Key Insights

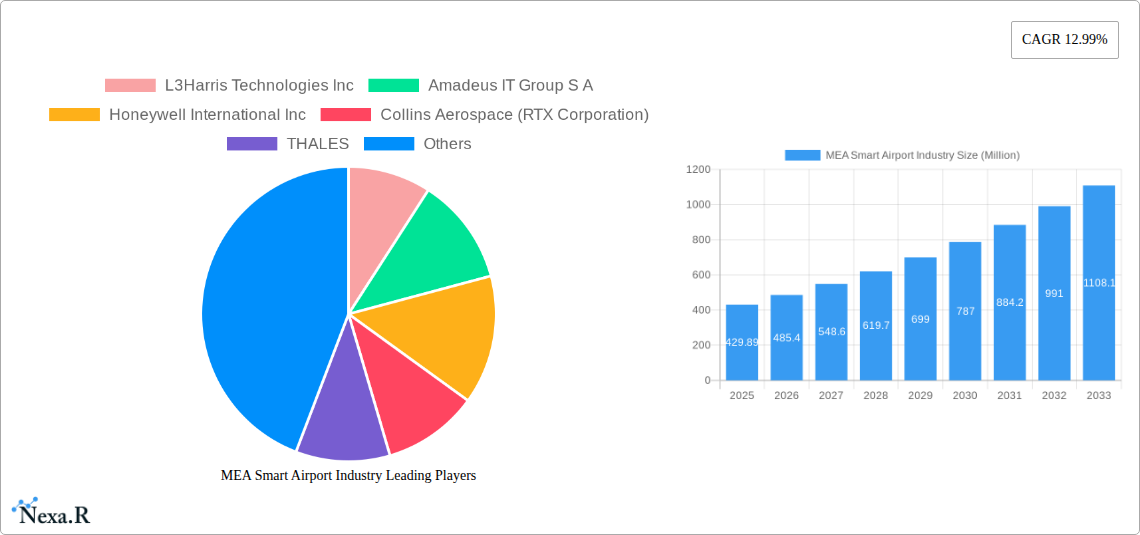

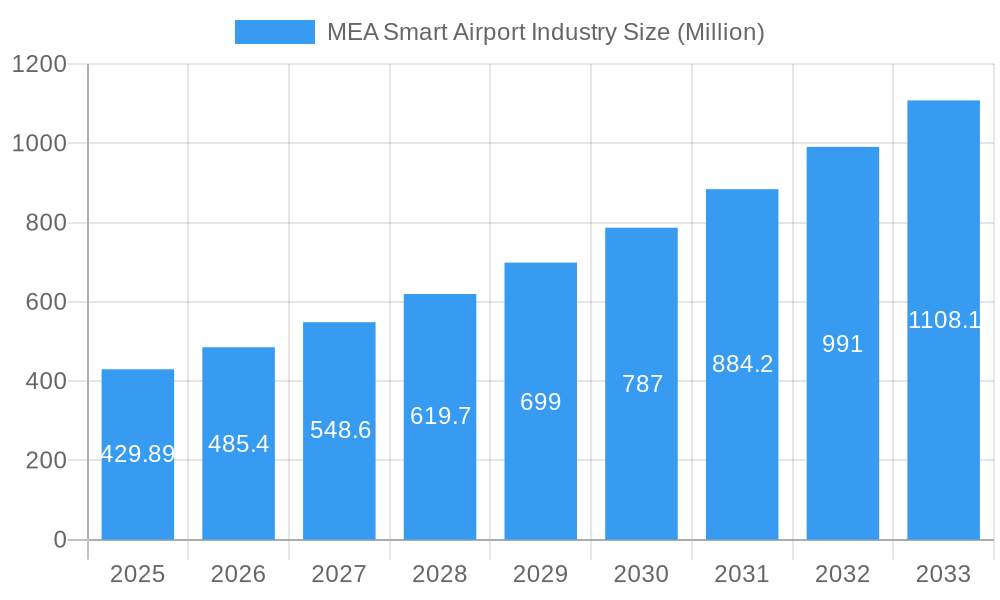

The Middle East and Africa (MEA) Smart Airport Industry is poised for substantial growth, projected to reach approximately USD 429.89 million by 2025. This expansion is driven by a robust Compound Annual Growth Rate (CAGR) of 12.99% throughout the forecast period of 2025-2033. The region's increasing focus on enhancing passenger experience, streamlining operations, and bolstering security is a primary catalyst for this surge. Investments in advanced technologies such as sophisticated security systems, integrated communication networks, and efficient air/ground traffic control are paramount. Furthermore, the burgeoning air travel demand across the MEA region, fueled by economic development and tourism initiatives, necessitates the adoption of smart airport solutions to manage passenger flow, cargo operations, and baggage handling effectively. Ground handling systems are also undergoing significant technological advancements, contributing to the overall smart airport ecosystem. Key countries like Saudi Arabia, the United Arab Emirates, and Turkey are leading this transformation with substantial infrastructure development projects and a commitment to embracing digital innovations within their aviation sectors.

MEA Smart Airport Industry Market Size (In Million)

The market is characterized by a dynamic interplay of technological advancements and evolving passenger expectations. While drivers like increased air passenger traffic and government initiatives supporting smart city development are propelling the market forward, potential restraints such as high initial investment costs for advanced infrastructure and the need for skilled personnel to manage these complex systems require strategic attention. Nevertheless, the inherent benefits of smart airports—including improved operational efficiency, enhanced passenger satisfaction through seamless journeys, and robust security measures—are outweighing these challenges. The competitive landscape features major global players alongside regional specialists, all vying to provide innovative solutions across various segments, from advanced communication systems and passenger flow management to cargo and baggage handling. As the MEA region continues to solidify its position as a global aviation hub, the demand for intelligent and integrated airport solutions will undoubtedly accelerate.

MEA Smart Airport Industry Company Market Share

MEA Smart Airport Industry Market Research Report: Unlocking Future Air Travel

This comprehensive report delivers an in-depth analysis of the MEA Smart Airport Industry, providing critical insights and data for stakeholders navigating this dynamic sector. With a study period spanning 2019–2033, encompassing historical data from 2019–2024, a base year of 2025, and a detailed forecast period of 2025–2033, this report is an essential resource for strategic planning and investment decisions. Leveraging advanced analytics and extensive market research, we explore market dynamics, growth trends, regional dominance, product innovations, key players, and emerging opportunities. This report is designed for immediate use without further modification.

MEA Smart Airport Industry Market Dynamics & Structure

The MEA Smart Airport Industry is characterized by a moderately concentrated market, with key players like L3Harris Technologies Inc, Amadeus IT Group S.A., Honeywell International Inc, Collins Aerospace (RTX Corporation), THALES, Sabre GLBL Inc, Cisco Systems Inc, Siemens AG, International Business Machines Corporation (IBM), NATS Holdings Limited, SITA, and Indra Sistemas S.A. holding significant influence. Technological innovation is the primary driver, fueled by the ongoing digital transformation across the aviation sector and the escalating demand for enhanced passenger experiences, operational efficiency, and robust security. Regulatory frameworks, while evolving, are increasingly supportive of smart airport development, encouraging investments in next-generation infrastructure. Competitive product substitutes are emerging, particularly in areas like biometrics and AI-powered passenger flow management, though the integration complexity of smart airport solutions often acts as a barrier to rapid substitution. End-user demographics are shifting towards a more tech-savvy traveler base, expecting seamless and personalized journeys. Mergers and Acquisitions (M&A) trends are notable, with companies strategically acquiring smaller innovators to expand their portfolios and gain a competitive edge. For instance, recent M&A activity in the parent market has seen an estimated $500 million in deal volume within the last two years, indicating consolidation and strategic growth.

- Market Concentration: Moderately concentrated, dominated by a few large technology providers.

- Technological Innovation Drivers: Digital transformation, AI, IoT, cloud computing, big data analytics, passenger experience enhancement, operational efficiency, security modernization.

- Regulatory Frameworks: Increasingly favorable, with governments prioritizing aviation sector modernization and smart infrastructure development.

- Competitive Product Substitutes: Emerging in niche areas, but full integration is a significant differentiator.

- End-User Demographics: Growing demand for personalized, contactless, and efficient airport experiences.

- M&A Trends: Strategic acquisitions to enhance technological capabilities and market reach, with an estimated parent market M&A volume of $500 million.

MEA Smart Airport Industry Growth Trends & Insights

The MEA Smart Airport Industry is poised for substantial growth, projected to reach an estimated market size of $15,000 million by 2025, with a projected Compound Annual Growth Rate (CAGR) of 18.5% during the forecast period (2025–2033). This robust expansion is underpinned by increasing passenger traffic, a surge in air travel demand post-pandemic, and significant government investments in aviation infrastructure across the Middle East and Africa. The adoption rate of smart technologies is accelerating, driven by the urgent need for enhanced security, improved operational efficiency, and a superior passenger experience. Technological disruptions, including the widespread implementation of Artificial Intelligence (AI), Internet of Things (IoT), facial recognition, and advanced data analytics, are transforming airport operations from curb to gate. Consumer behavior is rapidly shifting towards contactless solutions, self-service options, and personalized travel information, compelling airports to invest in these capabilities. The development of next-generation air traffic management systems and the integration of advanced communication networks are also key growth drivers. The parent market, with an estimated market size of $70,000 million in 2025, serves as a benchmark and influencer for the MEA region. The overall market penetration of smart airport solutions in the MEA region is currently estimated at 25%, with significant room for expansion.

- Market Size Evolution: Projected to reach $15,000 million by 2025.

- CAGR: 18.5% during the forecast period (2025–2033).

- Adoption Rates: Accelerating due to demand for security, efficiency, and passenger experience.

- Technological Disruptions: AI, IoT, biometrics, data analytics revolutionizing operations.

- Consumer Behavior Shifts: Growing preference for contactless, self-service, and personalized travel.

- Market Penetration (MEA): Estimated at 25%.

- Parent Market Size (2025): $70,000 million.

Dominant Regions, Countries, or Segments in MEA Smart Airport Industry

Within the MEA Smart Airport Industry, the Technology segment of Security Systems is emerging as a dominant force, driven by a confluence of factors including escalating security concerns, evolving regulatory mandates, and the desire to create a safe and seamless travel environment. Saudi Arabia and the United Arab Emirates are leading the charge in terms of investment and adoption of smart airport technologies. These countries are actively investing in upgrading their existing airport infrastructure and developing new, state-of-the-art facilities designed with cutting-edge smart solutions. The economic policies in these nations strongly favor technological advancement and foreign investment in the aviation sector, creating a fertile ground for smart airport deployments.

Key Drivers for Dominance:

- Economic Policies: Proactive government initiatives, substantial aviation infrastructure budgets, and a focus on tourism and trade.

- Infrastructure Development: Ambitious projects to build new airports and modernize existing ones with smart capabilities.

- Security Imperatives: Heightened global and regional security concerns necessitate advanced surveillance, access control, and passenger screening systems.

- Technological Adoption: Strong willingness to adopt and integrate the latest innovations in AI, biometrics, and IoT for security and operational enhancements.

- Passenger Experience Focus: A strategic aim to enhance passenger flow, reduce wait times, and provide a premium travel experience through integrated security solutions.

The Security Systems segment, which includes biometrics, advanced surveillance, threat detection, and access control, is expected to capture a significant market share, estimated at 30% of the total MEA Smart Airport market by 2025. The growth potential within this segment is immense, projected to grow at a CAGR of 20% over the forecast period. This dominance is further amplified by the strategic importance placed on national security and the continuous need to adapt to emerging threats.

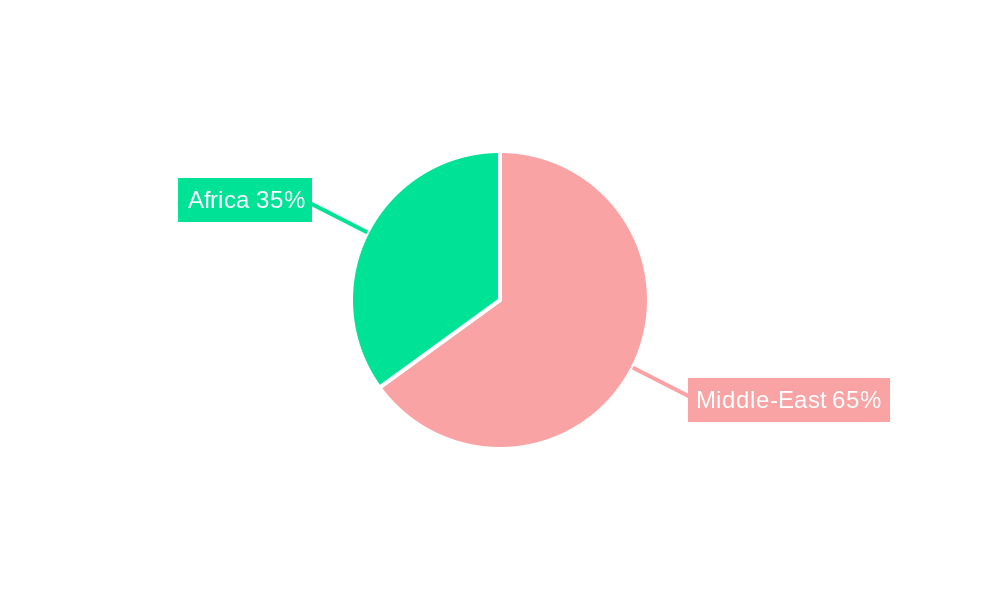

In terms of geographical focus, the United Arab Emirates is expected to lead the market in smart airport technology adoption and expenditure, with an estimated market share of 35% within the MEA region in 2025. Dubai International Airport (DXB) and Abu Dhabi International Airport (AUH) are at the forefront of implementing biometric boarding, AI-powered passenger flow management, and advanced baggage handling systems. Saudi Arabia, with its Vision 2030, is also making substantial investments, aiming to transform its aviation sector with smart infrastructure and advanced technologies, projecting a market share of 28% in 2025. Turkey, with its strategic location and growing aviation hub, is also a significant contributor, expected to hold 15% of the market share. Egypt and South Africa, while currently at an earlier stage of smart airport development, represent substantial growth opportunities with projected market shares of 10% and 7% respectively in 2025. The "Rest of Middle-East and Africa" segment, while diverse, collectively represents a growing interest in smart airport solutions, with an estimated 5% market share. The investment in these regions is driven by a need to enhance connectivity, support economic diversification, and improve the overall travel experience for a growing population and increasing tourism.

MEA Smart Airport Industry Product Landscape

The MEA Smart Airport Industry is witnessing a proliferation of innovative product solutions designed to revolutionize air travel. These include advanced biometric systems for seamless passenger identification and boarding, AI-powered passenger flow management solutions that optimize terminal operations, and IoT-enabled sensors for real-time asset tracking and predictive maintenance. Communication systems are evolving with 5G integration, enabling faster data transfer for enhanced operational coordination and passenger services. Ground handling systems are becoming more automated and intelligent, improving efficiency and safety. The unique selling proposition of these products lies in their ability to integrate disparate airport systems, creating a unified and intelligent operational ecosystem. Technological advancements are focused on enhancing cybersecurity, data privacy, and the overall user experience, with a strong emphasis on contactless technologies. The market is seeing a rise in modular and scalable solutions that can be adapted to airports of varying sizes and complexities.

Key Drivers, Barriers & Challenges in MEA Smart Airport Industry

Key Drivers:

- Government Initiatives & Investments: Strong governmental push for aviation sector modernization and smart city integration.

- Growing Air Passenger Traffic: Increasing passenger volumes necessitate more efficient and streamlined airport operations.

- Demand for Enhanced Passenger Experience: Traveler expectations for seamless, personalized, and contactless journeys.

- Technological Advancements: Proliferation of AI, IoT, biometrics, and data analytics offering transformative solutions.

- Need for Improved Security: Escalating security concerns driving investment in advanced surveillance and identification systems.

Barriers & Challenges:

- High Implementation Costs: Significant initial investment required for smart airport infrastructure and technology deployment.

- Integration Complexity: Challenges in integrating diverse legacy systems with new smart technologies.

- Cybersecurity Threats: Vulnerability to cyber-attacks necessitates robust security measures and continuous monitoring.

- Regulatory Harmonization: Lack of standardized regulations across different countries can hinder widespread adoption.

- Skilled Workforce Shortage: Requirement for specialized talent to manage and maintain complex smart airport systems.

- Data Privacy Concerns: Ensuring compliance with data protection laws and maintaining passenger trust.

- Supply Chain Disruptions: Potential for delays and cost overruns due to global supply chain volatility, impacting hardware procurement.

Emerging Opportunities in MEA Smart Airport Industry

Emerging opportunities in the MEA Smart Airport Industry are centered around the expansion of AI-driven predictive analytics for operations, the integration of sustainability solutions into smart infrastructure, and the development of hyper-personalized passenger services. The growing demand for "airport-as-a-service" models presents untapped markets for specialized technology providers. Furthermore, the increasing focus on cargo logistics and the need for efficient, transparent tracking solutions create significant potential. The "Rest of MEA" region, with its developing aviation infrastructure, offers fertile ground for early adopters of smart technologies, presenting opportunities for market penetration and growth. The rise of drones for inspection and security, alongside advanced air mobility integration, are also nascent but promising areas.

Growth Accelerators in the MEA Smart Airport Industry Industry

Long-term growth in the MEA Smart Airport Industry will be significantly accelerated by continuous technological breakthroughs in AI and machine learning, leading to more autonomous and intelligent airport operations. Strategic partnerships between technology providers, airport operators, and government entities are crucial for fostering innovation and facilitating large-scale project implementations. Market expansion strategies, particularly focusing on emerging African economies and their burgeoning aviation sectors, will unlock new revenue streams. The development of standardized interoperability protocols for smart airport systems will reduce integration challenges and encourage broader adoption. Furthermore, the growing emphasis on passenger well-being and health safety post-pandemic is driving demand for smart solutions that enhance hygiene and contactless experiences, acting as a significant growth accelerator.

Key Players Shaping the MEA Smart Airport Industry Market

- L3Harris Technologies Inc

- Amadeus IT Group S A

- Honeywell International Inc

- Collins Aerospace (RTX Corporation)

- THALES

- Sabre GLBL Inc

- Cisco Systems Inc

- Siemens AG

- International Business Machines Corporation (IBM)

- NATS Holdings Limited

- SITA

- Indra Sistemas S A

Notable Milestones in MEA Smart Airport Industry Sector

- 2023/04: Dubai International Airport (DXB) continues to expand its biometric boarding capabilities across more airlines and gates.

- 2023/09: King Khalid International Airport (RUH) in Riyadh announces major upgrades to its passenger processing systems, incorporating AI.

- 2023/11: Hamad International Airport (DOH) in Doha invests in advanced IoT solutions for real-time baggage tracking and asset management.

- 2024/01: Turkish Airlines enhances its digital passenger journey with a new contactless check-in solution at Istanbul Airport (IST).

- 2024/03: Several African airports, including in Kenya and Nigeria, begin pilot programs for smart security screening technologies.

- 2024/06: Major technology providers announce strategic alliances to offer integrated smart airport solutions in the MEA region.

In-Depth MEA Smart Airport Industry Market Outlook

The future of the MEA Smart Airport Industry is exceptionally promising, driven by a relentless pursuit of operational excellence, enhanced security, and unparalleled passenger experiences. Growth accelerators such as advanced AI integration for predictive operations, the adoption of sustainable smart technologies, and the expansion into nascent African markets will shape the landscape. Strategic partnerships between global tech giants and local entities will be pivotal in navigating regulatory complexities and fostering localized innovation. The ongoing digital transformation, coupled with significant government backing, ensures that the MEA region will continue to be a trailblazer in smart airport development, offering substantial opportunities for investment and innovation.

MEA Smart Airport Industry Segmentation

-

1. Technology

- 1.1. Security Systems

- 1.2. Communication Systems

- 1.3. Air/Ground Traffic Control

- 1.4. Passenger, Cargo, and Baggage Control

- 1.5. Ground Handling Systems

- 1.6. Other Technologies

-

2. Geography

-

2.1. Middle-East and Africa

- 2.1.1. Saudi Arabia

- 2.1.2. United Arab Emirates

- 2.1.3. Turkey

- 2.1.4. Egypt

- 2.1.5. South Africa

- 2.1.6. Rest of Middle-East and Africa

-

2.1. Middle-East and Africa

MEA Smart Airport Industry Segmentation By Geography

-

1. Middle East and Africa

- 1.1. Saudi

- 2. United

-

3. Turkey

- 3.1. Egypt

- 3.2. South

- 4. Rest

MEA Smart Airport Industry Regional Market Share

Geographic Coverage of MEA Smart Airport Industry

MEA Smart Airport Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.99% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Security Systems to Dominate Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEA Smart Airport Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Security Systems

- 5.1.2. Communication Systems

- 5.1.3. Air/Ground Traffic Control

- 5.1.4. Passenger, Cargo, and Baggage Control

- 5.1.5. Ground Handling Systems

- 5.1.6. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Middle-East and Africa

- 5.2.1.1. Saudi Arabia

- 5.2.1.2. United Arab Emirates

- 5.2.1.3. Turkey

- 5.2.1.4. Egypt

- 5.2.1.5. South Africa

- 5.2.1.6. Rest of Middle-East and Africa

- 5.2.1. Middle-East and Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East and Africa

- 5.3.2. United

- 5.3.3. Turkey

- 5.3.4. Rest

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Middle East and Africa MEA Smart Airport Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Security Systems

- 6.1.2. Communication Systems

- 6.1.3. Air/Ground Traffic Control

- 6.1.4. Passenger, Cargo, and Baggage Control

- 6.1.5. Ground Handling Systems

- 6.1.6. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Middle-East and Africa

- 6.2.1.1. Saudi Arabia

- 6.2.1.2. United Arab Emirates

- 6.2.1.3. Turkey

- 6.2.1.4. Egypt

- 6.2.1.5. South Africa

- 6.2.1.6. Rest of Middle-East and Africa

- 6.2.1. Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. United MEA Smart Airport Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Security Systems

- 7.1.2. Communication Systems

- 7.1.3. Air/Ground Traffic Control

- 7.1.4. Passenger, Cargo, and Baggage Control

- 7.1.5. Ground Handling Systems

- 7.1.6. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Middle-East and Africa

- 7.2.1.1. Saudi Arabia

- 7.2.1.2. United Arab Emirates

- 7.2.1.3. Turkey

- 7.2.1.4. Egypt

- 7.2.1.5. South Africa

- 7.2.1.6. Rest of Middle-East and Africa

- 7.2.1. Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Turkey MEA Smart Airport Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Security Systems

- 8.1.2. Communication Systems

- 8.1.3. Air/Ground Traffic Control

- 8.1.4. Passenger, Cargo, and Baggage Control

- 8.1.5. Ground Handling Systems

- 8.1.6. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Middle-East and Africa

- 8.2.1.1. Saudi Arabia

- 8.2.1.2. United Arab Emirates

- 8.2.1.3. Turkey

- 8.2.1.4. Egypt

- 8.2.1.5. South Africa

- 8.2.1.6. Rest of Middle-East and Africa

- 8.2.1. Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Rest MEA Smart Airport Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Security Systems

- 9.1.2. Communication Systems

- 9.1.3. Air/Ground Traffic Control

- 9.1.4. Passenger, Cargo, and Baggage Control

- 9.1.5. Ground Handling Systems

- 9.1.6. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Middle-East and Africa

- 9.2.1.1. Saudi Arabia

- 9.2.1.2. United Arab Emirates

- 9.2.1.3. Turkey

- 9.2.1.4. Egypt

- 9.2.1.5. South Africa

- 9.2.1.6. Rest of Middle-East and Africa

- 9.2.1. Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 L3Harris Technologies Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Amadeus IT Group S A

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Honeywell International Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Collins Aerospace (RTX Corporation)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 THALES

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Sabre GLBL Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Cisco Systems Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Siemens AG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 International Business Machines Corporation (IBM)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 NATS Holdings Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 SITA

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Indra Sistemas S A

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 L3Harris Technologies Inc

List of Figures

- Figure 1: Global MEA Smart Airport Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Middle East and Africa MEA Smart Airport Industry Revenue (Million), by Technology 2025 & 2033

- Figure 3: Middle East and Africa MEA Smart Airport Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 4: Middle East and Africa MEA Smart Airport Industry Revenue (Million), by Geography 2025 & 2033

- Figure 5: Middle East and Africa MEA Smart Airport Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 6: Middle East and Africa MEA Smart Airport Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Middle East and Africa MEA Smart Airport Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: United MEA Smart Airport Industry Revenue (Million), by Technology 2025 & 2033

- Figure 9: United MEA Smart Airport Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 10: United MEA Smart Airport Industry Revenue (Million), by Geography 2025 & 2033

- Figure 11: United MEA Smart Airport Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 12: United MEA Smart Airport Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: United MEA Smart Airport Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Turkey MEA Smart Airport Industry Revenue (Million), by Technology 2025 & 2033

- Figure 15: Turkey MEA Smart Airport Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Turkey MEA Smart Airport Industry Revenue (Million), by Geography 2025 & 2033

- Figure 17: Turkey MEA Smart Airport Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 18: Turkey MEA Smart Airport Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Turkey MEA Smart Airport Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest MEA Smart Airport Industry Revenue (Million), by Technology 2025 & 2033

- Figure 21: Rest MEA Smart Airport Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Rest MEA Smart Airport Industry Revenue (Million), by Geography 2025 & 2033

- Figure 23: Rest MEA Smart Airport Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Rest MEA Smart Airport Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest MEA Smart Airport Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MEA Smart Airport Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global MEA Smart Airport Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: Global MEA Smart Airport Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global MEA Smart Airport Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 5: Global MEA Smart Airport Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Global MEA Smart Airport Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Saudi MEA Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global MEA Smart Airport Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 9: Global MEA Smart Airport Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Global MEA Smart Airport Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global MEA Smart Airport Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 12: Global MEA Smart Airport Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 13: Global MEA Smart Airport Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Egypt MEA Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: South MEA Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global MEA Smart Airport Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 17: Global MEA Smart Airport Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Global MEA Smart Airport Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Smart Airport Industry?

The projected CAGR is approximately 12.99%.

2. Which companies are prominent players in the MEA Smart Airport Industry?

Key companies in the market include L3Harris Technologies Inc, Amadeus IT Group S A, Honeywell International Inc, Collins Aerospace (RTX Corporation), THALES, Sabre GLBL Inc, Cisco Systems Inc, Siemens AG, International Business Machines Corporation (IBM), NATS Holdings Limited, SITA, Indra Sistemas S A.

3. What are the main segments of the MEA Smart Airport Industry?

The market segments include Technology, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 429.89 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Security Systems to Dominate Market Share.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Smart Airport Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Smart Airport Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Smart Airport Industry?

To stay informed about further developments, trends, and reports in the MEA Smart Airport Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence