Key Insights

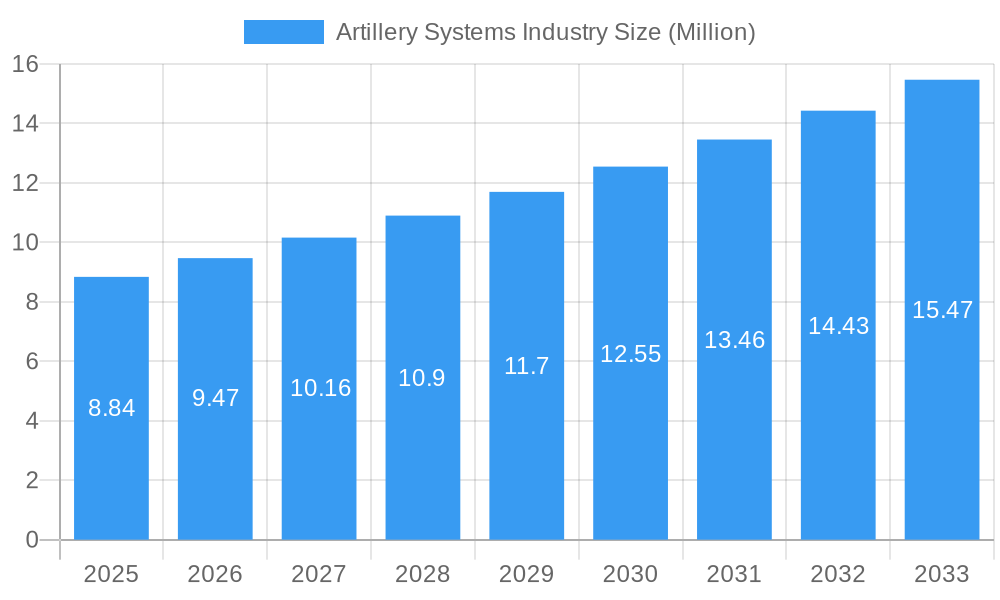

The global Artillery Systems market is poised for robust growth, projected to reach \$8.84 million in value by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 7.24% extending through 2033. This expansion is primarily fueled by escalating geopolitical tensions and the consequent increase in defense spending by nations worldwide. Key drivers include the modernization of existing artillery fleets, the development of advanced artillery technologies such as smart munitions and longer-range systems, and the persistent need to counter evolving battlefield threats. The market is witnessing a significant trend towards enhanced precision-guided munitions, improved mobility and deployability of systems, and the integration of digital command and control capabilities. Furthermore, the growing emphasis on artillery systems capable of operating in diverse environments and their crucial role in both offensive and defensive operations are contributing to market dynamism.

Artillery Systems Industry Market Size (In Million)

While the outlook is overwhelmingly positive, certain restraints could temper growth. These include stringent regulatory frameworks surrounding arms sales, the high cost associated with research, development, and manufacturing of sophisticated artillery systems, and potential budgetary constraints in some defense sectors. Nevertheless, the industry is expected to see innovation surge as companies focus on lightweight, modular designs, advanced sensor integration, and counter-battery capabilities. The market segmentation reveals a diverse landscape, with Howitzers and Rocket Artillery likely to dominate demand due to their widespread application. The strategic importance of artillery in modern warfare, coupled with continuous technological advancements, ensures sustained interest and investment, positioning the Artillery Systems market for a significant upward trajectory over the forecast period.

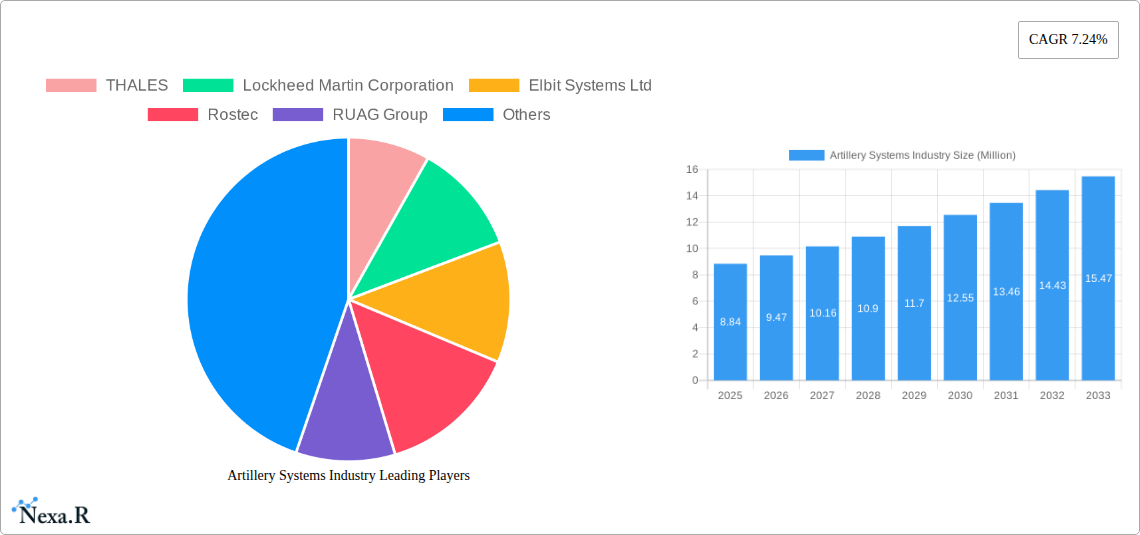

Artillery Systems Industry Company Market Share

Artillery Systems Industry: Comprehensive Market Analysis & Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the global Artillery Systems Industry, offering unparalleled insights into market dynamics, growth trends, and future projections. Designed for defense procurement specialists, defense manufacturers, government agencies, and strategic investors, this report equips you with the critical data and expert analysis needed to navigate this complex and evolving market. Spanning the historical period of 2019-2024 and projecting through 2033, with a base year of 2025, this report details market size in Million units, crucial competitive intelligence, and regional dominance factors. Discover the impact of cutting-edge technologies, evolving geopolitical landscapes, and the strategic maneuvers of key players like THALES, Lockheed Martin Corporation, Elbit Systems Ltd., Rostec, RUAG Group, Denel SOC Ltd, Nexter Group, Leonardo S p A, Norinco International Cooperation Ltd, Hanwha Group, Avibras Indústria Aeroespacial SA, Singapore Technologies Engineering Ltd, Rheinmetall A, and BAE Systems plc.

Artillery Systems Industry Market Dynamics & Structure

The Artillery Systems Industry is characterized by a moderately concentrated market, with a few dominant players holding significant shares, particularly in advanced defense solutions. Technological innovation is a primary driver, fueled by relentless demand for enhanced precision, extended range, and improved survivability. Key innovations focus on smart munitions, networked artillery systems, and counter-battery radar integration. Regulatory frameworks, primarily driven by national defense policies, export controls, and international arms treaties, significantly shape market access and product development. Competitive product substitutes are limited within the direct artillery domain, but indirect threats from emerging aerial and missile defense technologies are increasing. End-user demographics are predominantly government defense ministries and armed forces worldwide, with a growing emphasis on modernizing existing arsenals and acquiring advanced capabilities. Mergers and acquisitions (M&A) trends are notable, with larger entities acquiring smaller, specialized firms to broaden their technological portfolios and market reach.

- Market Concentration: Dominated by a few key global players, with emerging regional manufacturers gaining traction.

- Technological Innovation Drivers: Need for precision, range, networked warfare capabilities, and reduced collateral damage.

- Regulatory Frameworks: Stringent export controls, national procurement policies, and international arms trade agreements.

- Competitive Product Substitutes: Limited direct substitutes, but increasing pressure from advanced aerial and missile defense systems.

- End-User Demographics: Primarily national defense ministries and armed forces globally.

- M&A Trends: Strategic acquisitions to gain technological expertise and expand market share.

Artillery Systems Industry Growth Trends & Insights

The global Artillery Systems Industry is poised for robust growth over the forecast period (2025-2033), driven by escalating geopolitical tensions, ongoing military modernization programs across various nations, and the increasing adoption of advanced, smart artillery solutions. The market size is projected to expand from an estimated 450 Million units in 2025 to over 600 Million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 3.5%. This growth is further fueled by the continuous evolution of artillery technology, moving towards highly accurate, long-range systems capable of precise targeting, thereby reducing logistical footprints and minimizing collateral damage. The adoption rates of these advanced systems are accelerating as nations prioritize force projection and territorial defense capabilities. Technological disruptions, such as the integration of artificial intelligence (AI) for targeting and battlefield management, the development of directed energy weapons as potential future artillery replacements, and the proliferation of unmanned artillery systems, are reshaping the industry landscape. Consumer behavior shifts, or rather, end-user demand patterns, are increasingly focused on platform modularity, interoperability with existing command and control systems, and cost-effectiveness in terms of lifecycle support and ammunition expenditure. The industry is witnessing a strong demand for both legacy system upgrades and the procurement of entirely new, next-generation artillery platforms.

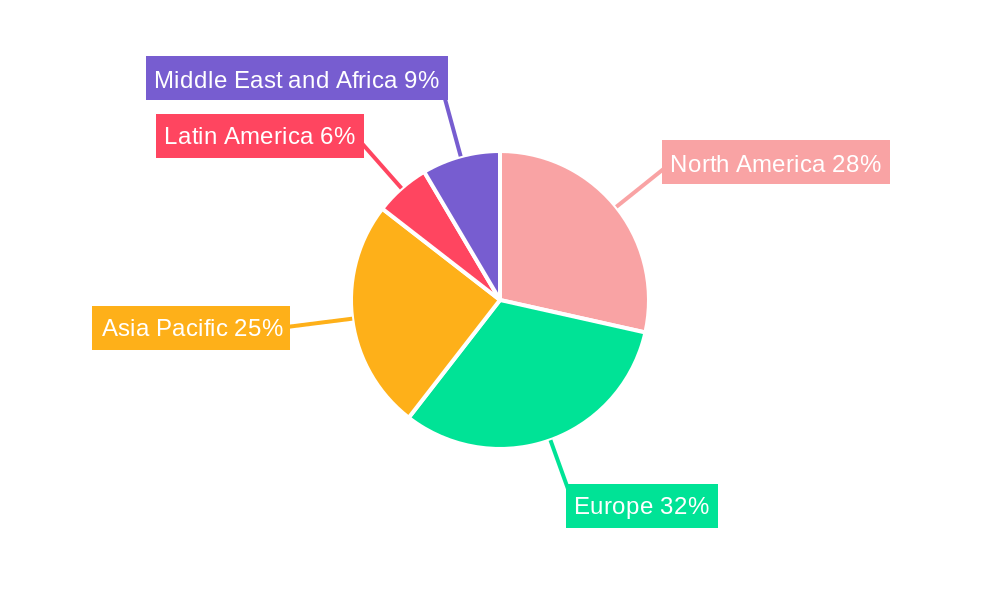

Dominant Regions, Countries, or Segments in Artillery Systems Industry

The Rocket Artillery segment is identified as the most dominant driver of market growth within the Artillery Systems Industry. This dominance is attributed to its unparalleled versatility in delivering high-volume firepower at various ranges, its crucial role in modern maneuver warfare, and the significant advancements in guided rocket technology. The Long Range (Above 60 kilometers) capability within rocket artillery, in particular, is experiencing a surge in demand due to evolving strategic doctrines emphasizing standoff capabilities and the need to neutralize distant threats with precision.

Several regions and countries are significantly contributing to this dominance. North America, led by the United States, is a major consumer and innovator, consistently investing in advanced rocket artillery systems and precision-guided munitions. The ongoing modernization of military forces and the demand for rapid deployment capabilities in diverse operational environments underscore this region's influence.

Furthermore, Europe, particularly countries with active defense industrial bases like Germany, France, and the United Kingdom, is witnessing substantial investment in upgrading their rocket artillery capabilities. Initiatives such as the development of HIMARS-like systems and advanced missile programs reflect a strategic shift towards precision strike capabilities. The presence of key players like BAE Systems plc and THALES in these regions further bolsters the market.

The Asia-Pacific region, driven by nations like China and South Korea, is another significant growth engine. Rapid economic development, coupled with increasing regional security concerns, has led to substantial procurement and indigenous development of sophisticated rocket artillery systems. Countries are prioritizing firepower capabilities to enhance their defense posture.

- Dominant Segment: Rocket Artillery, particularly systems with Long Range (Above 60 kilometers) capabilities.

- Key Drivers: Strategic importance in modern warfare, advancements in guided munitions, and demand for standoff capabilities.

- Market Share Influence: Rocket artillery systems consistently command a significant portion of global defense budgets allocated to artillery procurement.

- Dominant Regions:

- North America (USA): Leading in R&D, procurement of advanced systems, and integration of smart technologies.

- Key Drivers: Military modernization, global force projection needs, and technological innovation.

- Europe: Significant investments in upgrading and developing new rocket artillery platforms, driven by regional security dynamics and a strong defense industrial base.

- Key Drivers: Geopolitical instability, interoperability initiatives, and technological advancement.

- Asia-Pacific (China, South Korea): Rapid procurement and indigenous development fueled by economic growth and regional security concerns.

- Key Drivers: Economic development, regional power balancing, and modernization of armed forces.

- North America (USA): Leading in R&D, procurement of advanced systems, and integration of smart technologies.

- Country-Specific Factors: National defense strategies, technological partnerships, and export market access play crucial roles in influencing country-level demand and innovation.

Artillery Systems Industry Product Landscape

The Artillery Systems Industry product landscape is characterized by a dynamic evolution towards greater precision, lethality, and integration with networked battlefield management systems. Key product innovations include the widespread adoption of guided munitions for howitzers and rocket artillery, offering enhanced accuracy and extended range, significantly reducing collateral damage and increasing first-hit probabilities. Self-propelled howitzers, such as the Archer Artillery System and M109 Paladin, continue to be modernized, emphasizing speed of deployment, crew survivability, and digital fire control systems. Mortars are evolving with automated loading systems and smart targeting capabilities, making them more deployable and effective. Anti-air artillery is increasingly integrated with advanced radar and missile systems for enhanced threat detection and engagement. Naval and coastal artillery systems are also seeing upgrades with improved fire control and longer-range capabilities. The unique selling propositions of modern artillery systems lie in their modular design, interoperability, and the ability to deliver precision effects at reduced operational costs.

Key Drivers, Barriers & Challenges in Artillery Systems Industry

Key Drivers:

- Geopolitical Instability and Regional Conflicts: Escalating tensions and ongoing conflicts worldwide necessitate increased defense spending and modernization of artillery arsenals for deterrence and operational effectiveness.

- Technological Advancements: The development of precision-guided munitions, networked artillery, and autonomous systems are creating new demand for advanced artillery solutions.

- Military Modernization Programs: Many nations are undertaking comprehensive upgrades of their defense capabilities, with artillery systems being a critical component of land warfare.

- Demand for Standoff Capabilities: The increasing threat landscape drives the need for artillery systems capable of engaging targets from extended ranges, such as long-range rocket artillery.

Barriers & Challenges:

- High Procurement Costs: Advanced artillery systems are capital-intensive, posing a significant financial burden for many countries and limiting broader market adoption.

- Supply Chain Disruptions: Global events and geopolitical factors can lead to vulnerabilities in the supply chain for critical components, impacting production timelines and costs.

- Regulatory Hurdles and Export Controls: Stringent export regulations and international arms control treaties can restrict market access and complicate international sales.

- Training and Maintenance Complexity: Modern artillery systems require specialized training for operators and maintenance personnel, adding to the overall lifecycle cost and logistical challenges.

- Emerging Counter-Technologies: Advancements in electronic warfare, counter-battery radar, and drone technology pose a challenge to traditional artillery dominance, requiring continuous innovation.

Emerging Opportunities in Artillery Systems Industry

Emerging opportunities in the Artillery Systems Industry lie in the development and integration of highly autonomous artillery platforms, leveraging AI for rapid targeting and fire adjustment. The proliferation of smart munitions with enhanced terminal guidance capabilities, including those guided by GPS, laser, or radar, presents a significant growth avenue. Furthermore, the increasing demand for modular and scalable artillery solutions that can be rapidly deployed and integrated into existing command and control networks offers lucrative prospects. Untapped markets in developing nations undergoing defense modernization and the potential for urban warfare-optimized artillery systems also represent significant opportunities. The integration of artillery systems with unmanned aerial vehicles (UAVs) for enhanced reconnaissance and targeting further expands the operational envelope and market potential.

Growth Accelerators in the Artillery Systems Industry Industry

Growth accelerators in the Artillery Systems Industry are predominantly driven by continuous technological breakthroughs, particularly in areas like artificial intelligence, advanced materials, and precision-guided munition technology. Strategic partnerships between defense contractors and technology firms are crucial for developing next-generation systems and fostering innovation. Furthermore, market expansion strategies, including focusing on emerging economies with significant defense modernization needs and leveraging existing geopolitical alliances for collaborative development and procurement, are critical growth catalysts. The increasing emphasis on network-centric warfare, where artillery systems are seamlessly integrated with other battlefield assets, also acts as a significant accelerator, driving demand for advanced, connected artillery solutions.

Key Players Shaping the Artillery Systems Industry Market

- THALES

- Lockheed Martin Corporation

- Elbit Systems Ltd.

- Rostec

- RUAG Group

- Denel SOC Ltd

- Nexter Group

- Leonardo S p A

- Norinco International Cooperation Ltd

- Hanwha Group

- Avibras Indústria Aeroespacial SA

- Singapore Technologies Engineering Ltd

- Rheinmetall A

- BAE Systems plc

Notable Milestones in Artillery Systems Industry Sector

- July 2023: Elbit Systems Ltd. was awarded a USD 150 million contract to supply PULS™ (Precise and Universal Launching Systems) rocket launchers and a package of precision-guided long-range rockets, signaling a significant advancement in precision strike capabilities.

- July 2023: The UK Ministry of Defence awarded a USD 4.5 million contract to BAE Systems Bofors AB for the support of the Archer Artillery System, covering critical areas such as equipment, training, maintenance, and repair, underscoring the ongoing commitment to modernizing and sustaining advanced artillery platforms.

In-Depth Artillery Systems Industry Market Outlook

The future market potential for the Artillery Systems Industry remains exceptionally strong, propelled by persistent geopolitical uncertainties and the ongoing global drive for military modernization. Strategic opportunities are abundant in the development of highly autonomous and network-enabled artillery, capable of integrating seamlessly with AI-driven battlefield management systems. The increasing demand for modular, scalable, and interoperable artillery solutions, particularly those offering enhanced precision strike capabilities with extended range, will continue to shape market trends. Emerging markets undergoing significant defense transformation, coupled with the continuous innovation in smart munitions and counter-battery technologies, present further avenues for growth and strategic investment. The industry is on the cusp of a new era, defined by enhanced lethality, superior accuracy, and integrated battlefield awareness, ensuring its continued relevance and expansion.

Artillery Systems Industry Segmentation

-

1. Type

- 1.1. Howitzer

- 1.2. Mortar

- 1.3. Anti-air Artillery

- 1.4. Rocket Artillery

- 1.5. Other Types (Naval and Coastal Artillery)

-

2. Range

- 2.1. Short Range (5-30 kilometers)

- 2.2. Medium Range (31-60 kilometers)

- 2.3. Long Range (Above 60 kilometers)

Artillery Systems Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Australia

- 3.6. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Israel

- 5.4. South Africa

- 5.5. Rest of Middle East and Africa

Artillery Systems Industry Regional Market Share

Geographic Coverage of Artillery Systems Industry

Artillery Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Defense Expenditure Supporting the Growth of the Artillery Systems Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Artillery Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Howitzer

- 5.1.2. Mortar

- 5.1.3. Anti-air Artillery

- 5.1.4. Rocket Artillery

- 5.1.5. Other Types (Naval and Coastal Artillery)

- 5.2. Market Analysis, Insights and Forecast - by Range

- 5.2.1. Short Range (5-30 kilometers)

- 5.2.2. Medium Range (31-60 kilometers)

- 5.2.3. Long Range (Above 60 kilometers)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Artillery Systems Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Howitzer

- 6.1.2. Mortar

- 6.1.3. Anti-air Artillery

- 6.1.4. Rocket Artillery

- 6.1.5. Other Types (Naval and Coastal Artillery)

- 6.2. Market Analysis, Insights and Forecast - by Range

- 6.2.1. Short Range (5-30 kilometers)

- 6.2.2. Medium Range (31-60 kilometers)

- 6.2.3. Long Range (Above 60 kilometers)

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Artillery Systems Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Howitzer

- 7.1.2. Mortar

- 7.1.3. Anti-air Artillery

- 7.1.4. Rocket Artillery

- 7.1.5. Other Types (Naval and Coastal Artillery)

- 7.2. Market Analysis, Insights and Forecast - by Range

- 7.2.1. Short Range (5-30 kilometers)

- 7.2.2. Medium Range (31-60 kilometers)

- 7.2.3. Long Range (Above 60 kilometers)

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Artillery Systems Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Howitzer

- 8.1.2. Mortar

- 8.1.3. Anti-air Artillery

- 8.1.4. Rocket Artillery

- 8.1.5. Other Types (Naval and Coastal Artillery)

- 8.2. Market Analysis, Insights and Forecast - by Range

- 8.2.1. Short Range (5-30 kilometers)

- 8.2.2. Medium Range (31-60 kilometers)

- 8.2.3. Long Range (Above 60 kilometers)

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Artillery Systems Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Howitzer

- 9.1.2. Mortar

- 9.1.3. Anti-air Artillery

- 9.1.4. Rocket Artillery

- 9.1.5. Other Types (Naval and Coastal Artillery)

- 9.2. Market Analysis, Insights and Forecast - by Range

- 9.2.1. Short Range (5-30 kilometers)

- 9.2.2. Medium Range (31-60 kilometers)

- 9.2.3. Long Range (Above 60 kilometers)

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Artillery Systems Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Howitzer

- 10.1.2. Mortar

- 10.1.3. Anti-air Artillery

- 10.1.4. Rocket Artillery

- 10.1.5. Other Types (Naval and Coastal Artillery)

- 10.2. Market Analysis, Insights and Forecast - by Range

- 10.2.1. Short Range (5-30 kilometers)

- 10.2.2. Medium Range (31-60 kilometers)

- 10.2.3. Long Range (Above 60 kilometers)

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 THALES

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lockheed Martin Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Elbit Systems Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Rostec

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 RUAG Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Denel SOC Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nexter Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Leonardo S p A

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Norinco International Cooperation Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hanwha Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Avibras Indústria Aeroespacial SA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Singapore Technologies Engineering Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Rheinmetall A

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 BAE Systems plc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 THALES

List of Figures

- Figure 1: Global Artillery Systems Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Artillery Systems Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Artillery Systems Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Artillery Systems Industry Revenue (Million), by Range 2025 & 2033

- Figure 5: North America Artillery Systems Industry Revenue Share (%), by Range 2025 & 2033

- Figure 6: North America Artillery Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Artillery Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Artillery Systems Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Artillery Systems Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Artillery Systems Industry Revenue (Million), by Range 2025 & 2033

- Figure 11: Europe Artillery Systems Industry Revenue Share (%), by Range 2025 & 2033

- Figure 12: Europe Artillery Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Artillery Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Artillery Systems Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Artillery Systems Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Artillery Systems Industry Revenue (Million), by Range 2025 & 2033

- Figure 17: Asia Pacific Artillery Systems Industry Revenue Share (%), by Range 2025 & 2033

- Figure 18: Asia Pacific Artillery Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Artillery Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Artillery Systems Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Latin America Artillery Systems Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Artillery Systems Industry Revenue (Million), by Range 2025 & 2033

- Figure 23: Latin America Artillery Systems Industry Revenue Share (%), by Range 2025 & 2033

- Figure 24: Latin America Artillery Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Artillery Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Artillery Systems Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Artillery Systems Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Artillery Systems Industry Revenue (Million), by Range 2025 & 2033

- Figure 29: Middle East and Africa Artillery Systems Industry Revenue Share (%), by Range 2025 & 2033

- Figure 30: Middle East and Africa Artillery Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Artillery Systems Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Artillery Systems Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Artillery Systems Industry Revenue Million Forecast, by Range 2020 & 2033

- Table 3: Global Artillery Systems Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Artillery Systems Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Artillery Systems Industry Revenue Million Forecast, by Range 2020 & 2033

- Table 6: Global Artillery Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Artillery Systems Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Artillery Systems Industry Revenue Million Forecast, by Range 2020 & 2033

- Table 11: Global Artillery Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Russia Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Spain Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Artillery Systems Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Artillery Systems Industry Revenue Million Forecast, by Range 2020 & 2033

- Table 20: Global Artillery Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: China Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: India Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: South Korea Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Australia Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Artillery Systems Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 28: Global Artillery Systems Industry Revenue Million Forecast, by Range 2020 & 2033

- Table 29: Global Artillery Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Brazil Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Mexico Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Latin America Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Artillery Systems Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 34: Global Artillery Systems Industry Revenue Million Forecast, by Range 2020 & 2033

- Table 35: Global Artillery Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: United Arab Emirates Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Saudi Arabia Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Israel Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: South Africa Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Artillery Systems Industry?

The projected CAGR is approximately 7.24%.

2. Which companies are prominent players in the Artillery Systems Industry?

Key companies in the market include THALES, Lockheed Martin Corporation, Elbit Systems Ltd, Rostec, RUAG Group, Denel SOC Ltd, Nexter Group, Leonardo S p A, Norinco International Cooperation Ltd, Hanwha Group, Avibras Indústria Aeroespacial SA, Singapore Technologies Engineering Ltd, Rheinmetall A, BAE Systems plc.

3. What are the main segments of the Artillery Systems Industry?

The market segments include Type, Range.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.84 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Defense Expenditure Supporting the Growth of the Artillery Systems Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2023: Elbit Systems Ltd. announced it was awarded a USD 150 million contract to supply PULS™ (Precise and Universal Launching Systems) rocket launchers and a package of precision-guided long-range rockets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Artillery Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Artillery Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Artillery Systems Industry?

To stay informed about further developments, trends, and reports in the Artillery Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence