Key Insights

The European coal market, despite decarbonization pressures and the rise of renewables, retains significant influence in critical sectors such as electricity generation and steel manufacturing. Projected to reach **€42.6 billion** by **2025**, the market is expected to grow at a CAGR of **1.9%** through 2033. This moderate expansion is tempered by stringent environmental regulations leading to coal plant closures and reduced demand. However, geopolitical instability and energy security concerns have provided short-term resilience, prompting diversification of energy sources and ensuring supply. Dominant producers and consumers like Germany and Poland will continue to shape market dynamics. Market segmentation by coal type (anthracite, bituminous, sub-bituminous, lignite) and application (electricity, steel, cement, others) highlights varied growth trends. While coal's role in electricity generation is decreasing, industrial applications show persistent demand.

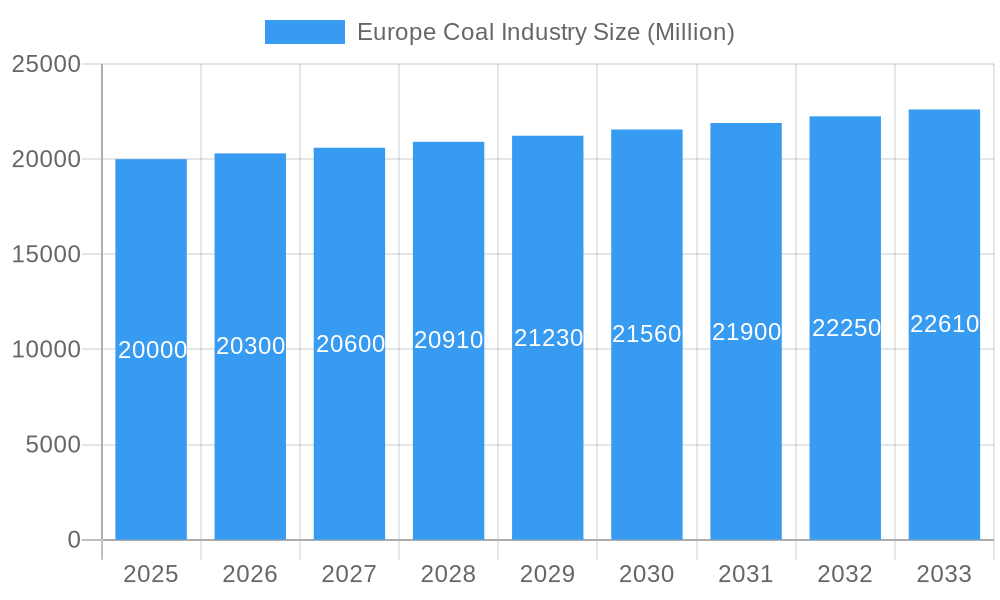

Europe Coal Industry Market Size (In Billion)

The competitive landscape comprises multinational corporations and regional entities. Key players like Jastrzębska Spółka Węglowa SA and Suek AG are adapting strategies through operational diversification, investment in carbon capture technologies, and exploring energy sector synergies to navigate the evolving regulatory environment and maintain profitability. The future trajectory will be influenced by energy transition policies, global energy price volatility, and industry innovation. While the long-term outlook indicates a steady decline in demand, niche markets and strategic partnerships may offer opportunities for specific segments, regions, and companies.

Europe Coal Industry Company Market Share

Europe Coal Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the European coal industry, covering market dynamics, growth trends, key players, and future outlook. With a focus on the period 2019-2033, this report is essential for industry professionals, investors, and policymakers seeking to understand this evolving sector. The report includes detailed segmentation by coal type (Anthracite, Bituminous, Sub-Bituminous, Lignite) and application (Electricity, Steel, Cement, Other Applications), offering granular insights into market performance and future projections.

Europe Coal Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, and regulatory influences shaping the European coal market. The market is characterized by a moderate level of concentration, with a few major players holding significant market share, while numerous smaller companies operate regionally. Technological innovation is focused on improving extraction efficiency and reducing environmental impact. Stringent environmental regulations across Europe significantly impact operational costs and investment decisions. The rise of renewable energy sources presents a significant competitive threat, forcing coal companies to adapt and diversify. Mergers and acquisitions (M&A) activity has been moderate in recent years, driven by consolidation efforts among larger players and attempts to secure access to key resources.

- Market Concentration: xx% held by top 5 players in 2024.

- M&A Deal Volume (2019-2024): xx deals, totaling xx Million.

- Key Regulatory Frameworks: EU Emissions Trading System (ETS), national-level environmental regulations.

- Competitive Substitutes: Renewable energy sources (solar, wind, hydro).

- Innovation Barriers: High capital expenditure requirements, stringent environmental regulations.

Europe Coal Industry Growth Trends & Insights

The European coal market experienced a significant decline from 2019 to 2024, primarily driven by the accelerating transition to renewable energy sources and increasingly stringent environmental regulations. This downward trend, however, has been partially reversed by recent geopolitical events, notably the energy crisis sparked by the war in Ukraine. This has led to a resurgence in coal demand, especially for electricity generation, in several European nations. The forecast period (2025-2033) anticipates moderate growth, fueled by persistent energy demands, potential supply chain disruptions affecting alternative energy sources, and the fluctuating prices of natural gas and other renewables. Technological advancements focusing on enhanced efficiency and reduced environmental impact will remain pivotal for the industry's future. Simultaneously, evolving consumer behavior, reflecting heightened environmental awareness, will continue to exert pressure for a faster transition towards cleaner energy alternatives.

- Market Size (2024): xx Million units

- CAGR (2025-2033): xx%

- Market Penetration (Electricity Generation): xx% in 2024

Dominant Regions, Countries, or Segments in Europe Coal Industry

Germany, Poland, and Russia historically held the most significant shares of the European coal market. However, Germany's commitment to phasing out coal is expected to alter its market position. Lignite remains the dominant coal type in Europe, predominantly used for electricity generation. Bituminous coal is also significant, utilized in steel production and other industrial applications. Poland continues to be a significant producer and consumer of coal, while Russia faces challenges from both domestic and international factors impacting its coal exports. Growth is expected to be driven by regions where coal remains a key component of the energy mix. The demand for coal in steel and cement manufacturing acts as a supporting factor despite alternative materials becoming more prevalent.

- Leading Coal Type: Lignite (market share xx% in 2024)

- Leading Application: Electricity generation (market share xx% in 2024)

- Key Growth Drivers: Existing energy infrastructure reliance on coal, relatively lower costs compared to some alternatives in specific regions.

Europe Coal Industry Product Landscape

The European coal industry's product landscape is characterized by a mature technological base, with a strong emphasis on improving extraction and processing efficiency while minimizing environmental impact. While innovations in cleaner coal technologies exist, their widespread adoption remains limited due to high costs and competing renewable energy alternatives. The industry faces continuous pressure to curtail carbon emissions and enhance sustainability, prompting increased interest in carbon capture, utilization, and storage (CCUS) technologies. However, the relatively lower initial capital expenditure compared to renewable energy sources remains a significant competitive advantage for coal in certain contexts. The ongoing debate about the role of gas as a transition fuel also impacts the industry’s future.

Key Drivers, Barriers & Challenges in Europe Coal Industry

Key Drivers: Sustained energy demand in certain regions, strategic energy security concerns, and the affordability of coal compared to some alternative fuels, especially in the short term.

Key Challenges: Stringent environmental regulations leading to higher operating costs and limited expansion opportunities, competition from renewable energy sources reducing long-term demand, and supply chain disruptions impacting production and distribution. The phasing out of coal in several countries reduces market potential.

Emerging Opportunities in Europe Coal Industry

Emerging opportunities exist in the development and implementation of carbon capture and storage (CCS) technologies, improving energy efficiency in existing coal-fired power plants, and utilizing coal by-products in other industries. While the long-term outlook for coal is challenging, opportunities exist in targeted niches where coal’s established infrastructure and relative affordability persist.

Growth Accelerators in the Europe Coal Industry Industry

Technological breakthroughs in clean coal technologies and CCS could extend the lifespan of coal in power generation. Strategic partnerships between coal companies and renewable energy developers could enable a more sustainable transition away from coal, reducing the negative impact of the transition.

Key Players Shaping the Europe Coal Industry Market

- Jastrzębska Spółka Węglowa SA

- Suek AG

- Siberian Coal Energy Company

- UK Kuzbassrazrezugol OAO

- Lubelski Wegiel Bogdanka SA

- Mechel PAO

- Raspadskaya PAO

- Mitteldeutsche Braunkohlengesellschaft mbH (MIBRAG)

- Severstal PAO

Notable Milestones in Europe Coal Industry Sector

- October 2022: Agreement to expand the Garzweiler lignite mine in Germany, aiming to extract 280 million metric tons by 2030. This decision highlights the complex interplay between energy security concerns and environmental sustainability goals.

- August 2022: Reactivation of the Heyden coal power plant in Germany (875 MW capacity). This underscores the short-term reliance on coal to address energy supply shortages, even as long-term decarbonization plans remain in place.

- [Add other notable milestones as relevant, with brief descriptions and context]

In-Depth Europe Coal Industry Market Outlook

The future of the European coal industry is intertwined with the broader energy transition. While demand will continue to decline in many regions, coal will likely retain a role in the energy mix, particularly in countries with heavy reliance on coal-fired power plants and those seeking to maintain energy security in the short to medium term. Strategic investments in cleaner coal technologies and diversification into related businesses will be crucial for survival and growth within this evolving landscape. Opportunities for companies focusing on efficiency improvements, CCS, and niche applications will remain.

Europe Coal Industry Segmentation

-

1. Type

- 1.1. Anthracite

- 1.2. Bituminous

- 1.3. Sub-Bituminous

- 1.4. Lignite

-

2. Application

- 2.1. Electricity

- 2.2. Steel

- 2.3. Cement

- 2.4. Other Applications

Europe Coal Industry Segmentation By Geography

- 1. Russia

- 2. Germany

- 3. Poland

- 4. Rest of Europe

Europe Coal Industry Regional Market Share

Geographic Coverage of Europe Coal Industry

Europe Coal Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Renewable Energy Installations 4.; Energy Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. 4.; Political and Economic Instability

- 3.4. Market Trends

- 3.4.1. Electricity Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Coal Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Anthracite

- 5.1.2. Bituminous

- 5.1.3. Sub-Bituminous

- 5.1.4. Lignite

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Electricity

- 5.2.2. Steel

- 5.2.3. Cement

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.3.2. Germany

- 5.3.3. Poland

- 5.3.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Russia Europe Coal Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Anthracite

- 6.1.2. Bituminous

- 6.1.3. Sub-Bituminous

- 6.1.4. Lignite

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Electricity

- 6.2.2. Steel

- 6.2.3. Cement

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Germany Europe Coal Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Anthracite

- 7.1.2. Bituminous

- 7.1.3. Sub-Bituminous

- 7.1.4. Lignite

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Electricity

- 7.2.2. Steel

- 7.2.3. Cement

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Poland Europe Coal Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Anthracite

- 8.1.2. Bituminous

- 8.1.3. Sub-Bituminous

- 8.1.4. Lignite

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Electricity

- 8.2.2. Steel

- 8.2.3. Cement

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Europe Europe Coal Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Anthracite

- 9.1.2. Bituminous

- 9.1.3. Sub-Bituminous

- 9.1.4. Lignite

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Electricity

- 9.2.2. Steel

- 9.2.3. Cement

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Jastrzębska Spółka Węglowa SA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Suek AG

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Siberian Coal Energy Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 UK Kuzbassrazrezugol OAO

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Lubelski Wegiel Bogdanka SA

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Mechel PAO

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Raspadskaya PAO*List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Mitteldeutsche Braunkohlengesellschaft mbH (MIBRAG)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Severstal PAO

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Jastrzębska Spółka Węglowa SA

List of Figures

- Figure 1: Europe Coal Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Coal Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Coal Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Coal Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: Europe Coal Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Europe Coal Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: Europe Coal Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Coal Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Europe Coal Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Europe Coal Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 9: Europe Coal Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Europe Coal Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: Europe Coal Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Europe Coal Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: Europe Coal Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Europe Coal Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 15: Europe Coal Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 16: Europe Coal Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 17: Europe Coal Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Europe Coal Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 19: Europe Coal Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Europe Coal Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 21: Europe Coal Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Europe Coal Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 23: Europe Coal Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Europe Coal Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Europe Coal Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Europe Coal Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 27: Europe Coal Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Europe Coal Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 29: Europe Coal Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Europe Coal Industry Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Coal Industry?

The projected CAGR is approximately 1.9%.

2. Which companies are prominent players in the Europe Coal Industry?

Key companies in the market include Jastrzębska Spółka Węglowa SA, Suek AG, Siberian Coal Energy Company, UK Kuzbassrazrezugol OAO, Lubelski Wegiel Bogdanka SA, Mechel PAO, Raspadskaya PAO*List Not Exhaustive, Mitteldeutsche Braunkohlengesellschaft mbH (MIBRAG), Severstal PAO.

3. What are the main segments of the Europe Coal Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 42.6 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Renewable Energy Installations 4.; Energy Infrastructure Development.

6. What are the notable trends driving market growth?

Electricity Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Political and Economic Instability.

8. Can you provide examples of recent developments in the market?

October 2022: The German government has an agreement with a German multinational energy company that plans to expand the Garzweiler coal mine over Lutzerath village. The company plans to extract 280 million metric tons of lignite by 2030.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Coal Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Coal Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Coal Industry?

To stay informed about further developments, trends, and reports in the Europe Coal Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence