Key Insights

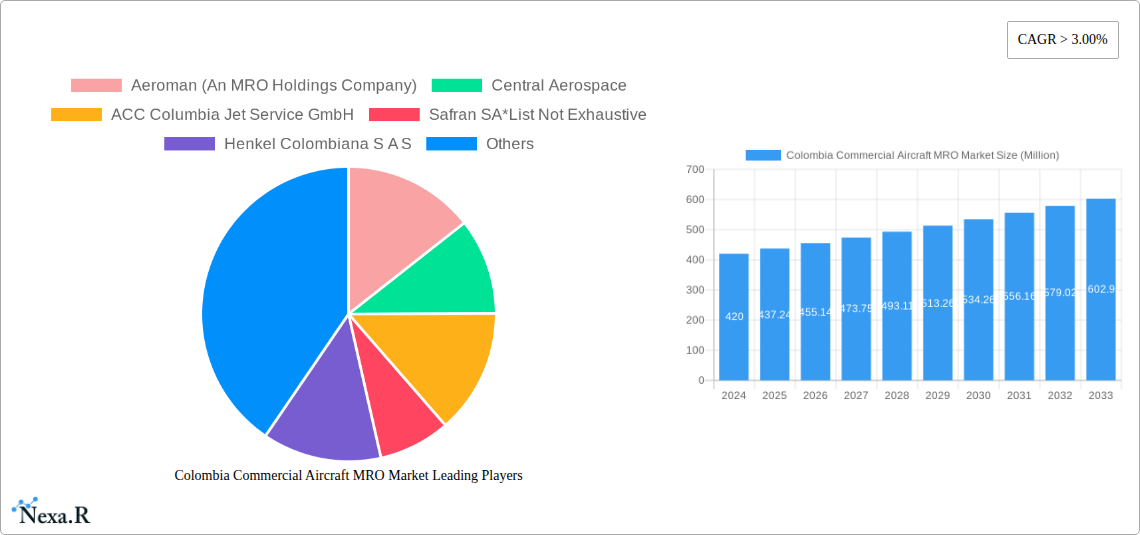

The Colombia Commercial Aircraft Maintenance, Repair, and Overhaul (MRO) market is poised for significant expansion, demonstrating robust growth potential. With a market size of USD 420 million in 2024, the sector is projected to expand at a CAGR of 4.1% through 2033. This growth is propelled by an increasing fleet size in Colombia, coupled with the rising complexity of modern aircraft requiring specialized maintenance. Key drivers include the country's strategic geographical location, serving as a hub for regional air travel, and a growing demand for air transport services for both passengers and cargo. The expansion of low-cost carriers and increased passenger traffic contribute to a higher demand for MRO services to ensure fleet airworthiness and operational efficiency. Furthermore, advancements in MRO technologies and the increasing adoption of predictive maintenance strategies are also fueling market expansion.

Colombia Commercial Aircraft MRO Market Market Size (In Million)

The market's trajectory is influenced by several prevailing trends. A notable trend is the increasing demand for component MRO services, driven by the aging of aircraft fleets and the need for component upgrades and replacements. Airframe and engine MRO segments also represent substantial market shares, with operators focusing on extending the lifecycle of these critical components. While the market is experiencing positive momentum, certain restraints, such as the high cost of advanced MRO technologies and skilled labor shortages, could pose challenges. However, strategic investments in training and technology by key players are expected to mitigate these concerns. The presence of established MRO providers and the ongoing development of aviation infrastructure within Colombia are crucial for sustaining this growth trajectory and meeting the evolving demands of the commercial aviation sector.

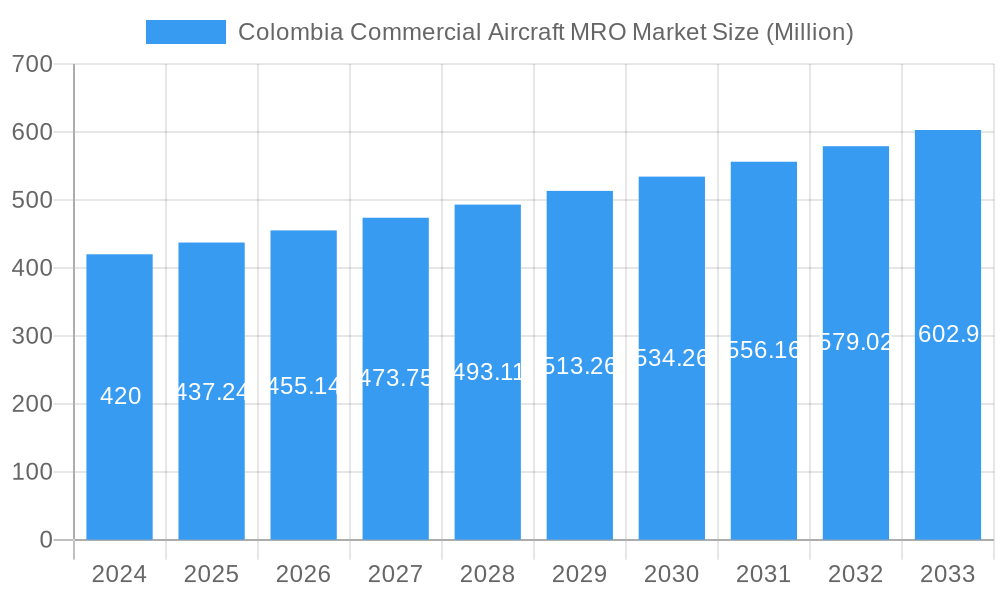

Colombia Commercial Aircraft MRO Market Company Market Share

Here's the SEO-optimized report description for the Colombia Commercial Aircraft MRO Market, designed for maximum visibility and engagement:

Colombia Commercial Aircraft MRO Market: Growth Drivers, Industry Outlook & Key Players (2019-2033)

Gain comprehensive insights into the burgeoning Colombia Commercial Aircraft MRO (Maintenance, Repair, and Overhaul) market. This in-depth report analyzes market dynamics, growth trends, and the competitive landscape from 2019 to 2033, with a base year of 2025. Discover critical data on MRO types (Airframe, Engine, Component, Line), regional dominance, technological innovations, and strategic initiatives by leading companies such as Aeroman (An MRO Holdings Company), Central Aerospace, ACC Columbia Jet Service GmbH, Safran SA, Henkel Colombiana S A S, Nediar InnLab, Avianca Cargo, SGS (Société Générale de Surveillance SA), and Indaer Aviation Technical Services S A S. Understand the key drivers, challenges, and emerging opportunities that will shape the future of aviation MRO in Colombia.

Colombia Commercial Aircraft MRO Market Market Dynamics & Structure

The Colombia Commercial Aircraft MRO market exhibits a dynamic and evolving structure, characterized by a moderate level of market concentration with key players holding significant shares. Technological innovation is a primary driver, with a constant push for advanced diagnostic tools, predictive maintenance solutions, and eco-friendly repair processes. Regulatory frameworks, overseen by bodies like Colombia's Civil Aviation Authority (Aerocivil), are crucial in ensuring safety and compliance, influencing operational standards and investment decisions. Competitive product substitutes, while present in some component repairs, are generally limited due to the specialized nature of aircraft MRO. End-user demographics are primarily driven by the growth of domestic and international airlines operating in and to Colombia, including major carriers and expanding cargo operations. Mergers and acquisitions (M&A) trends are gradually shaping the market, with strategic consolidations aimed at expanding service portfolios and geographic reach. For instance, the consolidation of MRO service providers can lead to increased efficiency and enhanced capabilities, potentially impacting market share by 5-10% per significant deal. Barriers to innovation include high capital expenditure for advanced equipment and the need for highly skilled, specialized labor.

- Market Concentration: Moderate, with a few key players dominating specific MRO segments.

- Technological Innovation: Focus on digital tools, predictive analytics, and sustainable repair methods.

- Regulatory Frameworks: Stringent safety and compliance standards by Aerocivil.

- Competitive Landscape: Specialized nature of MRO limits direct substitutes.

- End-User Demographics: Driven by airline fleet growth and cargo operations.

- M&A Trends: Gradual consolidation for service expansion and efficiency gains.

- Innovation Barriers: High upfront investment and demand for specialized talent.

Colombia Commercial Aircraft MRO Market Growth Trends & Insights

The Colombia Commercial Aircraft MRO market is poised for robust growth, projecting a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033. This expansion is fueled by the steady increase in air travel demand, the aging global aircraft fleet requiring more extensive maintenance, and Colombia's strategic position as a regional aviation hub. Market size is estimated to reach significant figures, with the overall MRO market projected to grow from approximately $1,800 million in 2025 to over $3,000 million by 2033. Adoption rates for advanced MRO technologies, such as digital twins and artificial intelligence for predictive maintenance, are accelerating, driven by airlines' pursuit of cost optimization and operational efficiency. Technological disruptions, including the rise of additive manufacturing for spare parts and the increasing complexity of newer aircraft models like the A320neo and Boeing 737 MAX, are creating new service opportunities. Consumer behavior shifts are evident, with airlines prioritizing MRO providers that offer integrated solutions, faster turnaround times, and enhanced sustainability practices. The market penetration of specialized MRO services is expected to deepen as airlines focus on core competencies and outsource complex maintenance tasks. The increasing number of aircraft entering their mid-life cycle, a critical period for heavy maintenance, will further stimulate demand for MRO services.

- Projected CAGR (2025-2033): ~7.5%

- Market Size (2025): ~$1,800 million

- Market Size (2033): >$3,000 million

- Adoption of Advanced Technologies: Increasing for cost savings and efficiency.

- Technological Disruptions: Additive manufacturing, complex new aircraft models.

- Airline Priorities: Integrated solutions, speed, and sustainability.

- Market Penetration: Deepening for specialized MRO services.

- Key Growth Factor: Aging aircraft fleets requiring heavy maintenance.

Dominant Regions, Countries, or Segments in Colombia Commercial Aircraft MRO Market

Within the Colombia Commercial Aircraft MRO market, the Engine MRO segment is anticipated to be the dominant force, driven by the inherent complexity, high cost, and critical role of aircraft engines in flight operations. This segment is expected to capture a significant market share, estimated at around 35-40% of the total MRO expenditure. Key drivers for engine MRO dominance include the increasing number of aircraft powered by advanced turbofan engines, the intricate nature of engine repairs requiring specialized facilities and expertise, and the substantial value associated with engine overhauls. Colombia's strategic location and its role as a hub for regional aviation further amplify the demand for efficient and reliable engine maintenance solutions. Economic policies that encourage fleet modernization and expansion directly benefit the engine MRO sector. Infrastructure development, including state-of-the-art engine repair shops and training facilities, is crucial for supporting this segment's growth. Market share within engine MRO is influenced by the types of engines prevalent in airline fleets; for example, the growing presence of CFM International LEAP-1A engines, as seen in Avianca's A320neo fleet, directly boosts demand for related MRO services. Growth potential in this segment is further enhanced by the extended service life of modern engines, necessitating regular and comprehensive maintenance throughout their operational journey.

- Dominant Segment: Engine MRO

- Estimated Market Share: 35-40%

- Key Drivers: Complexity and cost of engine repairs, advanced engine technologies, regional aviation hub status.

- Economic Influence: Fleet modernization and expansion policies.

- Infrastructure Needs: Advanced repair shops and training.

- Engine Types: Demand influenced by prevalent engine models (e.g., LEAP-1A).

- Growth Potential: Extended engine service life driving recurring maintenance needs.

- Other Significant Segments: Airframe MRO (estimated 25-30% share) and Component MRO (estimated 20-25% share) also exhibit strong growth trajectories, supported by fleet expansion and aging aircraft. Line Maintenance (estimated 10-15% share) remains crucial for day-to-day operational efficiency.

Colombia Commercial Aircraft MRO Market Product Landscape

The product landscape in the Colombia Commercial Aircraft MRO market is characterized by a focus on advanced repair techniques, specialized tooling, and innovative material solutions. OEMs and third-party MRO providers are continuously introducing enhanced repair processes for critical components, extending their service life and reducing the need for full replacements. Applications range from complex airframe structural repairs using composite materials to sophisticated engine component refurbishment and advanced avionics diagnostics. Performance metrics are continuously improving, with faster turnaround times, higher repair yields, and enhanced reliability becoming key differentiators. Unique selling propositions often revolve around specialized expertise for specific aircraft types or engine models, proprietary repair technologies, and the integration of digital solutions for traceability and quality control. Technological advancements are also seen in the development of environmentally friendly repair solutions, minimizing waste and chemical usage.

Key Drivers, Barriers & Challenges in Colombia Commercial Aircraft MRO Market

Key Drivers: The Colombia Commercial Aircraft MRO market is propelled by several key drivers. The sustained growth in air travel demand, both domestically and internationally, necessitates a larger and more actively maintained fleet. Colombia's strategic geographical location as a gateway to the Americas also stimulates aviation activity and, consequently, MRO demand. Furthermore, the increasing age of aircraft fleets worldwide means more components and airframes require extensive maintenance, repair, and overhaul. Technological advancements in diagnostic tools and repair techniques offer opportunities for efficiency gains and cost reduction for MRO providers. Government initiatives promoting the aviation sector and attracting foreign investment also play a significant role.

Barriers & Challenges: Despite the positive outlook, the market faces several barriers and challenges. The high cost of specialized MRO equipment and the need for a highly skilled workforce present significant investment hurdles. Stringent and evolving regulatory requirements can be complex and costly to comply with. The global supply chain disruptions, particularly for critical spare parts, can lead to significant delays and increased operational costs. Intense competition from established international MRO providers and the emergence of new local players can put pressure on pricing and margins. The reliance on foreign technology and expertise for certain advanced MRO services can also be a challenge.

Emerging Opportunities in Colombia Commercial Aircraft MRO Market

Emerging opportunities in the Colombia Commercial Aircraft MRO market lie in several key areas. The growing demand for sustainable MRO practices, including eco-friendly repair processes and material recycling, presents a significant untapped market. The development of specialized MRO capabilities for next-generation aircraft, such as those with advanced composite structures and novel propulsion systems, offers substantial growth potential. Evolving consumer preferences for integrated MRO solutions, encompassing predictive maintenance, component management, and full-service support, create opportunities for service providers offering end-to-end capabilities. The increasing focus on digitalization and data analytics in MRO can lead to the development of innovative service offerings focused on fleet optimization and predictive asset management.

Growth Accelerators in the Colombia Commercial Aircraft MRO Market Industry

The Colombia Commercial Aircraft MRO market industry is experiencing significant growth acceleration driven by several catalysts. Technological breakthroughs in areas such as artificial intelligence for predictive maintenance and advanced non-destructive testing methods are enhancing MRO efficiency and accuracy. Strategic partnerships between airlines and MRO providers, including long-term service agreements and joint ventures, are fostering innovation and ensuring consistent demand. Market expansion strategies by both local and international MRO players, aimed at increasing their service offerings and geographic footprint within Colombia and the wider Latin American region, are further fueling growth. The increasing adoption of digitalization across the aviation value chain is also a key accelerator, enabling better data management, streamlined operations, and improved customer service.

Key Players Shaping the Colombia Commercial Aircraft MRO Market Market

- Aeroman (An MRO Holdings Company)

- Central Aerospace

- ACC Columbia Jet Service GmbH

- Safran SA

- Henkel Colombiana S A S

- Nediar InnLab

- Avianca Cargo

- SGS (Société Générale de Surveillance SA)

- Indaer Aviation Technical Services S A S

Notable Milestones in Colombia Commercial Aircraft MRO Market Sector

- November 2022: Safran Nacelles signed a four-year agreement with Avianca for the support of the nacelles of the airline's Airbus A320neo powered by CFM International LEAP-1A turbofan engines. Under the agreement, the airline will get OEM-guaranteed MRO solutions at the Safran Nacelles repair station.

- April 2022: Ultra Air, a new Colombian airline, selected Airbus' flight hours services (FHS) for its A320 aircraft fleet. Airbus will provide parts pooling, on-site stock at the airline's main base in Medellin, engineering services, and components maintenance.

In-Depth Colombia Commercial Aircraft MRO Market Market Outlook

The future outlook for the Colombia Commercial Aircraft MRO market is exceptionally promising, driven by sustained aviation growth and technological advancements. Key growth accelerators, including the continuous demand for engine and airframe maintenance, the increasing adoption of digital MRO solutions, and the expansion of specialized component repair capabilities, will shape this market. Strategic opportunities lie in developing capabilities for next-generation aircraft, offering integrated and sustainable MRO solutions, and leveraging data analytics for predictive maintenance. The market is expected to see further consolidation and specialization, with MRO providers focusing on niche expertise and enhanced customer service to gain a competitive edge. The Colombian MRO sector is well-positioned to capitalize on these trends, benefiting from its strategic location and a growing aviation ecosystem.

Colombia Commercial Aircraft MRO Market Segmentation

-

1. MRO Type

- 1.1. Airframe

- 1.2. Engine

- 1.3. Component

- 1.4. Line

Colombia Commercial Aircraft MRO Market Segmentation By Geography

- 1. Colombia

Colombia Commercial Aircraft MRO Market Regional Market Share

Geographic Coverage of Colombia Commercial Aircraft MRO Market

Colombia Commercial Aircraft MRO Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growing Air Traffic Across Colombia Propels the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Colombia Commercial Aircraft MRO Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 5.1.1. Airframe

- 5.1.2. Engine

- 5.1.3. Component

- 5.1.4. Line

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Colombia

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aeroman (An MRO Holdings Company)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Central Aerospace

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ACC Columbia Jet Service GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Safran SA*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Henkel Colombiana S A S

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nediar InnLab

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Avianca Cargo

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SGS (Société Générale de Surveillance SA)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Indaer Aviation Technical Services S A S

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Aeroman (An MRO Holdings Company)

List of Figures

- Figure 1: Colombia Commercial Aircraft MRO Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Colombia Commercial Aircraft MRO Market Share (%) by Company 2025

List of Tables

- Table 1: Colombia Commercial Aircraft MRO Market Revenue undefined Forecast, by MRO Type 2020 & 2033

- Table 2: Colombia Commercial Aircraft MRO Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Colombia Commercial Aircraft MRO Market Revenue undefined Forecast, by MRO Type 2020 & 2033

- Table 4: Colombia Commercial Aircraft MRO Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Colombia Commercial Aircraft MRO Market?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Colombia Commercial Aircraft MRO Market?

Key companies in the market include Aeroman (An MRO Holdings Company), Central Aerospace, ACC Columbia Jet Service GmbH, Safran SA*List Not Exhaustive, Henkel Colombiana S A S, Nediar InnLab, Avianca Cargo, SGS (Société Générale de Surveillance SA), Indaer Aviation Technical Services S A S.

3. What are the main segments of the Colombia Commercial Aircraft MRO Market?

The market segments include MRO Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growing Air Traffic Across Colombia Propels the Market Growth.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2022: Safran Nacelles signed a four-year agreement with Avianca for the support of the nacelles of the airline's Airbus A320neo powered by CFM International LEAP-1A turbofan engines. Under the agreement, the airline will get OEM-guaranteed MRO solutions at the Safran Nacelles repair station.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Colombia Commercial Aircraft MRO Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Colombia Commercial Aircraft MRO Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Colombia Commercial Aircraft MRO Market?

To stay informed about further developments, trends, and reports in the Colombia Commercial Aircraft MRO Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence