Key Insights

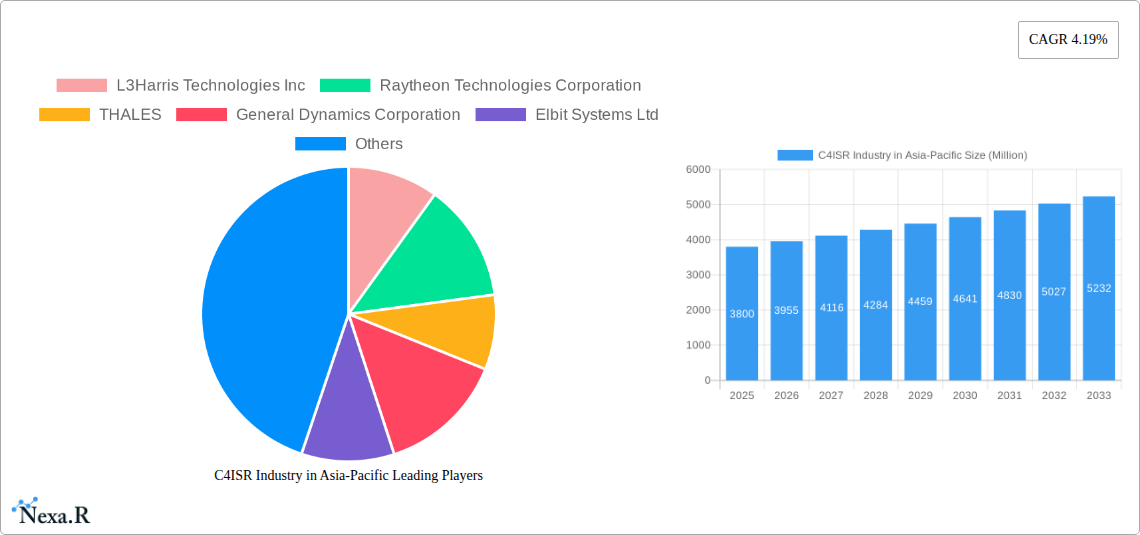

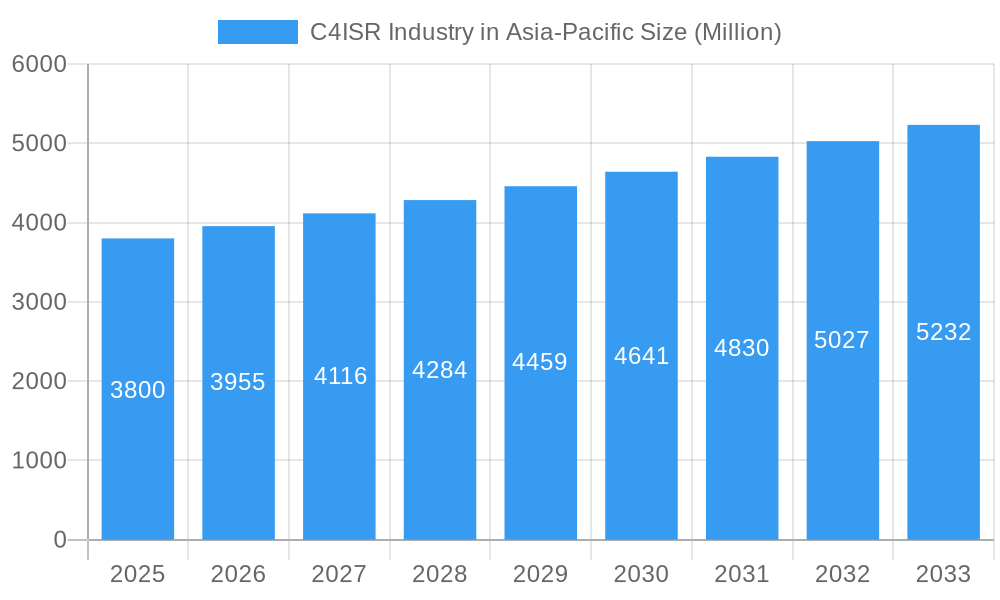

The C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) market in the Asia-Pacific region is poised for robust growth, driven by increasing geopolitical tensions, rising defense budgets, and the burgeoning adoption of advanced technologies. With an estimated market size of USD 3,800 million in 2025, the region is projected to experience a Compound Annual Growth Rate (CAGR) of 4.19% through 2033, indicating a steady and significant expansion. Key drivers for this growth include the modernization of military forces, the pursuit of enhanced situational awareness, and the need for sophisticated intelligence gathering capabilities to counter emerging threats. Nations across Asia-Pacific are heavily investing in upgrading their C4ISR infrastructure to maintain a strategic advantage and ensure national security. This includes the integration of artificial intelligence (AI), machine learning (ML), and advanced networking solutions to create more connected and responsive defense systems. The platform segment is particularly dynamic, with substantial investments anticipated in air, land, and sea-based C4ISR systems, reflecting a comprehensive approach to defense modernization.

C4ISR Industry in Asia-Pacific Market Size (In Billion)

The Asia-Pacific C4ISR market is characterized by a strong focus on technological innovation and strategic partnerships. Major global players like L3Harris Technologies, Raytheon Technologies, THALES, Lockheed Martin, and Northrop Grumman are actively engaged in the region, either through direct sales, joint ventures, or local manufacturing. Trends such as the development of resilient communication networks, the deployment of unmanned systems for ISR missions, and the implementation of cyber warfare capabilities are shaping the market landscape. While the market is propelled by these positive growth factors, certain restraints, such as budgetary constraints in some developing nations and the complexity of integrating legacy systems with new technologies, need to be navigated. Nevertheless, the overarching trend points towards an increasingly sophisticated and interconnected C4ISR ecosystem in Asia-Pacific, driven by a proactive approach to defense and security in a complex geopolitical environment. The region's diverse threat landscape and its strategic importance globally underscore the sustained demand for advanced C4ISR solutions.

C4ISR Industry in Asia-Pacific Company Market Share

C4ISR Industry in Asia-Pacific: Strategic Outlook & Growth Dynamics (2019-2033)

Report Description:

Gain a comprehensive understanding of the Asia-Pacific C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) market, a rapidly expanding sector critical for national security and defense modernization. This in-depth report analyzes market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, emerging opportunities, and strategic initiatives shaping the C4ISR industry across the Asia-Pacific region. With a focus on the Air C4ISR market, Land C4ISR market, and Sea C4ISR market, and considering the burgeoning Space C4ISR market, this report provides actionable insights for stakeholders, defense contractors, government agencies, and investors. Leveraging extensive data from the Historical Period (2019-2024) and projecting through the Forecast Period (2025-2033), with a Base Year of 2025, this report offers a strategic roadmap for navigating this evolving landscape. Explore the competitive strategies of leading players like L3Harris Technologies Inc, Raytheon Technologies Corporation, THALES, General Dynamics Corporation, Elbit Systems Ltd, Lockheed Martin Corporation, General Atomics, Israel Aerospace Industries Limited, BAE Systems plc, Northrop Grumman Corporation, and Saab AB.

C4ISR Industry in Asia-Pacific Market Dynamics & Structure

The Asia-Pacific C4ISR market is characterized by a moderate to high market concentration, driven by a select group of global defense giants and a growing number of regional players specializing in niche technologies. Technological innovation remains the primary driver, fueled by escalating geopolitical tensions and the continuous pursuit of advanced defense capabilities by nations in the region. Regulatory frameworks are increasingly evolving to facilitate domestic defense production and technology transfer, albeit with varying degrees of stringency across countries. Competitive product substitutes primarily stem from advancements in commercial off-the-shelf (COTS) technologies that are adapted for defense applications, alongside indigenous development efforts. End-user demographics are predominantly military and government intelligence agencies, with a growing emphasis on interoperability and network-centric warfare. Mergers & Acquisition (M&A) trends are observed as larger companies seek to consolidate their market position and acquire specialized technologies, while smaller firms leverage M&A for market access and funding. For instance, in the Air C4ISR market, the demand for integrated sensor and communication systems is high. The Land C4ISR market sees innovation in tactical communication and battlefield management systems. The Sea C4ISR market is focused on maritime surveillance and command and control for naval operations. The nascent Space C4ISR market is rapidly gaining traction due to the strategic importance of satellite-based intelligence and communication.

- Market Concentration: Dominated by a few major global players, but with increasing participation from regional manufacturers.

- Technological Innovation: Driven by AI, IoT, cloud computing, and advanced sensor technologies.

- Regulatory Frameworks: Evolving policies promoting indigenous manufacturing and cross-border defense cooperation.

- Competitive Substitutes: COTS technology adaptation and indigenous R&D.

- End-User Demographics: Military, intelligence agencies, and homeland security forces.

- M&A Trends: Strategic acquisitions for technology and market share consolidation.

C4ISR Industry in Asia-Pacific Growth Trends & Insights

The Asia-Pacific C4ISR market is poised for substantial growth, projected to expand at a significant Compound Annual Growth Rate (CAGR) over the forecast period. This expansion is underpinned by a confluence of factors including increasing defense budgets in key nations, the modernization of aging military infrastructure, and a heightened awareness of regional security threats. The adoption rates for advanced C4ISR systems are accelerating as nations prioritize enhanced situational awareness, rapid decision-making, and seamless interoperability across different branches of their armed forces and with allied nations. Technological disruptions, such as the integration of Artificial Intelligence (AI) in data analysis and threat detection, the proliferation of unmanned systems, and the advancement of secure communication networks, are fundamentally reshaping the market. Consumer behavior, in this context, refers to the evolving procurement strategies of defense ministries, which are increasingly prioritizing systems that offer flexibility, scalability, and long-term operational efficiency. The push towards a more integrated battlespace environment is a key trend, driving demand for sophisticated command and control solutions across all platforms.

Market penetration of advanced C4ISR technologies is on an upward trajectory, particularly within the Air C4ISR market for advanced fighter jets and surveillance aircraft, and the Land C4ISR market for mobile command centers and soldier modernization programs. The Sea C4ISR market is witnessing increased investment in naval C4ISR systems for enhanced maritime domain awareness and fleet coordination. The emerging Space C4ISR market is experiencing rapid growth driven by the need for resilient satellite-based intelligence, surveillance, and reconnaissance capabilities. The overall market size evolution is a testament to the strategic importance placed on robust C4ISR capabilities for national security and power projection in the Asia-Pacific region.

- Market Size Evolution: Significant expansion driven by defense modernization and geopolitical considerations.

- Adoption Rates: Accelerating adoption of advanced C4ISR systems across all defense services.

- Technological Disruptions: AI integration, unmanned systems, and secure communication networks transforming capabilities.

- Consumer Behavior Shifts: Procurement prioritizing interoperability, flexibility, and efficiency.

- Market Penetration: Increasing integration of C4ISR solutions in next-generation platforms.

Dominant Regions, Countries, or Segments in C4ISR Industry in Asia-Pacific

The Air C4ISR market is a dominant segment driving significant growth within the Asia-Pacific C4ISR industry. This dominance is fueled by the strategic imperative for air superiority, enhanced surveillance, and rapid response capabilities. Countries like China, India, Japan, and South Korea are making substantial investments in advanced fighter jets, reconnaissance aircraft, and unmanned aerial vehicles (UAVs), all of which are heavily reliant on sophisticated C4ISR systems. Economic policies in these nations often prioritize indigenous defense manufacturing, leading to significant R&D investments and the establishment of robust industrial ecosystems for aerospace and defense. Infrastructure development, including the expansion of airbases and air traffic control systems, further supports the growth of the Air C4ISR market.

China is a leading country in terms of overall C4ISR spending and domestic production, driven by its modernization drive and regional ambitions. India, with its significant defense budget and focus on indigenization, represents another major growth market, actively seeking advanced C4ISR solutions for its air force. Japan's commitment to enhancing its defense posture, particularly in response to regional security dynamics, also fuels demand for cutting-edge Air C4ISR technologies. South Korea's advanced technological capabilities and strategic alliances further bolster its position as a key player. The market share within the Air C4ISR segment is distributed among major global defense contractors and a growing number of specialized regional suppliers. Growth potential in this segment remains exceptionally high due to ongoing fleet modernizations and the continuous introduction of new combat and surveillance platforms.

- Dominant Segment: Air C4ISR, driven by the need for air superiority and advanced surveillance.

- Key Countries: China, India, Japan, and South Korea leading in investment and development.

- Key Drivers:

- Economic Policies: Focus on defense modernization and indigenous production.

- Infrastructure Development: Expansion of airbases and air traffic control capabilities.

- Geopolitical Dynamics: Regional security concerns and power projection.

- Market Share & Growth Potential: Significant share held by major players, with high growth potential due to ongoing fleet modernization.

C4ISR Industry in Asia-Pacific Product Landscape

The product landscape in the Asia-Pacific C4ISR industry is characterized by a rapid evolution of integrated solutions that enhance battlefield awareness and operational efficiency. Innovations are centered around resilient communication systems, advanced sensor fusion, intelligent data processing, and secure network architectures. Key product categories include tactical data links, battlefield management systems (BMS), intelligence, surveillance, and reconnaissance (ISR) platforms, electronic warfare (EW) suites, and command and control (C2) centers. Applications span across diverse platforms, from advanced fighter jets and naval vessels to ground vehicles and dismounted soldiers. Performance metrics are increasingly focused on real-time data dissemination, reduced latency, enhanced signal intelligence capabilities, and improved situational awareness for decision-makers. Unique selling propositions often lie in the modularity, scalability, and interoperability of these systems, allowing for seamless integration into existing defense architectures and adaptability to evolving threats. Technological advancements are also pushing towards AI-driven predictive analysis and autonomous capabilities within C4ISR systems.

Key Drivers, Barriers & Challenges in C4ISR Industry in Asia-Pacific

Key Drivers:

The Asia-Pacific C4ISR industry is propelled by several critical drivers. Escalating geopolitical tensions and territorial disputes across the region necessitate robust command, control, and intelligence capabilities for national security. The ongoing military modernization programs in key nations, such as China and India, involve significant investments in advanced C4ISR systems to achieve technological parity and enhance operational effectiveness. The increasing adoption of network-centric warfare doctrines, emphasizing interoperability and seamless information flow between different military assets, also fuels demand. Furthermore, the growing prevalence of asymmetric threats and the need for enhanced border surveillance and counter-terrorism operations are driving investments in sophisticated ISR and communication technologies. The Air C4ISR market, Land C4ISR market, and Sea C4ISR market are all experiencing this surge due to these drivers.

Barriers & Challenges:

Despite the strong growth trajectory, the Asia-Pacific C4ISR market faces significant barriers and challenges. The high cost of advanced C4ISR systems can be a deterrent for some developing nations, impacting the speed of adoption. Regulatory hurdles and intellectual property protection concerns can impede technology transfer and international collaboration. The complex cybersecurity landscape presents a constant threat, requiring robust defense mechanisms for sensitive C4ISR networks. Supply chain disruptions, as evidenced by global events, can impact the timely delivery of critical components and systems. Intense competition among global and regional players, while beneficial for innovation, also puts pressure on profit margins and necessitates continuous R&D investment. The interoperability of legacy systems with new technologies can also pose a technical challenge, requiring substantial integration efforts.

Emerging Opportunities in C4ISR Industry in Asia-Pacific

Emerging opportunities in the Asia-Pacific C4ISR industry lie in the growing demand for AI-powered intelligence analysis and autonomous systems, enhancing decision-making speed and effectiveness. The rapid development of the Space C4ISR market presents a significant opportunity, with nations increasingly investing in satellite-based reconnaissance and communication capabilities for global situational awareness and resilient command structures. There is also a burgeoning demand for advanced cybersecurity solutions tailored for C4ISR networks to counter sophisticated cyber threats. The increasing focus on multi-domain operations creates opportunities for integrated C4ISR systems that can seamlessly connect air, land, sea, and space domains. Furthermore, the trend towards sovereign defense capabilities is creating opportunities for regional manufacturers and technology providers to develop and supply customized C4ISR solutions that meet specific national requirements.

Growth Accelerators in the C4ISR Industry in Asia-Pacific Industry

Several key catalysts are accelerating the long-term growth of the C4ISR industry in the Asia-Pacific. The continuous pursuit of technological superiority by major powers in the region is a primary accelerator, driving consistent investment in R&D and the adoption of cutting-edge solutions. Strategic partnerships and alliances between nations, such as the security ties between Japan and the Philippines, are fostering collaboration and driving demand for interoperable C4ISR equipment. The increasing adoption of advanced technologies like Artificial Intelligence (AI), Machine Learning (ML), and cloud computing is enhancing the capabilities and efficiency of C4ISR systems, making them more attractive. Market expansion strategies by leading companies, including the establishment of local manufacturing facilities and R&D centers, further fuel growth by tailoring solutions to regional needs and fostering closer ties with end-users. The integration of C4ISR capabilities into unmanned systems and cyber warfare domains also represents significant growth avenues.

Key Players Shaping the C4ISR Industry in Asia-Pacific Market

- L3Harris Technologies Inc

- Raytheon Technologies Corporation

- THALES

- General Dynamics Corporation

- Elbit Systems Ltd

- Lockheed Martin Corporation

- General Atomics

- Israel Aerospace Industries Limited

- BAE Systems plc

- Northrop Grumman Corporation

- Saab AB

Notable Milestones in C4ISR Industry in Asia-Pacific Sector

- February 2021: India's Hindustan Aeronautics Limited (HAL) announced the development of a futuristic high-altitude pseudo satellite with a local start-up company to enhance the C4ISR capabilities of the Indian armed forces.

- March 2022: The Defence Ministry of India signed a partnership with BEL to supply an Advanced Electronic Warfare suite for the Indian Air Force fighter jets. The contract was signed between the Ministry of Defense and Bharat Electronics Limited (BEL), with an estimated INR 1993 Crore (USD 255 million).

- April 2022: Japan and the Philippines formed an agreement to set up security ties, to bolster security cooperation and joint drills. This partnership is expected to drive significant demand for the C4ISR equipment to be used for various military activities executed by the partnership.

In-Depth C4ISR Industry in Asia-Pacific Market Outlook

The future outlook for the Asia-Pacific C4ISR market is exceptionally robust, driven by sustained defense modernization efforts and evolving geopolitical landscapes. Growth accelerators such as AI-driven intelligence, the expansion of the Space C4ISR market, and the increasing emphasis on multi-domain operations will continue to shape investment strategies. Strategic opportunities lie in developing and integrating highly resilient and secure C4ISR networks capable of operating in contested environments. The push towards indigenous defense capabilities will foster collaboration between international primes and regional players, creating a dynamic market for localized solutions. Furthermore, advancements in quantum computing and advanced sensor technologies are expected to usher in a new era of C4ISR capabilities, presenting significant long-term growth potential.

C4ISR Industry in Asia-Pacific Segmentation

-

1. Platform

- 1.1. Air

- 1.2. Land

- 1.3. Sea

- 1.4. Space

C4ISR Industry in Asia-Pacific Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

C4ISR Industry in Asia-Pacific Regional Market Share

Geographic Coverage of C4ISR Industry in Asia-Pacific

C4ISR Industry in Asia-Pacific REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Increasing Investments to Enhance the Space-based C4ISR Capabilities in Asia-Pacific

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global C4ISR Industry in Asia-Pacific Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Air

- 5.1.2. Land

- 5.1.3. Sea

- 5.1.4. Space

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. North America C4ISR Industry in Asia-Pacific Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 6.1.1. Air

- 6.1.2. Land

- 6.1.3. Sea

- 6.1.4. Space

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 7. South America C4ISR Industry in Asia-Pacific Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 7.1.1. Air

- 7.1.2. Land

- 7.1.3. Sea

- 7.1.4. Space

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 8. Europe C4ISR Industry in Asia-Pacific Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 8.1.1. Air

- 8.1.2. Land

- 8.1.3. Sea

- 8.1.4. Space

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 9. Middle East & Africa C4ISR Industry in Asia-Pacific Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 9.1.1. Air

- 9.1.2. Land

- 9.1.3. Sea

- 9.1.4. Space

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 10. Asia Pacific C4ISR Industry in Asia-Pacific Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 10.1.1. Air

- 10.1.2. Land

- 10.1.3. Sea

- 10.1.4. Space

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 L3Harris Technologies Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Raytheon Technologies Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 THALES

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 General Dynamics Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Elbit Systems Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lockheed Martin Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 General Atomics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Israel Aerospace Industries Limite

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BAE Systems plc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Northrop Grumman Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Saab AB

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 L3Harris Technologies Inc

List of Figures

- Figure 1: Global C4ISR Industry in Asia-Pacific Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America C4ISR Industry in Asia-Pacific Revenue (Million), by Platform 2025 & 2033

- Figure 3: North America C4ISR Industry in Asia-Pacific Revenue Share (%), by Platform 2025 & 2033

- Figure 4: North America C4ISR Industry in Asia-Pacific Revenue (Million), by Country 2025 & 2033

- Figure 5: North America C4ISR Industry in Asia-Pacific Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America C4ISR Industry in Asia-Pacific Revenue (Million), by Platform 2025 & 2033

- Figure 7: South America C4ISR Industry in Asia-Pacific Revenue Share (%), by Platform 2025 & 2033

- Figure 8: South America C4ISR Industry in Asia-Pacific Revenue (Million), by Country 2025 & 2033

- Figure 9: South America C4ISR Industry in Asia-Pacific Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe C4ISR Industry in Asia-Pacific Revenue (Million), by Platform 2025 & 2033

- Figure 11: Europe C4ISR Industry in Asia-Pacific Revenue Share (%), by Platform 2025 & 2033

- Figure 12: Europe C4ISR Industry in Asia-Pacific Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe C4ISR Industry in Asia-Pacific Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa C4ISR Industry in Asia-Pacific Revenue (Million), by Platform 2025 & 2033

- Figure 15: Middle East & Africa C4ISR Industry in Asia-Pacific Revenue Share (%), by Platform 2025 & 2033

- Figure 16: Middle East & Africa C4ISR Industry in Asia-Pacific Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa C4ISR Industry in Asia-Pacific Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific C4ISR Industry in Asia-Pacific Revenue (Million), by Platform 2025 & 2033

- Figure 19: Asia Pacific C4ISR Industry in Asia-Pacific Revenue Share (%), by Platform 2025 & 2033

- Figure 20: Asia Pacific C4ISR Industry in Asia-Pacific Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific C4ISR Industry in Asia-Pacific Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global C4ISR Industry in Asia-Pacific Revenue Million Forecast, by Platform 2020 & 2033

- Table 2: Global C4ISR Industry in Asia-Pacific Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global C4ISR Industry in Asia-Pacific Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: Global C4ISR Industry in Asia-Pacific Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States C4ISR Industry in Asia-Pacific Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada C4ISR Industry in Asia-Pacific Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico C4ISR Industry in Asia-Pacific Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global C4ISR Industry in Asia-Pacific Revenue Million Forecast, by Platform 2020 & 2033

- Table 9: Global C4ISR Industry in Asia-Pacific Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil C4ISR Industry in Asia-Pacific Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina C4ISR Industry in Asia-Pacific Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America C4ISR Industry in Asia-Pacific Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global C4ISR Industry in Asia-Pacific Revenue Million Forecast, by Platform 2020 & 2033

- Table 14: Global C4ISR Industry in Asia-Pacific Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom C4ISR Industry in Asia-Pacific Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany C4ISR Industry in Asia-Pacific Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France C4ISR Industry in Asia-Pacific Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy C4ISR Industry in Asia-Pacific Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain C4ISR Industry in Asia-Pacific Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia C4ISR Industry in Asia-Pacific Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux C4ISR Industry in Asia-Pacific Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics C4ISR Industry in Asia-Pacific Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe C4ISR Industry in Asia-Pacific Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global C4ISR Industry in Asia-Pacific Revenue Million Forecast, by Platform 2020 & 2033

- Table 25: Global C4ISR Industry in Asia-Pacific Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey C4ISR Industry in Asia-Pacific Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel C4ISR Industry in Asia-Pacific Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC C4ISR Industry in Asia-Pacific Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa C4ISR Industry in Asia-Pacific Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa C4ISR Industry in Asia-Pacific Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa C4ISR Industry in Asia-Pacific Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global C4ISR Industry in Asia-Pacific Revenue Million Forecast, by Platform 2020 & 2033

- Table 33: Global C4ISR Industry in Asia-Pacific Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China C4ISR Industry in Asia-Pacific Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India C4ISR Industry in Asia-Pacific Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan C4ISR Industry in Asia-Pacific Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea C4ISR Industry in Asia-Pacific Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN C4ISR Industry in Asia-Pacific Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania C4ISR Industry in Asia-Pacific Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific C4ISR Industry in Asia-Pacific Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the C4ISR Industry in Asia-Pacific?

The projected CAGR is approximately 4.19%.

2. Which companies are prominent players in the C4ISR Industry in Asia-Pacific?

Key companies in the market include L3Harris Technologies Inc, Raytheon Technologies Corporation, THALES, General Dynamics Corporation, Elbit Systems Ltd, Lockheed Martin Corporation, General Atomics, Israel Aerospace Industries Limite, BAE Systems plc, Northrop Grumman Corporation, Saab AB.

3. What are the main segments of the C4ISR Industry in Asia-Pacific?

The market segments include Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Increasing Investments to Enhance the Space-based C4ISR Capabilities in Asia-Pacific.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

In February 2021, India's Hindustan Aeronautics Limited (HAL) announced the development of a futuristic high-altitude pseudo satellite with a local start-up company to enhance the C4ISR capabilities of the Indian armed forces.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "C4ISR Industry in Asia-Pacific," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the C4ISR Industry in Asia-Pacific report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the C4ISR Industry in Asia-Pacific?

To stay informed about further developments, trends, and reports in the C4ISR Industry in Asia-Pacific, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence