Key Insights

The GCC luxurious furniture market, currently exhibiting robust growth with a CAGR exceeding 6%, presents a lucrative opportunity for investors and businesses. Driven by rising disposable incomes, a burgeoning affluent population increasingly focused on home aesthetics, and a preference for high-quality, designer pieces, the market is experiencing significant expansion. Key market segments include lighting, bedroom furniture, sofas, and chairs, with residential end-users representing a substantial portion of the market. Growth is further fueled by the increasing popularity of online shopping and the expansion of home centers and flagship stores offering luxury brands. While the market faces potential restraints such as global economic fluctuations and material cost increases, the long-term outlook remains positive, underpinned by the region's ongoing economic development and the consistent demand for premium home furnishings.

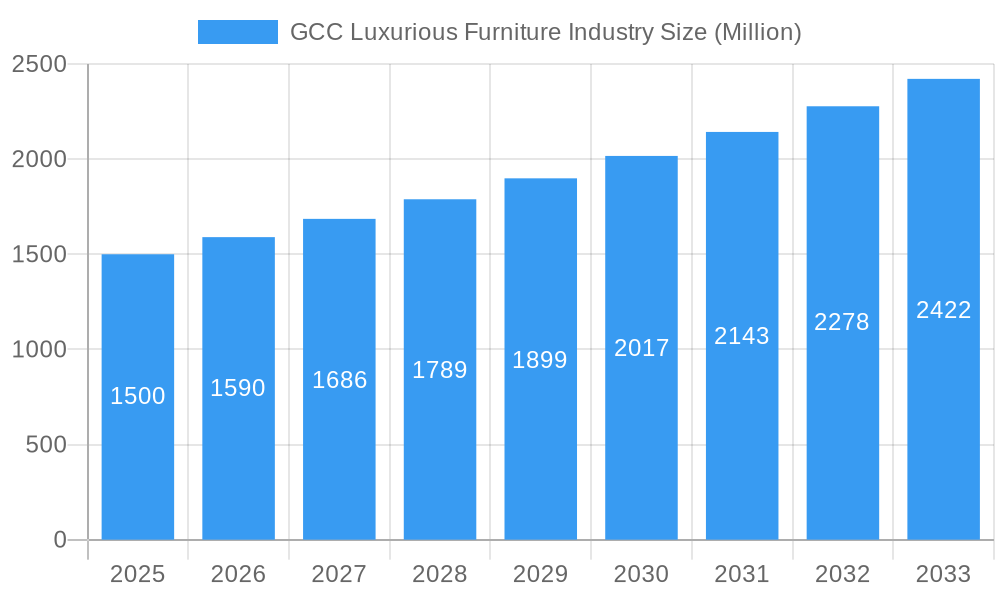

GCC Luxurious Furniture Industry Market Size (In Billion)

The competitive landscape is dynamic, featuring both established international players like IKEA and B&B Italia, and successful regional brands such as Al Huzaifa and Danube. The market’s segmentation extends beyond product types and end-users to include diverse distribution channels like online retailers, specialty stores, and home centers. This diverse distribution network caters to the varying preferences and purchasing behaviors of consumers within the GCC. Future growth will likely see an acceleration in e-commerce adoption and a continuing emphasis on sustainability and bespoke design options. Brands that successfully integrate digital marketing strategies, focus on personalized customer experiences, and offer environmentally conscious products are poised to capture significant market share. The overall market is expected to continue its upward trajectory, driven by a convergence of economic prosperity and evolving consumer preferences within the GCC region.

GCC Luxurious Furniture Industry Company Market Share

GCC Luxurious Furniture Industry: Market Dynamics, Trends & Opportunities 2019-2033

This comprehensive report provides a detailed analysis of the GCC luxurious furniture industry, encompassing market size, growth trends, competitive landscape, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is invaluable for industry professionals, investors, and strategic planners seeking to understand and capitalize on the opportunities within this lucrative market. The analysis considers key segments like Residential and Commercial end-users, and distribution channels including Home Centers, Flagship Stores, Specialty Stores, and Online platforms. Major players like Al Huzaifa, Bukannan Furnishing, ID Design, PAN Home (formerly PAN Emirates), Danube, IKEA, Home Center, Luxe Living, B&B Italia, and Royal Furniture are analyzed within the context of the overall market. Product types include Lighting, Tables, Chairs & Sofas, Accessories, Bedroom sets, Cabinets, and Other Products.

GCC Luxurious Furniture Industry Market Dynamics & Structure

The GCC luxurious furniture market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of numerous smaller, specialized firms contributes to a dynamic competitive environment. Technological advancements, particularly in design software, manufacturing processes, and smart home integration, are key drivers of innovation. Regulatory frameworks concerning product safety and sustainability are increasingly influential. While there are some substitute products (e.g., mass-market furniture), the luxury segment retains its distinct appeal based on quality, craftsmanship, and exclusivity. End-user demographics reveal a growing preference for high-end furniture among affluent households and commercial establishments seeking premium interiors. Mergers and acquisitions (M&A) activity is relatively moderate, with occasional strategic acquisitions to expand market reach or product portfolios. The total market size in 2024 is estimated at xx Million.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately 60% market share in 2024.

- Technological Innovation: Focus on sustainable materials, smart furniture, and personalized design solutions.

- Regulatory Framework: Emphasis on safety standards and environmental compliance.

- Competitive Substitutes: Limited direct substitutes, mainly from mass-market furniture segments.

- End-User Demographics: Rising affluence and preference for luxury lifestyles drive demand.

- M&A Trends: Moderate activity, primarily focused on strategic acquisitions. xx M&A deals recorded in the historical period.

GCC Luxurious Furniture Industry Growth Trends & Insights

The GCC luxurious furniture market has experienced steady growth over the past few years, fueled by increasing disposable incomes, urbanization, and a growing preference for sophisticated home interiors. The market size is projected to reach xx Million by 2025 and xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Technological disruptions such as the rise of e-commerce and personalized design tools are reshaping consumer behavior, leading to increased demand for customized and digitally integrated furniture. Market penetration remains relatively high in urban centers, but significant growth potential exists in expanding into secondary and tertiary markets. Adoption rates for smart furniture and sustainable products are increasing, creating new market segments.

- Market Size Evolution: Steady growth from xx Million in 2019 to an estimated xx Million in 2024.

- Adoption Rates: Increasing adoption of smart furniture and sustainable products.

- Technological Disruptions: E-commerce and personalized design tools are transforming the market.

- Consumer Behavior Shifts: Growing demand for customized, high-quality, and sustainable furniture.

Dominant Regions, Countries, or Segments in GCC Luxurious Furniture Industry

The UAE and Saudi Arabia represent the most significant markets within the GCC, driving a majority of the overall growth. Within product types, Chairs and Sofas, followed by Bedroom sets and Cabinets hold the largest market share due to their essential role in home furnishing. The residential segment accounts for the largest share of the end-user market, although the commercial sector is exhibiting strong growth potential. Home centers and flagship stores remain the dominant distribution channels, but online sales are steadily gaining traction. Economic growth, expanding middle-class populations, and government initiatives promoting infrastructure development are primary drivers.

- Key Drivers: Strong economic growth in UAE and Saudi Arabia, rising disposable incomes, urbanization.

- Dominant Segments: Chairs & Sofas, Bedroom sets, Residential end-user, Home Centers & Flagship Stores.

- Market Share: UAE and Saudi Arabia account for approximately 75% of the total market in 2024.

- Growth Potential: High potential in expanding into other GCC countries and the commercial sector.

GCC Luxurious Furniture Industry Product Landscape

The GCC luxurious furniture market showcases a diverse range of products characterized by superior materials, exquisite craftsmanship, and innovative designs. High-end materials such as solid wood, premium leather, and handcrafted fabrics are prevalent. Technological advancements include smart furniture integration, 3D printing for customized designs, and sustainable manufacturing processes. Unique selling propositions encompass brand heritage, personalized design services, and exclusivity.

Key Drivers, Barriers & Challenges in GCC Luxurious Furniture Industry

Key Drivers: Rising disposable incomes, urbanization, increased awareness of luxury lifestyles, and government investments in infrastructure development are driving market growth. Technological advancements in design and manufacturing are also contributing to improved product offerings and efficiency.

Key Challenges: Supply chain disruptions due to global events can impact material availability and lead times. Regulatory hurdles, especially related to import/export and environmental compliance, add complexity. Intense competition, particularly from both established international brands and emerging local players, creates pressure on pricing and profitability. Estimated impact of supply chain issues on 2024 market growth: xx Million.

Emerging Opportunities in GCC Luxurious Furniture Industry

Untapped markets in smaller GCC countries present significant growth potential. The increasing demand for sustainable and eco-friendly furniture creates opportunities for brands that emphasize sustainable sourcing and manufacturing. Evolving consumer preferences towards personalized experiences and custom design solutions offer niches for specialized firms.

Growth Accelerators in the GCC Luxurious Furniture Industry Industry

Technological breakthroughs in smart home integration and personalized design tools are set to accelerate market growth. Strategic partnerships between luxury brands and interior design firms can tap into new customer segments. Expansion into new markets within the GCC and exploring export opportunities will further fuel market expansion.

Key Players Shaping the GCC Luxurious Furniture Industry Market

- Al Huzaifa

- Bukannan Furnishing

- ID Design

- PAN Home (formerly PAN Emirates)

- Danube

- IKEA

- Home Center

- Luxe Living

- B&B Italia

- Royal Furniture

Notable Milestones in GCC Luxurious Furniture Industry Sector

- May 2023: PAN Emirates rebrands as PAN Home, signaling a modernized approach to the market.

- June 2023: Daze Furniture enters the UAE market, poised to disrupt the luxury segment with bespoke offerings.

In-Depth GCC Luxurious Furniture Industry Market Outlook

The GCC luxurious furniture market is poised for continued growth, driven by robust economic conditions, evolving consumer preferences, and technological advancements. Strategic opportunities exist for companies focusing on sustainability, personalized design, and smart home integration. Expanding into untapped markets and forging strategic partnerships will be critical for long-term success in this dynamic industry.

GCC Luxurious Furniture Industry Segmentation

-

1. Product Type

- 1.1. Lighting

- 1.2. Tables

- 1.3. Chairs and Sofas

- 1.4. Accessories

- 1.5. Bedroom

- 1.6. Cabinets

- 1.7. Other Products

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Home Centers

- 3.2. Flagship Stores

- 3.3. Specialty Stores

- 3.4. Online

- 3.5. Other Distribution Channels

-

4. Geography

- 4.1. Saudi Arabia

- 4.2. United Arab Emirates

- 4.3. Kuwait

- 4.4. Qatar

- 4.5. Rest of GCC Countries

GCC Luxurious Furniture Industry Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Kuwait

- 4. Qatar

- 5. Rest of GCC Countries

GCC Luxurious Furniture Industry Regional Market Share

Geographic Coverage of GCC Luxurious Furniture Industry

GCC Luxurious Furniture Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Consumer Trend for Luxury Furniture; Real Estate Development

- 3.3. Market Restrains

- 3.3.1. High Import Taxes and Duties; High Cost of Raw Materials

- 3.4. Market Trends

- 3.4.1. Changing Consumer Preferences Toward Luxury Goods Like Luxury Furniture

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Luxurious Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Lighting

- 5.1.2. Tables

- 5.1.3. Chairs and Sofas

- 5.1.4. Accessories

- 5.1.5. Bedroom

- 5.1.6. Cabinets

- 5.1.7. Other Products

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Home Centers

- 5.3.2. Flagship Stores

- 5.3.3. Specialty Stores

- 5.3.4. Online

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. Kuwait

- 5.4.4. Qatar

- 5.4.5. Rest of GCC Countries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Saudi Arabia

- 5.5.2. United Arab Emirates

- 5.5.3. Kuwait

- 5.5.4. Qatar

- 5.5.5. Rest of GCC Countries

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Saudi Arabia GCC Luxurious Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Lighting

- 6.1.2. Tables

- 6.1.3. Chairs and Sofas

- 6.1.4. Accessories

- 6.1.5. Bedroom

- 6.1.6. Cabinets

- 6.1.7. Other Products

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Home Centers

- 6.3.2. Flagship Stores

- 6.3.3. Specialty Stores

- 6.3.4. Online

- 6.3.5. Other Distribution Channels

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Saudi Arabia

- 6.4.2. United Arab Emirates

- 6.4.3. Kuwait

- 6.4.4. Qatar

- 6.4.5. Rest of GCC Countries

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Arab Emirates GCC Luxurious Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Lighting

- 7.1.2. Tables

- 7.1.3. Chairs and Sofas

- 7.1.4. Accessories

- 7.1.5. Bedroom

- 7.1.6. Cabinets

- 7.1.7. Other Products

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Home Centers

- 7.3.2. Flagship Stores

- 7.3.3. Specialty Stores

- 7.3.4. Online

- 7.3.5. Other Distribution Channels

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Saudi Arabia

- 7.4.2. United Arab Emirates

- 7.4.3. Kuwait

- 7.4.4. Qatar

- 7.4.5. Rest of GCC Countries

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Kuwait GCC Luxurious Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Lighting

- 8.1.2. Tables

- 8.1.3. Chairs and Sofas

- 8.1.4. Accessories

- 8.1.5. Bedroom

- 8.1.6. Cabinets

- 8.1.7. Other Products

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Home Centers

- 8.3.2. Flagship Stores

- 8.3.3. Specialty Stores

- 8.3.4. Online

- 8.3.5. Other Distribution Channels

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Saudi Arabia

- 8.4.2. United Arab Emirates

- 8.4.3. Kuwait

- 8.4.4. Qatar

- 8.4.5. Rest of GCC Countries

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Qatar GCC Luxurious Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Lighting

- 9.1.2. Tables

- 9.1.3. Chairs and Sofas

- 9.1.4. Accessories

- 9.1.5. Bedroom

- 9.1.6. Cabinets

- 9.1.7. Other Products

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Home Centers

- 9.3.2. Flagship Stores

- 9.3.3. Specialty Stores

- 9.3.4. Online

- 9.3.5. Other Distribution Channels

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Saudi Arabia

- 9.4.2. United Arab Emirates

- 9.4.3. Kuwait

- 9.4.4. Qatar

- 9.4.5. Rest of GCC Countries

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of GCC Countries GCC Luxurious Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Lighting

- 10.1.2. Tables

- 10.1.3. Chairs and Sofas

- 10.1.4. Accessories

- 10.1.5. Bedroom

- 10.1.6. Cabinets

- 10.1.7. Other Products

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Home Centers

- 10.3.2. Flagship Stores

- 10.3.3. Specialty Stores

- 10.3.4. Online

- 10.3.5. Other Distribution Channels

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. Saudi Arabia

- 10.4.2. United Arab Emirates

- 10.4.3. Kuwait

- 10.4.4. Qatar

- 10.4.5. Rest of GCC Countries

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Al Huzaifa

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bukannan Furnishing

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ID Design**List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PAN Emirates

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Danube

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 IKEA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Home Center

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Luxe Living

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 B&B Italia

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Royal Furniture

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Al Huzaifa

List of Figures

- Figure 1: Global GCC Luxurious Furniture Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Saudi Arabia GCC Luxurious Furniture Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: Saudi Arabia GCC Luxurious Furniture Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Saudi Arabia GCC Luxurious Furniture Industry Revenue (undefined), by End User 2025 & 2033

- Figure 5: Saudi Arabia GCC Luxurious Furniture Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: Saudi Arabia GCC Luxurious Furniture Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 7: Saudi Arabia GCC Luxurious Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: Saudi Arabia GCC Luxurious Furniture Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 9: Saudi Arabia GCC Luxurious Furniture Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 10: Saudi Arabia GCC Luxurious Furniture Industry Revenue (undefined), by Country 2025 & 2033

- Figure 11: Saudi Arabia GCC Luxurious Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: United Arab Emirates GCC Luxurious Furniture Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 13: United Arab Emirates GCC Luxurious Furniture Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: United Arab Emirates GCC Luxurious Furniture Industry Revenue (undefined), by End User 2025 & 2033

- Figure 15: United Arab Emirates GCC Luxurious Furniture Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: United Arab Emirates GCC Luxurious Furniture Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 17: United Arab Emirates GCC Luxurious Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: United Arab Emirates GCC Luxurious Furniture Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 19: United Arab Emirates GCC Luxurious Furniture Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 20: United Arab Emirates GCC Luxurious Furniture Industry Revenue (undefined), by Country 2025 & 2033

- Figure 21: United Arab Emirates GCC Luxurious Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Kuwait GCC Luxurious Furniture Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 23: Kuwait GCC Luxurious Furniture Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: Kuwait GCC Luxurious Furniture Industry Revenue (undefined), by End User 2025 & 2033

- Figure 25: Kuwait GCC Luxurious Furniture Industry Revenue Share (%), by End User 2025 & 2033

- Figure 26: Kuwait GCC Luxurious Furniture Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 27: Kuwait GCC Luxurious Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 28: Kuwait GCC Luxurious Furniture Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 29: Kuwait GCC Luxurious Furniture Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Kuwait GCC Luxurious Furniture Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Kuwait GCC Luxurious Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Qatar GCC Luxurious Furniture Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 33: Qatar GCC Luxurious Furniture Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 34: Qatar GCC Luxurious Furniture Industry Revenue (undefined), by End User 2025 & 2033

- Figure 35: Qatar GCC Luxurious Furniture Industry Revenue Share (%), by End User 2025 & 2033

- Figure 36: Qatar GCC Luxurious Furniture Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 37: Qatar GCC Luxurious Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Qatar GCC Luxurious Furniture Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 39: Qatar GCC Luxurious Furniture Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Qatar GCC Luxurious Furniture Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: Qatar GCC Luxurious Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of GCC Countries GCC Luxurious Furniture Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 43: Rest of GCC Countries GCC Luxurious Furniture Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 44: Rest of GCC Countries GCC Luxurious Furniture Industry Revenue (undefined), by End User 2025 & 2033

- Figure 45: Rest of GCC Countries GCC Luxurious Furniture Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Rest of GCC Countries GCC Luxurious Furniture Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 47: Rest of GCC Countries GCC Luxurious Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 48: Rest of GCC Countries GCC Luxurious Furniture Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 49: Rest of GCC Countries GCC Luxurious Furniture Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 50: Rest of GCC Countries GCC Luxurious Furniture Industry Revenue (undefined), by Country 2025 & 2033

- Figure 51: Rest of GCC Countries GCC Luxurious Furniture Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 5: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 7: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 8: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 9: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 10: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 12: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 13: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 15: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 17: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 18: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 19: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 22: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 23: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 24: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 25: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 27: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 28: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 29: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 30: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Luxurious Furniture Industry?

The projected CAGR is approximately 7.13%.

2. Which companies are prominent players in the GCC Luxurious Furniture Industry?

Key companies in the market include Al Huzaifa, Bukannan Furnishing, ID Design**List Not Exhaustive, PAN Emirates, Danube, IKEA, Home Center, Luxe Living, B&B Italia, Royal Furniture.

3. What are the main segments of the GCC Luxurious Furniture Industry?

The market segments include Product Type, End User, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Consumer Trend for Luxury Furniture; Real Estate Development.

6. What are the notable trends driving market growth?

Changing Consumer Preferences Toward Luxury Goods Like Luxury Furniture.

7. Are there any restraints impacting market growth?

High Import Taxes and Duties; High Cost of Raw Materials.

8. Can you provide examples of recent developments in the market?

June 2023: Daze Furniture, the leading furniture brand known for its bespoke collection of furniture, lighting, and home accessories, is poised to revolutionise the luxury furniture segment in the UAE.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Luxurious Furniture Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Luxurious Furniture Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Luxurious Furniture Industry?

To stay informed about further developments, trends, and reports in the GCC Luxurious Furniture Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence