes a significant engine overhaul project, showcasing advanced in-house capabilities.

- 2022: AMMROC (Edge) secures new maintenance contracts, expanding its regional footprint.

- 2021: Ethiopian Airlines invests in new engine testing facilities to enhance its MRO services.

- 2020: Joramco (Dubai Aerospace Enterprise) achieves new OEM approvals, broadening its service offerings.

- 2019: Pratt & Whitney (RTX Corporation) expands its MRO network in the Middle East to support growing airline demand.

In-Depth Middle East And Africa Aircraft Engine MRO Market Market Outlook

The outlook for the Middle East and Africa Aircraft Engine MRO market remains exceptionally positive, driven by sustained fleet growth, increasing air connectivity, and a strong emphasis on operational efficiency and reliability. The ongoing digital transformation, coupled with a growing demand for sustainable MRO practices, will shape future strategies. Strategic partnerships, localized service offerings, and investments in advanced technologies will be crucial for capturing market share. The region's commitment to developing its aviation ecosystem presents a fertile ground for innovation and growth, positioning the Middle East and Africa as a critical hub for aircraft engine MRO services in the coming years.

Middle East And Africa Aircraft Engine MRO Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Middle East And Africa Aircraft Engine MRO Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East And Africa Aircraft Engine MRO Market Regional Market Share

Geographic Coverage of Middle East And Africa Aircraft Engine MRO Market

Middle East And Africa Aircraft Engine MRO Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Commercial Aviation Segment to Exhibit the Highest Growth Rate During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East And Africa Aircraft Engine MRO Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ethiopian Airlines

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CFM International (Safran Aircraft Engines and General Electric Company)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Joramco (Dubai Aerospace Enterprise)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Honeywell International Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Safran

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lockheed Martin Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Pratt & Whitney (RTX Corporation)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 EGYPTAIR MAINTENANCE & ENGINEERING (EGYPTAIR Group)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sanad (Mubadala Investment Company)6 2 Other Players

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Lufthansa Technik AG (Lufthansa Group)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Rolls-Royce plc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Emirates Engineering (Emirates Group)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Turbine Engine Maintenance Repair and Overhaul (Pty) Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 AMMROC (Edge)

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 General Electric Company

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 STS Aviation Group

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Saudia Aerospace Engineering Industries

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Ethiopian Airlines

List of Figures

- Figure 1: Middle East And Africa Aircraft Engine MRO Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East And Africa Aircraft Engine MRO Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Saudi Arabia Middle East And Africa Aircraft Engine MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Arab Emirates Middle East And Africa Aircraft Engine MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Israel Middle East And Africa Aircraft Engine MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Qatar Middle East And Africa Aircraft Engine MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Kuwait Middle East And Africa Aircraft Engine MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Oman Middle East And Africa Aircraft Engine MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Bahrain Middle East And Africa Aircraft Engine MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Jordan Middle East And Africa Aircraft Engine MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Lebanon Middle East And Africa Aircraft Engine MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East And Africa Aircraft Engine MRO Market?

The projected CAGR is approximately 6.96%.

2. Which companies are prominent players in the Middle East And Africa Aircraft Engine MRO Market?

Key companies in the market include Ethiopian Airlines, CFM International (Safran Aircraft Engines and General Electric Company), Joramco (Dubai Aerospace Enterprise), Honeywell International Inc, Safran, Lockheed Martin Corporation, Pratt & Whitney (RTX Corporation), EGYPTAIR MAINTENANCE & ENGINEERING (EGYPTAIR Group), Sanad (Mubadala Investment Company)6 2 Other Players, Lufthansa Technik AG (Lufthansa Group), Rolls-Royce plc, Emirates Engineering (Emirates Group), Turbine Engine Maintenance Repair and Overhaul (Pty) Ltd, AMMROC (Edge), General Electric Company, STS Aviation Group, Saudia Aerospace Engineering Industries.

3. What are the main segments of the Middle East And Africa Aircraft Engine MRO Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.17 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Commercial Aviation Segment to Exhibit the Highest Growth Rate During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East And Africa Aircraft Engine MRO Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East And Africa Aircraft Engine MRO Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East And Africa Aircraft Engine MRO Market?

To stay informed about further developments, trends, and reports in the Middle East And Africa Aircraft Engine MRO Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence