Key Insights

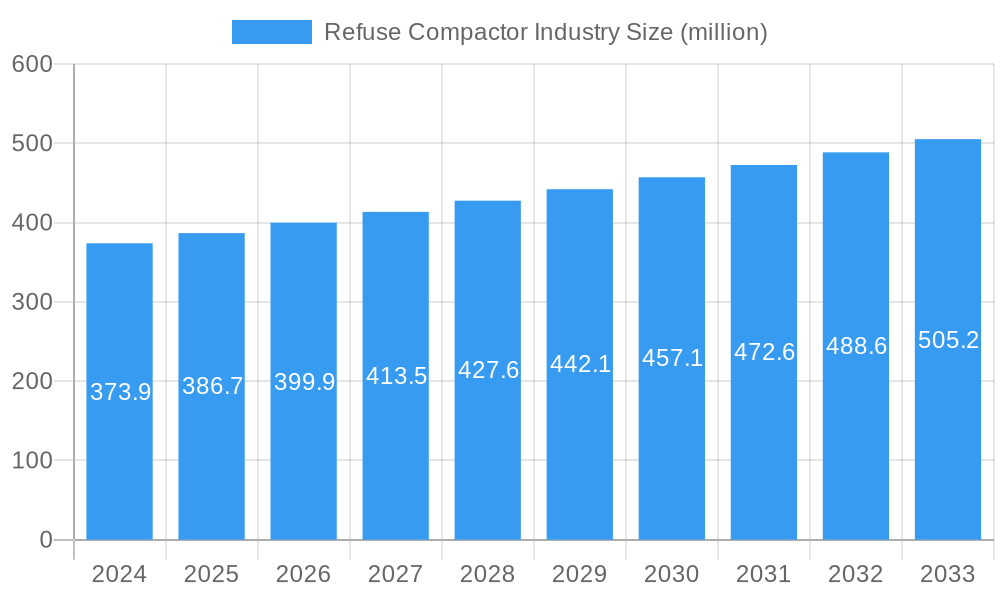

The global refuse compactor market is poised for substantial growth, projected to reach an estimated USD 373.9 million by 2024 with a steady Compound Annual Growth Rate (CAGR) of 3.4% from 2025 to 2033. This expansion is primarily fueled by increasing urbanization and a growing awareness of efficient waste management solutions. The escalating volume of waste generated by burgeoning populations and commercial activities across residential, commercial, and industrial sectors is creating a robust demand for effective waste reduction technologies. Furthermore, stringent environmental regulations and a global push towards sustainable practices are compelling businesses and municipalities to invest in advanced refuse compactors to minimize landfill dependency and optimize waste transportation costs. The market is segmented across various product types, including portable and stationary compactors, and caters to diverse waste streams such as dry and wet waste, indicating a broad application spectrum.

Refuse Compactor Industry Market Size (In Million)

The competitive landscape is characterized by the presence of both established global players and emerging regional manufacturers, all striving to innovate and capture market share. Key drivers for market expansion include the rising need for operational efficiency in waste handling, the economic benefits derived from reduced waste volume and transportation frequency, and the development of smart, automated compactor systems. However, certain restraints, such as the high initial investment cost of sophisticated compactors and the availability of alternative waste management strategies, may temper the growth trajectory. Despite these challenges, the prevailing trends toward cleaner cities, circular economy principles, and technological advancements in compactor design are expected to drive sustained market development, particularly in regions with significant industrial and commercial activity.

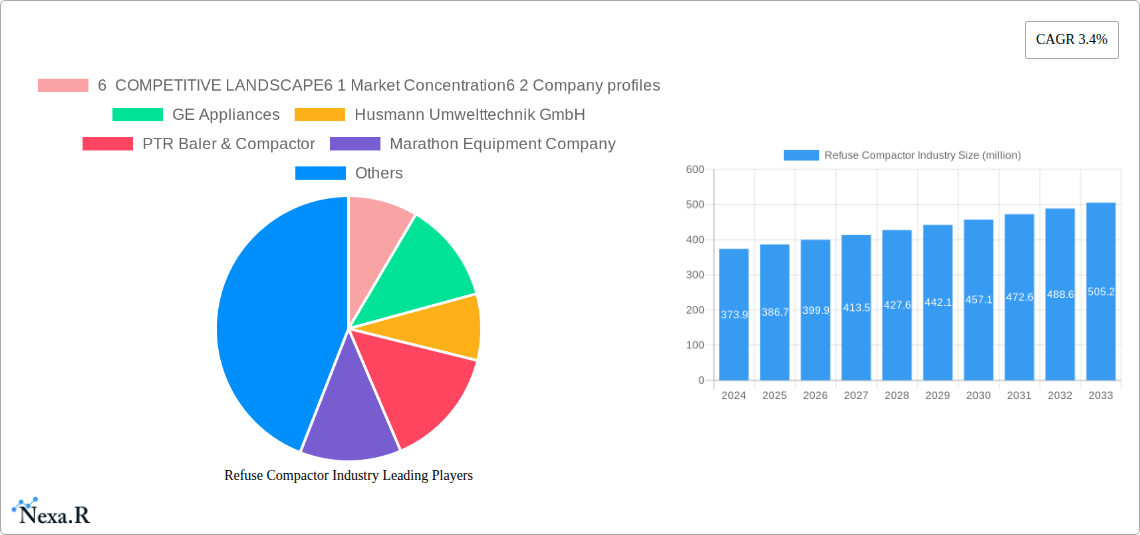

Refuse Compactor Industry Company Market Share

Refuse Compactor Industry: Market Dynamics, Growth Forecasts, and Competitive Landscape (2019–2033)

This comprehensive report offers an in-depth analysis of the global Refuse Compactor Industry, a critical sector facilitating efficient waste management for residential, commercial, municipal, and industrial applications. With a detailed forecast period from 2025 to 2033, building upon the base year of 2025 and encompassing historical data from 2019 to 2024, this report illuminates market dynamics, growth trajectories, and the competitive ecosystem. Discover key drivers, emerging opportunities, and the strategic landscape of leading companies shaping the future of waste compaction. This report is an indispensable resource for industry professionals, investors, and stakeholders seeking to understand and capitalize on the evolving refuse compactor market.

Refuse Compactor Industry Market Dynamics & Structure

The refuse compactor industry is characterized by a moderate market concentration, with the top 6 players accounting for approximately 55% of the global market share. Technological innovation is a primary driver, fueled by the demand for more efficient, automated, and environmentally friendly waste processing solutions. Regulatory frameworks, including stringent waste disposal laws and environmental protection mandates, significantly influence market growth, pushing for advanced compaction technologies. Competitive product substitutes, such as balers and manual waste sorting systems, exist but are increasingly being outcompeted by the space-saving and volume-reducing benefits of refuse compactors. End-user demographics are diverse, spanning residential complexes, agricultural operations, municipal waste management facilities, commercial establishments like hotels and supermarkets, and large-scale industrial sites. Mergers and acquisitions (M&A) trends indicate consolidation efforts as larger companies acquire smaller, innovative players to expand their product portfolios and geographic reach.

- Market Concentration: Top 6 players hold an estimated 55% market share.

- Technological Innovation Drivers: Demand for automation, energy efficiency, and smart waste management solutions.

- Regulatory Frameworks: Strict waste disposal regulations and environmental compliance driving adoption.

- Competitive Landscape: Competition from balers and manual systems is diminishing due to compactor efficiency.

- End-User Demographics: Broad application across residential, agricultural, municipal, commercial, and industrial sectors.

- M&A Trends: Strategic acquisitions to enhance market presence and technological capabilities.

Refuse Compactor Industry Growth Trends & Insights

The refuse compactor industry is projected to experience robust growth, driven by increasing urbanization, mounting waste generation, and a growing emphasis on sustainable waste management practices. The global market size is expected to witness a significant expansion from an estimated $1,800 million in 2025 to a projected $2,800 million by 2033, exhibiting a compound annual growth rate (CAGR) of approximately 6.5% during the forecast period. Adoption rates are escalating across all application segments, particularly in municipal and commercial sectors where efficient waste handling is paramount. Technological disruptions, such as the integration of IoT sensors for real-time data monitoring and predictive maintenance, are enhancing operational efficiency and driving innovation. Consumer behavior shifts are also playing a crucial role, with a growing preference for compacting solutions that minimize waste volume, reduce collection frequency, and lower transportation costs. The increasing awareness of environmental responsibility is further propelling the demand for advanced refuse compactors that contribute to cleaner environments and reduced landfill burden. Furthermore, advancements in material science and engineering are leading to the development of more durable, energy-efficient, and cost-effective compactor models, catering to a wider range of user needs and budget constraints. The overall market penetration of refuse compactors is expected to deepen as more businesses and municipalities recognize their long-term economic and environmental benefits, solidifying their position as an essential component of modern waste management infrastructure.

Dominant Regions, Countries, or Segments in Refuse Compactor Industry

The Commercial application segment is anticipated to dominate the refuse compactor industry, driven by the continuous increase in waste generation from retail establishments, hospitality services, and office complexes worldwide. This segment is projected to hold a significant market share of approximately 35% of the total market value by 2025. Key drivers for this dominance include the growing need for space optimization in urban commercial areas, the imperative to maintain hygiene and aesthetics, and the cost-effectiveness of reducing waste collection frequency. Leading countries within this segment include the United States, with its highly developed commercial infrastructure and stringent waste management regulations, followed by China and Germany, which are experiencing rapid urbanization and a surge in commercial activities.

The Stationary product type is expected to be the largest segment, accounting for an estimated 60% of the total market revenue by 2025. This is primarily due to their suitability for high-volume waste generation points like industrial facilities, large commercial buildings, and municipal transfer stations. Their robust design and high compaction ratios make them ideal for consistent, large-scale waste processing.

In terms of Waste Type, Dry Waste compactors are projected to lead the market, representing about 65% of the total market value. This is attributed to the prevalence of dry waste materials generated from various sources, including packaging, paper, and plastics.

- Dominant Application Segment: Commercial (Estimated 35% market share by 2025), driven by space optimization and cost reduction needs in businesses.

- Leading Countries (Commercial): United States, China, Germany, propelled by urbanization and robust regulatory environments.

- Dominant Product Type: Stationary compactors (Estimated 60% market share by 2025), favored for high-volume waste processing in industrial and commercial settings.

- Dominant Waste Type: Dry Waste compactors (Estimated 65% market share by 2025), due to the high generation of dry waste materials.

- Growth Potential: Emerging markets in Southeast Asia and Latin America are exhibiting significant growth potential due to rapid industrialization and increasing waste management awareness.

Refuse Compactor Industry Product Landscape

The refuse compactor industry is witnessing a continuous evolution in its product landscape, driven by advancements in engineering and a focus on user-centric design. Innovations are geared towards enhancing compaction efficiency, improving energy consumption, and integrating smart technologies. Portable refuse compactors are increasingly designed for mobility and ease of use in smaller commercial spaces and event venues, while stationary compactors are being developed with higher compaction ratios and larger capacities for industrial and municipal applications. Key applications span the spectrum from residential waste management in multi-unit dwellings to high-volume waste streams in manufacturing plants and food processing facilities. Performance metrics such as compaction force, cycle times, and energy consumption are key differentiators. Unique selling propositions often lie in features like automated loading systems, self-cleaning mechanisms, and remote monitoring capabilities, which significantly improve operational efficiency and reduce labor costs. Technological advancements include the incorporation of advanced hydraulic systems for superior power and durability, and the development of specialized compactors for specific waste streams, such as organic waste or hazardous materials.

Key Drivers, Barriers & Challenges in Refuse Compactor Industry

The refuse compactor industry is propelled by several key drivers. Increasing global waste generation due to population growth and urbanization is a primary catalyst. Stringent environmental regulations mandating efficient waste disposal and recycling are forcing industries and municipalities to adopt advanced compaction solutions. Growing awareness of the economic benefits of waste reduction, including lower transportation costs and optimized landfill usage, further fuels demand. Technological advancements in automation and smart waste management are also significant drivers.

- Key Drivers:

- Rising waste volumes.

- Environmental regulations and sustainability goals.

- Cost-saving benefits of efficient waste management.

- Technological innovations in smart and automated systems.

However, the industry faces notable barriers and challenges. High initial investment costs for advanced compactor systems can be a deterrent for smaller businesses and developing regions. Limited infrastructure and technical expertise in certain geographical areas can hinder adoption and maintenance. Supply chain disruptions and increasing raw material costs can impact production and pricing. Furthermore, competition from alternative waste management methods and the perceived complexity of operation and maintenance for some advanced models can pose challenges.

- Barriers & Challenges:

- High upfront capital expenditure.

- Inadequate infrastructure and skilled labor in some regions.

- Supply chain volatility and rising material costs.

- Competition from alternative waste disposal methods.

- Perception of operational complexity.

Emerging Opportunities in Refuse Compactor Industry

Emerging opportunities in the refuse compactor industry are primarily centered around smart and connected waste management solutions. The integration of IoT technology for real-time data analytics, predictive maintenance, and route optimization for waste collection fleets presents significant potential. There is also a growing demand for specialized compactors designed for specific waste streams, such as food waste digesters and hazardous waste compactors, driven by niche market needs and stricter regulations. Furthermore, the development of eco-friendly and energy-efficient compactor models utilizing renewable energy sources or advanced power management systems is an area ripe for innovation and market penetration. The increasing focus on the circular economy also opens avenues for compactors that facilitate the pre-treatment of materials for recycling and reuse.

Growth Accelerators in the Refuse Compactor Industry Industry

The long-term growth of the refuse compactor industry will be significantly accelerated by continued technological breakthroughs, particularly in the realm of Artificial Intelligence (AI) and machine learning for optimizing compaction processes and waste sorting. Strategic partnerships between compactor manufacturers, waste management companies, and technology providers will be crucial for developing integrated waste solutions. Market expansion into developing economies with rapidly growing industrial and urban populations offers substantial growth potential. Furthermore, government initiatives and incentives promoting sustainable waste management and the adoption of advanced equipment will act as powerful catalysts, driving widespread implementation of refuse compaction technologies across diverse sectors.

Key Players Shaping the Refuse Compactor Industry Market

- GE Appliances

- Husmann Umwelttechnik GmbH

- PTR Baler & Compactor

- Marathon Equipment Company

- Capital Compactors Ltd

- Compactor Management Company

- Genesis Waste Handling Private Limited

- Precision Machinery Systems

- ACE Equipment Company

- Wastequip LLC

Notable Milestones in Refuse Compactor Industry Sector

- February 2022: The New Town Kolkata Development Authority planned to set up 15 compactor stations across New Town, India, at an estimated cost of approximately Rs 4.1 crore, aiming to streamline daily waste collection and disposal.

- September 2021: Wastequip, a leading North American manufacturer of waste handling equipment, launched Wasteware, a cloud technology solutions suite designed to enhance waste and recycling industry operations by providing a digital partnership for products, equipment, and services.

In-Depth Refuse Compactor Industry Market Outlook

The future of the refuse compactor industry is exceptionally promising, driven by a confluence of escalating waste management needs and relentless technological innovation. The ongoing push towards smarter, more sustainable urban development will continue to fuel demand for efficient waste compaction solutions across residential, commercial, and municipal sectors. Opportunities abound in the development of highly automated and IoT-enabled compactors that offer predictive analytics and remote management capabilities, thereby optimizing operational efficiency and reducing downtime. Furthermore, the increasing global focus on environmental conservation and the principles of the circular economy will spur the demand for specialized compactors that facilitate effective pre-treatment of waste for recycling and resource recovery. Strategic collaborations and continuous product development are expected to drive market expansion, making refuse compactors an indispensable component of future waste management infrastructures worldwide.

Refuse Compactor Industry Segmentation

-

1. Product Type

- 1.1. Portable

- 1.2. Stationary

-

2. Waste Type

- 2.1. Dry Waste

- 2.2. Wet Waste

-

3. Application

- 3.1. Residential

- 3.2. Agricultural

- 3.3. Municipal

- 3.4. Commercial

- 3.5. Industrial

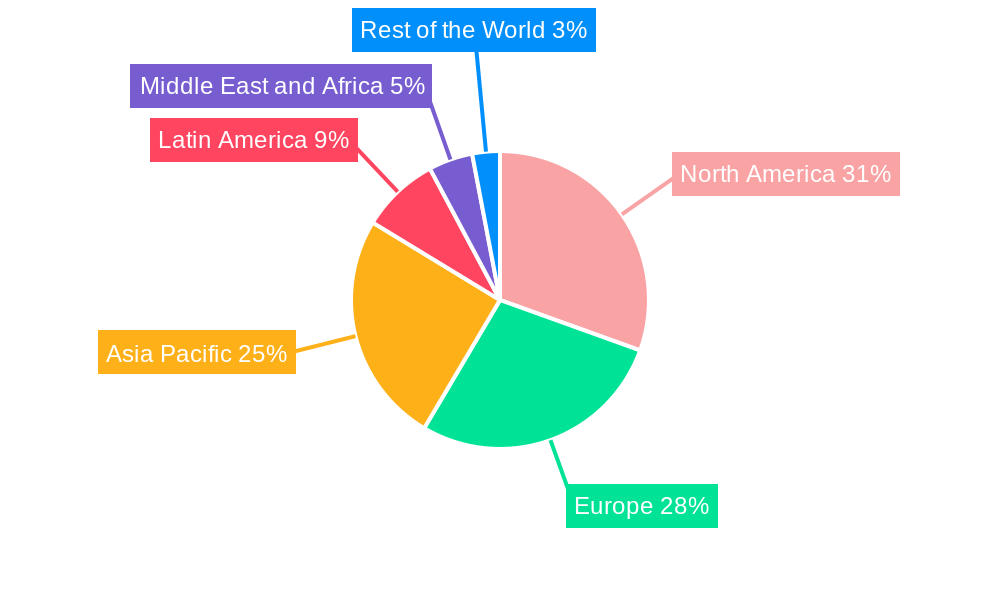

Refuse Compactor Industry Segmentation By Geography

- 1. North America

- 2. Latin America

- 3. Asia Pacific

- 4. Middle East and Africa

- 5. Europe

- 6. Rest of the World

Refuse Compactor Industry Regional Market Share

Geographic Coverage of Refuse Compactor Industry

Refuse Compactor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Asia-Pacific to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Refuse Compactor Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Portable

- 5.1.2. Stationary

- 5.2. Market Analysis, Insights and Forecast - by Waste Type

- 5.2.1. Dry Waste

- 5.2.2. Wet Waste

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Residential

- 5.3.2. Agricultural

- 5.3.3. Municipal

- 5.3.4. Commercial

- 5.3.5. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Latin America

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. Europe

- 5.4.6. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Refuse Compactor Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Portable

- 6.1.2. Stationary

- 6.2. Market Analysis, Insights and Forecast - by Waste Type

- 6.2.1. Dry Waste

- 6.2.2. Wet Waste

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Residential

- 6.3.2. Agricultural

- 6.3.3. Municipal

- 6.3.4. Commercial

- 6.3.5. Industrial

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Latin America Refuse Compactor Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Portable

- 7.1.2. Stationary

- 7.2. Market Analysis, Insights and Forecast - by Waste Type

- 7.2.1. Dry Waste

- 7.2.2. Wet Waste

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Residential

- 7.3.2. Agricultural

- 7.3.3. Municipal

- 7.3.4. Commercial

- 7.3.5. Industrial

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Refuse Compactor Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Portable

- 8.1.2. Stationary

- 8.2. Market Analysis, Insights and Forecast - by Waste Type

- 8.2.1. Dry Waste

- 8.2.2. Wet Waste

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Residential

- 8.3.2. Agricultural

- 8.3.3. Municipal

- 8.3.4. Commercial

- 8.3.5. Industrial

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Refuse Compactor Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Portable

- 9.1.2. Stationary

- 9.2. Market Analysis, Insights and Forecast - by Waste Type

- 9.2.1. Dry Waste

- 9.2.2. Wet Waste

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Residential

- 9.3.2. Agricultural

- 9.3.3. Municipal

- 9.3.4. Commercial

- 9.3.5. Industrial

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Europe Refuse Compactor Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Portable

- 10.1.2. Stationary

- 10.2. Market Analysis, Insights and Forecast - by Waste Type

- 10.2.1. Dry Waste

- 10.2.2. Wet Waste

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Residential

- 10.3.2. Agricultural

- 10.3.3. Municipal

- 10.3.4. Commercial

- 10.3.5. Industrial

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Rest of the World Refuse Compactor Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Portable

- 11.1.2. Stationary

- 11.2. Market Analysis, Insights and Forecast - by Waste Type

- 11.2.1. Dry Waste

- 11.2.2. Wet Waste

- 11.3. Market Analysis, Insights and Forecast - by Application

- 11.3.1. Residential

- 11.3.2. Agricultural

- 11.3.3. Municipal

- 11.3.4. Commercial

- 11.3.5. Industrial

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 6 COMPETITIVE LANDSCAPE6 1 Market Concentration6 2 Company profiles

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 GE Appliances

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Husmann Umwelttechnik GmbH

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 PTR Baler & Compactor

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Marathon Equipment Company

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Capital Compactors Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Compactor Management Company

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Genesis Waste Handling Private Limited

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Precision Machinery Systems

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 ACE Equipment Company

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Wastequip LLC **List Not Exhaustive

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 6 COMPETITIVE LANDSCAPE6 1 Market Concentration6 2 Company profiles

List of Figures

- Figure 1: Global Refuse Compactor Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Refuse Compactor Industry Revenue (million), by Product Type 2025 & 2033

- Figure 3: North America Refuse Compactor Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Refuse Compactor Industry Revenue (million), by Waste Type 2025 & 2033

- Figure 5: North America Refuse Compactor Industry Revenue Share (%), by Waste Type 2025 & 2033

- Figure 6: North America Refuse Compactor Industry Revenue (million), by Application 2025 & 2033

- Figure 7: North America Refuse Compactor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Refuse Compactor Industry Revenue (million), by Country 2025 & 2033

- Figure 9: North America Refuse Compactor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Latin America Refuse Compactor Industry Revenue (million), by Product Type 2025 & 2033

- Figure 11: Latin America Refuse Compactor Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Latin America Refuse Compactor Industry Revenue (million), by Waste Type 2025 & 2033

- Figure 13: Latin America Refuse Compactor Industry Revenue Share (%), by Waste Type 2025 & 2033

- Figure 14: Latin America Refuse Compactor Industry Revenue (million), by Application 2025 & 2033

- Figure 15: Latin America Refuse Compactor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Latin America Refuse Compactor Industry Revenue (million), by Country 2025 & 2033

- Figure 17: Latin America Refuse Compactor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Refuse Compactor Industry Revenue (million), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Refuse Compactor Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Refuse Compactor Industry Revenue (million), by Waste Type 2025 & 2033

- Figure 21: Asia Pacific Refuse Compactor Industry Revenue Share (%), by Waste Type 2025 & 2033

- Figure 22: Asia Pacific Refuse Compactor Industry Revenue (million), by Application 2025 & 2033

- Figure 23: Asia Pacific Refuse Compactor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Refuse Compactor Industry Revenue (million), by Country 2025 & 2033

- Figure 25: Asia Pacific Refuse Compactor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Refuse Compactor Industry Revenue (million), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Refuse Compactor Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Refuse Compactor Industry Revenue (million), by Waste Type 2025 & 2033

- Figure 29: Middle East and Africa Refuse Compactor Industry Revenue Share (%), by Waste Type 2025 & 2033

- Figure 30: Middle East and Africa Refuse Compactor Industry Revenue (million), by Application 2025 & 2033

- Figure 31: Middle East and Africa Refuse Compactor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: Middle East and Africa Refuse Compactor Industry Revenue (million), by Country 2025 & 2033

- Figure 33: Middle East and Africa Refuse Compactor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Refuse Compactor Industry Revenue (million), by Product Type 2025 & 2033

- Figure 35: Europe Refuse Compactor Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Europe Refuse Compactor Industry Revenue (million), by Waste Type 2025 & 2033

- Figure 37: Europe Refuse Compactor Industry Revenue Share (%), by Waste Type 2025 & 2033

- Figure 38: Europe Refuse Compactor Industry Revenue (million), by Application 2025 & 2033

- Figure 39: Europe Refuse Compactor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: Europe Refuse Compactor Industry Revenue (million), by Country 2025 & 2033

- Figure 41: Europe Refuse Compactor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of the World Refuse Compactor Industry Revenue (million), by Product Type 2025 & 2033

- Figure 43: Rest of the World Refuse Compactor Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 44: Rest of the World Refuse Compactor Industry Revenue (million), by Waste Type 2025 & 2033

- Figure 45: Rest of the World Refuse Compactor Industry Revenue Share (%), by Waste Type 2025 & 2033

- Figure 46: Rest of the World Refuse Compactor Industry Revenue (million), by Application 2025 & 2033

- Figure 47: Rest of the World Refuse Compactor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 48: Rest of the World Refuse Compactor Industry Revenue (million), by Country 2025 & 2033

- Figure 49: Rest of the World Refuse Compactor Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Refuse Compactor Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Global Refuse Compactor Industry Revenue million Forecast, by Waste Type 2020 & 2033

- Table 3: Global Refuse Compactor Industry Revenue million Forecast, by Application 2020 & 2033

- Table 4: Global Refuse Compactor Industry Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Refuse Compactor Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 6: Global Refuse Compactor Industry Revenue million Forecast, by Waste Type 2020 & 2033

- Table 7: Global Refuse Compactor Industry Revenue million Forecast, by Application 2020 & 2033

- Table 8: Global Refuse Compactor Industry Revenue million Forecast, by Country 2020 & 2033

- Table 9: Global Refuse Compactor Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 10: Global Refuse Compactor Industry Revenue million Forecast, by Waste Type 2020 & 2033

- Table 11: Global Refuse Compactor Industry Revenue million Forecast, by Application 2020 & 2033

- Table 12: Global Refuse Compactor Industry Revenue million Forecast, by Country 2020 & 2033

- Table 13: Global Refuse Compactor Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 14: Global Refuse Compactor Industry Revenue million Forecast, by Waste Type 2020 & 2033

- Table 15: Global Refuse Compactor Industry Revenue million Forecast, by Application 2020 & 2033

- Table 16: Global Refuse Compactor Industry Revenue million Forecast, by Country 2020 & 2033

- Table 17: Global Refuse Compactor Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 18: Global Refuse Compactor Industry Revenue million Forecast, by Waste Type 2020 & 2033

- Table 19: Global Refuse Compactor Industry Revenue million Forecast, by Application 2020 & 2033

- Table 20: Global Refuse Compactor Industry Revenue million Forecast, by Country 2020 & 2033

- Table 21: Global Refuse Compactor Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 22: Global Refuse Compactor Industry Revenue million Forecast, by Waste Type 2020 & 2033

- Table 23: Global Refuse Compactor Industry Revenue million Forecast, by Application 2020 & 2033

- Table 24: Global Refuse Compactor Industry Revenue million Forecast, by Country 2020 & 2033

- Table 25: Global Refuse Compactor Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 26: Global Refuse Compactor Industry Revenue million Forecast, by Waste Type 2020 & 2033

- Table 27: Global Refuse Compactor Industry Revenue million Forecast, by Application 2020 & 2033

- Table 28: Global Refuse Compactor Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Refuse Compactor Industry?

The projected CAGR is approximately 3.4%.

2. Which companies are prominent players in the Refuse Compactor Industry?

Key companies in the market include 6 COMPETITIVE LANDSCAPE6 1 Market Concentration6 2 Company profiles, GE Appliances, Husmann Umwelttechnik GmbH, PTR Baler & Compactor, Marathon Equipment Company, Capital Compactors Ltd, Compactor Management Company, Genesis Waste Handling Private Limited, Precision Machinery Systems, ACE Equipment Company, Wastequip LLC **List Not Exhaustive.

3. What are the main segments of the Refuse Compactor Industry?

The market segments include Product Type, Waste Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 280 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Asia-Pacific to Dominate the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2022: The New Town Kolkata Development Authority has planned to set up 15 compactor stations in different locations across New Town to facilitate a daily waste collection and disposal system. The compactor stations will be constructed at an estimated cost of about Rs 4.1 crore.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Refuse Compactor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Refuse Compactor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Refuse Compactor Industry?

To stay informed about further developments, trends, and reports in the Refuse Compactor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence