Key Insights

The European non-resilient floor covering market is poised for significant expansion, driven by sustained demand for attractive and durable flooring solutions across residential and commercial applications. Key growth catalysts include widespread renovation and new construction projects in leading European economies, alongside a consumer shift towards premium, long-lasting materials such as ceramic, stone, and laminate. The increasing preference for sustainable and eco-friendly flooring options further fuels this market's upward trajectory. Segmentation includes end-users (residential, commercial), distribution channels (home centers, specialty stores, online), and product types (ceramic, stone, laminate, wood). While ceramic tiles currently lead, laminate and wood segments show robust growth due to their affordability and versatility.

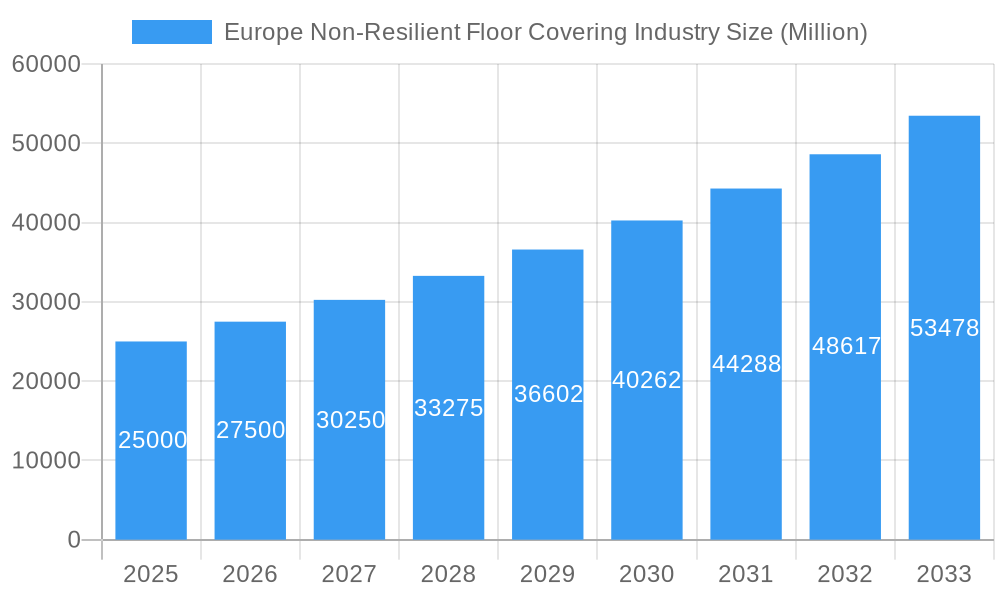

Europe Non-Resilient Floor Covering Industry Market Size (In Billion)

The market navigates challenges including raw material price volatility and intensifying competition, demanding continuous innovation and strategic marketing. Despite potential economic headwinds and construction sector fluctuations, the long-term outlook remains strong. The market is projected to reach approximately 312.46 billion by the base year 2025, with a compound annual growth rate (CAGR) of 5.7%. Leading companies such as BerryAlloc, Forbo Flooring, and Mohawk Industries are actively investing in R&D to introduce novel products and enhance their market presence.

Europe Non-Resilient Floor Covering Industry Company Market Share

Europe Non-Resilient Floor Covering Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the European non-resilient floor covering market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a base year of 2025, this report delves into market dynamics, growth trends, and key players, equipping you with the knowledge to navigate this dynamic sector. The report segments the market by end-user (residential, commercial), distribution channel (home centers, specialty stores, online, other), and product type (ceramic tiles, stone tiles, laminate tiles, wood tiles, others). Market values are presented in million units.

Europe Non-Resilient Floor Covering Industry Market Dynamics & Structure

The European non-resilient floor covering market is characterized by a moderately consolidated structure, with key players like Berry Alloc, Forbo Flooring, Porcelanosa Group, and Tarkett holding significant market share. Technological innovation, particularly in materials science and design, is a key driver, alongside evolving consumer preferences for sustainable and aesthetically appealing flooring solutions. Stringent environmental regulations are increasingly shaping industry practices, encouraging the adoption of eco-friendly materials and manufacturing processes. The market faces competition from resilient flooring alternatives, but the unique aesthetic and performance characteristics of non-resilient options continue to fuel demand. Mergers and acquisitions have played a significant role in shaping the market landscape, with larger players consolidating their market positions.

- Market Concentration: The top 5 players account for approximately xx% of the market.

- Technological Innovation: Focus on sustainable materials (recycled content, low-VOC emissions) and improved durability.

- Regulatory Framework: Increasingly stringent environmental regulations drive adoption of eco-friendly products.

- Competitive Substitutes: Resilient flooring options (vinyl, linoleum) pose a competitive threat.

- M&A Activity: xx major M&A deals were recorded between 2019 and 2024.

Europe Non-Resilient Floor Covering Industry Growth Trends & Insights

The European non-resilient floor covering market experienced steady growth during the historical period (2019-2024), with a CAGR of xx%. This growth is projected to continue during the forecast period (2025-2033), driven by factors such as increasing disposable incomes, rising construction activity, and a growing preference for aesthetically pleasing and durable flooring solutions in both residential and commercial settings. Technological advancements, such as the development of larger format tiles and innovative surface treatments, are further enhancing market appeal. Consumer preferences are shifting towards sustainable and eco-friendly options, creating opportunities for manufacturers offering green certifications and sustainable sourcing. Market penetration in certain segments, such as online sales, continues to grow, indicating evolving distribution channels.

Dominant Regions, Countries, or Segments in Europe Non-Resilient Floor Covering Industry

Western European countries, particularly Germany, France, and the UK, constitute the largest segments of the European non-resilient flooring market due to high construction activity and strong consumer spending. The residential segment exhibits higher growth potential compared to the commercial segment, driven by renovations and new home constructions. Home centers dominate the distribution channel landscape but online sales are experiencing rapid growth.

- Key Drivers: Strong economic performance in key European countries, robust construction sector, increasing disposable incomes.

- Dominance Factors: High consumer demand, established distribution networks, strong brand presence.

- Growth Potential: Untapped potential in Eastern European markets, expansion of online sales channels.

Within product types, ceramic tiles dominate the market owing to their versatility and affordability. However, stone tiles and wood tiles are gaining traction due to rising demand for premium flooring options.

Europe Non-Resilient Floor Covering Industry Product Landscape

The European non-resilient floor covering market showcases diverse product offerings, encompassing various materials, designs, and sizes. Ceramic tiles continue to dominate, offering a wide range of styles, colors, and finishes. Stone tiles provide a premium alternative, prized for their durability and aesthetic appeal. Laminate and wood tiles offer cost-effective solutions, while innovations in manufacturing techniques are enhancing their performance characteristics and aesthetic appeal. Technological advancements focus on improving durability, water resistance, and ease of installation, alongside incorporating sustainable materials and manufacturing processes.

Key Drivers, Barriers & Challenges in Europe Non-Resilient Floor Covering Industry

Key Drivers: Rising disposable incomes, robust construction activity, increasing demand for aesthetically appealing and durable flooring solutions, technological innovation, and growing preference for sustainable products.

Challenges: Fluctuations in raw material prices, intense competition, supply chain disruptions, and environmental regulations. The impact of supply chain disruptions in 2022-2023 resulted in an estimated xx% reduction in production output.

Emerging Opportunities in Europe Non-Resilient Floor Covering Industry

The market presents opportunities in sustainable and eco-friendly products, large-format tiles, innovative designs that mimic natural materials, and specialized flooring solutions for niche markets (e.g., healthcare, hospitality). Expansion into Eastern European markets offers significant growth potential, while leveraging online sales channels can enhance market reach and accessibility.

Growth Accelerators in the Europe Non-Resilient Floor Covering Industry Industry

Long-term growth will be fueled by technological advancements in materials science, design innovations that cater to evolving consumer preferences, strategic partnerships that expand distribution networks, and expansion into emerging markets. Sustainable manufacturing practices and eco-friendly product offerings will become increasingly important factors driving market growth.

Key Players Shaping the Europe Non-Resilient Floor Covering Market

- Berry Alloc

- Forbo Flooring

- Porcelanosa Group

- Parador

- Johnson Tiles

- Shaw Industries Inc

- Mohawk Industries Inc

- Beaulieu International Group

- Tarkett Inc

- Atlas Concorde SPA

Notable Milestones in Europe Non-Resilient Floor Covering Industry Sector

- July 2022: Beaulieu International Group announced further price increases across its flooring portfolio due to sustained pressure on raw material and energy costs.

- 2022: Tarkett released its 2021 CSR report, outlining ambitious climate targets for 2030, including a 30% reduction in greenhouse gas emissions across its value chain.

In-Depth Europe Non-Resilient Floor Covering Industry Market Outlook

The European non-resilient floor covering market is poised for continued growth, driven by robust demand from both residential and commercial sectors. Strategic investments in innovation, sustainable manufacturing, and market expansion will be crucial for long-term success. The focus on eco-friendly materials and designs will shape future market dynamics, presenting both challenges and opportunities for industry players. The continued shift towards online sales channels will also significantly influence distribution strategies and market competitiveness.

Europe Non-Resilient Floor Covering Industry Segmentation

-

1. Product

- 1.1. Ceramic Tiles Flooring

- 1.2. Stone Tiles Flooring

- 1.3. Laminate Tiles Flooring

- 1.4. Wood Tiles Flooring

- 1.5. Others

-

2. End-User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Home Centers

- 3.2. Specialty Stores

- 3.3. Online

- 3.4. Other Distribution Channels

Europe Non-Resilient Floor Covering Industry Segmentation By Geography

- 1. Spain

- 2. Germany

- 3. Italy

- 4. United Kingdom

- 5. Rest Countries in Europe

Europe Non-Resilient Floor Covering Industry Regional Market Share

Geographic Coverage of Europe Non-Resilient Floor Covering Industry

Europe Non-Resilient Floor Covering Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Construction and Real Estate Sector; Adoption of Ceramic tiles for Sustainable Development of Buildings

- 3.3. Market Restrains

- 3.3.1. Volatile Raw Material Prices; Increasing Regulations and Tariffs

- 3.4. Market Trends

- 3.4.1. Growing Residential Construction Industry Across Europe is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Non-Resilient Floor Covering Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Ceramic Tiles Flooring

- 5.1.2. Stone Tiles Flooring

- 5.1.3. Laminate Tiles Flooring

- 5.1.4. Wood Tiles Flooring

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Home Centers

- 5.3.2. Specialty Stores

- 5.3.3. Online

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Spain

- 5.4.2. Germany

- 5.4.3. Italy

- 5.4.4. United Kingdom

- 5.4.5. Rest Countries in Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Spain Europe Non-Resilient Floor Covering Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Ceramic Tiles Flooring

- 6.1.2. Stone Tiles Flooring

- 6.1.3. Laminate Tiles Flooring

- 6.1.4. Wood Tiles Flooring

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Home Centers

- 6.3.2. Specialty Stores

- 6.3.3. Online

- 6.3.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Germany Europe Non-Resilient Floor Covering Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Ceramic Tiles Flooring

- 7.1.2. Stone Tiles Flooring

- 7.1.3. Laminate Tiles Flooring

- 7.1.4. Wood Tiles Flooring

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Home Centers

- 7.3.2. Specialty Stores

- 7.3.3. Online

- 7.3.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Italy Europe Non-Resilient Floor Covering Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Ceramic Tiles Flooring

- 8.1.2. Stone Tiles Flooring

- 8.1.3. Laminate Tiles Flooring

- 8.1.4. Wood Tiles Flooring

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Home Centers

- 8.3.2. Specialty Stores

- 8.3.3. Online

- 8.3.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. United Kingdom Europe Non-Resilient Floor Covering Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Ceramic Tiles Flooring

- 9.1.2. Stone Tiles Flooring

- 9.1.3. Laminate Tiles Flooring

- 9.1.4. Wood Tiles Flooring

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Home Centers

- 9.3.2. Specialty Stores

- 9.3.3. Online

- 9.3.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Rest Countries in Europe Europe Non-Resilient Floor Covering Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Ceramic Tiles Flooring

- 10.1.2. Stone Tiles Flooring

- 10.1.3. Laminate Tiles Flooring

- 10.1.4. Wood Tiles Flooring

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Home Centers

- 10.3.2. Specialty Stores

- 10.3.3. Online

- 10.3.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Berry Alloc**List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Forbo Flooring

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Porcelanosa Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Parador

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Johnson Tiles

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Shaw Industries Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mohawk Industries Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Beaulieu International Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Tarkett Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Atlas Concorde SPA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Berry Alloc**List Not Exhaustive

List of Figures

- Figure 1: Europe Non-Resilient Floor Covering Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Non-Resilient Floor Covering Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 6: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 7: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 10: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 11: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 14: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 15: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 16: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 18: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 19: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 20: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 22: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 23: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 24: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Non-Resilient Floor Covering Industry?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the Europe Non-Resilient Floor Covering Industry?

Key companies in the market include Berry Alloc**List Not Exhaustive, Forbo Flooring, Porcelanosa Group, Parador, Johnson Tiles, Shaw Industries Inc, Mohawk Industries Inc, Beaulieu International Group, Tarkett Inc, Atlas Concorde SPA.

3. What are the main segments of the Europe Non-Resilient Floor Covering Industry?

The market segments include Product, End-User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 312.46 billion as of 2022.

5. What are some drivers contributing to market growth?

Expanding Construction and Real Estate Sector; Adoption of Ceramic tiles for Sustainable Development of Buildings.

6. What are the notable trends driving market growth?

Growing Residential Construction Industry Across Europe is Driving the Market.

7. Are there any restraints impacting market growth?

Volatile Raw Material Prices; Increasing Regulations and Tariffs.

8. Can you provide examples of recent developments in the market?

In 2022, Beaulieu International Group To Implement Further Price Increases Across Its Flooring Solutions Portfolio. B.I.G. is a leading producer of resilient flooring, hard flooring, tufted carpet and mats, needle felt and artificial grass, in Europe, North America, Russia-CIS and Australia. The sustained price pressure of polymers, plasticizers, logistics and energy is obliging us to further adapt our list prices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Non-Resilient Floor Covering Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Non-Resilient Floor Covering Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Non-Resilient Floor Covering Industry?

To stay informed about further developments, trends, and reports in the Europe Non-Resilient Floor Covering Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence