Key Insights

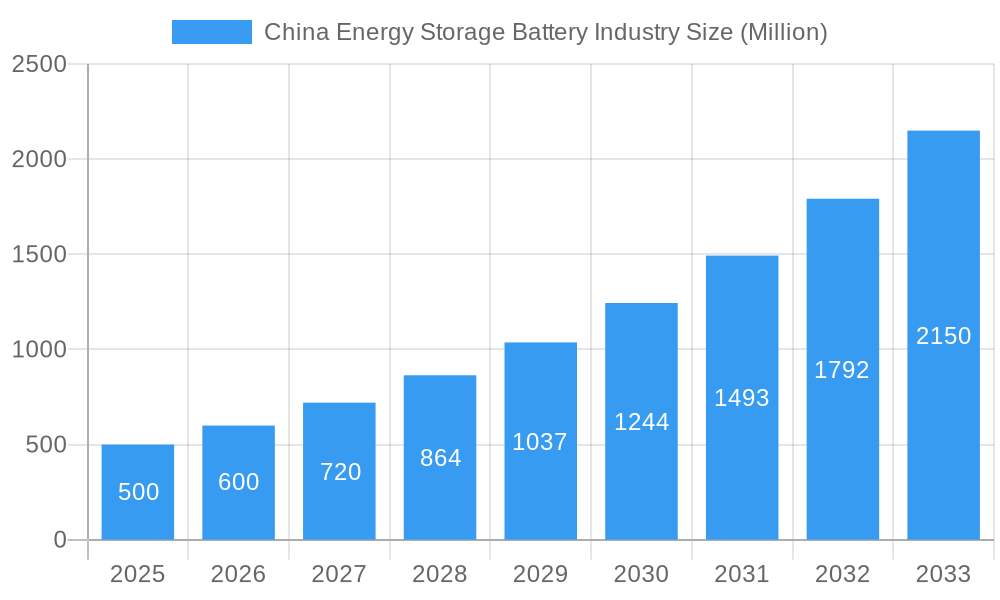

China's energy storage battery market is poised for significant expansion, projected to reach a market size of 223.3 billion by 2033, driven by a robust Compound Annual Growth Rate (CAGR) of 25.4%. This growth trajectory is fueled by China's ambitious renewable energy targets, the accelerating adoption of electric vehicles (EVs), and supportive government policies promoting grid modernization and energy efficiency. The market is segmented by battery type, including Pumped Hydro and Electrochemical, and application, such as Residential and Industrial. Electrochemical batteries currently lead due to their cost-effectiveness and technological maturity. Key industry players are investing heavily in research and development to meet escalating demand.

China Energy Storage Battery Industry Market Size (In Billion)

This robust market performance in China reflects a global shift towards sustainable energy solutions. China's leadership in manufacturing and its commitment to clean energy position it at the forefront of the energy storage sector. While electrochemical batteries are expected to maintain dominance, ongoing innovations in other battery technologies could reshape the market landscape. Intensified competition among major players will likely spur innovation and cost reductions, benefiting consumers and promoting wider renewable energy integration. The residential segment is anticipated to grow significantly, supported by increasing affordability and incentives for home energy storage. The industrial segment will continue its steady growth, critical for large-scale energy infrastructure development.

China Energy Storage Battery Industry Company Market Share

China Energy Storage Battery Market Analysis: 2024-2033

This report offers a comprehensive analysis of the China energy storage battery industry, detailing market dynamics, growth trends, key participants, and future projections. It covers the period from 2024 to 2033, with a base year of 2024 and a forecast period of 2024-2033. Market values are presented in billion units.

China Energy Storage Battery Industry Market Dynamics & Structure

The China energy storage battery market is characterized by high growth potential, driven by increasing renewable energy integration and government support for clean energy initiatives. Market concentration is moderate, with several key players dominating different segments. Technological innovation, particularly in lithium-ion battery technologies, is a major driver, while regulatory frameworks are continuously evolving to encourage sustainable practices and ensure safety. Competitive pressures are intense, with both domestic and international companies vying for market share. M&A activity is prevalent, indicating consolidation and strategic expansion within the sector.

- Market Concentration: Moderate, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on improving energy density, lifespan, and safety of lithium-ion batteries, with emerging interest in solid-state and other advanced technologies.

- Regulatory Framework: Government incentives and policies are driving market growth, while safety regulations and environmental standards are shaping industry practices.

- Competitive Landscape: Intense competition among domestic and international players, leading to price wars and technological advancements.

- M&A Activity: Significant M&A activity in recent years, reflecting consolidation and strategic expansion within the industry (xx deals in the past 5 years).

- End-User Demographics: Growth across residential, commercial, and industrial sectors, with increasing demand from large-scale energy storage projects.

China Energy Storage Battery Industry Growth Trends & Insights

The China energy storage battery market has experienced significant growth over the past few years, driven by factors such as increasing renewable energy adoption, government support for clean energy, and falling battery prices. The market size has grown from xx million units in 2019 to xx million units in 2024, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. Technological advancements, particularly in lithium-ion batteries, have further fueled market expansion. Consumer behavior is shifting towards greener energy solutions, contributing to increased adoption rates. Market penetration is expected to increase significantly in the coming years, driven by continued government support and falling battery costs. Disruptions from new technologies, like solid-state batteries, are anticipated to reshape the landscape in the longer term.

Dominant Regions, Countries, or Segments in China Energy Storage Battery Industry

The electrochemical segment dominates the China energy storage battery market, accounting for approximately xx% of the total market share in 2024. This dominance is largely attributed to the cost-effectiveness and technological maturity of electrochemical batteries. The industrial application sector is the largest end-use segment, driven by the increasing need for reliable energy storage solutions in industrial settings. Coastal provinces like Guangdong and Jiangsu, benefitting from robust infrastructure and proximity to key manufacturing hubs, are leading regional markets.

- Key Drivers for Electrochemical Segment: Cost-effectiveness, technological maturity, and extensive manufacturing capacity.

- Key Drivers for Industrial Application: Need for reliable power backup, grid stabilization, and renewable energy integration in industrial processes.

- Key Drivers for Coastal Provinces: Well-developed infrastructure, proximity to manufacturing facilities, and access to key markets.

- Market Share: Electrochemical segment holds approximately xx% of the market, while Industrial applications account for xx% of overall demand.

China Energy Storage Battery Industry Product Landscape

China's energy storage battery market showcases a diverse array of products, predominantly dominated by lithium-ion batteries due to their superior energy density and extended cycle life. Lead-acid and flow batteries also hold niche market segments. The industry is characterized by continuous product innovation focused on enhancing energy density, extending lifespan, bolstering safety features, and driving down costs. Key applications span diverse sectors, encompassing large-scale grid energy storage, residential energy solutions, and the burgeoning electric vehicle (EV) market. Technological advancements are steadily improving performance metrics, including higher energy density, faster charging capabilities, and significantly enhanced safety protocols. Furthermore, the increasing focus on sustainability and environmental concerns is driving the adoption of more eco-friendly battery technologies and manufacturing processes.

Key Drivers, Barriers & Challenges in China Energy Storage Battery Industry

Key Drivers:

- Government policies and subsidies aimed at promoting renewable energy integration and reducing reliance on fossil fuels.

- Growing demand for renewable energy sources, requiring efficient energy storage solutions.

- Technological advancements leading to improved battery performance and reduced costs.

Key Barriers and Challenges:

- Supply chain disruptions impacting raw material availability and production costs.

- Regulatory hurdles related to safety standards and environmental regulations.

- Intense competition among domestic and international players. This pressure impacts pricing and profit margins.

Emerging Opportunities in China Energy Storage Battery Industry

- Booming Residential Energy Storage Market: Fueled by growing consumer awareness regarding renewable energy sources and the desire for energy independence, this sector presents significant growth potential.

- Expansion into Microgrids and Off-Grid Applications: The demand for reliable power in remote and underserved areas is driving the development and deployment of energy storage solutions tailored to these specific needs.

- Development of Advanced Battery Chemistries: Intensive research and development efforts are focused on next-generation battery technologies, such as solid-state batteries and other advanced chemistries, promising superior performance, enhanced safety profiles, and potentially lower environmental impact.

- Integration with Smart Grid Technologies: The synergy between energy storage and smart grid technologies creates new opportunities for optimizing energy distribution and improving grid stability and efficiency.

Growth Accelerators in the China Energy Storage Battery Industry Industry

Technological breakthroughs in battery chemistry and manufacturing processes will continue to drive cost reductions and improve performance. Strategic partnerships between battery manufacturers, renewable energy developers, and grid operators will accelerate market adoption. Expansion into new application areas, such as electric vehicles and data centers, will further fuel market growth.

Key Players Shaping the China Energy Storage Battery Industry Market

- Contemporary Amperex Technology Co Limited (CATL)

- Gotion High-Tech

- BSLBATT

- BYD Company Ltd.

- Narada Power Source

- Ganfeng Lithium

- CALB

- EVE Energy Co Ltd

- Higee Energy

- Tianjin Lishen Battery Joint-Stock Co Ltd

Notable Milestones in China Energy Storage Battery Industry Sector

- April 2022: BSLBATT successfully launched the BSL-BOX-HV high-voltage battery system, a notable advancement featuring LFP batteries and an innovative modular design.

- March 2022: China Huadian Corporation commenced construction of a cutting-edge high-power maglev flywheel and battery storage project, underscoring significant investment in advanced energy storage technologies (CNY 33.72 million budget).

- [Add more recent milestones here with dates and brief descriptions. For example, new factory openings, significant investment announcements, or product launches.]

In-Depth China Energy Storage Battery Industry Market Outlook

The China energy storage battery market is poised for continued robust growth, driven by supportive government policies, technological advancements, and expanding application areas. Strategic investments in R&D, capacity expansion, and international collaborations will be crucial for companies seeking to capitalize on this significant market opportunity. The long-term outlook is positive, with substantial growth potential across various segments and applications.

China Energy Storage Battery Industry Segmentation

-

1. Type

- 1.1. Pumped Hydro

- 1.2. Electrochemical

- 1.3. Molten Salt

- 1.4. Compressed Air

- 1.5. Flywheel

-

2. Application

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

China Energy Storage Battery Industry Segmentation By Geography

- 1. China

China Energy Storage Battery Industry Regional Market Share

Geographic Coverage of China Energy Storage Battery Industry

China Energy Storage Battery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Petroleum Products Due to the Growth of the Local Economy4.; Government Initiatives to Boost the Production of Crude Oil and Natural Gas

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Electrochemical Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Energy Storage Battery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Pumped Hydro

- 5.1.2. Electrochemical

- 5.1.3. Molten Salt

- 5.1.4. Compressed Air

- 5.1.5. Flywheel

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Contemporary Amperex Technology Co Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shanghai Electric Gotion New Energy Technology Co ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BSLBATT*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BYD

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Narada

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ganfeng Battery

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CALB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 EVE Energy Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Higee Enegry

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tianjin Lishen Battery Joint-Stock Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Contemporary Amperex Technology Co Limited

List of Figures

- Figure 1: China Energy Storage Battery Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Energy Storage Battery Industry Share (%) by Company 2025

List of Tables

- Table 1: China Energy Storage Battery Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: China Energy Storage Battery Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: China Energy Storage Battery Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: China Energy Storage Battery Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: China Energy Storage Battery Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: China Energy Storage Battery Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: China Energy Storage Battery Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: China Energy Storage Battery Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 9: China Energy Storage Battery Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 10: China Energy Storage Battery Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: China Energy Storage Battery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: China Energy Storage Battery Industry Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Energy Storage Battery Industry?

The projected CAGR is approximately 25.4%.

2. Which companies are prominent players in the China Energy Storage Battery Industry?

Key companies in the market include Contemporary Amperex Technology Co Limited, Shanghai Electric Gotion New Energy Technology Co ltd, BSLBATT*List Not Exhaustive, BYD, Narada, Ganfeng Battery, CALB, EVE Energy Co Ltd, Higee Enegry, Tianjin Lishen Battery Joint-Stock Co Ltd.

3. What are the main segments of the China Energy Storage Battery Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 223.3 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Petroleum Products Due to the Growth of the Local Economy4.; Government Initiatives to Boost the Production of Crude Oil and Natural Gas.

6. What are the notable trends driving market growth?

Electrochemical Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Renewable Energy.

8. Can you provide examples of recent developments in the market?

On 9th April 2022, BSLBATT introduced the High Voltage Battery System (BSL-BOX-HV), and the system uses a lithium iron phosphate (LFP) battery. The BSL-BOX-HV is a high voltage battery system with a flexible modular design. The system does not have internal cables. The system is capable of stacking 3 to 7 battery modules. Furthermore, the system is available in various capacities ranging from 15.36kWh to 35.84 kWh and voltages from 153.6V to 358.4V. These battery systems have significant applications in solar energy storage.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Energy Storage Battery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Energy Storage Battery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Energy Storage Battery Industry?

To stay informed about further developments, trends, and reports in the China Energy Storage Battery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence