Key Insights

The Power-to-Gas (P2G) market is experiencing significant expansion, driven by the demand for renewable energy storage and decarbonization initiatives. Projected to reach 78.9 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 6.4%, the sector offers substantial investment potential. Key growth factors include increased renewable energy integration (solar, wind) and the need for effective energy storage solutions. P2G technology addresses this by converting surplus renewable electricity into storable hydrogen and methane. Supportive government policies for renewable energy and carbon neutrality further stimulate market growth. The market is segmented by application, with utilities, industrial, and commercial sectors leading adoption. Technological advancements in P2G systems are improving efficiency and reducing costs. Challenges include high initial capital expenditure and the development of large-scale hydrogen storage and transportation infrastructure. Despite these, the P2G market exhibits a highly positive long-term outlook, supported by innovation, policy, and climate change mitigation efforts.

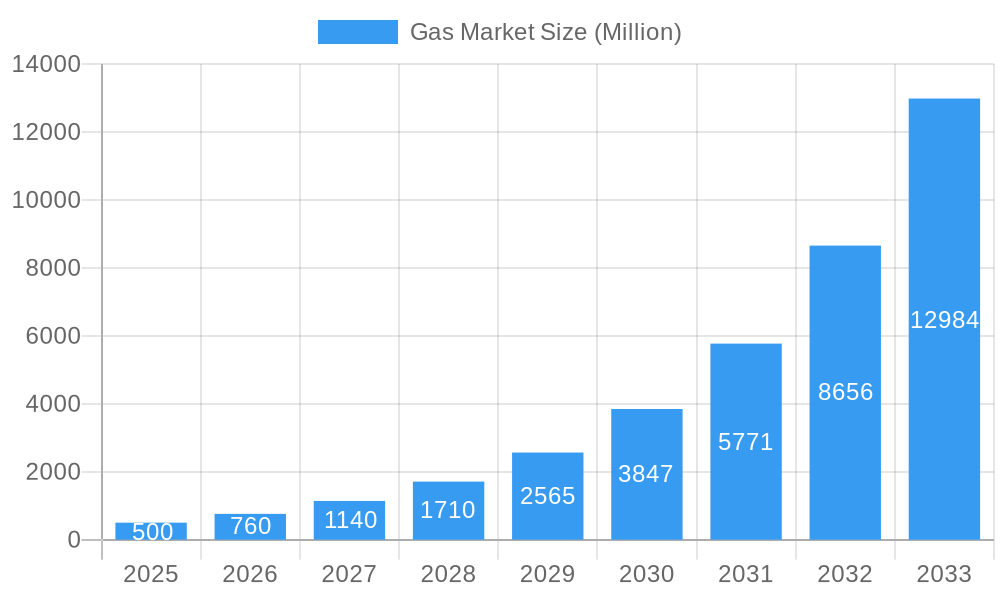

Gas Market Market Size (In Billion)

Geographically, the P2G market is led by North America, Europe, and Asia-Pacific due to strong renewable energy resources, favorable regulations, and economic conditions. Emerging markets in the Middle East, Africa, and South America are also seeing rapid growth. The competitive landscape includes established energy firms, P2G technology specialists, and startups, fostering innovation and the development of cost-effective P2G solutions. Growth is anticipated across all capacity segments (over 1000 KW, 100-1000 KW, under 100 KW) as P2G technology matures and becomes more accessible.

Gas Market Company Market Share

Gas Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Gas Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is crucial for industry professionals, investors, and strategic decision-makers seeking a clear understanding of this rapidly evolving market. The report analyzes the parent market of Energy and the child market of Gas, providing granular insights into market segmentation by technology (Power-to-Hydrogen, Power-to-Methane), capacity (More than 1000 KW, 100 to 1000 KW, Less than 100 KW), and end-user (Utilities, Industrial, Commercial).

Gas Market Market Dynamics & Structure

The Gas Market is characterized by a dynamic interplay of technological innovation, evolving regulatory landscapes, and intensifying competition. Market concentration is moderate, with several key players vying for market share. Technological advancements, particularly in Power-to-Hydrogen and Power-to-Methane technologies, are driving significant market expansion. Regulatory frameworks, including government incentives and carbon emission reduction targets, play a crucial role in shaping market growth. The emergence of clean energy solutions is impacting the market by offering competitive substitutes to traditional gas sources.

- Market Concentration: Moderate, with no single dominant player controlling a significant market share. xx% market share held by top 5 players (estimated).

- Technological Innovation: Power-to-X technologies (Power-to-Hydrogen, Power-to-Methane) are key innovation drivers, leading to increased efficiency and reduced carbon emissions.

- Regulatory Frameworks: Government policies supporting renewable energy and carbon neutrality are stimulating market growth. Stringent emission regulations are pushing the adoption of cleaner gas alternatives.

- Competitive Product Substitutes: Renewable energy sources (solar, wind) and other clean energy technologies pose competitive challenges.

- End-User Demographics: Utilities, industrial sectors, and commercial entities are primary end-users, with demand patterns varying across regions and applications.

- M&A Trends: The number of M&A deals in the Gas Market increased by xx% between 2021 and 2024, driven by companies seeking to expand their market presence and technological capabilities (estimated value of deals: xx Million).

Gas Market Growth Trends & Insights

The Gas Market is experiencing robust growth, driven by increasing energy demand, the growing adoption of renewable energy sources, and supportive government policies. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). The adoption rate of clean energy solutions is accelerating, with significant market penetration expected in the coming years. Technological disruptions, such as advancements in electrolysis and carbon capture technologies, are fundamentally reshaping the industry. Consumer behavior is shifting towards environmentally friendly solutions, fostering increased demand for cleaner gas alternatives.

Technological advancements in electrolysis and carbon capture are key growth drivers. Power-to-X technologies are gaining traction, enabling the production of renewable gas from surplus renewable energy. Increasing government support for green energy initiatives and strict emission regulations have accelerated the growth.

Dominant Regions, Countries, or Segments in Gas Market

North America and Europe are currently leading the Gas Market, driven by strong government support for clean energy initiatives and robust investments in renewable energy infrastructure. Within the technological segments, Power-to-Hydrogen is experiencing faster growth than Power-to-Methane, fueled by advancements in electrolyzer technology and rising hydrogen demand. The "More than 1000 KW" capacity segment dominates due to large-scale industrial applications. The Utilities sector is the largest end-user, followed by the Industrial sector.

- Key Drivers:

- North America: USD 504.4 Million investment in Advanced Clean Energy Storage (June 2022) demonstrates strong government commitment.

- Europe: Stringent emission regulations are accelerating the adoption of clean energy solutions.

- Power-to-Hydrogen: Advancements in electrolyzer technology and rising hydrogen demand drive growth.

- Utilities Sector: High demand from power generation and grid integration.

Gas Market Product Landscape

The Gas Market offers a diverse range of products, including electrolyzers, gas turbines, and carbon capture systems. These products are characterized by varying efficiency levels, scalability, and cost-effectiveness. Technological advancements are continuously improving the performance of these products, leading to increased efficiency, lower emissions, and improved cost competitiveness. Unique selling propositions encompass higher energy efficiency, lower operating costs, and reduced environmental impact.

Key Drivers, Barriers & Challenges in Gas Market

Key Drivers:

- Growing demand for clean energy solutions.

- Increasing government incentives and supportive policies for renewable energy.

- Technological advancements in electrolysis and carbon capture.

Key Challenges & Restraints:

- High initial investment costs for clean energy technologies.

- Limited availability of renewable energy sources in certain regions.

- Infrastructure limitations for hydrogen storage and transportation. Supply chain bottlenecks in obtaining critical materials could limit production by xx% (estimated).

Emerging Opportunities in Gas Market

- Untapped markets in developing economies.

- Innovative applications in transportation, heating, and industrial processes.

- Growing demand for integrated solutions combining gas production, storage, and distribution.

Growth Accelerators in the Gas Market Industry

Technological breakthroughs in electrolysis and carbon capture, coupled with strategic partnerships between energy companies and technology providers, are accelerating market growth. Market expansion into developing economies and innovative applications in emerging sectors offer substantial growth potential.

Key Players Shaping the Gas Market Market

- MAN Energy Solutions

- GRT Gaz SA

- Sunfire GmbH

- MicroPyros BioEnerTec GmbH

- Ineratec GmbH

- AquahydreX Inc

- Siemens Energy AG

- Electrochaea GmbH

- Hitachi Zosen Inova AG

- Sempra Energy

- Nel ASA

Notable Milestones in Gas Market Sector

- June 2022: USD 504.4 Million investment in Advanced Clean Energy Storage facility in Delta, Utah.

- February 2022: Mitsubishi Power signs a purchase contract with HydrogenPro for a large-scale electrolyzer system.

In-Depth Gas Market Market Outlook

The Gas Market is poised for significant growth in the coming years, driven by strong demand for clean energy, supportive government policies, and technological advancements. Strategic opportunities exist for companies to capitalize on the increasing adoption of Power-to-X technologies, particularly in underserved markets and emerging applications. The market's future growth trajectory hinges on continued innovation, infrastructure development, and favorable regulatory frameworks.

Gas Market Segmentation

-

1. Technology

- 1.1. Power-to-Hydrogen

- 1.2. Power-to-Methane

-

2. Capacity (Qualitative Analysis Only)

- 2.1. More than 1000 KW

- 2.2. 100 to 1000 KW

- 2.3. Less than 100 KW

-

3. y End-User

- 3.1. Utilities

- 3.2. Industrial

- 3.3. Commercial

Gas Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Gas Market Regional Market Share

Geographic Coverage of Gas Market

Gas Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand to Develop the Natural Gas Infrastructure4.; Increase in Offshore Oil and Gas Exploration and Production (E&P) Activities

- 3.3. Market Restrains

- 3.3.1. 4.; High Volatility of Oil and Gas Prices

- 3.4. Market Trends

- 3.4.1. Power-to-hydrogen to be the Fastest-growing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gas Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Power-to-Hydrogen

- 5.1.2. Power-to-Methane

- 5.2. Market Analysis, Insights and Forecast - by Capacity (Qualitative Analysis Only)

- 5.2.1. More than 1000 KW

- 5.2.2. 100 to 1000 KW

- 5.2.3. Less than 100 KW

- 5.3. Market Analysis, Insights and Forecast - by y End-User

- 5.3.1. Utilities

- 5.3.2. Industrial

- 5.3.3. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Gas Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Power-to-Hydrogen

- 6.1.2. Power-to-Methane

- 6.2. Market Analysis, Insights and Forecast - by Capacity (Qualitative Analysis Only)

- 6.2.1. More than 1000 KW

- 6.2.2. 100 to 1000 KW

- 6.2.3. Less than 100 KW

- 6.3. Market Analysis, Insights and Forecast - by y End-User

- 6.3.1. Utilities

- 6.3.2. Industrial

- 6.3.3. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Gas Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Power-to-Hydrogen

- 7.1.2. Power-to-Methane

- 7.2. Market Analysis, Insights and Forecast - by Capacity (Qualitative Analysis Only)

- 7.2.1. More than 1000 KW

- 7.2.2. 100 to 1000 KW

- 7.2.3. Less than 100 KW

- 7.3. Market Analysis, Insights and Forecast - by y End-User

- 7.3.1. Utilities

- 7.3.2. Industrial

- 7.3.3. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Gas Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Power-to-Hydrogen

- 8.1.2. Power-to-Methane

- 8.2. Market Analysis, Insights and Forecast - by Capacity (Qualitative Analysis Only)

- 8.2.1. More than 1000 KW

- 8.2.2. 100 to 1000 KW

- 8.2.3. Less than 100 KW

- 8.3. Market Analysis, Insights and Forecast - by y End-User

- 8.3.1. Utilities

- 8.3.2. Industrial

- 8.3.3. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. South America Gas Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Power-to-Hydrogen

- 9.1.2. Power-to-Methane

- 9.2. Market Analysis, Insights and Forecast - by Capacity (Qualitative Analysis Only)

- 9.2.1. More than 1000 KW

- 9.2.2. 100 to 1000 KW

- 9.2.3. Less than 100 KW

- 9.3. Market Analysis, Insights and Forecast - by y End-User

- 9.3.1. Utilities

- 9.3.2. Industrial

- 9.3.3. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Gas Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Power-to-Hydrogen

- 10.1.2. Power-to-Methane

- 10.2. Market Analysis, Insights and Forecast - by Capacity (Qualitative Analysis Only)

- 10.2.1. More than 1000 KW

- 10.2.2. 100 to 1000 KW

- 10.2.3. Less than 100 KW

- 10.3. Market Analysis, Insights and Forecast - by y End-User

- 10.3.1. Utilities

- 10.3.2. Industrial

- 10.3.3. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 MAN Energy Solutions

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 GRT Gaz SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sunfire GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 MicroPyros BioEnerTec GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ineratec GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AquahydreX Inc *List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Siemens Energy AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Electrochaea GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hitachi Zosen Inova AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sempra Energy

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Nel ASA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 MAN Energy Solutions

List of Figures

- Figure 1: Global Gas Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Gas Market Revenue (billion), by Technology 2025 & 2033

- Figure 3: North America Gas Market Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Gas Market Revenue (billion), by Capacity (Qualitative Analysis Only) 2025 & 2033

- Figure 5: North America Gas Market Revenue Share (%), by Capacity (Qualitative Analysis Only) 2025 & 2033

- Figure 6: North America Gas Market Revenue (billion), by y End-User 2025 & 2033

- Figure 7: North America Gas Market Revenue Share (%), by y End-User 2025 & 2033

- Figure 8: North America Gas Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Gas Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Gas Market Revenue (billion), by Technology 2025 & 2033

- Figure 11: Europe Gas Market Revenue Share (%), by Technology 2025 & 2033

- Figure 12: Europe Gas Market Revenue (billion), by Capacity (Qualitative Analysis Only) 2025 & 2033

- Figure 13: Europe Gas Market Revenue Share (%), by Capacity (Qualitative Analysis Only) 2025 & 2033

- Figure 14: Europe Gas Market Revenue (billion), by y End-User 2025 & 2033

- Figure 15: Europe Gas Market Revenue Share (%), by y End-User 2025 & 2033

- Figure 16: Europe Gas Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Gas Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Gas Market Revenue (billion), by Technology 2025 & 2033

- Figure 19: Asia Pacific Gas Market Revenue Share (%), by Technology 2025 & 2033

- Figure 20: Asia Pacific Gas Market Revenue (billion), by Capacity (Qualitative Analysis Only) 2025 & 2033

- Figure 21: Asia Pacific Gas Market Revenue Share (%), by Capacity (Qualitative Analysis Only) 2025 & 2033

- Figure 22: Asia Pacific Gas Market Revenue (billion), by y End-User 2025 & 2033

- Figure 23: Asia Pacific Gas Market Revenue Share (%), by y End-User 2025 & 2033

- Figure 24: Asia Pacific Gas Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Gas Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Gas Market Revenue (billion), by Technology 2025 & 2033

- Figure 27: South America Gas Market Revenue Share (%), by Technology 2025 & 2033

- Figure 28: South America Gas Market Revenue (billion), by Capacity (Qualitative Analysis Only) 2025 & 2033

- Figure 29: South America Gas Market Revenue Share (%), by Capacity (Qualitative Analysis Only) 2025 & 2033

- Figure 30: South America Gas Market Revenue (billion), by y End-User 2025 & 2033

- Figure 31: South America Gas Market Revenue Share (%), by y End-User 2025 & 2033

- Figure 32: South America Gas Market Revenue (billion), by Country 2025 & 2033

- Figure 33: South America Gas Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Gas Market Revenue (billion), by Technology 2025 & 2033

- Figure 35: Middle East and Africa Gas Market Revenue Share (%), by Technology 2025 & 2033

- Figure 36: Middle East and Africa Gas Market Revenue (billion), by Capacity (Qualitative Analysis Only) 2025 & 2033

- Figure 37: Middle East and Africa Gas Market Revenue Share (%), by Capacity (Qualitative Analysis Only) 2025 & 2033

- Figure 38: Middle East and Africa Gas Market Revenue (billion), by y End-User 2025 & 2033

- Figure 39: Middle East and Africa Gas Market Revenue Share (%), by y End-User 2025 & 2033

- Figure 40: Middle East and Africa Gas Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Gas Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Gas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: Global Gas Market Revenue billion Forecast, by Capacity (Qualitative Analysis Only) 2020 & 2033

- Table 3: Global Gas Market Revenue billion Forecast, by y End-User 2020 & 2033

- Table 4: Global Gas Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Gas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 6: Global Gas Market Revenue billion Forecast, by Capacity (Qualitative Analysis Only) 2020 & 2033

- Table 7: Global Gas Market Revenue billion Forecast, by y End-User 2020 & 2033

- Table 8: Global Gas Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Gas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 10: Global Gas Market Revenue billion Forecast, by Capacity (Qualitative Analysis Only) 2020 & 2033

- Table 11: Global Gas Market Revenue billion Forecast, by y End-User 2020 & 2033

- Table 12: Global Gas Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Gas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 14: Global Gas Market Revenue billion Forecast, by Capacity (Qualitative Analysis Only) 2020 & 2033

- Table 15: Global Gas Market Revenue billion Forecast, by y End-User 2020 & 2033

- Table 16: Global Gas Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Gas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 18: Global Gas Market Revenue billion Forecast, by Capacity (Qualitative Analysis Only) 2020 & 2033

- Table 19: Global Gas Market Revenue billion Forecast, by y End-User 2020 & 2033

- Table 20: Global Gas Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Gas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 22: Global Gas Market Revenue billion Forecast, by Capacity (Qualitative Analysis Only) 2020 & 2033

- Table 23: Global Gas Market Revenue billion Forecast, by y End-User 2020 & 2033

- Table 24: Global Gas Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gas Market?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the Gas Market?

Key companies in the market include MAN Energy Solutions, GRT Gaz SA, Sunfire GmbH, MicroPyros BioEnerTec GmbH, Ineratec GmbH, AquahydreX Inc *List Not Exhaustive, Siemens Energy AG, Electrochaea GmbH, Hitachi Zosen Inova AG, Sempra Energy, Nel ASA.

3. What are the main segments of the Gas Market?

The market segments include Technology, Capacity (Qualitative Analysis Only), y End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 78.9 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand to Develop the Natural Gas Infrastructure4.; Increase in Offshore Oil and Gas Exploration and Production (E&P) Activities.

6. What are the notable trends driving market growth?

Power-to-hydrogen to be the Fastest-growing Segment.

7. Are there any restraints impacting market growth?

4.; High Volatility of Oil and Gas Prices.

8. Can you provide examples of recent developments in the market?

June 2022- The United States Department of Energy announced a USD 504.4 million investment to finance Advanced Clean Energy Storage, a clean hydrogen and energy storage facility capable of providing long-term energy storage. Located in Delta, Utah, the facility will combine 220 megawatts of alkaline electrolysis with two 4.5-million-barrel salt caverns to store clean hydrogen. When operational, the projects will capture excess renewable energy, store it as hydrogen, and deploy it as fuel for the Intermountain Power Agency's (IPA) Renewed Project-a hydrogen-capable gas turbine combined cycle power plant that intends to be fueled by 100% clean hydrogen by 2045 incrementally.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gas Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gas Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gas Market?

To stay informed about further developments, trends, and reports in the Gas Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence