Key Insights

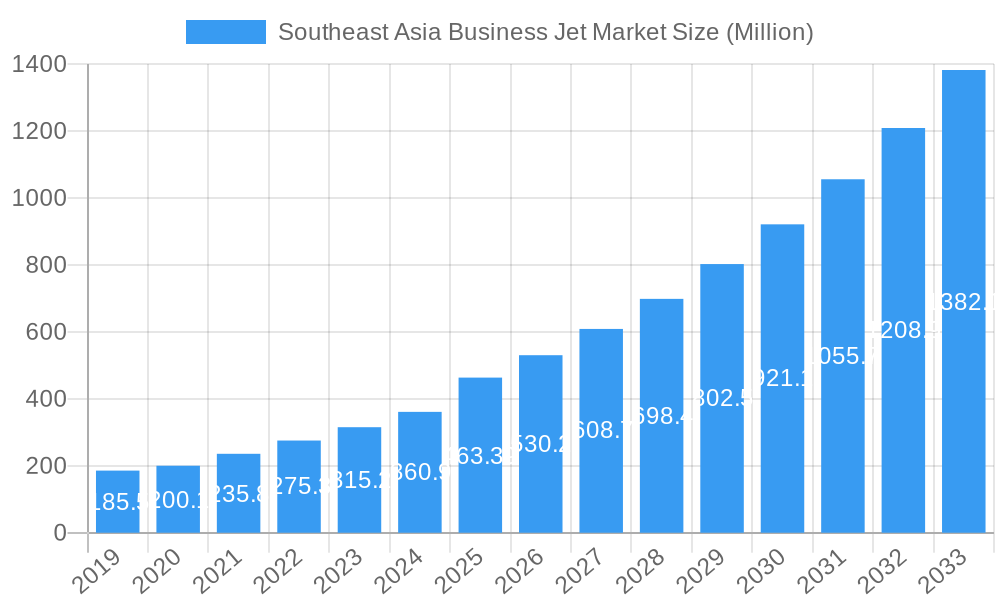

The Southeast Asia business jet market is poised for significant expansion, projected to reach USD 463.39 million by 2025 with a robust Compound Annual Growth Rate (CAGR) of 14.36% through 2033. This impressive growth is fueled by a confluence of factors, primarily driven by the increasing wealth and economic dynamism across the region. As businesses in countries like Singapore, Indonesia, Thailand, the Philippines, and Vietnam expand their global reach and operational footprints, the demand for swift, flexible, and private air travel solutions for executives and high-net-worth individuals escalates. The ongoing development of aviation infrastructure, including the enhancement of smaller airports capable of accommodating business jets, further supports this upward trajectory. Moreover, a growing emphasis on efficiency and time-saving measures in the corporate world inherently favors the adoption of business aviation.

Southeast Asia Business Jet Market Market Size (In Million)

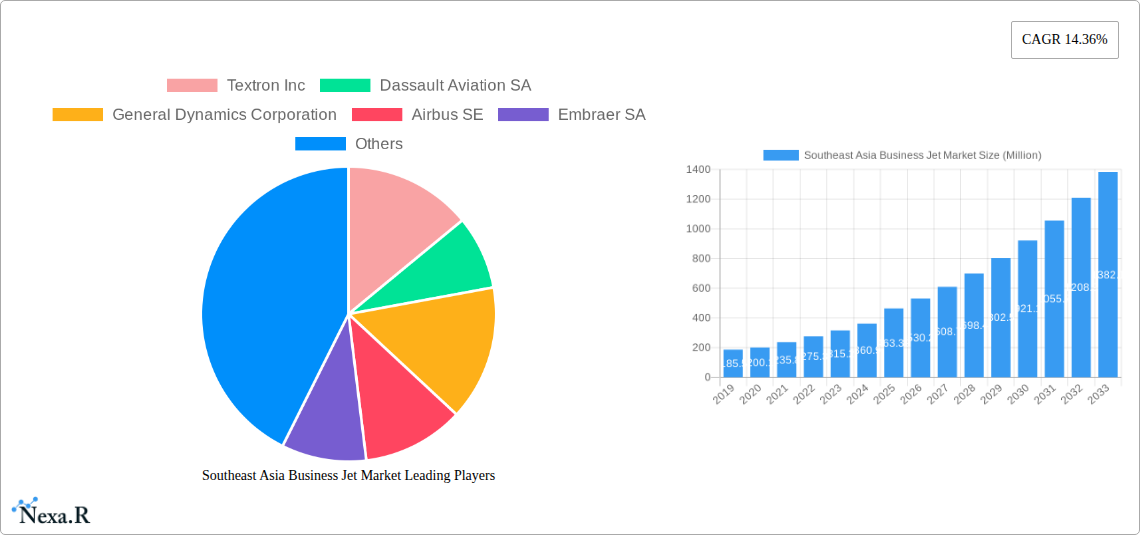

The market segmentation reveals a balanced demand across various aircraft types, with light jets, mid-size jets, and large jets all contributing to the overall market volume. While specific regional data for Singapore, Indonesia, Thailand, Philippines, and Vietnam, alongside the broader "Rest of Southeast Asia," is not explicitly detailed, it is understood that these key economies will collectively represent the primary demand centers. Major industry players such as Textron Inc., Dassault Aviation SA, General Dynamics Corporation, Airbus SE, Embraer SA, Bombardier Inc., Honda Aircraft Company, and The Boeing Company are actively vying for market share, introducing innovative aircraft and services tailored to the region's evolving needs. Future market dynamics are expected to be shaped by continued economic growth, potential regulatory shifts, and the ongoing pursuit of enhanced connectivity and operational flexibility by businesses operating within and from Southeast Asia.

Southeast Asia Business Jet Market Company Market Share

This in-depth report provides a definitive analysis of the Southeast Asia Business Jet Market, offering strategic insights and actionable intelligence for stakeholders. Covering a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this report is essential for understanding market dynamics, growth trends, and key opportunities in this rapidly evolving sector. All values are presented in Million units for clear quantitative assessment.

Southeast Asia Business Jet Market Market Dynamics & Structure

The Southeast Asia business jet market exhibits a moderately concentrated structure, with key players like Textron Inc., Dassault Aviation SA, General Dynamics Corporation, Airbus SE, Embraer SA, Bombardier Inc., Honda Aircraft Company, and The Boeing Company holding significant influence. Technological innovation is a primary driver, with advancements in fuel efficiency, cabin comfort, and connectivity shaping aircraft development. Regulatory frameworks, while generally supportive of aviation growth, vary across countries, influencing import/export policies and operational standards. Competitive product substitutes, such as commercial airline upgrades and fractional ownership schemes, present alternative solutions for business travel needs. End-user demographics are shifting, with a growing number of ultra-high-net-worth individuals and expanding corporate footprints in the region fueling demand. Mergers and acquisitions (M&A) trends are less pronounced in this specific sector compared to broader aerospace, but strategic partnerships and joint ventures are emerging as key growth strategies.

- Market Concentration: Moderate, dominated by a few international manufacturers.

- Technological Innovation Drivers: Enhanced performance, advanced avionics, sustainable aviation fuel integration, and cabin customization.

- Regulatory Frameworks: Evolving aviation policies across ASEAN nations, impacting import duties and operating permits.

- Competitive Product Substitutes: High-end commercial first/business class, and on-demand charter services.

- End-User Demographics: Increasing demand from expanding businesses, regional entrepreneurs, and a growing affluent population.

- M&A Trends: Limited direct M&A of major business jet manufacturers, but strategic alliances for component supply and aftermarket services are noted.

Southeast Asia Business Jet Market Growth Trends & Insights

The Southeast Asia business jet market is poised for robust expansion, driven by escalating economic development and an increasing demand for efficient, flexible business travel solutions. The market size is projected to witness a significant upward trajectory throughout the forecast period. Adoption rates for business jets are steadily rising, propelled by the region's dynamic economic growth, which translates into higher disposable incomes and a greater need for private aviation to connect key business hubs. Technological disruptions are playing a crucial role, with manufacturers continuously innovating to offer lighter, more fuel-efficient, and technologically advanced aircraft. This includes the integration of advanced avionics, improved cabin interiors, and the exploration of sustainable aviation technologies. Consumer behavior is shifting towards a greater appreciation for time-saving and personalized travel experiences, making business jets an increasingly attractive option for corporate executives and high-net-worth individuals. The Compound Annual Growth Rate (CAGR) is estimated to be robust, indicating a sustained period of market penetration and expansion. The increasing volume of cross-border trade and investment within Southeast Asia further amplifies the need for seamless and rapid transportation, directly benefiting the business jet sector. Furthermore, the expansion of tourism and the development of new business centers across countries like Vietnam and the Philippines are creating new pockets of demand.

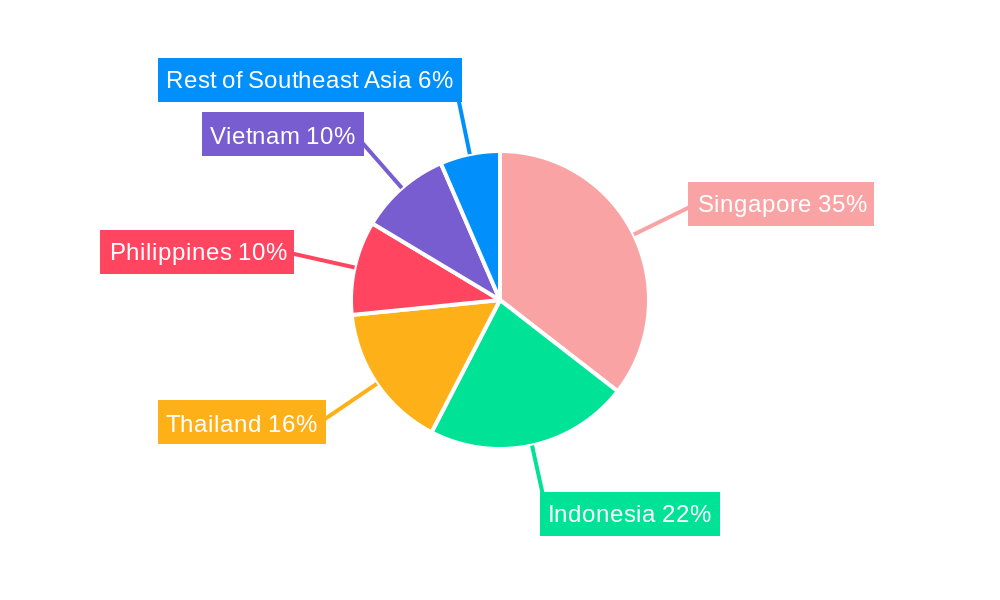

Dominant Regions, Countries, or Segments in Southeast Asia Business Jet Market

Singapore consistently emerges as a dominant force in the Southeast Asia business jet market, largely due to its well-established status as a global financial hub and a strategic gateway to the region. Its advanced infrastructure, favorable business environment, and strong connectivity make it a primary base for corporate aviation operations and aircraft ownership. Indonesia, with its vast archipelago and significant natural resources, represents a substantial market for business jets, facilitating travel to remote operational sites and connecting dispersed business interests. Thailand, driven by its thriving tourism industry and growing manufacturing sector, also showcases considerable demand for business aviation, particularly for corporate travel and executive transport. The Philippines, an emerging economic powerhouse with a significant diaspora and burgeoning business opportunities, is witnessing increasing interest in business jet acquisition and utilization. Vietnam, on the other hand, is emerging as a high-growth potential market, fueled by its rapid industrialization and increasing foreign direct investment, which necessitates efficient business travel solutions.

Key Drivers of Dominance:

- Singapore: Advanced aviation infrastructure, proactive government policies, high concentration of multinational corporations, and a robust wealth management sector.

- Indonesia: Geographic necessity for inter-island connectivity, significant mining and energy sector operations requiring remote access, and a growing number of high-net-worth individuals.

- Thailand: Strong tourism ties, a well-developed manufacturing base, and increasing MICE (Meetings, Incentives, Conferences, and Exhibitions) activities.

- Philippines: Growing IT and BPO sectors, increasing foreign investment, and the need to connect its many islands for business.

- Vietnam: Rapid economic growth, a surge in foreign direct investment, and the development of new industrial zones.

Within the aircraft type segmentation, Large Jets are expected to command a significant market share due to their longer range, greater cabin capacity, and suitability for intercontinental travel, a necessity for multinational corporations operating in and out of Southeast Asia. Mid-size Jets will also play a crucial role, offering a balance of range, efficiency, and comfort for regional travel. Light Jets, while catering to shorter-haul needs, will see steady demand from local enterprises and individuals for intra-regional business connectivity. The interplay of these segments within the dominant geographies will define the overall market landscape.

Southeast Asia Business Jet Market Product Landscape

The Southeast Asia business jet market is characterized by continuous product innovation focused on enhancing range, fuel efficiency, and passenger comfort. Manufacturers are introducing advanced aerodynamic designs and lighter composite materials to improve performance metrics, while cabin configurations are becoming increasingly customizable to meet the specific needs of discerning clients. These innovations translate into unique selling propositions, offering unparalleled access to remote locations and enabling efficient point-to-point business travel across the diverse Southeast Asian landscape. The integration of cutting-edge avionics and inflight connectivity ensures productivity and seamless communication for passengers.

Key Drivers, Barriers & Challenges in Southeast Asia Business Jet Market

Key Drivers:

- Economic Growth & Wealth Creation: Rising GDP and an expanding base of high-net-worth individuals in Southeast Asia are creating a strong demand for private aviation.

- Globalization & Trade Expansion: Increased cross-border business activities necessitate efficient and time-saving travel solutions.

- Technological Advancements: Innovations in aircraft design, fuel efficiency, and cabin amenities are making business jets more attractive and accessible.

- Government Support & Infrastructure Development: Investments in aviation infrastructure and supportive policies in key countries facilitate market growth.

Barriers & Challenges:

- High Acquisition Costs: The substantial initial investment remains a significant barrier for many potential buyers.

- Operating Expenses: Fuel, maintenance, crew, and landing fees contribute to high ongoing operational costs.

- Regulatory Hurdles: Varied and complex aviation regulations across different Southeast Asian nations can pose challenges for operators.

- Infrastructure Limitations: While improving, the availability of suitable FBOs (Fixed-Base Operators) and maintenance facilities can be a constraint in certain locations.

- Environmental Concerns: Increasing scrutiny on carbon emissions and noise pollution may lead to stricter regulations and a push for sustainable aviation solutions.

- Supply Chain Disruptions: Global supply chain issues can impact aircraft manufacturing and availability of parts for maintenance.

Emerging Opportunities in Southeast Asia Business Jet Market

Emerging opportunities within the Southeast Asia business jet market lie in the untapped potential of countries like Vietnam and the Philippines, which are experiencing rapid economic expansion. The growing trend of fractional ownership and jet card programs presents an avenue to cater to a wider spectrum of users who may not require full aircraft ownership. Innovative applications, such as specialized medical evacuation services and expedited cargo transport for high-value goods, are also gaining traction. Furthermore, evolving consumer preferences towards sustainability are creating opportunities for the adoption of eco-friendlier business jet models and the development of advanced biofuel infrastructure. The increasing demand for connectivity in remote yet economically vital areas will continue to drive the need for efficient business aviation solutions.

Growth Accelerators in the Southeast Asia Business Jet Market Industry

Several key catalysts are accelerating long-term growth in the Southeast Asia business jet market. Technological breakthroughs in electric and hybrid-electric propulsion systems, while still nascent, promise to significantly reduce operating costs and environmental impact, thereby broadening market appeal. Strategic partnerships between aircraft manufacturers, component suppliers, and regional operators are crucial for streamlining production, enhancing aftermarket services, and tailoring solutions to local market needs. Market expansion strategies, including the establishment of new FBOs, maintenance centers, and pilot training facilities in high-growth corridors, will further support the sector's development. The increasing adoption of smart aviation technologies, such as AI-powered flight planning and predictive maintenance, will also contribute to operational efficiency and customer satisfaction.

Key Players Shaping the Southeast Asia Business Jet Market Market

- Textron Inc.

- Dassault Aviation SA

- General Dynamics Corporation

- Airbus SE

- Embraer SA

- Bombardier Inc.

- Honda Aircraft Company

- The Boeing Company

Notable Milestones in Southeast Asia Business Jet Market Sector

- 2019: Increased order volumes for new generation super-midsize and large-cabin jets, reflecting growing demand for longer-range capabilities.

- 2020: Initial impact of global travel restrictions due to the COVID-19 pandemic, followed by a surge in demand for private travel as a safer alternative.

- 2021: Several Southeast Asian countries initiated infrastructure upgrades at key business airports, enhancing FBO services and maintenance capabilities.

- 2022: Launch of new fuel-efficient aircraft models by major manufacturers, responding to environmental concerns and operating cost pressures.

- 2023: Significant growth in the pre-owned business jet market in Southeast Asia, driven by availability and attractive pricing.

- 2024: Increased focus on sustainable aviation fuels (SAFs) and research into advanced air mobility solutions within the region's aviation sector.

In-Depth Southeast Asia Business Jet Market Market Outlook

The future outlook for the Southeast Asia business jet market is exceptionally promising, driven by sustained economic expansion, increasing globalization, and rapid technological advancements. Growth accelerators such as the development of more sustainable and efficient aircraft, coupled with strategic market expansion by key players, will solidify the region's position as a critical hub for private aviation. The market is expected to witness a significant uptake in large and super-midsize jets, catering to both regional and intercontinental travel needs. Furthermore, the growing emphasis on connectivity and efficiency in business operations across the diverse Southeast Asian landscape will continue to fuel demand. Strategic opportunities lie in catering to emerging economies, developing specialized aviation services, and embracing innovative ownership models. The overall trajectory points towards a dynamic and expanding market, offering substantial potential for stakeholders.

Southeast Asia Business Jet Market Segmentation

-

1. Aircraft Type

- 1.1. Light Jets

- 1.2. Mid-size Jets

- 1.3. Large Jets

-

2. Geography

- 2.1. Singapore

- 2.2. Indonesia

- 2.3. Thailand

- 2.4. Philippines

- 2.5. Vietnam

- 2.6. Rest of Southeast Asia

Southeast Asia Business Jet Market Segmentation By Geography

- 1. Singapore

- 2. Indonesia

- 3. Thailand

- 4. Philippines

- 5. Vietnam

- 6. Rest of Southeast Asia

Southeast Asia Business Jet Market Regional Market Share

Geographic Coverage of Southeast Asia Business Jet Market

Southeast Asia Business Jet Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.36% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Large Jets Segment held the Largest Share in 2021

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Southeast Asia Business Jet Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.1.1. Light Jets

- 5.1.2. Mid-size Jets

- 5.1.3. Large Jets

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Singapore

- 5.2.2. Indonesia

- 5.2.3. Thailand

- 5.2.4. Philippines

- 5.2.5. Vietnam

- 5.2.6. Rest of Southeast Asia

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Singapore

- 5.3.2. Indonesia

- 5.3.3. Thailand

- 5.3.4. Philippines

- 5.3.5. Vietnam

- 5.3.6. Rest of Southeast Asia

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6. Singapore Southeast Asia Business Jet Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6.1.1. Light Jets

- 6.1.2. Mid-size Jets

- 6.1.3. Large Jets

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Singapore

- 6.2.2. Indonesia

- 6.2.3. Thailand

- 6.2.4. Philippines

- 6.2.5. Vietnam

- 6.2.6. Rest of Southeast Asia

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7. Indonesia Southeast Asia Business Jet Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7.1.1. Light Jets

- 7.1.2. Mid-size Jets

- 7.1.3. Large Jets

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Singapore

- 7.2.2. Indonesia

- 7.2.3. Thailand

- 7.2.4. Philippines

- 7.2.5. Vietnam

- 7.2.6. Rest of Southeast Asia

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8. Thailand Southeast Asia Business Jet Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8.1.1. Light Jets

- 8.1.2. Mid-size Jets

- 8.1.3. Large Jets

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Singapore

- 8.2.2. Indonesia

- 8.2.3. Thailand

- 8.2.4. Philippines

- 8.2.5. Vietnam

- 8.2.6. Rest of Southeast Asia

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9. Philippines Southeast Asia Business Jet Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9.1.1. Light Jets

- 9.1.2. Mid-size Jets

- 9.1.3. Large Jets

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Singapore

- 9.2.2. Indonesia

- 9.2.3. Thailand

- 9.2.4. Philippines

- 9.2.5. Vietnam

- 9.2.6. Rest of Southeast Asia

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10. Vietnam Southeast Asia Business Jet Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10.1.1. Light Jets

- 10.1.2. Mid-size Jets

- 10.1.3. Large Jets

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Singapore

- 10.2.2. Indonesia

- 10.2.3. Thailand

- 10.2.4. Philippines

- 10.2.5. Vietnam

- 10.2.6. Rest of Southeast Asia

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 11. Rest of Southeast Asia Southeast Asia Business Jet Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 11.1.1. Light Jets

- 11.1.2. Mid-size Jets

- 11.1.3. Large Jets

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. Singapore

- 11.2.2. Indonesia

- 11.2.3. Thailand

- 11.2.4. Philippines

- 11.2.5. Vietnam

- 11.2.6. Rest of Southeast Asia

- 11.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Textron Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Dassault Aviation SA

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 General Dynamics Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Airbus SE

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Embraer SA

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Bombardier Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Honda Aircraft Compan

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 The Boeing Company

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Textron Inc

List of Figures

- Figure 1: Southeast Asia Business Jet Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Southeast Asia Business Jet Market Share (%) by Company 2025

List of Tables

- Table 1: Southeast Asia Business Jet Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 2: Southeast Asia Business Jet Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: Southeast Asia Business Jet Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Southeast Asia Business Jet Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 5: Southeast Asia Business Jet Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Southeast Asia Business Jet Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Southeast Asia Business Jet Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 8: Southeast Asia Business Jet Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: Southeast Asia Business Jet Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Southeast Asia Business Jet Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 11: Southeast Asia Business Jet Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Southeast Asia Business Jet Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Southeast Asia Business Jet Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 14: Southeast Asia Business Jet Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Southeast Asia Business Jet Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Southeast Asia Business Jet Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 17: Southeast Asia Business Jet Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Southeast Asia Business Jet Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Southeast Asia Business Jet Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 20: Southeast Asia Business Jet Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 21: Southeast Asia Business Jet Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Southeast Asia Business Jet Market?

The projected CAGR is approximately 14.36%.

2. Which companies are prominent players in the Southeast Asia Business Jet Market?

Key companies in the market include Textron Inc, Dassault Aviation SA, General Dynamics Corporation, Airbus SE, Embraer SA, Bombardier Inc, Honda Aircraft Compan, The Boeing Company.

3. What are the main segments of the Southeast Asia Business Jet Market?

The market segments include Aircraft Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 463.39 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Large Jets Segment held the Largest Share in 2021.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Southeast Asia Business Jet Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Southeast Asia Business Jet Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Southeast Asia Business Jet Market?

To stay informed about further developments, trends, and reports in the Southeast Asia Business Jet Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence