Key Insights

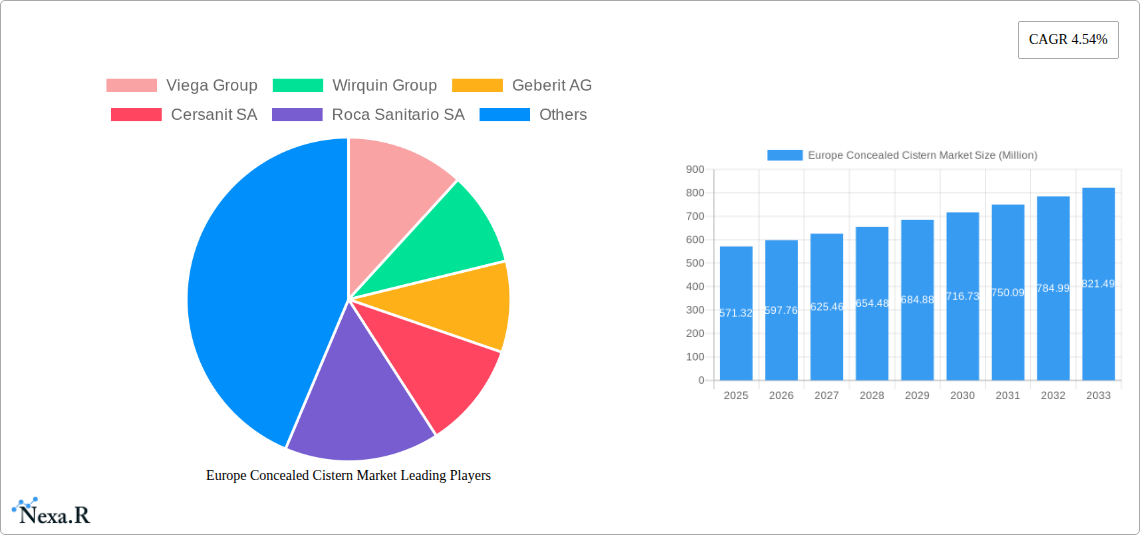

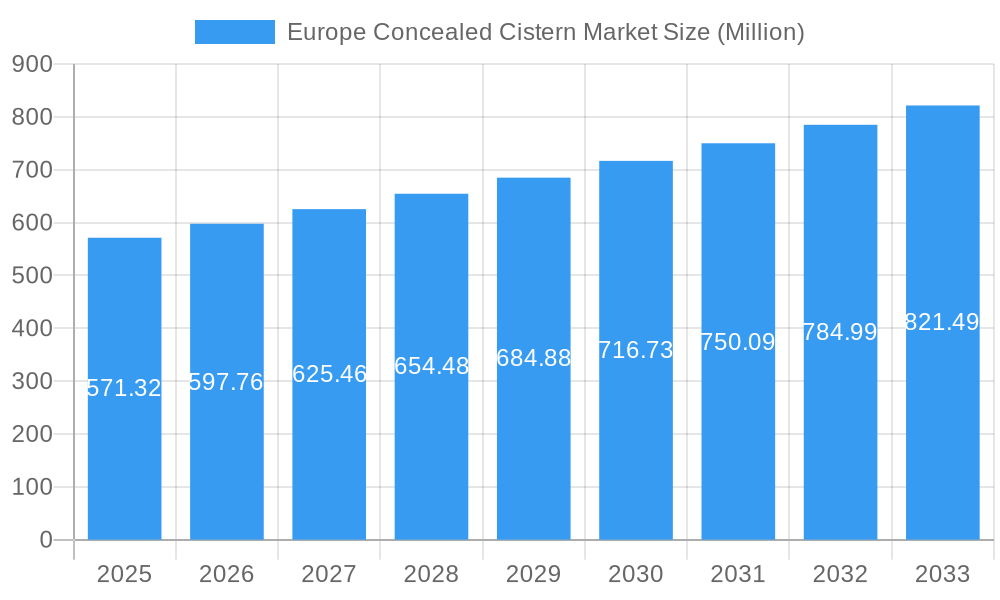

The European concealed cistern market, valued at €571.32 million in 2025, is projected to experience steady growth, driven by increasing demand for water-efficient plumbing solutions and the rising popularity of modern, space-saving bathroom designs across residential and commercial sectors. The market's Compound Annual Growth Rate (CAGR) of 4.54% from 2025 to 2033 reflects a sustained preference for concealed cisterns due to their aesthetic appeal and enhanced hygiene compared to exposed cisterns. Growth is fueled by robust construction activity, particularly in the residential sector across major European economies like Germany, the UK, and France. The preference for frameless and half-frame models indicates a trend towards minimalist bathroom designs. Online sales channels are experiencing significant growth, mirroring the broader shift towards e-commerce in the building materials sector. However, the market faces potential restraints from fluctuating raw material prices and economic uncertainties impacting construction activities. Competitive intensity is high, with major players like Viega, Grohe, and Geberit continually innovating to maintain market share through product differentiation and strategic partnerships with distributors. The sustained growth trajectory is expected to be supported by continuous technological advancements leading to improved water efficiency and smart features in concealed cistern systems.

Europe Concealed Cistern Market Market Size (In Million)

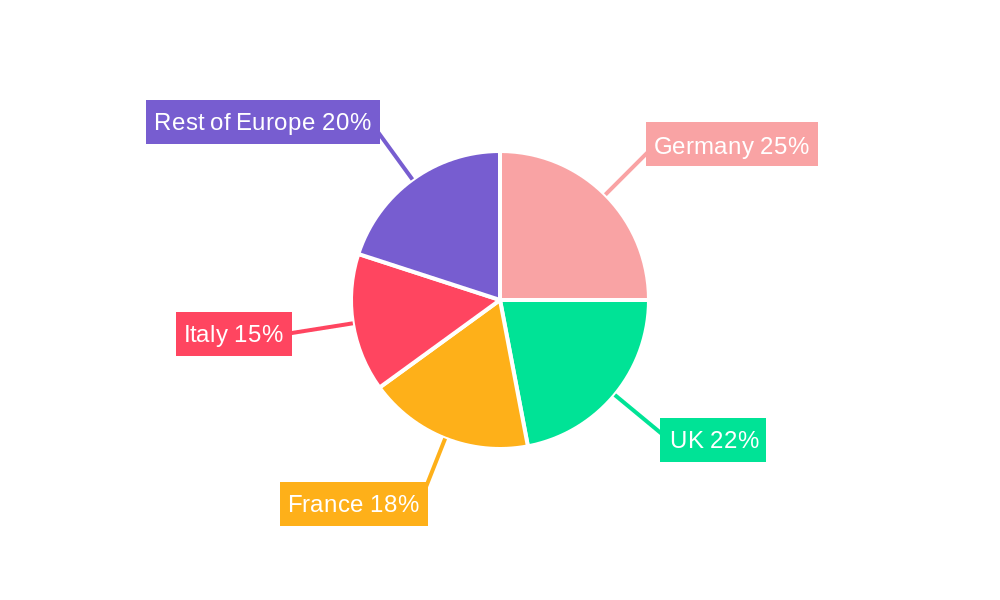

Further market segmentation reveals significant regional variations. Germany, the UK, and France represent the largest national markets, contributing significantly to the overall European market size. Italy and other countries like the Netherlands and Sweden represent important, albeit smaller, market segments. Within product types, frameless cisterns are anticipated to hold a major market share due to their design appeal, followed closely by half-frame and then with-frame cisterns. The commercial segment's growth will likely outpace the residential sector, driven by large-scale construction projects in commercial and public spaces demanding multiple concealed cistern installations. Strategic partnerships and strong distribution networks through home centers and specialty stores are crucial for sustained growth. The market is expected to benefit from the growing focus on sustainable building practices, aligning with the overall demand for water-saving solutions.

Europe Concealed Cistern Market Company Market Share

This in-depth report provides a comprehensive analysis of the Europe Concealed Cistern Market, covering market dynamics, growth trends, regional performance, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. The market is segmented by product type (With Frame, Without Frame, Half Frame), end-user (Residential, Commercial), distribution channel (Home Centers, Specialty Stores, Online Stores), and country (United Kingdom, Germany, France, Italy, Rest of Europe). The report offers invaluable insights for manufacturers, distributors, investors, and industry professionals seeking to navigate this evolving market.

Europe Concealed Cistern Market Market Dynamics & Structure

The Europe concealed cistern market is characterized by a dynamic landscape, showcasing moderate concentration with a few dominant players like Geberit AG, Viega Group, and Grohe AG holding substantial market share. A significant driver of this market is continuous technological innovation, with a strong emphasis on enhancing water efficiency and integrating advanced smart functionalities for greater user convenience. The market is also heavily influenced by stringent regulatory frameworks across European nations that mandate water conservation, directly shaping product development and encouraging the adoption of efficient solutions. While exposed cisterns present a competitive alternative, concealed cisterns maintain a strong foothold due to their superior aesthetic appeal and significant space-saving benefits, particularly crucial in modern, often compact living spaces. The residential segment continues to be the primary end-user, but a steady and promising growth is being observed in commercial applications, including hotels, offices, and public facilities. Mergers and acquisitions (M&A) activity has been moderate in recent years, with a notable number of strategic consolidations observed between 2019 and 2024, aimed at expanding market reach and product portfolios.

- Market Concentration: Moderately concentrated, with top 5 players estimated to hold approximately 60-70% market share in 2024, indicating a significant influence of established brands.

- Technological Innovation: The primary focus areas include advanced water-saving technologies (e.g., dual-flush systems, flow restrictors), seamless smart integration (e.g., wireless controls, app connectivity), and sophisticated, minimalist design aesthetics to complement modern interiors.

- Regulatory Framework: Stringent environmental and water conservation regulations across the EU and individual member states are a key catalyst, driving demand for high-efficiency concealed cisterns and penalizing wasteful alternatives.

- Competitive Substitutes: Exposed cisterns pose a minor competitive threat, primarily appealing to budget-conscious segments or specific renovation projects where minimal disruption is prioritized.

- End-User Demographics: The residential sector remains the dominant end-user, fueled by new constructions and extensive home renovation trends. The commercial sector is exhibiting robust and consistent growth, driven by a demand for modern, hygienic, and efficient sanitary solutions in hospitality and corporate spaces.

- M&A Trends: Moderate M&A activity, with approximately 5-7 major deals recorded between 2019 and 2024. Consolidation is a primary driver, enabling companies to gain economies of scale, broaden product offerings, and enhance their competitive positioning.

- Innovation Barriers: Significant barriers to innovation include high initial investment costs for research and development of cutting-edge technologies, the rigorous and time-consuming need for robust testing to meet stringent European quality and safety regulations, and the challenge of educating consumers about the long-term benefits of advanced concealed cistern systems.

Europe Concealed Cistern Market Growth Trends & Insights

The European concealed cistern market demonstrated a healthy Compound Annual Growth Rate (CAGR) of approximately 5.5% during the period of 2019-2024, culminating in a market size estimated at around 12.5 Million units in 2024. This commendable growth is underpinned by a confluence of critical factors. The escalating trend of urbanization and a sustained surge in new construction activities across key European economies have significantly boosted the demand for modern bathroom fixtures. Furthermore, the increasing global awareness of environmental issues and supportive government initiatives promoting water conservation have accelerated the adoption of water-efficient technologies, thereby fueling market expansion. Consumer preferences are demonstrably shifting towards aesthetically pleasing, minimalist, and space-saving bathroom solutions, positioning concealed cisterns as a highly desirable choice. Emerging technological disruptions, notably the integration of intuitive smart features and advanced wireless control systems, are not only enhancing user experience but also contributing to market premiumization and driving higher average selling prices. The market is projected to maintain its upward trajectory, with an anticipated CAGR of around 6.0% anticipated during the forecast period (2025-2033). This sustained growth is expected to be propelled by ongoing robust construction activity, rising disposable incomes across the continent, and continuous advancements in product innovation and smart home integration. Market penetration is forecast to reach an impressive 45-50% by 2033, signifying a widespread acceptance and adoption of concealed cisterns across European households and commercial establishments.

Dominant Regions, Countries, or Segments in Europe Concealed Cistern Market

Germany, the United Kingdom, and France collectively represent the leading markets for concealed cisterns in Europe, accounting for a substantial combined market share of approximately 55-60% in 2024. The robust performance in these countries is attributed to a combination of factors including the strong presence of established and innovative manufacturers, consistently high levels of construction activity, and relatively high disposable incomes that support investment in premium bathroom solutions. Within the product segments, "Without Frame" concealed cisterns currently hold the largest market share, estimated at around 40-45%. This dominance is largely driven by their inherent affordability and versatility, making them suitable for a broad spectrum of installation scenarios and price points. The residential segment unequivocally leads the end-user landscape, representing roughly 70-75% of the market, primarily fueled by new housing projects and extensive home renovation initiatives. However, the commercial sector is exhibiting particularly promising growth potential. In terms of distribution channels, Home Centers continue to be the primary and most significant channel, capturing an estimated 50-55% of sales due to their extensive reach, established retail infrastructure, and accessibility for consumers. Specialty plumbing and bathroom stores, as well as increasingly influential online retail platforms, follow as important secondary channels.

- Key Drivers for Germany: A highly robust and innovative construction industry, strong consumer spending power, and the strategic presence of leading global manufacturers contribute to Germany's leading position.

- Key Drivers for UK: Significant government-backed housing development projects, coupled with strong consumer demand for contemporary and efficient bathroom fixtures, are key growth catalysts.

- Key Drivers for France: Steady and consistent growth in the construction sector, alongside a strong national focus on energy-efficient building solutions and sustainable living, are driving demand.

- Product Type: Without Frame: This segment's dominance stems from its cost-effectiveness, ease of installation in diverse settings, and broad applicability across various bathroom designs, making it a popular choice for both new builds and renovations.

- End-User: Residential: The residential sector's leadership is a direct result of ongoing new home construction, significant investment in home renovations and upgrades, and a growing preference for concealed cisterns in both primary residences and holiday homes.

- Distribution Channel: Home Centers: Their extensive network, wide product selection, competitive pricing, and convenient accessibility make Home Centers the go-to destination for a majority of consumers purchasing concealed cisterns.

Europe Concealed Cistern Market Product Landscape

The product landscape of concealed cisterns in Europe is marked by continuous evolution and refinement, with manufacturers actively integrating a suite of advanced features. These include highly efficient dual-flush mechanisms for optimized water usage, cutting-edge water-saving technologies like flow restrictors and smart sensors, and sophisticated smart functionalities that enhance user experience and system control. A key focus for manufacturers is the development of improved, more robust designs that offer enhanced durability and longevity, alongside user-friendly interfaces that simplify operation and maintenance. Unique selling propositions that differentiate products in this competitive market include exceptionally silent flushing mechanisms, significantly reduced water consumption per flush, and seamless aesthetic integration with a wide range of bathroom fixtures and interior designs. Advancements in materials science are also playing a crucial role, leading to the development of cisterns that are not only lighter and more robust but also boast superior aesthetic appeal and contribute to a more sustainable product lifecycle.

Key Drivers, Barriers & Challenges in Europe Concealed Cistern Market

Key Drivers: Rising disposable incomes in many European countries are boosting demand for premium bathroom fittings. Increased focus on water conservation is driving the adoption of water-efficient concealed cisterns. Government incentives and regulatory frameworks promoting sustainable building practices further stimulate the market.

Key Challenges: Fluctuations in raw material prices and supply chain disruptions can impact manufacturing costs and profitability. Intense competition among established players puts pressure on pricing and profit margins. Stringent regulatory compliance requirements can add to the complexity and cost of product development.

Emerging Opportunities in Europe Concealed Cistern Market

The market presents opportunities for manufacturers offering smart concealed cisterns with integrated controls and monitoring capabilities. Untapped potential exists in the Eastern European countries, where rising living standards and increasing construction activity are creating new demand. Manufacturers can target niche markets by offering customized designs and solutions for specific applications. The growing interest in sustainable products opens opportunities for eco-friendly concealed cisterns made from recycled or sustainable materials.

Growth Accelerators in the Europe Concealed Cistern Market Industry

Technological advancements in water-saving mechanisms and smart technologies are major growth catalysts. Strategic partnerships between manufacturers and distributors can help expand market reach and increase brand visibility. Aggressive marketing campaigns promoting the benefits of concealed cisterns will increase adoption. Expansion into new markets in Eastern Europe and other regions holds significant growth potential.

Key Players Shaping the Europe Concealed Cistern Market Market

Notable Milestones in Europe Concealed Cistern Market Sector

- 2020: Geberit AG launches a new line of smart concealed cisterns with integrated water management features.

- 2021: Viega Group and Wirquin Group announce a strategic partnership to expand their distribution networks in Europe.

- 2022: New EU regulations concerning water efficiency in sanitary ware come into effect, impacting product development.

- 2023: Roca Sanitario SA introduces a new range of sustainable concealed cisterns made from recycled materials.

In-Depth Europe Concealed Cistern Market Market Outlook

The European concealed cistern market is poised for sustained growth in the coming years, driven by technological advancements, increasing construction activity, and the growing preference for energy-efficient and stylish bathroom solutions. Strategic investments in research and development, focus on sustainable manufacturing practices, and expansion into new markets will be key success factors. The integration of smart technologies and the development of innovative designs will further enhance market growth and create exciting opportunities for industry players.

Europe Concealed Cistern Market Segmentation

-

1. Product Type

- 1.1. With Frame

- 1.2. Without Frame

- 1.3. Half Frame

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Home Centers

- 3.2. Specialty Stores

- 3.3. Online Stores

Europe Concealed Cistern Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Concealed Cistern Market Regional Market Share

Geographic Coverage of Europe Concealed Cistern Market

Europe Concealed Cistern Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization and Renovation Activity; Advances in Technology and Innovative Developments

- 3.3. Market Restrains

- 3.3.1. High Initial Cost of Installation; Lack of Technical Proficiency; Limited Space Availability for Installation

- 3.4. Market Trends

- 3.4.1. Innovation in Design and Materials in Concealed Cistern Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Concealed Cistern Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. With Frame

- 5.1.2. Without Frame

- 5.1.3. Half Frame

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Home Centers

- 5.3.2. Specialty Stores

- 5.3.3. Online Stores

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Viega Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Wirquin Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Geberit AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cersanit SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Roca Sanitario SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ideal Standard International

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Villeroy & Boch AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Siamp

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Grohe AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TECE GmbH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Viega Group

List of Figures

- Figure 1: Europe Concealed Cistern Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Concealed Cistern Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Concealed Cistern Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Europe Concealed Cistern Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Europe Concealed Cistern Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Europe Concealed Cistern Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 5: Europe Concealed Cistern Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Europe Concealed Cistern Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: Europe Concealed Cistern Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Europe Concealed Cistern Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Europe Concealed Cistern Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: Europe Concealed Cistern Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 11: Europe Concealed Cistern Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Europe Concealed Cistern Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 13: Europe Concealed Cistern Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Europe Concealed Cistern Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: Europe Concealed Cistern Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Concealed Cistern Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Europe Concealed Cistern Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Europe Concealed Cistern Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Germany Europe Concealed Cistern Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Europe Concealed Cistern Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: France Europe Concealed Cistern Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: France Europe Concealed Cistern Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Italy Europe Concealed Cistern Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Italy Europe Concealed Cistern Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Spain Europe Concealed Cistern Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Spain Europe Concealed Cistern Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Netherlands Europe Concealed Cistern Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Netherlands Europe Concealed Cistern Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Belgium Europe Concealed Cistern Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Belgium Europe Concealed Cistern Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Sweden Europe Concealed Cistern Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Sweden Europe Concealed Cistern Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Norway Europe Concealed Cistern Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Norway Europe Concealed Cistern Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Poland Europe Concealed Cistern Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Poland Europe Concealed Cistern Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Denmark Europe Concealed Cistern Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Denmark Europe Concealed Cistern Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Concealed Cistern Market?

The projected CAGR is approximately 4.54%.

2. Which companies are prominent players in the Europe Concealed Cistern Market?

Key companies in the market include Viega Group, Wirquin Group, Geberit AG, Cersanit SA, Roca Sanitario SA, Ideal Standard International, Villeroy & Boch AG, Siamp, Grohe AG, TECE GmbH.

3. What are the main segments of the Europe Concealed Cistern Market?

The market segments include Product Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 571.32 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization and Renovation Activity; Advances in Technology and Innovative Developments.

6. What are the notable trends driving market growth?

Innovation in Design and Materials in Concealed Cistern Market.

7. Are there any restraints impacting market growth?

High Initial Cost of Installation; Lack of Technical Proficiency; Limited Space Availability for Installation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Concealed Cistern Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Concealed Cistern Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Concealed Cistern Market?

To stay informed about further developments, trends, and reports in the Europe Concealed Cistern Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence