Key Insights

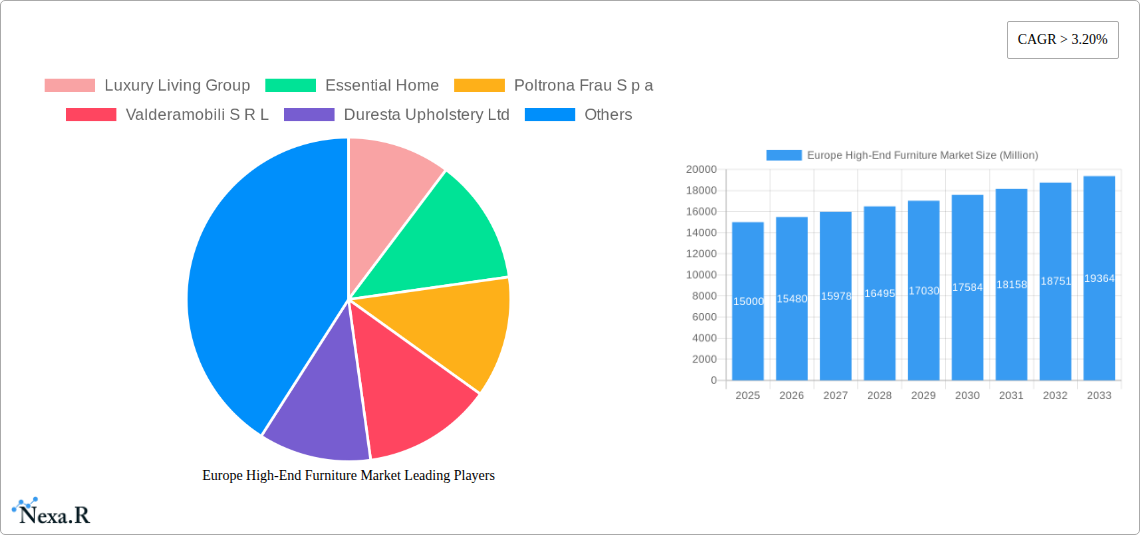

The European high-end furniture market, valued at approximately €15 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) exceeding 3.20% from 2025 to 2033. This growth is fueled by several key drivers. Firstly, the increasing disposable incomes of high-net-worth individuals across major European economies like Germany, France, and the UK are driving demand for luxury goods, including premium furniture. Secondly, a shift towards personalized and bespoke designs is evident, with consumers seeking unique pieces that reflect their individual tastes and lifestyles. This trend benefits established luxury brands and smaller, bespoke design studios alike. The rise of e-commerce platforms is also playing a significant role, providing increased accessibility to high-end furniture for a wider consumer base across Europe. However, economic downturns and potential fluctuations in consumer confidence could act as restraints, impacting the market's trajectory. Segmentation analysis reveals a strong preference for seating products (chairs, armchairs, sofas), followed by cabinets and entertainment units. Designer studios and furniture specialty stores remain crucial distribution channels, although online sales are progressively gaining traction. The residential segment dominates the end-user market, reflecting the growing focus on creating luxurious home environments. Leading brands like Poltrona Frau, Roche Bobois, and Molteni Group are leveraging their established reputations and design innovation to maintain their market leadership.

Europe High-End Furniture Market Market Size (In Billion)

The forecast for the European high-end furniture market points towards continued expansion, particularly in the segments catering to personalized designs and e-commerce channels. Growth will be regionally varied, with countries like Germany and the UK expected to continue leading the market due to their robust economies and affluent consumer base. Competition will intensify as both established luxury brands and emerging designers vie for market share. Successful players will need to adapt to the evolving consumer preferences and maintain a balance between traditional craftsmanship and innovative design. Sustainability and ethically sourced materials are also emerging as crucial factors influencing consumer choices, impacting production strategies and brand positioning. Effective marketing strategies emphasizing brand heritage, exclusivity, and exceptional craftsmanship will be essential for maintaining a strong presence in this competitive market.

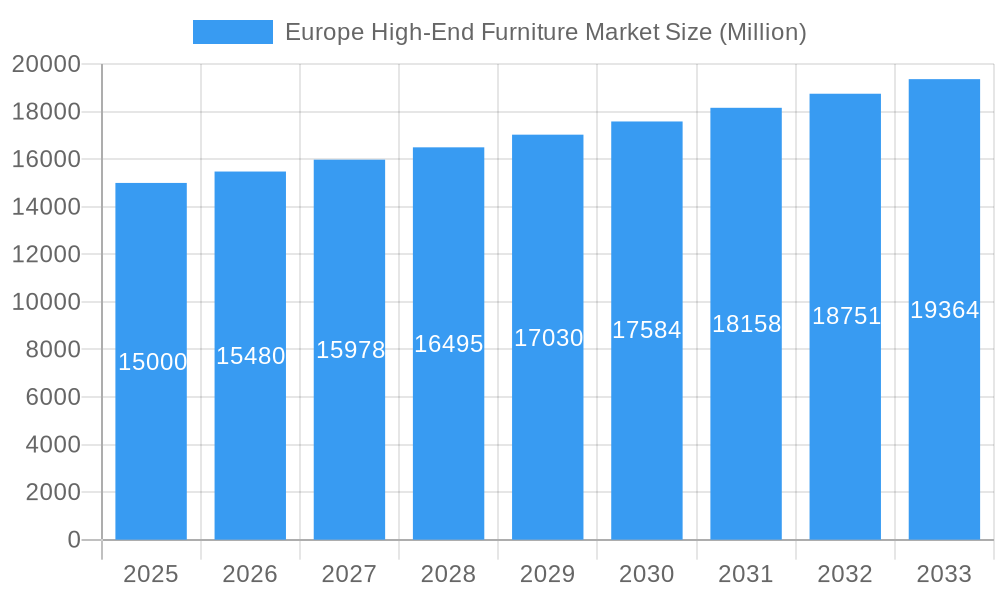

Europe High-End Furniture Market Company Market Share

Europe High-End Furniture Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe high-end furniture market, encompassing market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report segments the market by product (Seating Products, Cabinets & Entertainment Units, Tables, Beds, Other Products), distribution channel (Designer Studios, Furniture Specialty Stores, Online, Other), and end-user (Residential, Commercial). Key players analyzed include Luxury Living Group, Essential Home, Poltrona Frau S.p.a, Valderamobili S.R.L, Duresta Upholstery Ltd, Roche Bobois, Muebles Pic, Giovanni Visentin S.R.L, Luxxu, B&B Italia, Boca do Lobo, Molteni Group, and Ligne Roset.

Europe High-End Furniture Market Dynamics & Structure

This section delves into the intricate structure of the European high-end furniture market, analyzing market concentration, technological advancements, regulatory landscapes, competitive dynamics, and market trends. The analysis covers the period from 2019 to 2024, providing valuable insights into past performance and laying the groundwork for future projections.

- Market Concentration: The market exhibits a moderately concentrated structure, with a few major players holding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx in 2024, indicating a moderately competitive landscape.

- Technological Innovation: Technological advancements in materials, manufacturing processes (e.g., 3D printing, CNC machining), and design software are driving innovation, enabling customization and enhancing product quality. However, high initial investment costs pose a barrier to entry for smaller players.

- Regulatory Framework: EU regulations on product safety, sustainability, and environmental impact significantly influence the industry. Compliance with these regulations adds to production costs but builds consumer trust.

- Competitive Product Substitutes: The market faces competition from mid-range and mass-market furniture segments, posing a challenge to high-end brands.

- End-User Demographics: High-net-worth individuals, luxury hotels, and high-end commercial spaces are the primary drivers of demand. Changing consumer preferences towards sustainable and ethically sourced products are influencing purchasing decisions.

- M&A Trends: The market has witnessed a moderate number of mergers and acquisitions (M&A) deals over the past few years, primarily aimed at expanding market reach and product portfolios. The total deal volume is estimated at xx deals between 2019 and 2024, with an average deal value of xx million.

Europe High-End Furniture Market Growth Trends & Insights

This section provides a comprehensive analysis of the Europe high-end furniture market's growth trends, leveraging extensive data and insights to project future market size and adoption rates. The analysis considers technological disruptions, shifts in consumer preferences, and other market factors.

The European high-end furniture market has witnessed steady growth from 2019 to 2024. The market size reached xx million in 2024, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the historical period. This growth is attributed to several factors, including rising disposable incomes in key European markets, a growing preference for luxury goods, and increasing investments in commercial spaces such as high-end hotels and restaurants. Technological advancements, such as the introduction of smart furniture and the use of sustainable materials, are further driving market expansion. Consumer behavior is shifting towards personalized and bespoke furniture, fueling demand for custom-designed pieces. The market penetration rate for high-end furniture in the residential sector is estimated at xx% in 2024, while the commercial sector penetration is estimated at xx%. The forecast period (2025-2033) anticipates continued growth, with a projected CAGR of xx%, driven by factors such as increasing urbanization, growth of the tourism industry, and evolving consumer preferences. The market is expected to reach xx million by 2033.

Dominant Regions, Countries, or Segments in Europe High-End Furniture Market

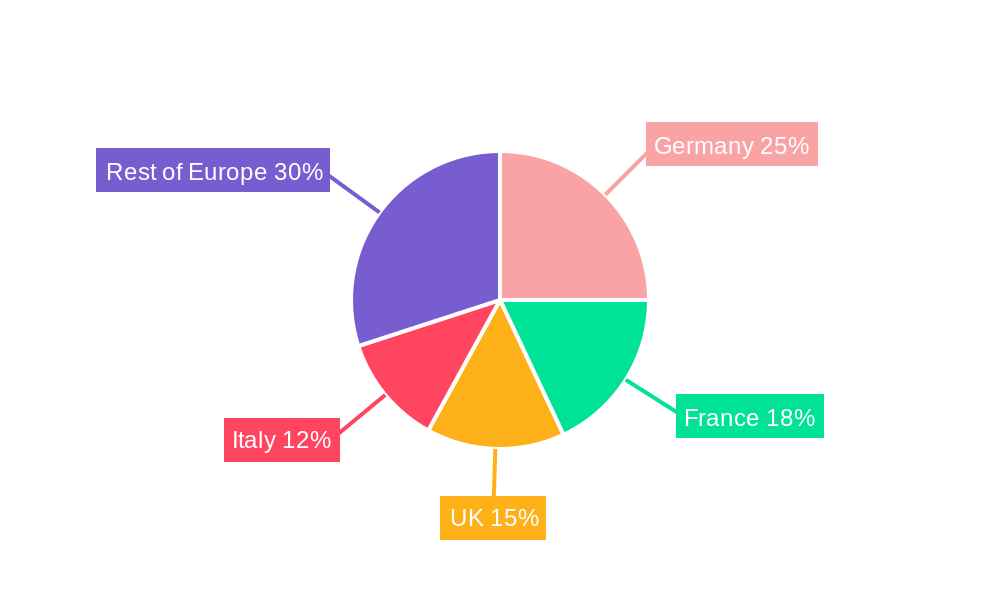

This section identifies the leading regions, countries, and market segments within the European high-end furniture market, analyzing the factors that contribute to their dominance.

- Leading Region: Western Europe (Germany, France, UK, Italy) commands the largest market share due to high disposable incomes and established design traditions.

- Leading Country: Germany leads the market in terms of value and volume, driven by its strong economy and consumer preference for high-quality furniture.

- Leading Product Segment: Seating products (chairs, armchairs, sofas) constitute the largest segment, followed by cabinets and entertainment units, due to their high demand in both residential and commercial settings.

- Leading Distribution Channel: Designer studios maintain a significant market share as they offer personalized services and curated product selections catering to the high-end customer base. However, the online channel is witnessing rapid growth, driven by increased internet penetration and e-commerce adoption.

- Leading End-User Segment: The residential segment holds the highest market share, due to increased demand for luxury and customized furniture for high-end homes. The commercial segment, particularly hotels and hospitality, is expected to show strong growth.

Key drivers include strong economic performance in certain European countries, investments in infrastructure projects (including luxury hotels and upscale developments), and supportive government policies promoting design and craftsmanship.

Europe High-End Furniture Market Product Landscape

The high-end furniture market showcases a variety of innovative products characterized by superior craftsmanship, high-quality materials (e.g., exotic woods, premium leathers), and sophisticated design. Key features include customization options, ergonomic designs (especially in seating), and the integration of smart technology in some product lines. This segment is driven by the increasing preference for unique and personalized furniture that reflects individual style and taste. Technological advancements, including advancements in materials science and manufacturing processes, enable the creation of lighter, stronger, and more aesthetically pleasing furniture pieces.

Key Drivers, Barriers & Challenges in Europe High-End Furniture Market

Key Drivers:

- Rising Disposable Incomes: Increased purchasing power fuels demand for luxury goods.

- Growing Affluent Population: A larger high-net-worth population drives market expansion.

- Emphasis on Design & Craftsmanship: Consumers value superior quality and aesthetic appeal.

Key Challenges:

- Supply Chain Disruptions: Global supply chain volatility affects material sourcing and production timelines. The impact on production costs is estimated at xx% in 2024.

- Fluctuating Raw Material Prices: Price volatility affects product pricing and profitability.

- Intense Competition: Competition from both domestic and international brands creates pressure on margins.

Emerging Opportunities in Europe High-End Furniture Market

- Sustainable and Eco-Friendly Furniture: Growing environmental consciousness is driving demand for eco-friendly materials and sustainable manufacturing practices.

- Smart Home Integration: Integration of smart technology into furniture pieces presents a promising avenue for growth.

- Customization and Personalization: The increasing demand for personalized furniture tailored to individual needs offers significant potential.

Growth Accelerators in the Europe High-End Furniture Market Industry

Strategic partnerships between high-end furniture brands and interior designers, collaborations with luxury hotels and developers, and the expansion into new markets will be key growth catalysts. Technological advancements, such as the adoption of 3D printing and virtual reality design tools, will further accelerate growth by enabling greater customization and reducing production time. The adoption of sustainable and ethical sourcing practices will bolster brand reputation and appeal to eco-conscious consumers.

Key Players Shaping the Europe High-End Furniture Market Market

- Luxury Living Group

- Essential Home

- Poltrona Frau S.p.a

- Valderamobili S.R.L

- Duresta Upholstery Ltd

- Roche Bobois

- Muebles Pic

- Giovanni Visentin S.R.L

- Luxxu

- B&B Italia

- Boca do Lobo

- Molteni Group

- Ligne Roset

Notable Milestones in Europe High-End Furniture Market Sector

- 2021-Q3: Luxury Living Group launched a new sustainable furniture collection.

- 2022-Q1: Poltrona Frau S.p.a partnered with a renowned architect for a limited edition chair.

- 2023-Q2: B&B Italia invested in a new state-of-the-art manufacturing facility. (Further milestones require specific data for accurate representation.)

In-Depth Europe High-End Furniture Market Market Outlook

The Europe high-end furniture market is poised for continued growth, driven by several factors, including rising disposable incomes, increasing demand for luxury and customized furniture, and technological advancements. Strategic partnerships, expansion into new markets, and the adoption of sustainable practices will be key drivers of future growth. The market is expected to witness a significant expansion in the forecast period (2025-2033), with substantial opportunities for players that effectively cater to the evolving needs and preferences of high-end consumers. The market's focus on sustainability, technology integration, and personalization will be crucial in shaping its future landscape.

Europe High-End Furniture Market Segmentation

-

1. Product

- 1.1. Seating Products (Chairs, Armchairs, Sofas)

- 1.2. Cabinets and Entertainment Units

- 1.3. Tables (Dining Tables, Reception Tables, etc.,)

- 1.4. Beds

- 1.5. Other Products

-

2. Distribution Channel

- 2.1. Designer Studios

- 2.2. Furniture Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

-

3. End-User

- 3.1. Residential

- 3.2. Commercial

Europe High-End Furniture Market Segmentation By Geography

- 1. Germany

- 2. Italy

- 3. United Kingdom

- 4. France

- 5. Rest of Europe

Europe High-End Furniture Market Regional Market Share

Geographic Coverage of Europe High-End Furniture Market

Europe High-End Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Health and Wellness Trends are Driving the Market; Rising Disposable Income is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Market Saturation is Handering the Growth; Seasonal Nature of Sales is Challenging the Market

- 3.4. Market Trends

- 3.4.1. Growing Demand for Seating Products is Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe High-End Furniture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Seating Products (Chairs, Armchairs, Sofas)

- 5.1.2. Cabinets and Entertainment Units

- 5.1.3. Tables (Dining Tables, Reception Tables, etc.,)

- 5.1.4. Beds

- 5.1.5. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Designer Studios

- 5.2.2. Furniture Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. Italy

- 5.4.3. United Kingdom

- 5.4.4. France

- 5.4.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Germany Europe High-End Furniture Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Seating Products (Chairs, Armchairs, Sofas)

- 6.1.2. Cabinets and Entertainment Units

- 6.1.3. Tables (Dining Tables, Reception Tables, etc.,)

- 6.1.4. Beds

- 6.1.5. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Designer Studios

- 6.2.2. Furniture Specialty Stores

- 6.2.3. Online

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Residential

- 6.3.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Italy Europe High-End Furniture Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Seating Products (Chairs, Armchairs, Sofas)

- 7.1.2. Cabinets and Entertainment Units

- 7.1.3. Tables (Dining Tables, Reception Tables, etc.,)

- 7.1.4. Beds

- 7.1.5. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Designer Studios

- 7.2.2. Furniture Specialty Stores

- 7.2.3. Online

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Residential

- 7.3.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. United Kingdom Europe High-End Furniture Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Seating Products (Chairs, Armchairs, Sofas)

- 8.1.2. Cabinets and Entertainment Units

- 8.1.3. Tables (Dining Tables, Reception Tables, etc.,)

- 8.1.4. Beds

- 8.1.5. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Designer Studios

- 8.2.2. Furniture Specialty Stores

- 8.2.3. Online

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Residential

- 8.3.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. France Europe High-End Furniture Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Seating Products (Chairs, Armchairs, Sofas)

- 9.1.2. Cabinets and Entertainment Units

- 9.1.3. Tables (Dining Tables, Reception Tables, etc.,)

- 9.1.4. Beds

- 9.1.5. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Designer Studios

- 9.2.2. Furniture Specialty Stores

- 9.2.3. Online

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Residential

- 9.3.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Rest of Europe Europe High-End Furniture Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Seating Products (Chairs, Armchairs, Sofas)

- 10.1.2. Cabinets and Entertainment Units

- 10.1.3. Tables (Dining Tables, Reception Tables, etc.,)

- 10.1.4. Beds

- 10.1.5. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Designer Studios

- 10.2.2. Furniture Specialty Stores

- 10.2.3. Online

- 10.2.4. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Residential

- 10.3.2. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Luxury Living Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Essential Home

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Poltrona Frau S p a

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Valderamobili S R L

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Duresta Upholstery Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Roche Bobois

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Muebles Pic

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Giovanni Visentin S R L

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Luxxu

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 B&B Italia

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Boca Do Lobo

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Molteni Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Ligne Roset

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Luxury Living Group

List of Figures

- Figure 1: Europe High-End Furniture Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe High-End Furniture Market Share (%) by Company 2025

List of Tables

- Table 1: Europe High-End Furniture Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Europe High-End Furniture Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: Europe High-End Furniture Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 4: Europe High-End Furniture Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 5: Europe High-End Furniture Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 6: Europe High-End Furniture Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 7: Europe High-End Furniture Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Europe High-End Furniture Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Europe High-End Furniture Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 10: Europe High-End Furniture Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 11: Europe High-End Furniture Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 12: Europe High-End Furniture Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 13: Europe High-End Furniture Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 14: Europe High-End Furniture Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 15: Europe High-End Furniture Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Europe High-End Furniture Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Europe High-End Furniture Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 18: Europe High-End Furniture Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 19: Europe High-End Furniture Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 20: Europe High-End Furniture Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 21: Europe High-End Furniture Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 22: Europe High-End Furniture Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 23: Europe High-End Furniture Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Europe High-End Furniture Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Europe High-End Furniture Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 26: Europe High-End Furniture Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 27: Europe High-End Furniture Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 28: Europe High-End Furniture Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 29: Europe High-End Furniture Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 30: Europe High-End Furniture Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 31: Europe High-End Furniture Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Europe High-End Furniture Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Europe High-End Furniture Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 34: Europe High-End Furniture Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 35: Europe High-End Furniture Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 36: Europe High-End Furniture Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 37: Europe High-End Furniture Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 38: Europe High-End Furniture Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 39: Europe High-End Furniture Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: Europe High-End Furniture Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Europe High-End Furniture Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 42: Europe High-End Furniture Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 43: Europe High-End Furniture Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 44: Europe High-End Furniture Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 45: Europe High-End Furniture Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 46: Europe High-End Furniture Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 47: Europe High-End Furniture Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 48: Europe High-End Furniture Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe High-End Furniture Market?

The projected CAGR is approximately 4.25%.

2. Which companies are prominent players in the Europe High-End Furniture Market?

Key companies in the market include Luxury Living Group, Essential Home, Poltrona Frau S p a, Valderamobili S R L, Duresta Upholstery Ltd, Roche Bobois, Muebles Pic, Giovanni Visentin S R L, Luxxu, B&B Italia, Boca Do Lobo, Molteni Group, Ligne Roset.

3. What are the main segments of the Europe High-End Furniture Market?

The market segments include Product, Distribution Channel, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Health and Wellness Trends are Driving the Market; Rising Disposable Income is Driving the Market.

6. What are the notable trends driving market growth?

Growing Demand for Seating Products is Driving the Market Growth.

7. Are there any restraints impacting market growth?

Market Saturation is Handering the Growth; Seasonal Nature of Sales is Challenging the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe High-End Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe High-End Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe High-End Furniture Market?

To stay informed about further developments, trends, and reports in the Europe High-End Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence