Key Insights

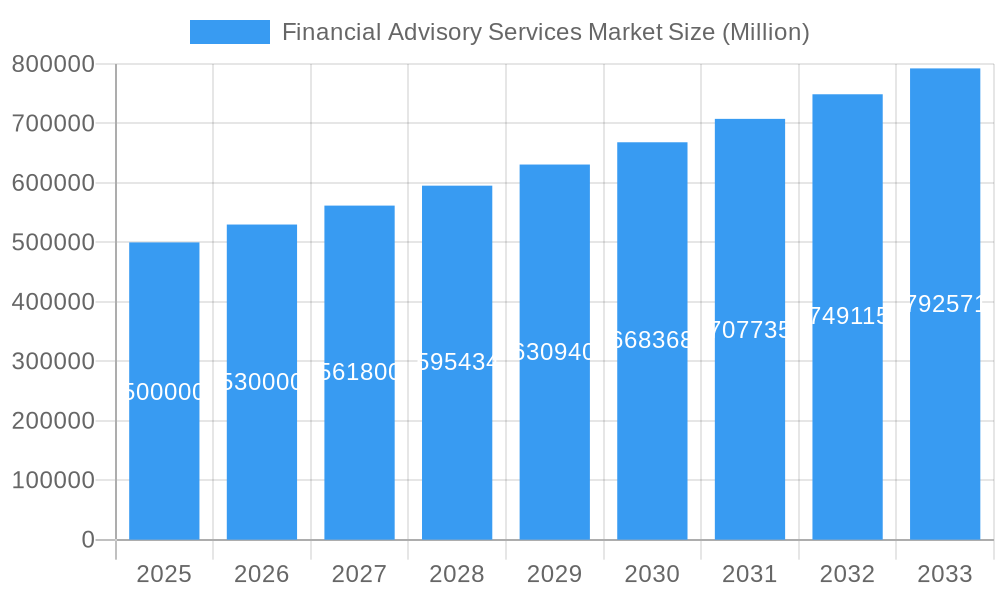

The Financial Advisory Services market is projected for substantial expansion, exhibiting a Compound Annual Growth Rate (CAGR) of 8.9%. This growth is propelled by several key factors. Escalating regulatory complexity across global financial markets necessitates expert guidance for both individuals and institutions. The increasing emphasis on wealth management and retirement planning, particularly among younger demographics, is significantly driving demand for personalized financial advice. The proliferation of fintech and digital platforms is also expanding advisory service reach, offering innovative and accessible solutions. Leading firms are strategically investing in technology and broadening their service offerings to leverage these trends. Market segmentation spans diverse service types, including investment management, retirement planning, and wealth management, alongside varied client demographics such as high-net-worth individuals and corporations. Despite challenges like economic volatility and competition from automated advisory solutions, the market outlook is robust, forecasting considerable growth.

Financial Advisory Services Market Market Size (In Billion)

With an estimated market size of $134.87 billion in the base year 2025, and a sustained growth trajectory, significant opportunities exist for both established and emerging market participants. Competition is intense among financial institutions, consulting firms, and fintech innovators, all focused on enhancing technological capabilities and client acquisition. While North America and Europe currently lead in market penetration, emerging economies in Asia and Latin America are anticipated to experience significant growth. Success in this dynamic market will hinge on specialized expertise, tailored client service, and strategic technology adoption to meet the evolving demands of a sophisticated investor base.

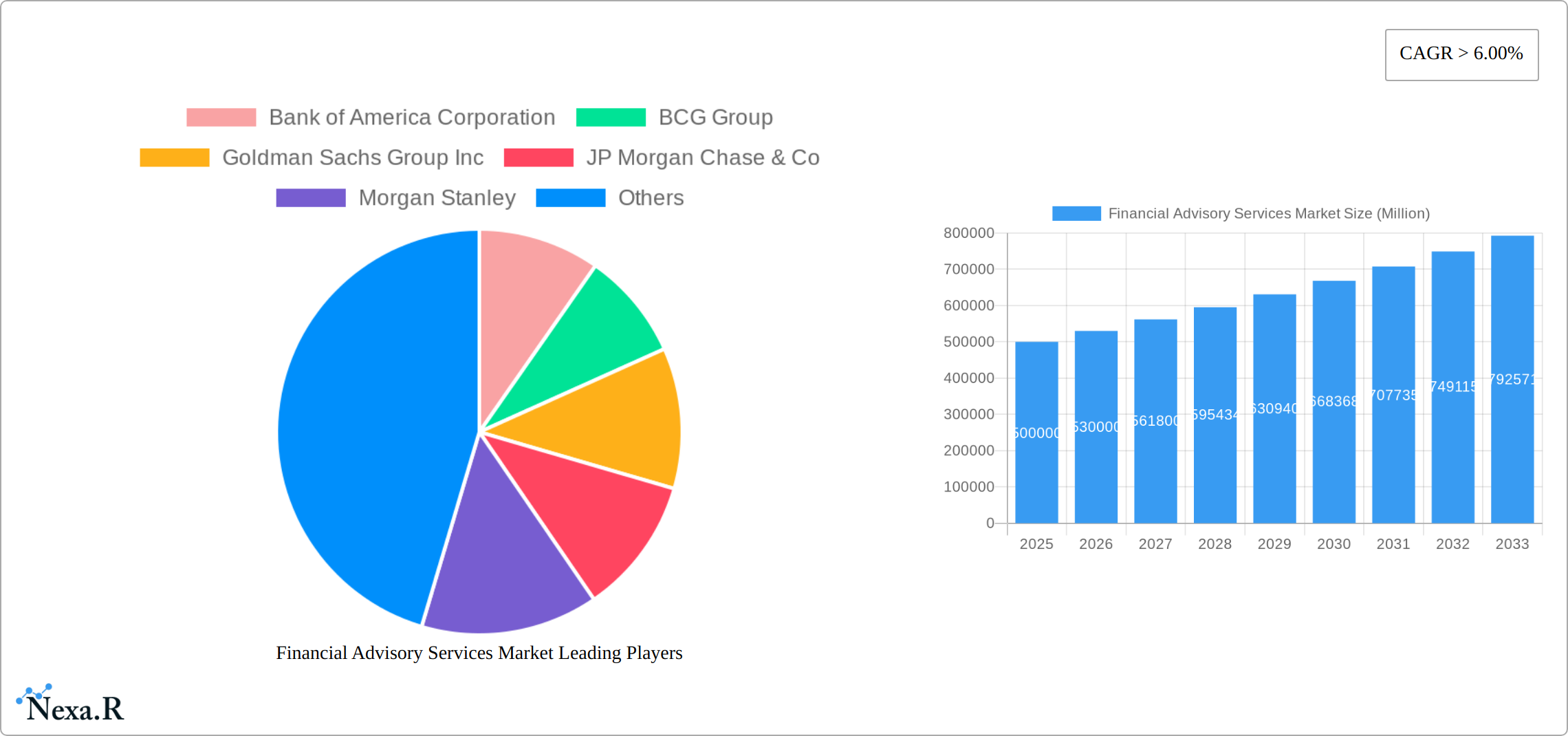

Financial Advisory Services Market Company Market Share

Financial Advisory Services Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Financial Advisory Services market, encompassing its dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report segments the market into various sub-sectors [Specific sub-sectors to be added based on available data] providing a granular understanding of the parent market and its various child markets. The total market size is estimated at XXX Million in 2025 and is projected to reach XXX Million by 2033.

Financial Advisory Services Market Dynamics & Structure

The Financial Advisory Services market is characterized by a moderately concentrated structure, with key players like Bank of America Corporation, BCG Group, Goldman Sachs Group Inc, JP Morgan Chase & Co, Morgan Stanley, Deloitte, EY Financial Services, KPMG, PwC, and Wells Fargo & Co. holding significant market share. However, the market also accommodates numerous smaller niche players. The market's growth is fueled by technological innovation, particularly in areas like AI-powered portfolio management and robo-advisory platforms. Regulatory frameworks, including compliance requirements and evolving data privacy regulations, play a significant role in shaping market dynamics. Competitive substitutes, such as DIY investment platforms and online financial tools, exert pressure on traditional advisory services. The end-user demographic is expanding, driven by increasing financial literacy and the growing demand for personalized wealth management solutions across age groups and income levels. M&A activity remains significant, with deal volumes averaging xx per year over the past five years (2019-2024), reflecting the industry's consolidation trend.

- Market Concentration: Moderately concentrated, with top 10 players holding approximately xx% market share in 2025.

- Technological Innovation: AI, robo-advisory, blockchain technology are key drivers.

- Regulatory Framework: Compliance, data privacy regulations impacting operational costs and strategies.

- Competitive Substitutes: DIY investment platforms and online financial tools pose competitive pressure.

- End-User Demographics: Growing demand from diverse age groups and income levels.

- M&A Trends: Average of xx M&A deals annually (2019-2024), indicating ongoing consolidation.

Financial Advisory Services Market Growth Trends & Insights

The Financial Advisory Services market experienced a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). This growth is driven by several factors, including rising disposable incomes, increased awareness of wealth management, and the adoption of sophisticated financial planning solutions. Technological advancements, such as algorithmic trading and personalized financial advice, are accelerating adoption rates. Consumer behavior is shifting towards digital platforms, demanding seamless online experiences and personalized financial advice. Market penetration is expected to increase from xx% in 2025 to xx% by 2033, driven by wider accessibility and affordability of financial advisory services. [Further detailed analysis using specific data points to replace XXX].

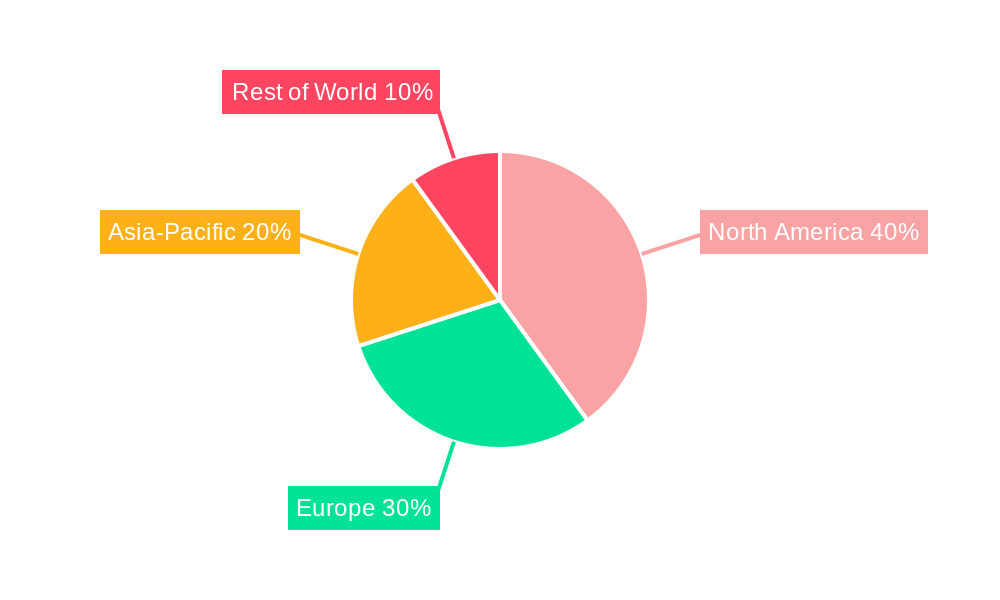

Dominant Regions, Countries, or Segments in Financial Advisory Services Market

[Detailed analysis of dominant regions/countries/segments to be added here (600 words). Include specific data points for market share and growth potential. Use bullet points to highlight key drivers.] For example, North America currently holds the largest market share due to its well-developed financial infrastructure and high disposable income levels. Asia-Pacific is expected to exhibit the highest growth rate due to rapid economic expansion and a burgeoning middle class.

- North America: High disposable incomes, developed financial infrastructure.

- Europe: Stringent regulatory environment, increasing adoption of digital platforms.

- Asia-Pacific: Rapid economic growth, expanding middle class.

- Other Regions: [Add relevant regions and their drivers]

Financial Advisory Services Market Product Landscape

The Financial Advisory Services market is characterized by a sophisticated and evolving suite of offerings designed to meet diverse client needs. Core services encompass comprehensive investment management, strategic financial planning, meticulous retirement planning, and expert tax advisory. Recent product innovations are heavily influenced by the digital transformation, with a strong emphasis on hyper-personalized digital solutions. These often integrate advanced AI-driven tools for sophisticated portfolio optimization, dynamic risk management, and predictive financial modeling. Performance metrics are increasingly shifting beyond traditional returns to encompass broader measures of success, such as enhanced client satisfaction, superior risk-adjusted returns, and the achievement of sustainable long-term financial outcomes. The unique selling propositions in this competitive landscape are increasingly defined by deeply personalized financial planning strategies, specialized, niche expertise in complex asset classes, and the seamless integration of cutting-edge technologies that enhance client experience and advisory efficiency.

Key Drivers, Barriers & Challenges in Financial Advisory Services Market

Key Drivers: The market is propelled by several robust drivers including sustained wealth accumulation across demographics, a burgeoning demand for bespoke and actionable financial advice tailored to individual circumstances, and the relentless pace of technological advancements that enable more efficient and accessible advisory services. Furthermore, proactive government initiatives aimed at fostering financial literacy and promoting long-term financial well-being are also significant contributors to market growth.

Key Barriers & Challenges: Navigating a complex and ever-changing regulatory landscape presents a significant barrier. Economic downturns and periods of market volatility can erode client confidence and impact asset values. The intense competition from agile and innovative fintech firms, offering alternative and often disruptive advisory models, poses a continuous challenge. Maintaining and reinforcing client trust, particularly in the face of market uncertainties and economic headwinds, is paramount. Furthermore, the escalating threat of sophisticated cybersecurity attacks and stringent data privacy concerns represent critical operational risks that demand robust and proactive mitigation strategies.

Emerging Opportunities in Financial Advisory Services Market

Significant growth opportunities lie in exploring untapped markets within developing economies, where financial advisory services are still nascent but demand is growing. The increasing global imperative for sustainable and ESG-aligned investments is creating a substantial niche for advisors who can guide clients in making ethically and environmentally conscious investment decisions. The widespread adoption and continuous evolution of fintech solutions are not only a challenge but also a fertile ground for innovation, offering new avenues for service delivery and client engagement. The strategic integration of Artificial Intelligence (AI) and advanced big data analytics promises to unlock unprecedented levels of personalization and efficiency, enabling advisors to offer more precise, proactive, and value-driven services.

Growth Accelerators in the Financial Advisory Services Market Industry

Strategic collaborations and partnerships with forward-thinking fintech companies are crucial growth accelerators, allowing for the co-creation of innovative solutions and the expansion of service reach. Deliberately expanding into underserved or emerging markets presents substantial opportunities for client acquisition and market penetration. The introduction and promotion of innovative financial products and advisory models that address evolving client needs and market trends are also key to driving growth. Essential for maintaining a competitive edge and driving sustained growth is continuous investment in upgrading technological infrastructure and enhancing data analytics capabilities, enabling a deeper understanding of client behavior and market dynamics.

Key Players Shaping the Financial Advisory Services Market Market

Notable Milestones in Financial Advisory Services Market Sector

- February 2023: Morgan Stanley Investment Management received CSRC approval for full control of Morgan Stanley Huaxin Funds, expanding its presence in China.

- February 2023: Boston Consulting Group hired Axel Weber, former president of Germany's central bank, as a senior advisor.

In-Depth Financial Advisory Services Market Market Outlook

The Financial Advisory Services market is poised for sustained growth, driven by technological advancements, increasing financial literacy, and a growing demand for personalized wealth management. Strategic partnerships, expansion into new markets, and the development of innovative products and services will be crucial for success. The market's future potential is significant, particularly in developing economies and within the rapidly evolving digital landscape.

Financial Advisory Services Market Segmentation

-

1. Type

- 1.1. Corporate Finance

- 1.2. Accounting Advisory

- 1.3. Tax Advisory

- 1.4. Transaction Services

- 1.5. Risk Management

-

2. Organization Size

- 2.1. Large Enterprises

- 2.2. Small & Medium-Sized Enterprises

-

3. Industry Vertical

- 3.1. Bfsi

- 3.2. It And Telecom

- 3.3. Manufacturing

- 3.4. Retail And E-Commerce

- 3.5. Public Sector

- 3.6. Healthcare

Financial Advisory Services Market Segmentation By Geography

-

1. North America

- 1.1. USA

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. UK

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. Australia

- 3.4. India

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. Saudi Arabia

- 4.2. Egypt

- 4.3. UAE

- 4.4. Rest of Middle East and Africa

-

5. South America

- 5.1. Argentina

- 5.2. Colombia

- 5.3. Rest of South America

Financial Advisory Services Market Regional Market Share

Geographic Coverage of Financial Advisory Services Market

Financial Advisory Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Majority of Revenues generated from United states

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Corporate Finance

- 5.1.2. Accounting Advisory

- 5.1.3. Tax Advisory

- 5.1.4. Transaction Services

- 5.1.5. Risk Management

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Large Enterprises

- 5.2.2. Small & Medium-Sized Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. Bfsi

- 5.3.2. It And Telecom

- 5.3.3. Manufacturing

- 5.3.4. Retail And E-Commerce

- 5.3.5. Public Sector

- 5.3.6. Healthcare

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Corporate Finance

- 6.1.2. Accounting Advisory

- 6.1.3. Tax Advisory

- 6.1.4. Transaction Services

- 6.1.5. Risk Management

- 6.2. Market Analysis, Insights and Forecast - by Organization Size

- 6.2.1. Large Enterprises

- 6.2.2. Small & Medium-Sized Enterprises

- 6.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 6.3.1. Bfsi

- 6.3.2. It And Telecom

- 6.3.3. Manufacturing

- 6.3.4. Retail And E-Commerce

- 6.3.5. Public Sector

- 6.3.6. Healthcare

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Corporate Finance

- 7.1.2. Accounting Advisory

- 7.1.3. Tax Advisory

- 7.1.4. Transaction Services

- 7.1.5. Risk Management

- 7.2. Market Analysis, Insights and Forecast - by Organization Size

- 7.2.1. Large Enterprises

- 7.2.2. Small & Medium-Sized Enterprises

- 7.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 7.3.1. Bfsi

- 7.3.2. It And Telecom

- 7.3.3. Manufacturing

- 7.3.4. Retail And E-Commerce

- 7.3.5. Public Sector

- 7.3.6. Healthcare

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Corporate Finance

- 8.1.2. Accounting Advisory

- 8.1.3. Tax Advisory

- 8.1.4. Transaction Services

- 8.1.5. Risk Management

- 8.2. Market Analysis, Insights and Forecast - by Organization Size

- 8.2.1. Large Enterprises

- 8.2.2. Small & Medium-Sized Enterprises

- 8.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 8.3.1. Bfsi

- 8.3.2. It And Telecom

- 8.3.3. Manufacturing

- 8.3.4. Retail And E-Commerce

- 8.3.5. Public Sector

- 8.3.6. Healthcare

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Corporate Finance

- 9.1.2. Accounting Advisory

- 9.1.3. Tax Advisory

- 9.1.4. Transaction Services

- 9.1.5. Risk Management

- 9.2. Market Analysis, Insights and Forecast - by Organization Size

- 9.2.1. Large Enterprises

- 9.2.2. Small & Medium-Sized Enterprises

- 9.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 9.3.1. Bfsi

- 9.3.2. It And Telecom

- 9.3.3. Manufacturing

- 9.3.4. Retail And E-Commerce

- 9.3.5. Public Sector

- 9.3.6. Healthcare

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Corporate Finance

- 10.1.2. Accounting Advisory

- 10.1.3. Tax Advisory

- 10.1.4. Transaction Services

- 10.1.5. Risk Management

- 10.2. Market Analysis, Insights and Forecast - by Organization Size

- 10.2.1. Large Enterprises

- 10.2.2. Small & Medium-Sized Enterprises

- 10.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 10.3.1. Bfsi

- 10.3.2. It And Telecom

- 10.3.3. Manufacturing

- 10.3.4. Retail And E-Commerce

- 10.3.5. Public Sector

- 10.3.6. Healthcare

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bank of America Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BCG Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Goldman Sachs Group Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 JP Morgan Chase & Co

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Morgan Stanley

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Deloitte

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 EY Financial Services

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 KPMG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Pwc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Wells Fargo & Co**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Bank of America Corporation

List of Figures

- Figure 1: Global Financial Advisory Services Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Financial Advisory Services Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Financial Advisory Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Financial Advisory Services Market Revenue (billion), by Organization Size 2025 & 2033

- Figure 5: North America Financial Advisory Services Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 6: North America Financial Advisory Services Market Revenue (billion), by Industry Vertical 2025 & 2033

- Figure 7: North America Financial Advisory Services Market Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 8: North America Financial Advisory Services Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Financial Advisory Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Financial Advisory Services Market Revenue (billion), by Type 2025 & 2033

- Figure 11: Europe Financial Advisory Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Financial Advisory Services Market Revenue (billion), by Organization Size 2025 & 2033

- Figure 13: Europe Financial Advisory Services Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 14: Europe Financial Advisory Services Market Revenue (billion), by Industry Vertical 2025 & 2033

- Figure 15: Europe Financial Advisory Services Market Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 16: Europe Financial Advisory Services Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Financial Advisory Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Financial Advisory Services Market Revenue (billion), by Type 2025 & 2033

- Figure 19: Asia Pacific Financial Advisory Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Financial Advisory Services Market Revenue (billion), by Organization Size 2025 & 2033

- Figure 21: Asia Pacific Financial Advisory Services Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 22: Asia Pacific Financial Advisory Services Market Revenue (billion), by Industry Vertical 2025 & 2033

- Figure 23: Asia Pacific Financial Advisory Services Market Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 24: Asia Pacific Financial Advisory Services Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Financial Advisory Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Financial Advisory Services Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Financial Advisory Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Financial Advisory Services Market Revenue (billion), by Organization Size 2025 & 2033

- Figure 29: Middle East and Africa Financial Advisory Services Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 30: Middle East and Africa Financial Advisory Services Market Revenue (billion), by Industry Vertical 2025 & 2033

- Figure 31: Middle East and Africa Financial Advisory Services Market Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 32: Middle East and Africa Financial Advisory Services Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East and Africa Financial Advisory Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Financial Advisory Services Market Revenue (billion), by Type 2025 & 2033

- Figure 35: South America Financial Advisory Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: South America Financial Advisory Services Market Revenue (billion), by Organization Size 2025 & 2033

- Figure 37: South America Financial Advisory Services Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 38: South America Financial Advisory Services Market Revenue (billion), by Industry Vertical 2025 & 2033

- Figure 39: South America Financial Advisory Services Market Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 40: South America Financial Advisory Services Market Revenue (billion), by Country 2025 & 2033

- Figure 41: South America Financial Advisory Services Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 3: Global Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 4: Global Financial Advisory Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 7: Global Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 8: Global Financial Advisory Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: USA Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 13: Global Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 14: Global Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 15: Global Financial Advisory Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: UK Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Germany Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Spain Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 23: Global Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 24: Global Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 25: Global Financial Advisory Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: China Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Japan Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Australia Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: India Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Korea Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 33: Global Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 34: Global Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 35: Global Financial Advisory Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Saudi Arabia Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Egypt Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: UAE Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of Middle East and Africa Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Global Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 41: Global Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 42: Global Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 43: Global Financial Advisory Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 44: Argentina Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Colombia Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of South America Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Financial Advisory Services Market?

The projected CAGR is approximately 8.9%.

2. Which companies are prominent players in the Financial Advisory Services Market?

Key companies in the market include Bank of America Corporation, BCG Group, Goldman Sachs Group Inc, JP Morgan Chase & Co, Morgan Stanley, Deloitte, EY Financial Services, KPMG, Pwc, Wells Fargo & Co**List Not Exhaustive.

3. What are the main segments of the Financial Advisory Services Market?

The market segments include Type, Organization Size, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 134.87 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Majority of Revenues generated from United states.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Morgan Stanley Investment Management announced that it had received approval from the China Securities Regulatory Commission (CSRC) to take a full controlling stake in Morgan Stanley Huaxin Funds, marking a key strategic advancement for the company's broader footprint in China.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Financial Advisory Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Financial Advisory Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Financial Advisory Services Market?

To stay informed about further developments, trends, and reports in the Financial Advisory Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence