Key Insights

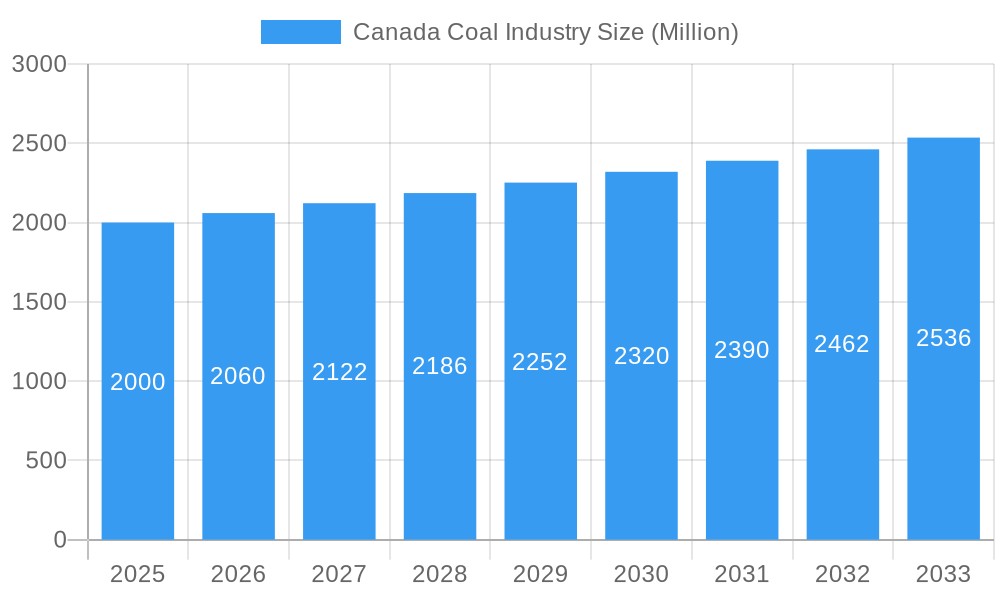

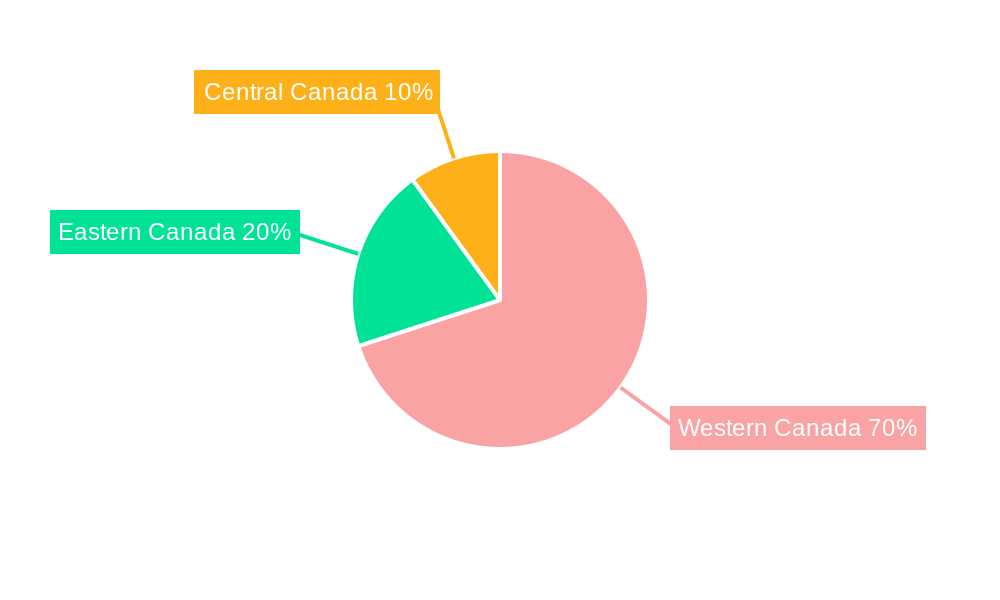

Despite environmental pressures and a global pivot to renewables, the Canadian coal market demonstrates resilience, projected for a Compound Annual Growth Rate (CAGR) of 5.2% from 2024 to 2033. This moderate growth is underpinned by sustained demand for metallurgical coal in steel production, a sector where Canada leverages its high-quality reserves and robust mining infrastructure. Conversely, the coal power generation segment is contracting due to the rising adoption of hydroelectric, wind, and solar energy, acting as a primary market constraint. Significant regional disparities are evident, with Western Canada, possessing extensive reserves and established operations, anticipated to lead market share over Central and Eastern Canada. Key industry participants, including Teck Resources Limited and Peabody Energy Corp, alongside other regional producers, are actively pursuing diversification strategies, encompassing sustainable mining initiatives and exploration into alternative energy sectors.

Canada Coal Industry Market Size (In Billion)

The Canadian coal market was valued at $11 billion in 2024. Industry analysis, considering the projected CAGR and historical data, indicates a stable market trajectory. Companies are prioritizing operational efficiency and cost optimization to ensure sustained profitability within a competitive environment. While the long-term market outlook is influenced by the ongoing global energy transition, consistent demand for metallurgical coal provides a degree of market stability. The industry's future prosperity will be contingent upon its adaptability to evolving environmental regulations, effective cost management, and strategic exploration of diversification avenues and technological innovations, such as carbon capture and storage (CCS) technologies.

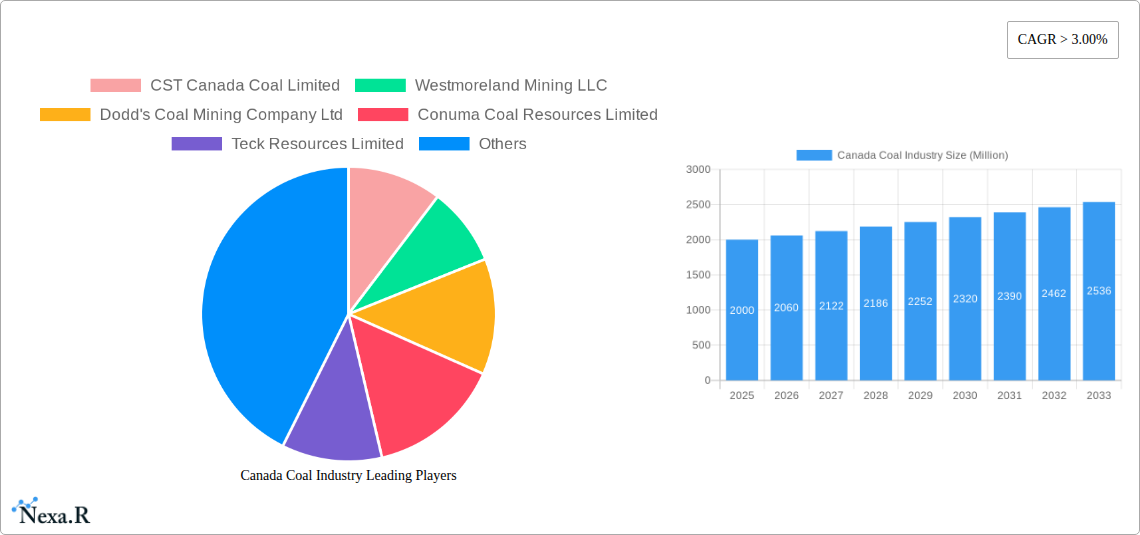

Canada Coal Industry Company Market Share

Canada Coal Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Canadian coal industry, encompassing market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The report leverages extensive primary and secondary research to deliver actionable insights and accurate market projections, valued in millions of units.

Canada Coal Industry Market Dynamics & Structure

The Canadian coal industry is characterized by a moderate level of market concentration, with a few major players dominating the landscape. Technological innovation is slow, hampered by high capital expenditures and regulatory constraints. Stringent environmental regulations, particularly concerning greenhouse gas emissions, significantly impact the industry's operations and future prospects. The industry faces increasing competition from renewable energy sources, acting as a significant substitute. End-user demographics are primarily focused on power generation and metallurgical applications. M&A activity has been relatively limited in recent years, reflecting the industry's challenges.

- Market Concentration: The top 5 players hold approximately xx% market share in 2025.

- Technological Innovation: Limited investment in carbon capture and storage technologies.

- Regulatory Framework: Stringent environmental regulations driving operational costs and limiting expansion.

- Competitive Substitutes: Growing adoption of renewable energy sources (solar, wind) impacting coal demand.

- End-User Demographics: Power generation remains the largest consumer, followed by metallurgical applications.

- M&A Trends: Low M&A activity in recent years, with only xx deals recorded between 2019 and 2024, totaling xx million CAD.

Canada Coal Industry Growth Trends & Insights

The Canadian coal industry experienced a decline in market size from xx million tonnes in 2019 to xx million tonnes in 2024, primarily driven by decreasing demand from the power generation sector and increasing environmental regulations. However, metallurgical coal demand remains relatively stable, offsetting some of the decline. The forecast period (2025-2033) projects a CAGR of -xx%, reflecting continued pressure from renewable energy alternatives and environmental policies. Market penetration of coal in the energy sector is expected to further decrease, while metallurgical coal maintains a relatively consistent market share. Technological disruptions, primarily from renewable energy technologies, significantly impact the industry's long-term trajectory. Consumer behavior shifts towards environmentally sustainable energy sources are further reducing coal consumption.

Dominant Regions, Countries, or Segments in Canada Coal Industry

British Columbia and Alberta remain the dominant regions for coal production in Canada. The power generation segment historically held the largest market share; however, this is projected to decline. The metallurgical segment is expected to maintain a relatively stable market share throughout the forecast period.

- Key Drivers (British Columbia): Existing coal mining infrastructure, proximity to export markets.

- Key Drivers (Alberta): Established coal mining infrastructure, historical demand from domestic power plants.

- Key Drivers (Metallurgy): Steady demand from steel industries, relatively stable pricing.

- Dominance Factors: Existing infrastructure, proximity to key markets, consistent metallurgical demand.

- Growth Potential: Limited growth potential in power generation, moderate growth in metallurgy.

Canada Coal Industry Product Landscape

The Canadian coal industry primarily produces metallurgical and thermal coal. Recent innovations have focused on improving coal quality and reducing environmental impact through enhanced extraction techniques and increased efficiency. Key selling propositions include consistent quality, reliable supply, and competitive pricing (relative to imported coal). Technological advancements are primarily focused on improving mining efficiency and reducing operational costs.

Key Drivers, Barriers & Challenges in Canada Coal Industry

Key Drivers:

- Steady demand for metallurgical coal in global steel production.

- Existing infrastructure and established mining expertise.

Challenges:

- Stringent environmental regulations limiting expansion and increasing operational costs.

- Competition from renewable energy sources, impacting demand from the power generation sector.

- Supply chain disruptions, impacting coal transportation and logistics, resulting in an estimated xx% increase in transportation costs in 2024.

Emerging Opportunities in Canada Coal Industry

- Exploration of carbon capture and storage technologies to mitigate environmental impact.

- Increased focus on sustainable mining practices to reduce environmental footprint.

- Potential for growth in niche metallurgical coal applications requiring high-quality coal.

Growth Accelerators in the Canada Coal Industry Industry

Technological advancements in coal mining and processing, coupled with strategic partnerships to secure long-term coal supply agreements, are crucial for future growth. Expansion into niche metallurgical coal markets and improved supply chain efficiency can further accelerate industry growth.

Key Players Shaping the Canada Coal Industry Market

- CST Canada Coal Limited

- Westmoreland Mining LLC

- Dodd's Coal Mining Company Ltd

- Conuma Coal Resources Limited

- Teck Resources Limited

- Peabody Energy Corp

Notable Milestones in Canada Coal Industry Sector

- 2020: Increased regulatory scrutiny on coal mining operations in British Columbia.

- 2022: Conuma Coal Resources Ltd. announced a significant expansion of its mining operations in Alberta.

- 2023: Several coal mining companies announced investments in carbon capture and storage technologies.

In-Depth Canada Coal Industry Market Outlook

The future of the Canadian coal industry hinges on its ability to adapt to evolving environmental regulations and compete effectively with renewable energy sources. While the overall market is projected to decline, the metallurgical coal segment offers sustained opportunities. Strategic partnerships, technological innovation, and a focus on sustainable mining practices will be crucial to long-term success. The industry's long-term viability depends on the balancing of economic needs with environmental concerns and global energy transitions.

Canada Coal Industry Segmentation

-

1. Application

- 1.1. Metallurgy

- 1.2. Power Generation

- 1.3. Others

Canada Coal Industry Segmentation By Geography

- 1. Canada

Canada Coal Industry Regional Market Share

Geographic Coverage of Canada Coal Industry

Canada Coal Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Industrialization across the Globe4.; Increasing Utilization of Natural Gas

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost of Installation and Maintenance

- 3.4. Market Trends

- 3.4.1. Metallurgy Sector to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Coal Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Metallurgy

- 5.1.2. Power Generation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CST Canada Coal Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Westmoreland Mining LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dodd's Coal Mining Company Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Conuma Coal Resources Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Teck Resources Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Peabody Energy Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 CST Canada Coal Limited

List of Figures

- Figure 1: Canada Coal Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Coal Industry Share (%) by Company 2025

List of Tables

- Table 1: Canada Coal Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Canada Coal Industry Volume Tonnes Forecast, by Application 2020 & 2033

- Table 3: Canada Coal Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Canada Coal Industry Volume Tonnes Forecast, by Region 2020 & 2033

- Table 5: Canada Coal Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Canada Coal Industry Volume Tonnes Forecast, by Application 2020 & 2033

- Table 7: Canada Coal Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Canada Coal Industry Volume Tonnes Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Coal Industry?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Canada Coal Industry?

Key companies in the market include CST Canada Coal Limited, Westmoreland Mining LLC, Dodd's Coal Mining Company Ltd, Conuma Coal Resources Limited, Teck Resources Limited, Peabody Energy Corp.

3. What are the main segments of the Canada Coal Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 11 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Industrialization across the Globe4.; Increasing Utilization of Natural Gas.

6. What are the notable trends driving market growth?

Metallurgy Sector to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Cost of Installation and Maintenance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Coal Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Coal Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Coal Industry?

To stay informed about further developments, trends, and reports in the Canada Coal Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence