Key Insights

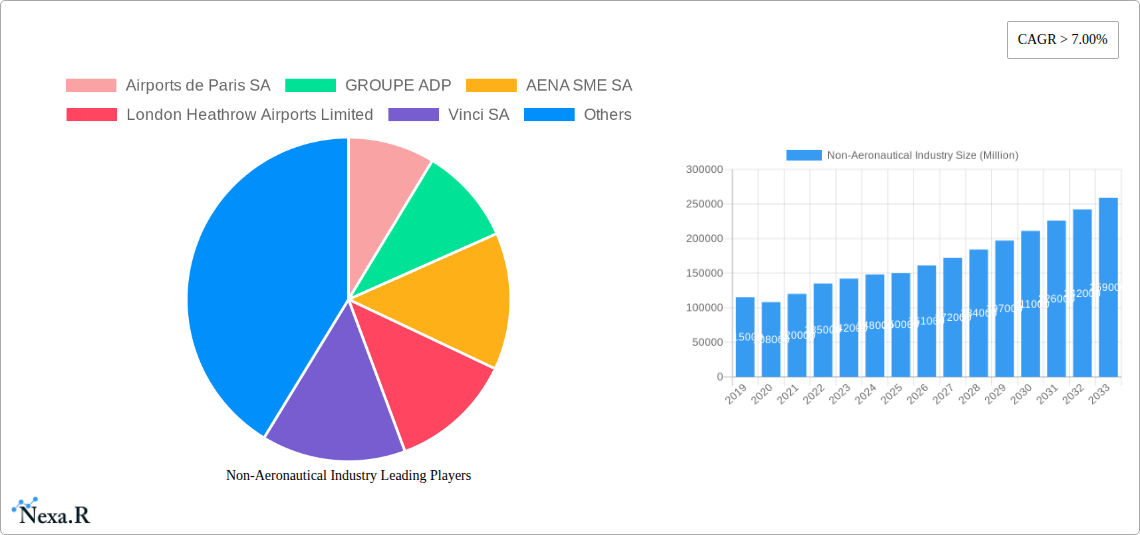

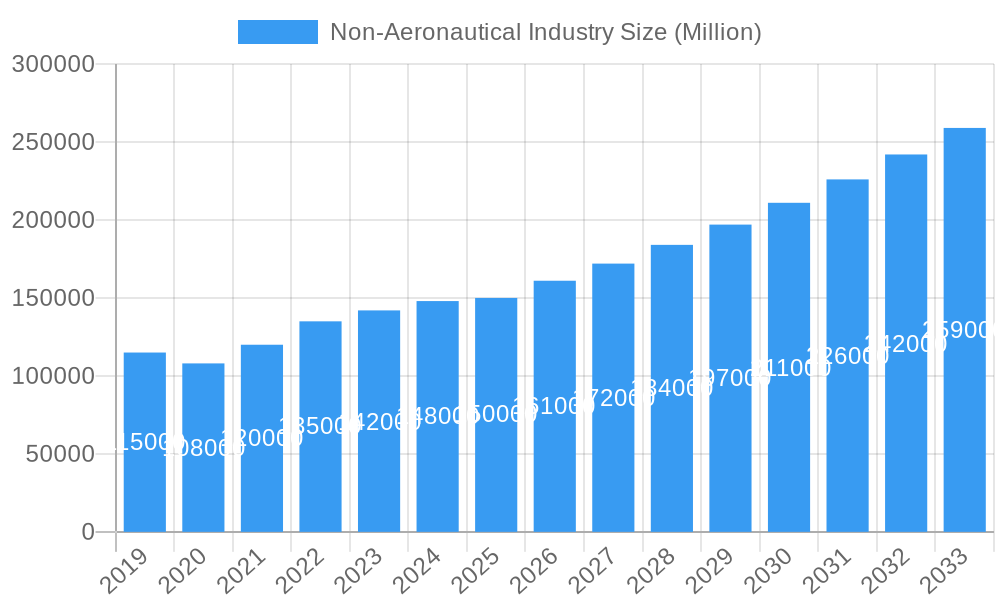

The Non-Aeronautical Industry is projected for significant growth, expected to reach a market size of 9.17 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 14.75% from 2025 to 2033. This expansion is fueled by rising passenger expectations, enhanced airport experiences, and airport operators diversifying revenue streams. Key drivers include global airport infrastructure development, increased reliance on retail, F&B, and parking services, and technology adoption for operational efficiency. Growing air travel and tourism recovery further boost demand for non-aeronautical services, including Food Services, Car Rentals, Baggage Handling Systems, and Other Services.

Non-Aeronautical Industry Market Size (In Billion)

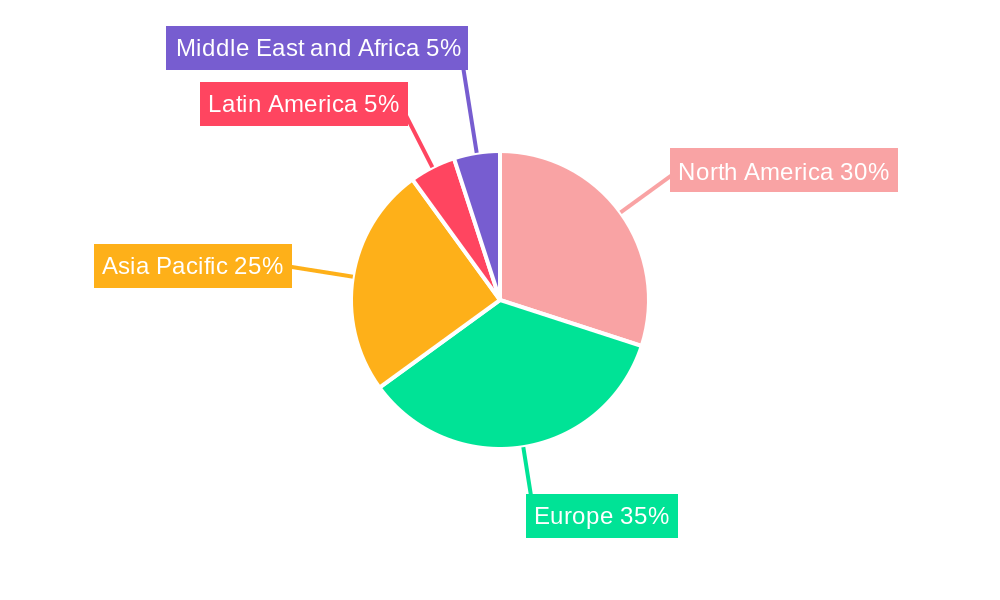

The non-aeronautical services market presents both opportunities and challenges. While passenger traffic growth and the pursuit of superior passenger experiences drive expansion, high capital expenditure for infrastructure, stringent regulations, and economic uncertainties can act as restraints. Leading companies like Airports de Paris SA, GROUPE ADP, AENA SME SA, and London Heathrow Airports Limited are investing in innovation. Asia Pacific, particularly China and India, is a key growth region due to urbanization and airport projects. North America and Europe remain dominant, while the Middle East and Africa offer considerable potential driven by aviation hub investments.

Non-Aeronautical Industry Company Market Share

This report provides an in-depth analysis of the global Non-Aeronautical Industry, a vital sector for airport revenue. Covering 2019 to 2033 with a 2025 base year, it details market dynamics, growth trends, regional performance, product landscape, drivers, opportunities, and competitive strategies. Designed for industry professionals and investors, it uses high-traffic keywords and a parent-child market structure for maximum visibility and actionable insights. All values are presented in Million units.

Non-Aeronautical Industry Market Dynamics & Structure

The non-aeronautical industry within airports is characterized by a moderately concentrated market, with significant players like GROUPE ADP, AENA SME SA, and Fraport Group holding substantial influence. Technological innovation is a key driver, with advancements in digital retail, personalized passenger experiences, and efficient baggage handling systems shaping market evolution. Regulatory frameworks, particularly concerning passenger data privacy and airport security, influence operational strategies. Competitive product substitutes are increasingly prevalent, ranging from online retail and ride-sharing services to alternative entertainment options. End-user demographics are diverse, encompassing leisure travelers, business professionals, and a growing segment of "digital nomads" with specific spending habits. Mergers and acquisition (M&A) trends are on the rise, indicating consolidation and strategic expansion efforts by major airport operators and service providers.

- Market Concentration: Moderate, with a few key global players dominating.

- Technological Innovation Drivers: Digital retail platforms, AI-powered passenger services, IoT in infrastructure management, advanced baggage tracking.

- Regulatory Frameworks: Evolving data privacy laws (GDPR), security compliance standards, environmental regulations.

- Competitive Product Substitutes: Online travel agencies, e-commerce platforms, alternative transport providers, airport lounges as integrated services.

- End-User Demographics: Millennial and Gen Z travelers prioritizing experiential spending, business travelers seeking efficiency and convenience, families with specific needs.

- M&A Trends: Strategic acquisitions to expand service portfolios, increase geographical reach, and integrate technological capabilities. For instance, a projected XX M&A deals in the forecast period focusing on technology integration and service diversification.

Non-Aeronautical Industry Growth Trends & Insights

The global Non-Aeronautical Industry is poised for robust growth, driven by evolving passenger expectations and airports' strategic imperative to diversify revenue streams beyond traditional landing fees and air traffic control. The market size is projected to expand significantly, with a compound annual growth rate (CAGR) of XX% from 2025 to 2033. This growth is fueled by increasing passenger traffic, which acts as a direct driver for retail, food, and other service consumption. Adoption rates for new technologies, such as contactless payment systems, AI-driven personalized recommendations, and advanced loyalty programs, are accelerating as airports strive to enhance the passenger journey.

Technological disruptions are fundamentally reshaping the industry. The rise of e-commerce and the "phygital" retail experience, blending online and offline shopping, is creating new opportunities for airports to offer curated product selections and seamless purchasing options. Advanced data analytics are enabling airports to understand passenger behavior more deeply, leading to personalized offerings in food services, retail, and other amenities. Shifts in consumer behavior, such as a growing preference for sustainable and ethically sourced products, are also influencing product development and service delivery. The demand for unique experiences, including premium lounges, curated dining, and entertainment options, is increasing, particularly among millennial and Gen Z travelers who prioritize experiential spending. This evolving consumer landscape necessitates continuous innovation in service offerings and operational efficiency.

Furthermore, the increasing sophistication of baggage handling systems, driven by the need for faster, more secure, and trackable luggage, represents a significant growth segment. As airlines and airports invest in automation and AI for baggage management, the market for these integrated systems is set to surge. Car rental services continue to be a staple, with growth influenced by evolving mobility solutions and integrated booking platforms. The broader "Other Services" category, encompassing everything from airport hotels and spas to financial services and business facilities, is also expanding as airports transform into multifaceted urban hubs. The base year of 2025 sees the market valued at approximately $XXX billion, with projections indicating a substantial increase to over $XXX billion by 2033, reflecting the dynamic and expanding nature of the non-aeronautical airport ecosystem.

Dominant Regions, Countries, or Segments in Non-Aeronautical Industry

The Non-Aeronautical Industry is experiencing dynamic growth across various regions and segments, with North America and Europe currently leading in terms of market size and sophistication, driven by mature aviation infrastructure and high disposable incomes. However, the Asia-Pacific region, particularly China and Southeast Asian nations, is emerging as a significant growth engine due to rapid urbanization, increasing air travel, and substantial investments in airport modernization. The Food Services segment consistently drives a significant portion of non-aeronautical revenue. This dominance is attributed to the universal nature of food consumption and the vast number of passengers passing through airports daily. Airports are transforming their food offerings, moving beyond basic concessions to include gourmet restaurants, celebrity chef partnerships, and diverse ethnic cuisines, catering to a global palate. Market share for food services is estimated to be around XX% of the total non-aeronautical revenue.

Key drivers for the dominance of food services include:

- High Passenger Volume: Airports serve millions of travelers, creating a captive audience for F&B outlets.

- Passenger Dwell Time: Extended layovers and pre-flight waiting periods encourage food and beverage purchases.

- Brand Partnerships: Collaboration with renowned food brands and restaurateurs enhances appeal and revenue.

- Demand for Variety: A growing desire for diverse culinary experiences, from fast casual to fine dining.

While Food Services hold a strong position, Other Services is a rapidly expanding segment, encompassing a wide array of offerings that are crucial for modern airport operations and passenger satisfaction. This segment includes premium lounge access, duty-free retail (though often categorized separately, its experiential component aligns here), Wi-Fi services, currency exchange, and increasingly, airport hotels and business centers. The growth in this segment is fueled by the airport's evolving role as a destination in itself, offering a comprehensive suite of services that enhance the travel experience.

Key drivers for the growth of "Other Services" include:

- Passenger Comfort & Convenience: Premium lounges and on-site amenities cater to the need for relaxation and productivity.

- Ancillary Revenue Generation: Diversified services offer multiple touchpoints for revenue capture.

- Technological Integration: Smart airport solutions and digital concierge services are becoming integral.

- Experiential Travel: Passengers seek unique and valuable experiences beyond basic travel needs.

Baggage Handling Systems are another critical segment, experiencing significant technological advancements and investment. The demand for efficient, secure, and automated baggage processing is paramount for airlines and airport operators. Innovations in RFID technology, AI-powered sorting, and real-time tracking systems are driving growth. The market share for Baggage Handling Systems, while capital-intensive, is steadily increasing due to the critical operational necessity and the ongoing upgrades to infrastructure.

Key drivers for Baggage Handling Systems:

- Operational Efficiency: Reducing baggage mishandling and improving turnaround times.

- Security Enhancements: Advanced screening and tracking capabilities.

- Technological Upgrades: Investment in automation and AI for optimized performance.

- Airport Expansion Projects: Integration of new systems in new terminals and facilities.

Car Rentals remain a stable, though perhaps slower-growing, segment. Its dominance is directly tied to the volume of leisure and business travelers requiring ground transportation. Growth is influenced by partnerships with ride-sharing services and integrated booking platforms.

Key drivers for Car Rentals:

- Leisure and Business Travel Demand: Direct correlation with passenger numbers.

- Integrated Booking Systems: Seamless booking experience alongside flight and accommodation.

- Fleet Modernization: Introduction of electric and hybrid vehicles to meet sustainability demands.

Overall, while Food Services remain a foundational pillar, the "Other Services" category is demonstrating the most significant growth potential, reflecting the broader trend of airports transforming into comprehensive travel and lifestyle hubs. Regions like the UAE, with its ambitious airport development projects, and burgeoning economies in Southeast Asia are showing particularly high growth rates, reshaping the global dominance landscape.

Non-Aeronautical Industry Product Landscape

The non-aeronautical airport product landscape is characterized by a growing emphasis on digital integration and personalized passenger experiences. Innovations in baggage handling systems now feature AI-driven sorting and real-time tracking, offering unparalleled efficiency and security. Retail offerings are evolving from traditional duty-free to curated brand boutiques and experiential pop-up shops, enhanced by augmented reality try-on features and seamless mobile payment integration. Food services are witnessing a rise in smart ordering kiosks, personalized dietary recommendations through app integration, and a focus on locally sourced and sustainable ingredients. Car rental services are increasingly offering connected car features and mobile-based keyless entry, streamlining the pick-up and drop-off process.

- Unique Selling Propositions: Enhanced convenience, personalized offers, seamless integration of services, and experiential value.

- Technological Advancements: AI in baggage tracking, AR/VR in retail, IoT for operational efficiency, contactless payment solutions, predictive analytics for demand forecasting.

Key Drivers, Barriers & Challenges in Non-Aeronautical Industry

The non-aeronautical industry is propelled by several key drivers, primarily the ever-increasing global passenger traffic, which directly translates to a larger customer base for retail, food, and other services. Airports are actively seeking to diversify revenue streams to mitigate risks associated with airline industry volatility, making non-aeronautical income crucial. Technological advancements in digital platforms, AI, and data analytics are enabling personalized passenger experiences and more efficient operations. Furthermore, the transformation of airports into comprehensive lifestyle hubs, offering entertainment and business facilities, attracts and retains passengers.

- Key Drivers: Rising passenger traffic, revenue diversification strategies, technological innovation (AI, IoT, data analytics), airport as a destination.

However, the industry faces significant barriers and challenges. Intense competition from off-airport retail and service providers necessitates continuous innovation and value proposition enhancement. Regulatory hurdles, including stringent security protocols, data privacy concerns, and evolving environmental standards, can impact operational flexibility and investment. Supply chain disruptions, particularly for perishable goods in food services or specialized components for baggage systems, can lead to operational inefficiencies and increased costs. The significant capital investment required for infrastructure upgrades and technology adoption presents another substantial challenge for airport operators and service providers.

- Key Barriers & Challenges: Intense competition, stringent regulatory compliance, supply chain volatility, high capital investment, evolving passenger expectations.

Emerging Opportunities in Non-Aeronautical Industry

Emerging opportunities in the Non-Aeronautical Industry lie in the expansion of digital ecosystems and the creation of hyper-personalized passenger journeys. The integration of airport apps with loyalty programs, retail platforms, and transportation services offers a unified, seamless experience that can drive significant ancillary revenue. Untapped markets include the development of niche retail concepts catering to specific traveler demographics and the growing demand for wellness and bio-hacking services within airports. Innovative applications of AI for predictive analytics in retail and F&B can optimize inventory management and personalize promotions, while the increasing focus on sustainability presents opportunities for eco-friendly retail concepts and energy-efficient operational solutions.

Growth Accelerators in the Non-Aeronautical Industry Industry

Growth accelerators for the Non-Aeronautical Industry include the continued global rebound in air travel, which directly fuels passenger volume for all airport services. Strategic partnerships between airports, airlines, and third-party service providers are crucial for creating integrated travel experiences and unlocking new revenue streams. Technological breakthroughs in data analytics and AI are enabling airports to gain deeper insights into passenger behavior, leading to more effective targeted marketing and service delivery. Furthermore, significant investments in airport infrastructure and the development of new terminals and hubs create substantial opportunities for the deployment of new non-aeronautical services and technologies.

Key Players Shaping the Non-Aeronautical Industry Market

- Airports de Paris SA

- GROUPE ADP

- AENA SME SA

- London Heathrow Airports Limited

- Vinci SA

- Fraport Group

- Korea Airports Cor

- Airports of Thailand Plc

- Airport Authority Hong Kong

- Japan Airport Terminal Co Ltd

Notable Milestones in Non-Aeronautical Industry Sector

- 2019: Launch of integrated retail and F&B apps by major airports, enhancing personalized offers.

- 2020: Increased adoption of contactless payment systems across retail and F&B outlets due to global health concerns.

- 2021: Significant investment in AI-powered baggage tracking systems by Fraport Group for improved efficiency.

- 2022: Vinci Airports expands its portfolio with the acquisition of several regional airports, focusing on non-aeronautical revenue enhancement.

- 2023: AENA SME SA announces ambitious plans for sustainable retail and dining concepts in its key European hubs.

- 2024: GROUPE ADP invests in smart airport technologies to optimize passenger flow and personalize services.

In-Depth Non-Aeronautical Industry Market Outlook

The future of the Non-Aeronautical Industry is exceptionally promising, driven by the ongoing recovery and anticipated growth in global air travel. The strategic imperative for airports to maximize non-aeronautical revenue remains paramount, fostering continuous innovation and investment. Key growth accelerators include the widespread adoption of advanced digital technologies such as AI for personalized passenger engagement and predictive analytics for demand forecasting. Furthermore, the increasing focus on creating holistic, experiential airport environments—transforming them into vibrant hubs of commerce, dining, and entertainment—will significantly expand the market's potential. Strategic partnerships and the ongoing evolution of airport infrastructure will further bolster growth, creating a dynamic and lucrative landscape for stakeholders in the coming years.

Non-Aeronautical Industry Segmentation

-

1. Services

- 1.1. Food Services

- 1.2. Car Rentals

- 1.3. Baggage Handling Systems

- 1.4. Other Services

Non-Aeronautical Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Non-Aeronautical Industry Regional Market Share

Geographic Coverage of Non-Aeronautical Industry

Non-Aeronautical Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Ground Handling Systems Will Showcase Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Non-Aeronautical Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Food Services

- 5.1.2. Car Rentals

- 5.1.3. Baggage Handling Systems

- 5.1.4. Other Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. North America Non-Aeronautical Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Services

- 6.1.1. Food Services

- 6.1.2. Car Rentals

- 6.1.3. Baggage Handling Systems

- 6.1.4. Other Services

- 6.1. Market Analysis, Insights and Forecast - by Services

- 7. Europe Non-Aeronautical Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Services

- 7.1.1. Food Services

- 7.1.2. Car Rentals

- 7.1.3. Baggage Handling Systems

- 7.1.4. Other Services

- 7.1. Market Analysis, Insights and Forecast - by Services

- 8. Asia Pacific Non-Aeronautical Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Services

- 8.1.1. Food Services

- 8.1.2. Car Rentals

- 8.1.3. Baggage Handling Systems

- 8.1.4. Other Services

- 8.1. Market Analysis, Insights and Forecast - by Services

- 9. Latin America Non-Aeronautical Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Services

- 9.1.1. Food Services

- 9.1.2. Car Rentals

- 9.1.3. Baggage Handling Systems

- 9.1.4. Other Services

- 9.1. Market Analysis, Insights and Forecast - by Services

- 10. Middle East and Africa Non-Aeronautical Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Services

- 10.1.1. Food Services

- 10.1.2. Car Rentals

- 10.1.3. Baggage Handling Systems

- 10.1.4. Other Services

- 10.1. Market Analysis, Insights and Forecast - by Services

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Airports de Paris SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 GROUPE ADP

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AENA SME SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 London Heathrow Airports Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Vinci SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fraport Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Korea Airports Cor

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Airports of Thailand Plc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Airport Authority Hong Kong

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Japan Airport Terminal Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Airports de Paris SA

List of Figures

- Figure 1: Global Non-Aeronautical Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Non-Aeronautical Industry Revenue (billion), by Services 2025 & 2033

- Figure 3: North America Non-Aeronautical Industry Revenue Share (%), by Services 2025 & 2033

- Figure 4: North America Non-Aeronautical Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Non-Aeronautical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Non-Aeronautical Industry Revenue (billion), by Services 2025 & 2033

- Figure 7: Europe Non-Aeronautical Industry Revenue Share (%), by Services 2025 & 2033

- Figure 8: Europe Non-Aeronautical Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Non-Aeronautical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Non-Aeronautical Industry Revenue (billion), by Services 2025 & 2033

- Figure 11: Asia Pacific Non-Aeronautical Industry Revenue Share (%), by Services 2025 & 2033

- Figure 12: Asia Pacific Non-Aeronautical Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Non-Aeronautical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Non-Aeronautical Industry Revenue (billion), by Services 2025 & 2033

- Figure 15: Latin America Non-Aeronautical Industry Revenue Share (%), by Services 2025 & 2033

- Figure 16: Latin America Non-Aeronautical Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Latin America Non-Aeronautical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Non-Aeronautical Industry Revenue (billion), by Services 2025 & 2033

- Figure 19: Middle East and Africa Non-Aeronautical Industry Revenue Share (%), by Services 2025 & 2033

- Figure 20: Middle East and Africa Non-Aeronautical Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa Non-Aeronautical Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Non-Aeronautical Industry Revenue billion Forecast, by Services 2020 & 2033

- Table 2: Global Non-Aeronautical Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Non-Aeronautical Industry Revenue billion Forecast, by Services 2020 & 2033

- Table 4: Global Non-Aeronautical Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Global Non-Aeronautical Industry Revenue billion Forecast, by Services 2020 & 2033

- Table 8: Global Non-Aeronautical Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Germany Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Russia Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global Non-Aeronautical Industry Revenue billion Forecast, by Services 2020 & 2033

- Table 15: Global Non-Aeronautical Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: India Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: China Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Japan Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Rest of Asia Pacific Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Global Non-Aeronautical Industry Revenue billion Forecast, by Services 2020 & 2033

- Table 21: Global Non-Aeronautical Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Brazil Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Latin America Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Non-Aeronautical Industry Revenue billion Forecast, by Services 2020 & 2033

- Table 25: Global Non-Aeronautical Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: United Arab Emirates Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Saudi Arabia Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: South Africa Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of Middle East and Africa Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Non-Aeronautical Industry?

The projected CAGR is approximately 14.75%.

2. Which companies are prominent players in the Non-Aeronautical Industry?

Key companies in the market include Airports de Paris SA, GROUPE ADP, AENA SME SA, London Heathrow Airports Limited, Vinci SA, Fraport Group, Korea Airports Cor, Airports of Thailand Plc, Airport Authority Hong Kong, Japan Airport Terminal Co Ltd.

3. What are the main segments of the Non-Aeronautical Industry?

The market segments include Services.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.17 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Ground Handling Systems Will Showcase Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Non-Aeronautical Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Non-Aeronautical Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Non-Aeronautical Industry?

To stay informed about further developments, trends, and reports in the Non-Aeronautical Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence