Key Insights

The European nuclear reactor decommissioning market is poised for significant expansion, driven by the aging nuclear power infrastructure and increasingly stringent regulatory frameworks. Valued at 9.84 billion in the base year 2025, the market is projected to achieve a Compound Annual Growth Rate (CAGR) of 18.5% from 2025 to 2033. This growth trajectory is underpinned by a rising number of reactors reaching their operational end-of-life, mandating complex and substantial decommissioning procedures. Key growth catalysts include heightened demand for specialized services such as radioactive waste management, site remediation, and dismantling, alongside intensified environmental and nuclear safety regulations. Substantial governmental funding for decommissioning initiatives further bolsters market development. Market segmentation spans applications (commercial, prototype, research), capacity (below 100 MW, 100-1000 MW, above 1000 MW), and reactor types (Pressurized Water Reactor, Boiling Water Reactor, Gas-Cooled Reactor, others), presenting diverse strategic opportunities for industry participants. Germany, France, and the United Kingdom are anticipated to lead market share due to their extensive nuclear power generation capacity and aging reactor fleets.

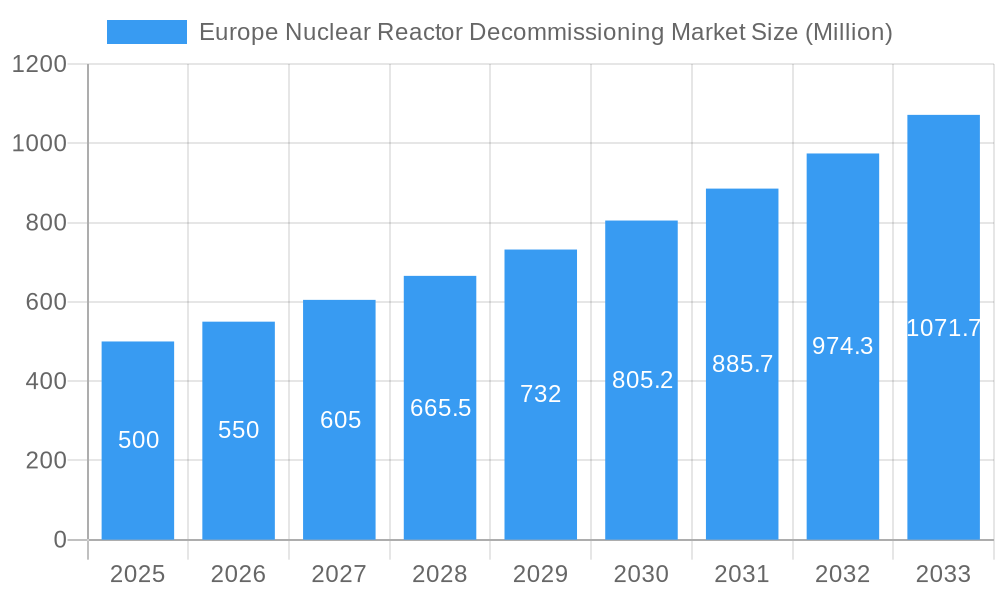

Europe Nuclear Reactor Decommissioning Market Market Size (In Billion)

Competitive dynamics within the European nuclear reactor decommissioning market are escalating, with established corporations and specialized enterprises actively pursuing contracts. Leading entities are leveraging their expertise in nuclear engineering, project management, and waste management to secure market positions. However, the market faces challenges, including substantial capital investment requirements, potential regulatory obstacles, and a persistent need for highly skilled professionals. Successful navigation of these hurdles will be critical for companies seeking to capitalize on this burgeoning sector. Future growth will be shaped by advancements in decommissioning technologies, evolving environmental standards, and the potential for extended reactor lifespans through refurbishment. The market outlook remains robust, driven by the imperative for the safe dismantling of aging nuclear facilities across Europe.

Europe Nuclear Reactor Decommissioning Market Company Market Share

Europe Nuclear Reactor Decommissioning Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Europe Nuclear Reactor Decommissioning market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The market is segmented by application (Commercial Power Reactor, Prototype Power Reactor, Research Reactor), capacity (Below 100 MW, Between 100-1000 MW, Above 1000 MW), and reactor type (Pressurized Water Reactor, Boiling Water Reactor, Gas Cooled Reactor, Other Reactor Types). The report covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), projecting significant growth opportunities within the parent market of Nuclear Power and the child market of Decommissioning Services. The total market size is projected to reach xx Million by 2033.

Europe Nuclear Reactor Decommissioning Market Dynamics & Structure

The European nuclear reactor decommissioning market is characterized by a moderate level of concentration, with several key players holding significant market share. The market is driven by the increasing number of aging nuclear power plants reaching the end of their operational lifespan, stringent regulatory frameworks mandating safe decommissioning practices, and technological advancements in dismantling and waste management techniques. However, high decommissioning costs, complex regulatory processes, and the need for specialized expertise pose significant challenges. Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with a focus on strategic partnerships and collaborations to acquire specialized skills and technologies.

- Market Concentration: Moderately concentrated, with the top 5 players holding approximately xx% of the market share in 2024.

- Technological Innovation: Focus on robotic dismantling, advanced waste management solutions, and improved safety protocols. Barriers include high R&D costs and regulatory approvals.

- Regulatory Framework: Stringent regulations across European nations regarding nuclear safety and waste disposal drive decommissioning activities but also add complexity.

- Competitive Landscape: Competitive intensity is moderate, characterized by both large multinational corporations and specialized decommissioning firms.

- M&A Activity: Moderate level of M&A activity, driven by the need for specialized expertise and access to advanced technologies. An estimated xx M&A deals were concluded between 2019 and 2024.

Europe Nuclear Reactor Decommissioning Market Growth Trends & Insights

The European nuclear reactor decommissioning market is poised for substantial expansion in the coming years, driven by a confluence of factors. A significant portion of Europe's nuclear power plant infrastructure is nearing or has surpassed its operational lifespan, initiating a wave of large-scale and complex decommissioning projects. Continuous innovation in decommissioning technologies is instrumental in enhancing operational efficiency, mitigating risks, and importantly, reducing overall project costs. This technological evolution is expected to foster a higher adoption rate of advanced solutions, projecting a compound annual growth rate (CAGR) of approximately [Insert specific CAGR % here] between 2025 and 2033. While consumer behavior is not a direct market driver, increasing public and governmental emphasis on environmental stewardship and the secure management of nuclear legacy sites is a significant underlying influence. The market penetration of cutting-edge decommissioning technologies is anticipated to reach around [Insert specific penetration % here] by 2033, underscoring the growing sophistication and adoption of specialized methodologies.

Dominant Regions, Countries, or Segments in Europe Nuclear Reactor Decommissioning Market

Geographically, countries like France, Germany, and the United Kingdom are expected to lead the European nuclear reactor decommissioning market. This dominance stems from their substantial installed base of nuclear power plants, many of which are in various stages of their lifecycle and approaching decommissioning. From an application perspective, the Commercial Power Reactor segment represents the largest and most active area, directly linked to the number of operational reactors slated for decommissioning. Within the reactor capacity segmentation, units ranging from 100-1000 MW are anticipated to constitute the largest and fastest-growing segment, reflecting the prevalent sizes of currently operating plants. In terms of reactor technology, Pressurized Water Reactors (PWRs) hold the dominant share, a direct consequence of their widespread adoption across the European nuclear landscape.

- Key Geographical Drivers:

- High concentration of aging nuclear power plants, particularly in France, Germany, and the UK.

- Robust regulatory frameworks mandating safe and comprehensive decommissioning practices.

- Active government support through dedicated funding programs and policy initiatives to facilitate decommissioning.

- Factors Contributing to Dominance:

- Extensive existing nuclear power plant portfolios requiring eventual decommissioning.

- Well-established national and international expertise and infrastructure in nuclear decommissioning.

- Supportive and predictable regulatory environments that facilitate project planning and execution.

Europe Nuclear Reactor Decommissioning Market Product Landscape

The product landscape includes a wide range of services and technologies, from initial site surveys and planning to final site restoration. Innovations focus on improving safety, efficiency, and cost-effectiveness. This includes the use of robotics, advanced waste management systems, and specialized decommissioning tools. Unique selling propositions often revolve around specific expertise in handling various reactor types and minimizing environmental impact.

Key Drivers, Barriers & Challenges in Europe Nuclear Reactor Decommissioning Market

Key Drivers: The primary impetus for market growth is the advancing age of nuclear power facilities across Europe, coupled with increasingly stringent environmental regulations that necessitate responsible and thorough decommissioning. Growing public awareness and demand for secure nuclear waste management further amplify the need for these services. Crucially, supportive government policies and dedicated financial allocations are instrumental in accelerating the pace and scale of decommissioning activities.

Challenges: The decommissioning process is inherently complex and costly, presenting significant financial hurdles. A shortage of highly specialized skilled personnel, lengthy and intricate regulatory approval pathways, and the potential for public apprehension or opposition can impede progress. Furthermore, disruptions within the supply chain for specialized equipment and services can impact project timelines and budget adherence. The cumulative effect of these challenges is estimated to potentially influence projected market growth by approximately [Insert specific % reduction here] by 2033.

Emerging Opportunities in Europe Nuclear Reactor Decommissioning Market

Emerging opportunities lie in the development and deployment of innovative technologies such as robotics and AI for enhanced efficiency and safety. Expansion into new markets with emerging decommissioning needs, and providing integrated decommissioning and waste management solutions are also significant opportunities. The exploration of alternative uses for decommissioned sites, such as renewable energy facilities, represents a potentially lucrative area.

Growth Accelerators in the Europe Nuclear Reactor Decommissioning Market Industry

Technological advancements, strategic partnerships between decommissioning firms and technology providers, and expansion into new markets will significantly accelerate market growth. Governments' commitment to sustainable nuclear waste management through policy support and funding will also prove crucial for long-term growth.

Key Players Shaping the Europe Nuclear Reactor Decommissioning Market Market

- WS Atkins PLC

- Electricite de France SA

- NorthStar Group Services Inc

- GE Hitachi Nuclear Services

- Cavendish Nuclear Ltd

- James Fisher & Sons PLC

- Fluor Corporation

- Babcock International Group PLC

- Studsvik AB

Notable Milestones in Europe Nuclear Reactor Decommissioning Market Sector

- June 2022: Enresa completes demolition of the turbine building at the Jose Cabrera nuclear power plant in Spain.

- December 2021: Westinghouse Electric Company signs a contract with RWE Nuclear GmbH to dismantle two reactors in Gundremmingen, Germany.

In-Depth Europe Nuclear Reactor Decommissioning Market Market Outlook

The European nuclear reactor decommissioning market holds significant long-term growth potential, driven by the aging nuclear power plant fleet and the increasing need for safe and efficient decommissioning solutions. Strategic partnerships, technological advancements, and supportive government policies will be crucial for realizing this potential. The market is expected to witness continued consolidation among key players, with further M&A activity anticipated. The focus will remain on enhancing efficiency, reducing costs, and minimizing the environmental impact of decommissioning activities.

Europe Nuclear Reactor Decommissioning Market Segmentation

-

1. Reactor Type

- 1.1. Pressurized Water Reactor

- 1.2. Boiling Water Reactor

- 1.3. Gas Cooled Reactor

- 1.4. Other Reactor Types

-

2. Application

- 2.1. Commercial Power Reactor

- 2.2. Prototype Power Reactor

- 2.3. Research Reactor

-

3. Capacity

- 3.1. Below 100 MW

- 3.2. Between 100 - 1000 MW

- 3.3. Above 1000 MW

Europe Nuclear Reactor Decommissioning Market Segmentation By Geography

- 1. France

- 2. Germany

- 3. United Kingdom

- 4. Ukraine

- 5. Rest of Europe

Europe Nuclear Reactor Decommissioning Market Regional Market Share

Geographic Coverage of Europe Nuclear Reactor Decommissioning Market

Europe Nuclear Reactor Decommissioning Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Presence of Strict Government Regulations to Control Air Pollution

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Research Reactors to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Nuclear Reactor Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Reactor Type

- 5.1.1. Pressurized Water Reactor

- 5.1.2. Boiling Water Reactor

- 5.1.3. Gas Cooled Reactor

- 5.1.4. Other Reactor Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial Power Reactor

- 5.2.2. Prototype Power Reactor

- 5.2.3. Research Reactor

- 5.3. Market Analysis, Insights and Forecast - by Capacity

- 5.3.1. Below 100 MW

- 5.3.2. Between 100 - 1000 MW

- 5.3.3. Above 1000 MW

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. France

- 5.4.2. Germany

- 5.4.3. United Kingdom

- 5.4.4. Ukraine

- 5.4.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Reactor Type

- 6. France Europe Nuclear Reactor Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Reactor Type

- 6.1.1. Pressurized Water Reactor

- 6.1.2. Boiling Water Reactor

- 6.1.3. Gas Cooled Reactor

- 6.1.4. Other Reactor Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Commercial Power Reactor

- 6.2.2. Prototype Power Reactor

- 6.2.3. Research Reactor

- 6.3. Market Analysis, Insights and Forecast - by Capacity

- 6.3.1. Below 100 MW

- 6.3.2. Between 100 - 1000 MW

- 6.3.3. Above 1000 MW

- 6.1. Market Analysis, Insights and Forecast - by Reactor Type

- 7. Germany Europe Nuclear Reactor Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Reactor Type

- 7.1.1. Pressurized Water Reactor

- 7.1.2. Boiling Water Reactor

- 7.1.3. Gas Cooled Reactor

- 7.1.4. Other Reactor Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Commercial Power Reactor

- 7.2.2. Prototype Power Reactor

- 7.2.3. Research Reactor

- 7.3. Market Analysis, Insights and Forecast - by Capacity

- 7.3.1. Below 100 MW

- 7.3.2. Between 100 - 1000 MW

- 7.3.3. Above 1000 MW

- 7.1. Market Analysis, Insights and Forecast - by Reactor Type

- 8. United Kingdom Europe Nuclear Reactor Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Reactor Type

- 8.1.1. Pressurized Water Reactor

- 8.1.2. Boiling Water Reactor

- 8.1.3. Gas Cooled Reactor

- 8.1.4. Other Reactor Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Commercial Power Reactor

- 8.2.2. Prototype Power Reactor

- 8.2.3. Research Reactor

- 8.3. Market Analysis, Insights and Forecast - by Capacity

- 8.3.1. Below 100 MW

- 8.3.2. Between 100 - 1000 MW

- 8.3.3. Above 1000 MW

- 8.1. Market Analysis, Insights and Forecast - by Reactor Type

- 9. Ukraine Europe Nuclear Reactor Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Reactor Type

- 9.1.1. Pressurized Water Reactor

- 9.1.2. Boiling Water Reactor

- 9.1.3. Gas Cooled Reactor

- 9.1.4. Other Reactor Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Commercial Power Reactor

- 9.2.2. Prototype Power Reactor

- 9.2.3. Research Reactor

- 9.3. Market Analysis, Insights and Forecast - by Capacity

- 9.3.1. Below 100 MW

- 9.3.2. Between 100 - 1000 MW

- 9.3.3. Above 1000 MW

- 9.1. Market Analysis, Insights and Forecast - by Reactor Type

- 10. Rest of Europe Europe Nuclear Reactor Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Reactor Type

- 10.1.1. Pressurized Water Reactor

- 10.1.2. Boiling Water Reactor

- 10.1.3. Gas Cooled Reactor

- 10.1.4. Other Reactor Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Commercial Power Reactor

- 10.2.2. Prototype Power Reactor

- 10.2.3. Research Reactor

- 10.3. Market Analysis, Insights and Forecast - by Capacity

- 10.3.1. Below 100 MW

- 10.3.2. Between 100 - 1000 MW

- 10.3.3. Above 1000 MW

- 10.1. Market Analysis, Insights and Forecast - by Reactor Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 WS Atkins PLC*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Electricite de France SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NorthStar Group Services Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GE Hitachi Nuclear Services

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cavendish Nuclear Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 James Fisher & Sons PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fluor Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Babcock International Group PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Studsvik AB

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 WS Atkins PLC*List Not Exhaustive

List of Figures

- Figure 1: Europe Nuclear Reactor Decommissioning Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Nuclear Reactor Decommissioning Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 2: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 4: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 6: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 8: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 10: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 12: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 14: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 16: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 18: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 20: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 22: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Application 2020 & 2033

- Table 23: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 24: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Nuclear Reactor Decommissioning Market?

The projected CAGR is approximately 18.5%.

2. Which companies are prominent players in the Europe Nuclear Reactor Decommissioning Market?

Key companies in the market include WS Atkins PLC*List Not Exhaustive, Electricite de France SA, NorthStar Group Services Inc, GE Hitachi Nuclear Services, Cavendish Nuclear Ltd, James Fisher & Sons PLC, Fluor Corporation, Babcock International Group PLC, Studsvik AB.

3. What are the main segments of the Europe Nuclear Reactor Decommissioning Market?

The market segments include Reactor Type, Application, Capacity.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.84 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Presence of Strict Government Regulations to Control Air Pollution.

6. What are the notable trends driving market growth?

Research Reactors to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Renewable Energy.

8. Can you provide examples of recent developments in the market?

June 2022- The Spanish decommissioning and waste management firm Enresa announced the completion of the demolition works on the last remaining large building, the turbine building, at the Jose Cabrera (Zorita) nuclear power plant in Spain. The 30 meters high structure made of reinforced concrete was converted to the Auxiliary Decommissioning Building, where radioactive waste from dismantling the plant's active parts was conditioned.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Nuclear Reactor Decommissioning Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Nuclear Reactor Decommissioning Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Nuclear Reactor Decommissioning Market?

To stay informed about further developments, trends, and reports in the Europe Nuclear Reactor Decommissioning Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence